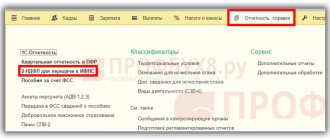

When and how to confirm VAT benefits in 2021

Organizations and entrepreneurs who are engaged in certain activities are entitled to VAT benefits (Article of the Tax Code of the Russian Federation).

For example, the sale of some medical equipment, buns in the school canteen, passenger transportation services, funeral services, etc. are exempt from VAT. If you indicated such benefits in section 7 of the VAT return, be prepared to confirm them with the tax authorities (clause 6 of Article RF Tax Code) . The Federal Tax Service will send a request for clarification, which must be responded to within five working days. If this is not done, a fine will follow - 5,000 rubles for the first and 20,000 rubles for a repeated violation.

Submit your VAT return online for free

When checking benefits, the Federal Tax Service uses a risk-based approach. This means that initially it does not require all documents from the company for preferential transactions. To confirm the benefit, it is enough to send supporting documents to the tax register.

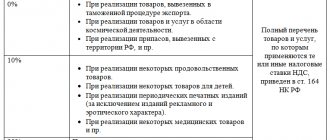

New reasons for zero rate

Law dated September 29, 2019 No. 322-FZ, effective January 1, 2022, expanded the list of transactions subject to VAT at a rate of 0%.

Thus, railway carriers received the right to apply a zero VAT rate not only for international transportation of goods, but also for (new edition of Articles 164 and 165 of the Tax Code of the Russian Federation):

- transit transportation of empty wagons and containers through the territory of Russia;

- implementation of work/services directly related to the movement of empty cargo through Russia, if the cost of work or services is indicated in the transportation documents.

This takes into account transit through the EAEU countries.

In addition, aviation companies and aircraft manufacturers were also allowed to apply a 0% VAT rate. These are new subp. 15-17 p. 1 art. 164 Tax Code of the Russian Federation. clause 3 art. 2 of the Law of September 29, 2019 No. 324-FZ.

We are talking about their implementation:

- civil aircraft registered in the state register;

- works and services for the construction of civil aircraft;

- aircraft engines, spare parts and components for the construction, repair and modernization of civil aircraft;

- services for the rental/leasing of civil aircraft registered in the state register.

In all cases, a mandatory condition for receiving benefits is the submission to the tax authorities of the documents provided for in Art. 165 Tax Code of the Russian Federation.

How to submit a register of documents confirming benefits

The register of documents is submitted in response to the tax office’s request for clarification. Starting from November 23, 2022, it can be sent via TKS, electronically in xml format (letter of the Federal Tax Service of Russia dated November 12, 2020 No. EA-4-15/18589).

A registry form is recommended but not required. You can submit explanations in any form, but the electronic registry form has an advantage - only when submitting it, the tax office will require not all documents on the benefit, but only a part. If the explanations are not drawn up according to the form or the register is submitted in paper form, the documents will have to be submitted in full.

The inspectorate will study the information in the submitted register and request documents confirming the validity of tax benefits (Article 93 of the Tax Code of the Russian Federation). Using the ASK-VAT system, the inspectorate will assess the level of tax risk of the organization. The number of documents required depends on it - 5% at a low level and up to 40% at a high level. 10 working days are allotted for submitting documents from the date of receipt of the request.

There is one more limitation on the list of documents - at least 50% of the volume of requested documents must confirm the largest amounts of transactions for which benefits are applied.

VAT benefits

So, added value is part of the product value created in the organization. It can be calculated by subtracting from the total cost of goods and services produced by the company (in other words, sales revenue) the goods and services purchased by the company from third parties (for example, materials, costs of heating, lighting, insurance). For the sale of certain goods and services For certain operations For certain categories of companies and individual entrepreneurs

- handicrafts;

- brands;

- precious metals and coins made from them;

- repair under warranty;

- government scientific research;

- restoration of historical monuments;

- preparing food for medical and educational institutions;

- medical services;

- home sales;

- transportation of people in the city and suburbs;

- transfer of rights to part of the common property in an apartment building.

Please note => What is due to a person who has lived 100 years

Criteria for assessing the risk-based approach

The criteria for assessing the risk-based approach to conducting desk audits of declarations with benefits are given in the letter of the Federal Tax Service of the Russian Federation dated January 26, 2017 No. ED-4-15/ [email protected] and supplemented by the letter dated November 12, 2020 No. EA-4-15/18589.

