The role of a travel agent in tourism activities

A travel agent is a person who promotes and sells a tourism product (Article 1 of the Law “On Tourism Activities in the Russian Federation” dated November 24, 1996 No. 132-FZ). What distinguishes a travel agent from a tour operator is that:

- It can be either a company or an individual entrepreneur. A tour operator is just an organization.

- He is engaged only in the sale of a tourist product, while a tour operator is first of all a person who creates this tourist product, and only then - someone who sells it.

- It is not subject to a number of requirements mandatory for a tour operator (Article 4.1 of Law No. 132-FZ).

Thus, a travel agent is a seller of a tourism product created by a tour operator. Distinctive features of this product:

- is a service (Article 1 of Law No. 132-FZ);

- in fact, it is performed only by the tour operator, and reference to him as a performer is mandatory in the contract concluded with the final buyer of the tourism product on behalf of the travel agent (Article 10.1 of Law No. 132-FZ).

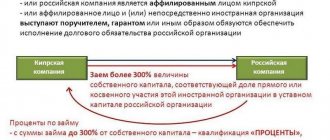

There is a practice of concluding a purchase and sale agreement for a tourism product between a tour operator and a travel agent for the purpose of resale by the travel agent to the end consumer. It seems that the scheme of interaction along such a chain does not correspond to the very essence of the purchase and sale agreement, according to which the thing must be transferred to the buyer (Articles 454, 455 of the Civil Code of the Russian Federation), and not a service. Within the meaning of paragraph 5 of Art. 38 of the Tax Code of the Russian Federation, a service cannot be resold, since it is sold and consumed in the process of its provision. The Ministry of Finance and the Federal Tax Service do not consider the service a product (letters of the Ministry of Finance of the Russian Federation dated July 20, 2005 No. 03-11-04/2/28, dated January 27, 2006 No. 03-11-04/2/20, Federal Tax Service for the Moscow Region dated April 8, 2005 No. 22-19/4554), and the courts support them (resolution of the Federal Antimonopoly Service of the North-Western District dated 04/06/2006 No. A52-4772/2005/2).

Meanwhile, there are schemes of interaction between the three participants in the process that do not raise questions and fully meet not only the goals of the travel agent, but also all the requirements for the tourism product:

- An agency agreement between a tour operator and a travel agent, in which the travel agent, on the instructions of the tour operator, sells a tourism product that does not belong to him to a third-party buyer and receives a remuneration from the tour operator for his services. Since an already formed package of services is usually sold, this type of contract is the most common.

- An agency agreement between the final buyer and a travel agent, in which the travel agent, on the buyer’s instructions, purchases a travel product for him from the tour operator (without reflecting it in his accounting) and receives remuneration for his services from the buyer.

- An agreement for the provision of services for a fee between the end buyer and a travel agent, the use of which is possible for tourism activities (clause 2 of Article 779 of the Civil Code of the Russian Federation) if there is a clause in it that a third party (tour operator) may be involved in the provision of the service. In this case, the costs of the travel agent in providing the service will be the costs of the services of the tour operator (subclause 5, clause 1, article 346.16 and subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation).

A travel agent has the right to enter into a sales agreement with the final buyer of a tourism product both on its own behalf and on behalf of the tour operator in compliance with the mandatory requirements for such an agreement (Articles 10 and 10.1 of Law No. 132-FZ). In any case, responsibility for the quality of service provision lies with the tour operator (Article 9 of Law No. 132-FZ).

Thus, under an agency agreement, the travel agent enters into an intermediary agreement with one of the parties, and with the other, accordingly, a sales or purchase agreement on its own behalf or on behalf of the guarantor. And in the case of paid services, the contract is drawn up with the buyer on behalf of the travel agent, indicating the tour operator as a co-executor.

A mandatory attribute of a tourism product for any type of contract is a tour package, which is a strict reporting form.

For more details, see: “BSO tourist voucher - form and sample.”

Features of accounting in tourism

An issued tourist voucher is a written consent to an offer to enter into an agreement for the sale of a tourist product by a tour operator or travel agent. It is an integral part of the contract for the sale of tourism services and the primary accounting document for the tour operator or travel agent.

The voucher issued to the tourist indicates the specific travel conditions and the retail price of the tour. The tour operator is responsible for preparing the trip. To organize a tour, the operator enters into contracts with organizations and entrepreneurs providing certain services.

