Which legal acts regulate the indication of the type of payment in a payment order?

Sending a payment order to a bank is a legal action regulated by separate sources of law. Before carrying out it on a systematic basis, it will be useful for an entrepreneur or accountant to know which legal acts establish the rules for registration. Apart from a large number of departmental acts, as well as various by-laws, the main documents regulating the filling out of payment slips and the rules for indicating the type of payment are:

- Regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P;

- Order of the Ministry of Finance dated November 12, 2013 No. 107n.

The first source establishes standards in accordance with which Russian financial institutions must transfer funds, including when using payment orders. The second regulatory legal act regulates the rules for transferring funds.

Why is it necessary to indicate the type of payment?

So what is the purpose of such a detail as “Type of payment” in payment cards? This detail indicates how the financial institution should carry out the transaction.

There are traditional methods of making payments - by mail, telegraph, as well as innovative ones, primarily involving the use of the infrastructure of the banking electronic express payment system (BESP). In the second case, payments are always classified as urgent (clause 1.3 of Chapter 1 of the instructions of the Central Bank of the Russian Federation dated April 25, 2007 No. 1822-U).

In paragraph 3.12 of Ch. 3 of Regulation No. 384-P states that an urgent transfer can be carried out, firstly, when using electronic channels and when drawing up electronic payment orders, and secondly, in the relevant document the “Type of payment” detail must be recorded in the meaning “urgent” .

In turn, if the bank implements a non-urgent transfer, in particular, when using telegraph or postal items, then nothing should be indicated in the orders in the “Type of payment” detail (clause 3.14 of Chapter 3 of Regulation No. 384-P). In this case, a document for a non-urgent transaction can be drawn up both in paper and electronic form.

The details under consideration are also important when implementing the procedure for monitoring the sufficiency of financial resources, provided for by the instructions of the Central Bank of the Russian Federation No. 1822-U and regulated by Regulation No. 384-P. So, in accordance with clause 4.5.1 of Ch. 4 of Regulation No. 384-P, this procedure in the receipt mode is carried out for each document for which the sign of appropriate control or the value “urgent” in the details in question are recorded in the electronic message.

In accordance with clause 4.5.2 of Ch. 4 of Regulation No. 384-P, such control measures are carried out in discrete mode at separate periods during the day for all orders for which the sign of appropriate control is recorded in electronic messages or, as in the first case, the value “urgent” is set in the “Type” attribute payment."

It is important not to confuse the detail in question with the one that corresponds to number 18 in the structure of the payment order - “Type of transaction” - and can be represented in the following values:

- 01 - for payment orders;

- 06 - for collection orders;

- 02 - for payment requests.

The “Type of transaction” detail must comply with Bank of Russia regulations or accounting rules for specific banks operating in the Russian Federation.

To learn about the form of a payment order and its main details, read the article “Main fields of a payment order in 2020-2021 (sample).”

Payment order form - sample form and description of fields

Here you will find a payment order form (sample) and a detailed description of the fields for error-free filling, on which the crediting of funds depends.

Sample payment order form and description of how to fill out the fields

Payment order form (sample) and detailed description of fields for error-free filling

Explanation of the meaning and description of how to fill out each of the fields of the payment order form

| Number | Name | Meaning |

| 1 | 2 | 3 |

| 1 | Payment order | Title of the document |

| 2 | 0401060 | Form number according to OKUD OK 011-93, class “Unified system of banking documentation” |

| 3 | № | Payment order number. The payment order number is indicated in numbers. If the number consists of more than three digits, payment orders when making payments through the Bank of Russia settlement network are identified by the last three digits of the number, which must be different from “000” |

| 4 | date | Date of drawing up the payment order. The date, month, year are indicated in numbers (in the format DD.MM.YYYY) or the number is in numbers, the month is in words, the year is in numbers (in full) |