When conducting desk audits, tax authorities take into account a combination of the following factors:

- the level of tax risk assigned by the Risk Management System of JSC NDS-2 (hereinafter referred to as the RMS);

- the result of previous desk audits of VAT returns to determine the legality of applying tax benefits.

The RMS automatically distributes VAT payers into three risk groups: high, medium, low. The distribution is based on information about the taxpayer that the tax office has. Information about the assigned risk group is closed.

| Risk group | Criteria |

| Low risk |

|

| High risk |

|

| Medium risk | taxpayers who are not included in high or low tax risk groups. |

Information about the assigned tax risk criteria is displayed in the ASK VAT-2 software package. Tax authorities use the assessment results during desk, field and counter audits.

Sale of waste paper

Let us remind you that since October 1, 2016, the sale of waste paper in the Russian Federation is not subject to VAT. This exemption had a limited duration and applied only until December 31, 2022 inclusive (Federal Law of June 2, 2016 No. 174-FZ).

From January 1, 2022, the VAT exemption for the sale of waste paper is no longer valid, and the sale of waste paper is subject to this tax (Federal Law of November 27, 2022 No. 424-FZ). The tax is calculated by buyers - tax agents.

Sellers of waste paper must now prepare their own invoices. They need to indicate that VAT is calculated by a tax agent. He will have to charge tax at an estimated rate of 20%/120% or 10%/110% and pay it to the budget. Moreover, regardless of whether the tax agent is a VAT payer or not. Based on the invoice received from the waste paper seller (including an advance invoice), the buyer will be able to deduct the paid VAT.

Read in the taker

How tax agents pay VAT

How to fill out the register of VAT documents

The procedure for filling out the register is given in Appendix No. 1 to the Letter of the Federal Tax Service of Russia dated November 12, 2020 No. EA-4-15/18589. When listing all documents in the register, group them first by transaction codes, then by type, and then by counterparty. Let's analyze the filling according to the columns:

- Column 1 is a seven-digit transaction code, which was indicated in section 7 of the declaration (Appendix No. 1 to Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558).

- Column 2 - type, group, direction of operation within the tax benefit code. For example, medicine - compulsory health insurance services, diagnostic, prevention and treatment services, ambulance services, etc.

- Column 3 - the amount of quarterly revenue for each operation from column 2. In the last line of column 3 “Total by code”, indicate the amount of revenue for all operations.

- Columns 4, 5, 6 - name/full name, INN and KPP of the counterparty under the contract.

- Columns 7, 8, 9 - type, number and date of the document confirming the benefit.

- Column 10 - the total amount of the transaction for a counterparty or several counterparties when using a standard agreement. Revenue in column 10 is summed up for all operations with one code and is indicated in the line “Total by code”.

Enter the total amount of the preferential transaction in the “Total by code” line. Enter the total amount for all counterparties in the “Total transaction amount” line.

Send a free register of documents confirming VAT benefits

How to apply the VAT exemption under Art. 145 Tax Code of the Russian Federation

The application of VAT exemption is of a notification nature, so permission from the inspectorate is not required.

Also, a VAT payer exempt from duties is not obliged to:

- calculate and pay VAT, except in cases where he issues an invoice with an allocated tax (clause 5 of Article 173 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-14/30264);

- submit a VAT return (letter of the Federal Tax Service of Russia dated April 29, 2013 No. ED-4-3/ [email protected] );

- keep a purchase book (letter of the Federal Tax Service of Russia dated April 29, 2013 No. ED-4-3 / [email protected] ).

IMPORTANT! Once you start using this VAT exemption, you will not be able to refuse it within 12 calendar months (clause 4 of Article 145 of the Tax Code of the Russian Federation), after which you must submit to the Federal Tax Service:

- documents confirming that during the exemption period your revenue for every 3 consecutive calendar months did not exceed 2 million rubles;

- notification of the extension of the VAT exemption for the next 12 calendar months or of its refusal.

Taxpayer exempt from VAT:

- Is not exempt from issuing an invoice to the buyer. In invoices, it does not highlight VAT, but makes the inscription: “Without VAT” (Clause 5 of Article 168 of the Tax Code of the Russian Federation).

