What is PBU “Accounting Policy”

To begin with, let us remember that the legal regulation of accounting (hereinafter referred to as accounting) in the Russian Federation is represented by several levels:

Art. 21 of Law No. 402-FZ defines the following structure of BU regulatory documentation:

Until federal and industry accounting standards are drawn up and given legislative force, the regulatory framework developed before the entry into force of Law No. 402-FZ is in force (information of the Ministry of Finance of the Russian Federation No. PZ-10/2012 “On the entry into force of the law of December 6, 2013”) 2011 No. 402-FZ “On Accounting”).

New federal standards will come into force in 2022. The most used are FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”, which will replace PBU 6/01. ConsultantPlus experts explained how to apply the new FAS in practice and what nuances needed to be taken into account when making changes to the accounting policy for 2022. Get free demo access to K+ and go to the ready-made solution to find out all the details of the procedure.

PBU “Accounting Policies” is one of the accounting provisions that regulate the procedure for drawing up and applying accounting policies in an organization. This PBU has serial number 1, the first edition of the PBU “Accounting Policy” (PBU 1/98) was approved by order of the Ministry of Finance of the Russian Federation dated December 9, 1998 No. 60n. Currently, PBU 1/2008 is in force, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n.

The norms of PBU “Accounting Policies of an Organization” apply to all legal entities, except for credit institutions and budgetary institutions - they draw up accounting policies for other legal acts (clause 1 of PBU 1/2008).

What is accounting policy

Accounting policy (hereinafter referred to as UP) is a set of methods for maintaining accounting by an organization (Clause 1, Article 8 of Law No. 402-FZ). UP are required to be compiled by all economic entities, except for those exempt from the obligation to maintain accounting: individual entrepreneurs, branches or representative offices of a foreign company - provided that they keep records of income and expenses in accordance with other legal acts of the Russian Federation (clause 2 of article 6 of law No. 402-FZ ).

Note! Unlike accounting, tax accounting (TA) is mandatory for all taxpayers - both legal entities and individual entrepreneurs, regardless of the taxation regime. Therefore, the UE for the purposes of NU is made up of all economic entities (clause 2 of article 11, article 313 of the Tax Code of the Russian Federation). Entrepreneurs can draw up the UE for accounting purposes at their own request, but are not required to do so. In the following, in the article we will consider the issues of drawing up and designing the UE only for accounting purposes.

Accounting policies are drawn up not only for the purposes of accounting and national accounting, but also for the needs of management accounting - you will find an approximate structure of such an accounting policy in the article “Accounting policies for management accounting purposes .

Economic entities draw up UP independently on the basis of regulatory legal acts according to accounting regulations. The company chooses accounting methods from those established by federal standards, and if a situation arises that is not regulated by the federal standard, then it is allowed to develop an accounting method independently.

The latest changes made to the text of PBU 1/2008 (Order of the Ministry of Finance of Russia dated April 28, 2017 No. 69n) established the order of preferences in choosing a model for an independently developed accounting method (clause 7.1 of PBU 1/2008):

- rules contained in IFRS standards;

- analogies available in Russian standards;

- recommendations given on this issue.

The UE is applied consistently from year to year. Changes made to the UP must be effective from the beginning of the next calendar year. Changing the UE during the year is allowed in exceptional cases:

- changes in the legislation of the Russian Federation;

- the use of other methods of accounting in order to generate the most reliable information about accounting objects;

- change in the conditions of the company’s activities (clause 5, article 8 of law No. 402-FZ).

In practice, changes and additions to the management program are of two types:

- actual changes in the management program (for example, in connection with changes in legislation), the consequences of which are reflected in accounting and reporting in accordance with legal requirements, and in the absence of such requirements - retrospectively;

- additions made to the management program (for example, when developing a new line of business) - they are introduced and are in effect from the moment it became necessary. And in accounting and reporting they are reflected prospectively.

For more information about the procedure for making changes to the accounting policy, read the article “When and how a change in accounting policy should be introduced.”

GLAVBUKH-INFO

| All pages |

Page 1 of 2

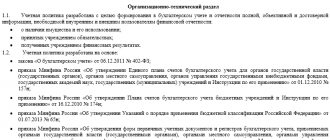

Appendix No. 1 to Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n

ACCOUNTING REGULATIONS “ACCOUNTING POLICIES OF THE ORGANIZATION” (PBU 1/2008)

(as amended by Order of the Ministry of Finance of the Russian Federation dated March 11, 2009 N 22n)

I. General provisions

1. These Regulations establish the rules for the formation (selection or development) and disclosure of the accounting policies of organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and budgetary institutions) (hereinafter referred to as organizations). Branches and representative offices of foreign organizations located on the territory of the Russian Federation may formulate accounting policies in accordance with these Regulations or based on the rules established in the country of location of the foreign organization, if the latter do not contradict International Financial Reporting Standards. 2. For the purposes of these Regulations, the accounting policy of an organization is understood as the set of accounting methods adopted by it - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity. Accounting methods include methods of grouping and assessing facts of economic activity, repaying the value of assets, organizing document flow, inventory, using accounting accounts, organizing accounting registers, and processing information. 3. These Regulations apply: in terms of the formation of accounting policies - to all organizations; in terms of disclosure of accounting policies - to organizations that publish their financial statements in whole or in part in accordance with the legislation of the Russian Federation, constituent documents or on their own initiative.