| 5 | Payment type | In payment orders submitted to Bank of Russia institutions for payment by post or telegraph, it is indicated by “mail” or “telegraph”, respectively. In payment orders submitted for electronic settlements, “electronically” is entered in this field in accordance with the regulations of the Bank of Russia regulating electronic settlements. In other cases the field is not filled in |

| 6 | Suma in cuirsive | The amount of payment in words in rubles is indicated from the beginning of the line with a capital letter, while the word “ruble” (“rubles”, “ruble”) is not abbreviated, kopecks are indicated in numbers, the word “kopeyka” (“kopecks”, “kopecks”) is also not is shrinking. If the payment amount is expressed in words in whole rubles, then kopecks can be omitted, and in the “Amount” field the payment amount and the equal sign “=” are indicated. |

| 7 | Sum | The payment amount is indicated in numbers, rubles are separated from kopecks by a dash sign “-“. If the payment amount is expressed in numbers in whole rubles, then kopecks can be omitted; in this case, the payment amount and the equal sign “=” are indicated, while in the “Amount in words” field the payment amount is indicated in whole rubles |

| 8 | Payer | The name of the payer of the funds is indicated. Additionally, the number of the client’s personal account, the name and location (abbreviated) of the servicing credit organization, a branch of the credit organization are indicated if the client’s payment is made through a correspondent account opened in another credit organization, another branch of the credit organization, a settlement participant account, an inter-branch settlement account, entered in the “Account” field. No." of the payer, or indicate the name and location (abbreviated) of the branch of the credit institution servicing the client, if the client's personal account number is entered in the "Account. No. of the payer and the client’s payment is made through the inter-branch settlement account, while the branch’s inter-branch settlement account number is not entered |

| 9 | Account No. | Payer's account number. The number of the payer’s personal account in a credit institution, a branch of a credit institution or in an institution of the Bank of Russia is indicated (with the exception of a correspondent account (sub-account) of a credit institution, a branch of a credit institution opened in an institution of the Bank of Russia), formed in accordance with the rules of accounting in the Bank of Russia or rules for maintaining accounting records in credit institutions located on the territory of the Russian Federation. The personal account number in a credit organization or a branch of a credit organization may not be entered if the payer is a credit organization or a branch of a credit organization |

| 10 | Payer's bank | The name and location of the credit institution, branch of the credit institution or institution of the Bank of Russia, whose BIC is indicated in the “BIC” field of the payer’s bank, is indicated. If the payer of the funds is a credit institution, a branch of the credit institution, whose name is indicated in the “Payer” field, then the name of this credit institution , branch of the credit institution is indicated again in the “Payer’s bank” field |

| 11 | BIC | Bank identification code (BIC) of the payer's bank. The BIC of a credit organization, a branch of a credit organization or an institution of the Bank of Russia is indicated in accordance with the “BIC of the Russian Federation” |

| 12 | Account No. | Payer's bank account number. The number of the correspondent account (sub-account) opened by a credit organization, a branch of a credit organization in an institution of the Bank of Russia is indicated, or is not filled in if the payer is a client who is not a credit organization, a branch of a credit institution, is serviced in an institution of the Bank of Russia, or an institution of the Bank of Russia |

| 13 | payee's bank | The name and location of the credit institution, branch of the credit institution or institution of the Bank of Russia, whose BIC is indicated in the “BIC” field of the recipient bank, is indicated. If the recipient of the funds is a credit institution, branch of the credit institution, whose name is indicated in the “Recipient” field, then the name of this credit institution , the branch of the credit institution is indicated again in the “Recipient's Bank” field |

| 14 | BIC | Bank identification code (BIC) of the recipient's bank. The BIC of a credit organization, a branch of a credit organization or an institution of the Bank of Russia is indicated in accordance with the “BIC of the Russian Federation” |

| 15 | Account No. | Recipient's bank account number. The number of the correspondent account (sub-account) opened by a credit organization, a branch of a credit organization in an institution of the Bank of Russia is indicated, or is not filled in if the recipient is a client who is not a credit organization, a branch of a credit institution, is serviced in an institution of the Bank of Russia, or an institution of the Bank of Russia, and also when transferring funds to a credit organization, a branch of a credit organization to an institution of the Bank of Russia for the issuance of cash to a branch of a credit organization that does not have a correspondent subaccount |