A tour operator selling tours using cash register technology can use any form for registration, including one developed independently. This is permitted by the Letter of the Ministry of Finance of Russia dated February 19, 2003.

Features of accounting in tourism activities

The article examines the economic content of tourism and certain aspects of accounting for tourism activities, in particular, the formation of financial results as the basis for calculating income tax. The authors of the article focus on a differentiated approach to the taxation of value added tax, depending on the place of sale of tourism services.

Important

Key words: tourism, accounting, income tax, value added tax. Tourism is an important component of the economy of many countries, which provides employment to the local population, occupancy of hotels, hotels, restaurants, attendance at entertainment events, and inflow of foreign currency.

Tourism as a product is sold in the form of services.

Features of accounting in tourism

Dt sch. 006 – reflects the cost of received air tickets for S.S. Petrov; K-t sch. 006 – air tickets were transferred to S. S. Petrov; Dt sch. 76 Set count. 90 – the amount of agency fees is reflected in revenue; Dt sch. 90 Set count.

68 – VAT is charged on the amount of the agent’s remuneration. During the existence of the tourism industry in the market conditions of the Russian Federation, certain experience in developing the tourism business has been accumulated, but, nevertheless, this type of business faces many problems.

These are: insufficient investment inflow, weak regulatory framework, lack of specific plans for the development of this sector of the economy.

An equally important problem in the development of Russian tourism and the reason for its lag behind world standards is the lack of necessary educational institutions for the training of highly qualified personnel.

Features of accounting and taxation in the tourism sector

NOTE! If the vouchers transferred to the travel agent turned out to be unclaimed and were returned to the operator, their cost should be included in the amount of other costs. Nuances of reflection in accounting for non-standard situations:

- The electronic air ticket purchased for the client is returned. In this case, the airline reimburses part of the money spent, leaving itself the amount of the fine specified by the rules. The amount of this compensatory deduction is written off to non-operating expenses. The transaction must be reflected in accounting on the day the ticket is returned.

- If a company was processing a visa for an employee, but the document was not useful due to the cancellation of a business trip, the expenses incurred cannot be recognized as expenses that reduce the taxable base.

Features of accounting in travel companies

The contract is drawn up on behalf of the agent with the involvement of the operator.

In fact, a triple contract, in which each of the parties has its own terms of rights and obligations Agency agreement Concluded between the tour operator and the agent for the right to carry out transactions on behalf of the operator In addition to the agency agreement, a separate agreement is drawn up between the agent and the client for the sale of the finished tourism product Each of the contractual agreements is drawn up in writing, indicating the required details:

- Full details of the tour operator and travel agent - name, registration numbers, bank details, location, contact numbers.

- The cost of the tourist product - vouchers, indicating the payment procedure.

- Rights and obligations of the parties.

- Conditions for the sale of tourism products.

- The procedure for resolving disputes and other conditions.

The subject of all contracts is a trip.

Features of the organization of accounting in the tourism sector

If an accountant decides to account for a promotional tour as other or as material expenses, it is necessary to correctly prepare the documents and thereby confirm the production nature of the expenses for the promotional tour. The Travel Agent's arguments could be, for example, the following:

- The activities of the Travel Agent are aimed at promoting tourism products.

- Promotion of tourism products is a set of measures aimed at selling tourism products.

- Advertising, including participation in exhibitions and attending promotional events, is aimed specifically at selling tourism products.

- A manager serving tourists must have extensive and reliable information to provide quality service to tourists.

We recommend that you prepare an Order for the event, a Plan for the event, an Estimate for the event, and a Report on the event.

Features of accounting in the tourism business

This formulation assumes that the moment of determining the proceeds from the sale of a tourism product is the date of its transfer to the tourist.

Therefore, while such contradictions exist in the legislation, travel agencies are recommended to consolidate in their accounting policies the type of contract they have chosen under which the tourism product will be sold.

The moment at which revenue from the sale of a tourism product is reflected in accounting will depend on this document. Tour operators who provide tours in Russia charge VAT at a rate of 18 percent on the cost of the sold tour.

And the VAT amounts presented by service providers are taken into account on account 19 and, based on the received invoice, are reimbursed from the budget. In Russia, only the services of sanatorium-resort, health-improving and recreational organizations that are located on the territory of the Russian Federation are not taxed.