II. Formation of accounting policies

4. The accounting policy of the organization is formed by the chief accountant or another person who, in accordance with the legislation of the Russian Federation, is entrusted with maintaining the accounting records of the organization, on the basis of these Regulations and is approved by the head of the organization. At the same time, the following are approved: a working chart of accounts, containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting; forms of primary accounting documents, accounting registers, as well as documents for internal accounting reporting; the procedure for conducting an inventory of the organization’s assets and liabilities; methods for assessing assets and liabilities; document flow rules and accounting information processing technology; the procedure for monitoring business operations; other solutions necessary for organizing accounting. 5. When forming an accounting policy, it is assumed that: the assets and liabilities of an organization exist separately from the assets and liabilities of the owners of this organization and the assets and liabilities of other organizations (assuming property separation); the organization will continue its activities for the foreseeable future and it has no intention or need to liquidate or significantly reduce its activities and, therefore, obligations will be repaid in the prescribed manner (going concern assumption); the accounting policy adopted by the organization is applied consistently from one reporting year to another (assumption of consistency in the application of accounting policies); the facts of the organization’s economic activities relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts (the assumption of temporary certainty of the facts of economic activity). 6. The accounting policy of the organization must ensure: completeness of reflection in the accounting records of all facts of economic activity (completeness requirement); timely reflection of the facts of economic activity in accounting and financial statements (timeliness requirement); greater willingness to recognize expenses and liabilities in accounting than possible income and assets, avoiding the creation of hidden reserves (requirement of prudence); reflection in accounting of facts of economic activity based not so much on their legal form, but on their economic content and business conditions (the requirement of priority of content over form); the identity of analytical accounting data with turnovers and balances on synthetic accounting accounts on the last calendar day of each month (consistency requirement); rational accounting, based on business conditions and the size of the organization (the requirement of rationality). 7. When forming an organization’s accounting policy on a specific issue of organizing and maintaining accounting, one method is selected from several allowed by the legislation of the Russian Federation and (or) regulatory legal acts on accounting. If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method, based on this and other accounting provisions, as well as International Financial Reporting Standards. At the same time, other accounting provisions are applied to develop an appropriate method in terms of similar or related facts of economic activity, definitions, recognition conditions and procedures for assessing assets, liabilities, income and expenses. 8. The accounting policy adopted by the organization is subject to registration with the relevant organizational and administrative documentation (orders, instructions, etc.) of the organization. 9. Accounting methods chosen by the organization when forming its accounting policies are applied from the first January of the year following the year of approval of the relevant organizational and administrative document. Moreover, they are applied by all branches, representative offices and other divisions of the organization (including those allocated to a separate balance sheet), regardless of their location. A newly created organization, an organization resulting from a reorganization, draws up its chosen accounting policy in accordance with these Regulations no later than 90 days from the date of state registration of the legal entity. The accounting policy adopted by the newly created organization is considered to be applied from the date of state registration of the legal entity.

III. Change in accounting policy

10. Changes in the accounting policies of an organization can be made in the following cases: changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting; the organization's development of new accounting methods. The use of a new method of accounting implies a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information; significant changes in business conditions. A significant change in the business conditions of an organization may be associated with reorganization, change in types of activities, etc. It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from the facts that occurred previously, or that arose for the first time in the organization’s activities. 11. Changes in accounting policies must be justified and formalized in the manner prescribed by paragraph 8 of these Regulations. 12. Changes in accounting policies are made from the beginning of the reporting year, unless otherwise determined by the reason for such a change. 13. The consequences of changes in accounting policies that have had or may have a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are assessed in monetary terms. The assessment in monetary terms of the consequences of changes in accounting policies is made on the basis of data verified by the organization as of the date from which the changed method of accounting is applied. 14. The consequences of changes in accounting policies caused by changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting are reflected in accounting and reporting in the manner established by the relevant legislation of the Russian Federation and (or) regulatory legal acts on accounting. If the relevant legislation of the Russian Federation and (or) a regulatory legal act on accounting do not establish a procedure for reflecting the consequences of changes in accounting policies, then these consequences are reflected in accounting and reporting in the manner established by paragraph 15 of these Regulations. 15. The consequences of changes in accounting policies caused by reasons other than those specified in paragraph 14 of these Regulations, and which had or could have a significant impact on the financial position of the organization, financial results of its activities and (or) cash flows, are reflected in the financial statements retrospectively, for except in cases where the assessment in monetary terms of such consequences in relation to periods preceding the reporting period cannot be made with sufficient reliability. When retrospectively reflecting the consequences of changes in accounting policies, we proceed from the assumption that the changed method of accounting was applied from the moment the facts of economic activity of this type arose. Retrospective reflection of the consequences of a change in accounting policy consists of adjusting the opening balance under the item “Retained earnings (uncovered loss)” for the earliest period presented in the financial statements, as well as the values of related financial statements items disclosed for each period presented in the financial statements, as if the new accounting policy was applied from the moment the facts of economic activity of this type arose. In cases where the monetary assessment of the consequences of a change in accounting policy in relation to periods preceding the reporting period cannot be made with sufficient reliability, the changed method of accounting is applied to the relevant facts of economic activity that occurred after the introduction of the changed method (prospectively). 16. Changes in accounting policies that have had or are capable of having a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are subject to separate disclosure in the financial statements.

Previous — Next >>

| < Previous |

Contents of PBU “Accounting policies of the organization”

PBU 1/2008 consists of four sections.

Section I is devoted to general information about the normative act itself and the terminology used below.

What to pay attention to:

- PBU applies only to legal entities, with the exception of credit and budget organizations. All companies that are subject to the PBU must comply with the regulations regarding the formation of the UP; in terms of disclosure of information about the provisions of the CP, its changes and other aspects provided for in Section IV of PBU 1/2008 - only companies that publish accounting reports.

- Branches and divisions of foreign legal entities on the territory of the Russian Federation can draw up UE either according to the rules of PBU 1/2008, or according to the rules of the country of origin, but then they should not contradict IFRS (clause 1 of PBU 1/2008).

- Methods of maintaining accounting include methods of grouping, assessing the facts of economic activity, repaying the value of assets, organizing document flow and processing information, inventory, using accounts and registers of accounting (clause 2 of PBU 1/2008).

Section II contains detailed instructions for the formation of the UP and a checklist of what should be in the UP.

What to pay attention to:

- The UP is compiled by the chief accountant or the person responsible for maintaining accounting records in the company, and is approved by the manager by order or directive (clause 4 of PBU 1/2008).

- UP is based on the following assumptions: property isolation, continuity of activity, consistency of application of UP and time certainty of business operations (clause 5 of PBU 1/2008).

- The requirements for UP are: completeness, timeliness, prudence, consistency, rationality of reflecting business operations, priority of content over form (clause 5 of PBU 1/2008).

- companies that are allowed to use simplified accounting methods can keep records without double entry (clause 6.1 of PBU 1/2008) and, when independently choosing an accounting method, be guided only by the requirement of rationality (clause 7.2 of PBU 1/2008).

- If you have just recently created a company or reorganized an existing one, then the UP for the BU should be formed within 90 days from the date of state registration, and after approval, the UP is considered valid from the moment of state registration of the company.

- The methods of maintaining accounting records recorded in the UP are applied from the beginning of the calendar year following the year of approval of the UP, by all divisions of the legal entity, even if they are allocated to a separate balance sheet (clause 9 of PBU 1/2008).

Section III is devoted to changes in the CP.

What to pay attention to:

- Changes to the accounting policies come into force from the beginning of the next reporting year or in exceptional cases, which were discussed in the section “What are accounting policies”.

- Changes to the management program are made by instructions or orders of the manager.

- The approval of methods for conducting accounting for new business operations that are significantly different from those carried out by the organization previously, or that arose for the first time in the company’s activities (clause 10 of PBU 1/2008) is not considered a change in the CP.

- The results of changes in the UE are expressed in monetary terms, and are reflected in accounting in accordance with the legislation of the Russian Federation. If the PP has changed not due to changes in legislation, then the consequences of the change in the PP should be reflected retrospectively, that is, by adjusting the opening balance under the item “Retained earnings (uncovered loss)” for the earliest period presented in the reporting and presenting related reporting items as if if the new UP had been applied earlier (clauses 13, 14 of PBU 1/2008).

- Firms that use simplified methods of accounting reflect in their accounting records the consequences of changing the accounting program without retrospective recalculation, unless otherwise established by the legislation of the Russian Federation (clause 15.1 of PBU 1/2008).

Section IV of PBU 1/2008 informs the accountant about the need to disclose the provisions of the UP in accounting reports.

What to pay attention to:

- Information about the UE should be disclosed in an explanatory note (Appendix 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

- If the UE is formed taking into account the assumptions from clause 5 of PBU 1/2008, then such assumptions may not be voiced in the accounting reports. In other cases, the composition and volume of information about the UE subject to disclosure in accounting statements is determined in accordance with other PBUs. If there are doubts about the applicability of the continuity assumption, they must be pointed out and the reasons for such doubts must be given (clauses 19, 20 of PBU 1/2008).

- The essential methods of accounting adopted in the organization are revealed (clause 17 of PBU 1/2008).

