Normative base

The following documents are used as the regulatory framework governing accounting relations and the procedure for calculating taxes for trademarks.

| №pp | Document Number | Document's name |

| Accounting and tax accounting | ||

| 1 | PBU 14/2007 | Accounting Regulations “Accounting for Intangible Assets” |

| 2 | GOST R 58591-2019 | Intellectual property. Accounting and intangible assets |

| 3 | IAS 38 | International Financial Reporting Standard “Intangible Assets” |

| 4 | — | Tax Code of the Russian Federation, Chapter 25, Art. 257 |

| 5 | No. 66n | Order of the Ministry of Finance dated July 2, 2010 |

| Trademark evaluation | ||

| 6 | No. 135-FZ | “On appraisal activities in the Russian Federation” |

| 7 | No. 297 (FSO No. 1) | Order of the Ministry of Economic Development of Russia on the approval of the Federal Valuation Standard “General Concepts of Valuation, Approaches and Requirements for Valuation” |

| 8 | No. 298 (FSO No. 2) | Order of the Ministry of Economic Development of Russia on approval of the Federal standard “Purpose of valuation and types of value” |

| 9 | No. 299 (FSO No. 3) | Order of the Ministry of Economic Development of Russia on approval of the Federal standard “Requirements for an assessment report” |

| 10 | No. 385 (FSO No. 11) | Order of the Ministry of Economic Development of Russia on approval of the Federal Standard “Valuation of Intangible Assets and Intellectual Property” |

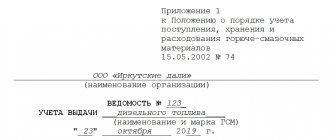

Costs for using a trademark

Expenses for the use of a trademark (TK received under license agreements, commercial concession agreements) are reflected depending on the procedure for paying fees for the right to use the TK (clause 39 of PBU 14/2007):

- In case of one-time payment as deferred expenses.

- For periodic payments - as current expenses.

The cost of the technical knowledge received for use is taken into account on the balance sheet. There is no separate account for such assets in the chart of accounts. It is recommended to create an off-balance sheet account yourself, for example, the “Intangible assets received for use” account.

Typical accounting entries for this case are shown in Table 2.

Accounting table

| No. | Contents of accounting entries | Accounts | |

| Debit | Credit | ||

| 1 | The cost of the received technical specifications is reflected | 012 “Intangible assets received for use” | |

| 2 | Expenses of future periods are reflected (one-time payment for the rights to use technical knowledge) | 97 | 60 (76…) |

| 3 | Reflects periodic payments for the right to use technical knowledge | 20 (26, 44…) | 60 (76…) |

| 4 | VAT on expenses associated with the use of the right to trademark. | 19 | 60 (76…) |

| 5 | Write-off of future expenses for current expenses (in accordance with accounting policies, usually monthly) | 20 (26, 44…) | 97 |

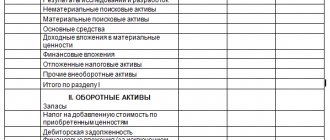

Balancing

According to PBU 14/2007 and the Tax Code of the Russian Federation, intangible assets can be included in accounting records if several basic conditions are met:

- The object must have no material form. Although a trademark is a marketing sign (logo, word or other types of trademarks) that can be used as tags, labels and stickers to mark products, it generally refers to intangible objects.

- The property must generate income in the future. This provision applies to both for-profit and non-profit organizations. For the former, the economic benefit lies in the use of a trademark for the production of products (labeling them) or the provision of services to satisfy management and marketing needs.

For non-profit organizations, the benefit from using the designation is to achieve their goals in accordance with the constituent documents, including business activities (Article 24 No. 7-FZ “On Non-Profit Organizations”).

- The right to receive economic benefits is confirmed by properly executed documents - a registration certificate, agreements on the transfer of rights to use a trademark, or documents justifying their receipt in the manner of universal succession.

- The organization exercises control over the object. Control consists in the presence of exclusive rights to the designation, which are confirmed by the state registration of the trademark in Rospatent.

- The object is intended for use for a period exceeding 12 months. According to the Civil Code of the Russian Federation, the term of legal protection for a trademark is 10 years, after which it can be extended for another 10 years.

- The initial cost of a trademark can be documented, that is, the costs of its acquisition can be calculated. Here we again return to the need for registration with Rospatent or documenting an alienation agreement or license, which also acquire their legitimacy only after registration with the patent office.

Trademarks: Accounting and Taxation

Vera Vladimirovna Sidorova, chief expert consultant at PRAVOVEST

Today we will introduce our readers to the procedure for accounting and tax accounting of operations for the creation, acquisition and use of a trademark.

| Help A trademark is a designation used to individualize goods, work performed or services provided by legal entities or individuals. The holder of an exclusive right (copyright holder) can be a legal entity or an individual engaged in entrepreneurial activities. A trademark can be developed independently or by specialized companies by concluding a copyright order agreement with them. Legal protection of a trademark is carried out on the basis of its state registration or by virtue of international treaties of the Russian Federation. The copyright holder (a person who has registered exclusive rights in the prescribed manner) can use and dispose of both the trademark and his right to the trademark. In accordance with Art. 25, 26 of the Law of the Russian Federation of September 23, 1992 No. 3520-1, there are two possible ways to transfer the rights to use a trademark to another person: granting an exclusive right (assignment of a trademark) and granting the right to use it under a license agreement. |

Accounting for the exclusive right to a trademark

Accounting for trademarks is carried out in accordance with regulatory acts on accounting and the Tax Code of the Russian Federation. In accounting, the exclusive right to a trademark refers to intangible assets (intangible assets). To recognize a trademark as an intangible asset, the following conditions must be met: – absence of a tangible (physical) structure; – the possibility of identification (allocation, separation) by the organization from other property; – use in the production of products (when performing work or providing services) or for the management needs of the organization; - long-term use, that is, a useful life exceeding 12 months or a normal operating cycle if it exceeds 12 months; — the organization does not intend to subsequently resell this property; — the ability to bring economic benefits (income) to the organization in the future; — the presence of properly executed documents confirming the existence of the asset itself and the organization’s exclusive right to the results of intellectual activity (patents, certificates, other documents of protection, agreement of assignment (acquisition) of a patent, trademark, etc.).

