What are profitable investments?

The legislation determines that profitable investments in material assets should be considered financing the purchase of objects with a long period of use, which are endowed with a tangible form and are transferred to other entities for use in their economic activities for a certain period of time for a fee established by the contract.

These include, for example:

- Building.

- Facilities.

- Equipment.

- Vehicles, etc.

That is, in essence, these are fixed assets (fixed assets). But they have a main distinguishing feature - these assets are used in activities not by the owner himself, but by those who lease these assets. Thus, income-generating investments represent leased assets.

The company must carry out separate accounting of fixed assets and income-generating investments, since they have a different nature of use by the entity.

The rules of law require that objects acquired and transferred by an organization to another entity under a rental or leasing agreement must still be reflected in the accounting and reporting of the direct owner.

In this case, it does not matter for what funds the property was acquired - from own sources or from borrowed capital.

These objects must be registered at their original cost, which is the sum of the actual costs incurred for their purchase or construction.

Attention! However, like fixed assets, these assets should be reflected in reporting at their residual value, that is, the amount of depreciation accrued during their use is subtracted from the original cost. A separate line 1160 is provided in the balance sheet to reflect information about these objects.

Typical accounting entries

| Operation | Debit | Credit |

| Fixed assets are registered at their original cost | 03 | 08 |

| OS is registered as a contribution to the authorized capital | 03 | 80 |

| OS shortage reflected | 94 | 03 |

| Excess OS detected | 03 | 91 |

| Revaluation based on revaluation results | 03 | 83 |

| Markdown based on revaluation results | 91 | 03 |

| Disposal of fixed assets due to sale, gratuitous transfer | 91 | 03 |

| The fixed asset has ceased to be used for use | 01 | 03 |

What is taken into account on account 03 of accounting

The current Chart of Accounts provides that income-generating investments must be accounted for separately from fixed assets in a special account 03.

Here you can see the objects that the company receives to generate income from renting them out for temporary use by third parties. These objects have the same cost as an OS and have a useful life of more than one year.

An important characteristic for this kind of objects is also established in the form of the presence of a material form. Thus, intangible assets (intangible assets) cannot be reflected in this account.

Thus, in account 03 it is necessary to take into account the costs of purchasing buildings, structures, equipment, vehicles, inventory, etc.

Attention! In addition, on this account it is necessary to show objects that are transferred to other counterparties under a leasing agreement, in cases where the material value is listed on the lessor’s balance sheet. If, according to the provisions of the concluded agreement, such property is included in the balance sheet of the lessee, then off-balance sheet account 011 is used to reflect such funds.

You might be interested in:

Account 60 “Settlements with suppliers and contractors” in accounting: what it is intended for, characteristics, postings

Investment property valuation

Investment property, which is also accounted for on account 03 as part of income-generating investments in tangible assets, is accounted for at its original cost, determined in accordance with clauses 9 - 16 of FAS 26/2020 (clause 12 of FSBU 6/2020) .

It is determined based on the actual capital investments made - the costs of their acquisition (including costs of delivery, installation and installation, etc.), which are recorded in account 08 “Investments in non-current assets”.

After recognition, investment property is valued at its original or revalued cost (clause 13 of FSBU 6/2020).

In the first case, the initial cost of investment property is repaid by calculating depreciation (clause 27 of FSBU 6/2020). The amounts of accrued depreciation are reflected in account 02 “Depreciation of fixed assets” according to the corresponding analytics.

Investment property valued at a revalued value is not depreciated (clause 28 of FSBU 6/2020). It is reflected in account 03 at fair value, which is determined at each reporting date (clause 21 of FAS 6/2020). And the amount of revaluation or depreciation is included in the income or expenses of the current period in which the revaluation was made.

If an object is acquired solely to generate income from an increase in its value, then it is obvious that it should be valued precisely at its revalued value.

Characteristics of account 03 - “Profitable investments in material assets”

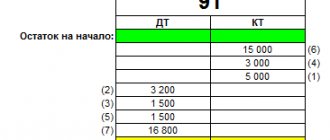

As indicated in the Chart of Accounts, account 03 is active. The debit balance of such an account reflects the presence at the beginning of the period of certain profitable investments in assets. The debit of the account reflects the receipt of objects, and the credit reflects their disposal.

The balance at the end of the period is calculated by adding the balance of profitable investments at the beginning of the period with the turnover on the debit of the account, and subtracting the turnover on the credit of this account from the resulting amount.