- When changing the UE, the explanatory note records the reasons for the changes, their essence, the procedure for reflecting the results of the change in the accounting records and the amount of adjustments for reporting items (clause 21 of PBU 1/2008).

- If an organization plans to change some provisions of the CP for the next reporting year, then this fact must be documented in the explanations to the accounting reports for the current period (clause 25 of PBU 1/2008).

II. Formation of accounting policies

4. The accounting policy of the organization is formed by the chief accountant or another person who, in accordance with the legislation of the Russian Federation, is entrusted with maintaining the accounting records of the organization, on the basis of these Regulations and is approved by the head of the organization.

In this case it is stated:

- a working chart of accounts containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

- forms of primary accounting documents, accounting registers, as well as documents for internal accounting reporting;

- the procedure for conducting an inventory of the organization’s assets and liabilities;

- methods for assessing assets and liabilities;

- document flow rules and accounting information processing technology;

- the procedure for monitoring business operations;

- other solutions necessary for organizing accounting.

5. When developing accounting policies, it is assumed that:

- the assets and liabilities of an organization exist separately from the assets and liabilities of the owners of this organization and the assets and liabilities of other organizations (assuming property separation);

- the organization will continue its activities for the foreseeable future and it has no intention or need to liquidate or significantly reduce its activities and, therefore, obligations will be repaid in the prescribed manner (going concern assumption);

- the accounting policy adopted by the organization is applied consistently from one reporting year to another (assumption of consistency in the application of accounting policies);

- the facts of the organization's economic activities relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts (the assumption of temporary certainty of the facts of economic activity).

6. The organization’s accounting policies must ensure:

- completeness of reflection in accounting of all facts of economic activity (completeness requirement);

- timely reflection of the facts of economic activity in accounting and financial statements (timeliness requirement);

- greater willingness to recognize expenses and liabilities in accounting than possible income and assets, avoiding the creation of hidden reserves (requirement of prudence);

- reflection in accounting of facts of economic activity based not so much on their legal form, but on their economic content and business conditions (the requirement of priority of content over form);

- the identity of analytical accounting data with turnovers and balances on synthetic accounting accounts on the last calendar day of each month (consistency requirement);

- rational accounting, based on business conditions and the size of the organization (the requirement of rationality).

7. When forming an organization’s accounting policy on a specific issue of organizing and maintaining accounting, one method is selected from several allowed by the legislation of the Russian Federation and (or) regulatory legal acts on accounting. If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method, based on this and other accounting provisions, as well as International Financial Reporting Standards. At the same time, other accounting provisions are applied to develop an appropriate method in terms of similar or related facts of economic activity, definitions, recognition conditions and procedures for assessing assets, liabilities, income and expenses.

8. The accounting policy adopted by the organization is subject to registration with the relevant organizational and administrative documentation (orders, instructions, etc.) of the organization.

9. Accounting methods chosen by the organization when developing accounting policies are applied from the first January of the year following the year of approval of the relevant organizational and administrative document. Moreover, they are applied by all branches, representative offices and other divisions of the organization (including those allocated to a separate balance sheet), regardless of their location.

A newly created organization, an organization resulting from a reorganization, draws up its chosen accounting policy in accordance with these Regulations no later than 90 days from the date of state registration of the legal entity. The accounting policy adopted by the newly created organization is considered to be applied from the date of state registration of the legal entity.

Differences between PBU 1/08 “Accounting Policies of an Organization” and PBU 1/98 “Accounting Policies of an Organization”

As mentioned above, PBU 1/2008 “Accounting Policy of the Organization” is currently in force, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n.

Below in the table we present the key differences between PBU 1/2008 and PBU 1/98, which was in force previously:

| PBU 1/98 (approved by order of the Ministry of Finance of the Russian Federation dated December 9, 1998 No. 60n, lost force on the basis of order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n) | PBU 1/2008 (approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n as amended on April 28, 2017) |

| Absent | 5.1. The company chooses accounting methods independently of other organizations, but the management system established by it is mandatory for its subsidiaries |

| 5. UP is formed by the chief accountant | 4. UP is formed by the chief accountant or other person leading accounting in the organization |

| 5. Non-standard forms of primary records, registers and internal accounting documents are approved | 4. Primary forms, registers, internal accounting documents are approved |

| Absent | 6.1. Firms that have the right to maintain accounting records in a simplified form can maintain it without double entry |

| 8. When forming the UE, a choice is made from the accounting methods allowed by accounting legislation. If there is no method, then the company can develop it itself in accordance with PBU 1/98 and other PBUs | 7. When forming the UE, a choice is made from the accounting methods allowed by accounting legislation. If there is no method, then the company can develop it itself in accordance with the rules established by PBU 1/2008. Organizations creating reports under IFRS, if the methods contained in RAS standards do not comply with the requirements of IFRS, have the right to prefer in the management program the use of the methods established for IFRS |

| Absent | 7.1. When independently developing accounting methods, the following sequence of priorities is established in the selection of role models: IFRS standards - analogues in RAS standards - recommendations in the field of accounting |

