The article will discuss setting up and displaying VAT, the most “popular” tax. First, let’s set up the “Accounting Policy” so that VAT is taken into account correctly.

It is impossible to consider all the issues and nuances regarding VAT accounting in one article. That is why we will analyze only the main features using clear examples.

Our organization, a VAT payer, bought 5 desks at a price of 1600 rubles for the amount of 8000 rubles (VAT is 1333.33 rubles). Then they sold the tables for 3,000 rubles, for a total of 15,000 rubles (VAT is 2,288.14 rubles).

- We will enter the documents into 1C.

- Let's create two main books: purchases and sales.

- We will include information in the VAT return for the first quarter of this year.

Input VAT. Display of product receipts. Book of purchases

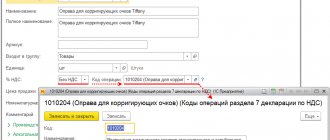

We will indicate the receipt of products through the menu bar “Purchases” - “Receipt” and issue a receipt document. Let's enter the data in the header of the document, then enter the purchased products into the tabular part, highlighting the VAT amount. The bottom line requires you to enter information and register the incoming invoice.

When posting the document, postings will be made and the VAT amount will be allocated.

6666.67 rubles created the cost - debit of account 41.01 “Goods in warehouses” - in correspondence with the debt to the counterparty - credit of account 60.01 - “Settlements with suppliers and contractors”.

1333.33 rubles - “input” VAT, which we will accept for offset - debit of account 19 “VAT on purchased inventories” - in correspondence with our debt to the counterparty - credit of account 60.01 - “Settlements with suppliers and contractors”.

The cost of the goods will be 6666.67 rubles. (Invoice date 41.01), VAT credited RUB 1,333.33. (Account item 19) and the debt to the counterparty will be 8,000 rubles (Account item 60.01).

In this case, an entry will be created in the “VAT presented” register, the “Receipt” field.

Income from such a register accumulates incoming VAT, similar to an entry in the debit of account 19. As you can see, the movement of the document is based on the movement of registers. Let's look at what this is.

All information in the program is placed in registers and VAT accounting in the application is based on accumulation registers. The list of VAT registers can be viewed using the options panel, opening the “All functions” menu and the “Accumulation registers” tab. If the “All functions” tab is not visible, you can enable it in the “Tools” - “Options” menu bar by clicking the “All functions” checkbox.

Each register has its own purpose:

- “VAT presented” is necessary to store information about VAT amounts provided by counterparties of purchased assets;

- “Purchase VAT” is needed to store data on purchase book entries; using its information, the “Purchase Book” report is generated;

- “Sales VAT” is required to store information about sales ledger entries and its

- information, a “Sales Book” report is created, and so on.

As you can see from the names, each register is responsible for a specific tab.

Then, by opening the completed “Invoice”, you can see what transactions and entries in the registers were made by this document - the “Dt/Kt” key.

We accept input VAT from the credit of account 19.03 to the debit of account 68.02. With this operation we will reduce the VAT payable.

After “Creating purchase book entries”, the balance on account 19.03 is 0, and on 68.02 the debit balance is equal to 1333.33 rubles, that is, the budget owes us at the moment. This is indicated in the report “Account balance sheet” - 03/19 and 02/68, in the “Reports” menu bar from the “Standard” report category.

The same document makes an entry in the accumulation lists “VAT presented” (line “Expense” and entry in the list “VAT purchases”).

An entry in the “VAT submitted” list under the “Expense” line is similar to entering on credit account 19 “VAT on purchased assets.” This means that we have accepted input VAT for deduction. By recording in the “VAT purchases” register, our purchase will appear in the “Purchases Book”. Let’s create it in the menu bar “Reports”, section “VAT” - “Purchase Book”.

Click “Generate”, specifying the period, and check the information.

How to organize separate VAT accounting - draw up an accounting policy

There are no rules in the Tax Code that require separate VAT accounting. Organizations and entrepreneurs develop them independently and consolidate them in their accounting policies. When combining taxable and non-taxable transactions, four procedures must be specified in the document.

- How to keep separate records of taxable and non-taxable transactions. This can be done on subaccounts or in separate registers. For example, they often open second-order subaccounts to subaccount 90-1 “Revenue” and divide the proceeds from taxable and VAT-exempt transactions. If you want to keep records in tax registers, write down their form and procedure.

- How to account for input VAT on taxable and non-taxable transactions. The developed rules should help to separately account for “input” VAT for the following groups of goods: For separate accounting of VAT, subaccounts are usually opened to account 19 “Value added tax on acquired values” for each of the groups. Another option is to develop special tax accounting registers.

