Founders are the persons who initiated the creation of an organization. A constituent agreement is concluded between them. They are the ones who approve the charter and invest property in the authorized capital. The founders receive dividends from the company's activities. That is, calculations are made with them. They must be recorded in accounting and tax accounting.

Question: The organization received an interest-bearing loan from the founder - an individual with a share in the authorized capital of more than 25%. Interest is paid one-time upon expiration of the loan agreement. According to the lender's statement, the entire amount is transferred to the bank account to repay the loan that the founder took out as an individual. Is it legal to take into account the amount of interest when calculating the Unified Agricultural Tax? Do you need documents confirming the relationship between an individual and a bank? View answer

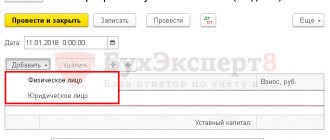

Calculations relating to the formation of the authorized capital of JSC and LLC

For settlements on deposits, subaccount 1 is created to account 75. The size of the authorized capital and the debts of the founders on deposits are reflected by this posting: DT75/1 KT80.

How to take into account assistance from the founder when calculating income tax ?

Posting is carried out on the basis of information from the constituent documents. Within 90 days from the date of registration, the founders must make at least half of the capital contributions. The remaining 50% is due within 12 months from the date of registration. The memorandum of association may stipulate a shorter period. If the founders of the organization did not meet the deadline, the posting above must be recorded in accounting.

When a contribution is made in the form of money to capital, this posting is made: DT50, 51, 52 KT75/1. Money has been contributed to the capital.

Question: How to reflect in the accounting of an organization (borrower) the receipt and repayment of an interest-bearing loan from an individual - the founder (lender), if the terms of the agreement provide for the calculation of interest using the compound interest formula? An individual is a tax resident of the Russian Federation. The organization received an interest-bearing loan in the amount of RUB 2,000,000. According to the agreement, interest is accrued (capitalized) daily according to the compound interest formula at a rate of 18% per annum on a monthly basis, based on the number of days the agreement is valid in the current month, from the day following the day the loan was issued until the day the loan is repaid inclusive. The loan was received on February 19 and repaid on April 24. Interest accrued for the period of validity of the loan agreement (64 days) is paid on the day of repayment of the loan in non-cash form. Borrowed funds were used to finance current activities. The lender's share of participation in the organization is more than 25%. At the same time, the transaction between the borrower and the lender for the purposes of applying the Tax Code of the Russian Federation is not controlled. View answer

If the contribution is made in the form of property, these entries are needed:

- DT08, 10, 41, 58 KT75/1. Capital includes intangible or tangible assets, products, shares or other objects.

- DT19 KT75/1. Fixation of VAT on the deposit made.

Accounting involves performing an assessment of deposits. This is not always easy to do. For example, it is difficult to value an intangible asset. The evaluation is carried out on the basis of mutual consent of the creators. The corresponding agreement is recorded in the constituent documents. If the asset is not in cash form, the valuation is carried out by an independent appraiser. The amount received as a result of a professional assessment may be reduced by the founders. However, it cannot be increased on the basis of paragraph 2 of Article 66 of the Civil Code of the Russian Federation.

Example

The capital amount is 200 thousand rubles. It is divided into four parts:

- JSC Luna owns three shares. This is 75% of the authorized capital. That is 150 thousand rubles.

- Ivan Ivanov owns one share. This is 25% of capital. That is, it is 50 thousand rubles.

To record deposits, these sub-accounts are opened:

- The score is 75/1/1. Settlements on deposits with JSC Luna.

- The score is 75/1/2. Settlements on deposits with Ivan Ivanov.

JSC Luna contributed materials worth 150 thousand rubles. The VAT amount was 22,882 rubles. Ivan Ivanov contributed money. The following transactions are performed:

- DT75/1/1 KT80. Luna's debt amounted to 150 thousand rubles.

- DT75/1/2 KT80. Ivanov's debt amounted to 50 thousand rubles.

- DT08 KT75/1/1. Luna contributed materials in the amount of 140,880 rubles.

- DT19 KT75/1/1. Recovered VAT on contributed materials in the amount of 22,992 rubles.

- DT50 KT75/1/2. Ivanov made a contribution in the amount of 50,000 rubles.

Upon completion of all calculations, the balance of the open subaccount should be equal to zero. A zero value indicates that the capital is fully formed.