| Absent | 7.2. Firms that have the right to conduct accounting in a simplified form have the right, when independently choosing an accounting method, to be guided solely by the requirement of rationality |

| Absent | 7.3. If the use of accounting methods established by RAS leads to the generation of unreliable information, deviation from them is permissible |

| 7.4. With regard to information regarded as unimportant for making economic decisions, when choosing an accounting method, it is also permissible to focus only on the requirement of rationality | |

| 12. The methods of maintaining accounting adopted during the formation of the unitary enterprise and subject to disclosure in the accounting statements include methods of depreciation of fixed assets, intangible assets, assessment of inventory items, profit recognition and other methods that meet the requirements of clause 11 of PBU 1/98 | 2. Methods of maintaining accounting include methods of grouping and assessing facts of economic activity, repaying the value of assets, organizing document flow, inventory, using accounting accounts, organizing accounting registers, processing information |

| 21. The consequences of changes in the management program that have had or are capable of having a significant impact on the financial position or financial results are reflected in the financial statements based on the requirement to present numerical indicators for at least 2 years, except in cases where the assessment in monetary terms of these consequences cannot be sufficiently reliable. The accountant should proceed from the assumption that the changed accounting method was applied from the first moment the case for which the method was intended arose. Reflection of the consequences of changes in the UE consists of adjusting only the accounting records - according to data for the periods preceding the reporting one. No entries are made in the accounting department. | 15. The consequences of changes in the management program that have had or are capable of having a significant impact on the financial position or financial results are reflected in the financial statements retrospectively, except in cases where the assessment in monetary terms of such consequences cannot be sufficiently reliable |

| Absent | 15.1. Firms using simplified methods of accounting are allowed to reflect in their accounting statements the significant consequences of changes in the accounting program, prospectively, unless a different procedure is specified in the legislation |

| None | 20.1 and 20.2. Deviations from RAS standards must be disclosed with an explanation of the reasons for this in the notes to the accounting statements. This applies to both preferences in favor of IFRS standards (20.1) and the RAS method replaced by an alternative method (20.2) |

| Absent | 21. In the event of a change in the management program, the reason, content of the changes, the procedure for reflecting the consequences of the change in the accounting statements and the amount of adjustments should be disclosed. If an entity is required to report earnings per share, an adjustment should be reported to basic and diluted earnings or loss per share. In addition, the amount of adjustments for periods preceding those indicated in the accounting records should be indicated. |

| Absent | 22. If the disclosure of information provided for in paragraph 21 of this PBU for any particular previous reporting period presented in the accounting reports, or for reporting periods earlier than those presented, is impossible, this fact should be reflected in the reporting along with indicating the reporting period in which the change in the CP will be applied |

| Absent | 23. If the regulation according to accounting can be applied voluntarily before its official entry into force, the company must disclose this fact in its accounting reports |

III. Change in accounting policy

10. Changes in the accounting policies of an organization can be made in the following cases:

- changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting;

- the organization's development of new accounting methods. The use of a new method of accounting implies a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information;

- significant changes in business conditions. A significant change in the business conditions of an organization may be associated with reorganization, change in types of activities, etc.

It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from the facts that occurred previously, or that arose for the first time in the organization’s activities.

11. Changes in accounting policies must be justified and formalized in the manner prescribed by paragraph 8 of these Regulations.

12. Changes in accounting policies are made from the beginning of the reporting year, unless otherwise determined by the reason for such a change.

13. The consequences of changes in accounting policies that have had or may have a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are assessed in monetary terms. The assessment in monetary terms of the consequences of changes in accounting policies is made on the basis of data verified by the organization as of the date from which the changed method of accounting is applied.

14. The consequences of changes in accounting policies caused by changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting are reflected in accounting and reporting in the manner established by the relevant legislation of the Russian Federation and (or) regulatory legal acts on accounting. If the relevant legislation of the Russian Federation and (or) a regulatory legal act on accounting do not establish a procedure for reflecting the consequences of changes in accounting policies, then these consequences are reflected in accounting and reporting in the manner established by paragraph 15 of these Regulations.

15. The consequences of changes in accounting policies caused by reasons other than those specified in paragraph 14 of these Regulations, and which had or could have a significant impact on the financial position of the organization, financial results of its activities and (or) cash flows, are reflected in the financial statements retrospectively, for except in cases where the assessment in monetary terms of such consequences in relation to periods preceding the reporting period cannot be made with sufficient reliability.

When retrospectively reflecting the consequences of changes in accounting policies, we proceed from the assumption that the changed method of accounting was applied from the moment the facts of economic activity of this type arose. Retrospective reflection of the consequences of a change in accounting policy consists of adjusting the opening balance under the item “Retained earnings (uncovered loss)” for the earliest period presented in the financial statements, as well as the values of related financial statements items disclosed for each period presented in the financial statements, as if the new accounting policy was applied from the moment the facts of economic activity of this type arose.

