Who files the declarations

Declarations of income and assets are submitted annually, no later than April 1, by civil servants and other public officials within the framework of the civil service legislation and the anti-corruption law. Information is also submitted regarding their family members: spouse and minor children. The declarations indicate data for the previous year: information on income, ownership of transport and real estate, shares and property obligations.

Filling out and sample declaration of a civil servant for 2022

The most convenient way is to fill out a certificate (declaration of a civil servant) on a computer. There is a special program - “BK Certificates”, posted on the official websites of the President of the Russian Federation and GIS in the field of civil service.

From 07/01/2020, it will be possible to fill out income certificates for civil servants only in this software. But for 2022, you can still choose the option of generating it in Excel or manually on paper.

The completed certificate must be certified with a personal signature.

The title page is the usual stuff, nothing unusual here.

Section “Income Information”

When completing this section, please include all income from January 1 to December 31, 2022. These, in particular, do not include loans and credits, as well as payments for reimbursement of expenses.

In the section you need to indicate:

- in the column “Income from the main place of work” - earnings at the place of service;

- in the column “Income from teaching and scientific activities” - income received, for example, for the publication of scientific articles;

- in the column “Income from other creative activities” - income from various creative activities;

- in the column “Income from deposits in banks and other credit institutions” - the amount of interest you received on deposits;

- in the column “Income from securities and participation interests in commercial organizations” - the amount of income from transactions with securities and dividends;

- in the “Other income” column – all income that is not reflected in the previous lines.

After filling out all the lines in the section, summarize all income and indicate the total amount.

Section “Information about expenses”

This section must be completed if a civil servant, spouse or minor children in 2022 bought (acquired as a result of an exchange) real estate, land, transport, securities or shares (including participation in construction).

A nuance: this section is not filled out by those who are just entering the civil service and submitting a certificate along with a package of documents for applying for a position.

Section “Information about property”

In this section, you need to provide information about the real estate and vehicles you owned as of December 31, 2022.

Section “Information on securities”

In this section you need to provide information about available securities, shares in the authorized capital of commercial organizations and funds.

Section “Information on property obligations”

In this section you need to indicate the real estate that is provided to you for temporary use, as well as the basis for use (lease agreement, actual provision, etc.)

Section “Information on real estate, vehicles and securities alienated during the reporting period as a result of a gratuitous transaction”

This section must be completed if you donated real estate, transport, or securities during 2022.

The procedure for filling out each section is discussed in detail in the Methodological Recommendations on the provision of information on income, expenses, property and property-related liabilities and filling out the appropriate certificate form in 2022 (for the reporting year 2022). They were approved by letter of the Ministry of Labor of Russia dated December 27, 2019 No. 18-2/10/B-11200.

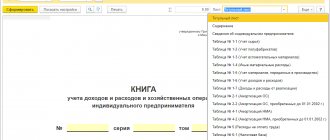

Here is a sample of filling out a declaration of income and expenses of a civil servant for 2022 (can be downloaded from the link below and viewed in full):

EXAMPLE OF COMPLETING A CERTIFICATES OF INCOME FOR A CIVIL EMPLOYEE 2020

And this is an example of filling out a declaration of income and expenses of a family member of a civil servant for 2022 (can be downloaded from the link below and viewed in full):

EXAMPLE OF COMPLETING AN INCOME CERTIFICATE FOR A FAMILY MEMBER OF A CIVIL EMPLOYEE 2020

The first anti-corruption laws in the Russian Federation

For the first time, the requirement to provide information about income and property in relation to civil servants in Russia was introduced in 1995. According to Art. 12 of the Federal Law of July 31, 1995 “On the Fundamentals of the Civil Service of the Russian Federation”, civil servants were required to provide relevant data to the tax authorities. However, all this information received the status of official secret, and was verified only by the tax service.

In 2006, Russia ratified the UN Convention against Corruption of October 31, 2003. Article 8 of the document states that States Parties to the Convention must “establish measures and systems requiring public officials to make declarations of non-official activities, activities, investments, assets and significant gifts or benefits that may give rise to a conflict of interest.”

Rules for filing declarations

The requirement for officials and members of their families to declare their income, property and property-related liabilities was established by federal law of December 25, 2008. “On combating corruption.” On December 29 of the same year, amendments were made to Article 10 of the federal constitutional law “On the Government of the Russian Federation” obliging members of the Cabinet of Ministers to submit to the tax authorities information about their income, securities and other property owned by them and members of their families.

