Why do you need a power of attorney in form M-2?

Typically, representatives of those companies in which the receipt of some goods or materials by proxy occur with high frequency and in large quantities resort to drawing up such a document.

However, a power of attorney is most often formed for a one-time acceptance of goods and for a strictly limited period.

The basis for drawing up a power of attorney is an agreement concluded between enterprises: on supply, purchase and sale, etc., as well as receipts, invoices, acts, invoices and other similar papers.

How to write a document correctly

The power of attorney must have two signatures: from the one who entrusts the goods and the one who is entrusted with it.

There is no mandatory template for filling out such a power of attorney. Organizations can write this document in free form or develop a template at their discretion. The power of attorney can be issued either on the company’s letterhead or on a blank sheet of standard format.

When drawing up a power of attorney to receive goods, you must adhere to the recommendations and standards established for writing such papers by the rules of jurisprudence and office work, so that the document does not subsequently raise doubts among the interested party. Here you need to enter the personal data of the representative (according to the passport), as well as carefully and in detail specify all the functions that are assigned to the representative and the list of documents that he is authorized to sign.

In addition, it is necessary to indicate the period of validity of the power of attorney, which is not limited by law (i.e., a power of attorney can be issued for at least 10 or 100 years). In the absence of such information, the validity period of the document is automatically equal to one year from the date of its signing.

To whom can a power of attorney be issued in form M-2?

Unlike powers of attorney, which are written in free form and which can be issued to any individual and even a third-party organization, a standard M-2 power of attorney can only be issued to employees of an enterprise who are on its staff.

Typically, the function of issuing a power of attorney falls on a specialist in the accounting department, who controls the financial part of the transaction, as well as the process of receiving and receiving inventory items, but it must also be endorsed by the director of the company.

Decor

As for the procedure for issuing a power of attorney itself, it has not changed.

As before, only a director can act without a power of attorney on behalf of the organization, since his powers are confirmed by the charter of the legal entity and the minutes of the general meeting (decision of the only participant) at which the manager was elected.

An individual entrepreneur does not need a power of attorney if he acts independently, but he will have to confirm his powers and status (for example, submit an agreement and a certificate of registration as an entrepreneur).

In all other cases, the representative must issue a power of attorney. In this case, the representative can be not only an employee of a legal entity (merchant), but also any other citizen, the only condition is his full legal capacity.

Attention

It is not necessary to organize records of issued powers of attorney. However, if the volume of powers of attorney issued is large, it is still better to keep a logbook, as it will help track to whom, when, for what period and how many copies of powers of attorney were issued.

Before issuing a power of attorney, it is necessary to determine what scope and nature of powers it will contain and for what purposes it is being issued. Thus, a distinction is made between general, special and one-time powers of attorney.

A general power of attorney is a power of attorney that is issued to perform actions that cover the entire scope of activity of a legal entity or businessman. For example, disposing of property, signing documents, concluding contracts, etc. Most often, it is issued to the heads of branches or representative offices, as well as deputy managers;

A special power of attorney is issued to perform a set of related actions. For example, issued to a legal adviser to conduct all matters in arbitration or to a secretary to receive correspondence by mail, etc.;

A one-time power of attorney is issued to perform a specific action or transaction and after execution it terminates. For example, receiving a certain batch of goods, signing an agreement, drawing up an act, etc.

A power of attorney is always issued in writing. At the same time, it can be written by hand or printed on a computer; it is also not prohibited to draw up a power of attorney combining both methods of writing.

In most cases, this document is drawn up in any form. However, there are also unified forms. Thus, a power of attorney to receive material assets is drawn up according to forms No. M-2 and M-2a (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a). They differ only in that form No. M-2 has a counterfoil, which is used to record issued powers of attorney. These counterfoils are filled out and filed, forming a log of registration of powers of attorney.

At the moment, organizations and entrepreneurs are not required to record issued powers of attorney. However, if the volume of powers of attorney is issued, it is still better to keep a large accounting journal, as it will help track to whom, when, for what period and how many copies of powers of attorney were issued.

