Accounting for import transactions

In accordance with the Federal Law of December 8, 2003 No. 164-FZ “On the Fundamentals of State Regulation of Foreign Trade Activities” (as amended and supplemented) (clause 10 of Article 2), import of goods is the import of goods into the Russian Federation without the obligation to re-export .

To avoid problems with legislation, it is necessary to very scrupulously maintain both accounting and tax records of import transactions.

Accounting for import transactions is in many ways similar to tax accounting, but there are a number of distinctive features:

| Similarities | Differences |

| When determining the cost of goods, the costs incurred by the taxpayer when importing goods into the territory of the Russian Federation are taken into account. Actual costs can be classified as expenses when calculating the organization's income tax. | When calculating income tax, an organization has the right to write off expenses in any manner convenient for it. |

Rules and exceptions

The general rule states: the actual cost of goods in which they are accepted for accounting is not subject to change (clause 12 of PBU 5/01). However, there is an exception to every rule. Thus, according to paragraph 26 of PBU 5/01, goods owned by the organization, but in transit, are taken into account in accounting in the assessment provided for in the contract, with subsequent clarification of the actual cost (Letter of the Ministry of Finance of the Russian Federation dated December 26, 2011 No. 07-02- 06/256).

Consequently, the cost of imported products can be clarified until the goods actually arrive at the company’s warehouse or are shipped to the buyer, bypassing the company’s warehouse.

At the same time, it is impossible to exclude a situation in which documents on expenses to be included in the cost (in practice, this mainly concerns TKR) will be received by the organization after the goods are received into the warehouse, or even after its sale. Let's assume that all the described actions occurred during the calendar year. In this case, most accountants will attribute “late” costs to account 44 “Sales expenses” with further disclosure in the line “Selling expenses” of the Statement of Financial Results.

The general rule is: the actual cost of goods in which they are accepted for accounting is not subject to change. However, there is an exception to every rule...

If, according to the terms of the accounting policy, the organization forms the actual cost taking into account the technical requirements, then, in my opinion, it is necessary to make an adjustment to the actual cost of the goods and the cost of sales if the products were sold. This way the above accounting can be applied.

In addition, attributing “late” costs to account 44 with their further disclosure in the “Business expenses” line of the Income Statement may lead to distortions in the financial statements. After all, the actual cost is recognized as an expense for ordinary activities and forms the cost of sales (Debit 90, subaccount 90-2 Credit 41; clauses 5, 9 PBU 10/99 “Organization expenses”, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n). And, therefore, it is subject to disclosure under the line “Cost of sales” of the Financial Results Report.

To reflect “late” expenses in accounting, it is permissible to use account 44 if information about such expenses is disclosed in the reporting in accordance with the requirements of current legislation (that is, according to the line “Cost of sales”). To do this, it is advisable to organize separate accounting of such expenses, for example, in a separate sub-account or by maintaining appropriate analytics for account 44. The method of accounting for these expenses can be disclosed in the accounting policy of the organization.

Accounting entries for accounting for import transactions

A detailed explanation of accounting and tax accounting for import transactions will be given below:

| Accounting entry | Explanation | Document confirming the operation | |

| D 60 | K 52 | Transfer of advance payment to the supplier for imported goods | Bank statement, payment order |

| D 76 | K 51 | Payment of customs duties | DT, bank statement, payment order |

| D 07 D 08-4 D 10 D 41 | K 60 K 76 | Ownership rights to goods as:

The owner makes an independent decision, guided by regulations. | Form No. OS-14 “Act of acceptance (receipt) of equipment” Form No. MX-1 “Act of acceptance and transfer of inventory items for storage” Form TORG-1 “Act of acceptance of goods” |

| D 19 | K 76 | Import VAT reflected | DT, bank statement, accounting certificate |

| D 07 D 08-4 D 10 | K 60 | Costs of delivering property to the territory of the Russian Federation | Accounting information |

| D 19 | K 60 | VAT on property transportation | Invoices, accounting certificates |

| D 01 | K 08-4 | Capitalization of received property | Form No. OS-1 “Act of acceptance and transfer of fixed assets (except for buildings, structures)” |

| D 68 | K 19 | Submitting import VAT for deduction | Invoice, accounting certificate |

| D 60 | K 91-1 | Accrual of positive exchange rate differences on settlements with suppliers in foreign currency | Accounting information |

| D 91-2 | K 60 | Accrual of negative exchange rate differences on settlements with suppliers in foreign currency | Accounting information |

| D 60 | K 52 | Final payment to the supplier for the imported goods | Bank statement |

Tax accounting of import transactions

According to paragraph 3 of paragraph 1 of Article 268 of the Tax Code of the Russian Federation, when selling property or property rights, the taxpayer has the right to reduce income from such transactions by the amount of expenses directly related to such sale.

The following expenses are accepted for accounting: (click to expand)

- at the rate;

- storage;

- service;

- transportation.

In accordance with Article 320 of the Tax Code of the Russian Federation, the procedure for determining expenses for trade operations is determined. According to this normative act, the amount of distribution costs includes expenses for:

- delivery of goods;

- warehousing costs;

- other expenses associated with the purchase of goods.

The taxpayer has the right to determine the cost of goods taking into account distribution costs. The formation of the cost of goods is explained in detail in the section “How is the cost of imported goods formed?”.

Example of accounting for import transactions

ABC LLC purchased goods in Spain for the amount of €8,000 on July 11, 2017. ABC LLC received property rights to the goods on July 11, 2017.

- Customs duty – 12,000 rubles.

- Customs duty – 15%.

- Calculated VAT: 8000*68.77*1.15*0.18=113883.12 rubles.

- Costs for delivery of property to the territory of the Russian Federation 34650.00 (including VAT 6237.00)

On July 16, 2017, the final payment for the goods was made. € exchange rate: 07/11/2017 – 68.77 rubles, 07/16/2017 – 68.36 rubles.

| Accounting entry | Explanation | Amount (rub.) | |

| D 76 | K 51 | Payment of customs duties | 12 000,00 |

| D 76 | K 51 | Payment of customs duties | 82 524,00 (8000*68,77*0,15) |

| D 07 D 08-4 D 10 D 41 | K 60 K 76 | Ownership rights to goods as:

The owner makes an independent decision, guided by regulations. | 550 160,00 (8000*68,77) |

| D 19 | K 76 | Import VAT reflected | 113 883,12 |

| D 07 D 08-4 D 10 | K 60 | Costs of delivering property to the territory of the Russian Federation | 34 650,00 |

| D 19 | K 60 | VAT on property transportation | 6 237,00 |

| D 01 | K 08-4 | Capitalization of received property | 550 160,00 |

| D 68 | K 19 | Submission for VAT deduction | 120 120,12 (113 883,12+6237) |

| D 60 | K 91-1 | Accrual of positive exchange rate differences on settlements with suppliers in foreign currency | 3 280,00 (8000*(68,77-68,36)) |

| D 60 | K 52 | Final payment to the supplier for the imported goods | 546 880,00 (8 000*68,36) |

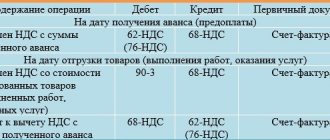

Acceptance of VAT paid at customs for deduction

VAT paid at customs is accepted for deduction if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- goods are accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation);

- the goods must be used in activities subject to VAT;

- We have a customs declaration (copy) on paper, incl. for electronic declaration (Letter of the Ministry of Finance of the Russian Federation dated 02/22/2017 N 03-07-08/10198, Letter of the Ministry of Finance dated 05/29/2015 N 03-07-15/31200, Letter of the Ministry of Finance of the Russian Federation dated 08/18/2010 N 03-07-08/237 , paragraph and paragraph 39 of the Procedure approved by Order of the Federal Customs Service of the Russian Federation dated September 17, 2013 N 1761);

- confirmation of VAT payment is available in the form of a Report on the expenditure of customs duties (payment order for the payment of VAT).

Acceptance of VAT for deduction is formalized by the document Generating purchase ledger entries in the Operations section - Closing the period - Regular VAT operations - Create button.

Purchased Assets tab is filled in automatically by clicking the Fill . But to correctly fill out the purchase book, you need to make adjustments.

When initially filling out the document Formation of purchase ledger entries, the Doc. No. columns. payment and date of doc. payments are hidden, but if VAT on import supplies is accepted for deduction, then it is very important to check that the details of the payment document for payment of “import” VAT to the budget are filled out correctly.

See also How an importer can set up and fill out a document Creating purchase ledger entries

Let's look at the features of filling out the document Formation of purchase ledger entries using an example.

As a result of auto-filling, the tabular part of the document will look like this:

- Date doc. payment and Doc number. payment - the date and numbers of payment orders for the payment of VAT and duties, as well as the fee for which the advance payment was offset in the customs declaration document for import .

In the purchase book, in column 7 for transactions with the code “Importation of imported goods into the territory of the Russian Federation,” you must indicate the number and date of the payment order confirming the payment of the tax. That is, that payment order according to which VAT was paid (clause to clause 6 of the Rules for maintaining a purchase ledger, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

In our example, VAT was paid by payment order No. 100 dated March 27, 2018 (column 47 “Calculation of payments” of the goods declaration, payment type 5010). PDF

This means that in order for the correct tax payment details to be indicated in the purchase book, you need to make adjustments to the tabular part of the document Formation of purchase book entries and indicate there the number and date of the payment order only for VAT - No. 100 dated March 27, 2018.

See also How to quickly find the number and date of a payment order for payment of VAT at customs when filling out a document Creating purchase ledger entries

In the process of work, the accountant may need to clarify and refill the document Formation of purchase ledger entries . In order to avoid having to repeat manual adjustments in the tabular section, we recommend creating a separate document Formation of purchase ledger entries only for the offset of VAT paid at customs. In the Comment you can place a corresponding note, for example, Import .

Postings according to the document

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

VAT declaration

The VAT return reflects the amount of VAT deducted:

In Section 3 p. 150 “The amount of tax paid by the taxpayer to the customs authorities...”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- TD data, transaction type code "".

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Errors in accounting for import transactions

When accounting for import transactions, you must be very careful to avoid errors that are often identified during an audit:

- incorrect conversion of foreign currency into rubles when conducting a foreign exchange transaction;

- there is no translation into Russian of the text of the document on the basis of which payment is made from a foreign currency account;

- failure to meet deadlines for fulfilling obligations under contracts that provide for advance payments;

- incorrect correspondence of invoices for accounting of import transactions.

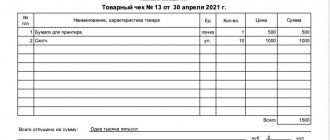

Documents required for registration of imported goods

According to the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (Article 9), each fact of economic activity must be subject to registration with a primary accounting document. To account for import transactions, the primary accounting documents, the presence of which is necessary for accounting and tax accounting of imported goods, are:

- foreign trade contract with the importer of goods;

- invoice issued by the seller;

- transport, forwarding documents;

- insurance documents;

- declaration of goods (DT);

- bank certificates confirming payment of customs duties and taxes;

- invoices, acts of acceptance of inventory items;

- technical documentation.

And in tax accounting

The procedure for determining expenses for trade operations is regulated by Article 320 of the Tax Code, according to which direct expenses include: the cost of purchasing goods sold in a given reporting period and expenses for delivering purchased products to the customer’s warehouse.

Indirect expenses include all other expenses incurred in the current month.

Unfortunately, the legislator did not disclose a specific list of works and services included in transportation costs. Therefore, let us turn to the institutions, concepts and terms of other branches of law (clause 1 of article 11 of the Tax Code of the Russian Federation).