- Must keep a sales book (subclause 1, clause 3, article 169 of the Tax Code of the Russian Federation, clause 1 of the Rules for maintaining a sales book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

- Does not have the right to deduct VAT (subclause 1, clause 2, article 171, subclause 3, clause 1, article 170 of the Tax Code of the Russian Federation).

- Includes VAT presented by suppliers in the cost of goods, works, services (subclause 3, clause 1, article 170 of the Tax Code of the Russian Federation).

- Obliged to restore deductible VAT from the cost of goods (work, services), fixed assets, intangible assets that will be used during the exemption period. Restoration must be made in the last tax period before the start of using the exemption, if the tax exemption begins from the first month of the quarter or, if the exemption is applied from the second or third month of the quarter, then in the same quarter when the application of the exemption began (clause 8 of Art. 145 of the Tax Code of the Russian Federation).

See " Sample Waiver Notice " .

At the same time, in some circumstances the right to exemption from VAT can be lost, namely in cases where (clause 5 of Article 145 of the Tax Code of the Russian Federation):

- revenue for any 3 months will exceed 2 million rubles;

- The sale of excisable goods will begin.

See also “How to properly exempt from VAT.”

Example of a register of supporting documents for VAT

Let's look at filling out the register using the example of the Bulat LLC pharmacy. In the first quarter of 2022, the organization provided services for the manufacture of medicines and the repair of prosthetic and orthopedic products. The medicines were manufactured at the request of city medical institutions. The total amount of revenue from non-taxable transactions is 500,000 rubles. Repair services for prosthetic and orthopedic products were provided to legal entities and individuals for a total amount of 125,000 rubles.

The total cost of medical services provided by the pharmacy was 625,000 rubles. Let us remind you that such medical services are not subject to VAT (Article 149 of the Tax Code of the Russian Federation).

The pharmacy submitted a VAT return for the first quarter of 2022 with completed section 7 under transaction code 1010269 (sales of services of pharmacy organizations) and received a requirement to provide explanations for the benefit. In response to the request, Bulat will submit a completed register:

"Popular" benefits

In practice, VAT benefits are most often used for the provision of medical or educational services. And here there are some peculiarities that must be taken into account in the work.

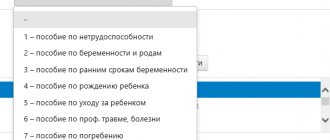

Medical services

The sale of “...medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, with the exception of cosmetic, veterinary and sanitary-epidemiological services” is not subject to VAT. If veterinary and sanitary-epidemiological services are financed from the budget, then they are also not subject to VAT. This benefit is established by subparagraph 2 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation.

The benefit can be used by medical organizations and institutions, private individual entrepreneurs - doctors and medical centers on the balance sheet of non-medical companies.

Here is a list of medical services that are not subject to VAT.

1. Services provided under compulsory health insurance. Such services can be provided to both individuals and companies. The list of these services is given in Decree of the Government of the Russian Federation dated October 4, 2010 No. 782 and Methodological recommendations approved by the Ministry of Health of the Russian Federation and the Federal Compulsory Medical Insurance Fund on August 28, 2001 No. 2510/9257-01, 3159/40-1.

2. Services provided to the population according to the list approved by Decree of the Government of the Russian Federation dated February 20, 2001 No. 132. These include:

- diagnostic, prevention and treatment services directly provided to the population within the framework of outpatient (including pre-medical) medical care, including medical examination;

- diagnostic, prevention and treatment services directly provided to the population as part of inpatient medical care, including medical examination;

- diagnostic, prevention and treatment services directly provided to the population in day hospitals and by the services of general (family) doctors, including medical examinations;

- diagnostic, prevention and treatment services directly provided to the population in sanatorium and resort institutions;

- health education services provided directly to the public.

According to financial officials, if a licensed organization provides the population with medical services mentioned in this list free of charge, then these services are also not subject to VAT (letter of the Ministry of Finance of Russia dated April 13, 2016 No. 03-07-11/21224).

3. Services for collecting blood from the population. A medical organization or private doctor must have an agreement with a medical organization providing medical care in outpatient and inpatient settings.

