Title page

The title page contains the following information:

- the name of the organization that represents the accounting policy for tax purposes, as well as its TIN and KPP;

- code of the tax authority to which the document is submitted;

- year of commencement of the accounting policy;

- date and number of the order approving the accounting policy.

The organization presents the accounting policy in force in the calendar year in which the application for tax monitoring is submitted.

The signer is also indicated on the title page:

- “Manager” - if the report is submitted by the taxpayer,

- “Authorized representative” - if the document is presented by a legal or authorized representative of the taxpayer. In this case, the name of the representative and details of the document confirming his authority are indicated.

When separate accounting may be necessary

Separate accounting may be required as a result of the fact that significant changes have occurred in the company’s activities (clause 10 of PBU 1/2008). For example:

- you have changed or started new activities;

- you are changing the tax regime.

All these changes in activities may lead to the need to maintain separate accounting, and the methodology for such accounting must be prescribed in the accounting policy. If you do not do this, you will be charged additional taxes by calculation, will be required to pay penalties and will be fined.

Separate accounting may be required in accounting for income, expenses, and input VAT.

When implementing new types of activities, changes (additions) to the accounting policy can be made not only from the new year, but also during the current period.

Setting up accounting policies in 1C:ERP

:

If the organization is exempt from VAT, then you must set the flag The organization is exempt from VAT

.

In this case, input VAT upon purchase is included in the cost of goods (services), sales are carried out without VAT

.

If an enterprise carries out activities with different taxation procedures (sales of goods “Without VAT”, applies UTII, etc.), then it is necessary to set the Separate accounting for VAT taxation

.

If separate VAT accounting is used and it is necessary to maintain separate accounting of incoming VAT for itemized production costs, then you must set the Separate accounting of itemized production costs for VAT taxation

.

If separate accounting of itemized production costs for VAT taxation is used and a special procedure for accounting for VAT is applied for products with a long production cycle, then you must set the VAT accounting for long production cycle

.

If separate VAT accounting is used, you can set the flag VAT accounting is applied based on actual use

. In this case, input VAT upon receipt is not accepted for deduction, but awaits the precise determination of the type of activity in the sale (consumption) of goods.

Flag 5% threshold when distributing VAT by type of activity

determines the possibility of attributing the entire amount of VAT to deduction if the proceeds from sales of non-VAT-taxable activities in the current tax period did not exceed 5% of the total revenue for the organization.

Rule for selecting advances for registering invoices

determines the period during which an uncredited advance payment is taken into account without generating an Advance Invoice. The selected value affects the need to generate documents in the VAT Accounting Assistant.

When writing off VAT on expenses in primary documents, the expense item and expense analytics are not indicated in the documents. These parameters are reflected in the accounting policy settings in the section Direction of write-off of VAT not accepted for taxation

VAT

bookmarks .

Option for accounting for VAT separated from the cost of goods when changing the type of activity to a VAT-free one

determines the accounting procedure for corresponding changes in the type of activity of consignments of goods. The chosen accounting procedure determines the policy for attributing VAT, both already accepted for deduction (subject to restoration), and not yet accepted, but allocated from the cost of goods. Depending on the selected option, articles and analytics for VAT attribution are available for customization.

Figure 6 – Setting up VAT accounting

Separate accounting of income and expenses - elements of accounting policy

In cases where it is necessary to keep separate records of income and expenses, two elements must be reflected in the accounting policy:

- separate accounting of income;

- separate accounting of expenses.

Separate accounting for these elements is needed for targeted revenues (clause 2 of Article 251 of the Tax Code of the Russian Federation), as well as for the purposes of calculating income tax, Unified Agricultural Tax, single tax under the simplified tax system and special tax system.

All business activities as a whole, and not individual types of activities, are transferred to the general, simplified and unified agricultural tax regime. Therefore, a company cannot combine the general regime, simplified taxation system, unified agricultural tax, as well as simplified taxation system and unified agricultural tax. But the patent regime, which is allowed for individual entrepreneurs, is applied to specific types of activities. Therefore, an entrepreneur using PSN can combine it with OSN, simplified tax system or unified agricultural tax.

Separate accounting of income can be kept on separate sub-accounts to accounts 90 “Revenue” and 91 “Other income”, as well as using special tax registers.

Expenses can also be taken into account by opening separate sub-accounts to account 90 “Revenue” or using special tax registers. And you can calculate them:

- in proportion to the share of income from activities for a specific type of activity in the total income for all types of activities (clause 9 of Article 274 of the Tax Code of the Russian Federation);

- in proportion to the shares of income received within each tax regime in the total amount of income for all types of activities.

Accounting policy for tax purposes: VAT nuances

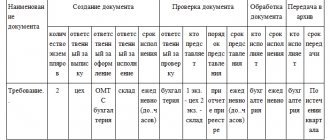

The VAT accounting elements collected in the following table are included in the accounting policy for 2022 - 2022, if necessary or optional, for the future.

| Tax | UE element | In what cases is it included in the UE? |

| VAT | Procedure for separate accounting of input VAT, level of materiality | When combining tax regimes, the presence of taxable and non-taxable transactions and transactions taxed at different rates, keeping records of transactions in joint activities, performing the functions of a trustee |

| Procedure for submitting input VAT for deduction | When carrying out transactions subject to VAT at a rate of 0% | |

| The procedure for accounting for prepayments for goods, works, services with a long production cycle | If there are such operations | |

| Using a Separate Division Index | If there are such units |

What is an accounting policy?

