You have decided to register an individual entrepreneur in order to officially pay taxes, increase pension savings and sleep peacefully without fear of a fine for illegal business activities. But the very thought of trips to the Federal Tax Service and queues, let’s say, is not motivating. Is it possible to do without this?

Not only is it possible, but it’s also quite simple. We will tell you about four ways to register an individual entrepreneur without leaving home, show their pros and cons, and give step-by-step instructions on what to pay attention to so that the registration goes smoothly.

From this article you will learn:

- What is needed to register an individual entrepreneur

- How to register an individual entrepreneur through the State Services website

- How to register an individual entrepreneur through the Federal Tax Service website

- How to register an individual entrepreneur through an intermediary

- How to register an individual entrepreneur through a notary

- What documents are issued after registration of an individual entrepreneur?

- Expert commentary

- Conclusion

What is needed to register an individual entrepreneur

To register an individual entrepreneur, you must meet certain requirements:

- age at least 16 years. Before reaching the age of majority, to register an individual entrepreneur, you need the permission of both parents or guardians certified by a notary, a court decision on emancipation or marriage. If you are already 18, everything is easier;

- Russian Federation citizenship. Foreign citizens can also register an individual entrepreneur - but this is a topic for a separate article, we will not consider it in detail here;

- capacity;

- absence of criminal record for serious and especially serious crimes - rape, murder, etc.

In this article we will analyze options for registering individual entrepreneurs only for citizens of the Russian Federation. They can complete the procedure online:

- through the State Services website;

- official website of the tax office;

- through intermediary websites;

- at the notary.

From January 1, 2022, those who register online do not pay a state fee. And those who come to the Federal Tax Service with a package of paper documents still have to pay 800 rubles.

If you are more interested in registering an individual entrepreneur offline, read our material on how to do this.

What is needed to register an individual entrepreneur

Whichever method you choose, you will need:

- Passport;

- Certificate of assignment of TIN;

- Application for registration of individual entrepreneurs in form No. P21001. Filled out online on websites;

In special cases - for registration of individual entrepreneurs by citizens with temporary registration or teenagers from 16 to 18 years old - additional documents will be needed.Registration of individual entrepreneurs by citizens with temporary registration or teenagers

- Electronic signature (hereinafter referred to as ES). It is required for the State Services website. For the Federal Tax Service website - if you choose the registration method with electronic signature.

What is an electronic signature and where to get it

An electronic signature is information in electronic form that is used to identify the person signing other information in electronic form. In other words, an electronic signature is an electronic replacement for a handwritten signature and has the same legal force.

There are three types of electronic signatures that differ in the level of rights and opportunities: simple, unqualified and qualified.

a qualified electronic signature is suitable for registering an individual . It makes it possible to determine the author of the information and guarantee that the document will not change since the moment of signing. The signature contains cryptographic algorithms that completely protect the contents of the document. With it you can save your time: remotely submit documents to the customs service, tax office, extra-budgetary funds, statistical authorities, etc.

You can obtain a qualified electronic signature only from a certification center accredited by the Ministry of Telecom and Mass Communications of Russia, for example, on the Unified Electronic Signature Portal, at the MFC, or through an intermediary company. To do this, you will need a passport and SNILS.

The procedure for obtaining is clearly explained on the Unified Electronic Signature Portal

To register an individual entrepreneur through the Federal Tax Service website and through the State Services website, a basic qualified electronic signature is suitable. Its cost is about 2,000 rubles. (Prices according to portals that offer registration of electronic signatures - Contour. electronic signature, Alta-soft, podpis.su, etc.)

The electronic signature is issued on a special medium, a token. Looks like a USB flash drive. To work with electronic signature, you need to insert the token into the computer and enter the password.

Important! Before registering, determine which tax system you will use. You need to indicate it when you submit the package of documents - and the procedure will be much simpler.

Read our articles on taxation:

Reporting and taxes without pain - about what taxation systems exist, what needs to be submitted and when.

Tax holidays for individual entrepreneurs - about how to temporarily but legally not pay taxes to the state.

Combining special regimes as a way to pay less taxes.

7 legal ways to pay less taxes.

Registration of individual entrepreneurs through the tax office

For most of the population, registering an individual entrepreneur by contacting the tax office will seem most familiar and simple.

