Along with tax reporting, enterprises must submit statistical reporting that allows Rosstat to obtain information about the structure and value of assets, reserves, and financial position of enterprises. In the article we will tell you how to prepare the P-3 form, sample filling, and provide a form for downloading.

A comparative analysis of indicators with the previous period provides the statistical body with information about trends in changes in the activities of the enterprise. Form P-3, starting from 2022, is presented on the form approved by the FSGS order No. 390 dated 05.08.2016. Starting from 2022, the form loses its relevance and will be presented on a new form.

Obligation to submit form P-3

Enterprises of all forms of ownership, the number of employees of which exceeds 15 people, are required to submit Form P-3 when carrying out sales. The number is determined based on the results of the previous year and is calculated according to the rules established by the statistical authorities. When calculating the number of employees, persons employed on a part-time basis, for a certain time, season, or executed under GPC agreements are taken into account.

Sales mean the sale of goods, provision of services to organizations or the public. The obligation also applies to foreign companies operating in the Russian Federation. Legal entities are exempt from the obligation to submit the form:

- Enterprises whose indicators allow the organization to be classified as small.

- State or municipal institutions.

- Banks and other financial and credit organizations.

- Insurance companies.

- Non-profit organizations that do not sell products or services.

Enterprises for which bankruptcy proceedings have been initiated must submit reports along with operating organizations. The obligation terminates upon liquidation and removal of the person from the register.

Who submits Form P-3 and when?

Form P-3 is submitted by:

- Monthly:

- commercial organizations, with some exceptions;

- non-profit organizations when producing goods and services for sale to other legal entities and individuals;

- mining license holders; the number of employees and the volume of turnover do not matter;

- companies that were incorporated or reorganized in the current or previous year; The number of employees and the volume of turnover do not matter.

2. Annually:

- federal state unitary enterprises;

- joint stock companies (except for SMP) that meet the following requirements: - their shares are in federal ownership; — during the previous two years, the average number of their employees was no more than 15 people; — during this period, the organization’s annual turnover does not exceed 800 million rubles.

The deadline for submitting the monthly form is on the 28th day after the reporting period, quarterly and annual - on the 30th day.

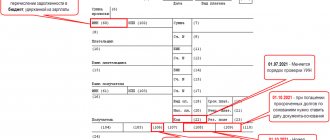

If the deadline falls on a weekend (holiday), the form is submitted no later than the first working day following it (Resolution of the State Statistics Committee of Russia dated 03/07/2000 No. 18). Thus, the deadline for submitting the report for the 3rd quarter of 2021 falls on November 1. This day has been declared a non-working day. In this regard, Rosstat postponed the deadline for submitting the report to 11/08/2021. Keep in mind that non-working days in the regions may last longer than “presidential” days. Therefore, we recommend checking the deadline with your statistics department.

Should not submit Form 3-P:

- small businesses (SMB);

- state and municipal institutions;

- banks;

- non-credit financial organizations;

- organizations whose average number of employees does not exceed 15 people over the two previous years, including part-time and part-time workers, and whose annual turnover during the two previous years does not exceed 800 million rubles. The exceptions are legal entities that hold a license for the extraction of mineral resources, and legal entities that were registered or reorganized in the current or previous year. They report anyway.

The publication “Find out what statistical reporting and within what time frame you must submit” will help you find out whether you must submit Form P-3.

IMPORTANT! A legal entity with separate divisions generates data on the organization as a whole.

Form submission deadlines

P-3 reporting is submitted to TOGS. Organizations that do not operate at their registered address provide statistical data at their actual location. The filing date is considered the day of submission to the territorial body, sending by mail or transmission in electronic form, confirmed by a report from the receiving party. There are deadlines for submitting the form:

- Every month, before the 28th day of the month following the reporting month, the first section is submitted.

- Quarterly, by the 30th day of the month following the reporting period, the report is submitted in full.

A date that falls on a non-working day is moved to the first working day. The form is signed by the person responsible for submitting data to the statistical authority on behalf of the organization. The head of the enterprise imposes an obligation in an order or job description of the responsible person.

Form representation methods

The enterprise has the right to independently choose the method of reporting. Several reporting methods are allowed:

- Representation by an authorized representative of the company in person. The document is submitted on paper. Used if you have time to visit the territorial office of Rosstat.

- By post. The shipment is accompanied by an inventory to confirm that Form P-3 was sent. Used when the territorial authority is remote or has access to the Internet.

- In electronic form, using an electronic signature to transfer data. The forms must contain a code assigned to identify the territorial authority. The transfer is made using an electronic digital signature certificate or specialized telecom operators. Used when there is no time to visit a territorial office or post office.

Each reporting method has advantages and disadvantages.

| Conditions | Personal submission | Mailing | Electronic form |

| Advantages | No additional expenses | There is no need to personally visit the territorial authority, obtain an electronic digital signature or contact an operator | Data transfer rate |

| Flaws | Significant waste of time | Additional shipping costs | The need to create an electronic signature or enter into an agreement with the operator. |

Features of filling out form P-3

Data from form P-3 are formed on the basis of synthetic accounting of the enterprise or financial statements. When filling out the data, the Instructions approved by Rosstat Order No. 498 dated October 26, 2015 are taken into account:

- Persons with separate branches generate data on all structures of the enterprise. Separate branches are understood as structures that have jobs created for a period of more than a month.

- Reporting is submitted at the location of the main enterprise and a separate division allocated to an independent balance sheet.

- In the data of the parent enterprise, which has separate divisions, they are presented without indicators of the subsidiary structure.

- The form requires you to indicate the organization’s use of the simplified tax system.

- Enterprises that partially do not operate during the reporting period must indicate the period of inactivity in the explanations of the form.

The full form of form P-3 consists of a title page and 4 sections. When submitting quarterly reports, all sections are required to be completed.

Ready solution ConsultantPlus, 02.11.2018

How to fill out form N P-3 starting with the report for January 2019.

| Fill out Form N P-3 “Information on the financial condition of the organization” for the organization as a whole, including all separate divisions. Reflect the data on an accrual basis at the end of the reporting period. When filling out form N P-3, follow the Instructions for filling out the federal statistical observation form (Appendix No. 3 to Rosstat Order No. 468 dated July 31, 2018) and the Instructions approved by Rosstat Order No. 772 dated November 22, 2017. Submit Form N P-3 to the territorial body of Rosstat at the location of the organization. Submission deadlines are indicated on the form. You can submit the form on paper or as an electronic document signed with an enhanced, qualified electronic signature. For failure to submit or untimely submission of Form N P-3, as well as for reflecting false data in it, you face an administrative fine. |

Table of contents:

1. Who, where and within what time frame submits Form N P-3

2. How to fill out form N P-3

3. How to submit form N P-3

1. Who, where and within what time frame submits Form N P-3

Federal statistical observation form N P-3 “Information on the financial condition of the organization” is submitted by the following organizations (Instructions approved by Rosstat Order No. 468 dated July 31, 2018, clause 58 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017):

all commercial organizations, as well as non-profit organizations of all forms of ownership, that produce goods and (or) provide services, if the average number of employees for 2022 exceeds 15 people, including part-time workers and civil contracts. Organizations holding a mining license submit the form regardless of the average number of employees;

branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation;

non-credit financial organizations, except for organizations not subject to survey.

Form N P-3 is not submitted by:

small businesses;

state and municipal institutions;

banks and non-bank credit organizations that have licenses to carry out banking operations;

insurance organizations;

non-state pension funds;

organizations Homeowners' associations, housing cooperatives, civil society cooperatives and other non-profit organizations that do not sell goods and services to legal entities and individuals.

Fill out the form for the organization as a whole, taking into account all the separate divisions that are part of it. Submit the completed form to the territorial body of Rosstat at the location of the organization (Instructions approved by Rosstat Order No. 468 dated July 31, 2018, paragraphs 2, 58 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017).

Submit the form within the following deadlines:

monthly - no later than the 28th day of the month following the reporting period;

quarterly - no later than the 30th day of the month following the reporting period.

If the delivery day falls on a weekend (holiday), then submit the form no later than the first working day following it (Resolution of the State Statistics Committee of Russia dated 03/07/2000 N 18).

When applying the simplified tax system, submit Form N P-3 monthly in full (clauses 9, 58 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017).

2. How to fill out form N P-3

When filling out form N P-3, follow the following rules:

reflect the indicators in thousands of rubles;

if you are preparing interim accounting (financial) statements for a month or quarter on an accrual basis from the beginning of the reporting year, fill out the form based on the data from such statements and (or) primary accounting data;

if you do not prepare interim accounting (financial) statements, fill out the form based on primary accounting data;

draw up the form based on synthetic and analytical accounting data (clause 58 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017);

The data presented in the form for the reporting period for the corresponding period of last year must coincide with the indicators for the same period last year. An exception is reorganization, change in the structure of the organization, change in the methodology for generating indicators, or clarification of data for the previous year. Please comment on all cases of discrepancies in data for the same periods given in different forms in the explanation to the form. Provide information for the reporting period and for the corresponding period of the previous year based on the new structure of the organization or methodology adopted in the reporting period (clause 8 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017).

Form N P-3 includes:

title part;

section 1 “Indicators of financial condition and calculations”;

section 2 “Income and expenses”;

section 3 “Assets of organizations”;

section 4 “The state of settlements with organizations and enterprises in Russia and foreign countries.”

2.1. How to fill out the title section

The title part of form N P-3 consists of address and code parts.

In the address part, reflect (Instructions approved by Rosstat Order No. 468 dated July 31, 2018, paragraphs 7, 58 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017):

on the line “Name of the reporting organization” - the full name of the organization in accordance with the constituent documents, and then the short name in brackets. If your organization has switched to the simplified tax system, after the name indicate: “simplified taxation system”;

on the line “Postal address” - the name of the subject of the Russian Federation, legal address with postal code. If the actual address does not coincide with the legal address, then indicate the actual location of the organization.

In the code part, provide the code for OKPO based on the Notification of assignment of the OKPO code posted on the Rosstat Internet portal: https://websbor.gks.ru/online/#!/gs/statistic-codes (Instructions approved by the Order of Rosstat dated July 31 .2018 N 468, clause 7 of the Instructions approved by Order of Rosstat dated November 22, 2017 N 772).

2.2. How to fill out section 1 “Indicators of financial condition and calculations”

Reflect the indicators in the order established by clauses 59 - 65 of the Instructions, approved by Order of Rosstat dated November 22, 2017 N 772.

On lines 03 - 27 in column 1, provide the total amount of receivables and payables, as well as debt on loans and credits received (according to lines), in column 2, highlight overdue debt from the total amount.

| Line | Features of the formation of indicators |

| 01 | Report the profit (loss) before tax received for the reporting period. This is the final financial result identified on the basis of accounting of all business transactions. It consists of the sum of the financial result from the sale of goods, products, works and services, fixed assets, other property and other income, reduced by the amount of expenses for these operations. The indicator of line 01 corresponds to the indicator “Profit (loss) before tax for the reporting period” of the “Income Statement” form |

| 02 | Show profit (loss) before tax for the corresponding period of the previous year. Provide the data in prices in force in the corresponding period of the previous year (without recalculation into prices of the reporting year). The indicator of line 02 corresponds to the indicator “Profit (loss) before tax for the period of the previous year, similar to the reporting period” of the “Income Statement” form |

| 03 — 07 | Record accounts receivable. This includes, but is not limited to: debt of buyers and customers for goods, works and services (including those secured by bills of exchange); debt on settlements with subsidiaries and dependent companies; amounts of advances paid to other organizations; debt on settlements with other debtors (including with financial and tax authorities for overpayment of taxes, fees and other payments to the budget); debt of employees on loans provided to them; debt of accountable persons; debt of suppliers for shortages discovered during acceptance of goods and materials; debt of government customers under concluded government contracts; fines, penalties and penalties that are recognized by the debtor or for which court decisions have been received |

| 12 | Show short-term receivables for which payments are expected within 12 months after the reporting date |

| 13 — 20 | Record accounts payable. In its composition, show including: debt on settlements with suppliers and contractors for material assets received, work performed and services rendered, including debt secured by issued bills of exchange; debt on settlements with subsidiaries and dependent companies for all types of transactions; debt to employees for wages (accrued but unpaid amounts); debt for all types of payments to the budget and extra-budgetary funds; advances received; fines, penalties and penalties that are recognized by the organization or for which court decisions have been received; outstanding amounts of borrowed funds subject to repayment in accordance with agreements |

| 25 | Show short-term receivables for which payments are expected within 12 months after the reporting date |

| 26 — 27 | Provide the amounts of debt on loans and credits received, including short-term ones (line 27) |

2.3. How to fill out section 2 “Income and Expenses”

Fill out Section 2 in the reports for January - March, January - June, January - September, January - December.