If the power of attorney is issued in any form, then it must contain the following data ():

Data for power of attorney

- The name of the document is “Power of Attorney”. The type of power of attorney (general, special, one-time) is not indicated;

- date and place of compilation. Without specifying this detail, the power of attorney will be considered void;

- details of the principal (mandatory details). Organizations indicate name, address, telephone number, tax identification number, checkpoint and bank details. Individual entrepreneurs - full name, address and Taxpayer Identification Number;

- attorney details (mandatory details). If the attorney is an individual, then indicate his full name and passport details. In the case of an organization, the name, address, telephone number, TIN, KPP and bank details are indicated;

- a list of powers of the representative, which must be specific. If the power of attorney is irrevocable, then indicate this. Also list in which cases it is possible to revoke a document;

- validity. Without specifying a period, the power of attorney will be valid for one year from the date of its issue;

- sample signature of the attorney;

- signature of the head of the organization (entrepreneur). If necessary, the signature of the chief accountant is also affixed. Please note that the signature of the manager on the power of attorney must be genuine. Letter No. 18-0-09/000042 of the Ministry of Taxes and Taxes of Russia dated April 1, 2004 states that the use of a facsimile signature on a power of attorney is not allowed. Therefore, only an authentic signature must be affixed.

Let us remind you that since September 2013, legal entities may not affix the organization’s seal to the power of attorney. However, no one forbids doing this. As for entrepreneurs, if they have a seal, they are required to affix it.

The power of attorney is issued on the organization’s letterhead or simply on a regular A4 sheet.

How to correctly draw up and execute an M-2 power of attorney

Already from the name of the power of attorney it is clear that it has a standard form, therefore its execution is strictly regulated by law.

All cells must be filled out without making any mistakes or adjustments - if there are any, it is better not to make corrections to the form, but to create a new document.

When filling out the intersectoral form M-2, you should use the data from the passport of the authorized person or other document proving his identity. The signature of the principal must also be present on the form and must be certified by the head of the enterprise or a person authorized to act on his behalf.

One power of attorney can be issued to receive goods from one supplier using several accompanying documents at once - in the M-2 form you just need to indicate all their details. But if the suppliers are different, then in each case you will need to create an individual document.

The power of attorney is drawn up in a single original copy.

It consists of two parts:

- one, after filling out, is torn off and remains with the accountant,

- the second, the main one, is transferred to a trusted person. He, in turn, gives it to the supplier, who adds it to his package of shipping documents.

All powers of attorney issued to employees of the organization, after losing their relevance, must be stored in the archive for the period established by the legislation of the Russian Federation or internal regulations of the enterprise, after which they can be disposed of.

Registration of a power of attorney to receive goods and materials

Powers of attorney to receive goods, regardless of whose name they are drawn up, have the usual written form that does not require notarization.

For example, a power of attorney for receiving goods or goods and materials issued on behalf of an individual is drawn up in free form and certified only by the personal signature of the principal. This document, in accordance with Article 185 of the Civil Code of the Russian Federation, can be issued either directly to a third party who will ship (delivery, etc.) of the goods, or to a representative for presentation at the place of demand.

Powers of attorney from legal entities are usually drawn up, in accordance with Resolution of the State Statistics Committee of Russia No. 71a of October 30, 1997, according to unified forms M-2 and M-2a. We'll talk more about these forms later. In addition to unified forms, legal entities can also use their usual form of powers of attorney - provided that all the necessary details are indicated - this does not contradict the law.

It should be said that a power of attorney to receive goods and materials must necessarily contain an indication of specific goods or other valuables indicating their quantity that the authorized person is supposed to receive. If goods are received according to an invoice, specification for a contract or other document containing a complete list of those goods to be received, it is permissible not to list all the values to be received in the power of attorney itself. But in this case, it must contain an indication of such a document.

It is also important to note that, regardless of the form in which the power of attorney to receive goods is drawn up (free or unified), a mandatory condition for the validity of the power of attorney is to indicate the date of its preparation. If this requirement is not fulfilled, the power of attorney is considered void - and therefore does not entail the rights or obligations of the parties.

Sample of filling out a standard interindustry form M-2

- At the beginning of the document you need to fill out a table in which you should enter:

- form number (according to the company’s internal document flow), date of issue and validity period,

- information about the person to whom it was issued: the employee’s position and his full name - opposite these data the employee must put his signature.

- The organization to which the document must be presented (i.e., the supplier) is indicated below.

- Next, you should enter information about the number and date of the order, as well as the document confirming the execution of the entrusted action. This part remains with the accountant after registration.

Registration of the second part of the M-2 form

The second part of the form is the main one.

- First of all, the name of the granting organization is entered into it.