❗️So,

we opened a tg channel in which the team writes thoughts on a routine basis - now we work mainly with NFTs, p2e, etc. you know what to do: https://t.me/+ZxiOULipNZo0NmYy.

To register an individual entrepreneur, you will need documents, namely: a passport, an application for registration of an individual entrepreneur in the form P21001 and, if desired, an application for the transition to a simplified taxation system, or simplified taxation system.

This system involves paying 6% of the net profit received, and not of the company’s total revenue.

Useful : reporting for individual entrepreneurs on the simplified tax system - see what reports you will have to submit. There is an alternative to individual entrepreneurs - Self-employment - at first glance, there are fewer taxes and no reporting.

In 2022, a certificate of payment of the state fee was also required, which amounted to 800 rubles, but from 2022 this fee was abolished - now an individual entrepreneur can be opened for free .

How to register an individual entrepreneur through the State Services website

Registration as an individual entrepreneur on the State Services website takes 5–7 days. In order to complete the procedure, you will need a verified account on the portal.

Step 1. Get a verified account

Registration of an individual as an individual entrepreneur is legally significant, so it is necessary to confirm your identity.

If you do not yet have an account, register on the State Services website. Registration takes place in three stages. You need to go through everything - with each new stage you get access to more services:

- get a simplified notation . Enter your phone number or email address into the registration form. Get the code. Enter it and go to the page where you need to create a password. After you do this, the form will open. Fill it out, indicate your SNILS number and passport details;

- get a standard entry . Fill out your profile in your Personal Account. The data will be checked by the police, the Pension Fund and the tax office. This takes from 7 – 10 minutes to a day. A message will be sent to your mobile phone or email that registration is complete.

After this comes the stage of obtaining a verified account . The State Services website offers several methods:

- Visit to the service center . This could be the Department of the Ministry of Internal Affairs, a branch of the Pension Fund, a branch of the Russian Post, an office, etc. The website will tell you the address. Click the blue button to find out the location of the center. It will be marked with a flag on the map;

- After registering a standard account, the site will prompt you with the address of the service center where you can confirm your personal data

- Confirmation using electronic signature. The fastest way. A few minutes - and the recording is created. Insert the token into your computer like a regular flash drive, select the “electronic signature” confirmation method and enter the PIN code that was given to you along with the signature.

After confirming your identity, you need to log out of your account and log in again - the account will start working with a new access level

Step 2. Collect documents

There are difficulties with this. To do everything quickly, collect scans of documents in tif format into one folder. Files are accepted only in this format.

Use your phone to photograph the passport, the spread and the registration page (some people take photographs of all pages, including blank ones, for insurance purposes. The author of the article made do with the spread and registration).

Next, open any graphic editor. The Paint program is suitable - and in it you convert photos of documents into tif format. To speed up the process - in order to upload everything to the site at once, and not one document at a time - you can archive it in zip.

If you don't have time, you can use a free online document converter.

Step 3. Fill out the application online

After confirming your registration with State Services, you need to fill out an application for registration of an individual entrepreneur.

Go to the service catalog and select the line: “Business, entrepreneurship and non-profit organizations”, link “Registration of legal entities and entrepreneurs”.

Sections of the State Services website. You need the first one on the left - Business, entrepreneurship, NPO

From the list that opens, select “Registration of an individual as an individual entrepreneur.” In this section there will be a question “How to get it and click on the “Get service” button.

The site offers to choose the type of application - choose P21001. Fill it out, enter your passport details and TIN. Everything here is clear and simple.

Next, fill out the item “Information on codes according to the All-Russian Classifier of Types of Economic Activities” (OKVED). This is a list of all types of economic activities permitted in Russia.

An example of filling out the section about the types of activities of an individual entrepreneur

In the “main activity” column, write what you plan to do: trade, car rental, farming, etc. You can choose any OKVED codes, including those not related to each other.

As soon as you fill out this line, a list of additional activities unfolds.

In “additional activities” you can register up to ten related types.

It’s better to play it safe - choose the maximum. You will not have to pay additional taxes for each type of activity. If you decide to expand your business, you will already have a document for this activity.

At the end, choose a convenient way to receive documents:

- issued to the applicant at the Federal Tax Service office;

- issue there, by proxy;

- send by mail.

The check will take 5 - 7 minutes. Then upload scans of documents that have been prepared in advance and archived in zip.

Click on the link pointed to by the arrow

The application must be signed electronically - the blue “Sign document” button. And submit for consideration - “Next” button.

Step 4. Receive documents from the Federal Tax Service

Within 3 days after submitting the application, an invitation from the Federal Tax Service will be sent by email to receive an extract from the Unified State Register of Individual Entrepreneurs. The document must be picked up, otherwise the application will be canceled 3 days after the date specified in the invitation.

To visit the Federal Tax Service, take two documents with you:

- Passport;

- Invitation from the Federal Tax Service.

At the tax office you receive documents on registration of individual entrepreneurs. At this stage there will be no problems, all checks have been passed.

Registration of individual entrepreneurs through the MFC

Also, many citizens prefer to use the services of MFCs located in most large settlements. In multifunctional centers, it is also possible to register individual entrepreneurs.

The main advantage of this registration method is that if there is an error in filling out the P21001 application, MFC employees will provide qualified assistance and, if necessary, issue a new application form.

To contact the MFC, you just need to present your passport when visiting.

The disadvantage of multifunctional centers is the longer registration procedure. A delay of 3-5 working days occurs due to the need to send documents from the MFC to the tax office. But at the same time, submitting an application using the multifunctional center guarantees professional assistance and advice, if necessary.

How to register an individual entrepreneur on the Federal Tax Service website

There are two ways to register through the Federal Tax Service website: without an electronic signature and with it. The first involves only submitting an application online. The second is the complete registration procedure and receipt of electronic documents.

Method No. 1. Register an individual entrepreneur on the tax website without an electronic signature

By choosing this method, you only submit your application online. Next you need to come to the Federal Tax Service twice. The first time is to confirm the application, the second time is to receive a certificate.

This method will save you time compared to filing your application as usual. At the branch you will have to sit in line, fill out an application manually, and a specialist will spend a long time checking your documents in your presence. You will lose at least 40 minutes - only during the procedure.

If you submit your application online, the Federal Tax Service will only need to confirm it in a few minutes.

Step 1. Create an account on the Federal Tax Service website

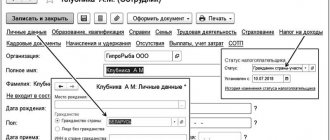

You will need to create an account on the Federal Tax Service website (you will need an email and mobile phone number) and select the “Individual Entrepreneurs” button, and then click on the “Fill out a new application” button. The required form will open.

Section with individual entrepreneur registration on the Federal Tax Service website

Step 2. Fill out an electronic application

In form No. P21001, enter your last name, first name, patronymic, gender, date and place of birth, business information. Write in Russian letters and Arabic numerals. The fields that are filled in in Latin letters are intended for foreign citizens. The Russians let them through.

Electronic version of application form No. P21001

Indicate the address of registration or temporary registration (if available).

Example of filling out form No. P21001

If you have an unconventional address: no street or a complex house number: building 1, building A (not 1 or 2), the site may give an error. In this case, it is better not to waste time and use another registration method.

Page No. 3 - codes for the classifier of types of economic activity can also cause difficulty. The website does not offer options (like the State Services portal). You need to find the codes yourself.

You must specify at least 4 digits of the code. When defining your type of activity, be precise: not just “farming,” but “pig farming” or “winemaking.”

On page No. 4, select the method for receiving documents. You can pick it up in person or receive it by mail. An important field on this page is email. You will receive a letter stating that the documents are ready, where and when you need to receive them.

Step 3. Receive documents from the Federal Tax Service

Next you will have two short visits to the tax office.

The first is three days after filling out the application. Come to the Federal Tax Service with your passport and confirm your application within 5-7 minutes. If you filled out everything correctly, then no problems should arise at this stage.

Next, the specialist will set a time for a return visit or the tax office will send an invitation by email. Depends on how the work is organized in a particular department.

The period for registration of individual entrepreneurs is 3 working days. After 3 days, you come to the Federal Tax Service again, take a coupon, stand in line - and receive a package of documents.

