Attention! With the entry into force of Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p (from February 17, 2017), the SPV-2 form became invalid. See also: “New personalized accounting documents from 02/11/2020.”

The SPV-2 form was approved to replace the SPV-1 form previously submitted (until 2014) to the Pension Fund. The procedure for filling out the SPV-2 form differs significantly from how the previously valid form was filled out. Therefore, we recommend that you read this article to understand how to draw up and to whom to submit a new settlement document.

SPV-2 - what is it?

Form SPV-2 allows Pension Fund employees to find out additional information about the insured for the last 3 months before his retirement. From this document, the Pension Fund will be able to obtain information from the policyholder during the inter-reporting period about the insurance experience of the insured person.

form of SPV-2 in August 2014 was facilitated by changes in Russian pension legislation that came into force. The new form was put into effect by Resolution of the Pension Fund Board of July 21, 2014 No. 237p (hereinafter referred to as Resolution No. 237p).

In accordance with the changes that have come into force, the employer now does not divide contributions into funded and insurance parts, but is obliged to indicate the fact whether contributions were made at an increased rate. The document reflects information about the length of service of the retiring employee and confirms the accrual of insurance contributions made towards the insurance part of the pension for the last three months.

You can get more information about the insurance period by studying our article “What is the insurance period for a pension?”

All this is reflected in the SPV-2 form , which the policyholder submits to the Pension Fund. Without providing all relevant information until the day of retirement, the future pensioner will receive a smaller pension, and recalculation after providing additional information will take a lot of time.

What happened in 2022

From January 1, 2022, control over the calculation and payment of insurance premiums, including for pension insurance and security, was transferred from extra-budgetary funds to the Federal Tax Service. In connection with these changes, Resolution of the Board of the Pension Fund of January 11, 2017 No. 2p was issued, which canceled all forms previously used in personalized accounting. In particular, from February 17, 2022, the SPV-2 form was declared invalid.

A direct analogue to this report has not been approved. But this does not mean that employers are now completely exempt from submitting information to the Pension Fund about employees retiring. To control the accounting of such categories of citizens, two new forms of accounting are currently used, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p:

- SZV-STAGE;

- SZV-M.

What is the procedure for submitting the SPV-2 form for a pension fund?

To obtain the SPV-2 form , an employee who plans to retire in the near future (labor, length of service, disability or other reasons) applies to the employer to submit this document. At the same time, the employee does not need any notifications from the Pension Fund to receive the specified form.

The application is written in free form, its text can be as follows:

“Please provide the territorial branch of the Pension Fund with individual information about my length of service and the calculation of insurance contributions for compulsory pension insurance in the SPV-2 form in connection with the registration of an old-age pension from July 1, 2016.”

The employer must prepare the above document within ten days and submit it to the Pension Fund (clause 36 of the order of the Ministry of Health and Social Development dated December 14, 2009 No. 987n). And the employee himself can submit an application for the assignment of pension payments to him a month before the expected date of retirement (clause 73 of Order of the Ministry of Labor dated March 28, 2014 No. 157n), which means that the future pensioner can contact the employer with a request to submit the SPV-2 form in advance.

The new form does not indicate information on the amount of accrued insurance premiums - this data is displayed in quarterly reporting on the RSV-1 form. And even if an application from an employee with a request to submit the SPV-2 form was received just in time for the preparation and submission of the RSV-1 report, then the document ordered by the employee is still prepared and submitted to the Pension Fund of the Russian Federation along with an inventory in the ADV-6-1 form (para. 3 clause 7 of the resolution of the Board of the Pension Fund of July 31, 2006 No. 192p).

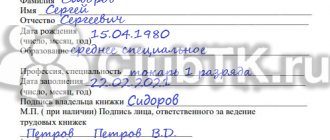

The completed SPV-2 form should be signed by the manager and certified with the seal of the insurer (paragraph 8, subclause 3, clause 4 of Resolution No. 237p). The form is submitted to the territorial branch of the Pension Fund (at the place of registration of the policyholder) on paper or in electronic form. The employer must also provide the employee with a copy of this form.

Article

Personalized accounting information for the inter-reporting period for assigning a pension to an employee will now have to be submitted using the SPV-2 form. In the new form, which replaced the usual SPV-1 form, it is not necessary, in particular, to reflect data on accrued and paid contributions for the insurance and savings part. Let's talk about the intricacies of filling out the new item in more detail.

What is it for?

Form SPV-2 “Information on the period of work of the insured person to establish a labor pension” contains personalized accounting information for the inter-reporting period. It is provided to the Pension Fund to assign a pension to the insured person. The form was approved by Resolution of the Board of the Pension Fund of July 21, 2014 No. 237p (registered with the Ministry of Justice of Russia on August 7, 2014).

Form SPV-2 contains information about the insured person, including those who have entered into a civil contract for benefits for which insurance premiums are calculated. The document is created based on the application of an employee who is about to retire.

When is it handed over?

Form SPV-2 is submitted in cases where it is necessary to submit to the Pension Fund information about the length of service of the insured person for the current quarter, which the company has not yet submitted to the Pension Fund as part of the general reporting package. If this is not done, some of the information about the length of service will not be taken into account when assigning a pension.

Form SPV-2 must be submitted within 10 calendar days after the employee’s written request. The completed document is certified by the signature of the head and the seal of the organization.

What information is included in it?

The document contains the following information about the insured person:

- periods of work for the last three months from the beginning of the quarter in which the expected date of establishment of the labor pension falls, to the expected date of establishment of the labor pension;

- information on the calculation of insurance premiums for compulsory health insurance during the inter-reporting period;

- information on the calculation of insurance premiums at additional tariffs in relation to persons employed in work with harmful and dangerous working conditions specified in subparagraphs 1-18 of paragraph 1 of Article 27 of Federal Law No. 173-FZ.

For more information about calculating insurance premiums, see the berator. Install Berator for Windows

Filling out the SPV-2 form

The rules for filling out the SPV-2 form are given in the table:

| Props | Filling rules | Mandatory filling |

| Policyholder details: | ||

| Registration number in the Pension Fund of Russia | The number under which the employer is registered as a payer of insurance premiums is indicated, indicating the codes of the region and district according to the classification adopted by the Pension Fund of Russia | Required to fill out. The registration number of the Pension Fund is communicated to the employer by the territorial body of the Pension Fund. |

| Name | The short name of the organization is indicated | Required to fill out |

| INN checkpoint | Indicate the taxpayer identification number and reason code for registration | Required to fill out |

| Insured person category code | Filled out in accordance with the parameter classifier of the same name (Appendix 1 to these Instructions) | Required to fill out |

| Compilation date on | The expected date of establishment of the labor pension is indicated. Fill in as follows: DD month name YYYY | Required to fill out |

| Date of submission to the Pension Fund | Fill in as follows: DD name of the month YYYY. The date of receipt of documents by the territorial body of the Pension Fund of Russia is indicated. | To be completed by the territorial body of the Pension Fund of Russia |

| Reporting period | The period for which information is provided is indicated. Reporting periods are the first quarter, half a year, nine months of the calendar year, the calendar year, which are designated respectively as “3”, “6”, “9” and “0” | Required to fill out |

| Information about the insured person: | ||

| Last name, first name, patronymic (if available) | Similar to the details of the SZV-1 form of the same name | Required to fill out |

| Insurance number | Similar to the details of the SZV-1 form of the same name | Required to fill out |

| Information type | The “X” symbol indicates one of the following values: | Required to fill out |

| “original” - the form first submitted by the employer for the insured person; | If the original form submitted was returned to the employer due to errors, the original form will also be submitted in its place. | |

| “corrective” - a form submitted to change previously submitted information about the insured person; | If the original form contained information that did not correspond to reality, then the corrective form must contain the information in full, and not just the information being corrected. The information in the corrective form completely replaces the information in the original form. | |

| “oPeriod of work for the last three months of the reporting period” | ||

| Operating period for the last three months of the reporting period: | ||

| Start of period from (dd.mm.yyyy) | The dates must be within the period from the day following the end of the reporting period preceding the reporting period on which the expected date of establishment of the labor pension falls, to the expected date of establishment of the labor pension. Periods of administrative leave, temporary disability, rotational leave, etc. indicated using parameter classifier codes (Appendix 1) | Required to fill out |

| End of period (dd.mm.yyyy) | ||

| Territorial conditions (code) | Similar to the details of the SZV-1 form of the same name. If an employee performs work full-time during a part-time work week, periods of work are reflected based on the time actually worked. If the employee performs work part-time, the volume of work (share of the rate) in this period is reflected | Filled out when the insured person works in the regions of the Far North and equivalent areas, as well as in the exclusion zone, zone of residence with the right to resettlement, zone of residence with a preferential socio-economic status, zone of residence with the right of resettlement and the resettlement zone of the Chernobyl Nuclear Power Plant |

| Special working conditions (code) | Similar to the details of the SZV-1 form of the same name. | |

| Calculation of insurance period basis (code) | For insured persons employed in the work specified in subparagraphs 1 - 18 of paragraph 1 of Article 27 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation” (if the class of working conditions at the workplace for this work corresponded to a harmful and (or) dangerous class of working conditions established based on the results of a special assessment of working conditions), codes of special working conditions are indicated only in the case of accrual (payment) of insurance premiums at an additional rate. In the absence of accrual (payment) of insurance premiums at an additional tariff, codes of special working conditions are not indicated | |

| additional information | ||

| Conditions for early assignment of a labor pension | ||

| Base (code) Additional information | ||

Form SPV-2 is accompanied by an inventory according to form ADV-6-1 “Inventory of documents transferred by the policyholder to the Pension Fund of the Russian Federation.”

