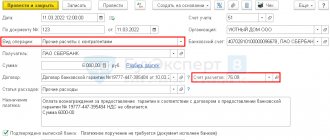

EXAMPLE

On 02/01/2013, the organization received a loan in the amount of 600,000 rubles from a foreign organization. with monthly interest payment at a rate of 17% per annum. The share of direct participation of a foreign organization in the authorized capital of the organization is 25%.

Let us determine what amount of interest an organization can include in expenses based on the results of the first quarter of 2013, if the value of its equity capital as of March 31, 2013 is 100,000 rubles.

1. Let’s find the capitalization ratio (CR) as of March 31:

CC = 600,000 rub. / (RUB 100,000 x 25%) / 3 = 8.

2. Let’s calculate the amount of actual interest (FA) for the first quarter (the period of using the loan from February 1 to March 31 is equal to 59 calendar days):

FP = 600,000 rub. x 17% / 366 days x 59 days = 16,442.6 rub.

3. Let’s determine the maximum amount of interest (IP) that can be included in expenses: PP = 16,442.6 rubles. / 8 = 2055.3 rub.

4. Let’s compare the amount of actually accrued interest (AC) and the maximum amount of interest (MC): 16,442.6 rubles. > 2055.3 rub.

Thus, the organization can include 2055.3 rubles in expenses. Positive difference in the amount of RUB 14,387.3. (16,442.6 rubles - 2055.3 rubles) is recognized as a dividend of a foreign organization, from which the Russian organization must calculate and pay income tax to the budget at a rate of 15% (clause 3 of article 275, clause 3 of clause 3 Article 284 of the Tax Code of the Russian Federation).

Particular attention should be paid to the fact that, in the opinion of the Ministry of Finance of the Russian Federation, set out in Letter dated July 31, 2012 N 03-03-06/1/373, the amount of interest calculated using the capitalization ratio, taken into account for profit tax purposes, should not exceed the limit level determined in accordance with paragraph 1 of Art. 269 of the Tax Code of the Russian Federation.

Interest calculation procedure

Before making calculations, you need to study what is included in the structure of controlled debt. The latter includes interest on obligations. Their size does not exceed the total amount of charges included in the percentage. Let's look at the procedure for calculating interest:

- At the end of each reporting period, the debtor transfers the maximum possible amount of interest accrued. Accruals are the ratio of the amount of interest accrued on the debt at the end of the period to the capitalization ratio.

- The coefficient is calculated as of the last date of the tax period. To obtain it, you need to divide the total amount of debt by the amount of the authorized capital. Then you need to divide the result by 3 (for ordinary legal entities) or 12.5 (for leasing companies and banking institutions).

- The authorized capital does not include arrears of fees and debts, late payments and deferred payments.

The main rule for determining controlled debts is their calculation at the closing date of the tax period. The billing periods are 3 and 9 months, half a year.

Interest is determined by these balance lines:

- Column 300 (assets).

- Columns 690 and 590 (liabilities).

- Columns 623 and 624 (debt of tax payments).

The calculation is performed using this formula:

Spread = Sact% * CoefCap

The formula contains these values:

- Spread is the maximum amount of interest recognized as an expense and subject to a reduction in the tax base.

- Cactual % - accrued interest.

- CoefCap – capitalization ratio.

To determine the capitalization rate, this formula is used:

CoefCap = Skz / Sobcap / 3

The formula uses these values:

- Skz – the amount of controlled debt that has not been paid.

- SobCap – the amount of the debtor's fund.

If the value of the fund is zero at the end of the period, interest on debt during the reporting period will not be taken into account.

Let's consider the main stages of calculations:

- Determination of the amount of equity capital. This value is equal to the share of direct or indirect participation of a foreign company in the debtor’s capital. To determine this value, you need to multiply your own capital by the share of participation of a foreign person.

- Setting the capitalization ratio.

- Establishing the maximum amount of interest that is taken into account for taxation on the basis of paragraph 3 of Article 269 of the Tax Code of the Russian Federation. For calculations, you need to divide the actual accrued interest by the capitalization ratio determined earlier.

IMPORTANT! If the interest on obligations is greater than the maximum interest (determined at the third stage of calculations), the resulting difference is recognized as dividends, which are paid to the foreign company. The amount will be taxed at a rate of 15% based on paragraph 3 of Article 284 of the Tax Code of the Russian Federation.

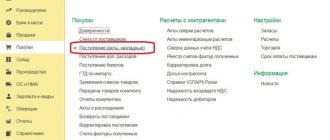

Accounting

Interest on controlled debt in accordance with clause 6 and clause 7 of PBU 15/2008 “Accounting for expenses on loans and credits”, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 N 107n (as amended on April 27, 2012) and p 18 PBU 10/99 “Expenses of the organization”, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 N 33n (as amended on April 27, 2012), are recognized as other expenses of the reporting period in which they are incurred and are reflected in the accounting accounting and reporting in the reporting period to which they relate. The exception is interest that must be included in the cost of an investment asset in accordance with clause 7 of PBU 15/2008. In accordance with clause 4 of PBU 15/2008, interest due for payment should be reflected in accounting separately from the principal amount of the obligation.

Thus, the interest payable can be reflected in the accounting records by the following entry:

Dt 91 “Other income and expenses” Kt 66 “Settlements on short-term loans and borrowings”, subaccount “Amounts of accrued interest” (or 67 “Settlements on long-term loans and borrowings”, subaccount “Amounts of accrued interest”).

The amount of interest recognized as another expense in accounting, but not accepted for tax purposes on the basis of clause 8 of Art. 270 of the Tax Code of the Russian Federation, in accordance with clause 4 and clause 7 of PBU 18/02 “Accounting for calculations of corporate income tax”, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n (as amended on December 24, 2010 .) can be recognized as a permanent difference leading to the formation of a permanent tax liability (Dt. 99 Kt. 68).

Regulatory acts

Controlled debts are regulated by Article 269 of the Tax Code of the Russian Federation “Nuances of accounting for interest on obligations.” Previously, controlled debt was considered to be loans taken from foreign entities. However, in June 2005, amendments appeared that expanded the circle of creditors. In particular, loans to affiliated legal entities are now considered controlled. In 2005, Federal Law No. 58 was also signed, concerning changes in the second part of the Tax Code.

Question: Can a Russian organization with negative (zero) equity capital take into account interest on controlled debt (clause 4 of Article 269 of the Tax Code of the Russian Federation)? View answer

Debt is not considered controlled in these cases:

- It was formed when foreign legal entities placed bonds with the subsequent extraction of dividends.

- Debt has arisen to interdependent legal entities and individuals if they are recognized as tax residents throughout the reporting period.

- The individual and legal entities to which the debtor has a debt have no outstanding loans to affiliated legal entities throughout the reporting period.

In 2022, amendments were introduced that established new rules for accounting for interest on debts.

interest on controlled debt in income tax

Administration

Can debt collectors sue? Restructuring of utility debts - .

The wiring assignment agreement - here are the details.

The tax charge accrued on dividends must be reflected in a timely manner in the relevant reporting in the form according to KND 1151056. Moreover, these costs do not need to be indicated in the tax return (namely in sheet No. 03), since in this case we are not talking about ordinary dividends.

Taxation of KZ interest is accompanied by the following difficulties:

- if the company's income is from 1,000,000 rubles, the tax base is formed in accordance with Chapter 25 of the Tax Code of the Russian Federation using the accrual method (this rule does not apply to enterprises with a lower level of income);

- if the liability arose in connection with indirect affiliation, it is not necessary to determine and pay the tax fee;

- If a report on accrued interest but not yet paid has been submitted to the Federal Tax Service, the government body has the legal right to reclassify this payment as a dividend or vice versa.

The CC indicator depends on three main factors - the amount of debt of the borrowing organization, the size of its own capital and the share of the foreign enterprise. If the coefficient has changed since the previous billing period, the question arises about the need to change the tax base.

Based on the innovations in the Tax Code of the Russian Federation and clarifications of the Supreme Arbitration Court, there is no need to make adjustments when determining the amount of the tax fee.

New terminology

From January 1, 2022, the norms of paragraph 2 of Article 269 of the Tax Code of the Russian Federation contain references to articles of Section V.1 of the Tax Code of the Russian Federation governing provisions on interdependent persons, for example, to subparagraphs 1, 2, 3 and 9 of paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation. These standards mean that interdependent means an individual or legal entity whose share of direct or indirect participation in a third-party business is more than 25 percent (subclauses 1 and 2 of clause 2 of Article 105.1 of the Tax Code of the Russian Federation), or one and the same person directly or indirectly owns a share of more than 25 percent in each of the organizations (subclause 3, clause 2, article 105.1 of the Tax Code of the Russian Federation), or the share of participation of each previous person in each subsequent organization is 50 percent (subclause 9, clause 2, art. 105.1 Tax Code of the Russian Federation). Let me remind you that earlier, before the changes that took effect on January 1, 2017, paragraph 2 of Article 269 of the Tax Code was about affiliated entities.