Method No. 2. Register an individual entrepreneur on the tax website with an electronic signature

Submitting an application and creating a package of documents is no different from method No. 1. Problems arise at the next stage, when you need to “form a transport container for sending documents” - collecting all documents certified by electronic signature into the archive for the tax office. This is an alternative to providing originals on paper to the Federal Tax Service.

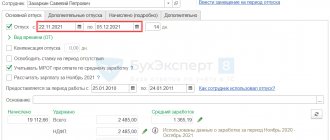

Formation of a transport container for sending documents on the Federal Tax Service website

To “form a container” you need:

- Download and install a special program from the Federal Tax Service website;

- Prepare scans of documents and a free-form inventory;

- Certify the entire package using an electronic signature and send it to the tax office.

The program for creating a shipping container sometimes does not work correctly with electronic documents and displays an error if you have an unusual address: no street or an atypical house number.

As they explained to us, this is a conflict between the software of the Federal Tax Service website and the program for forming a transport container installed in several departments. The issue is being resolved.

If you have a traditional address: street, house, apartment, it should work. You can download electronic versions of documents through your Personal Account. They completely replace paper ones; there is no need to go to the Federal Tax Service office.

If an attempt to register fails, send only the application to the tax office, and bring the documents to the department - according to the scheme of method No. 1.

How to register an individual entrepreneur through an intermediary

If you don’t have time to register an individual entrepreneur yourself, you can turn to intermediaries. The service costs from 1,600 to 4,600 rubles (according to the websites of intermediary companies VostokInvest, Profi-Lex, APS, Eclex). Plus the state duty is 800 rubles. This service is provided by some banks and specialized organizations. You can find them on the Internet by searching: “Register an individual entrepreneur.”

Offer on one of the websites of intermediary companies

Among the documents, intermediaries only ask for a passport and SNILS (data or scan). Registration takes from 15 minutes to several days.

Be sure to find out exactly what they offer. Perhaps - just filling out an application and selecting OKVED codes - and for this they ask from 1,000 to 2,000 rubles. In this case, you will scan and send documents to the tax office yourself and pay the state fee.

Turnkey registration is more expensive. You can simply photograph documents with your phone. The intermediaries will bring them into the required form, they will fill out the application, and you will only receive the document from the tax office.

How to register an individual entrepreneur through a notary

To use this method, all you need to do is visit a specialist and hand over a package of documents. The notary will complete the application electronically and verify your signature. Afterwards, he will transfer everything to the tax office.

In three working days, documents confirming that you have received individual entrepreneur status will be sent to the notary’s email from the Federal Tax Service. They can be obtained both electronically and in paper form - it all depends on your desire and the capabilities of the notary.

This method completely eliminates visits to the tax office. It is suitable for those who live far from the place of registration - in another city or regional center (as a rule, one branch of the Federal Tax Service serves several cities at once) and for those who cannot come to the tax office themselves.

In this case, there is no state fee; you only pay for notary services. They will cost approximately 4,000 – 6,000 rubles.

What is an EDS?

Let us briefly recall what an electronic signature is. Issues of obtaining and using digital signatures are regulated by Federal Law No. 63 of April 6, 2011 “On Electronic Signatures” (hereinafter referred to as Law No. 63-FZ). The same Law defines the types of digital signatures.

EDS is information in electronic form that is attached or linked to other information, and is used to identify the person signing this information (Clause 1, Article 2 of Law No. 63-FZ).

TAX AUDIT

The types of electronic signatures are simple electronic signature and enhanced electronic signature. There is a distinction between an enhanced unqualified electronic signature and an enhanced qualified electronic signature (Clause 1, Article 5 of Law No. 63-FZ).

ELECTRONIC TRAVEL DOCUMENTS

Algorithm for sending electronic documents for state registration of a company

The most popular electronic communication format occurs when electronically submitting documents to the tax office in connection with the state registration of a company.

What documents are issued after registration of an individual entrepreneur?

If you submitted an application online through State Services, the Federal Tax Service website or the website of an intermediary company, you will receive documents at the tax office. The address and operating hours of the branch will be indicated in the invitation, which will be sent by email.

The notary will receive a document by email, which will be signed with the electronic signature of a Federal Tax Service employee. He will either print it out and give it to him or send it to the email of the newly created individual entrepreneur.