Debt repayment methods

There are several options for contributing funds to the authorized capital. These include:

- money;

- property;

- securities;

- right of claim under the contract.

In accordance with current legislation, the minimum amount of capital must be kept in cash equivalent; the surplus can be represented by any of the above assets. When drawing up the authorized capital, it is necessary to take into account that an assessment of the organization’s material base must be carried out by an independent expert.

Cash payments can be made in two ways:

- Cash (a cash receipt order is drawn up in form No. KO-1).

- Transfer to the company's current account.

It is also often used to repay debt on a deposit in a management company through loan repayments.

This method implies that one of the founders of the company who has incurred a penalty will enter it into the balance sheet in the form of a receivable. For this purpose, a general meeting of co-owners is convened, where the feasibility and size of this investment in capital is determined.

If the total amount of debt exceeds 20 thousand rubles, then by law it is necessary to attract a third-party, independent appraiser to calculate the value of the deposit. The basis for transferring the property rights to the management company may be:

- Assignment agreement.

- Credit agreement.

- Debtor's receipt.

- A writ of execution, if the arrears are already being collected through the court.

In addition to the complete elimination of the penalty, partial payment of the obligation is possible.

The authorized capital can be replenished not only with money, but also with securities

Calculations for the creation of the authorized capital of a unitary education

The founders of a unitary entity can be state or municipal structures. To record settlements, you need to open subaccount 1 to account 75. Replenishment of the fund is recorded with this posting: DT75/1 KT80. Formation of a fund of a unitary structure.

When the creator transferred the funds to the balance sheet of the unitary entity, you need to make this posting: DT08, 10, 50-51, 58 KT75/1. Contribution of property or money by the founder.

If OS are entered in excess of the norm, these entries are used:

- DT75/1 KT84. The cost of fixed assets subject to payment in excess of the norm.

- DT08 KT75/1. Receipt of fixed assets contributed in excess of the specified fund amount. For example, the size of the fund is 100 thousand rubles. The founder contributed an amount of 120 thousand rubles. In this case, the wiring in question is used.

- DT01 KT08. The provided fixed assets have been accepted for accounting.

If property is seized within the fund's value, this entry is needed:

- DT80 KT75/1. Reducing the fund size by the initial cost of the operating system.

- DT75/1 KT01. Write-off of fixed assets at their residual value.

- DT75/1 KT91/1. Write-off of the difference between the initial and residual value of the fixed assets.

Each settlement with the founders must be accompanied by paperwork.

Calculation of dividends

The founders have the right to receive profits in the form of dividends. The terms of payments are stipulated by the constituent documents. The decision on the distribution of funds is made by the management structure. For example, this could be a shareholders meeting. The founders are paid dividends in the amount of the initial contribution. For example, the creator contributed 50% of the authorized capital. Consequently, he becomes entitled to half of the organization's profits. To account for dividend payments, subaccount 2 is opened to account 75.

The accrual of funds to the founder is reflected in these entries:

- DT84 KT75/2. Payment of dividends to persons who are not employees of the organization.

- DT84 KT70. Transfer of dividends to company employees.

Funds must be paid to the founders within 2 months from the date of the decision on profit distribution. The corresponding rule is given in paragraph 3 of Article 28 of the Federal Law “On LLC” No. 14 of February 8, 1998. If this instruction is violated, the founders can recover from the LLC a percentage in the amount of 1/360 of the refinancing rate on the basis of Article 395 of the Civil Code of the Russian Federation.

The following taxes are charged on dividends:

- For FL income.

- For the profit of the legal entity.

The tax agent will be the company itself. The rate for residents of the country will be 13%. The tax base for dividends is determined separately. For example, if a person receives a salary and dividends, the base must be calculated separately from these forms of income.

IMPORTANT! A resident is a person who stays in the country for at least 183 days throughout the year. The period must be continuous.

The income tax rate is 0% when one resident receives funds from another resident. However, the following conditions must be met:

- The dividend recipient's contribution is 50% or more of the authorized capital.

- The recipient holds the deposit for at least a year.

In other cases, the rates will be as follows:

- 13% if dividends are issued by a company that does not meet the conditions given above.

- 15% if funds are paid to non-residents.

These entries will appear in the accounting:

- DT75/2 KT68. Withholding personal income tax on dividends paid to persons who are not employees of the organization.

- DT70 KT68. Withholding personal income tax from amounts transferred to employees of the subject.