On May 18, 2009, Russian President Dmitry Medvedev signed a package of anti-corruption decrees, which, in particular, regulate the circle of officials and members of their families who submit declarations. It included not only the president, members of his administration, members of the government, but also parliamentarians, judges, law enforcement officers, as well as military personnel holding command and management positions in the Russian army. Since 2012, the heads of the Central Bank of the Russian Federation, the Pension Fund, the Social Insurance Fund, the Mandatory Medical Insurance Fund, their spouses and minor children began to report.

In accordance with the federal law of December 25, 2008 “On Combating Corruption” and the Presidential Decree of July 8, 2013 “Issues of Combating Corruption,” the list of persons obliged to disclose information about their income and property was expanded. It includes heads of state-owned companies and state corporations. In March 2015, the Russian government exempted the management of a number of companies with state participation from publishing such information (JSC Russian Railways, PJSC Rosneft, etc.). The requirement for a public declaration applies only to employees of non-profit and budgetary organizations, foundations, corporations and companies that are 100% owned by the state and whose managers are appointed by the government of the Russian Federation. Commercial companies (joint stock companies) must provide information about the declarations of their managers to the government, but are not required to publish them.

Since January 1, 2013, Russian officials report not only on income, but also on expenses, including the expenses of wives (husbands) and children. Transactions for the acquisition of land, real estate, vehicles, securities, shares are subject to verification if the transaction amount exceeds the total income for the last three years. The sources of funds at the expense of which transactions were concluded are also required to be declared. On August 19, 2013, a ban on officials having accounts in foreign banks came into force. Failure to comply with the above requirements is subject to administrative punishment, up to and including dismissal with the wording “due to loss of confidence.” Civil servants, according to the law, do not have the right to engage in commercial or entrepreneurial activities.

On November 4, 2015, a law came into force that provides for the possibility of early deprivation of the mandates of parliamentarians if they or members of their families do not submit income declarations on time. Previously, there was no liability for failure to submit or late submission of declarations in the legislation.

In May 2022, Russian President Vladimir Putin signed amendments to the current legislation, according to which acting heads of regions and atamans of military Cossack societies are also required to report on their income and expenses.

On August 4, 2022, the President signed a law to monitor the compliance of the expenses of former officials with their income received while working in government positions. The document establishes that such control is carried out within 6 months from the date of dismissal or dismissal of persons “who held (occupied) one of the positions, the exercise of powers for which entails the obligation to provide information about their expenses, as well as about the expenses of their spouses ( spouses) and minor children." We are talking about transactions for the acquisition of a land plot, other real estate, a vehicle, securities, shares, etc.

Who and in what cases must file a 3-NDFL declaration?

Tax return 3-NDFL is a document using which individuals report to the state on income tax (NDFL).

At the end of the calendar year, the 3-NDFL declaration must be filled out and submitted to the tax authority:

- Citizens who independently calculate and pay income tax to the budget : individual entrepreneurs on the general taxation system, notaries, lawyers and other groups of persons.

- Tax residents of the Russian Federation who received income outside of Russia . Personal income tax must be withheld from this income.

- Citizens who have received additional income subject to taxation . For example:

- from the sale of a car;

- from the sale of an apartment/house/land;

- from rental housing;

- from winning the lottery.

Example : In 2022, Pushkin A.S. sold an apartment that I owned for less than 5 years. At the end of 2022 (until April 30, 2020), Alexander Sergeevich must submit a declaration to the tax authority in Form 3-NDFL, in which the tax payable as a result of the sale will be calculated.

Also, the 3-NDFL declaration can be filled out and submitted by individuals who want to receive a tax deduction , that is, return part of the tax paid.

For example:

- To receive a tax deduction for education.

- To receive a tax deduction for treatment.

- To receive a tax deduction when purchasing an apartment.

Publication of declarations

Information on income and property has been published on the official websites of relevant departments and in the media since 2010. However, the public version of officials’ declarations differs significantly from the one that the official submits to the personnel service. The “open” version does not contain information about accounts and debt obligations, the exact location of the declared real estate and the year of manufacture of the car are not reported, there is no information about expenses, and the names of spouses and minor children are not reported. If there is real estate abroad, only the country where it is located is indicated.

Checks of declarations

About 1.6 million government employees file income declarations annually. The information received is checked by the Anti-Corruption Department of the Administration of the President of the Russian Federation. In 2016, according to the head of the department, Oleg Plokhy (now Deputy Minister of Justice), about 70 thousand corruption-related crimes were identified (in 2015 - 32 thousand). 16 thousand officials of various levels (18 thousand in 2015) were brought to disciplinary liability for failure to comply with anti-corruption restrictions and prohibitions. Later data on the results of the verification of declarations by the Administration of the President of the Russian Federation were not made public.

