In the accounting policy for the purposes of calculating income tax, the taxpayer determines the procedure for maintaining tax accounting, which provides for a large number of different options.

Let's take a closer look:

- where and how the accounting policy for income tax is set in 1C;

- where profit tax rates are set by budget level;

- how to set up a list of direct expenses;

- how and why to indicate nomenclature groups for the sale of products and services;

- and much more.

Accounting policy for income tax

Each enterprise must develop an accounting policy regarding profit taxation that fully takes into account the nuances of its activities.

Read more Income tax accounting policy designer

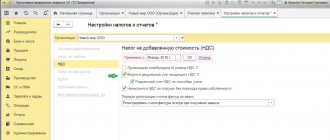

Setting up accounting policy parameters for income tax is carried out in the Main section - Settings - Taxes and reports - Income Tax tab.

This tab is available for editing only if tax system is General .

On it you need to determine the general parameters of tax accounting in 1C:

- methods of calculating depreciation;

- ways to pay off the cost of workwear and special equipment;

- cost distribution base if the organization conducts different types of activities;

- formation of reserves for doubtful debts;

- list of direct expenses;

- nomenclature groups for the sale of products and services;

- procedure for making advance payments.

Despite the fact that the accounting policy is formed once and applied consistently from year to year (Part 4 of Article 8 of the Federal Law of December 6, 2011 N 402-FZ), it is advisable to create it annually in the program, since the mechanisms of the program’s operation can be improved , legislation changes, etc.

To do this you need:

- Make any changes: you can simply flip the switch and return it to its place. In the Applies to specify the new year and click OK .

- Follow the link History of changes, create or copy the accounting policy for income tax of the previous year.

Let's figure out how to set this or that setting, what it affects, and how it will be reflected in the program.

Who applies PBU 18/02 and why?

PBU 18/02 is used by organizations on OSNO that do not have the right to simplified methods of accounting.

Setting up PBU 18/02 in 1C: Accounting 8.3:

The main thing is Accounting policy:

Look at our detailed analysis explaining what PBU 18 02 is in simple words:

- Why is the standard needed and who applies PBU 18/02

Tax rates

The standard tax rate for income tax established by the Tax Code of the Russian Federation is 20% (clause 1 of Article 284 of the Tax Code of the Russian Federation):

- 3% - to the federal budget;

- 17% goes to the regional budget.

The laws of the constituent entities of the Russian Federation may determine a reduced percentage of tax to be transferred to the regional budget, but up to 12.5%.

The corresponding income tax rates for budgets must be indicated in the fields:

- Federal budget;

- Regional budget.

In accordance with the specified rates, the program automatically calculates income tax when performing the Month Closing procedure. The calculated amount of tax by budget level is reflected in Sheet 02 of the Income Tax Declaration: PDF

- p. 140 - total rate;

- p. 150 - rate to the federal budget;

- p. 160 - rate to the regional budget.

Who has the right not to account for corporate income tax?

In accordance with PBU 18/02, accounting for NPs is not carried out (clauses 1, 2 of PBU 18/02):

- Companies and individual entrepreneurs that do not calculate taxes. These categories include: special regime officers - on the simplified tax system, UTII, Unified Agricultural Tax, as well as those executing a production sharing agreement and other persons exempt from paying tax in accordance with the provisions of Chapter. 25 Tax Code of the Russian Federation. Let us remind you that economic entities under special regimes pay a single tax and are exempt from the tax burden under NP.

- Credit organizations.

- State or municipal enterprises.

- Organization with simplified accounting. Moreover, if such organizations do not have NU, this must be reflected in the UP.

For information on who should apply PBU 18/02, see the article “ PBU 18/02 - who should apply and who should not?” "

Depreciation method

In the accounting policy for taxable assets for depreciable objects, it is necessary to establish one of the methods for calculating depreciation (clause 1 of article 259 of the Tax Code of the Russian Federation):

- linear method;

- nonlinear method.

The transition from one method to another can be carried out once every 5 years from the beginning of the next tax period.

For buildings, structures, transmission devices and intangible assets included in depreciation groups 8-10, the linear method of calculating depreciation is always used, regardless of this setting (clause 3 of article 259 of the Tax Code of the Russian Federation).

Unlike accounting accounting, the method of calculating depreciation in NU is specified only in the accounting policy settings, without the possibility of changing it in the document for putting depreciable property into operation.