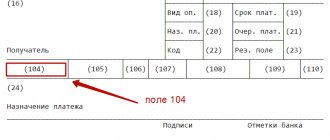

| 16 | Recipient | The name of the recipient of the funds is indicated. Additionally, the number of the client’s personal account, the name and location (abbreviated) of the servicing credit organization, a branch of the credit organization are indicated if the client’s payment is made through a correspondent account opened in another credit organization, another branch of the credit organization, a settlement participant account, an inter-branch settlement account, entered in the “Account” field. No." of the recipient, or indicate the name and location (abbreviated) of the branch of the credit institution servicing the client, if the client's personal account number is entered in the "Account" field. No. of the recipient and the client’s payment is made through the inter-branch settlement account, while the branch’s inter-branch settlement account number is not entered |

| 17 | Account No. | Recipient's account number. The number of the recipient's personal account in a credit organization, a branch of a credit organization or the number of a personal account in an institution of the Bank of Russia (with the exception of a correspondent account (sub-account) of a credit organization, a branch of a credit organization opened in an institution of the Bank of Russia), formed in accordance with the rules of accounting, is indicated. in the Bank of Russia or the rules of accounting in credit institutions located on the territory of the Russian Federation. The personal account number in a credit organization or a branch of a credit organization may not be entered if the recipient is a credit organization or a branch of a credit organization |

| 18 | Type op. | Type of operation. The code (01) is entered in accordance with the rules for maintaining accounting records in the Bank of Russia or the rules for maintaining accounting records in credit institutions located on the territory of the Russian Federation |

| 19 | Payment deadline. | Payment term. Not to be filled out before instructions from the Bank of Russia |

| 20 | Name pl. | The purpose of the payment is coded. Not to be filled out before instructions from the Bank of Russia |

| 21 | Essay. plat. | Sequence of payment. The order of payment is indicated in accordance with the legislation and regulations of the Bank of Russia, or the field is not filled in in cases provided for by regulations of the Bank of Russia |

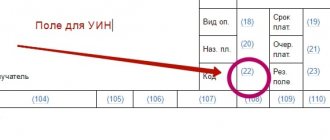

| 22 | Code | Not to be filled out before instructions from the Bank of Russia |

| 23 | Res. field | Reserve field. Filled out in cases established by regulations of the Bank of Russia |

| 24 | Purpose of payment | The purpose of payment, the name of goods, work performed, services rendered, numbers and dates of commodity documents, contracts, tax (highlighted on a separate line, or a reference is made to the fact that tax is not paid) may also be indicated, other necessary information may also be indicated, including deadline for paying a tax or fee, deadline for payment under the agreement |

| 43 | M.P. | Place for the payer's stamp. A seal imprint (if any) is affixed in accordance with the sample declared by the credit institution, branch of the credit institution or institution of the Bank of Russia |

| 44 | Signatures | Payer's signatures. Signatures (signature) of persons who have the right to sign settlement documents are affixed in accordance with the samples declared by the credit organization, branch of the credit organization or institution of the Bank of Russia |

| 45 | Bank marks | Notes from the payer's bank. The stamp(s) of the credit institution, branch of the credit institution or institution of the Bank of Russia, the date and signature of the responsible executor are affixed |

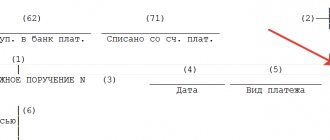

| 62 | Admission to the bank of payments. | Received by the payer's bank. The date of receipt of the payment order at the payer’s bank is indicated according to the rules established for the “Date” field |

| 71 | Debited from account plat. | Debited from the payer's account. The date of debiting funds from the payer’s account is indicated according to the rules established for the “Date” field |

| 60 | TIN | Payer's TIN. Indicate the payer's TIN, if assigned |

| 61 | TIN | Recipient's TIN. Indicate the recipient's TIN, if assigned |

| 101 — 110 | The information established by the Ministry of the Russian Federation for Taxes and Duties, the Ministry of Finance of the Russian Federation and the State Customs Committee of the Russian Federation is indicated in accordance with clause 2.10 of Part I of these Regulations |