Judicial practice allows the determination of the composition of transport costs based on the decoding of the types of services according to OKVED (see Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 30, 2004 No. F03-A51/04-2/3629). In turn, the section “Transport and Communications” of OKVED (OK 029-2001, approved by Decree of the State Standard of the Russian Federation dated November 6, 2001 No. 454-st), includes subsection 63 “Auxiliary and additional transport activities”, which identifies the following types services, such as, for example, “Cargo handling and storage (including loading and unloading of goods, regardless of the type of transport used for transportation)” and others.

Judicial practice allows determining the composition of transport costs based on the decoding of the types of services according to OKVED...

Thus, the organization will be able to classify as direct expenses not only payment for transport services for the transportation of goods, but also payment for the services of counterparties for loading and unloading products, as well as payment for temporary storage of cargo. The legitimacy of this approach is confirmed by the servants of Themis (see Resolution of the Federal Antimonopoly Service of the Far Eastern District dated December 30, 2004 No. F03-A51/04-2/3629). Officials agree with this. Thus, financiers believe that transportation costs include, in particular, expenses for storing goods during customs clearance, for the use of wagons during transportation and during customs clearance, costs of paying for forced downtime of wagons during customs clearance, commissions to forwarders, delivering goods. (Clause 5 of the Letter of the Ministry of Finance of the Russian Federation dated November 11, 2004 No. 03-03-01-04/1/105).

The financial department also allows the inclusion in direct expenses of trade operations of the amount of paid import customs duties and fees, provided that such a procedure for creating value is provided for by the accounting policy (Letter of the Ministry of Finance of the Russian Federation dated May 29, 2007 No. 03-03-06/1/335 ).

At the same time, insurance costs do not participate in the formation of the cost of goods, but are taken into account as part of indirect expenses of the current reporting period (clause 5, clause 1, article 253, clause 2, clause 1, clause 3, article 263 of the Tax Code of the Russian Federation). Indirect costs also include costs for services for pre-sale preparation of goods, for example, costs for packaging, sticking radioprotective labels (Letter of the Ministry of Finance of the Russian Federation dated September 4, 2012 No. 03-03-06/1/465).

Category “Questions and Answers”

Question No. 1. Are we required to make advance payments to a foreign seller when purchasing imported goods?

The obligation to pay an advance payment arises provided that this obligation appears in the contract that you have concluded with the foreign supplier. If the contract does not provide for an advance payment when purchasing imported goods, you are not obliged to pay it.

Question No. 2. Do I understand correctly that accounting for goods begins on the day the property rights to them are transferred, even if the goods have not yet been received and paid for?

Yes, in accordance with the legislation of the Russian Federation, the buyer of imported goods accepts the goods for fixed assets or inventories at the time of transfer of property rights from the seller.

Accounting for imported goods in the 1C program: Accounting 8

Program 1c: Accounting 8

is a convenient solution for any company, both engaged in taxable and tax-exempt activities.

The VAT amount is deductible if the sale of goods is subject to taxes. There are also several cases when the amount of VAT is not deducted, but is attributed to an increase in the price of the product - these are:

- if the product is exempt from taxation;

- if sales are carried out outside the territory of the Russian Federation;

- if the sale of goods is not recognized as sales in accordance with Article No. 146 of the Tax Code of the Russian Federation.

If the buyer does not pay VAT or is exempt from paying taxes, then the VAT paid at customs is included in the costs of the payment period.

In the case of purchasing products for resale, it is immediately clear whether their subsequent sale is subject to VAT.