Read also “Controlled debt in 2022”

The problem of determining controlled debt

In accordance with paragraph 2 of Art. 269 if the taxpayer - a Russian organization has an outstanding debt under a debt obligation to a foreign organization that directly or indirectly owns more than 20 percent of the authorized capital of this Russian organization, and if the amount of controlled debt to the foreign organization is more than 3 times the difference between the amount of assets and the amount liabilities of a taxpayer - a Russian organization on the last day of the reporting (tax) period, when determining the maximum amount of interest to be included in expenses, special rules of “thin capitalization” are applied.

Definitions of such concepts as direct and indirect participation of one organization in another are in Art. 269 of the Tax Code of the Russian Federation are missing, therefore, in our opinion, it is necessary to refer to other norms of the Code, in this case to Art. 105.2. It establishes the procedure for determining the share of participation of one organization in another organization. This norm was introduced by Federal Law No. 227-FZ of July 18, 2011 “On amendments to certain legislative acts of the Russian Federation in connection with improving the principles of determining prices for tax purposes,” which came into force on January 1, 2012.

As follows from paragraph 2 of Art. 105.2 of the Tax Code of the Russian Federation, the share of direct participation of one organization in another is recognized as the share of voting shares directly owned by the first organization (share in the authorized capital) of the other organization.

The procedure for determining the share of indirect participation of one organization in another is established in paragraph 3 of Art. 105.2:

- all sequences of participation of one organization in another are determined through the direct participation of each previous organization in each subsequent organization of the corresponding sequence;

- the shares of direct participation of each previous organization in each subsequent organization of the corresponding sequence are determined;

- the products of the shares of direct participation of one organization in another through the participation of each previous organization in each subsequent organization of all sequences are summed up.

In this case, the summation of the products of direct participation shares is carried out in the case when several independent sequences of participation of one organization in another organization are determined through the direct participation of each previous organization in each subsequent organization (Letter of the Ministry of Finance of Russia dated March 12, 2012 N 03-01-18/1-27 ).

Before January 1, 2012, when determining indirect participation, it was necessary to use the norm specified in paragraphs. 1 clause 1 art. 20 Tax Code of the Russian Federation. It said that the share of indirect participation of one organization in another through a sequence of other organizations is determined as the product of the shares of direct participation of organizations of this sequence in one another.

On the possibility of using this technique for the purpose of applying paragraph 2 of Art. 269 of the Tax Code of the Russian Federation was explained in Letter of the Ministry of Finance of Russia dated November 10, 2010 N 03-08-05.

From these definitions it follows that indirect ownership for tax purposes is the sequential participation of one organization in another. Meanwhile, the so-called sister organizations, that is, organizations that have the same participant (shareholder), do not fall under this definition, since none of them directly or indirectly owns a stake in another organization.

Previously, regulatory authorities took a similar position. In particular, the Federal Tax Service of Russia for Moscow, in Letter No. 16-15/115204 dated November 3, 2009, stated that the Russian organization - the borrower and the foreign company - the lender, the founders of which are a foreign organization, are not affiliated persons. Therefore, in the absence of information that a foreign organization is a guarantor (guarantor) of a Russian organization, expenses in the form of interest accrued for using a loan can be taken into account by the Russian organization for profit tax purposes in the manner established by paragraph 1 of Art. 269 and art. 328 of the Tax Code of the Russian Federation, i.e. the rules of thin capitalization cannot be applied to this debt (Letter of the Federal Tax Service of Russia for Moscow dated September 14, 2009 N 16-15/095462).

In addition, the Ministry of Finance of Russia in Letter dated July 14, 2010 N 03-03-06/1/459 explained that if a company has an outstanding debt under a debt obligation to a foreign organization, the amount of which is more than 3 times the size of the company’s equity capital, and at the same time, the foreign organization is not a direct or indirect owner of shares in the authorized capital of the company, the provisions of paragraph 2 of Art. 269 of the Tax Code of the Russian Federation are not applied for profit tax purposes.

However, later the tax authorities began to interpret the rules established by paragraph 2 of Art. 269 of the Tax Code of the Russian Federation, and qualify as controlled debt a loan received from a foreign affiliated (in particular, sister) company.

For example, the Ministry of Finance of Russia, in Letter dated July 20, 2011 N 03-08-13, expressed the opinion that if there is interdependence between a Russian organization - the borrower and a foreign creditor, the debt of such a Russian company may be considered controlled for tax purposes. Accordingly, the rules established by paragraphs 2 - 4 of Art. should be applied to interest expenses on the specified debt. 269 of the Tax Code of the Russian Federation.

According to the explanations of the Federal Tax Service of Russia, set out in Letter dated March 23, 2015 N ГД-4-3/ [email protected] , an outstanding debt under a debt obligation of a Russian organization to a sister foreign organization may be recognized as a controlled debt for income tax purposes, subject to the establishment of circumstances allowing us to draw a conclusion about the use of a sister organization as a transit organization for the transfer of funds from the parent organization. In other words, if in essence the loan was issued by a foreign shareholder (parent organization). To establish these circumstances, it is necessary to use information on cash flows and responses from the competent authorities of foreign countries. It is also necessary to analyze loan agreements for the presence of conditions in them that are characteristic of the interdependence of the parties.

At the same time, specialists of the Federal Tax Service of Russia believe that the indirect dependence of the Russian taxpayer on a foreign organization - creditor is expressed in the very fact that both persons are controlled by a single center - a foreign parent organization (entry into an international holding company), even if there is no direct relationship of subordination and control between the lender and the borrower themselves (ownership of shares or shares in the authorized capital).

The Letter of the Federal Tax Service of Russia dated June 22, 2015 N ГД-4-3/ [email protected] notes the advisability of using the OECD Comments on the Model Convention on Taxes on Income and Capital, which indicate that the application of thin (insufficient) capitalization rules is aimed at combating tax abuses in the hidden distribution of dividends under the guise of interest payments between affiliates. It is not necessary that the borrower be a subsidiary of the lender. Both of them, for example, may be subsidiaries of a third party, together be part of the same group of organizations or holding company controlled by such a third party, and the like. It is in this sense that the provision on the existence of a special relationship between the payer and the actual recipient of interest or between both of them and any third parties should be interpreted - the borrower and the lender must be affiliated directly with each other or both with third parties.

At the same time, the inspection may not prove the “transit” nature of the activities of such a company, since the above-mentioned letter dated March 23, 2015 N GD-4-3 / [email protected] , suggesting this, no longer applies.

The Ministry of Finance of Russia in Letters dated 08/12/2015 N 03-08-05/46443, dated 07/10/2014 N 03-08-05/33698, dated 08/28/2014 N 03-08-05/43013 supported the Federal Tax Service in this matter, indicating that the indirect dependence of the Russian taxpayer on a foreign company - creditor can be expressed in the very fact that both persons are controlled by a single center - the parent company or one individual, even if there is no direct relationship of subordination and control between the lender and the borrower themselves (ownership of shares or shares in the authorized capital) .

Unfortunately, the above legal position is also confirmed by judicial practice. In particular, the court decision, which became one of the first cases in which the tax authorities managed to prove the applicability of the rules of thin capitalization in relation to nursing debt, was the Resolution of the Federal Antimonopoly Service of the Moscow District dated February 27, 2012 N A40-1164/11-99-7 in the case .

The situation was repeated in the case dated December 19, 2012 N A40-58049/12-107-325. In this trial, the judicial panel concluded that the indirect dependence of the Russian taxpayer on a foreign company - creditor can be expressed in the very fact that both persons are controlled by a single center - the parent company (entry into an international holding company), even if there is no relationship between the organizations of the lender and the borrower direct relationship of subordination and control (ownership of shares or shares in the authorized capital). In this judgment, the court did not take into account the taxpayer’s argument that the provisions of the Russian Tax Code on thin capitalization do not apply to loans received from foreign sister companies.

Similar conclusions followed from other judicial practice: Resolutions of the Federal Antimonopoly Service of the Moscow District dated 08/19/2015 N F05-9762/2015 in case N A40-72507/14, dated 04/13/2015 N F05-3361/2015 in case N A40-41135/14 , dated September 24, 2013 in case No. A40-88761/12-99-495; FAS Far Eastern District dated 02/13/2014 N A04-1595/2013; FAS North-Western District dated 06/19/2015 N F07-3729/2015 in case N A56-41307/2014, dated 06/06/2014 in case N A52-4072/2012, etc.

Despite the existence of the arbitration practice described above, which is negative for taxpayers, there have also been positive court decisions.

