Why do you need a fuel card?

A fuel card is also called a gas card and a petrol card.

A fuel card for legal entities is a method of paying for fuel and lubricants at gas stations. Fuel cards for individuals can be used in a similar way, however, in our review we will focus on the features of working with fuel cards for individual entrepreneurs and legal entities.

Let's look at how a fuel card works. An organization or individual entrepreneur enters into an agreement for fuel cards with the company that issues them. This could be a fuel supplier or an intermediary. It is possible to receive several cards under one agreement.

The organization accepts fuel cards for registration in the accounting department (we will describe how to do this below) and issues them to employees. As a rule, these are drivers, but a refueling card can be obtained by any employee who, as part of their work duties, drives a car and fills it with gasoline. This could be a director, manager, courier, and so on. In other words, not only transport organizations can apply for a fuel card, but also any others that use transport for business purposes.

Employees pay at gas stations not with cash or corporate cards, but with fuel cards. Thus, you can use your fuel card like any other bank card - as a means of payment.

At the end of the month (or at other intervals), the organization issuing fuel cards submits a report on the funds spent, as well as a complete package of closing documents, which includes invoices.

We wrote about VAT on advance reports in the article “The procedure for reflecting VAT on advance reports in accounting .

Contents of the order

Two types of technical documentation are issued for the institution - the main one for accounting and the personal one for the driver. We are preparing an order for the driver’s personal card. In addition to the fact of transfer, record the limits on amounts for each month. A separate order to set limits on fuel cards is not needed.

Required components of the order:

- Information about the organization (company letterhead is used), basic details (number, date, place of issue).

- Reasons for publication: optimization of costs for fuels and lubricants, control over fuel circulation in the institution.

- The essence of the order: the use of TCs in the organization, assigning them to drivers or cars.

- User List: List all employees who will be issued individual cards.

- Information for each TC: name, number, limits and validity period.

- Penalties for violating established limits (if necessary). If these measures are not specified in the additional agreement to the employment contract, write down the standards here: justification for exceeding the limited costs, compensation for violations and rules for spending card balances.

- List of persons responsible for execution.

Here is an approximate template - a sample order for issuing fuel cards to employees and determining spending limits:

| Name of company ORDER No. ___________ "__" _______20 __ In order to optimize fuel costs and control fuel circulation I ORDER:

A completed sample order for using a fuel card looks like this: |

Nuances of fuel cards

Features of the use of fuel cards depend on the terms of the agreement with the organization issuing the fuel card. Here are examples of additional options when using fuel cards in addition to paying for fuel at gas stations, depending on the terms of a specific agreement:

What are the advantages of a fuel card:

You will learn about the procedure for working with advance reports from the article “Features of advance reports in accounting .

The organization that issues gasoline cards provides access to a personal account where you can monitor and manage fuel cards: change spending limits for each card, receive detailed information in real time on expenses (at which gas station, in what quantity and for what fuel were produced expenses), receive invoices for advance payments.

Accounting entries for fuel cards for budgetary institutions

Let’s say that the budgetary institution “Firm” purchased 2 fuel cards on September 1, 2016:

- A liter for a company car to dispense 1,000 liters of gasoline; 30,000 rubles were transferred to pay for it.

- Cash for a truck, the use of which is necessary for the main activities of the company. The card is designed for gasoline refills with a total cost of 30,000 rubles.

On September 19, 2016, the drivers of both cars submitted reports for refueling 200 liters of gasoline (100 liters each on 09/07/2016 and 09/15/2016). On the date of refueling, gasoline cost 27 and 27 rubles 50 kopecks, respectively.

| Operation | DEBIT | CREDIT | Price |

| The cost of purchased fuel cards is reflected | ● 120105510 ● 1302022830 | ● 1302022730 ● 120101610 | 60 thousand rubles. |

| The cost of cards issued to drivers is reflected | 120822560 | 120105610 | 60 thousand rubles. |

| The cost of fuel and lubricants paid by cash card is reflected | 110503340 | 120822660 | 6 thousand rubles. |

| The cost of fuels and lubricants paid with a liter card is reflected | 110503340 | 120822660 | 5450 rub. |

| The cost of fuel and lubricants spent on current expenses is reflected | 140101222 (or 140101272) | 110503440 | 6 thousand rubles. |

| The cost of fuel and lubricants spent on conducting the main activities of the enterprise is reflected | 110601310 | 110503440 | 5450 rub. |

Fuel cards have arrived: how to take them into account

So, we have described all the advantages of fuel cards for legal entities. How to apply for such a card and how to keep records of fuel cards in an organization?

To begin with, we select the fuel card issuer that suits us according to the terms and conditions and conclude an agreement with it.

We receive fuel cards in the required quantity. The card can be provided either free of charge or for a fee.

Acceptance of fuel cards from the issuing organization occurs according to the act of acceptance and transfer of fuel cards.

Accounting for fuel cards in accounting depends on whether the price of the fuel card is highlighted as a separate line in the documents transferring them to the organization or not.

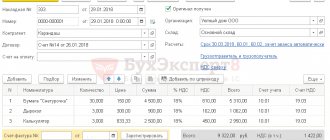

Let’s say that the issuer of fuel cards transferred ten cards for refueling under the act with an allocated price of 120 rubles per piece (including 20% VAT - 20 rubles). The invoice is included in the package of documents provided.

Fuel cards can be used for more than 12 months, their cost is less than 40,000 rubles. We take them into account on account 10 “Materials”. We make the following transactions:

Read about the new FSBU 6/2020 in our article “Procedure for accounting for fixed assets according to FSBU 6/2020” .

Now let’s assume that the value assessment of petrol cards upon transfer has not been carried out. This fact does not negate the need to keep accounting of fuel cards. If their cost is not indicated, then we will keep records of fuel cards on an off-balance sheet account, for example 012, at a conditional valuation of 1 ruble per 1 piece. In this case, upon receipt of cards, the following posting is made:

Accounting for fuel and lubricants using fuel cards in 1C: Accounting ed. 3.0

Published 04/08/2020 11:55 Author: Administrator Today, most companies use cars to operate and conduct their activities. And once you have a car, then the question arises of accounting for the costs of its maintenance: the purchase and write-off of fuel, consumables, insurance, etc. Many organizations choose fuel cards not only because of their ease of use, but also because they are legally deductible for VAT. However, there is a nuance here: company cars are refueled daily, and the accounting department receives closing documents from the gas station only at the beginning of the next month. Today we will discuss how an accountant can organize accounting for fuel cards in our article.

First of all, it is worth noting that, starting with release 3.0.74, in the 1C: Accounting ed. 3.0 provides a new functionality “Accounting for waybills”. In this regard, the program has undergone some changes.

Thus, instead of the previously used account 10.03, accounts 10.03.1 “Fuel in warehouse” and 10.03.2 “Fuel in tank” are now used to account for fuel. The previously used account 10.03 has become a group and is no longer used in postings. When using the “Waybills” functionality, accounting is maintained on account 10.03.2 by vehicle.

We also note that despite the added functionality for accounting for fuels and lubricants according to waybills, the program retains the ability to keep records as before - in terms of batches and warehouses. And for this purpose account 10.03.1 is now provided.

When updating the program to the specified release, all balances on the 10.03 account will automatically be transferred to the 10.03.1 account. If you keep records as before, the only thing that will change is the account: instead of 10.03, you will now use 10.03.1.

If you decide to use the new functionality and keep records by vehicle (and this, let’s say right away, is more convenient, although more labor-intensive), then you need to transfer the balances to account 10.03.2.

Also, starting with release 3.0.74, a new subaccount has been added to account 76 - 76.15 “Purchase with fuel cards”.

Now that we have talked about the new functionality, let's take a closer look at accounting for fuel and lubricants using fuel cards in the 1C: Accounting program ed. 3.0.

In order for a company to keep track of fuel and lubricants using fuel cards, it must first be purchased. To do this, the responsible person of the company (in small companies this function can be assigned to an accountant) submits an application to the gas station. Based on this application, the head center (the so-called gas station processing center - a point for collecting information about all gas station card terminals) prepares an agreement for the supply of fuel and lubricants with a list of all gas stations included in the service area of the card attached to it, and issues fuel cards for your organization ( their number depends on the number of your cars). An important point here is that the contract must stipulate how the fuel card will be given to you - for a fee or, if it is returned upon termination of the contract, for free.

Fuel cards come in two types: limited and unlimited.

Limited cards suggest that when you top up your card account, a certain amount of fuel is added to it and a limit is set for its consumption within a certain amount of time, for example, a month.

Unlimited cards assume that when replenishing the account, the amount of fuel corresponding to the date of replenishment is added to the card, which is then selected within the limits of the volume available on the card.

When transferring fuel cards to your organization, you will be issued an invoice in the TORG-12 form, which will serve as the basis for posting the cards.

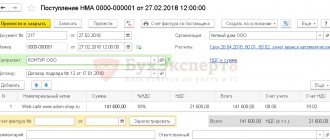

Typically, the production of fuel cards is pre-paid. This is done in the program using the document “Write-off from the current account” in the “Bank and cash desk” section.

To reflect the receipt of fuel cards to the account on 10.09, go to the “Purchases” section and create the document “Receipt (acts, invoices)”.

After posting the document, the program will generate the following transactions:

So, the fuel card has arrived at the organization and now it needs to be issued to the employee. Let's do this with the document “Transfer of materials into operation” in the “Warehouse” section.

Having generated the balance sheet for account MTs.04, you can see which employees have fuel cards assigned to them:

Now let's move on to considering options for accounting for fuel and lubricants and start with the old method.

To keep things simple, we will use the main warehouse by default. If the company has several cars, then it is advisable to enter the names of the cars in the form of warehouses. Then, after the fuel is posted according to the gas station documents to the main warehouse, it is necessary to formalize the movement of fuel from the main warehouse to the warehouse-vehicle (with the document “Movement of Goods”).

The organization, as necessary, replenishes the card account by transferring funds to the supplier’s bank account:

The gas station replenishes the card with a certain amount of fuel, and within a month the driver fills up his car using the card. At each refueling he is given a receipt, which reflects the number of liters filled and the cost. He reflects information about the amount of fuel filled in the waybill and attaches the receipt received to it.

At the end of the month, all waybills are submitted to the accounting department. They are the primary document on the basis of which the accountant writes off fuel costs as expenses. A generalized report (register) is usually attached to waybills. It might look, for example, like this:

Also, at the end of the month (or at the beginning of the next), the fuel supplier (processing center) will issue you closing documents (UPD or TORG-12 and an invoice), as well as a report on card transactions. As a rule, reports on fuel card transactions are provided in electronic form, which is more convenient and timely. The report looks something like this:

From the report, the accountant will see how many liters of fuel were actually purchased per month using the card. She will check this data with the employee’s register, where there is generalized information from waybills and gas station receipts (the column in the register “Purchased fuels, l” must coincide with the final data of the report from the gas station).

Based on the delivery note and the gas station report, the accountant credits the fuel with the document “Receipts (acts, invoices) to account 10.03.1 “Fuel in warehouse”:

The accountant will write off the fuel consumed during the month on the basis of the waybills and the register attached to them. Please note that fuel for write-off is calculated according to the standards established at the enterprise (approved by order of the manager). Fuel write-off is documented in the document “Request-waybill”, which is located in the “Warehouse” section:

The cost account for writing off fuel will depend on the type of activity: in trade it will be account 44.01, in production - account 20, if fuel is written off to the official vehicle of the management apparatus (as in our example) - then account 26.

After the consumed fuel has been written off, you can generate a balance sheet for account 10.03.1. The balance at the end of the month reflects the amount of fuel left; it must match the balance reflected in the last waybill for the month:

Now let’s look at fuel and lubricant accounting operations using fuel cards within the framework of the new functionality “Accounting for waybills”. To keep records using waybills, you need to check the appropriate box in the functionality settings:

Before you start keeping track of waybills, you need to enter information about the organization’s vehicles and employee driver’s licenses.

Data on driver's licenses is entered through the “Individuals” directory.

Now let’s fill out the “Vehicles” directory.

Important! When purchasing new vehicles, it is enough to enter all the necessary information when registering them, then the data in the “Vehicles” directory will be updated automatically.

So, we have filled out all the necessary reference books.

Now let's move directly to accounting for transactions.

We will reflect the replenishment of the transport card account in the same way as in the previous method, through the document “Debit from the current account”:

The employee then fuels his car for a month.

The program provides for the document “Waybill” to reflect the receipt and expenditure of fuel and lubricants. It is located in the "Shopping" section.

This document has two tabs: “Fuel” and “Route”.

The “Fuel” tab contains information about the fuel received – purchased using a fuel card or in cash. There are two important points here. First, the “Fuel” tab contains only quantitative information about the purchased fuel. And second, this document cannot reflect only the fact of receipt of fuel and lubricants; without filling out the “Route” tab, it will not be possible to process the document. Let’s fill out the “Route” tab and post the document.

As we can see, this document generates 2 transactions: receipt of fuel and lubricants and its write-off. In both cases, account 10.03.2 is used - despite the fact that this account is not selected anywhere in the document, the use of the accounting functionality using waybills automatically assumes accounting using this account.

We also see that a new, previously unused account 76.15 appears in the postings. This account has been introduced into the “Waybills” functionality so that when posting the receipt of fuel and lubricants through the documents “Waybill” and “Receipt of goods” (when documents are received from a gas station), account 60 does not double. Also note that both postings are generated only in quantitative terms. Total accounting for these accounts is generated at the end of the month.

To make the example clearer, let’s fill out another document “Waybill” with a different date:

At the end of the month (or the beginning of the next), when closing documents are received from the supplier, the document “Receipts (acts, invoices)” is drawn up in the program with the transaction type “Fuel” in the “Purchases” section.

Please note that this document generates a posting to account 10.03.2 only in total terms, because quantitative accounting for account 10.03.2 is reflected in the document “Way List” - we saw this above.

Also, the debit of account 76.15 reflects the amount of fuel received.

The balance sheet for account 76.15, if the waybills are correctly filled out, will have a zero balance at the end of the month - there should be no difference between the amount of fuel according to the waybills and the quantity reflected according to the supplier’s documents:

Having also generated the balance sheet for account 10.03 in the context of subaccounts, we will see that the balance of fuel has been stuck on account 10.03.1 since February, when accounting was kept in the old way, and there is movement on account 10.03.2 for March, when accounting was kept using new program functionality. But this remainder is not yet correct, because The receipt of fuel by debit is reflected both in quantitative and total terms, but the write-off is so far only in quantitative terms:

After the month is closed, transactions are generated in the amount of:

Now the balance sheet will form the correct balances:

Author of the article: Anna Kulikova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+4 Ustimovich Irina Nikolaevna 02/10/2021 20:02 Very detailed and clear. Thanks a lot

Quote

+3 Marina 01/12/2021 18:18 Good afternoon, please tell me, what if the UPD receipts are at the end of the month? They were introduced not as fuel but as goods and were carried out on 10.03.1, does this need to be corrected?

Quote

+4 Evgenia 06/10/2020 14:33 Good afternoon! Is it possible to find out if one car is refueled with both AI-92 and GAZ, how to write it off according to the waybill, if when filling the car the fuel and lubricants and the norm are strictly bound?

Quote

+2 Yulia 06/04/2020 15:19 Please do the same detail for fuel coupons.

Quote

+1 Irina Vinogradova 06/03/2020 21:05 Very cool material!!! Accessible and understandable!!!

Quote

0 Alya 04/16/2020 12:50 Very useful, thank you

Quote

Update list of comments

JComments

Fuel cards were issued to employees: how to take them into account

Next, fuel cards are handed over to employees. To do this, you need an order to assign a fuel card to a specific driver. Orders do not have standardized forms. An order to attach a fuel card is created on the usual enterprise order form, which is also used in other cases. You can download an example of an order for free from the link at the beginning of our article.

In addition, it is necessary to fill out a register for issuing fuel cards, according to which fuel cards are issued to employees against signature. The organization develops the format of the journal independently. You can download an example of a fuel card logbook form for legal entities at the beginning of our article for free.

The transfer of fuel cards is done as follows:

After the costs of fuel cards are included as expenses, their accounting in the accounting department does not stop. Gasoline cards are accounted for in account 012, which is located behind the balance sheet.

If the cards were received free of charge and no entries reflected in the balance were made, then when transferring the gas cards to employees, there is also no need to make any additional entries.

As a result, in both cases, after the transfer of fuel cards, there is an off-balance sheet account 012, which reflects the fuel cards assigned to the organization.

Accounting for fuel cards in 1C 8.3 is carried out using normal operations:

- posting cards for refueling - “Receipt” functionality;

- issuing cards for refilling - “Requirements-invoices” functionality.

Fuel quantity calculation

Based on the information provided in the waybill, you need to calculate the amount of fuel and lubricants that will be written off:

TS = OTV + TB – OTKM,

Where:

TS – fuel for write-off (in liters),

OTV - remaining fuel when the vehicle leaves,

TB - fuel in the car tank,

OTKM – remaining fuel at the end of the working day.