- DT75/2 KT68. Withholding tax on payments to legal entities.

At this stage, funds are only credited. Preparations for payment are in progress.

General concept of authorized capital

The concept of authorized capital means the amount of funds or other contributions for the development of an enterprise at the initial stage of formation. The authorized capital can increase and decrease through a general meeting of shareholders and their adoption of a decision on this, and then by notifying the tax inspectorate. Capital consists of additional and reserve capital. The company's charter may limit the maximum size of the share of a company participant. The company's charter may limit the possibility of changing the ratio of shares of the company's participants. Such restrictions cannot be established in relation to individual members of the company. The specified provisions may be provided for by the charter of the company upon its establishment, and also included in the charter of the company, amended and excluded from the charter of the company by decision of the general meeting of the company's participants, adopted unanimously by all the company's participants.

If the company's charter contains the restrictions provided for by this paragraph, a person who acquired a share in the authorized capital of the company in violation of the requirements of this paragraph and the relevant provisions of the company's charter has the right to vote at the general meeting of the company's participants with a portion of the share, the amount of which does not exceed that established by the company's charter the maximum size of the share of a company participant.

According to account 80, the amount of capital on the loan is formed. Don't forget about double entry in accounting. Thus, we also have a second debit account involved.

Payments to founders

Payments may be made in the form of money or property. If the founder receives money, this posting is made: DT75/2 (70) KT50, 51, 52. Payment of funds minus tax.

If the founder receives income in the form of property, this posting is made:

- DT75/2 KT90/1. Dividends were transferred in the form of services, goods, and property.

- DT75/2, 70 KT90/1. Dividends were transferred in the form of other property (materials).

- DT90/2 (91/2) KT43, 41, 20. Write-off of the cost of property.

- DT90/3 KT68. VAT accrual.

The cost of property paid to the founders as dividends includes the amount of VAT on the basis of Article 211 of the Tax Code of the Russian Federation. If taxes on personal income are withheld, the amount of dividends is not reduced by tax deductions.

Income tax

If the participant is a resident, the company paying the dividends does not need to charge income tax. If the participant is a non-resident, the tax is calculated on the difference between the real and nominal value. The corresponding rule is given in paragraph 1 of Article 309 of the Tax Code of the Russian Federation. If a foreign entity receives payments in the amount of its initial contribution, tax does not need to be assessed on the basis of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

The income tax rate is 20%. A lower rate is also possible if the corresponding instructions are given by international treaties (based on paragraph 1 of Article 310 of the Tax Code). Income tax is calculated using this formula:

Income tax = present value of the deposit – (nominal value * 20%)

The corresponding instructions are given in paragraph 1 of Article 251 of the Tax Code of the Russian Federation. The taxation procedure is specified in the letter of the Ministry of Finance No. 03-03-06/1/519 dated August 3, 2010.

Origination of taxable income

Sometimes a company has taxable income after settlements with participants. This is relevant for entities using a simplified and general taxation system. The relevant provisions are contained in Article 250, paragraph 1 of Article 346.15 of the Tax Code of the Russian Federation. A taxable base arises under these circumstances:

- The value of the property transferred to the capital is less than the real value of the contribution of the retired founder (letter of the Ministry of Finance No. 03-03-04/1/355 dated November 15, 2005).

- The value of assets based on tax accounting information is less than the real value of the deposit (letter of the Ministry of Finance No. 03-03-06/2/127 dated September 24, 2008.

- The real value of the deposit of the withdrawing founder exceeds the nominal value. The person renounced his dividends in favor of the entity.

IMPORTANT! If the contribution is not paid when the founder leaves the association, its real value must be reflected in income.

Value added tax

If dividends are paid to a participant leaving the association in the form of property, VAT is charged on the difference between the real and nominal value. An invoice is also issued on the basis of paragraph 2 of Article 146 of the Tax Code of the Russian Federation, paragraph 3 of Article 39 of the Tax Code of the Russian Federation. The instruction is also contained in the letter of the Ministry of Finance No. 03-07-11/112 dated April 17, 2012. In the event that subjects use special taxation systems, VAT does not need to be paid on the basis of Article 346.11 of the Tax Code of the Russian Federation, Article 346.26 of the Tax Code of the Russian Federation. To reflect the accrual of VAT, this posting is used: DT91/2 KT68. A sub-account is opened for the last account.