Learn more Depreciation of fixed assets

Method of paying off the cost of workwear and special equipment

The material costs for NU take into account the costs of purchasing special clothing and special tools that are not depreciable property (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

In the accounting policy for NU, it is necessary to fix one of the possible options for including the cost of workwear (special equipment) in expenses:

- according to the chosen method:

- linear;

- proportional to the period of use (volume of produced products, works, services);

- completely at the time of its commissioning.

When commissioning materials, their intended use is indicated.

Income Tax tab affects transactions :

- One-time - the cost is included in expenses in full at the time of their transfer into operation, regardless of the settings of the control unit;

- Indicated when transferring into operation - the procedure for recognizing material expenses in the NU is used directly from the document Transfer of materials into operation in the section Warehouse - Workwear and equipment - Transfer of materials into operation.

In this case, when posting the document Transfer of materials into operation, there will be no cost recognition postings, because The repayment method is set to Linear .

Expenses will be recognized when closing the month of the operation Repayment of the cost of workwear and special equipment.

Learn more Transfer of special clothing into service

What are the differences between income tax in accounting and tax accounting?

To reflect operations on the formation of income tax (hereinafter referred to as NP), PBU 18/02 “Accounting for calculations of income tax of organizations” is used.

In accordance with PBU, a business entity must distinguish between accounting profit and profit for calculating NP. Profit in accounting (hereinafter referred to as BU) is adjusted for differences that arise between accounting records and tax calculations, forming profit in tax accounting (hereinafter referred to as TA). These differences are divided into temporary and permanent (clause 3 of PBU 18/02). There are two types of temporary differences - deductible and taxable (clause 10 of PBU 18/02). Deductible temporary differences form deferred tax liabilities (DTL). Such differences occur if the amount of expenses according to the financial accounting system exceeds the amount of expenses in the financial accounting system or the amount of income in the financial accounting system exceeds the amount of income in the financial accounting system. IT is the product of the tax rate of 20% and the difference between the accounting and tax bases; the resulting “deferred tax” reduces the value of the tax base in the current period, while increasing the tax in subsequent periods. The reasons for the formation of ONO may be, for example, the use of unequal depreciation methods (in the accounting system the cost of a fixed asset can be written off faster than in the accounting system), the use of a depreciation bonus in the accounting system (in the accounting system the depreciation bonus is taken into account in expenses, for accounting this concept does not exist), purchase of workwear (in BU the cost of clothing is written off gradually, in NU - immediately). Taxable differences, or deferred tax assets (DTA), on the contrary, occur when expenses in the accounting system exceed expenses in the accounting system and income in the accounting system exceeds income in the accounting system. For example, the sale of a fixed asset at a loss (if the accounting system recognizes the loss immediately, and in the accounting system gradually), the gratuitous receipt of a fixed asset not from the founder (in the accounting system, the income from the received fixed asset will be taken into account immediately in non-operating income, in the accounting account the amount of income will be taken into account in parts the entire depreciation period). The algorithm for determining ONA is similar to that used when calculating ONA, while the resulting value, on the contrary, increases the IR of the current period, but reduces the future IR.

ConsultantPlus experts explained step by step how to apply PBU 18/02 when permanent and temporary differences arise. To do everything right, get a trial demo access to the K+ system and switch to the Ready-made solution for free.

Let us consider with examples the emergence and calculation of ONA and IT.

Example 1

The amount of costs incurred in connection with the depreciation of fixed assets as of June 30, 2021, in the accounting system amounted to 1,500,000 rubles, in the national accounting system - 1,300,000 rubles.

Let's determine the difference between BU and NU:

1 500 000 – 1 300 000= 200 000.

Note that the resulting difference is due to different rules for calculating depreciation provided for by the accounting policy (hereinafter referred to as the UP), taking into account the requirements of PBU 6/01 and Chapter. 25 Tax Code of the Russian Federation. This discrepancy led to the formation of ONA in the amount of 20% × 200,000 = 40,000 rubles. IT will be written off as the amount of depreciation in NU increases.

ATTENTION! From 2022, PBU 6/01 will no longer be in force. It will be replaced by the new FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”.

Find out how an organization can switch to accounting for fixed assets and capital investments in accordance with FAS 6/2020 and FAS 26/2020 in ConsultantPlus. If you do not have access to the K+ system, get a trial demo access for free.