Source: https://law-uradres.ru/osobennosti-buhucheta-v-turizme/

Possible terms of remuneration for a travel agent

When concluding an agreement for the provision of paid services, the income of a travel agent, subject to taxation, is formed in the usual manner as the difference between the sale price to a tourist and the purchase price of the service from a tour operator, taking into account other sales expenses (with a simplified tax system of 15%) or as the entire cost of sale (with a simplified tax system of 6 %).

For an agency agreement concluded between the final buyer and a travel agent, the travel agent's income (his agency fee) will be the difference between the amount received from the buyer and the amount paid to the tour operator. Depending on the chosen tax base, the entire amount of remuneration will be subject to tax (STS 6%) or reduced by sales expenses (STS 15%). A mandatory requirement for such an agreement will be the preparation of an agent’s report reflecting the amount of his remuneration, which must be signed by the end buyer.

For a sample of such a report, see the material “Sample Agent Report under an Agency Agreement.”

With an agency agreement, according to which the travel agent acts on the instructions of the tour operator, the amount of the travel agent’s remuneration, from which tax will be charged according to the rules of the selected tax base, largely depends on the conditions included in the agreement. Options for this reward may be:

- The tour operator pays a fixed amount of remuneration for each tourist product sold, regardless of its actual cost.

- The size of the travel agent's remuneration is determined as a percentage of the cost of the tourism product. Here it will be necessary to clarify which one, since the real cost of a tourist product can be changed due to a discount, an additional increase in price or exchange rate difference (if the cost is indicated in monetary units).

- The remuneration is calculated according to a special algorithm, which is given in the contract.

Special clauses in the contract are required in situations where sales are allowed at a discount or at a price higher than that offered by the tour operator. The right to such a sale must be included in the contract. A minimum acceptable selling price may be specified. But in any case, it is necessary to establish at whose expense the discount is being made, and who will be the recipient of the additional income.

The discount can be achieved through:

- tour operator income;

- travel agent fees;

- income of both of them, which requires defining in the contract the procedure for distributing the discount between them.

When sold at a higher price, the additional income can become income:

- tour operator,

- travel agent,

- both of them.

In the latter case, the agreement must specify the principle of distribution of additional income. If there is no such clause, then it must be divided equally between the parties to the agency agreement (Article 992 of the Civil Code of the Russian Federation).

Thus, the final amount of a travel agent’s remuneration under an agency agreement depends on its terms and consists of the agent’s remuneration itself (letter of the Ministry of Finance of the Russian Federation dated March 30, 2012 No. 03-11-06/2/50) and additional income (letter of the Ministry of Finance of the Russian Federation dated November 18, 2009 No. 03-11-06/2/244). Other amounts related to the fulfillment by a travel agent of the instructions assigned to him by the tour operator are not included in the travel agent’s income (letter of the Ministry of Finance of the Russian Federation dated September 4, 2013 No. 03-11-11/36394).

All calculations regarding the final amount of remuneration under the agency agreement concluded between the travel agent and the tour operator must be present in the travel agent’s monthly report provided to the tour operator. In accordance with them, both parties determine the actual amount of their income. For the tour operator, it will be equal to the entire amount of receipts from the final buyer. At the same time, the tour operator will also see in the report the amount of its expenses for this income. The expense will be equal to the amount of remuneration due to the travel agent. For a travel agent who is on the simplified tax system, the income subject to tax of 15 or 6% will be his agency fee.

The contract must also include a condition on how the travel agent will receive remuneration from the tour operator:

- deducting its amount from the cost of the tourism product received from the final buyer;

- directly from the tour operator after transferring to him the entire cost of the tourism product received from the final buyer.

With the simplified tax system, which involves accounting for income and expenses using the cash method, the date for determining the income on which tax will be calculated depends on this condition.

Common mistakes in accounting

Travel business companies sometimes make mistakes when maintaining data records.

| Position | Wrong position | Explanations |

| Service agreement between agent and client | Operator indication missing | The owner of the vouchers is the operator, which obliges to include information about the person in the terms of the contract |

| Agent's report | Absent from document flow | The presence of a report allows you to take into account fees and expenses from the provision of services |

| Agent's power of attorney to represent the interests of the operator | Absent | The agent's activities are carried out only on the basis of a power of attorney. In practice, one-time and long-term forms of powers of attorney are used, concluded for a period of up to 3 years. |

Choice of tax base under the simplified tax system: 15 or 6%

The issue of choosing a tax base for a contract for the provision of paid services is obvious. With a simplified tax system of 6% (“income”), the entire amount of receipts from the buyer will need to be taxed and, most likely, the tax, even taking into account the direct reduction in payments to funds, will be higher than with a simplified tax system of 15%. Using the simplified tax system of 15% (“income minus expenses”), the amount of income received from the sale can be reduced by the cost of the purchased service for the formation of a tourism product, as well as by the amount of expenses associated with its implementation (maintenance of the premises, employee salaries and charges for it, expenses for advertising, communication services).

For income coming in the form of agency fees under either of the two types of agency agreements, the choice of base will depend on the amount of selling expenses available to the travel agent. If they exceed 60% of income, then it may be more profitable to use the simplified tax system of 15%. In further comparison, the amount of payments to the funds will play a role, which will differently reduce the amount of accrued tax with a simplified tax system of 6% (directly) and with a simplified tax system of 15% (including in expenses).

For information on what should be reflected in the accounting policy for the simplified tax system of 15%, read the article “Accounting policy for the simplified tax system “income minus expenses” (2020).”

In any case, it is mandatory to maintain a book of income and expenses, which serves as a tax register when calculating the simplified tax system. As income resulting from a contract for the provision of paid services, it will reflect all receipts from customers in full. And with agency agreements, only the amounts of the agency fee will be included in the book as income.

Travel agency documents

Payments between legal entities in cash must be made using cash registers. Companies providing services to the public have the right to use BSO as a document confirming payment. With regard to the procedure for applying BSO, changes were introduced by Federal Law No. 290-FZ dated July 3, 2016. Legislative norms establish the mandatory details of the BSO and the procedure for printing them.

According to the requirements of Law No. 290-FZ, the form details include:

- Name and numbering of the document.

- Time, day, place of the transaction.

- Information about the organization or individual entrepreneur.

- Information about the operation being carried out - type of calculation, subject, quantitative or qualitative measurement.

- Calculation form.

- Details of the person responsible for the transaction.

The use of BSOs published in printing houses or by enterprises using automated systems is allowed for circulation. Automated systems mean cash register equipment that does not require registration with the Federal Tax Service. Starting from February 2022, forms must additionally be generated electronically.

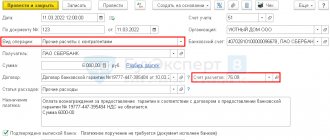

An example of accounting for BSO at a travel agent

The Agent enterprise ordered BSO forms from the printing house for settlements with clients in the amount of 25,000 (including VAT 3,813.56) rubles. The following entries are made in the accounting of the “Agent” enterprise:

- Payment for BSO is reflected: Dt 60 Kt 51 in the amount of 25,000 rubles.

- The receipt of forms was taken into account: Dt 10 Kt 60 in the amount of 21,186.44 rubles.

- VAT was taken into account on the purchased forms: Dt 19 Kt 60 in the amount of 3,813.56 rubles.

- Reception of forms for accounting on balance is reflected: Dt 006 in the amount of 21,186.44 rubles.

- The cost of the forms is included in the cost of transfer for use: Dt 20 (26) Kt 10 in the amount of 21,186.44 rubles.

- BSO was written off: Kt 006 in the amount of 21,186.44 rubles.

Information about the receipt and issuance of forms must be recorded in the BSO accounting book.

Options for accounting entries with a travel agent

For companies, including those using the simplified tax system, accounting is mandatory. Regardless of the chosen tax base (15 or 6%), accounting in a company using the simplified tax system must be conducted in accordance with established accounting rules. However, a travel agent company, as a rule, is a small organization (SMP) and therefore can carry out accounting in a simplified form, including one that allows for the absence of accounting entries. Therefore, the following schemes for reflecting accounting transactions will be valid for companies using double entry accounting options.

Read about the organization of accounting when applying the simplified tax system in the material “Procedure for maintaining accounting records under the simplified tax system.”

The letter abbreviations indicated in the transactions next to the account number indicate the presence of calculations on it:

- with PC - buyer;

- then - a tour operator.

When there is a contract for paid services between the buyer and the travel agent, the transactions associated with transactions for this product will be as follows:

Dt 50 (51) Kt 62 - money received for a tourist product from the buyer;

Dt 62 Kt 90 - income from sales accrued;

Dt 60 Kt 51 - the service for the formation of a tourist product is paid to the tour operator;

Dt 26 Kt 60 - service for the formation of a tourism product was received from a tour operator;

Dt 90 Kt 26 - the cost of the service for the formation of a tourist product is taken into account in expenses.