Registration of goods in the 1C: Accounting 8 program

First, you need to enter the purchased products into the directory called “Nomenclature”, indicating certain parameters:

- in the “item group” field, you must indicate the directory group to which the item belongs;

- in the “short name” field you need to enter the name of the product;

- indicate the relevant data in the “full name of the product” field;

- the unit for measuring the product must be selected from the reference book called “Classifier of units of measurement”. If the required unit of measurement is not available, you must click the following: selection from OKEI/All-Russian Classifier and select the required unit from the list that opens;

- it is necessary to indicate the VAT rate that is determined for this product;

- item group/index for warehouse accounting. It is best if the names of these groups coincide with the names of the groups in the “Nomenclature” directory;

- the number of the cargo customs declaration or customs declaration is selected from the corresponding directory. If the required number is not in the directory, you need to add it and fill in the details;

- Country of origin is the country in which the product was manufactured. To select a country, use the World Countries Classifier reference book.

To carry out operations on import transactions and correct accounting of settlements with foreign suppliers, in 1C: accounting 8

it is necessary to establish the terms of the contract. This can be done in the directory called “Contracts”.

In the “Type of agreement” field you need to put o, then select the currency that is present in the agreement. The order in which mutual settlements with counterparties will be carried out directly depends on the configuration settings of 1C: Accounting 8

. There are two options:

- in accordance with the agreement (if the agreement is closed, 1C:Accounting

itself will detect the settlement documents); - according to settlement documents (when closing, the user of the 1C:Accounting

independently indicates the required settlement document).

In order to correctly transfer money under an import contract for an advance payment to the supplier, a document called “Write-off from the current account” is used. In this document, the item “Payment to supplier” is selected as an option for the movement of money.

Next, you need to select accounting account 52 and indicate “Bank foreign currency account” through which the movement is carried out. It is also necessary to select an accounting account for advances and settlements - 60.22 and 60.21, respectively.

In order to correctly calculate the ruble amount, it is necessary to fill out information about the exchange rate that currently exists in the directory called “Currencies”. If an accountant needs the “Rate” field, it is always available for editing and reflects the current exchange rate.

In addition, in the directory called “Currencies”, it is possible to download an existing course from the RBC server.

To do this, click on the “Download courses” button on the document panel. In the dialog box you need to specify a specific period for which you want to download courses. Using the “Fill” and “Select” buttons, you can create a list of currencies for which you need to download rates. Once the exchange rate data has been downloaded, it will automatically be recorded in the register for each specific currency. Import of goods in 1C: Accounting 8

In the case of import of goods, a document called “Receipt of goods and services” is used, since receipt can be considered a purchase only from a foreign supplier.

You need to click the “Price and Currency” button and remove the o (the cost of the goods is not included in the tax amount, and the tax is paid at customs).

In receipt documents, automatic completion of the customs declaration number and country of origin is disabled. In order to indicate information about goods from import suppliers, you need to make the data fields visible - customs declaration and country of origin. In the field menu called “Products”, you must select the following item – “List settings”. As a rule, this item is located at the end of the context menu.

In the “List Settings” window, you need to check the boxes next to the “Country of origin” items, as well as “Customer declaration number” - now the corresponding columns will be visible in the table field.

After this, you need to fill out the document “Receipt of goods and services” and post it.

If the country of origin, as well as the customs declaration number, are indicated, a posting will be generated for the goods as a debit to an off-balance sheet account called “Accounting for imported goods by customs declaration numbers.”

This type of accounting is carried out exclusively by the quantity of goods. As a result, imported goods can be assigned to the warehouse. How to reflect additional customs expenses

To reflect additional funds spent on customs, the customs declaration document for import is used. You can enter this document based on “Receipt of goods and services”.

The following fields must be filled in:

- customs;

- foreign currency deposit;

- deposit at customs.

Information about customs and deposits is noted in directories under the titles “Counterparties Agreement”, as well as “Counterparties”. Also, if the agreement was not entered into the directory, this must be done in accordance with the new agreement.

You also need to select the exchange rate, select the value of the customs declaration number, and fill out information about fees and penalties paid at customs. In the “Sections of the customs declaration” tab, you must fill in information about the duty, goods by section and VAT rate. In addition, accounting accounts for regulated accounting are entered into the tabular part of the document. The following fields are filled in automatically:

- accounting account;

- VAT account;

- NU accounting account.