Example 2

When putting a fixed asset into operation, the organization applied a depreciation bonus in accordance with clause 9 of Art. 257 of the Tax Code of the Russian Federation in the amount of 10%. The initial cost of the fixed asset is RUB 7,000,000.

The amount of depreciation bonus that can be taken into account in expenses for NU was 7,000,000 × 10% = 700,000 rubles. For the purpose of calculating BU, the specified expense cannot be taken into account, since PBU 6/01 does not provide for this. In accounting, an IT will be formed in the amount of 20% × 700,000 = 14,000 rubles, which will be repaid after the cost of the specified fixed asset is completely written off.

PBU 18/02 also highlights permanent differences. Permanent differences are classified into permanent tax expense (PTR) and permanent tax income (PTI) (clause 4 of PBU 18/02). PNR has the same principle of occurrence as ONA, since PNR increases the value of the NP of the reporting period. The main difference between the two differences is that the PNR will not be taken into account in the future when calculating the tax. PND has common features with ONO, reducing the tax of the current period, but just like PNR, it is not written off later. The value of PNR and PND is calculated as the product of the difference between BU and NU and the rate of 20%.

Let's look at examples.

Example 3

The organization in 202021 incurred advertising expenses in the amount of 850,000 rubles. At the same time, revenue for the specified period amounted to 50,000,000 rubles.

In accordance with paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, advertising expenses for the purposes of NP can be taken at a value not exceeding 1% of revenue.

The organization has the right to take into account 1% × 50,000,000 = 500,000 rubles in expenses.

The difference between BU and NU will be 850,000 – 500,000 = 350,000 rubles.

PNR - 350,000 × 20% = 75,000 rubles.

Example 4

The tax authority returned the previously overpaid property tax in the amount of 300,000 rubles to the organization’s current account.

In the accounting system, the specified amount will be reflected in income, while in the tax accounting system, tax refunds are not recognized as income when determining the taxable base when calculating income tax (subclause 21, clause 1, article 251 of the Tax Code of the Russian Federation).

Thus, an IPA of 300,000 × 20% = 60,000 rubles will be generated.

Base for distribution of expenses by type of activity

This section sets up the basis for the distribution of so-called “general” expenses when combining the following types of activities:

- For organizations - a combination of the general taxation system (OSNO) and UTII. The setting is available when you enable the UTII on the Tax system . PDF

- For individual entrepreneurs - a combination of the general taxation system (OSNO) and UTII (PSN). The setting is available when you enable the UTII and (or) the Patent on the Tax system . PDF

According to paragraph 9 of Art. 274 of the Tax Code of the Russian Federation and clause 7 of Art. 346.26 of the Tax Code of the Russian Federation (clause 6 of Article 346.53 of the Tax Code of the Russian Federation), taxpayers are required to keep separate records of property, liabilities and business transactions in relation to business activities on OSNO and activities subject to UTII taxation (PSN).

When combining several types of activities, the organization’s expenses can be divided into three groups:

- expenses for activities on OSNO - are taken into account when calculating the tax base for income tax (for individual entrepreneurs - personal income tax) in full;

- expenses that can be fully attributed to activities on UTII (PSN) are not taken into account when calculating income tax;

- “general” expenses, which cannot be directly attributed to any type of activity, are associated simultaneously with activities on OSNO and on UTII (PSN).

“General” expenses cannot be directly attributed to OSNO or UTII (PSN) and must be distributed in proportion to the share of income from a specific activity in the total income for all types of activity.

In the program, the order of distribution of expenses by type of activity is configured directly in each cost item of the Cost Items directory.

If in the Cost Item section in Item section for accounting expenses of the organization the switch is set to For different types of activities , such expenses will be distributed among the types of activities OSNO and UTII (PSN) in proportion to the distribution base in the Month Closing .

At the same time, there is no consensus on whether non-operating income is taken into account when determining the base for distribution. The Federal Tax Service is of the opinion that non-operating income should not be included in the distribution of expenses (Letters of the Federal Tax Service of the Russian Federation dated March 24, 2006 N 02-1-07/27, dated September 28, 2005 N 02-1-08/ [email protected] , Letter of the Federal Tax Service of the Russian Federation on Moscow dated October 28, 2005 N 20-12/78737).

The opinion of the Ministry of Finance of Russia is ambiguous: for example, in Letters dated 02/18/2008 N 03-11-04/3/75 and dated 03/14/2006 N 03-03-04/1/224 it is stated that non-operating income is involved in determining the proportion, and Letter dated 03/17/2008 N 03-11-04/3/121 and dated 06/28/2007 N 03-11-04/3/237 provide other explanations.

Each taxpayer must independently indicate in the accounting policy the basis for the distribution of “general” expenses - taking into account non-operating income or without them.

The program offers two options for distributing expenses:

- Sales income only;

- Income from sales and non-operating.

In the operation Calculation of shares of write-off of indirect expenses of the Month Closing procedure, the UTII column will reflect the share in accordance with which the distributed expenses will be attributed to UTII (PSN).

Sales income only

When choosing the distribution method Only income from sales, the OSNO base is calculated as revenue reflected on the credit of account 90.01.1 “Revenue from activities with the main taxation system” minus the VAT amounts on the debit of account 90.03 “Value added tax”.

The base for UTII (PSN) is equal to the revenue that is reflected in the credit of account 90.01.2 “Revenue from certain types of activities with a special taxation procedure.”

In this case, the share of “total” expenses attributable to UTII will be determined by the formula:

Income from sales and non-operating

When choosing the method of distribution of sales and non-operating income, non-operating income is also added to the base according to OSNO: turnover on the credit of account 91.01 “Other income” minus VAT on the debit of account 91.02 “Other expenses”.

Then the share of “total” expenses attributable to UTII will be determined by the formula:

“General” expenses that relate to different types of activities are distributed in proportion to the calculated share in the Month Closing :

- in the operation Closing accounts 20, 23, 25, 26 , general business expenses distributed to: OSNO - are debited to account 90.08.1 “Administrative expenses for activities with the main taxation system”;

- UTII - written off to the debit of account 90.08.2 “Administrative expenses for activities with the main taxation system” (with the direct costing distribution method).

- OSNO - to account 90.07.1 “Sale expenses for activities with the main tax system”;

Balance sheet method of maintaining PBU 18/02

In the 1C Accounting 8 program, accounting for permanent and temporary differences PBU 18/02 is carried out using the balance sheet method.

The difference that arises between the book value of an asset (liability) and its tax value is temporary (clause 8 of PBU 18/02).

With the balance sheet method, temporary differences are determined on the reporting date, in 1C - on the last day of the month.

- What is the balance sheet method of maintaining PBU 18/02

Basic concepts of PBU 18/02

Temporary difference is a difference in accounting and accounting regulations that arises in the valuation of assets or liabilities (on balance sheet accounts).

How to determine the type of temporary difference.

- Temporary differences

- Procedure for determining temporary differences

Register of temporary differences

The register for accounting for temporary differences is an accounting register for determining temporary differences and deferred tax (ONA, ONO) for them.

It is formed by assets and liabilities and their corresponding accounts.

The register form was proposed by the National Accounting Standards Bureau BMC in Recommendation dated December 11, 2019 N R-109/2019 - Kpr “Register for accounting for temporary differences.”

The register is filled out taking into account the rules:

- written with a sign: “+” - asset value;

- “-” — cost of obligations;

- “+” - VVR x 20% = SHE;

- Temporary difference register

- Balance sheet method without reflecting PR and BP

Constant difference

Permanent differences are income and expenses:

- forming accounting profit (loss), but NEVER taken into account when determining the tax base, and vice versa:

- forming (reducing) the tax base, but not affecting accounting profit (loss).

Watch the video to understand the constant differences:

- Constant differences

- Expenses not accepted by NU. Formation of the People's Republic of Poland

Income tax expense

Income tax expense (income) is the amount of income tax that reduces (increases) profit (loss) before tax.

or

- Income tax expense (RPT)

- Memo on maintaining PBU 18/02 using the balance sheet method in 1C: Accounting

Checkbox Create provisions for doubtful debts

In tax accounting, creating a reserve is a right, i.e. the taxpayer may or may not create a reserve for doubtful debts (Letter of the Ministry of Finance of the Russian Federation dated May 16, 2011 N 03-03-06/1/295).

The taxpayer has the right to refuse to create a reserve from the beginning of the new tax period by making changes to its tax accounting policy (Article 313 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated September 21, 2007 N 03-03-06/1/688).

More details Accounting policy parameters for the purposes of Tax accounting for income tax

Doubtful debts (Article 26 of the Tax Code of the Russian Federation) are debts to an organization that arose during the sale of goods, works and services, which are not repaid within the time limits established by the agreement, and are not secured by a pledge, surety, or a bank guarantee.

An organization's receivables are considered doubtful if they are NOT repaid or with a high degree of probability will NOT be repaid within the time limits established by the agreement and are not secured with appropriate guarantees.

In tax accounting, the reserve for doubtful debts cannot exceed 10% of the revenue of the reporting period, determined in accordance with Art. 249 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated November 16, 2006 N 03-03-04/2/245).

In accounting, creating a reserve for doubtful debts is an obligation, including for small businesses (PBU 21/2008). But unlike NU, each taxpayer must develop the methodology for creating a reserve in accounting policies independently in their accounting policies, and, in our opinion, it is unacceptable to apply tax accounting rules.

More details Example of a Methodology for creating provisions for doubtful debts

In the program, support for the formation of a reserve for doubtful debts is specified:

- in accounting - in the form Accounting policy ; PDF

- in tax accounting - in the Tax and reporting settings form - Income tax tab.

In this case, the tax accounting program calculates the reserve using the following algorithm:

- if the duration of the debt exceeds 45 calendar days, then a reserve is accrued in the amount of 50% of the amount of the debit balance of accounts 62.01 and 76.06;

- if the period exceeds 90 days - then in the amount of 100%.

The debt period is calculated based on the number of days that have passed since the sale of goods (work, services) to the buyer. It is indicated:

- in the general specified parameters in Administration - Program Settings - Accounting Parameters - link Terms of payment by buyers - Deadline for payment of debt by buyers;

- in a specific agreement with the buyer, if the Payment term .

Learn more Buyer payment terms

In 1C: Accounting 3.0, reserves for contracts are currently only in rubles.

The creation of a reserve is carried out when performing the procedure Closing the month with a routine operation Calculation of reserves for doubtful debts.

How to organize tax accounting?

The procedure for organizing NU is stated in Art. 313 Tax Code of the Russian Federation. In accordance with this norm, business entities calculating NP need to formulate an accounting policy (hereinafter referred to as UP) for NP purposes. The UE should reflect the main points of the NU, which make it possible to determine the possibility of including income and expenses in the taxable base. In addition, the UE contains tax registers developed and used by the organization, from which one can see the composition of income and expenses involved in the formation of the tax base.

Based on the NU data, the taxpayer draws up a tax return, the form of which was approved by order of the Federal Tax Service of Russia dated September 23, 2019 N ММВ-7-3/ [email protected]

Find out what issues are reflected in the accounting policy for income tax accounting in ConsultantPlus by receiving trial demo access to the K+ system.

Link List of direct expenses

In tax accounting, expenses associated with production and sales are divided into two types: direct and indirect (Article 318 of the Tax Code of the Russian Federation):

- direct expenses reduce the tax base at the time of sale of products, works, services in the cost of which they are taken into account;

- indirect - at the moment of their occurrence.

The list of costs that relate to direct costs is determined by Art. 318 Tax Code of the Russian Federation:

- material costs;

- labor costs and compulsory insurance (insurance premiums and contributions for personal insurance and labor protection);

- the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect expenses include all other expenses incurred by the taxpayer during the reporting (tax) period, with the exception of non-operating expenses determined in accordance with Art. 265 Tax Code of the Russian Federation.

The list of direct expenses for NU is determined in the accounting policy independently by the taxpayer. It must be economically justified and applied for at least 2 tax periods.

In our opinion, it is necessary to include in the accounting policy for NL all direct expenses that are part of the finished product (work, services), i.e., initial elements.

In 1C, the list of direct costs for the production of finished products, performance of work, and provision of services is specified using the link List of direct costs . When you open the link, the list is displayed only for the year for which the accounting policy was drawn up.

For trade, there are special rules for determining direct costs.

Direct expenses for the sale of purchased goods (Sheet 02 Appendix No. 2 p. 020) include:

- cost of goods sold NU Dt 90.02.1 “Cost of sales for activities with OSNO” Kt 41, 45;

- direct transportation costs under Art. 320 of the Tax Code of the Russian Federation, NU Dt 90.07.1 “Sale expenses for activities with OSNO” Kt 44.01, having Type of expense (NU) - Transportation expenses .

Direct expenses for trading activities at the link a list of direct expenses ; the program will classify them as direct expenses based on other criteria.

The list of direct expenses on the Income Tax must be completed annually even if the list has remained unchanged.

The list of direct expenses in 1C for the current year can be set:

- in accordance with Art. 318 Tax Code of the Russian Federation;

- according to last year's records;

- manually yourself.

List in accordance with Art. 318 Tax Code of the Russian Federation

When choosing this method for determining direct costs in the information register Methods for determining direct production costs in NU, a list of costs will be automatically created in accordance with Art. 318 Tax Code of the Russian Federation.

If you click on the Yes , the list will be filled in automatically; if you click on the No , it will remain empty, allowing you to fill it out yourself.

List according to last year's entries

When creating a list for the next year, the program will offer to copy the list for the previous period.

If you click on the Yes , the records of the previous period will be copied to the current year; if you click on the No , you will be asked to fill out the list in accordance with Art. 318 Tax Code of the Russian Federation.

List manually yourself

With this method, it is necessary to abandon the automatic completion of the list and create entries in the register Methods for determining direct production costs in NU manually in accordance with the accounting policy according to the following rules.

Methods for determining direct production costs in NU

To indicate the parameters for attributing costs to direct costs, you need to create an entry in the information register Methods for determining direct production costs in NU , where the following must be filled in:

- Validity year —the year within which this entry is valid. Therefore, it is important to complete the list of direct expenses every year.

- Organization - a specific organization for which an entry is made in this register: for each organization its own list of direct expenses is created.

- Type of expenses NU - type of direct expense, which is selected from a predefined list of expenses. The type of expense (CO) is also required to be indicated for each cost item in the Cost Items directory.

If the method of attributing costs to direct ones is set, as shown in the figure above, then in this example, all costs whose cost items have Expense Type (OU) Depreciation .

In our opinion, it is not entirely correct to set rules for determining the list of direct expenses based only on the Type of Expense (NU) . Therefore, it is necessary to add clarifying parameters to classify flow as direct.

It can be:

- Division - a division for which direct costs are accumulated.

- Dt account is a cost accounting account, the debit of which accumulates direct costs. These could be bills of 20, or . If you set a rule in this field to include expenses recorded on account 44 in direct costs, then it will not work, since the program will always consider costs recorded on account 44 to be indirect. To attribute the costs recorded on the account to direct expenses in tax accounting, in addition to setting up the information register Methods for determining direct production costs in tax accounting , you also need to set up the distribution of indirect costs to the cost of products (works, services). That is, Methods for distributing general production and general economic expenses of organizations (section Main - Settings - Accounting Policies). PDF

- Account Kt is an account that corresponds with the direct cost account specified in the Account Dt . It can be anything, for example, account 10.01 “Raw materials and materials”.

- Cost item is a cost item in the Cost Items for which direct costs are accumulated.

According to the method of attributing expenses with the clarifying parameters indicated above in the figure, only expenses under Dt account 20 “Main production” and Kt 10.01 will be considered direct expenses. In this case, the analytics for account 20 should be as follows:

- Division - Production ;

- cost item Material costs (main production), which has Type of expense (NU) Material costs .

Recognition of direct expenses

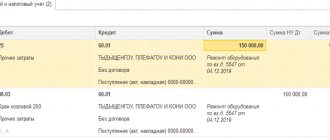

Direct costs are recognized as expenses that reduce the taxable base of the current period after the sale of finished products, works, and services. They are reflected according to Dt 90.02.1 “Cost of sales for activities with the main tax system”:

- when selling finished products in the document Sales of goods (invoice) ;

- when implementing production work, services in the document Provision of production services ;

- when implementing “ordinary” work, services when adjusting the calculation of the cost of finished products, work, services at the time of the month-end closing procedure in the operation Closing accounts 20, 23, 25, 26 .

Income tax return

Direct expenses in the Profit Tax Declaration are reflected in Sheet 02 of Appendix No. 2 as follows:

- line 010 - the amount of direct expenses related to sold finished products, services provided, work performed: turnover according to NU Dt 90.02.1 “Cost of sales for activities with the main taxation system” minus turnover NU Dt 90.02.1 Kt 41, 45.

- turnover according to NU Dt 90.02.1 “Cost of sales for activities with the main taxation system” Kt 41, 45 (line 030);

Costs that are not listed in the List of Direct Costs are indirect.

How to maintain corporate income tax accounting?

In the BU NP account 68 is used, to which the “Income Tax” subaccount is opened (for example, 68.01).

It is necessary to highlight the following sequence of reflection in the accounting of transactions for calculating NP:

- Accrual of conditional expenses - Dt 99 Kt 68.01 or conditional income - Dt 68.01 Kt 99.

Conditional expense is a tax calculated at a rate of 20% on accounting profit. Conditional income is the amount of tax in the accounting system determined from the loss that is formed on the basis of accounting data (clause 20 of PBU 18/02).

For example, in accordance with the accounting system, the amount of profit for the 1st quarter. 2022 - 1,100,000 rub. The conditional expense will be determined as 20% × 1,100,000 = 220,000 rubles.

- Reflection of entries for differences that have arisen: Dt 09 Kt 68.01 - ONA;

- Dt 68.01 Kt 77 - IT;

- Dt 99 Kt 68.01 - Poland;

- Dt 68.01 Kt 99 - PND.

In this case, the repayment of the differences will be reflected in “mirror” entries: Dt 68.01 Kt 09 - repayment of IT, Dt 77 Kt 68.01 - repayment of IT.

The conditional expense (income) reflected in the accounting, as well as temporary and permanent differences, form a current IR or loss in account 68, the value of which will be reflected in the IR declaration.

Let's look at an example.

The organization reflected the following income and expenses for 2022:

| Article | BOO |

| Total income: | 5 420 000 |

| sales income | 3 300 000 |

| free receipt of property | 780 000 |

| Other income | 1 340 000 |

| Total expenses: | 2 165 000 |

| depreciation | 700 000 |

| salary | 1 000 000 |

| entertainment expenses | 65 000 |

| employee meals | 150 000 |

| other expenses | 250 000 |

| Accounting profit | 3 255 000 |

In the NU register, the organization will reflect the following income and expenses:

| Article | WELL |

| Income: | 4 640 000 |

| sales income | 3 300 000 |

| Other income | 1 340 000 |

| Expenses: | 1 840 000 |

| depreciation | 600 000 |

| salary | 950 000 |

| entertainment expenses | 38 000 |

| other expenses | 250 000 |

| Profit | 2 800 000 |

Thus, in the organization’s accounting, the following differences have been identified between accounting and financial accounting:

| Type of income (expense) | BOO | WELL | Difference | Cause |

| Free receipt of property | 780 000 | 0 | 780 000 | It is not income to NU according to subparagraph. 11 clause 1 art. 251 Tax Code of the Russian Federation |

| Depreciation | 700 000 | 600 000 | 100 000 | Different methods of calculating depreciation in accordance with Art. 257 Tax Code of the Russian Federation and PBU 6/01 |

| Salary | 1 000 000 | 950 000 | 50 000 | Different methods of forming a reserve for vacations, taking into account the requirements of Art. 324.1 Tax Code of the Russian Federation and PBU 8/2010 |

| Entertainment expenses | 65 000 | 38 000 | 27 000 | In NU 4% of labor costs: 950,000 × 4%, according to clause 2 of Art. 264 Tax Code of the Russian Federation |

| Employee meals | 150 000 | 0 | 150 000 | Unreasonable expenses for NU purposes, taking into account the provisions of paragraph 1 of Art. 252 Tax Code of the Russian Federation |

The organization on December 31, 2022 will reflect the following transactions:

Dt 99 Kt 68 - 651,000 rub. = 3,255,000 × 20% — accrual of conditional expenses for NP;

Dt 09 Kt 68 — 30,000 rub. = (100,000 +50,000) × 20% — accrual of ONA;

Dt 99 Kt 68 - 35,400 rub. = (27,000 +150,000)× 20% — accrual of commissions;

Dt 68 Kt 99 - 156,000 rub. = 780,000 × 20% — accrual of IPA

Thus, the current NP will be equal to RUB 560,400. = 651,000 + 30,000 +35,400 – 156,000.

In reporting in Form 2, the organization will reflect information on the calculation of NP in the following lines:

- 2300 - 3,255,000 - profit before tax;

- 2410 - 560 400 - current NP

- 2421 - 120,600 (156,000 - 35,400) - value of PND and PNR;

- 2450 - 30,000 - ONA amount;

If the organization had accrued IT, then the value for the specified difference would be shown on line 2430.

Payment for NP will be reflected by posting Dt 68.1 Kt 51 - 560,400 rubles.

Link Nomenclature groups for sales of products and services

A nomenclature group is a type of goods, works, services, i.e. a generalized concept that accumulates costs and revenues in the context of types of products, goods, works and services.

Using the link Nomenclature groups for sales of products and services, you must indicate the nomenclature groups associated with the sale:

- manufactured finished products;

- services provided;

- executed works.

Then in the income tax return, line 011 “revenue from the sale of goods (work, services) of own production” of Sheet 02 of Appendix No. 1 will be filled in automatically.

To fill out other lines of Appendix No. 1 to Sheet 02, there is no need to make special settings in the accounting policy.

Study in more detail Algorithm for automatically filling out Sheet 02 of Appendix No. 1 in the income tax return

The list of nomenclature groups for the sale of products and services should not contain nomenclature groups related to wholesale and retail trade.

Nomenclature Groups for all years and enter them using the link Nomenclature Groups for Sales of Products and Services . You can do this at any time, as soon as a new type of product or service has been added, by indicating them in these settings of the Accounting Policy for Income Tax .

Results

Applying the norms of PBU 18/02, organizations are faced with accounting for income tax calculations , which consists of reflecting entries for accounting for conditional expenses (income), as well as permanent and temporary differences. It should be noted that the current legislation does not provide for liability for non-application of the provisions of PBU 18/02.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for making advance payments

Advance payments for income tax are paid throughout the entire tax period (year).

Setting up the payment of advance payments of income tax in 1C is performed on the Income Tax of the accounting policy: section Main - Settings - Taxes and reports - Income Tax tab.

The choice of payment option determines:

- frequency of payment of advances on profit in 1C (in the Accountant’s Task List): Quarterly - Quarter ;

- Monthly according to estimated profit - Month ;

- Monthly based on actual profit - Month .

Quarterly

If over the previous four quarters, income from sales (Article 249 of the Tax Code of the Russian Federation) on average did not exceed 15 million rubles. for every quarter.

Monthly according to estimated profit

- Organizations - if over the previous four quarters, sales revenues (Article 249 of the Tax Code of the Russian Federation) on average exceeded 15 million rubles. for every quarter.

- Newly created companies pay monthly advance payments provided that the revenue exceeds 5 million rubles. per month or 15 million rubles. per quarter, starting from the month following the month in which such an excess occurred (clause 5 of Article 287 of the Tax Code of the Russian Federation).

Monthly based on actual profit

An organization can voluntarily switch to making advance payments of income tax on a monthly basis based on the actual profit received. In this case, it is necessary to notify the tax authority of your intention no later than December 31 of the year preceding the tax period (paragraph 7, paragraph 2, article 286 of the Tax Code of the Russian Federation).

The option of monthly advances based on actual profits can be recommended if revenue is seasonal. In this case, it may not be profitable to pay monthly advance payments calculated based on data from previous quarters—with peak sales.

“Actual” means that NU calculates income, expenses and financial results specifically for the current reporting period. Then the tax amount is determined and paid to the budget monthly.

The organization loses the right to quarterly transfer of advances and is obliged to transfer monthly advance payments based on the profit received in the previous quarter if (clause 2, clause 3 of Article 286 of the Tax Code of the Russian Federation):

- she did not submit an application to switch to the transfer of monthly advance payments based on actual profits - this is done before December 31 of the previous year (Article 286 of the Tax Code of the Russian Federation).

The law does not require notifying tax authorities about the transition to advances calculated on the basis of estimated profits.

See also:

- Income tax in 1C 8.3 Accounting step by step

- Notification to the Federal Tax Service about the transition to advance payments for income tax based on actual profit

- Transition to making advance payments of income tax based on actual profit

- Transition to monthly payment of advance payments for income tax from the beginning of the year

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Setting up an accounting policy for tax accounting in 1C: VAT When creating an accounting policy for tax accounting, a special place occupies...

- Setting up accounting policies for NU in 1C: USN If an organization uses the simplified tax system, the procedure for recognizing expenses in its tax...

- Setting up accounting policies for NU in 1C: Insurance premiums In most cases, insurance premiums are calculated automatically and not…

- Setting up Accounting Policies when switching from UTII to OSNO...