Thus, in the Resolution of the Federal Antimonopoly Service of the North-Western District dated March 20, 2014 N F07-1457/2014 in case N A21-3697/2013, the judges came to the conclusion that the mere fact of affiliation of organizations or inclusion in one group of organizations is not, by virtue of the provisions clause 2 art. 269 of the Tax Code of the Russian Federation is the basis for recognizing debt as controlled. At the same time, the judges rejected the inspector’s arguments that, since the borrower and lenders are part of the same group of organizations and are interdependent persons, the lending organizations indirectly own the authorized capital of the borrower, and therefore the interest should not have been taken into account by the borrower for tax purposes, since the debt is controlled.

As the court pointed out, their share of participation cannot be determined by multiplying the shares of other organizations, as required by the provisions of Art. 20 of the Tax Code of the Russian Federation, due to the absence of any sequence of organizations between lenders and borrowers. The list of grounds for recognizing debt as controlled, specified in paragraph 2 of Art. 269 of the Tax Code of the Russian Federation is closed and is not subject to broad interpretation. In addition, the inspection did not provide evidence of the influence of the fact of affiliation of the borrower and lenders on the terms of the transaction in comparison with the market conditions for providing a loan between independent organizations; these circumstances were not clarified and were not established by the inspection during the inspection.

Taking into account all of the above, the risks that the tax authorities will apply the norms provided for in clauses to legal relations with an affiliated lender. 2-4 tbsp. 269 of the Tax Code of the Russian Federation are quite high.

At the same time, I would like to note two points that can play a positive role in such a dispute.

Firstly, as noted above, such actions of tax and judicial authorities are motivated by the desire to suppress tax abuses, when most transactions between interdependent persons were formally outside the scope of special tax control mechanisms. However, since 2015, for all controlled transactions in terms of recognition of income and expenses, restrictions provided for in clauses apply. 1.1 – 1.3. Art. 269 of the Tax Code of the Russian Federation. The Ministry of Finance believes that these rules should also be followed in the case when a transaction between related parties is not recognized as controlled (Letter of the Ministry of Finance of Russia dated 02/09/2016 N 03-01-18/6665). Thus, the tax authorities have a different tool to combat unscrupulous taxpayers, which, in our opinion, is more suitable for monitoring transactions involving sister companies.

Secondly, Federal Law No. 25-FZ dated February 15, 2016 “On amendments to Article 269 of Part Two of the Tax Code of the Russian Federation regarding the definition of the concept of controlled debt”, the rules of thin capitalization, starting from 2022, are extended to loans from foreign interdependent companies, not being direct or indirect participants of the Russian borrower.

The Explanatory Note “To the draft Federal Law “On Amendments to Article 269 of Part Two of the Tax Code of the Russian Federation regarding the definition of the concept of controlled debt” states that this bill is aimed at eliminating the ambiguity in the application of the provisions of Article 269 of the Tax Code of the Russian Federation. Thus, we can conclude that the legislator recognized that before it came into force, the legal grounds for an expansive interpretation of the current definition of controlled debt are quite dubious.

And all irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees must be interpreted in favor of the taxpayer (Clause 7, Article 3 of the Tax Code of the Russian Federation).

Unfortunately, judicial authorities, including higher authorities, do not always follow this declarative norm.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

How is debt controlled?

The amount of debt incurred by the enterprise and the timing of its repayment are fixed by an agreement drawn up by the parties to the transaction.

Payment of this amount is carried out under the control of the debtor organization itself, the lender (this can be done by a sales manager, a specially created collection department, etc.) and government bodies.

The tax authority pays special attention to enterprises that have a tax liability or foreign firms that influence various Russian companies.

Useful material : The bank sold the debt to collectors, what should I do?

Conditions of occurrence

There are several features that move regular debt into the controlled section. In the current tax code there are three of them:

- The debt was provided by a foreign company. The creditor company must own at least twenty percent of the authorized capital of the Russian organization.

- Debt obligations arose to a Russian company, but at the moment it is registered as an affiliate of a foreign company.

- To a company from the Russian Federation, if a foreign company or its affiliated entity supports the implementation of a loan obligation (for example, is listed as a guarantor, guarantor).

- Any affiliated companies from abroad, if debt has become greater than capital. In this case, debt must exceed capital by three times or more.

In addition, in order for a loan to become controllable, its size must be three times the difference between the amount of assets and loans of the debtor. For example, if a company is engaged in leasing (or we are talking about a bank), the debt must exceed the specified parameters by 12.5 times.