- fully used in taxable transactions - input VAT is accepted for deduction in full;

- fully used in non-taxable transactions - input VAT is included in expenses as part of the cost of the goods;

- used in both taxable and non-taxable transactions - input VAT is distributed in proportion to the share of taxable and non-taxable transactions in the total volume and is deducted or expensed accordingly.

- Should the 5 percent rule apply? (clause 4 of article 170 of the Tax Code of the Russian Federation). If you decide to use it, additionally determine:

- the procedure for generating calculation indicators - expenses for taxable and non-taxable transactions and the total amount of expenses;

- a form of accounting certificate, which is generated based on the results of checking compliance with the rule.

- How to calculate the proportion for the distribution of input VAT on goods, works and services that are used in taxable and non-taxable transactions. Write down the procedure for calculating the proportion and determine the form of the certificate or other document in which this calculation of the proportion will be shown.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Output VAT. Display of implementation. Sales book

For subsequent consideration of the issue, we will indicate the sale of purchased products and highlight VAT - the menu bar “Sales”, and in the documentation journal “Sales” we will make another document.

Having filled out the header of the document, we will select in the tabular section the products sold “Desk”. For example, let's enter the quantity we bought - 5 pieces, but our sales cost is 3,000 rubles, for a total of 15,000 rubles. The table shows VAT - 2500 rubles.

Let's look at how it was displayed on the accounting accounts when posting a document - the "Dt/Kt" key.

During the transaction, transactions were drawn up showing:

- Write-off of the cost of our tables 6666.67 rubles on credit 41.01 “Goods in warehouses” and immediately displayed as a debit 90.02 “Cost of sales”;

- Proceeds from the sale - 15,000 rubles on credit 90.01 “Revenue” and the buyer’s debt is immediately displayed in debit 62.01 “Settlements with buyers and customers”;

- VAT debt equal to 2,500 rubles to the budget under credit 68.02 “VAT”, in correspondence with debit 90.03 “VAT”.

In the second section of the “Document Movements” you can see an entry in the “VAT Sales” register, ensuring that the sale is included in the “Sales Book”.

Let’s create a “Sales Book” through the menu bar “Reports” - “VAT”.

By clicking “Generate”, we get a report.

VAT accounting analysis

Let’s issue SALT on account 68.02 “VAT” and consider the change in the situation.

- Turnover on the debit of the account – 1333.33 (input tax receipts);

- Turnover on account credit 2500 (coming from sales);

- The account credit balance is 1166.67 (the amount to be transferred to the budget for the first quarter of this year).

For a more detailed examination of the corresponding accounts, you can create the “Account Analysis” report, located in the menu bar “Reports” - “Standard reports”.

In the menu “Reports” - “Accounting Analysis” you can see “VAT Accounting Analysis”. Having completed the report, you can clearly see the picture of our work on VAT. Each cell is decrypted by double clicking the mouse.

When a separate method of distribution of “input” VAT is applied

If you can determine in advance in what kind of turnover - taxable or non-taxable - the received goods (works, services) will be used, use the separate method. Goods (work, services) used in taxable turnover and the VAT amounts on them should be taken into account separately from those used in non-taxable turnover.

Situation

The company uses a separate method for determining VAT to be offset

An enterprise that pays VAT at a rate of 15% produces book products that are exempt from VAT

VAT reporting in 1C

In the “All functions” menu there is “VAT Accounting Assistant”.

Thanks to the VAT accounting assistant, regulatory actions for VAT accounting are carried out, the correctness and sequence of these operations is regulated. You can immediately prepare VAT reports - a purchase book, a sales book, and a VAT return.

The VAT return must be submitted every quarter no later than the 25th day of the month following the reporting quarter. Since 2015, the VAT return is the only document that needs to be submitted only digitally. Filing a return in the standard form is equivalent to not filing a return.

In the application, the VAT return can be viewed in the “Regulated Reports” tab, the “Reports” menu bar.

Using the “Create” button, select “VAT Declaration” from the list of forms. In the dialog box that opens, enter the reporting period and click “Create”. In the report form that appears, click “Fill” and check the information. As you can note, the report displays the amount payable, and in tab 2 we will notice the amounts of incoming and outgoing VAT. Having carefully checked all the information, we send the declaration - the "Send" button or upload the document to a folder on the computer, with its further sending, thanks to other applications - the "Upload" button.

It should be noted that during the reporting period no transactions were carried out, subject to or not subject to VAT, and a zero VAT return is provided.

The application provides the option of generating VAT reports in digital form (purchase book, sales book, etc.). This tab is available in the menu bar “Reports” - “VAT reporting”.

Having entered information into the selected report, you will be able to download it for sending to the location required - the “Generate” button and the “Download” button.

Still have questions? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter