If the product does not comply with the terms of the contract or is of poor quality, the buyer has the right to return it to the supplier. Registration of returning goods to a supplier in 1C has a number of features that we will consider in the article.

You will learn:

- how to make a return to the supplier in 1C 8.3;

- what documents need to be used;

- what transactions for returning to the supplier are generated in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

What you need to pay attention to when returning to the supplier in 1C 8.3

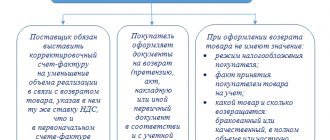

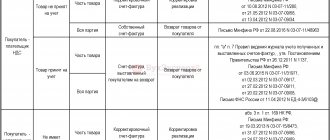

Registration of a return transaction to a supplier in 1C 8.3 Accounting depends on some nuances:

- whether the Organization (buyer) is a VAT payer;

- whether the goods are registered before they are returned.

In this case, a quality or low-quality product is returned, does not affect the design.

Returning materials to a supplier in 1C 8.3 is no different from returning goods, so the step-by-step instructions for returning goods to a supplier are also suitable for returning other materials. Postings in 1C 8.3 for returning materials to the supplier are similar.

Let's look at step-by-step instructions on how to return goods to a supplier in 1C in various circumstances and what transactions are generated by 1C Accounting 8.3 in each case.

Return to the supplier of goods not accepted for registration in 1C 8.3

On September 10, the organization’s warehouse received the goods “Chairman Parm” Sofa (10 pcs.) from the supplier MebelLand LLC in the amount of 300,000 rubles. (including VAT 20%). Upon acceptance of the goods, a defect was discovered (5 pieces).

On September 13, the defective product was returned to the supplier.

If a defective product is taken into custody or only part of it is returned, then the low-quality product is first registered and then returned to the supplier.

Receipt of goods

How to issue a return to a supplier in 1C 8.3? Document the receipt of goods at the warehouse using the document Receipt (act, invoice, UPD) transaction type Goods in the Purchases .

In the document, indicate the quality and defective goods in separate lines:

- % VAT : for quality goods - 20% ;

- for defective goods - Without VAT ;

- for quality goods - 41.01 “Goods in warehouses”;

Postings

Postings upon receipt of goods not accepted for registration.

The document generates transactions:

- Dt 60.01 Kt 60.02 - offset of advance payment to the supplier;

- Dt 41.01. Kt 60.01 - acceptance of quality goods for accounting;

- Dt 002 - reflection of goods not accepted for registration;

- Dt 19.03 Kt 60.01 - for quality goods, VAT is accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice, UPD) and click the Register .

Invoice document will be automatically filled in.

When the Reflect VAT deduction in the purchase book by the date of receipt , the document generates the following posting:

- Dt 68.02 Kt 19.03 - VAT on quality goods is accepted for deduction.

Returning goods to the supplier

How to return goods to the supplier in 1C? For the return of goods not accepted for registration to the supplier, document the return of goods to the supplier transaction type Purchase, commission based on the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) or in the Purchases .

If the document was created based on receipt, the data will be filled in automatically. In the document, leave only the line with the item being returned.

Postings

The document generates transactions:

- Kt 002 - goods returned to the supplier, not accepted for registration.

An invoice for the return of goods not accepted for accounting is not issued. An adjustment invoice from the supplier issued for a partial return of goods is not registered in the purchase book (Letter of the Ministry of Finance of the Russian Federation dated February 10, 2012 N 03-07-09/05). If necessary, save the CSF in the archive.

Return of goods to the supplier in 2022. What you need to know

Refunds, as a general rule, are made when the goods are delivered defective or, in violation of agreements, not in full. So any return of goods to the supplier in 1C 8.3 is preceded by the preparation of a written complaint. You should not limit yourself to telephone conversations, much less trust this important matter to instant messengers. Submit your claim in writing, stating your requirement to accept back the product of inadequate quality and return the money paid. Among the necessary attachments there must be an act documenting the identified deficiencies. A return invoice is issued for the return. When registering a defect identified during the acceptance process, it is most convenient to use the usual unified forms of acts (TORG-1, TORG-2, M-7), and when issuing an invoice, use the TORG-12 form marked “Return”. According to the explanations of the tax authorities, given in the letter of the Federal Tax Service dated October 23, 2022 No. SD-4-3/20667, the value added tax (VAT), which was accepted for deduction on the returned goods, should be restored by issuing an adjustment invoice from the supplier. Since neither income nor expenses are generated upon return, no transactions are performed for income tax purposes. Accounting should reflect both the disposal of goods and the restoration of VAT. When reflecting such an operation as the return of goods to a supplier in 1C 8.3, the postings must comply with the regulations. Let's look at them.

Return of defective goods

Example 1

. Upon receipt of 100 product units for a total amount of 120,000 rubles. (including VAT - 20,000 rubles) it turned out that 10 units for a total amount of 12,000 rubles. with marriage. The wiring diagrams will depend on the moment the defect is detected.

If a defect is discovered upon acceptance

Debit 41 Credit 60

— 90,000 rub.

((120,000 rub. - 20,000 rub.) - (12,000 rub. - 2,000 rub.)) - quality goods are accepted for accounting; Debit 19 Credit 60

- 18,000 rub.

— input VAT on quality goods; Debit 002

- 12,000 rubles.

– defective goods are accepted for storage; Loan 002

- 12,000 rub. – the defective product is returned to the seller.

If the defect is discovered after the goods have been accepted for accounting

Debit 41 Credit 60

— 100,000 rub.

— the goods are accepted for accounting; Debit 19 Credit 60

- 20,000 rub.

– reflected input VAT on the product; Debit 60 Credit 76-02

- 12,000 rubles.

– adjustment of settlements with the supplier; Debit 76-02 Credit 41

- 10,000 rub.

– the defective product is returned to the supplier; Debit 76-02 Credit 68

- 2000 rub. — VAT on defective goods has been restored.

Return of quality goods

If for some reason it is necessary to return a quality product, then it would be more reasonable to draw up a new supply agreement, under which your company will act as the seller and the supplier as the buyer. Under the new agreement, you can simply arrange a classic sale with VAT charging and issuing an invoice. For income tax and accounting purposes, revenue should be recognized and the cost of the goods written off as expenses.

Example 2

. 100 product units arrived from the supplier for a total amount of 120,000 rubles. (including VAT - 20,000 rubles), 10 units worth 12,000 rubles were returned. (including VAT - 2000 rubles).

Debit 41 Credit 60

— 100,000 rub.

– the acceptance of the goods for accounting is reflected; Debit 19 Credit 60

- 20,000 rub.

– reflected input VAT on the product; Debit 68 Credit 19

- 20,000 rub.

– VAT deduction on the product is reflected; Debit 62 Credit 90-01

- 12,000 rubles.

– revenue from returned goods is reflected. Debit 90-03 Credit 68

- 2000 rub.

– VAT is reflected on the returned goods. Debit 90-02 Credit 41

- 10,000 rubles. – reflects the cost of the returned goods.

Purchase returns. How to deal with VAT

If the return of goods is returned within the limits of the originally concluded contract - due to a defect or after making an innovation in the contract - then the refund is not subject to VAT. If the goods have already been accepted for accounting and a VAT deduction has been applied, upon return, the “input” VAT should be restored by issuing an adjustment invoice. If the goods were not accepted for accounting, then the deduction for return is applied according to the original invoice - in the part of the goods that were accepted for accounting. When returning goods under a separate agreement (for example, during a return delivery), VAT is charged as with normal sales.

If it is necessary to replace a product within the framework of warranty obligations, two operations are formalized: returning the product and purchasing a new one. VAT on returned goods should be restored (Article 170 of the Tax Code of the Russian Federation) on the basis of an adjustment invoice or primary documents documenting the reduction in the value of the shipped goods received from the seller. For goods received as a replacement, VAT is deductible in the usual manner if the necessary conditions are met (Article 171 of the Tax Code of the Russian Federation).

If the return is made as part of an initial transaction with a seller who is not a VAT payer, then there is no need to charge VAT, since the return is not recognized as a sale and an invoice is not required to be issued (Articles 39, 146, 168 of the Tax Code of the Russian Federation). In case of reverse sales, VAT is charged in the same way as in classical sales. This procedure also applies when working with “simplified” sellers.

Return to the supplier of goods accepted for registration in 1C 8.3

On January 10, the Organization purchased the “Imperial” Table (100 pcs.) from the supplier “CLERMONT” LLC for the amount of RUB 240,000. (including VAT 20%). On the same day, the goods arrived at the warehouse and were accepted for accounting.

On February 7, part of the goods (38 pieces) was returned due to a defect.

Receipt of goods

The purchase of goods is documented with the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) in the Purchases .

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

When the Reflect VAT deduction in the purchase book by the date of receipt , the document generates the following posting:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Returning goods to the supplier

How to reflect the return of goods to the supplier in 1C? Fill out the return of goods accepted for registration with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) or in the Purchases .

It does not matter whether part of the goods or the entire batch is returned.

If the document was created based on receipt, the data will be filled in automatically.

Calculations

tab unchanged.

Postings

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 76.02 Kt 68.02 - VAT on returned goods has been restored.