Reflect the indicators in the order established by paragraphs 66 - 68 of the Instructions, approved by Order of Rosstat dated November 22, 2017 N 772.

In column 1, provide data for the reporting period, in column 2 - for the corresponding period of the previous year.

| Line | Features of the formation of indicators |

| 30 | Show revenue from the sale of products and goods, as well as income related to the performance of work and the provision of services, the implementation of business transactions, which is income from ordinary activities. The line 30 indicator must correspond to the “Revenue” indicator of the “Income Statement” form |

| 31 | Reflect the costs of production of goods, products, works, services in proportion to the share of goods, products, works, services sold. If your organization recognizes administrative and commercial expenses entirely in the cost of goods, products, works, services sold as expenses for ordinary activities, in this line reflect the costs of production of goods, products, works, services sold without taking into account general production expenses and sales expenses . The line 31 indicator corresponds to the “Cost of sales” indicator of the “Income Statement” form |

| 32 | Show production overhead, distribution costs, and distribution costs. The indicator of line 32 corresponds to the sum of the indicators “Commercial expenses” and “Administrative expenses” of the “Income Statement” form |

| 33 | Reflect the profit (loss) from the sale of goods, products, works, services. To do this, subtract from the proceeds (net) from the sale of goods, products, works, services (excluding VAT, excise taxes and similar mandatory payments) the cost of goods, products, works, services sold, as well as commercial and administrative expenses. The indicator on line 33 corresponds to the indicator “Profit (loss) from sales” of the “Income Statement” form |

| 34 | Show the proceeds from the sale of fixed assets (excluding VAT and other mandatory payments) |

| 35 | Reflect the interest paid on loans and credits that are included in the expenses of the reporting period |

2.4. How to fill out section 3 “Assets of the organization”

Fill out Section 3 in the reports for January - March, January - June, January - September, January - December as of the end of the first quarter, half year, 9 months, year.

Reflect the indicators in the order established by paragraphs 70 - 72 of the Instructions, approved by Order of Rosstat dated November 22, 2017 N 772.

In column 1, provide data for the reporting period, in column 2 - for the corresponding period of the previous year (clause 69 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017).

| Line | Features of the formation of indicators |

| 36 | Show the value of non-current assets. These include: fixed assets, intangible assets, long-term financial investments, unfinished investments in non-current assets, exploration assets, profitable investments in tangible assets, deferred tax assets and so on, recorded in the accounting accounts of the financial and economic activities of the organization, section. 1 “Non-current assets”. The indicator in line 36 corresponds to the total for section. 1 “Non-current assets” of the “Balance Sheet” form |

| 37 | Reflect intangible assets at their residual value (except for intangible assets for which depreciation is not accrued) recorded on accounts 04, 05. Also show the amount of R&D expenses not written off as expenses for ordinary activities and (or) other expenses, accounted for account 04, and intangible exploration assets that are recognized as non-current assets. The indicator of line 37 corresponds to the indicators “Intangible assets”, “Results of research and development”, “Intangible exploration assets” section. 1 form “Balance Sheet” |

| 38 | From the intangible assets indicated on line 37, highlight negotiable contracts, lease agreements, licenses, business reputation (goodwill) and marketing assets |

| 39 | Reflect all fixed assets, including those for which depreciation is charged, at their residual value. Show tangible exploration assets that are recognized as non-current assets. When filling out line 39, use account data 01, 02, 03, 08 |

| 40 | From the assets reflected on line 39, highlight land plots and environmental management facilities |

| 41 | Reflect the costs of construction and installation work, purchase of buildings, equipment, vehicles, tools, inventory, other durable material objects, other capital works and other costs not documented in transfer documents. When filling out, use account data 07, 08, 16. This line does not take into account completed search assets recorded on account 08 |

| 42 | Show current assets recorded in accounts 10, 11, 14, 15, 16, 19 - 21, 23, 29, 41, 43 - 46, 50 - 58, 60, 62, 68 - 71, 73, 75, 76, 81 , 97. These include, but are not limited to: inventories at actual cost; VAT on purchased assets; accounts receivable; short-term financial investments; cash; Other current assets. The indicator of line 42 corresponds to the final indicator of section. 2 “Current assets” of the “Balance Sheet” form |