For reference:

Payment order for payment of taxes. How to format correctly and avoid mistakes

If you still made a mistake, the funds were transferred to the wrong place, then reconciliation with the tax office and extra-budgetary funds is a priority task. As a rule, failure to receive payments to the budget for taxes and contributions entails sanctions on the current account, the unlocking of which takes considerable time and resources.

Which financial documents indicate the type of payment?

Type of payment - details that are indicated in accordance with clause 1.10 of Chapter. 1 of Regulation No. 383-P, in documents such as:

- payment order;

- payment order;

- collection order;

- payment request.

Check whether you filled out the payment order correctly by studying the recommendations of ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

These sources can be generated both in paper and electronic form (clause 1.9 of Chapter 1 of Regulation No. 383-P). Documents from this list can be used both in settlements with the budget and in private monetary transactions.

Indicating the correct type of payment is a criterion that is extremely important for the taxpayer, that is, the entity who regularly sends orders to the bank to transfer taxes, contributions, fees, fines, penalties, duties due to existing obligations to the budget. If the taxpayer provides details that do not comply with legal requirements, the payment will not be accepted by the state.

Attention: the unique payment identifier can replace other order details

A unique payment identifier (UPI) serves to simplify settlements with the budget and between legal entities. The number allows you to determine the document on the basis of which the payment is made, eliminating the need to indicate its details in the purpose of the payment, and in the case of settlements with the budget and the payer’s TIN.

It appeared in the payment order from 03/31/2014. According to Regulation No. 383-P, from this date the payment order details are indicated in the following cases:

- if the UIP is assigned by the recipient of the funds. At the same time, in accordance with the agreement, the recipient of funds informs the payer of this UIP;

- when making payments to the budget system of the Russian Federation. In this case, the UIP is indicated in accordance with the requirements of regulatory legal acts adopted by the Ministry of Finance of the Russian Federation in agreement with the Central Bank of the Russian Federation on the basis of Part 1 of Art. 8 Federal Law dated June 27, 2011 No. 161-FZ;

- in accordance with federal laws and regulatory legal acts of the Russian Federation.

Thus, in the payment order for the transfer of funds to the counterparty, the UIP is indicated if it is assigned by this counterparty - the recipient of the funds.

According to subclause 1.21.1 of Regulation No. 383-P, if the recipient of funds has been assigned a UIP and it must be indicated in the payment order, the recipient's bank controls the payment identifier in the cases and in the manner established by the agreement with the recipient of funds.

Since this detail can replace, for example, data about the period for which the payment was made, it should be handled with particular care. Thus, in the Resolution of the Eighth Arbitration Court of Appeal dated June 20, 2019 No. 08AP-5358/2019, when collecting a disputed debt, the electricity supplier referred to the contract provision, according to which the client is obliged to indicate the UIP in the payment documents, and if the identifier does not coincide with the purpose of the payment, The period for which the payment is made is determined by the seller independently. Using this provision, the company attributed the buyer’s payments for 2022 to periods of previously incurred debt, with which the latter did not agree. The judges found the seller's behavior legal.

In another similar case (Resolution of the Eighth Arbitration Court of Appeal dated 02/05/2019 No. 08AP-15809/2018), the agreement did not provide for the instructions of the UIP, but it was contained in the primary documents. The buyer used the identifier, believing that it was providing accurate information about the purpose of the payment, but the court did not agree with this.

What are the basic requirements for indicating the type of payment?

Appendix 1 to Regulation No. 383-P states that the relevant details:

- indicated in the meaning “urgent”, “telegraph”, “mail” or in other values established by the bank;

- not indicated in cases established by the bank;

- when generating a payment order electronically, it is given only in the form of a code that is set by the bank.