An example of accounting for fuel and lubricants using fuel cards

Company A sent an advance payment to the fuel company for 1000 liters of gasoline at a price of 11 rubles 80 kopecks per 1 liter (including VAT 1 ruble 80 kopecks). The card itself was paid separately (118 rubles, including VAT 18 rubles). As of the last day of the month, 990 liters of gasoline were selected, leaving 20 liters in the car’s gas tank. Read also the article: → “Excise taxes on gasoline”

| Operation | Amount (rub.) | DEBIT | CREDIT |

| An advance payment was issued to the fuel company for gasoline | 11,800 (per 1 thousand l.) | 60-2 | 51 |

| Paid for the production of a fuel card (according to bank statement) | 118 | 60-1 | 51 |

| The fuel card has been accepted for accounting (according to the delivery note and the contract for the supply of fuel and lubricants) | – | 10-3 | 60 |

| VAT included (on invoice) | 18 | 19 | 60 |

| VAT is accepted for deduction after payment of the card (according to the invoice, entry in the purchase book) | 18 | 68 | 19 |

| On the last day of the month | |||

| The fuel card consumption for gasoline is reflected (according to the supplier’s report and gas station receipts) | 9900 (990 l * (11.8 – 1.8)) | 10-3 | 60-1 |

| VAT on gasoline costs included | 1782 | 19 | 60-1 |

| Previously credited prepayment for gasoline (according to the supplier’s report) | 11682 | 60-1 | 60-2 |

| Accepted for deduction of VAT on paid gasoline (according to invoice) | 1782 | 68 | 19 |

| The cost of actually consumed gasoline is written off (according to the waybill) | 9700 | 20 (23, 26, 29, 44) | 10-3 |

How to spend fuel purchased using refueling cards

Accounting for fuel using fuel cards is no different from accounting for fuel when paying in cash, since the use of fuel cards is only a way to pay for gasoline.

Fuel accounting using fuel cards is carried out through the following entries:

To write off fuel and lubricants using fuel cards, the presence and use of these cards is not enough. We remind you that payment for fuel and lubricants using fuel cards is only confirmation of the fact of payment for fuel and lubricants. In order to accept the costs of fuels and lubricants as expenses, it is necessary to confirm the use of fuels and lubricants in business activities, that is, to generate income. Waybills can serve as such confirmation.

We wrote about the procedure for working with waybills in the article “The procedure for recording and writing off fuel and lubricants using waybills in 2022.”

If the organization is not a transport organization, then it is not necessary to fill out vouchers to account for gasoline costs in expenses. If vehicles are equipped with a vehicle tracking system—the GLONASS vehicle monitoring system—then the use of gasoline for business needs can be justified based on the data provided by the electronic tracking system. Such data may include vehicle routes.

Look for the nuances of reflecting fuel and lubricants in accounting and tax accounting in ConsultantPlus. Sign up for a free trial access to the system and receive an algorithm of actions for accounting for fuel and lubricants with links to explanatory letters and the regulatory framework.

Examples of using the document “Waybill”

Let's look at the new possibilities for fuel accounting using specific examples. The first example is the recording of fuel purchased using a cash receipt.

Note

The prices in the examples are conditional.

Example 1

| The organization Sewing Factory LLC (OSNO, VAT payer) has its own Volkswagen Passat B7 on its balance sheet. The car is used for administrative purposes. On 08/01/2019, on the basis of an employee’s application, funds were issued from the organization’s cash desk in the amount of RUB 5,000.00 for reporting purposes. to buy gasoline in cash. On August 13, 2019, after completing an official assignment, the employee submitted an advance report, waybill and cash receipt to the organization’s accounting department. The cash receipt indicates: the name of the brand of gasoline is AI-95, the quantity is 70 liters, the cost of one liter is 45 rubles. and the total amount is 3,150 rubles. The VAT amount is not shown as a separate line. Based on the waybill, 60 liters of gasoline were consumed according to the route Moscow - Ivanovo - Moscow (600 km). On August 14, 2019, the balance of the unused accountable amount was handed over to the organization’s cash desk. In accordance with the accounting policy of the organization, expenses for fuel and lubricants are not standardized in tax accounting (they are taken into account in full). |

The issuance of cash to an employee for reporting is reflected in the document Cash Withdrawal with the type of transaction Issue to an Accountable Person. When posting the Cash Issue document, an accounting register entry is generated:

Debit 71.01 Credit 50.01 - for the amount of funds issued for the report (5,000 rubles).

Please note that for those accounts where tax accounting is supported, the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes. In the examples discussed in this article, there are no differences between accounting and tax accounting.