From January 1, 2022, instead of a certificate of registration of individual entrepreneurs, a Record Sheet from the Unified State Register of Individual Entrepreneurs (USRIP) form P60009 is issued.

The Unified State Register of Entrepreneurs officially confirms that the individual entrepreneur is registered

Along with it, you will be given a notice of form 2-3-Accounting.

Notification form 2-3-Accounting

All document flow is carried out electronically, so the sheet itself is not so important - the fact of the entry in the register is important. Access to it is open - just provide the TIN number and anyone interested will find information about the individual entrepreneur on the website of the tax service.

After registration, the Federal Tax Service automatically transfers the data to the Pension Fund. You don't need to go anywhere. From the date of registration of an individual entrepreneur, you automatically become a payer of insurance contributions to the Pension Fund.

When they refuse to issue documents on registration of individual entrepreneurs

There are three situations when registration may be denied:

- The application failed due to technical reasons. For example, a program crash occurred. In this situation, the application can be sent again;

- You were already an individual entrepreneur, but did not complete the liquidation of your status. In this case, you will have to complete the procedure and then start a new business;

- The court declared you bankrupt less than a year ago. In this situation, it will be possible to apply for registration of an individual entrepreneur one year after the date of bankruptcy.

Registration online through State Services or the Federal Tax Service website

And, a fairly innovative way to register an individual entrepreneur is online, through the official website of the Federal Tax Service or the website of government services.

On the tax website: https://service.nalog.ru/gosreg/main-ip.html

It is immediately worth noting that the applicant must have a formalized electronic digital signature. It is with the help of digital signature that submitted documents are certified.

The official deadline for processing documents is 3 days, but you can often pick up completed certificates earlier. The convenience of registering an individual entrepreneur through the website lies in the quick completion of the registration procedure, the absence of the need to visit the MFC or the Federal Tax Service and the ease of filling out the application - the ready-made form P21001 is on the website, you just need to enter personal data and send the finished document.

How quickly will I be registered?

Registration of individual entrepreneurs in the Russian Federation takes place quite quickly, and from January 1, 2019, it is free. In most cases, if all documents are completed correctly, an individual entrepreneur registration certificate is issued within 3 business days. But when filling out an application with the help of the MFC, this period increases by 3-5 days.

The fastest and most convenient way is to register online - after submitting the application, you only need to pick up the finished documents from the Federal Tax Service. But a significant drawback of this method is the need for an electronic signature.

Registration immediately with the tax office, where a passport is required instead of an electronic digital signature, is inconvenient due to possible errors in the application P21001, due to which the registration may be delayed.

Therefore, the most convenient option seems to be registration through the MFC. To do this, you need a passport or a copy of it, and application P21001, which can also be issued or adjusted at the multifunctional center. This method takes 6-8 business days, but eliminates the possibility of errors in the P21001 application.

Expert commentary

Elena Tarasova, lawyer in the practice of taxation and effective business management:

Over the past few years, the state has simplified the interaction between entrepreneurs and regulatory authorities as much as possible. Electronic signature and the ability to submit applications remotely allow you to save time on visits to the tax office. Submitting documents for registration electronically exempts you from paying state fees.

The tax office website is very easy to use and contains detailed information, step-by-step instructions, and forms of necessary documents.

I always recommend making maximum use of the services posted on the online resource nalog.ru - they greatly facilitate interaction with the inspection, save time and provide information that is necessary for everyone who has decided to engage in entrepreneurial activity.

Registration through Sberbank

Sberbank offered an interesting service: only 4 steps, including registering an individual entrepreneur and opening an account in Sberbank: https://www.sberbank.ru/ru/s_m_business/bankingservice/rbo

Without leaving home. Completely free.

To use the service, you need to have:

- Age 18+

- Login and password to enter Sberbank Online

- Biometric passport

- SNILS

- Smartphone with Android 5.0+ or iOS 11.0+ OS

How does the service work?

- Enter your personal data and confirm that you are a private client of Sberbank;

- Select types of activities and taxation system;

- Select a tariff and branch to service your account;

- Receive an electronic signature and sign documents to open an account.

Consideration of your application and making a decision to register a business with the tax service takes from 3 days.