IMPORTANT! The object of taxation appears only when there is a positive difference between the real and nominal value of the deposit. In the event that the positive difference is paid to the founder, no taxable object will be created.

Accounting: cash contributions

Reflect the cash contributions received from the founders by posting:

Debit 50 (51, 52) Credit 75-1

– money was contributed as a contribution to the authorized capital.

An example of how to reflect in accounting the founder’s monetary contribution to the authorized capital of an organization

LLC "Torgovaya" was founded by LLC "Alpha" and A.S. Glebova. The authorized capital of the organization is 400,000 rubles.

Alpha owns a 60 percent share worth RUB 240,000. (400,000 rubles × 60%), Glebova – 40 percent of the share in the amount of 160,000 rubles. (RUB 400,000 × 40%).

Hermes was registered in February. Before this date, the founders paid 50 percent of their shares in the authorized capital. In March, the founders fully repaid their debt on contributions to the authorized capital.

The organization's accountant made the following entries in the accounting.

In February:

Debit 51 Credit 75-1 – 120,000 rub. (RUB 240,000 × 50%) – 50 percent of Alpha’s debt on the contribution to the authorized capital has been repaid;

Debit 50 Credit 75-1 – 80,000 rub. (RUB 160,000 × 50%) – 50 percent of Glebova’s debt on contribution to the authorized capital has been repaid.

In March:

Debit 51 Credit 75-1 – 120,000 rub. (RUB 240,000 – RUB 120,000) – Alpha’s debt on contribution to the authorized capital has been repaid;

Debit 50 Credit 75-1 – 80,000 rub. (160,000 rubles – 80,000 rubles) – Glebova’s debt on contribution to the authorized capital has been repaid.

Situation: how to take into account the difference between the currency exchange rate on the date of formation and the date of payment of the authorized capital, if the founders of the LLC pay the authorized capital in foreign currency?

The authorized capital of a Russian organization is fixed in rubles (Clause 1, Article 317 of the Civil Code of the Russian Federation). Fluctuations in foreign currency exchange rates do not affect the size of the authorized capital reflected in the accounting records of the organization’s state registration (clause 14 of PBU 3/2006).

If on the date of payment of the deposit the exchange rate has increased, then reflect the resulting difference between the ruble valuation of the authorized capital and the debt of the founder as follows:

Debit 75-1 Credit 83

– reflects the positive difference between the ruble valuation of the authorized capital and the debt of the founder.

This is stated in paragraph 14 of PBU 3/2006.

If on the date of payment of the deposit the exchange rate has decreased, then the participant (founder) needs to pay the difference. This is explained by the fact that the value of the contribution of each founder should not be less than the nominal value of his share. If this rule is violated, the company is obliged to announce either a reduction in its authorized capital or liquidation (clauses 3, 4 of Article 90, clause 4 of Article 99 of the Civil Code of the Russian Federation).

Situation: is it necessary to enter a cash receipt for the amount of the deposit received from the founder in cash?

No no need.

A cash receipt must be entered if cash was received as payment for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003). The transfer of a contribution to the authorized capital is of an investment nature and is not recognized as a sale (subclause 4, clause 3, article 39 of the Tax Code of the Russian Federation).

Other Typical Wiring

Payment of dividends is not the only type of settlement with the founders. For example, a participant may issue a loan to an organization. This operation also needs to be taken into account in accounting. Let's look at other typical wiring:

- DT50, 51 KT66, 67. The founder provided financial assistance to the organization. It is framed as a loan.

- DT50, 51 KT91/1. The person provided gratuitous assistance, which is classified as other income.

- DT75 KT84. Receipt of funds from the founder to cover current losses.

To maintain accounting, you need synthetic (general ledger, balance sheet) and analytical (account card 75, analysis) registers.

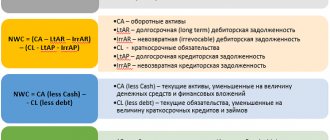

Calculations within the balance sheet

Settlements with the founders are reflected in account 75. This is an active-passive account. It may appear as a debt on both credit and debit. For example, the participants' debt for contributions is recorded on the debit of account 75, and the company's debt to the founders is on the credit of account 75. The debit balance of account 75 is recorded on line 1230, the credit balance of the same account is on line 1520. The relevant instructions are given in Order of the Ministry of Finance No. 66n dated July 2, 2010.