- Here we indicate the number of the power of attorney, the date of its issue and expiration date.

- After this, data is entered about the consumer enterprise (i.e., again, the company that issues the power of attorney), its name and address, as well as the current account number and information about the bank in which it is serviced.

- We fill in the position, last name, first name and patronymic of the representative of the organization who will act on the basis of this power of attorney and his passport details: series, number, date and place of issue (when receiving the goods, the representative of the organization must present his passport along with the power of attorney form).

- Just below is the name of the supplier organization and a link to the document according to which the inventory items are issued (in this case, it is an agreement).

Registration of the third part of the M-2 form

The third part of the intersectoral form M-2 includes a table in which all goods and materials that the authorized person is authorized to receive are entered. Here their number (in order), name, unit of measurement and quantity are indicated. The cost is not indicated in this document.

How to fill out a document

The unified form and procedure for filling out the M-2 power of attorney are enshrined in Goskomstat Resolution No. 71a. A separate M-2 is issued for each supplier. If you receive goods from one supplier, but under several contracts or invoices, write out one trust document and list all the calculation grounds.

M-2 is issued in one copy. The form consists of two parts. The detachable part remains with the accountant, the main part is transferred to the supplier. Here's how to correctly fill out the M-2 power of attorney to receive inventory items:

- In the introductory table, indicate the number, date of issue and validity period of the trust document.

- Enter your full name. and the position of a full-time employee of the organization. This is where the employee signs.

- Determine the supplier and the basis for receiving inventory items.

- Duplicate the name of the principal, number, date and term of M-2 in the main part for the supplier. Indicate the name of the bank and the current account number of the organization.

- Enter information about the person you trust: position, full name, passport details.

- Enter the name of the supplier and details of the basis document.

- List in order the goods, materials and valuables to be received.

The trust document must be signed by the trustee, the manager and the chief accountant of the organization. Corrections are not allowed: if you made a mistake, make a new M-2 form.

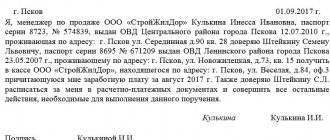

Sample

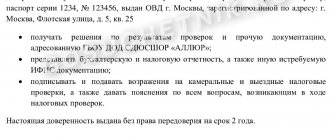

This is what a sample of filling out M-2 looks like in 2022:

Can it be issued for a year?

According to Article 186 of the Civil Code of the Russian Federation, if the power of attorney does not indicate its validity period, it remains valid for a year from the date of its execution. Consequently, the Law does not limit the period for which this document can be issued, which will undoubtedly contribute to the sustainability of trade turnover. It turns out that the power of attorney to receive inventory items can be annual as well.

Free form of power of attorney

The organization has the right to independently develop a form of power of attorney. Typically, the form and content of the document are determined by the supplier organization, since it is the supplier who bears the main risks of issuing the goods to an unauthorized person. The text can include not only the right of the representative to receive the goods, but also the authority to check its condition, as well as the right to sign shipping documents.

The power of attorney is prepared in compliance with the general rules provided for in Articles 182-189 of the Civil Code of the Russian Federation. When issuing a document, you should adhere to the following recommendations:

- indicate the name of the organization where you want to receive the goods;

- indicate the authority to receive and inspect the cargo, to sign documents on receipt of the cargo;

- you can specify the specific cargo that needs to be received or the number of the shipping document

- You need to sign the document with the manager and affix the organization's seal.

Authorization can be granted for one-time receipt or for regular receipt of various cargoes.

Validity periods of permits

A power of attorney to receive material assets from a legal entity using unified forms M-2 and M-2a is issued, as a rule, for a period of ten days to one month. This is due to the fact that the permit specifies a specific product and its volume to be issued.

If an organization issues a permit in its own form, then it can be issued for any period. To do this, it is necessary to provide not a one-time intake of goods and materials, but a regular one over time. There is no statutory maximum period for issuing permits. But if the document does not indicate the validity period, then it is valid for one year (clause 1 of Article 186 of the Civil Code of the Russian Federation).

Step by step filling

- Company name.

- Title of the document.

- Serial number (not required, but recommended).

- Place of issue (local area).

- The date of execution, the day, month, year is indicated in words (it is strictly necessary to fill out! Otherwise, the power of attorney is considered void).

- The text of the power of attorney, which includes:

- Name of the principal company, OGRN, INN, address.

- Details of the person (full name, position) signing the power of attorney on behalf of the company.