4. Services provided by medical organizations and private doctors to pregnant women, newborns, disabled people and drug addicts.

5. Emergency medical services.

6. Services for medical personnel on duty at the patient’s bedside.

7. Pathological services.

8. Services of pharmacies for the manufacture of medicines for medical use (the benefit is provided for in subclause 24, clause 2, article 149 of the Tax Code of the Russian Federation).

9. Services for the manufacture and repair of spectacle optics (except for sun protection), repair of hearing aids and prosthetic and orthopedic products, services for the provision of prosthetic and orthopedic care (the benefit is provided for in subclause 24, clause 2, article 149 of the Tax Code of the Russian Federation).

10. Sanitary, epidemiological and veterinary services financed from budget funds. In this case, the company must have the following documents:

- license;

- contract for the provision of veterinary or sanitary-epidemiological services indicating the source of financing;

- written notification of the customer, to whom funds have been allocated from the federal budget, to the company about the targeted budget funds allocated to him to pay for sanitary-epidemiological and veterinary services;

- a certificate from the financial authority about the opening of financing of veterinary and sanitary-epidemiological services at the expense of the regional or local budget.

Veterinary and sanitary-epidemiological services that are not financed from the budget or are financed on a repayable basis are subject to VAT.

A company or doctor engaged in private practice must have a license to practice medicine.

If there is no such license, then the benefit cannot be applied.

If your company provides medical services that are not subject to VAT, then you cannot refuse this benefit.

But the services of intermediaries in the field of medical services are subject to VAT.

EXAMPLE 7. Intermediary medical services are subject to VAT.

Be Healthy LLC provides paid emergency medical services to the population. At the same time, the company transports patients both within the framework of emergency care and for hospitalization for preventive and diagnostic purposes. Services provided within the framework of emergency care are not subject to VAT. Transportation of patients for hospitalization for preventive or diagnostic purposes, that is, in situations that do not threaten the life and health of people, is subject to VAT, since it is an intermediary service.

Educational services

Sales are not subject to VAT (subclause 14, clause 2, article 149 of the Tax Code of the Russian Federation) “...services in the field of education provided by non-profit educational organizations for the implementation of general education and (or) professional educational programs (main and (or) additional), professional training programs specified in the license, or the educational process, as well as additional educational services corresponding to the level and focus of educational programs specified in the license, with the exception of consulting services, as well as services for leasing premises.”

In other words, services in the field of education are exempt from VAT not only if they are specified in the license. The benefit also applies to additional services that correspond to the educational programs of the organization (for example, classes with a speech therapist in a preschool educational institution). The benefit is provided only to non-profit educational organizations. They do not pay VAT regardless of how the income received from the provision of educational services is distributed.

There are a number of fairly common services of non-profit educational organizations that are subject to VAT. Such services include, in particular:

- consulting services;

- premises rental services;

- sales of goods of own production, manufactured by educational enterprises;

- sale of goods purchased externally.

Services of commercial organizations and individual entrepreneurs in the field of education are taxed in accordance with the generally established procedure.

Classes with children in clubs, sections and studios are not subject to VAT (subclause 4, clause 2, article 149 of the Tax Code of the Russian Federation).

EXAMPLE 8. Fees for additional classes at school are not subject to VAT.

The school has a swimming pool on its balance sheet. In addition to the main classes with students, the organization also conducts additional classes for children under 18 years of age on a paid basis. In this case, fees received for additional classes are not subject to VAT.

If your company provides services in the field of education and is entitled to a benefit, then you must definitely apply it. You cannot refuse the benefit.

The services of intermediaries in the field of education are subject to value added tax at a rate of 20 percent.

In general, intermediaries deserve to talk about their taxation in a little more detail.

Is it possible not to respond to the tax authorities’ demand for benefits?

Tax authorities request clarification on almost all declarations with completed section 7. In doing so, they refer to clause 6 of Art. Tax Code of the Russian Federation. But this article allows you to request explanations and documents specifically for preferential transactions, and not for all that are exempt from VAT or are not recognized as objects of taxation (Articles 146, 149 of the Tax Code of the Russian Federation). When making a claim, the authorities must rely on the concept of “benefits”, enshrined in paragraph 1 of Art. Tax Code of the Russian Federation.