Trademarks recognized as intangible assets are accepted for accounting at their original cost (clause 6 of PBU 14/2000). Moreover, if the trademark was acquired by the copyright holder for a fee, then the initial cost is determined as the amount of actual acquisition costs (for example, amounts paid to the copyright holder (seller), information services, fees for intermediary organizations, state registration fees, etc.) for with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation). The initial cost of a trademark created by the organization itself is determined as the sum of the actual costs of development and production (material resources expended, labor costs, third-party services, duties, etc.) excluding value added tax and other refundable taxes.

In tax accounting, the exclusive right to a trademark is also an intangible asset (Clause 3, Article 257 of the Tax Code of the Russian Federation). To recognize a mark as an intangible asset for tax purposes, it is necessary to fulfill requirements essentially similar to those established in accounting:

- use in the production of products (performance of work, provision of services) or for the management needs of the organization for a long time (over 12 months);

- the ability to bring economic benefits (income) to the taxpayer;

- the presence of properly executed documents confirming the existence of the intangible asset itself and (or) the taxpayer’s exclusive right to the results of intellectual activity.

In tax accounting, as in accounting, the procedure for forming the initial value of intangible assets is provided.

Although the rules are similar, there are significant differences. For example, in accounting, the initial cost includes interest on borrowed funds (clause 27 of PBU 15/01), amount differences, while in tax accounting they relate to non-operating expenses (clause 2 of clause 1 of Article 265 of the Tax Code of the Russian Federation) . The initial cost will also differ if the trademark was received by the organization as a contribution to the authorized capital, received free of charge or under an agreement providing for the fulfillment of obligations in non-monetary means. In addition, in accordance with paragraph 3 of Art. 257 of the Tax Code of the Russian Federation, the cost of intangible assets created by the organization itself is defined as the amount of actual expenses for their creation, production (including material expenses, labor costs, expenses for services of third-party organizations, patent fees associated with obtaining patents, certificates), for excluding the amounts of taxes taken into account as expenses in accordance with the Tax Code of the Russian Federation.

For example, the unified social tax does not increase the initial cost of an intangible asset created by an organization, but relates to expenses depending on the chosen method of recognizing expenses and income.

It should be noted that the current legislation does not contain provisions allowing to change the initial cost of intangible assets in both accounting and tax accounting.

When considering the procedure for registering a trademark as an intangible asset, questions arise: what does the concept of “use in the production of products (performance of work, provision of services) or for management needs” mean? Is it possible to register a trademark as an intangible asset if it is not used by the copyright holder himself directly in the production of goods, but is provided under a contract to another person?

According to Art. 22 of the Law of the Russian Federation of September 23, 1992 No. 3520-1, the use of a trademark is considered:

- its use on goods for which the trademark is registered and (or) their packaging;

- use of a trademark in advertising, printed publications, on official letterheads, on signs, when displaying exhibits at exhibitions and fairs held in the Russian Federation, if there are valid reasons for not using the trademark on goods and (or) their packaging.

To understand these issues, we can try to draw an analogy with the recognition of property intended for rental as an object of fixed assets.

Before January 1, 2006, assets used in the production of products, in the performance of work or provision of services, or for the management needs of the organization were recognized as fixed assets. At the same time, property transferred for a fee for temporary use (lease) was not recognized as an object of fixed assets and was taken into account as part of profitable investments in material assets. In accordance with the amendments made to PBU 6/01 from January 1, 2006, objects intended for provision for a fee for temporary use are also recognized as fixed assets, but are reflected in accounting and reporting in a special way. The regulations on accounting for intangible assets do not contain either such clarifying norms or special rules for reflecting intangible assets that are not directly used by the copyright holder himself. Thus, the procedure for accounting for registered intellectual property (including trademarks) acquired (created) solely for the purpose of transferring registered intellectual property (including trademarks) for use to other persons is not regulated by law, therefore another way of recording such objects (not as intangible assets) seems quite problematic. The situation is similar in tax accounting. Indeed, in order to recognize an object (including a trademark) as an intangible asset, it is also necessary to use it in the production of products (performance of work, provision of services) or for management needs. But in this case, it is useful to remember that for tax purposes, the provision of rights to intellectual property for a fee is qualified as the provision of services (for example, in Article 148 of the Tax Code of the Russian Federation). This point of view was confirmed by the Ministry of Finance of the Russian Federation. This allows a trademark provided for use by other persons to be recognized as an intangible asset, since it meets the conditions specified in paragraph 3 of Art. 257 of the Tax Code of the Russian Federation, namely, directly participates in the process of providing services.

If the purpose of acquiring (creating) an object of intellectual property is subsequent resale, then, despite the ability of the trademark to bring economic benefit (income) to the taxpayer, use in the production of goods (work, services) does not occur. Officials of the Ministry of Finance of the Russian Federation did not give a specific answer to the question about the possibility of recognizing a trademark as an intangible asset in this case, only pointing out that depreciation charges on a trademark, calculated before the sale of the exclusive right, cannot be taken into account in reducing taxable profit. But, since we are talking about depreciation charges, apparently, the Ministry of Finance of the Russian Federation considers it necessary in this case to recognize such intellectual property objects as intangible assets.

If objects of intellectual property (including trademarks) are not used in activities aimed at generating income, then they are not recognized as intangible assets. Consequently, depreciation is not charged on them and expenses associated with their acquisition (creation) are not taken into account when calculating income tax and do not reduce taxable profit.

It should be noted that depreciation charges for a trademark registered for products that are not yet produced can be recognized as expenses for tax purposes provided, for example, that the trademark is used for advertising purposes.

Depreciation of the exclusive right to a trademark

In accounting, the cost of intangible assets is repaid by calculating depreciation using one of the methods set forth in the order on accounting policies (clauses 14, 15 of PBU 14/2000):

- linear;

- proportional to the volume of production;

- reducing balance.

During the reporting year, depreciation on intangible assets is accrued monthly in the amount of 1/12 of the annual amount, regardless of the calculation method used.

The useful life is determined based on the validity period of the trademark certificate or the expected time of use (clause 17 of PBU 14/2000). In this case, the useful life of the trademark should be reduced by the period the organization receives the certificate, since the registration of the trademark is valid until the expiration of ten years from the date of filing the application with Rospatent. Depreciation of intangible assets is reflected in accounting either on the credit of account 05 “Amortization of intangible assets”, or on the credit of account 04, on a special sub-account, which must be enshrined in the accounting policy.

When granting another person the right to use a trademark on the basis of a license agreement, the copyright holder must maintain separate accounting and depreciation of this asset (clause 25 of PBU 14/2000).

Depreciation of the exclusive right to a trademark in accounting refers to expenses for ordinary activities when the trademark is used directly by the copyright holder or the granting of rights is the main activity of the organization. If the transfer of the right to intangible assets for a fee for temporary use is not the subject of the organization’s activities, then the accrued amount of depreciation should be taken into account as part of operating expenses (clause 5 of PBU 10/99).

In tax accounting, the results of intellectual activity and other objects of intellectual property that are owned by the taxpayer, used by him to generate income and the cost of which is repaid by depreciation are recognized as depreciable property (clause 1 of Article 256 of the Tax Code of the Russian Federation). Depreciation of the exclusive right to a trademark is included in the costs associated with production and sales (Article 253 of the Tax Code of the Russian Federation). When granting the right to a trademark for use, the accounting procedure depends on the type of activity: if this activity is the main activity, then the accrued depreciation amounts are also included in the costs associated with production and sales (paragraph 2, paragraph 1, paragraph 1, Article 265 of the Tax Code RF). Otherwise, the costs of maintaining the intangible asset transferred under the agreement (including depreciation) are taken into account as non-sales assets.

It should be noted that there is no direct reference to this accounting procedure in the Tax Code, since the norm in paragraph. 1 pp. 1 clause 1 art. 265 of the Tax Code of the Russian Federation is defined only in relation to the costs of maintaining property transferred under a lease (leasing) agreement (including depreciation on this property). And according to Art. 128 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the results of intellectual activity, including exclusive rights to them (intellectual property), constitute an independent object of civil law.

Disposal of an intangible asset

In accordance with clause 22 of PBU 14/2000, the value of intangible assets, the use of which has been discontinued for the purposes of production, performance of work and provision of services, or for the management needs of the organization (due to the termination of a patent, certificate, other security documents, assignment (sale) ) exclusive rights to the results of intellectual activity or for other reasons) is subject to write-off. If depreciation charges are reflected in the accounting records on account 05 “Depreciation of intangible assets,” a simultaneous write-off of objects and amounts of accumulated depreciation charges is carried out. Income and expenses from the write-off of intangible assets are reflected in accounting in the reporting period to which they relate. When transferring the exclusive right to a trademark, the accounting records of the copyright holder reflect the disposal of intangible assets and income from the assignment of the exclusive right (clause 22 of PBU 14/2000). Funds from the sale of the exclusive right to a trademark are included in operating income, and expenses associated with the sale, disposal and other write-off of intangible assets are included in operating expenses (clause 11 of PBU 10/99).

When assigning rights to a trademark, tax accounting also reflects its disposal and recognizes income from sales (Clause 1, Article 249 of the Tax Code of the Russian Federation). Please note that Chap. 25 of the Tax Code of the Russian Federation contains practically no special provisions regarding the procedure for recording transactions for the sale of intangible assets. And in the above-mentioned article of the Tax Code we are talking about receiving proceeds from the sale of goods (works, services) and property rights without mentioning the rights to the results of intellectual activity. However, in Art. 41 of the Tax Code of the Russian Federation, income for tax purposes is any economic benefit in monetary or in-kind form, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined in accordance with the Tax Code of the Russian Federation.

In tax accounting (Article 323 of the Tax Code of the Russian Federation), profit (loss) from the disposal of depreciable property is determined on the basis of analytical accounting for each object on the date of recognition of income (expense). However, the procedure for recognizing expenses upon disposal of an under-depreciated intellectual property item is not clearly established in the Tax Code. It seems possible to extend the provisions of paragraphs to intangible assets. 8 clause 1 art. 265 of the Tax Code of the Russian Federation, which is defined for fixed assets.

Paragraphs are formulated in a similar way. 1 clause 1 art. 268 of the Tax Code of the Russian Federation, which determines that when selling goods and (or) property rights, the taxpayer has the right to reduce income from such transactions by the cost of goods sold and (or) property rights, and when selling depreciable property - by its residual value. Since intangible assets relate to depreciable property, this rule can be applied to them. It should be noted that legislators directly relate this provision with regard to determining the residual value only to property that complies with clause 1 of Art. 257 of the Tax Code of the Russian Federation - to fixed assets.

Taking into account the spread of general provisions for accounting for transactions for the sale of goods (works, services), property rights for transactions for the sale (assignment) of intangible assets, the following accounting procedure seems possible: profit from the assignment of the right to a trademark is subject to inclusion in the tax base in that reporting period , in which the assignment was made (Article 323 of the Tax Code of the Russian Federation); loss from the sale of intangible assets is included in other expenses evenly over a period defined as the difference between the useful life of this intangible asset and the actual period of its operation until the moment of sale (clause 3 of Article 268 of the Tax Code of the Russian Federation).

Granting the right to use a trademark

As noted, the right to use a trademark can be granted by the copyright holder (licensor) to another legal entity or individual engaged in business activities (licensee) under a license agreement in relation to all or part of the goods for which the trademark is registered. The license agreement must contain a condition that the quality of the licensee's goods will not be lower than the quality of the licensor's goods, and that the licensor will monitor compliance with this requirement. It is also possible to transfer a trademark under a commercial concession agreement: one party (the copyright holder) undertakes to provide the other party (the user), for a fee for a period or without specifying a period, the right to use in the user’s business activities a set of exclusive rights belonging to the copyright holder, including the right to a company name and (or) the commercial designation of the copyright holder, for protected commercial information, as well as for other objects of exclusive rights provided for in the contract - a trademark, service mark, etc. (Article 1027 of the Civil Code of the Russian Federation).

In the practice of licensed trade (including international), the following types of remuneration under license agreements are accepted:

- royalties – periodic payments (fixed amounts or percentages) during the entire term of the license agreement;

- lump-sum (one-time) payments – amounts fixed in the license agreement, paid at a time or in parts in several installments;

- combined (mixed) payments – periodic payments (royalties) combined with a lump sum payment.

Accounting with the licensor

The procedure for recording income from the transfer of rights to use a trademark in accounting depends on the nature of the payment (royalty, lump sum, combined) and the nature of the organization’s activities (main activity or one-time transaction). In accordance with clause 5 of PBU 9/99, revenue from ordinary activities is recognized as revenue. In the case of granting for a fee rights arising from patents for inventions, industrial designs and other types of intellectual property, it is considered to be receipts the receipt of which is associated with this activity (license payments (including royalties) for the use of intellectual property).

When generating income is not the subject of the organization's activities, income under the license agreement is classified as operating income. At the same time, according to paragraph 15 of PBU 9/99, license payments for the use of intellectual property objects (when this is not the subject of the organization’s main activity) are recognized in accounting based on the assumption of temporary certainty of the facts of economic activity and the terms of the relevant agreement.

If the provision of rights to use is provided for under a license agreement for a certain time period and a one-time payment is made, then such payment applies to the entire term of the agreement. Income received in the reporting period, but relating to subsequent reporting periods, is reflected in the balance sheet as a separate item as deferred income. Thus, one-time payments are reflected in account 98 “Deferred income” with subsequent write-off to income of the current period upon the onset of the reporting period to which they relate during the term of the agreement.

If license payments are periodic in nature (royalties) and the agreement establishes the frequency of accrual and payment, then in accounting the copyright holder recognizes such payments as part of the income of the period to which they relate, that is, in which the right to recognize them arises.

The procedure for reflecting income from the provision of a trademark for use in tax accounting also depends on whether this type of activity is the main one.

If the provision of rights is the main activity of the organization, license payments are taken into account as part of income from sales (Article 249 of the Tax Code of the Russian Federation), if non-core - as non-operating income (clause 5 of Article 250 of the Tax Code of the Russian Federation).

Under the accrual method, royalties are recognized in the reporting period in which they occurred, regardless of the actual receipt of funds (clause 1 of Article 271 of the Tax Code of the Russian Federation). And according to paragraphs. 3 p. 4 art. 271 of the Tax Code of the Russian Federation for non-operating income in the form of license payments (including royalties) for the use of intellectual property objects, the date of receipt of income is the date of settlements in accordance with the terms of concluded agreements or presentation to the taxpayer of documents serving as the basis for making calculations, or the last day of the reporting (tax) period. period. This is usually the last day of the month or quarter.

The lump sum payment is recognized evenly during the validity period of the license agreement on the last day of the month or quarter (clause 2 of Article 271 of the Tax Code of the Russian Federation).

With a combined (mixed) form of payment, a one-time payment is included in income in full at a time, and royalties are included as they accrue.

Under the cash method, income from the provision of a trademark for use is recognized on the day the funds are received in bank accounts or at the cash desk of the organization (Article 273 of the Tax Code of the Russian Federation).

Upon receipt of royalties

Upon receipt of a lump sum payment

Accounting with the licensee

The user organization reflects in its accounting the acquired right to use the trademark on an off-balance sheet account in the valuation established in the agreement. In accordance with clause 26 of PBU 14/2000, periodic payments for the granted right to use intellectual property objects, calculated and paid in the manner and within the terms established by the agreement, are included by the licensee in the expenses of the reporting period.

One-time payments are reflected in accounting as deferred expenses and are subject to write-off during the term of the agreement in the manner established by the organization (evenly, in proportion to the volume of production, etc.) in the period to which they relate (clause 65 of the Accounting Regulations) . Expenses for payments for the right to use intellectual property are related to expenses for ordinary activities as expenses associated with the manufacture and sale of products and the sale of goods (works, services) (clause 5 of PBU 10/99), and are included in the cost of products sold or expenses for sale, which are determined for the purpose of generating financial results for ordinary activities of the organization.

For tax purposes, royalties are recognized as other expenses associated with production and sales (clause 37, clause 1, article 264, clause 8, clause 2, article 256 of the Tax Code of the Russian Federation), and are taken into account when forming the tax base for income tax. Such expenses on the basis of Art. 318 of the Tax Code of the Russian Federation are indirect and fully relate to the expenses of the current reporting (tax) period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

One-time payments for tax purposes are recognized in the reporting period to which they relate (Article 272 of the Tax Code of the Russian Federation), based on the terms of transactions and the principle of uniformity and proportional formation of income and expenses (for transactions lasting more than one reporting period). Thus, one-time payments when calculating income tax will be reflected in equal shares during the validity period of the license agreement and will be included in costs associated with production and sales.

Under the cash method, the amounts of the license fee are taken into account as part of other expenses in the reporting period in which the payment occurred (clause 3 of Article 273 of the Tax Code of the Russian Federation).

It should be noted that costs must be justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

A license agreement on the transfer by the copyright holder of the right to use a trademark comes into force after its mandatory registration with the federal executive body for intellectual property (Article 27 of Law No. 3520-1). Consequently, until registration, license payments are not taken into account when calculating income tax.

When paying lump sum payments

* With regard to the amount of VAT accepted for deduction, it should be noted that Ch. 21 of the Tax Code of the Russian Federation does not contain a special rule requiring the deduction of VAT presented in parts, as a lump sum payment is recognized as an expense when calculating income tax. However, according to the tax authorities, the amount of input VAT should be distributed.

When paying royalties

About VAT calculation

When transferring or providing trademarks under a licensing agreement, the object of taxation with value added tax arises only if this right is transferred to residents of the Russian Federation (clause 4, clause 1, article 148 of the Tax Code of the Russian Federation). For the purposes of calculating VAT, the moment of determining the tax base is the earliest of the following dates (clause 1 of Article 167 of the Tax Code of the Russian Federation):

- day of shipment (transfer) of goods (works, services), property rights;

- day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

In this case, the moment of shipment will be recognized as the date of granting the use of rights for a one-time payment, the date of accrual of payments if they are periodic in nature in accordance with the terms of the contract.