In cases where an assessment in monetary terms of the consequences of a change in accounting policy in relation to periods preceding the reporting period cannot be made with sufficient reliability, the changed method of accounting is applied to the relevant facts of economic activity that occurred after the introduction of the changed method (prospectively).

15.1. Small businesses, except issuers of publicly offered securities, have the right to reflect in their financial statements the consequences of changes in accounting policies that have had or may have a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flow, prospectively, with the exception of cases when a different procedure is established by the legislation of the Russian Federation and (or) a regulatory legal act on accounting.

(clause 15.1 introduced by Order of the Ministry of Finance of the Russian Federation dated November 8, 2010 N 144n)

16. Changes in accounting policies that have had or are capable of having a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are subject to separate disclosure in the financial statements.

Are there any innovations in the accounting policy of the organization in 2021-2022?

The last minor amendments to PBU 1/2008 were made in 2020.

According to the current rule, organizations disclosing financial statements prepared in accordance with IFRS have the right not to apply the accounting method established by the FSB if this leads to a discrepancy between the accounting policies and the requirements of IFRS. From March 17, 2020, accounting standards approved by such organizations and mandatory for use by their subsidiaries may establish accounting methods chosen by them in accordance with the specified procedure.

There is no information yet about adjustments to the situation in 2022.

Until 2022, the latest innovations in PBU 1/2008 came into force on 08/06/2017, approved. by order of the Ministry of Finance of Russia dated April 28, 2017 No. 69n. As a result of these changes, a number of paragraphs of the PBU were subject to editorial changes that clarified the wording (paragraphs 1, 6, 7, 8, 10, 15, 17, 18, 24), but new provisions also appeared that supplemented the text of the PBU. The latter include the following:

- The organization chooses methods for maintaining accounting independently from other legal entities (clause 5.1). An exception is made for subsidiaries - they must use the same accounting methods as the parent company.

- If a company prepares financial statements according to IFRS, then it uses federal accounting standards in accordance with the requirements of IFRS (clause 7). However, if the accounting method recommended by federal standards contradicts IFRS, then the organization may not apply this method. In this case, the company will have to justify why the method proposed by the federal standard contradicts IFRS.

- The choice of a sample for independent development of an accounting method that is not in federal or industry standards is carried out in a certain sequence (clause 7.1): IFRS - analogies in RAS - accounting recommendations. Firms that have the right to use simplified accounting methods in such a situation can only proceed from the principle of rationality (clause 7.2).

- In exceptional situations, if the application of PBU 1/2008 leads to the receipt of unreliable information about the financial position of the company, it is allowed to deviate from the norms of PBU (clause 7.3) provided that circumstances that prevent the use of PBU are identified and alternative accounting methods are introduced that will not lead to to its even greater unreliability.

- With regard to the organization of accounting for information that is not essential for understanding the financial situation, it is possible to choose an accounting method based on the principle of rationality (clause 7.4).

- In the explanations to the statements, the company must disclose the reasons and consequences of replacing the methods contained in RAS with the provisions of IFRS (clause 20.1), as well as the reasons for the deviation from RAS standards (clause 20.2) with explanations of the differences arising in accounting.

- If the legislation on accounting has changed, and innovations can be voluntarily applied before the deadline for mandatory application, then the company that applied the new regulatory legal act ahead of schedule reflects this fact in the accounting reports (clause 23).

Excluded from the text of the PBU was the requirement to disclose in the explanations to the accounting statements the provisions of the accounting regulations for the year following the reporting year (clause 25).

info-pravo.rf

I. General provisions

1. These Regulations establish the rules for the formation (selection or development) and disclosure of the accounting policies of organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and state (municipal) institutions) (hereinafter referred to as organizations).

(as amended by order of the Ministry of Finance of Russia dated October 25, 2010 No. 132n)

Branches and representative offices of foreign organizations located on the territory of the Russian Federation may formulate accounting policies in accordance with these Regulations or based on the rules established in the country of location of the foreign organization, if the latter do not contradict International Financial Reporting Standards.

2. For the purposes of these Regulations, the accounting policy of an organization is understood as the set of accounting methods adopted by it - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity.

Accounting methods include methods of grouping and assessing facts of economic activity, repaying the value of assets, organizing document flow, inventory, using accounting accounts, organizing accounting registers, and processing information.

3. These Regulations apply: in terms of the formation of accounting policies - to all organizations; in terms of disclosure of accounting policies - to organizations that publish their financial statements in whole or in part in accordance with the legislation of the Russian Federation, constituent documents or on their own initiative.

II. Formation of accounting policies

4. The accounting policy of the organization is formed by the chief accountant or another person who, in accordance with the legislation of the Russian Federation, is entrusted with maintaining the accounting records of the organization, on the basis of these Regulations and is approved by the head of the organization.