It may be noted that regulation No. 384-P establishes another rule that predetermines the need to reflect the type of payment in payment orders. Namely, in the case of using bank orders, i.e. documents used when transferring funds in favor of foreign entities (clause 3.16 of Chapter 3 of Regulation No. 384-P). In this case, the detail “5” in the payment slip (and this is the type of payment) can be specified in 2 options:

- in the meaning of “urgent” - when issuing an order in paper form;

- in the meaning corresponding to the established code - when issuing an order in electronic form.

There are legal norms according to which the type of payment in some cases should not be indicated in the payment receipt at all, regardless of the fact whether such norms have been established by the bank or not.

For an example of completing a payment order, see the material “Filling out a payment order in 2022 - sample.”

Types and codes of currency transactions

Appendix 2 of the Central Bank of the Russian Federation Instruction No. 138-I contains a list of transactions of residents and non-residents. It is used to process transactions and related documents. The currency transaction code in the payment order is indicated based on the data specified in the List.

Here are some codes in general form (the code for the type of operation group is not considered):

| Operation type code | Name of the type of operation | |

| 01 | 010 | Sale by a resident of foreign currency for Russian currency |

| 01 | 030 | Purchase of foreign currency by a resident using Russian currency |

| 11 | 100 | Payments by a resident in the form of advance payment to a non-resident for goods imported into the territory of the Russian Federation, with the exception of payments specified in group 23 of the List |

| 13 | 020 | Settlements by a resident in favor of a non-resident for goods sold on the territory of the Russian Federation, with the exception of settlements under codes 23110, 23210, 23300 of the List |

| 20 | 200 | Payments by a non-resident for work performed by a resident, services provided, with the exception of payments under code 20400, and those specified in groups 22 and 58 of the List |

IMPORTANT!

The type of currency transaction in the payment order is indicated in numbers.

The absence of a unified federal form of payment order for the transfer of foreign currency has led to the appearance in each bank of some differences in the details and procedure for filling out this document.

Another feature is that currently filling out almost every banking document is carried out through the “bank-client” application interface, which also differs from the type of similar program in another bank.

With this specificity in mind, let’s look at the procedure for filling out a payment order step by step, using the form from the first section of our article.

When the “Type of payment” detail is not required

The Federal Treasury, in letter No. 42-7.4-05/5.3-350 dated June 11, 2013, establishes a rule according to which, from July 1, 2013, in orders received from clients of the Central Bank of the Russian Federation (submitted both in paper and electronic form):

- the “Type of payment” detail is fixed in the value “urgent” if funds are transferred through the urgent payment system - BESP;

- the “Type of payment” detail is not recorded if funds are transferred through the system of interregional settlements, electronic settlements within the region, by telegraph or by mail, that is, not through BESP.

The Federal Treasury also notes that if the details in question do not meet the specified criteria - they are not filled in as “urgent” (for payments through BESP) or are recorded if it was not required, then the treasury authorities return payment orders without execution.

The noted position of the Federal Treasury is reflected in local regulations of Russian banks. They, in turn, in most cases bring the noted provisions of letter No. 42-7.4-05/5.3-350 to the attention of clients who independently generate payment orders in the process of using cash settlement services.

It may be noted that the norms contained in letter No. 42-7.4-05/5.3-350 correspond with the above provisions of clause 3.12 and clause 3.14 of Chapter. 3 provisions No. 384-P.

Thus, at the moment, based on the provisions of the regulatory legislation, only one value can be recorded in the “Type of payment” attribute - “urgent” (for payments through BESP) - or nothing can be specified in it.

What is the BESP system

Since making a payment through the BESP system is one of the possible criteria for putting certain values in the “5” attribute, it will be useful to familiarize yourself with its main characteristics.

The main source of law regulating the functioning of the BESP system is the regulation of the Central Bank of the Russian Federation dated April 25, 2007 No. 303-P. It contains rules establishing that the BESP infrastructure operates within the framework of the payment system of the Central Bank of the Russian Federation and is used to make urgent payments in rubles and carry out continuous settlements in real time.

The BESP system works alongside traditional banking infrastructures - VER (system of intraregional settlements, carried out electronically), MER (system of interregional settlements, also carried out electronically).

Payments through BESP are carried out using settlement documents that meet exactly the requirements of provisions No. 383-P and 384-P and contain the details necessary for conducting correct transactions, including, of course, detail “5” - “Type of payment”.

A bank's participation in the BESP system can be direct or associated. In the first case, credit organizations and clients of the RF Bank of Russia who do not meet this status but have a BIC are connected to the system. Associated participants of BESP are credit organizations, structural divisions of the Central Bank of the Russian Federation that do not have a BIC, as well as clients that do not have the status of a credit organization.

The main advantage of the BIC system is efficiency. Financial transactions when activated must be carried out by the bank during the day. It may be noted that some credit institutions guarantee their implementation within 1 hour. Payments made through BESP are classified as irrevocable - from the moment the funds are debited from the sender’s bank account.

Payments through BESP are becoming increasingly popular, especially in the business environment. And this is quite logical - enterprises try to make payments under contracts as quickly as possible and receive revenue into circulation. True, making payments through BESP is usually more expensive for the taxpayer than when making non-urgent transactions - bank tariffs for urgent transfers are usually higher.

What is the payment code for?

Information about payment types is intended to identify the transaction, its type and purpose. One of the mandatory conditions is when this detail must be indicated if the funds are intended for foreign recipients. The legislation provides for conditions under which types of payments are not a mandatory detail in a payment order and nothing is indicated in this column. These are the cases:

- Registration of instructions in electronic format for urgent transfer of BESP;

- For situations provided for by the rules for processing payment documents.

Moreover, if the details are left unspecified, then the federal treasury service leaves the payments unexecuted, bringing to the client’s attention the absence of mandatory information in the payment order. All mandatory requirements for filling out payment slips and their details are set out in document No. 303-P dated April 25, 2007. It mentions the norm under which the concept of BESP and its functionality is given. The BESP system is designed to carry out money transfers between counterparties in real time. Participants in this payment system include treasuries, credit organizations, as well as other counterparties that do not have the status of credit enterprises, or rather, various structural divisions that do not have a BIC.

How critical is it to indicate the type of payment incorrectly?

As we noted above, indicating in detail “5” values that do not meet the criteria set by the Federal Treasury, as well as Regulation No. 384-P, may lead to the refusal of this department to process the payment and return the bank order to the client.

This can happen if:

- for a payment that does not involve the use of the BESP system, and also does not correspond to the characteristics of an urgent one, in detail “5”, in principle, something is indicated;

- When a payment is sent through the BESP system, that is, urgent in any case, nothing is indicated in detail “5” or a value is recorded that differs from the “urgent” mark.

The consequences of the return of a payment document by the Federal Treasury may be (if we are talking about tax payment) the recognition by the Federal Tax Service of the taxpayer’s obligations to the budget as unfulfilled. In this case, the subject’s obligation to pay tax is considered unfulfilled due to the provisions of sub-clause. 1 or sub. 2. clause 4 art. 45 of the Tax Code of the Russian Federation, that is, if the payment order is returned by the bank or the Federal Treasury (in principle, both options are possible, since in the payment systems of some banks transfers with incorrect details “5” are automatically rejected even before they reach the treasury).

Read more about the key provisions of Art. 45 of the Tax Code of the Russian Federation, read the material “Art. 45 of the Tax Code of the Russian Federation: questions and answers" .

RESULTS

The procedure for filling out field 5 “Type of payment” is established by the bank.

If the bank has not installed it, leave this detail blank. If the value in the “Type of payment” detail is entered incorrectly, the funds will be returned to the payer’s account and will have to be sent again, adjusting the payment as necessary. You can familiarize yourself with a sample of the corresponding application in the article “Sample application for clarification of tax payment (error in the KBK)” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.