We emphasize that the provision of trademarks under a license agreement with periodic payments (royalties) can be considered as a service provided over more than one VAT tax period, that is, of a continuing nature and provided virtually every day (by analogy with rent, protection of property and etc.). In this case, according to the Ministry of Finance of the Russian Federation, VAT should be calculated at the end of each month or quarter, depending on the tax period (Article 163 of the Tax Code of the Russian Federation) during which the relevant services were provided.

Of course, when drawing up a license agreement regarding the determination of the procedure for calculating periodic payments (royalties) in order to avoid disagreements with the tax authorities, this point of view should be taken into account regarding the moment of determining the tax base for VAT.

) art.

1 of the Law of the Russian Federation of September 23, 1992 No. 3520-1 “On trademarks, service marks and appellations of origin of goods” ), paragraph 3 of Art. 2 of the Law of the Russian Federation of September 23, 1992 No. 3520-1) clause 1 art. 2 of the Law of the Russian Federation of September 23, 1992 No. 3520-1

) clause 4 of the Accounting Regulations “Accounting for Intangible Assets” (PBU 14/2000), approved. By Order of the Ministry of Finance of the Russian Federation dated October 16, 2000 No. 91n

) Letter of the Ministry of Finance of the Russian Federation dated January 19, 2006 No. 03-03-04/1/40

) Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01), approved. By Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n

) Order of the Ministry of Finance of the Russian Federation dated December 12, 2005 No. 147n “On amendments to the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01”

) Letter of the Ministry of Finance of the Russian Federation dated March 30, 2005 No. 03-03-01-02/99

) Letter of the Ministry of Finance of the Russian Federation dated July 29, 2004 No. 07-05-14/199; Letter of the Federal Tax Service of the Russian Federation for Moscow dated 04/07/2005 No. 20-12/23565

) Letter of the Department of Tax Administration of the Russian Federation for Moscow dated November 10, 2003 No. 26-12/63423

) Law of the Russian Federation of September 23, 1992 No. 3520-1; clause 4 art. 264 Tax Code of the Russian Federation

) clause 5 of the Accounting Regulations “Expenses of the Organization” (PBU 10/99), approved. By Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n

) clause 7 of the Accounting Regulations “Income of the Organization” (PBU 9/99), approved. By Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n

) clause 81 of the Regulations on accounting and financial reporting in the Russian Federation, approved. By Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n

) pp. 37 clause 1 art. 264 Tax Code of the Russian Federation; Letter of the Ministry of Finance of the Russian Federation dated June 23, 2006 No. 03-03-04/1/542

) Letters of the Ministry of Finance of the Russian Federation dated 06/08/2006 No. 03-03-04/4/102, dated 03/14/2006 No. 03-03-04/1/230, dated 01/18/2006 No. 03-04-08/12

) Letter of the Department of Tax Administration of the Russian Federation for Moscow dated 08/10/2004 No. 24-11/52247

) Letters of the Ministry of Finance of the Russian Federation dated July 18, 2005 No. 03-04-11/166, dated May 21, 2001 No. VG-6-03/404

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

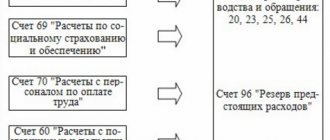

Accounting entries

Features of accounting entries for trademarks are as follows:

- The trademark is accepted for accounting first in account 08 “Investments in non-current assets”, in the subaccount “Acquisition of intangible assets”. The appearance of intangible assets on the organization's balance sheet should be reflected as the costs of their creation (or acquisition).

- After all costs have been collected and the initial cost of the trademark has been reflected, this asset at the time of its commissioning is transferred from account 08 to debit account 04. The start of use is documented by a commissioning certificate for intangible assets. Synthetic account 04 is intended to summarize information on the movement of existing intangible assets, as well as information on R&D expenses.

- Depreciation is reflected in account 05 “Depreciation of intangible assets”.

- If the trademark was created by the organization’s own resources, then the costs are accounted for in a separate sub-account opened to account 08.

Accounting scheme for trademarks

It should be borne in mind that registration of a trademark is not always successful. Rospatent may refuse to issue a certificate if the law is not complied with or if there is already a similar trademark in the state register. In this case, the organization will not have a new asset, and the costs for it will not be economically justified.

Using the services of patent attorneys from the Ezybrand bureau allows you to reduce financial risks and successfully register a trademark with Rospatent.

Find out more about registering a trademark at the Ezybrand patent office.

Trademark or trademark

There is no definition for such a concept as a “trademark” in our legislation. As a rule, it is understood as an element of individualization of any product or company that is not protected from a legal point of view. In fact, this is just a term for marketers, which is applied to such concepts as a trademark, trade names, etc. A trademark is represented by some kind of image, a combination of letters or an original name. If the organization that created the trademark decides to register the trademark in the state register, then it will be the exclusive copyright holder of the trademark. That is, a trademark is an already legally protected element of individualization of a company or product. The right to a mark is confirmed by a special certificate.

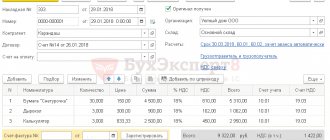

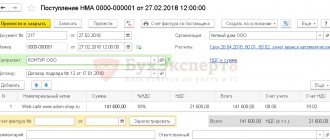

Postings when registering a trademark through the patent office

If the registration of a trademark is carried out by a third-party organization, then entries should be made in the company’s accounting records according to the example below.

| No. pp. | Debit | Credit | Amount, rub. | Posting Contents |

| 1 | 08 | 60 | 40 000 | Design studio developed a trademark |

| 2 | 19 | 60 | 7 200 | VAT submitted by the design studio |

| 3 | 60 | 51 | 47 200 | Payment for services for creating a trademark |

| 4 | 76 | 51 | 21 700 | Payment of state fees for filing an application, examination, registration and issuance of a certificate at Rospatent |

| 5 | 08 | 76 | 21 700 | Inclusion of state fees in the initial cost of a trademark |

| 6 | 04 | 08 | 68 900 | The trademark was put into operation according to the act |

| 7 | 68 | 19 | 7 200 | Acceptance for deduction of VAT claimed by the design studio |

| 8 | 20, 44 | 05 | 593, 96 (RUB 68,900: 116 months) | Depreciation calculation for a trademark |

Once a trademark is accepted for accounting, it can be depreciated. In this case, the useful life is calculated as follows:

Useful life = 120 months. – registration period (months);

Where

- 120 months is the validity period of a trademark certificate, which is 10 years, 10x12 months = 120 months.