Analytics for the account under consideration is built by type of objects of profitable investment in assets, by tenants and lessees, and also by separately accounted assets.

In addition, a sub-account can be created on this account, which can be used to account for the disposal of objects reflected as profitable investments in tangible assets.

The debit of this subaccount must reflect the cost of the retiring material asset, and the credit - the amount of accumulated depreciation for this object. After this, this sub-account is closed, and the result obtained is applied either to other income or to other expenses of the company.

Attention! However, a business entity has the right not to use it, but to determine the financial result from the disposal of such an object directly on account 91. The chosen method must be fixed in the company’s Accounting Policy.

Example of filling out line 1160 “Profitable investments in material assets”

The company reflects incomplete capital investments separately according to a independently entered line in section I “Non-current assets”. If the value of the indicator is insignificant, it is reflected in line 1190 “Other non-current assets”.

Let's pay attention to the company's accounting - the following indicators are shown for accounts 02 and 03:

Let's look at a fragment of the company's balance sheet for 2013:

Let's find out what the residual value of fixed assets that were taken into account by the company as part of profitable investments in tangible assets is:

We get the following reflection of the values in the balance sheet of the enterprise (the fragment of interest):

Specifics of profitable investments in real estate

Real estate is a special kind of property. According to the law, it is necessary to register ownership with the issuance of an appropriate certificate.

In this regard, accountants sometimes have a question: in what period of time to transfer the value of an object from account 08 to account 03 - before receiving the certificate, or after that.

There is one more feature associated with real estate objects. The law obliges to calculate and transfer property taxes to the budget. This must be done for the first time on the 1st day of the month, which follows the month of its acceptance for registration in the business entity.

PBU 6/01 establishes the rule that an object begins to be accounted for in account 01 or 03 from the moment it fully meets the criteria of a fixed asset. At the same time, this document does not say a word about the need to wait for official paper from a government agency - a certificate. The Ministry of Finance and the Federal Tax Service adhere to the same position in their letters.

Attention! At the same time, it is recommended that the organization itself does not have any confusion - which object has already received state registration and which has not, and that they be taken into account in different sub-accounts. For example, within the group, open two sub-accounts - “Objects that have passed state registration” and “Objects awaiting state registration”.

Accounting accounts in "1C: Accounting 8"

An accounting entry or accounting formula is a correspondence of accounts indicating the amount of transactions

The accounting entry is compiled only on the basis of primary accounting documents. Primary accounting documents include orders, contracts, acceptance certificates, payment orders, cash receipts and expenditure orders, invoices, orders, receipts, sales receipts, etc.

Primary documents are supporting documents on the basis of which accounting records are maintained and which certify the facts of business transactions. The primary document is drawn up at the time of the relevant transaction or immediately after its completion.

In general, to draw up a posting you need to:

- determine the essence of changes occurring with accounting objects as a result of a completed business transaction;

- select, according to the Chart of Accounts, suitable accounts for recording the amount of a business transaction using the double entry method - debit and credit.

After determining the correspondence of accounts as a result of this operation, an accounting entry is drawn up. If a transaction corresponds to only two accounts (one for debit, the other for credit), then it is called simple

.

Accounting entries in which more than two accounts interact are complex entries

.

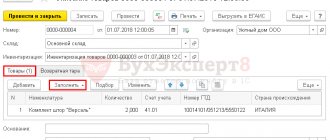

You can make accounting entries in 1C:Accounting 8 through standard configuration documents and through manually entered transactions.

The document “1C: Accounting 8” allows you to enter information about a certain business transaction into the accounting system, record the date and time of the transaction, the amount and content of the transaction. Examples of program documents: Receipt of goods and services, Expense cash order, Receipt to current account, Depreciation and depreciation of fixed assets

etc.

Based on the document, accounting entries are automatically generated and recorded in the accounting registers (each accounting entry corresponds to one entry in the accounting register), and entries are also entered into specialized information registers and accumulation registers. In the 1C:Enterprise system, accounting for a business transaction is always associated with the document that generated it: if the document needs to be edited, then when it is edited, the entries in the registers will be created anew, and when the document is deleted, the entries in the registers will also be deleted.

Using the document "1C: Accounting 8" you can also obtain a printed form of the primary document, for example, a Payment order

,

Advance report

, etc.