Are settlements with founders an asset or a liability? Accounts receivable are reflected on line 1230. It includes the balance of account 75.1 for unpaid deposits. The calculations are fully included in the liability side of the balance sheet on line 1310.

The final balance of account 75.2 reflects the company's debt to the founders for dividends. It is included in the accounts payable indicated on line 1450 in the structure of other liability obligations.

Tax accounting of debt under the Criminal Code

The founders' debt for contributions to the authorized capital must be reflected not only in the balance sheet, but also in tax documentation. Money and property that were invested by the shareholder (individual or legal entity) into the account of the management company:

- Not subject to value added tax.

- They are not registered in the personal income tax or simplified taxation system database.

The formation of debts on contributions to the authorized capital must be reflected in tax and accounting

However, if VAT has been paid, it must be restored when accepting the deduction. However, it should not be included in expenses based on profit indicators. The company has every right to take back the deduction that was restored.

If there is a redistribution of shares or the nominal price of shares of a particular company participant increases, then he is not obliged to calculate personal income tax. In the opposite situation, when the size of the capital company is reduced by decision of the meeting of shareholders, they need to pay personal income tax in full.

If you contribute to the capital an amount greater than that agreed upon in the founding document, it may be increased:

- Contributions received from participants of the company's joint stock company.

- By attracting funds from outside. At the same time, money received from third parties serves as a kind of reserve fund.

The first option is the key and most common, but there are some nuances. The decision to increase the capital must be made at a meeting of the founders. After the event, participants are required to replenish it with the amount that was accepted at the general discussion.

If it was not possible to collect this amount during this time, then the funds that have already been deposited are returned to investors. However, no one has the right to force a shareholder to contribute an additional amount. If even one participant refuses to pay additional capital, the capital will not be collected, and the founder will not bear any responsibility.

Audit of settlements with founders

During the audit, the specialist checks the following aspects:

- The actual receipt of funds from the founders and its reflection on the loan in correspondence with accounts 50-52, 01, 10.

- Capitalization of property and the correctness of its valuation.

- Fidelity to the accounting organization.

- Compliance with dividend payment deadlines.

- Timely adoption of decisions on the payment of dividends.

- Correct calculation of taxes and other obligatory payments.

- Checking the legality of the form of constituent documentation.

- Compliance of constituent documents with laws.

- Compliance with capital formation deadlines.

- Compliance of the amount of capital with the constituent documents and the law.

- Checking the correctness of capital formation in accounting.

The auditor checks constituent documents, accounting, tax reporting, order books, and decisions.

Common mistakes

During the audit of calculations, these errors are often identified:

- The credit balance of the account and the information specified in the constituent documents differ.

- Capital was improperly increased by increasing the value of assets.

- The founders did not make full contributions within the prescribed period.

- The changes were not reflected in the register in a timely manner.

- The contents of the documents were changed without sufficient grounds.

- Fictitious papers and transactions were discovered.

- The tax was calculated and transferred incorrectly.

At the end of the procedure, the auditor draws up a report. It indicates any deficiencies found and provides recommendations for correcting errors. The document must contain information about the organization being audited and the auditor. The conclusion will be legal only if it is drawn up by an auditor who has joined the SRO.

Payment of debt on authorized capital: accounting

When maintaining accounting records for transactions related to the formation and repayment of debts of the founders on the authorized capital, the following entries are used:

- Dt 75 Kt 80 - to reflect in accounting the fact of debt formation (when registering a company with the Federal Tax Service);

- Dt 50 (or 08, 10, 41, 51, 52 - depending on the method of payment of the authorized capital) Kt 75 - to reflect the fact of debt repayment (in whole or in part);

- Dt 80 Kt 75 - a reflection of the forced reduction of the capital when the debt is not repaid by the founder on time and is not subsequently redistributed.

If the authorized capital is formed at the expense of receivables, then the following sequence of transactions is applied:

- Dt 76 Kt 75 - the company has been transferred the right to claim the debt on account of the management company;

- Dt 51 Kt 76 - the debtor paid the company.

In the balance sheet, the authorized capital is classified as liabilities and is reflected in the amount determined by the constituent documents in line 1310 (even with partial payment). The current debt of the founders is, in turn, an asset, and it is reflected on the balance sheet in line 1230.

Read about the nuances of filling out the balance sheet in the article “Deciphering the lines of the balance sheet (1230, etc.).”