- The registration period is the period from filing an application with Rospatent until the issuance of a state certificate for a trademark.

The duration of registration depends on the correctness of filling out the documents and averages 4-6 months.

Algorithms for accounting for transactions of acquisition (creation) of a trademark

In accounting, TK is reflected as part of intangible assets if:

- the conditions specified in clause 3 of PBU 14/2000 “Accounting for intangible assets” are met (approved by order of the Ministry of Finance of the Russian Federation dated December 27, 2007 No. 153n);

- the necessary documents have been drawn up - confirming the existence of the technical specification and the exclusive right to it from the company (certificate, purchase agreement for the technical specification, etc.).

Scheme of transactions for reflecting transactions of receipt of technical assignment:

| Debit | Credit | Contents of operation |

| 08 | 60 | Reflection of the cost of acquired technical specifications |

| 19 | 60 | VAT is allocated from the cost of technical specifications |

| 60 | 51 | The cost of technical specifications has been paid |

| 08 | 76 | Patent fees are included in the price of technical specifications |

| 76 | 51 | Duty paid |

| 04 | 08 | TK accepted for accounting as intangible assets |

| 68 | 19 | VAT on technical specifications is accepted for deduction |

If the company created the technical specification on its own, then its initial cost is formed by the following expenses:

- material (for creating technical specifications);

- labor (salaries and accruals for developers of technical specifications);

- other (cost of consulting services, patent fees, etc.).

In tax accounting:

- TK is classified as intangible material when fulfilling the requirements specified in paragraph 3 of Art. 257 Tax Code of the Russian Federation criteria;

- supporting documents are required (certificate of technical specifications, etc.);

- the initial cost of technical knowledge in tax accounting may differ from the accounting estimate by the amount of unrecognized “tax” expenses (clause 3 of Article 263, subclauses 2, 5, 6 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

ConsultantPlus experts tell us how to take into account the costs of paying state fees for registering a trademark. Get trial access to the system for free.

The above accounting algorithms are also applicable to owners of technical specifications - simplifiers (subclauses 1, 2, clause 3 of Article 346.16 of the Tax Code of the Russian Federation), but taking into account the following:

- expenses for the acquisition of technical specifications must be paid (subclause 4, clause 2, article 346.17 of the Tax Code of the Russian Federation);

- TK is used to generate income (clause 3 of Article 346.16 of the Tax Code of the Russian Federation);

- writing off expenses for technical tasks is similar to the procedure provided for OS (Article 346.16 of the Tax Code of the Russian Federation).

ATTENTION! Small enterprises can take into account the costs of acquiring (creating) objects that are subject to accounting as intangible assets in cost accounts (Information message of the Ministry of Finance of Russia dated June 24, 2016 N IS-accounting-5 “On simplification of accounting by small entities entrepreneurship and a number of other organizations").

Subaccounts

The structure of subaccounts for intangible assets can be constructed at the discretion of the organization and must be recorded in its accounting policies.

For example, for account 04, subaccounts can be organized as follows:

| Subaccount number | Type of intangible asset |

| Subaccount 04-1 | "Trademarks and Service Marks" |

| Subaccount 04-2 | "Computer programs" |

| Subaccount 04-3 | "Inventions" |

| Subaccount 04-4 | "Utility models" |

If several units of intangible assets are registered, this can be reflected as follows:

- 01.1 — trademark “Milk cat”;

- 01.2 — trademark “Bird of Happiness”;

- 01.3 — trademark “All year round - no worries.”

Similarly, accounting is reflected in article 08.

Initial estimate of the cost of the sign

All companies strive to classify a trademark as an intangible asset. But then it must meet several conditions:

- it must bring economic benefit;

- must be used for more than 1 year, during which the sale of the right is not provided;

- it has no material form.

A trademark is entered into the financial statements at its original cost, which may vary depending on the method of acquiring the mark. There are several ways:

- A trademark can be developed in-house by an enterprise. Then subaccount 08-5 for the acquisition of intangible assets will take into account all the expenses incurred by the company to create the sign. These may include the salaries of employees, designers, their bonuses, materials, rent, payment of state duties, etc. It can be illustrated with an example that a company spent 100,000 rubles on development in April, after which it submitted an application for registration, the fee cost 25,000. The application was approved six months later. All expenses for this period are attributed to account 04 “Intangible assets”. As a result, the following entries will be created in the accounting report:

Contents of operation Debit Credit Amount, rub. Trademark development 08-5 70,69,60,68 100 000 Government duty 08-5 60 25 000 The mark has been accepted for registration 04 08-5 125 000 - Purchasing the exclusive right to a trademark from another copyright holder. In this case, acquisition costs must be taken into account. These may include the amount under the purchase agreement, payment of the state fee for re-issuance of the certificate, and intermediary services. For example, I bought a trademark for 50,000 rubles, while using it for the amount of 10,000 rubles, while VAT is taken into account in the usual way. The report will look like this:

Contents of operation Debit Credit Amount, rub. Purchase of the “Y” trademark 08-5 60 50 000 Payment 08-5 60 10 000 Amount of state duty 08-5 76 15 000 The mark has been accepted for registration 04 08-5 75 000 - The mark is purchased for temporary use under a license agreement. In this case, the trademark is taken into account in the reports of both the licensee (acquirer) and the copyright holder.

In this case, only the copyright holder pays depreciation. The licensee accounts for expenses depending on the terms of payment (lump sum or royalty). If there is a one-time payment under the contract, then these expenses relate to future periods and are written off evenly over the term of the contract. If payment is made monthly, expenses are taken into account in each reporting period. There is a combined scheme (franchise agreement), where you need to take into account both monthly payments and a one-time lump sum contribution.