In general, standard accounting system documents can generate accounting entries in various combinations, entries in special registers, and also offer or not offer printed forms of primary accounting documents, for example:

- in the document Invoice for payment to the buyer,

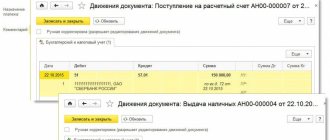

a printed form is available, but there are no entries in the accounting register and in special registers; - in the document Receipt to the current account

- there can be only one simple accounting entry, and there is no (as unnecessary) printed form of the document; - The document Sales of goods and services

contains a whole group of accounting entries, entries in registers, and also supports several options for printed forms.

You can view transactions using the DtKt

both from the document form and from the list of documents form.

If the automatically created records for some reason do not satisfy the user, then in the form for viewing document movements, you must set the Manual adjustment flag (allows editing of document movements).

This flag allows you to add new and edit existing document movements; the automatic generation of movements is disabled.

After removing the Manual adjustment...

, the document will be re-posted, and the movements will be restored automatically by the posting algorithm (Fig. 12).

Rice. 12. Form for viewing document movements

In the accounting register form (section Operations

hyperlink

Transaction log

) information in the list can only be viewed (Fig. 13). To find the necessary information, it is advisable to use the list selection and sorting settings.

Rice. 13. Accounting register

If the user does not find the business transaction he needs among the standard documents of 1C:Accounting 8, then in this case a manual Operation

(Section

Operations

, hyperlink

Operations entered manually

).

You can check the correctness of manually entered account correspondence using the accounting express check mechanism.

Correspondence of Accounts directory is intended to assist in registering business transactions.

(section

Main

hyperlink

Enter a business transaction

), which is a configuration navigator that will help the accountant, based on the content of the business transaction or the correspondence of the accounting accounts for the debit and (or) credit of the account, to understand which document needs to be reflected in the configuration.

You can select the required account correspondence by debit or credit accounts, by the content of the transaction (Fig. 14) or by the configuration document.

Rice. 14. Directory of correspondence accounts

To facilitate the entry of recurring business transactions, standard transactions are provided. To store a list of standard operations, as well as to create new standard operations, a reference book of standard operations is provided (section Operations

hyperlink

Typical operations

).

A typical operation is a template (standard scenario) for entering data about a business transaction and generating entries for accounting and tax accounting, as well as entries in accumulation and information registers.

The entered operation will be reflected in the operation log, as well as in the list of manually entered operations.

In the header of the directory element Typical operation

in the

Contents

, a brief content of the transaction is indicated (Fig. 15).

The information from this field will be filled in the field of the same name when creating the Operation

.

Rice. 15. Creating a new standard operation

The form displays elements of a typical operation on the following tabs:

- Accounting and tax accounting;

- List of parameters.

On the Accounting and Tax Accounting

a set of templates for automatic generation of accounting and tax accounting entries is displayed. Records are entered into the tabular part, each of which will correspond to the automatically generated invoice correspondence. When you select a value for a field, a form appears with a choice of filling options. There are three options:

- Parameter

(used for values that are not known in advance and are set at the time of document creation); - Value

(set in the

Operation

automatically with the value specified in the template and is not requested when entering the

Operation

); - Do not change

(applies only to periodic information registers, and the value of this field will be obtained from the infobase at the time of creation of the

Operation

).

On the Parameter List

All parameters used in this typical operation are displayed.

On this tab you can add new or change existing parameters, as well as manage the order of parameters. Order is used to display parameters in an Operation

.

To set up a template for filling information and accumulation registers, you need to add the required registers using the Select registers

(

More

-

Select registers

).

After selection, the selected registers will be displayed on additional tabs between the Accounting and Tax Accounting

and

List of Parameters

.

You can analyze data on accounting and tax accounts using standard reports:

- Turnover balance sheet;

- Account balance sheet;

- Account analysis;

- Account turnover;

- Account card;

- General ledger and others.

How to evaluate profitable investments

When assessing income-generating investments, the same rules are used as for fixed assets.

You might be interested in:

Account 01 - Fixed assets in accounting: correspondence of accounts, postings

Initially, the value of such an asset is collected from its direct value, reduced by the amount of taxes, as well as all related expenses.