In this case it is stated:

- a working chart of accounts containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

- forms of primary accounting documents, accounting registers, as well as documents for internal accounting reporting;

- the procedure for conducting an inventory of the organization’s assets and liabilities;

- methods for assessing assets and liabilities;

- document flow rules and accounting information processing technology;

- the procedure for monitoring business operations;

- other solutions necessary for organizing accounting.

5. When developing accounting policies, it is assumed that:

- the assets and liabilities of an organization exist separately from the assets and liabilities of the owners of this organization and the assets and liabilities of other organizations (assuming property separation);

- the organization will continue its activities for the foreseeable future and it has no intention or need to liquidate or significantly reduce its activities and, therefore, obligations will be repaid in the prescribed manner (going concern assumption);

- the accounting policy adopted by the organization is applied consistently from one reporting year to another (assumption of consistency in the application of accounting policies);

- the facts of the organization's economic activities relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts (the assumption of temporary certainty of the facts of economic activity).

6. The organization’s accounting policies must ensure:

- completeness of reflection in accounting of all facts of economic activity (completeness requirement);

- timely reflection of the facts of economic activity in accounting and financial statements (timeliness requirement);

- greater willingness to recognize expenses and liabilities in accounting than possible income and assets, avoiding the creation of hidden reserves (requirement of prudence);

- reflection in accounting of facts of economic activity based not so much on their legal form, but on their economic content and business conditions (the requirement of priority of content over form);

- the identity of analytical accounting data with turnovers and balances on synthetic accounting accounts on the last calendar day of each month (consistency requirement);

- rational accounting, based on business conditions and the size of the organization (the requirement of rationality).

6.1. When forming an accounting policy, microenterprises and socially oriented non-profit organizations have the right to provide for the maintenance of accounting records using a simple system (without using double entry).

(clause 6.1 was introduced by order of the Ministry of Finance of Russia dated December 18, 2012 No. 164n)

7. When forming an organization’s accounting policy on a specific issue of organizing and maintaining accounting, one method is selected from several allowed by the legislation of the Russian Federation and (or) regulatory legal acts on accounting. If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method, based on this and other accounting provisions, as well as International Financial Reporting Standards. At the same time, other accounting provisions are applied to develop an appropriate method in terms of similar or related facts of economic activity, definitions, recognition conditions and procedures for assessing assets, liabilities, income and expenses.

8. The accounting policy adopted by the organization is subject to registration with the relevant organizational and administrative documentation (orders, instructions, etc.) of the organization.

9. Accounting methods chosen by the organization when forming its accounting policies are applied from the first January of the year following the year of approval of the relevant organizational and administrative document. Moreover, they are applied by all branches, representative offices and other divisions of the organization (including those allocated to a separate balance sheet), regardless of their location.

A newly created organization, an organization resulting from a reorganization, draws up its chosen accounting policy in accordance with these Regulations no later than 90 days from the date of state registration of the legal entity. The accounting policy adopted by the newly created organization is considered to be applied from the date of state registration of the legal entity.

III. Change in accounting policy

10. Changes in the accounting policies of an organization can be made in the following cases: changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting; the organization's development of new accounting methods.

The use of a new method of accounting implies a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information; significant changes in business conditions. A significant change in the business conditions of an organization may be associated with reorganization, change in types of activities, etc.

It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from the facts that occurred previously, or that arose for the first time in the organization’s activities.

11. Changes in accounting policies must be justified and formalized in the manner prescribed by paragraph 8 of these Regulations.

12. Changes in accounting policies are made from the beginning of the reporting year, unless otherwise determined by the reason for such a change.

13. The consequences of changes in accounting policies that have had or may have a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are assessed in monetary terms. The assessment in monetary terms of the consequences of changes in accounting policies is made on the basis of data verified by the organization as of the date from which the changed method of accounting is applied.

14. The consequences of changes in accounting policies caused by changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting are reflected in accounting and reporting in the manner established by the relevant legislation of the Russian Federation and (or) regulatory legal acts on accounting. If the relevant legislation of the Russian Federation and (or) a regulatory legal act on accounting do not establish a procedure for reflecting the consequences of changes in accounting policies, then these consequences are reflected in accounting and reporting in the manner established by paragraph 15 of these Regulations.

15. The consequences of changes in accounting policies caused by reasons other than those specified in paragraph 14 of these Regulations, and which had or could have a significant impact on the financial position of the organization, financial results of its activities and (or) cash flows, are reflected in the financial statements retrospectively, for except in cases where the assessment in monetary terms of such consequences in relation to periods preceding the reporting period cannot be made with sufficient reliability.

When retrospectively reflecting the consequences of changes in accounting policies, we proceed from the assumption that the changed method of accounting was applied from the moment the facts of economic activity of this type arose. Retrospective reflection of the consequences of a change in accounting policy consists of adjusting the opening balance under the item “Retained earnings (uncovered loss)” for the earliest period presented in the financial statements, as well as the values of related financial statements items disclosed for each period presented in the financial statements, as if the new accounting policy was applied from the moment the facts of economic activity of this type arose.