- If the sign is received free of charge. In this case, it is necessary to put on the balance sheet the amount for which it could be sold.

You can determine the amount yourself or use the services of an appraiser. This cost is included in other income. Subsequently, this amount will be depreciated and transferred to other expenses in the reporting period. For example, I received a trademark worth 50,000 rubles for free use. (value determined by the appraiser). Then the state duty is paid, and the sign is accepted for 10-year use. The entries in the accounting report will look like this:

Contents of operation Debit Credit Amount, rub. Purchasing a trademark based on valuation 08-5 98 50 000 Payment for appraiser services 60 51 10 000 Amount of state duty 08-5 76 25 000 The mark has been accepted for registration 04 08-5 75 000 Part of the amount of deferred income 98 91-1 75000/10 years/12 months. = 625 It is worth considering that in the case of purchasing a sign free of charge, a difference arises in tax and accounting. The accounting report takes into account the full cost, along with the valuation. The tax report contains only real expenses for the services of an appraiser and state duty. Thus, the cost in accounting will be higher than in tax accounting. Therefore, there will be a difference when calculating depreciation every month.

- A trademark may appear on the balance sheet of an organization if it is contributed by the founder to the authorized capital.

In tax accounting, the sign will be represented by the amount that was indicated in the founder’s reporting documents. In accounting – according to the assessment of all founders. As a result, the wiring will look like this:

Contents of operation Debit Credit Amount, rub. Debt on contribution to the authorized capital 75 80 15 000 Contribution in the form of a trademark 08 75 15 000 The mark has been accepted for registration 04 08 15 000 It is worth noting that in case of refusal of registration by the Federal Service for Intellectual Property, Patents and Trademarks, expenses that had been incurred by that time (design, state duty) are included in the financial final result, because the intangible asset did not arise.

Also, if an organization decides to enter the international market and register its mark in other countries, this does not affect the cost of the trademark in Russia, because according to the law (clause 16 of PBU 14/2007), its initial cost cannot change.

Valuation and revaluation of a trademark

A trademark can be assessed:

- To determine the initial actual cost on the date of acceptance on the balance sheet, or to estimate the book value (see example above, entries).

- To determine the current market value during revaluation. The market value can exceed the book value by thousands of times.

Expenses for a trademark can be grouped as follows:

| No. pp. | Type of expenses | Cost item |

| 1 | Creating a trademark on your own or with the involvement of third-party specialists | Personnel costs: designers, naming specialists and others directly involved in the development of a trademark |

| Contributions for social needs | ||

| Costs under the contract for the provision of logo design services | ||

| Costs under a copyright contract for a designer to create a trademark | ||

| State fees for registering a trademark with Rospatent and its renewal after 10 years | ||

| Costs for patent attorneys | ||

| 2 | Trademark promotion | Costs for services of consulting firms (marketing research, product and market analysis, competitor research) |

| Advertising expenses | ||

| Costs for services of appraisal companies | ||

| 3 | Promotion of goods under this trademark | Advertising costs |

| Promotion costs |

Accounting for a trademark at its original cost can lead to a decrease in depreciation, an overestimation of the income tax base and a decrease in the company's capitalization. The market value of a trademark can be hundreds of millions of rubles, but the initial value is only several tens of thousands of rubles. Its service life (useful life of depreciable property) is at least 10 years.

Revaluation of a trademark at its market value is also necessary for making transactions with it, for transferring rights under an alienation agreement to other persons and obtaining adequate profit.

In addition to the cost method, which is used for the initial placement of a trademark on the balance sheet, its evaluation can be carried out in other ways at the choice of the business entity:

- Comparative method. The market value of a trademark is adjusted based on the value of actual licensing transactions for similar trademarks. To use this method, it is necessary to have reliable information about the price of a similar trademark of another company, about the income from the production of products and the terms of the transaction, but such information in practice is closed to third parties.

- Income methods: discounted cash flows, excess profit method, royalty waiver methods and profit advantages. These methods take into account the actual income from the use of the trademark and are the most promising for revaluation.

Trademark advertising: conditions, documents, postings

In accounting, expenses for advertising of technical specifications are written off using the following scheme:

- classification of expense - expense for ordinary activities (clauses 5, 7 of PBU 10/99);

- recognition of expenses - in the period of implementation (clause 18 of PBU 10/99);

- “accounting” entry: Dt 44 “Sales expenses” Kt 60 “Settlements with suppliers and contractors”;

- no restrictions (norms) on the amount.

The article “What is indicated in line 2210 Commercial expenses?” will tell you how advertising expenses are reflected in accounting records.

To understand the algorithm for tax accounting of expenses for advertising of technical knowledge, let’s consider the chain of regulatory definitions (see table):

| Normative act | Term | Explanation of the term |

| Civil Code of the Russian Federation (Article 1477) | Trademark | Registered designation that individualizes goods (works, services) |

| Law “On Advertising” dated March 13, 2006 No. 38-FZ (Article 3) | Advertising object | <…means of individualization of a legal entity and (or) product…> |

| Tax Code of the Russian Federation (clause 1, article 252) | Tax expense | Justified and documented expenses incurred by the taxpayer related to the receipt of income |

| Tax Code of the Russian Federation (subparagraph 28, paragraph 1, article 264) | Other expenses (related to production and sales) | Expenses for advertising a trademark, taking into account clause 4 of Art. 264 Tax Code of the Russian Federation. |

| Tax Code of the Russian Federation (clause 4, article 264) | Advertising expenses | Groups of standardized and non-standardized expenses |

The considered chain of regulatory terms, as well as general tax approaches to the advertising group of expenses, help formulate the following conclusions:

- classification of expenses - other related to production and sales (subclause 28, clause 1, article 264);

- the moment of recognition of expenses is the period of their implementation (clause 1 of Article 272 of the Tax Code of the Russian Federation);

- scientific register - its form is developed by the taxpayer (addendum to the accounting policy);

- the amount of expense is normalized for the purposes of calculating income tax (cannot exceed 1% of revenue) or not normalized, depending on the type of advertising (for example, expenses for advertising technical knowledge through the media and the Internet are not normalized).