The return of goods to the supplier is reflected according to Dt 76.02 “Calculations for claims” (chart of accounts 1C). If the returned goods have not previously been paid for, then when returning to the supplier in 1C 8.3, an additional entry Dt 60.01 Kt 76.02 is generated, which automatically reduces the debt to the supplier by the amount of the returned goods.

Registration of CSF supplier

Register the adjustment SF at the bottom of the document form Return of goods to supplier .

Adjustment invoice received will be automatically created .

- Operation type code — .

Blog

We separately discussed the procedure for documenting the return of goods in the ARTICLE.

In this article we will describe the algorithm of actions of an accountant in the 1C Accounting 8.3 program.

Return of goods for wholesale sales.

After registering the sale of the goods, the counterparty can carry out the so-called “crossing out” of the goods (the goods do not meet their expiration dates, appearance, etc.) in this case, we register the return of the goods in 1C:

If the goods are returned to the supplier:

/Purchases/ - /Receipts (acts, invoices)/ - select the document on receipt of goods and materials - press the command button “Create based on” - Return of goods to the supplier

In the document that opens, correct the data; in the lower field, if necessary, enter an invoice

You can view the transactions generated by the document using the icon: Dt/Kt

The document automatically generates the following transactions:

Dt 76.02 / Kt 41.01 – for the amount of the cost of the goods

Related course

1C: Accounting 8.3

Find out more

Dt 60.01 / Kt 76.02 – for the amount of the cost of the goods including VAT

Dt 91.02 / Kt 76.02 – for the amount of cost deviations

Dt 76.02 / Kt 68.02 – for the amount of restored VAT

If the goods are returned from the buyer:

/Sales/ - /Sales (acts/invoices) - select the sales document - press the command button “Create based on” - Return of goods from the buyer

In the document that opens, you need to correct the tabular part and enter the invoice/invoice.

The document automatically generates the following transactions:

Dt 90.02 / Kt 41.01 – the minus reflects the cost of goods

Dt 62.01 / Kt 90.01 – revenue is reflected as a minus

Dt 62.02 / Kt 62.01 – a minus reflects the offset of the advance

Dt 90.03 / Kt 19.03 – VAT is restored Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants , Accounting for beginners, Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting , Accounting, Accounting support, Provision of accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Accounting organization

Return of goods by VAT non-payer

On March 29, the organization’s warehouse received the goods Computer desk “Boomerang-3N(M)” (10 pcs.) from the supplier KMH LLC in the amount of 144,000 rubles. (including VAT 20%).

On April 8, part of the goods (2 pieces) was returned due to a defect.

Receipt of goods

The purchase of goods is reflected in the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) in the Purchases .

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice, UPD) and click the Register .

Invoice document will be automatically filled in.

Returning goods to the supplier

Fill out the return of goods with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice, UPD) transaction type Goods (invoice, UPD) or in the Purchases .

Return invoice in 1C 8.3 Accounting.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of MPZ including VAT;

- % VAT - Without VAT , because a company using the simplified tax system is not a VAT payer and does not issue an invoice (clause 5 of article 168 of the Tax Code of the Russian Federation).

Calculations tab unchanged.

Return of goods to the supplier in 1C 8.3 postings.

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 60.01 Kt 76.02 - the debt to the supplier was reduced by the amount of the returned goods.

Filling out the table section

The product is added to the tabular part either by using the Add or Selection . by selection , since you can immediately see whether there is a product left or not. In addition, there are a number of useful settings Selection

Price or Amount is filled in manually.

Note : in the account , an account is automatically installed from the chart of accounts, which is configured for one or another type of Item in the Item Accounting . For example, for goods this could be account 41.1, for equipment - 08.04. If accounts are not configured in the register, you must select the account manually.

On the Settlements tab, the accounts of settlements with the Counterparty are indicated, which will be included in 1C postings. For example: 60.01 - 76.09.

Postings for returning goods in 1C 8.3 look opposite to the postings when purchasing goods. For example:

- Dt 60.01 Kt 41.01

- Dt 76.05 Kt 41.01

Refunds from the supplier: postings in 1C 8.3

On February 7, part of the goods (3 pieces) was returned due to a defect.

On February 8, payment was received to the bank account for the returned goods in the amount of 72,000 rubles.

The return of funds from the supplier is formalized using the document Receipt to the current account, transaction type Return from supplier in the Bank and cash desk - Bank statements section or based on the document Return of goods to supplier the Create based button .

In the form we indicate:

- Advances account - 76.02 “Calculations for claims.”

- Document —a document for returning goods.

Postings

Wiring is generated:

- Dt Kt 76.02 - refund from the supplier for returned goods.

We looked at how to process the return of goods to the supplier in 1C.