- Data of the authorized person (full name, passport details, registered address at the place of residence).

- List of powers for which a power of attorney is issued (can be specified). An indication of the third party before whom the interests of the principal will be represented.

- Duration of the power of attorney.

- Information about the right to delegate powers (if such a right is granted).

- Signature of the person for whom this document is drawn up.

- Signature of the director and chief (senior) accountant.

- Company's stamp.

The list of goods transferred to the buyer, quantity, units of measurement, serial number are indicated on the reverse side.

If there are blank lines in the form, a dash is placed with a large zigzag . The document below is signed by the authorized person, which confirms that he has received this power of attorney.

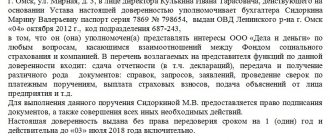

Example:

POWER OF ATTORNEY No. 22/2018

St. Petersburg First of February two thousand and eighteen

Hereby, LLC "Metiz88" INN 7811231201, OGRN 1037700211377, legal address: 193232 St. Petersburg, st. Moskovskaya, 21, represented by General Director Vitaly Aleksandrovich Velichko, acting on the basis of the Charter, authorizes

purchasing manager Lutz Olga Petrovna (passport 4501 1249, issued by TP 21 in the Nevsky district of St. Petersburg and Leningrad Region, 08/01/2008, registered at the address: St. Petersburg, Morskoy pr-t, 89, apt. 23) to represent the interests of the Company in LLC "Supplier", for which it is granted the rights:

- Receive goods and materials under the Supply Agreement dated No. 21 dated 07/01/2017.

- Receive the necessary documents for the goods (waybills, invoices, certificates of conformity, etc.).

- Sign the invoices for which the goods were received.

The power of attorney was issued without the right of substitution.

Luts O.P. I certify.

Signatures of the manager and chief accountant.

Read about how to fill out a power of attorney to receive inventory items here.

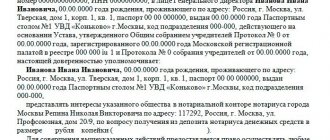

Sample

Let's look at an example of a power of attorney to receive goods, issued in form M-2 (OKUD 0315001). Use step-by-step instructions on how to fill out a power of attorney to receive goods.

Step 1. We start by filling in the number and date. It is important to accurately record the date of issue; without it, the document is void (Article 186 of the Civil Code of the Russian Federation).

Step 2. Fill in the details of the principal and representative.

Step 3. On the back of the form, fill out the list and quantity of inventory items to be issued.

Step 4. Don't forget to fill the tear-off spine.

How to revoke (cancel) a power of attorney

You may encounter a situation where it becomes necessary to revoke a power of attorney before it expires. In such situations, the applicant must submit the relevant document in writing. The refusal must be provided to the supplier or other persons to whom this power of attorney was presented. The moment when he is notified of the revocation of the power of attorney will be considered the moment when its effect begins. It is advisable to obtain a document confirming the receipt of such notification. If the review was sent by courier, it becomes effective from the moment of receipt.

However, to cancel, you need to remember some nuances. For example, the revocation must be drawn up in the same way as was used when drawing up the power of attorney. If it was certified by a notary, you must contact him to formalize the cancellation.

You also need to know that it is not necessary for the authorized person to agree to the revocation of the power of attorney. This document is drawn up unilaterally. To do this, it is enough only for the principal to wish to terminate the power of attorney early. There is no need at all to explain the reasons for this decision.

Duration of the power of attorney

The principal independently determines the period during which the power of attorney will be valid. You can draw up a document even for a hundred years. It is also worth noting that the absence of a specific deadline is not an error. The law stipulates that such a document can be used for one year. Moreover, the report begins from the time when the power of attorney is drawn up. That is why the contract must indicate the date of its preparation. In its absence, the document is considered invalid. Therefore, he cannot give any powers.

The law does not establish either the maximum or minimum validity period of a power of attorney. This is determined by the person who allows the representative to act on his behalf. A deadline or a specific date may be indicated. Often a one-time power of attorney is issued to carry out a specific assignment. After this, the document automatically ceases to be valid.

There are powers of attorney that allow you to draw up a sub-power of attorney. Here you need to understand that its validity period cannot exceed the validity period of the main power of attorney. Thus, if the main document is valid for two years, then the maximum period of reassignment cannot exceed two years.