Documentary evidence of advertising expenses for technical specifications can be provided by:

- contract (agreement) on the placement of advertisements for technical specifications;

- act on the performance of work under the contract;

- payment documents.

The considered accounting scheme does not contradict the opinion of officials of the Ministry of Finance of the Russian Federation (letter dated 04/30/2015 No. 03-03-06/1/25297).

The considered algorithm for recognizing expenses is also applicable for simplifiers, but taking into account the nuances of the simplified tax system:

- It is possible to take into account advertising expenses of technical specifications only after they have been paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation);

- the classification of advertising expenses of technical specifications into standardized and non-standardized applies in full to simplified ones (letter of the Ministry of Finance of the Russian Federation dated June 14, 2016 No. 03-11-06/2/34264).

The procedure for accounting and taxation of trademarks raises many questions, which cannot be discussed in one article. Patent specialist V. Yu. Jermakyan answered many questions. All his explanations are in the ConsultantPlus system.

Get trial access to ConsultantPlus and read expert explanations for free.

Detailed algorithms for accounting for advertising expenses - learn from the material “Features of accounting for advertising expenses”.

Decommissioning of a trademark

Disposal of a trademark may occur in the following cases:

- The period of legal protection has expired (10 years have elapsed from the date of filing the application with Rospatent) and the business entity did not renew it during the grace period - six months from the expiration date.

- The trademark was transferred under an alienation agreement to another legal entity or individual entrepreneur. Proceeds from the sale should be included in operating income.

- The exclusive rights to a trademark are transferred to another person without an agreement, for example, by way of collection, by a court decision.

- The trademark has been transferred to the authorized (share) capital of another organization, a mutual fund. In this case, the debt on deposits is reflected by posting to the debit of account 58 and the credit of a separate subaccount 76.

When writing off the cost of a trademark, depreciation charges must be written off at the same time.

The reliability of financial statements for trademarks is determined by their correlation with intangible assets contained in PBU 14/2007, the correct determination of the costs of their creation and promotion, and the need for revaluation. Placing a trademark on the balance sheet and transactions with it are impossible without a title document - a certificate from Rospatent. You can order trademark registration at the Ezybrand patent office; we provide legal registration of rights to all types of intellectual property.

Reflection of transactions on the transfer or sale of a trademark

If a businessman has a trademark, accounting and tax accounting (BU and NU) of transactions with it takes place taking into account special “design” and “regulatory” nuances.

The transfer or sale of technical knowledge is formalized by one of the following documents:

- licensing agreement - it allows the temporary use of technical knowledge by another person under certain conditions and for a specific period;

- alienation (assignment) agreement - with its help, the fact of transfer of the exclusive right to trademark to another person is recorded.

Each agreement is valid only if it is registered in the manner prescribed by law.

Scheme of accounting and accounting entries for the sale of technical specifications

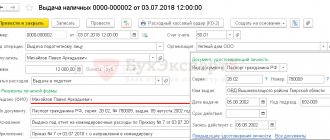

Accounting algorithm for selling technical specifications:

- reflection in accounting and accounting records of income from the sale of technical knowledge (clause 7 of PBU 9/99 “Income of the organization”, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n, clause 1 of Article 249 of the Tax Code of the Russian Federation);

- the residual value of the technical assignment and the costs associated with its sale are other (clause 11 of PBU 10/99 “Expenses of the organization”, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n, clause 1 of Article 268 of the Tax Code of the Russian Federation);

- VAT is calculated on the cost of technical specifications.

Correspondence of invoices for the sale of technical specifications:

| Debit | Credit | Contents of operation |

| 62 | 91.1 | Recognition of income from the sale of technical knowledge |

| 05 | 04 | Write-off of depreciation of technical specifications |

| 91.2 | 04 | Write-off of residual value of technical assignment |

Transfer of technical specifications

In this situation, it is necessary to take into account that under the license agreement there is no transfer of ownership of the TK and different entries are used in the accounting of the owner and the user.

Accounting with the owner of the technical assignment

- To account for this operation, a special sub-account “Intangible assets transferred for use” is opened to the account. 04 "NMA".

- Depreciation continues to accrue on the cost of technical equipment (clause 38 of PBU 14/2007 “Accounting for intangible assets”, approved by order of the Ministry of Finance of the Russian Federation dated December 27, 2007 No. 153n, subclause 1 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

- VAT is calculated on payments received from the user of the technical assignment (clause 2 of article 153 of the Tax Code of the Russian Federation).

- Income from the operation is recognized (subclause 3, clause 4, article 271 of the Tax Code of the Russian Federation).

Transfer of technical specifications in the owner's records

| Line no. | Debit | Credit | Contents of operation |

| 1 | 51 | 76 | Receiving an advance under a license agreement |

| 2 | 76 | 68.2 | Calculation of VAT on advance received |

| 3 | 76 | 91.1 | Monthly recognition of part of the income received in the form of a license fee |

| 4 | 20 (25, 26, 44) | 05 | Monthly calculation of depreciation of technical equipment |

| 5 | 91.2 | 68.2 | VAT is charged on the monthly license payment |

| 6 | 68.2 | 76 | Deduction of advance VAT |

The transactions indicated in the table refer to the situation of receiving a one-time payment under a license agreement. If payments are received monthly, invoice correspondence similar to the first four positions of the table is used to recognize income and calculate VAT.

“Accounting” actions of the TK user

The recipient of the TK for use must take into account that:

- TK does not become the property of the user, so it can only be taken into account on the balance sheet;

- payments made under the agreement are recognized as expenses of the reporting period (clause 30 of PBU 14/2007).

Correspondence of invoices with the recipient of the technical assignment

| Line no. | Debit | Credit | Contents of operation |

| 1 | 20 (25, 26, 44, 91) | 76 | The monthly payment for the use of technical specifications under the license agreement is reflected in the accounting |

| 2 | 19 | 76 | VAT reflected |

| 3 | 68 | 19 | VAT deduction |

| 4 | 76 | 51 | License fee transferred |

This posting scheme is used for monthly payment of obligations under the contract. If one payment is made for the full amount of the contract, the entries specified in paragraphs are used to reflect the expense in accounting on a monthly basis. 1–3 tables.