| 43 | Reflect the inventories recorded in accounts 10, 11, 14, 15, 16, 20, 21, 23, 29, 41, 43 - 46, 97. The indicator of line 43 corresponds to the indicator “Reserves” of section. 2 forms “Balance Sheet” |

| 44 | Show the balances of stocks of raw materials, materials, fuel, purchased semi-finished products, components, structures, parts, containers, spare parts, inventory and household supplies and similar assets of the organization, recorded in accounts 10, 11, 14, 15, 16 |

| 45 | Reflect the costs of work in progress and unfinished work (services) recorded in accounts 20, 21, 23, 29, 44, 46. Trade and public catering organizations that do not recognize the recorded distribution costs in the cost of goods (services) sold in full in the reporting period as expenses for ordinary activities, show on this line the amount of distribution costs attributable to the balance of unsold goods and raw materials |

| 46 | Show the actual production cost of the balance in warehouses of finished products that have passed testing and acceptance, complete with all parts in accordance with the terms of contracts with customers and complying with technical specifications and standards (accounts 43, 16). Products that do not meet the specified requirements and undelivered work are considered unfinished. They are shown as part of work in progress. |

| 47 | Record the cost of goods purchased for sale. Manufacturing organizations show the cost of products, materials and products purchased for sale, as well as the cost of finished products purchased for assembly (it is not included in the cost of manufactured products, it is reimbursed by the buyer separately) (accounts 41, 16) |

| 48 | Reflect the amount of VAT on acquired inventories, intangible assets, capital investments made and similar works and services, which reduces the amount of VAT to be transferred to the budget in the following reporting periods or is attributed to the appropriate sources of its coverage. The indicator in line 48 corresponds to the indicator “Value added tax on acquired assets” section. 2 forms “Balance Sheet” |

| 49 | Show investments in securities of other organizations, government securities and the like, loans provided to other organizations, deposits under a simple partnership agreement, and so on (accounts 58, 59) |

| 50 | Reflect the balances of cash in hand on settlement, currency and other accounts in credit institutions and the like (accounts 50, 51, 52, 55, 57) |

| 50.a 1 | Show net asset value. This indicator is equal to the difference between the value of assets accepted for calculation and the value of the organization’s liabilities accepted for calculation |

| 1 Fill in line 50.a only in the report for January - December at the end of the year. |

2.5. How to fill out section 4 “State of settlements with organizations and enterprises in Russia and foreign countries”

Fill out Section 4 in the reports for January - March, January - June, January - September, January - December as of the end of the first quarter, half a year, 9 months, year.

Reflect the indicators in the order established by clause 73 of the Instructions, approved by Rosstat Order No. 772 dated November 22, 2017.

In column 1, lines 51 - 63, show the volumes of finished products, goods, work performed, services rendered, shipped or released by way of sale, direct exchange, as well as sold fixed assets, intangible assets and other valuables (except for foreign currency). When filling out, use analytical accounting data for accounts 90, 91. Reflect the information in actual selling prices (including VAT, excise taxes and similar mandatory payments). When implementing barter agreements, fill out column 1 based on the data on the customs value given in the customs declarations.

This column also reflects:

construction organizations - the cost of completed construction projects or work performed under contract and subcontract agreements;

scientific research organizations - contractual (estimated) cost of research and development work delivered to customers;

trading, supply and sales organizations - the selling cost of goods sold.

Check the correctness of filling out the form using the control ratios.

| Sample of filling out form N P-3 |

3. How to submit form N P-3

You can submit Form N P-3 on paper or in the form of an electronic document signed with an enhanced qualified electronic signature.

If the form contains information, access to which is limited by federal laws (for example, information constituting state or commercial secrets, information about the taxpayer, etc.), submit a report in accordance with the legislation of the Russian Federation on restricting access to this data (clause 7, 13 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 N 620).

You can submit the form (clause 10 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 N 620):

personally or through a representative;

by post with a description of the contents;

using telecommunication channels.

If there are no indicators in the reporting period, you can send Form N P-3 with blank values (zero report), signed in the prescribed manner, or an official letter about the absence of indicators to the territorial body of Rosstat. Such a letter must be sent every time the reporting deadline arrives (Instructions approved by Rosstat Order No. 468 dated July 31, 2018, clause 3 of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017, clause 1 of the Appendix to the Rosstat Letter dated January 22. 2018 N 04-4-04-4/6-smi).