The tax authorities can demand confirmation of the right to a benefit only if the organization actually has advantages over other taxpayers. In other words, transactions are not taxed for everyone, but only for companies in certain categories. For example, transactions for the sale of land, warranty repairs, distribution of advertising materials worth up to 100 rubles per piece, and receipt of interest on loans are not taxed and are not preferential.

For such transactions, tax authorities do not have the right to request documents (letters from the Ministry of Finance dated February 11, 2019 No. 03-07-07/8029 and dated December 3, 2014 No. 03-07-15/6190, clause 14 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014). In this case, it is impossible to prosecute and fine for failure to provide explanations.

We do not recommend ignoring the tax authorities' requirements. You should at least send a letter refusing to submit documents or provide an explanation with a justification document. For example, if you sell non-taxable medical equipment, such a document will be a registration certificate.

The letter of refusal to submit documents must contain a link to the article, according to which the operation cannot be recognized as preferential. Here's an example:

“In accordance with paragraphs. 6 paragraph 2 art. 146 of the Tax Code of the Russian Federation, operations for the sale of land plots and shares in them are not recognized as subject to VAT. The absence of such transactions in the list of taxable objects is not a tax benefit. The right not to charge VAT on proceeds from the sale of land plots can be used by any organization without any restrictions. In this regard, Zvezda LLC notifies of its refusal to submit the documents specified in the request dated April 12, 2021 No. 321.”

How to apply for VAT exemption

You can be exempt from VAT from the beginning of any month. To do this, submit an application and a package of documents before the 20th day of the month in which you are ready to work without VAT (which means the upcoming three months will bring in revenue of less than 2 million rubles).

For tax purposes, collect documents:

- notification in the form approved by order of the Ministry of Finance dated December 26, 2019 No. 286n;

- invoice journal and its copy;

- an extract from the balance sheet for a company or an extract from the KUDiR for an individual entrepreneur for three months;

- an extract from the sales ledger for three months.

Please enter in your application:

- information about the individual entrepreneur or company;

- details of your tax office, to which you are sending your application;

- the date from which VAT exemption is planned;

- revenue volume for the previous three months;

- list of supporting documents.

The text of the notification fits on one and a half pages, while half the page is occupied by the header and title of the document. Filling it out is not difficult; it can be done by hand or using a computer. The application is signed by the director of the company and the accountant or the individual entrepreneur himself, certified by his signature and submitted in two copies to the tax office in person or by mail. There is no need to wait for a response from the tax office - just work without VAT from the beginning of the month indicated in the application and try not to “go overboard” with the proceeds.

Here is a sample application:

Income tax

When calculating income tax, the organization has the right to classify expenses in the form of funds aimed at ensuring social protection of disabled workers as other expenses associated with production and sales. The basis is subparagraph 38 of paragraph 1 of Article 264 of the Tax Code. However, it must meet the following requirements. Firstly, the number of disabled employees of the total number of employees must be at least 50 percent. Secondly, the share of expenses for remuneration of disabled people in the total payroll is at least 25 percent.

When determining the total number of disabled people, the average number of employees does not include disabled people working part-time, contracting and other civil contracts.

It should be borne in mind that the mentioned subparagraph contains a closed list of goals for social protection of people with disabilities. In particular, this includes improving the working conditions and safety of disabled people, creating and maintaining jobs for disabled people, sanatorium and resort services for disabled people, as well as persons accompanying group I disabled people and disabled children.

For the purpose of calculating income tax, additional payments to disabled people provided for by law are included in labor costs (clause 23 of Article 255 of the Tax Code of the Russian Federation). For example, an additional payment up to the amount of previous earnings when transferring a disabled person who was exposed to radiation as a result of the Chernobyl disaster for medical reasons to a lower-paid job (Clause 4 of Article 14 of the Law of May 15, 1991 No. 1244-1).

Thus, in addition to other expenses, an organization that employs disabled people may also increase its labor costs.

Other tax benefits

At the federal level, there are no tax breaks on corporate property tax, transport and land taxes for legal entities that employ disabled employees.

At the same time, the legislative bodies of the constituent entities of the Russian Federation may provide for various benefits when establishing transport tax and corporate property tax. The same powers are vested in the representative bodies of municipalities when establishing land taxes.

D.M. Radonova, tax consultant