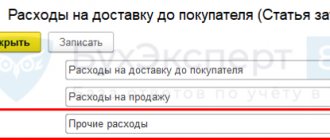

The latter may include:

- Transportation costs;

- Costs of engaging third-party specialists (for example, appraisers);

- Travel and fuel expenses, if they were associated with the acquisition of this object;

- Mandatory deductions, customs payments and state duties;

- Cost of materials used;

- etc.

Thus, all costs associated with the purchased object are collected in account 08. This is done until it is ready to be rented out or leased to generate income. After completion of all necessary work, the accumulated costs for the facility are transferred in one amount to account 03.

Attention! The state duty, if it was paid before the cost was transferred to account 03, can also be included in the costs of the object. Otherwise, it should be taken into account in account 91.

Income investments: concept and types

Income investments are understood as funds capitalized in the form of acquired material assets in order to obtain additional benefits from their use. The main types of profitable investments are buildings, premises, production and other equipment, vehicles and other fixed assets.

To receive income from investments, organizations, as a rule, transfer valuables for temporary use and ownership to other enterprises and organizations for a fee. The basis for the transfer of property is an agreement (rent, leasing, etc.), as well as an acceptance certificate confirming the fact of receipt of valuables by the tenant.

Modern practice shows that property that acts as income-generating investments is most often cars (car rental services) and premises (residential and industrial).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Which accounts does account 03 correspond to?

From the debit of account 03, postings can be made to the following accounts:

- 08—acceptance of acquired property for accounting as an income-generating investment;

- 76 - the value of the property for rent is being clarified due to a previously made mistake;

- 80 - property for rent was received from the participant as a contribution to the authorized capital.

On the credit of account 03, debit correspondence entries can be made with the following accounts:

- — transfer of property from the category of profitable investments to fixed assets;

- — write-off of depreciation of a retiring income investment;

- 76 - compensation for part of the cost of a profitable investment through insurance due to its damage;

- 80 - property was transferred to the founders upon their withdrawal from the company;

- 91 - the value of property is written off upon disposal or sale;

- 94 - the shortage of income-generating property is reflected;

- 99 - write-off of the value of an income-generating investment as a result of its loss due to an emergency.

Correspondence of account 03 with other accounting accounts

We have already found out that account 03 corresponds with accounts 02, 08 and 91. But these are not all possible combinations. Let's consider all the options:

| By debit | By loan |

| 08 “Investments in non-current assets” 76 “Settlements with various debtors and creditors” 80 “Authorized capital” | 01 “Fixed assets” 02 “Depreciation of fixed assets” 76 “Settlements with various debtors and creditors” 80 “Authorized capital” 91 “Other income and expenses” 94 “Shortages and losses” 99 “Profits and losses” |

Accounting entries for account 03

The postings that are made with account 03 are in many ways similar to those made for fixed assets.

| Debit | Credit | Operation description |

| Acquisition of property | ||

| Property purchased for further rental | ||

| 19 | 60 | VAT is deducted from the sales amount |

| 68 | 19 | VAT credited |

| 03/1 | 08 | The acquired property is accounted for as an income-generating investment. |

| Renting, leasing | ||

| 03/2 | 03/1 | Transfer of property for rent or leasing |

| 02 | Depreciation has been calculated | |

| 03/1 | 03/2 | Return of property previously leased, leasing |

| Disposal of property | ||

| 03/Disposal | 03/1 | The value of the property is written off |

| 02 | 03/Disposal | Accrued depreciation on retiring assets was written off |

| 91 | Property sold | |

| 91 | 68 | VAT accrued on the sale of property |

| 91 | 03/Disposal | Residual value written off as expenses |

Analytical accounting and subaccounts

You can consider analytics for account 03 by type of material assets, by their individual objects, or by tenants/lessees. The following subaccounts can be distinguished:

- MC for rent/leasing;

- MCs rented out/leasing;

- disposal of MC facilities.

If there are subaccounts, the initial cost of the fixed asset will be transferred from Kt 08 to Dt 03 “MC for renting/leasing”. Having transferred the fixed assets for rent, you should transfer it to another subaccount by posting Dt 03 “MC, rented out/leasing” Kt 03 “MC for renting/leasing”.

The disposal of investments is reflected in accounting by the following entries:

- Dt 03 “Disposal of MC” Kt 03 - write-off of the original cost;

- Dt 02 Kt 03 “Disposal of MC” - accumulated depreciation;

- Dt 91 Kt 03 “Disposal of MC” - write-off of residual value.