Let's reflect the purchase of gasoline using a cash receipt and its consumption using the document Waybill (see Fig. 2). The header of the document states:

- date of the waybill (the number is assigned automatically);

- vehicle;

- an employee who uses a car for business purposes;

- fuel consumption rate for the specified vehicle. By default, the norm is substituted from the vehicle card, but can be changed manually in the Waybill. In this case, the program will offer to save the changed norm for subsequent automatic filling of the Waybill;

- account and cost analytics in the Cost account form, which can be accessed through the appropriate link. By default, the Waybill document has a new predefined article Maintenance of official vehicles with the expense type Other expenses.

If fuel is purchased in cash, its quantity and price are determined at the time of refueling and are indicated on the cash receipt. When filling out the tabular part on the Fuel tab, in the Document field, select the Cash Receipt value, indicate the details of the cash receipt, quantity, price and amount of purchased fuel.

In the tabular section on the Route tab, you should fill in the points of departure and destination, the date, time and odometer readings at the time of departure and arrival, the distance between points and fuel consumption on each section of the route. The total amount of fuel in the tank, taking into account the balance at the beginning of the route, receipt and consumption according to the waybill, is calculated automatically and displayed in a visual form at the bottom of the document. The remaining fuel in the tank is automatically transferred to the next Waybill in chronological order.

When posting a document, the following transactions will be generated:

Debit 10.03.2 Credit 71.01 - for the amount of purchased gasoline (RUB 3,150.00) in the amount of 70 liters;

Debit 26 Credit 10.03.2 - for the amount of gasoline written off (60 l). Since during the month similar fuel can be purchased in different ways and at different prices, the final cost of fuel taken into account in expenses for accounting purposes and for profit tax purposes will be formed at the end of the month when performing the regulatory operation Adjustment of item cost

included in

the month end

.

The return of unused accountable amounts to the organization's cash desk is documented in the document Receipt of cash with the transaction type Return from an accountable person. When posting a document, the following entry is entered into the accounting register:

Debit 50.01 Credit 71.01 - for the amount of returned funds (RUB 1,850.00).

On the last day of the month, August 31, 2019, when performing the routine operation Adjustment of item cost, the cost of written-off gasoline is taken into account in expenses:

Debit 26 Credit 10.03.2 - for the amount of expenses for the purchase of fuel (RUB 2,700.00). At the same time, the amount of gasoline in account 10.03.2 is no longer reflected in this posting.

When purchasing fuel using a cash receipt, the following printable forms are available in the Waybill document using the Print command:

- Waybill - simplified form (see Fig. 4);

- Waybill (No. 3);

- Advance report (AO-1).

Rice. 4. Simplified form of waybill

If, as a result of a business trip, in addition to fuel expenses, other reimbursable expenses of the employee arise (for example, expenses for the purchase of goods and materials or travel expenses), then such a trip is reflected in the accounting system with a combination of documents:

- Waybill - first the employee reports for fuel;

- Advance report or Advance travel report - then the employee reports on other reimbursable expenses.

Let's consider the following example, when fuel and lubricants were purchased using a gas station fuel card.

Results

Refueling cards are a modern solution to the issue of paying for the costs of maintaining both a vehicle fleet and a small number of transport units in an organization. They are usually used to pay for fuel, but under special contractual conditions with the card provider, they can be used to pay for tire service, car service, and other related expenses. Gasoline cards, after being written off in accounting, continue to be included in the balance in the special account. To record cards for refueling, a log is kept, which indicates which employee was issued a certain card.

Sources:

- FSBU 5/2019 “Reserves”

- Federal Law of December 6, 2011 No. 402 “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Tax accounting of costs for purchasing a fuel card

The type of costs for the purchase of fuel cards must be fixed by order in the company’s accounting policy:

- material and production costs;

- vehicle maintenance costs;

- other production costs not related to the production process and sales.

VAT can be deducted if:

- an invoice confirming the purchase of a fuel card has been received;

- trade transactions are carried out using the card, and their cost is subject to VAT;

- The fuel card has been registered by the accounting department.

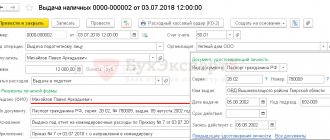

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Fig.8 Filling out the cash withdrawal document

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Fig.9 Cash documents

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Fig.10 Filling out the report

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Fig. 11 Printed form of the expense report