The date of submission of the form is considered to be the date (clause 11 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 N 620):

actual transfer of the report to the territorial body of Rosstat;

directions of the postal item with a description of the attachment;

sending via telecommunication channel.

3.1. What responsibility is established for violations associated with the submission of Form N P-3

For failure to submit or untimely submission of the form, as well as for submitting false data in the report, you face a fine (clause 14 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 N 620):

in case of a primary violation (part 1 of article 13.19 of the Code of Administrative Offenses of the Russian Federation):

— from 10,000 rub. up to 20,000 rub. - for an official;

— from 20,000 rub. up to 70,000 rub. — for the organization;

in case of repeated violation (part 2 of article 13.19 of the Code of Administrative Offenses of the Russian Federation):

— from 30,000 rub. up to 50,000 rub. - for an official;

— from 100,000 rub. up to 150,000 rub. - for the organization.

3.2. What to do if form N P-3 is submitted with inaccurate data

If you independently discover inaccurate data in the form submitted to the territorial body of Rosstat, submit a corrected form within three days from the date of discovery of such data.

If false data is discovered by the territorial body of Rosstat, it will send you a written notification within three days. Submit the corrected form within three days from the date of receipt of the notification.

In both cases, please submit a cover letter along with the corrected form. In it, indicate why you are making corrections, or give the necessary explanations (clause 6 of the Regulations approved by Decree of the Government of the Russian Federation of August 18, 2008 N 620).

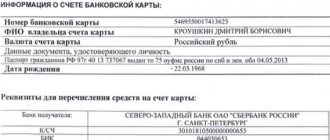

General information about the organization

The title part of the report contains general information about the enterprise. The name of the enterprise is indicated in full and, in brackets, in abbreviated form. The name must correspond to the constituent documents. The OKPO statistics code must be indicated on the title. When submitting reports, information about the address and actual location of the enterprise is provided. The data provided on the activities of a separate branch is accompanied by the name and address of the actual location.

The form presents comparative figures for the reporting and previous periods. When reorganizing the structure or changing the organizational form of an enterprise in one of the relevant periods, data must be presented according to the conditions of the reporting period. Additionally, explanations are provided for filling out the form in case of changes that occurred during the reporting period.

Procedure for filling out the statistical form

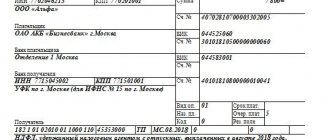

Form P-3 is filled out according to the data of the current reporting period (column 1) and the same period of time of the previous year (column 2).

| Line numbering | Information provided |

| Section 1, completed monthly | |

| 01-02 | Information relevant to the income statement |

| 03-12 | Accounts receivable of the enterprise without reflecting settlements with divisions. The amount of the provision for doubtful debts is not indicated |

| 13-25 | Accounts payable broken down by type, excluding settlements within the structure |

| 26-27 | Debts on loans and credits |

| Section 2, filled out quarterly with an accrual total | |

| 30 | Revenue without indirect taxes, corresponding to financial statements |

| 31, 32 | Cost and expenses that reduce revenue |

| 33 | Profit as the difference between income and expenses |

| 34 | Revenue received from the sale of fixed assets without indirect taxes |

| 35 | Loan interest included in expenses |

| Section 3, completed quarterly by analogy with section 2 | |

| 36-41 | Non-current assets corresponding to balance sheet indicators |

| 42-50 | Current assets by item |

| 50a | The value of net assets that determines the financial stability of the enterprise |

| Section 4 | Filled out quarterly, contains information on sales volume, receivables and payables by country |

Completes the information presented in Section 4 with information about the person responsible for submitting reports to the territorial statistics body. The position, full name, signature of the person, date of preparation and contact telephone number are indicated.

Instructions for filling out in 2022

Changes in the instructions for filling out form P-3 are effective from 07/01/2021. Those who take only the annual form will encounter them for the first time. P-3 contains a title page and four sections with information.

The source for filling out Form P-3 for 2022 is the financial statements for the corresponding period.

Title page

This section is filled in:

- name of the organization (full and short) for which information is being submitted;

- mailing address;

- OKPO.