Data on the number of documents of the SPV-2 form “Information on the period of work of the insured person for the establishment of a labor pension” included in the bundle is indicated in the line “Other incoming documents” of the table of the ADV-6-1 form.

https://buhgalteria.ru/article/n133612

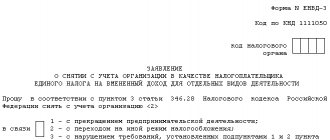

Features of the presentation of the SPV-2 form for individual entrepreneurs

Individual entrepreneurs who independently pay insurance contributions to the Pension Fund can also submit the SPV-2 form in relation to themselves to their Pension Fund branch. This form is submitted to the Pension Fund along with an application for a labor pension.

However, there are often cases where the Pension Fund refuses to accept this form for individual entrepreneurs - this is especially true for those individual entrepreneurs who pay insurance premiums once a year. This is due to the fact that only after payment of contributions the periods of activity indicated in the report are included in the insurance period of these insured persons.

Responsibility for failure to submit the SPV-2 form

If the employer does not submit the SPV-2 form to the Pension Fund, this will not threaten him with any sanctions or other administrative penalties. There is no liability for failure to submit this form, since this is not a reporting document, but a settlement document.

Failure to submit the SPV-2 form by the employer only has negative consequences for the insured person. After all, if he does not have enough work experience without these last months, which would be indicated in the form, then the employee may be denied a pension. Also, if a pension is assigned without a submitted form, the insured will be accrued a smaller pension, since the latest periods (not included in the quarterly report) will not be taken into account.

For more information about work experience, see our article “What will the pension be if there is no work experience?”

Certificate SPV-2 - procedure for filling out the document

Form SPV-2 is filled out according to the same principle as other documents for submitting personalized information about insured persons. We are talking about the same procedure for indicating information about the policyholder himself, the insured, the presence of special working conditions, periods for which contributions were not paid.

It is important to indicate the employee’s expected retirement date - when retiring from an old-age pension, this will be the day a man turns 60 and a woman turns 55 (or earlier in accordance with Article 27 of Law 17.12.2001 No. 173-FZ in the part that does not contradict the current pension legislation). If an employee is late in submitting an application for a pension, that is, he did it after his birthday, then SPV-2 indicates the date when this application was submitted to the Pension Fund.

The policyholder should accurately indicate his reporting period - this can be a quarter (3), a half-year (6), 9 months (9) or a year (0). For example, if the expected date of assignment of a pension is in September, then the reporting period code will be 9.

When you fill out the tabular part of the document in the column “Work period for the last three months,” then in the field with the start date of the period you should indicate the number that was the first after the end of the previous reporting period. For example, if the report was given in March, and the SPV-2 form is filled out in May, then the beginning of the period will be April 1.

In the field with the end date of the period, the day on which the pension is expected to be established for the insured person is indicated. If it is necessary to submit individual information on the insured for a period exceeding 3 months (when reports are submitted less than once a quarter), then you will need to fill out several forms of the SPV-2 form indicating information for every 3 months before the expected date of assignment of the retirement pension.

The SPV-2 form uses the codes specified in the classifier approved by Resolution No. 192p, and supplemented by Resolution No. 237p. These codes are used to indicate special periods, for example, to indicate sick time (VRNETRUD), administrative leave (ADMINISTER), downtime due to the fault of the enterprise (SIMPLE) and other situations.

What information is included in it?

The document contains the following information about the insured person:

- periods of work for the last three months from the beginning of the quarter in which the expected date of establishment of the labor pension falls, to the expected date of establishment of the labor pension;

- information on the calculation of insurance premiums for compulsory health insurance during the inter-reporting period;

- information on the calculation of insurance premiums at additional tariffs in relation to persons employed in work with harmful and dangerous working conditions specified in subparagraphs 1-18 of paragraph 1 of Article 27 of Federal Law No. 173-FZ.

For more information about calculating insurance premiums, see the berator. Install Berator for Windows

Results

In order for the insured person to have all periods of insurance coverage counted when assigning a labor pension, when the deadline for submitting mandatory reporting by the employer to the Pension Fund has not yet arrived, you should take care of drawing up the SPV-2 form .

In order for this settlement document to be submitted by the policyholder to the Pension Fund of the Russian Federation, the insured person who is planning to retire must submit a corresponding application to the employer. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.