In cases where an assessment in monetary terms of the consequences of a change in accounting policy in relation to periods preceding the reporting period cannot be made with sufficient reliability, the changed method of accounting is applied to the relevant facts of economic activity that occurred after the introduction of the changed method (prospectively).

15.1 Small businesses, except issuers of publicly offered securities, have the right to reflect in their financial statements the consequences of changes in accounting policies that have had or may have a significant impact on the financial position of the organization, financial results of its activities and (or) cash flow, prospectively, except in cases , when a different procedure is established by the legislation of the Russian Federation and (or) a regulatory legal act on accounting.

(clause 15.1 was introduced by order of the Ministry of Finance of Russia dated November 8, 2010 No. 144n, as amended by order of the Ministry of Finance of Russia dated April 27, 2012 No. 55n)

16. Changes in accounting policies that have had or are capable of having a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are subject to separate disclosure in the financial statements.

IV. Disclosure of accounting policies

17. The organization must disclose the accounting methods adopted when forming its accounting policies, which significantly influence the assessment and decision-making of interested users of the financial statements.

Accounting methods are considered essential, without knowledge of the application of which by interested users of financial statements it is impossible to reliably assess the financial position of the organization, the financial results of its activities and (or) cash flows.

18. The first paragraph was excluded by order of the Ministry of Finance of Russia dated March 11, 200 No. 22n.

The composition and content of information on the organization's accounting policies on specific accounting issues subject to mandatory disclosure in financial statements are established by the relevant accounting regulations.

If financial statements are not published in full, information on accounting policies is subject to disclosure, at least in part directly related to the published data.

19. If the accounting policy of an organization is formed on the basis of the assumptions provided for in paragraph 5 of these Regulations, then these assumptions may not be disclosed in the financial statements.

When forming an organization's accounting policy based on assumptions other than those provided for in paragraph 5 of these Regulations, such assumptions, along with the reasons for their application, must be disclosed in the financial statements.

20. If, in preparing the financial statements, there is significant uncertainty about events and conditions that may cast significant doubt on the applicability of the going concern assumption, the entity must identify the uncertainty and clearly describe what it relates to.

21. In the event of a change in accounting policy, the organization must disclose the following information: - the reason for the change in accounting policy; — content of changes in accounting policies; — the procedure for reflecting the consequences of changes in accounting policies in the financial statements; - the amount of adjustments associated with changes in accounting policies for each item in the financial statements for each of the reporting periods presented, and if the organization is required to disclose information about earnings per share - also according to data on basic and diluted earnings (loss) per share ; - the amount of the corresponding adjustment relating to reporting periods preceding those presented in the financial statements - to the extent practicable.

If a change in accounting policy is due to the application of a regulatory legal act for the first time or a change in a regulatory legal act, the fact of reflecting the consequences of the change in accounting policy in accordance with the procedure provided for by this act is also subject to disclosure.

22. If the disclosure of information provided for in paragraph 21 of these Regulations for any particular previous reporting period presented in the financial statements, or for reporting periods earlier than those presented, is impossible, the fact of the impossibility of such disclosure is subject to disclosure together with an indication of the reporting period in which the corresponding change in accounting policy will begin to be applied.

23. If a regulatory legal act on accounting has been approved and published, but has not yet entered into force, the organization must disclose the fact of its non-application, as well as a possible assessment of the impact of the application of such an act on the organization’s financial statements for the period in which application begins .

24. Significant methods of accounting, as well as information about changes in accounting policies are subject to disclosure in the explanatory note included in the financial statements of the organization.

In the case of presentation of interim financial statements, they may not contain information about the accounting policies of the organization, if there have been no changes in the latter since the preparation of the annual financial statements for the previous year, in which the accounting policies were disclosed.

25. Changes in accounting policies for the year following the reporting year are announced in an explanatory note to the organization’s financial statements.

We draw up accounting policies - PBU 1/2008

In accordance with clause 4 of PBU 1/2008, the organization’s management system must include the following documents:

- working chart of accounts;

- primary forms, accounting registers and internal accounting documents;

- inventory procedure;

- methods for assessing assets and liabilities;

- rules for document flow and information processing;

- control mechanism for business operations;

- other documents necessary for organizing accounting.

In a typical situation from ConsultantPlus you will find examples of accounting policies for different taxation systems. Check whether you took into account all the changes in legislation for 2022 when drawing up your UE. And if you do not have access to the legal reference system, sign up for temporary demo access. It's free.

Results

It is not for nothing that PBU 1/2008 “Accounting Policy of an Organization” has the first serial number among all PBUs, since the UP is the most important document for organizing the accounting of an economic entity. The Regulations contain the rules for drawing up, approving and amending the CP, and also describe the procedure for choosing methods for maintaining BU.

See also the section “Accounting Policies - 2022”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.