At the end of the form, it is mandatory to enter the position, full name and telephone number of the responsible person. Otherwise, the program will generate an error when sending the report.

Section I

This section contains information about profit, lines 1–2:

- profit before tax must correspond to the indicator in Form 2 of the appendix to the balance sheet;

- the same indicator for the same period of the previous reporting period.

Lines 3–12 contain information about accounts receivable, highlighting debt for goods and services supplied and indicating overdue.

Lines 13–25 disclose information about the organization’s accounts payable, including column 2 where the overdue debt is specified.

Lines 26–27 are intended to disclose information about existing loans and borrowings:

- in 26 – a generalized indicator reflected in accounting for accounts 66, 67;

- in 27 – only debt on short-term loans and borrowings is allocated.

Column 2 also specifies the overdue debt on lines 26–27.

Section 2

To form section 2, the indicators in Appendix 2 to the balance sheet “Profit and Loss Statement” are taken as a basis. This section has two columns reflecting the indicators of the reporting period and the past.

Line 30 – profit received from the sale of own products and purchased goods. The indicator does not contain the amount of VAT and excise taxes.

Lines 31–32 are devoted to expenses in terms of cost and commercial expenses.

Line 33 – profit (loss) indicator.

Expenses for paying interest on loans and borrowings are particularly highlighted and are reflected on line 35.

Section 3

The third section collects information about the organization’s assets:

- non-current, in the context of fixed assets, intangible assets and capital investments;

- negotiable

Current assets include balances of goods, materials, work in progress, finished products, VAT on purchased raw materials, goods and services, short-term investments, and cash.

The amount of the organization’s net assets on line 50a is also shown here. This figure appears only in the annual report.

Common form filling mistakes

The data presented in Form P-3 may contain errors that lead to unreliable indicators.

| Condition for entering data | Wrong position | Correct position |

| Linking indicators with financial statements and balance sheets | Inconsistency of revenue, expenses, non-current, current assets with the data of form P-3 | The report indicators must coincide with the accounting data of the enterprise’s activities |

| Calculation of numbers determining the need to pass P-3 | Using headcount calculations that do not meet Rosstat requirements | When calculating the number, the requirements established by Instructions No. 498 are taken into account |

| Presentation of reporting by enterprises that have separate divisions on a separate balance sheet | Reporting is submitted at the location of the main body of the enterprise | If there are separate divisions that have an independent balance sheet, reporting is presented for the parent organization and for the division |

Procedure for using the waybill

The waybill for a passenger car is filled out by the dispatcher or, in his absence, by the accountant.

This document must be completed daily, especially in motor transport enterprises. If a working day in a company consists of several shifts, then it is advisable to fill out waybills for each driver (shift). In small enterprises where the company has only official transport at its disposal (for example, the manager’s car), it is allowed to issue this form for several days. Also, one document can be issued for a long period if the car is used on a business trip.

Currently, the form of the waybill can be developed by the enterprise independently, taking into account the specifics of its activities. However, it must contain the mandatory details provided for accounting forms. Basically, the standard intersectoral form No. 3, approved by the State Statistics Committee, is used.

The issued document is entered into the waybill registration journal, according to which it is assigned the next number. After this, it is handed over to the driver.

When leaving the garage, the waybill must be signed by a mechanic who checks the serviceability of the car, the speedometer readings and the remaining fuel in the tank.

While performing his official duties, the driver on the second side of the waybill reflects the places he visits, recording information about the time and kilometers traveled.

When entering the garage, a technician inspects the car, checks its serviceability, records the speedometer readings and the displacement in the tank in the appropriate columns, and then endorses the waybill.

The employee submits this document to the control room, where a specialist calculates it and reflects it in the registration log.

Responsibility for violation of the procedure for submitting form P-3

If the deadlines for submission are violated, fines are imposed on the legal entity and the manager. Distortion of data submitted to Rosstat is also considered a violation. The legislation provides for Article 13.19 of the Administrative Code. Read also the article: → “Responsibility for tax offenses in 2022: fines, types.”

The amount of the fine ranges from 20 to 70 thousand rubles and from 10 to 20 thousand rubles for the head of the enterprise. If the violation is repeated, the fine increases.

The sanction for a repeated violation for an organization ranges from 100 to 150 thousand rubles, the punishment for officials ranges from 30 to 50 thousand rubles.