For an agency agreement between a buyer and a travel agent:

Dt 50 (51) Kt 76pk - money received for a tourist product from the buyer;

Dt 76pk Kt 76to - the amount payable to the tour operator for the generated tourism product has been accrued;

Dt 62pk Kt 90 - income from sales is accrued for the difference in cost;

Dt 76to Kt 51 - the service for the formation of a tourist product is paid to the tour operator.

In case of an agency agreement between a travel agent and a tour operator, which provides for the travel agent to deduct remuneration from the amount due to the tour operator, the postings will be as follows:

Dt 50 (51) Kt 76pk - money received for a tourist product from the buyer;

Dt 76pk Kt 76to - receipts from the buyer are re-discounted as a debt to the tour operator;

Dt 62to Kt 90 - income is accrued in the form of agency fees, withheld from the amount transferred to the tour operator;

Dt 76to Kt 62to - the amount of the agency fee is withheld from the amount to be transferred to the tour operator;

Dt 76to Kt 51 - the tour operator is transferred the money received from the buyer, minus the agency fee.

If the agency agreement between the travel agent and the tour operator contains a condition that the travel agent receives remuneration from the tour operator and does not retain it himself, then after posting the re-accounting of receipts from the buyer as a debt to the tour operator (Dt 76pk Kt 76to), a posting will immediately appear for the transfer of the entire amount debt to the tour operator (Dt 76to Kt 51). The posting for accrual of remuneration (Dt 62to Kt 90) will occur after receiving the reward from the tour operator (Dt 51 Kt 62to).

Accordingly, the travel agent’s taxable income will appear either on the date of receipt of money from the buyer (if it is withheld from the amount due to the tour operator), or on the date of receipt of remuneration from the tour operator.

If, according to the terms of the contract, the cost of the tourist product is indicated in currency. That is, if there is a difference in the amounts of receipts from the buyer and the transfer to the tour operator due to the exchange rate, then it will be non-operating income or expense of the travel agent generated due to the exchange rate difference. That is, the amount to be transferred to the tour operator will be adjusted by the travel agent to the required amount of one of the postings: Dt 76to Kt 91 or Dt 91 Kt 76to.

In the ConsultantPlus system you can see detailed explanations, including examples, for the situation when a travel company provides visa services. Get free trial access to K+ and see recommendations and postings.

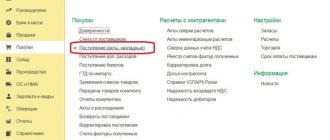

Accounting in tourism simplified tax system

To ensure separate accounting of transactions with buyers and suppliers of tourism products, two additional sub-accounts are opened: 76/Tour Operators and 76/Buyers. The correspondence will be as follows:

- D50 (or 51) – K76/Buyers – the record shows the fact of receiving money from the client for a tourism product;

- D76/Buyers – K76/Tour Operators – the money that must be paid to the tour operator for his trip from the proceeds has been accrued and accepted for accounting;

- D62 – K90 – shows the income received as a result of the sale of a tourism product to the client;

- D76/Tour Operators – K51 – payment has been made to the owner of the tourism product.

BY THE WAY, when one of the parties pays for travel packages in foreign currency, the travel agent will have exchange rate differences in their accounts. They must be included in non-operating income or expenses.

Features of accounting in tourism

InfoTourist companies operating in Russia are divided into 2 groups, which perform completely different functions.

- Group 1 is Tour Operators who arrange tours, tickets, hotels, selection of excursion programs, meals, etc.

- Group 2 are Travel Agents who enter into agency agreements with the Tour Operator and implement the tour operator’s program.

The most difficult part of running a travel agency is maintaining the accounting records for the travel agency. Let's look at the most common questions related to accounting. Documentation of the work of a travel agency In order for a travel agency to sell a tour operator's tour, it needs to conclude an agency agreement (agreement), which specifies the agency's remuneration.

Results

Accounting in a travel agency is subject to all existing accounting rules and does not have any deviations from them in reflecting accounting transactions. The nuances of accounting for a travel agent depend on the provisions of the contracts concluded by him in the implementation of his main activities.

Sources:

- Federal Law of November 24, 1996 N 132-FZ “On the fundamentals of tourism activities in the Russian Federation”

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting and tax accounting in a travel agency - 2 examples of accounting and posting

Attention The cost of the sold “Paris Weekend” tour was written off: 98,030 rubles. 05/22/16 76 51 The amount of revenue minus the sphere commission (98,030 rubles – 9,140 rubles) was transferred to the benefit of the tour operator “Cupid” 88,890 rubles. 05/22/16 76 90 Revenue Commission from the sale of the “Paris Weekend” tour is included in income 9,140 rubles. 05/22/16 91 62 Costs for the discount provided are taken into account (RUB 98,030 * 10%) RUB 9,803 Questions about profits and services Question No. 1. The Galatea travel agency provides clients with additional services for booking rooms in Moscow hotels. Is it necessary for Galatea to use a cash register or is it possible to get by by issuing a voucher? Galatea cannot issue travel packages, since this type of service is not a tourism product. In this case, the use of cash register equipment is mandatory. Read also the article: → “Application for registration of cash register equipment (cash register equipment).

Tourism as recreation, study, work, business

Selecting a taxation regime Before a travel agency starts operating, it is necessary to select a taxation regime - general (OSN) or simplified (USN). Their difference lies not only in the size of the tax burden, but also in the mode of determining income and expenses. Most travel agencies immediately choose a simplified regime when registering an enterprise, but one should take into account the restrictions established by the Tax Code of the Russian Federation in Art.

346.12.

In particular, the simplified taxation system cannot be used by taxpayers whose income is 20,000,000 rubles. (in 2008) per year. If your income exceeds this amount, you will lose the right to apply the simplified tax system. The simplified regime cannot be applied to those companies in which more than 25% of the founders are other organizations - legal entities.

"Uproshchenets" cannot have branches, and its staff cannot exceed 100 people.

The insurance amount to be paid is determined by agreement between the tour operator and the insurer, and it cannot be less than the amount of financial security (Article 17.6 of Law No. 132-FZ). According to Art. 17.2 of Law N 132-FZ, the minimum amount of security depends on the scope of tourism activity and on the income received as a result of the sale of tourism products. The terms of the compulsory insurance contract specified in Art. 936 of the Civil Code of the Russian Federation, provided for in Ch. VII.1 of Law No. 132-FZ. Consequently, if a tour operator chooses a liability insurance contract as financial security, then such insurance is mandatory for him and when applying the simplified tax system with the object “income minus expenses”, he has the right to include the corresponding costs as expenses. However, the inspection authorities will most likely be guided by the explanations of the financial department and will refuse to recognize such expenses. In this case, a period not exceeding three calendar years preceding the one in which the decision to conduct the inspection was made may be verified. The basis is paragraph 4 of Article 89 of the Tax Code of the Russian Federation. What income can be accrued to a travel agency? According to Article 346.15 of the Tax Code of the Russian Federation, a tour, when determining the object of taxation, takes into account income from sales (in accordance with Article 249 of the Tax Code of the Russian Federation) and non-sales (in accordance with Article 250 of the Tax Code of the Russian Federation). Many travel agencies sell tourism products under agency agreements. Then their income is an intermediary fee (subclause 9, clause 1, article 251 of the Tax Code of the Russian Federation). Let's look at what mistakes travel agencies make when accounting for income. It is necessary to have a business trip order, tickets, an official assignment, and an advance report from the traveler. · travel agency costs for promotional tours can be included in material costs. To do this, it is necessary to draw up an Action Plan, an order for the tour, and also draw up an estimate for the tour. Tax officials clarified the issue of application of Article 145 of the Tax Code of the Russian Federation. According to the legal position set out in the Resolution of the Supreme Arbitration Court of the Russian Federation dated November 27, 2012 N 10252/12, within the meaning of this norm of the Code, the institution of exemption from the performance of taxpayer obligations is aimed at reducing the tax burden in relation to taxpayers who have insignificant turnover in the sale of goods (works). , services) subject to VAT.

The moment and features of recognition of expenses under “simplified”

Since it is possible to engage in tour operator activities in Russia either with an insurance contract or with a bank guarantee, according to the Russian Ministry of Finance, neither form of financial support can be considered mandatory. Therefore, expenses under the insurance contract do not reduce the tax base for the single tax (letter of the Ministry of Finance of Russia dated May 20, 2009 No. 03-11-09/179). Purchase of a tourist product A travel package is a document containing the conditions of travel, confirming the fact of payment for the tourist product and is a strict reporting form (Article 1 of the Tourism Law). Therefore, according to the arbitrators, the tourism product is a special type of product. Moreover, the nature of the tourism product is such that it simultaneously combines the properties of a thing and obligations.