In total, with the wording “due to loss of trust” in Russia in 2018, according to the head of the department for interaction with the media of the Prosecutor General’s Office of the Russian Federation, Alexander Kurennoy, more than 1.3 thousand officials were dismissed (in 2016 - about 400 people, of which 177 - based on the results of inspections of declarations; in 2022 - 1 thousand 250 people).

On January 1, 2022, a law came into force according to which a public register of persons dismissed from the civil service due to loss of confidence for committing corruption offenses was created. The full names of officials, information about the government agency from which they were dismissed, the date of entering the information into the register and details of the legal act on dismissal are published in the public domain for a period of 5 years.

How to fill out a declaration under the simplified tax system

Download : Tax return according to the simplified tax system (PDF)

Entrepreneurs using the simplified tax system for income fill out the title page, sections 1.1 and 2.1.1. Sections that are not completed do not need to be submitted. The declaration should be filled out from the end - first section 2.1.1, then 1.1.

The declaration must be filled out manually or on a computer in capital block letters. Manually - with black or blue ink. If any data is missing, a dash is added.

All amounts are indicated in full rubles. Amounts less than 50 kopecks are discarded, and 50 kopecks or more are rounded up to the full ruble.

Attention ! This is an example of filling out a declaration for an individual entrepreneur using the simplified tax system for income for 2022 (without employees and trade tax).

Title page

- Please indicate your Taxpayer Identification Number (TIN) at the top of the title page. Place a dash in the checkpoint line.

- In the line adjustment number, indicate 0, tax period - 34, reporting year - 2022.

- Below, indicate the tax code at your place of residence and the code at your location (accounting) - 120.

- Please indicate your last name, first name and patronymic (if any).

- Indicate your contact phone number, number of pages - 4, put a dash in the line with attachments.

- In the details, indicate 1, sign and date. (If you have a stamp, you do not need to put one.)

Section 1.1

- Please indicate your Taxpayer Identification Number at the top. Place a dash in the checkpoint line. Enter page number 002.

- Indicate the OKTMO code at your place of residence. (OKTMO code in lines 030, 060, 090 is indicated only when the individual entrepreneur changes place of residence.)

- In line 020, indicate the amount of the advance payment payable for the 1st quarter. The amount is calculated using the formula: page 130 - page 140.

- In line 040, indicate the amount of the advance payment payable for the six months. The amount is calculated using the formula: page 131 - page 141 - page 020. If the amount received is less than 0, indicate it in line 050.

- In line 070, indicate the amount of the advance payment payable for 9 months. The amount is calculated using the formula: page 132 − page 142 − page 020. − page 040 + page 050. If the amount received is less than 0, indicate it in line 080.

- On line 100, enter the amount of tax payable for the year. The amount is calculated using the formula: page 133 − page 143 − page 020. − page 040 + page 050. − page 070 + page 080. If the amount received is less than 0, indicate it in line 110.

- Please sign and date below.

Section 2.1.1

- Please indicate your Taxpayer Identification Number at the top. Place a dash in the checkpoint line. Enter page number 003.

- On line 101 enter 1.

- On line 102 enter 2.

- In lines 110–113, indicate the amount of income for 2022 from Section I of KUDiR. Amounts are indicated on an accrual basis from the beginning of the year to the end of the relevant period.

- On lines 120–123, enter the tax rate, for example, 6.

- If you are using a preferential tax rate established by a constituent entity of the Russian Federation, then in the first part of line 124, enter code 3462010 for a rate from 1 to 6%, code 3462030 for Crimea and Sevastopol, code 3462040 for tax holidays. In the second part, indicate the number, clause and subclause of the article of the law of the subject of the Russian Federation (4 places each). For example, subclause 15.1 of clause 3 of Article 2 is indicated as “0002000315.1”.

- In lines 130–133, indicate the amount of tax calculated using the formula: line 110 (111, 112, 113) × 6 ÷ 100.

- At the top of the next sheet, indicate your Taxpayer Identification Number. Place a dash in the checkpoint line. Enter page number 004.

- In lines 140–143, indicate the amount of insurance premiums paid by individual entrepreneurs in 2022 from section IV of the KUDiR, but not more than the amount of tax indicated in lines 130–133 for the corresponding period.