An accounting policy is an internal document of an organization or individual entrepreneur, which regulates the procedure for organizing accounting and tax accounting. The requirements for the development of accounting policies are given in Article 8 of the Law dated December 6, 2011 N 402-FZ and in PBU 1/2008, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n.

As for the accounting policy for tax accounting , there are only scattered requirements for it. Thus, Article 167 of the Tax Code of the Russian Federation contains general instructions for accounting policies for VAT, and Articles 313 and 314 of the Tax Code of the Russian Federation - for income tax. The code does not contain requirements for the procedure for drawing up and processing tax accounting policies.

The accounting policy establishes the choice of accounting method from those allowed by law, but if there is only one method of accounting for any transaction, then it is not necessary to indicate it. In cases where the method of accounting for a business transaction is not provided for by law, it must be developed independently and prescribed in the accounting policy.

To be sure that your accounting policies are correct, we recommend that you periodically review all necessary documents or involve professionals who will check your accounting and be able to identify all shortcomings and financial risks in a timely manner.

Free business audit

Typically, an accounting policy is formed every year, but if it is not approved for the new year, then last year’s policy continues to apply. During the year, the document can only be supplemented if a new type of activity has appeared in the taxpayer’s activities (for example, a trade organization has also begun to provide maintenance services for these goods) or the law has made changes to the provisions on accounting or taxes. As for the provisions already enshrined in the annual accounting policy, they can only be changed starting from the new year.

A newly created organization must approve its accounting policy no later than 90 days from the date of registration (clause 9 of PBU 1/2008), and for the purposes of calculating VAT - before the end of the quarter in which it was registered. It is recognized that the organization applies accounting policies from the moment of state registration.

The accounting policy is developed by the chief accountant or other person responsible for accounting, and approved by the manager or individual entrepreneur.

Individual entrepreneurs, who may not keep accounting, develop accounting policies only for taxation, and organizations - for accounting and tax accounting. Individual entrepreneurs must formulate an accounting policy for tax purposes:

- are VAT payers;

- working on the simplified tax system Income minus expenses;

- agricultural tax payers;

- when combining simplified taxation system and UTII.

To avoid disputes with tax authorities, we also recommend that all other individual entrepreneurs create an accounting policy for tax accounting.

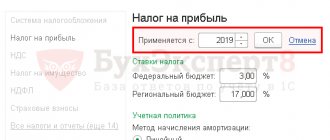

How to set up separate VAT accounting in 1C

Error-free accounting guarantees the correct parameters of the accounting policy/UP for the corresponding reporting period. In the section “Main-Settings-Accounting policies-Setting up taxes and reports”, open the corresponding tab and check the following sub-items:

Fig. 1 Accounting policy

Having checked the indicated points, we will have the option to indicate the procedure for accounting for VAT in the documents. He can be:

- Accepted for deduction

- Included in price

- Distributed

- For transactions at 0%

Thus, for each receipt there is a choice of determining VAT. This mechanism allows you to see input tax movements at any time, which makes VAT accounting clear and understandable.

At the next stage, in “Administration”, in the navigation we find “Accounting parameters - Setting up a chart of accounts”.

Fig.2 Setting options

Then check all the boxes.

Fig.3 Activating parameters

Step-by-step filling out the accounting policy

The main settings form opened before us. Let's look at filling out all the items step by step. Remember that these settings determine the rules for maintaining BU. Tax accounting is configured separately.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Specify the “ Method for assessing inventories ”. Here you have two ways to evaluate inventory:

- "Average";

- "According to FIFO."

The first method is to evaluate inventories by calculating the average cost for a group of goods. The second method calculates the cost of those inventories that were acquired earlier. Translated from English, this method sounds like “First in, first out.”

“ Method of valuing goods in retail ” - everything is simple here, but it’s worth considering that in tax accounting, goods are valued only at the cost of acquisition.

“ Main cost accounting account ” in accounting policy 1C 8.3 is used to substitute the default accounting account in documents and reference books. In our example, we left the account setting at 26. Depending on your organization’s accounting policy, this could be account 20 or 44.

In the parameter “ Activities for which costs are accounted for in account 20 “Main production””, mark the flags you need. When selecting at least one of the items, it will be necessary to indicate where general business expenses are included (in the cost of sales or production). Set up indirect cost distribution methods and other costing settings.

Next, indicate how expenses are recorded :

- By nomenclature groups (types of activity)

- By cost elements (recommended for preparing audited financial statements under IFRS).

- By cost item. In the event that the debt exceeds 45 days, a reserve is accrued in the amount of 50% of the amount of balances under Dt 62 and Dt 76.06, for 90 days 100%. Please note that reserves are formed only for ruble contracts and overdue debt.

Select the composition of the accounting reporting forms: complete, for small enterprises and for non-profit organizations.

Through the “Print” menu you can print accounting policy forms and various attachments to it: