VAT (value added tax) is the most difficult tax to understand, calculate and pay, although if you do not delve deeply into its essence, it will not seem very burdensome for a businessman, because is an indirect tax. Indirect tax, unlike direct tax, is transferred to the final consumer.

Each of us can see the total amount of the purchase and the amount of VAT in the receipt from the store, and it is we, as consumers, who ultimately pay this tax. In addition to VAT, indirect taxes include excise taxes and customs duties. To understand the complexity of VAT administration for its payer, you will need to understand the main elements of this tax.

VAT elements

The objects of VAT taxation are:

- sale of goods, works, services on the territory of Russia, transfer of property rights (the right to claim debt, intellectual rights, rental rights, the right to permanent use of land, etc.), as well as gratuitous transfer of ownership of goods, results of work and provision of services. A number of transactions specified in paragraph 2 of Article 146 of the Tax Code of the Russian Federation are not recognized as objects of VAT taxation;

- carrying out construction and installation work for own consumption;

- transfer for one's own needs of goods, works, services, the costs of which are not taken into account when calculating income tax;

- importation of goods into the territory of the Russian Federation.

Free tax consultation

The goods and services listed in Article 149 of the Tax Code of the Russian Federation are not subject to VAT. Among them there are socially significant ones, such as: sales of certain medical goods and services; nursing and child care services; sale of religious items; passenger transportation services; educational services, etc. In addition, these are services in the securities market; Bank operations; insurer services; legal services; sale of residential buildings and premises; public utilities.

The VAT tax rate can be 0%, 10% and 20%. There is also the concept of “settlement rates”, equal to 10/110 or 20/120. They are used in operations specified in paragraph 4 of Article 164 of the Tax Code of the Russian Federation, for example, when receiving advance payment for goods, work, services. All situations in which certain tax rates are applied are given in Article 164 of the Tax Code of the Russian Federation.

Export transactions are subject to a zero tax rate; pipeline transport of oil and gas; electricity transmission; transportation by rail, air and water transport. At a 10% rate – some food products; most products for children; medicines and medical products that are not included in the list of essential and vital; breeding cattle. For all other goods, works and services, the VAT rate is 20%.

Calculate the VAT amount using a calculator

The VAT tax base is generally equal to the cost of goods, works, and services sold, taking into account excise taxes for excisable goods (Article 154 of the Tax Code of the Russian Federation). At the same time, articles 155 to 162.1 of the Tax Code of the Russian Federation provide details for determining the tax base separately for different cases:

- transfer of property rights (Article 155);

- income from mandate, commission or agency agreements (Article 156);

- when providing transportation services and international communication services (Article 157);

- sale of an enterprise as a property complex (Article 158);

- carrying out construction and installation work and transferring goods (performing work, providing services) for one’s own needs (Article 159);

- importation of goods into the territory of the Russian Federation (Article 160);

- when selling goods (work, services) on the territory of the Russian Federation by taxpayers - foreign persons (Article 161);

- taking into account the amounts associated with settlements for payment for goods, works, services (Article 162);

- during the reorganization of organizations (Article 162.1).

Tax period , that is, the period of time at the end of which the tax base is determined and the amount of tax payable under VAT is calculated, is a quarter.

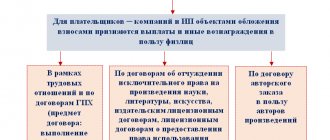

Russian organizations and individual entrepreneurs, as well as those who move goods across the customs border, that is, importers and exporters, are recognized as VAT payers Taxpayers working under special tax regimes: simplified taxation system and PSN (except for cases when they import goods into the territory of the Russian Federation) and participants in the Skolkovo project do not pay VAT. Payers of the Unified Agricultural Tax from 2022 are also required to pay VAT, but they have the right to receive an exemption from paying it if their annual income does not exceed 60 million rubles.

In addition, taxpayers who meet the requirements of Article 145 of the Tax Code of the Russian Federation can receive an exemption from VAT: the amount of revenue from the sale of goods, work, and services for the three previous months, excluding VAT, did not exceed two million rubles. The exemption does not apply to individual entrepreneurs and organizations selling excisable goods.

Tax Code of the Russian Federation | Article 146. Object of taxation

Tax Code of the Russian Federation (TC RF) (part two). N 117-ФЗ dated 03/05/2000 (List of amending documents).

Article 146. Object of taxation

1. The following transactions are recognized as the object of taxation:

1) sale of goods (work, services) on the territory of the Russian Federation, including the sale of collateral and transfer of goods (results of work performed, provision of services) under an agreement to provide compensation or novation, as well as transfer of property rights (as amended by the Federal Law dated May 29, 2002 N 57-FZ - Collection of Legislation of the Russian Federation, 2002, N 22, Art. 2026).

For the purposes of this chapter, the transfer of ownership of goods, results of work performed, and the provision of services free of charge is recognized as the sale of goods (work, services);

2) transfer on the territory of the Russian Federation of goods (performance of work, provision of services) for one’s own needs, expenses for which are not deductible (including through depreciation charges) when calculating corporate income tax (as amended by the Federal Law of December 29, 2000 N 166-FZ - Collection of Legislation of the Russian Federation, 2001, No. 1, Article 18; Federal Law of August 6, 2001 N 110-FZ - Collection of Legislation of the Russian Federation, 2001, No. 33, Article 3413);

3) carrying out construction and installation work for own consumption;

4) import of goods into the territory of the Russian Federation and other territories under its jurisdiction (as amended by Federal Law No. 306-FZ of November 27, 2010 - Collection of Legislation of the Russian Federation, 2010, No. 48, Art. 6247).

2. For the purposes of this chapter, the following are not recognized as an object of taxation (as amended by Federal Law No. 57-FZ of May 29, 2002 - Collection of Legislation of the Russian Federation, 2002, No. 22, Art. 2026):

1) operations specified in paragraph 3 of Article 39 of this Code;

2) transfer, free of charge, of residential buildings, kindergartens, clubs, sanatoriums and other objects of social, cultural and housing and communal services, as well as roads, electrical networks, substations, gas networks, water intake structures and other similar objects to government bodies and bodies local government (or, by decision of these bodies, specialized organizations that use or operate these facilities for their intended purpose);

3) transfer of property of state and municipal enterprises purchased through privatization;

4) performance of work (provision of services) by bodies included in the system of state authorities and local self-government bodies, within the framework of the exercise of the exclusive powers assigned to them in a certain field of activity in the event that the obligation to perform the specified work (provision of services) is established by the legislation of the Russian Federation, legislation of the constituent entities of the Russian Federation, acts of local government bodies (as amended by the Federal Law of May 29, 2002 N 57-FZ - Collection of Legislation of the Russian Federation, 2002, N 22, Art. 2026);

4-1) performance of work (provision of services) by state institutions, as well as budgetary and autonomous institutions within the framework of a state (municipal) assignment, the source of financial support for which is a subsidy from the corresponding budget of the budget system of the Russian Federation (subparagraph 4-1 introduced by Federal Law dated 18 July 2011 N 239-FZ - Collection of Legislation of the Russian Federation, 2011, N 30, Article 4587);

4-2) provision of services for granting the right of passage of vehicles on public toll roads of federal significance (toll sections of such highways), carried out in accordance with the trust management agreement for highways, the founder of which is the Russian Federation, with the exception of services, fees for the provision of which remains at the disposal of the concessionaire in accordance with the concession agreement (subparagraph 4-2 introduced by Federal Law of November 28, 2011 N 338-FZ - Collection of Legislation of the Russian Federation, 2011, N 49, Art. 7016);

5) transfer on a free basis, provision of services for the transfer for free use of fixed assets to state authorities and administrative bodies and local governments, as well as state and municipal institutions, state and municipal unitary enterprises (as amended by the Federal Law of July 19, 2011 N 245-FZ - Collection of Legislation of the Russian Federation, 2011, N 30, Art. 4593);

6) operations for the sale of land plots (shares in them) (subparagraph 6 was introduced by Federal Law of August 20, 2004 N 109-FZ - Collection of Legislation of the Russian Federation, 2004, N 34, Art. 3524);

7) transfer of the organization’s property rights to its legal successor(s) (subparagraph 7 introduced by Federal Law No. 118-FZ of July 22, 2005 - Collection of Legislation of the Russian Federation, 2005, No. 30, Art. 3129);

transfer of funds or real estate for the formation or replenishment of the endowment capital of a non-profit organization in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” (subparagraph 8 introduced by the Federal Law of December 30, 2006 N 276-FZ - Collection of Legislation of the Russian Federation, 2007, N 1, Article 39; as amended by the Federal Law of November 21, 2011 N 328-FZ - Collection of Legislation of the Russian Federation, 2011, N 48, Article 6729 );

8-1) transfer of real estate in the event of dissolution of the endowment capital of a non-profit organization, cancellation of a donation, or in another case, if the return of such property transferred to replenish the endowment capital of a non-profit organization is provided for by the donation agreement and (or) Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations.” The norm of this subparagraph is applied when such property is transferred by a non-profit organization - the owner of endowment capital to the donor, his heirs (successors) or another non-profit organization in accordance with Federal Law of December 30, 2006 N 275-FZ "On the procedure for the formation and use of endowment capital of non-profit organizations" (subparagraph 8-1 was introduced by Federal Law No. 328-FZ of November 21, 2011 - Collection of Legislation of the Russian Federation, 2011, No. 48, Art. 6729);

9) operations for the sale by taxpayers who are Russian organizers of the Olympic Games and Paralympic Games in accordance with Article 3 of the Federal Law “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments to certain legislative acts of the Russian Federation", goods (works, services) and property rights, carried out in agreement with persons who are foreign organizers of the Olympic Games and Paralympic Games in accordance with Article 3 of the Federal Law "On the organization and holding of the XXII Olympic Winter Games" games and the XI Paralympic Winter Games 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments to certain legislative acts of the Russian Federation", as part of the fulfillment of obligations under the agreement concluded by the International Olympic Committee with the Olympic Committee of Russia and the city of Sochi to host the XXII Olympic Winter Games and XI Paralympic Winter Games 2014 in the city of Sochi (subparagraph 9 introduced by Federal Law of December 1, 2007 N 310-FZ - Collection of Legislation of the Russian Federation, 2007, N 49, Art. 6071, the provisions of the subparagraph apply until January 1, 2022);

9-1) provision of services for the transfer for free use of the autonomous non-profit organization "Organizing Committee of the XXII Olympic Winter Games and XI Paralympic Winter Games of 2014 in Sochi", which is the Russian organizer of the XXII Olympic Winter Games and XI Paralympic Winter Games of 2014 in the city Sochi in accordance with Article 3 of the Federal Law of December 1, 2007 N 310-FZ “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments to certain legislative acts of the Russian Federation", Olympic venues of federal significance, the list of which, in accordance with Part 22 of Article 14 of the said Federal Law, is determined by the Government of the Russian Federation (subparagraph 9-1 introduced by Federal Law of July 23, 2013 N 216-FZ - Collection of Legislation of the Russian Federation, 2013, No. 30, Article 4049, the provisions of the subparagraph apply until January 1, 2022);

9-2) transfer, free of charge, of federal Olympic facilities into state or municipal ownership, into the ownership of the State Corporation for the construction of Olympic facilities and the development of the city of Sochi as a mountain climatic resort (subparagraph 9-2 introduced by Federal Law of July 23, 2013 N 216- Federal Law - Collection of Legislation of the Russian Federation, 2013, No. 30, Article 4049, the provisions of the subparagraph apply until January 1, 2022);

9-3) transfer of ownership free of charge to educational and scientific non-profit organizations for the implementation of statutory activities of state property not assigned to state enterprises and institutions, constituting the state treasury of the Russian Federation, the treasury of a republic within the Russian Federation, the treasury of a territory, region, federal city significance, autonomous region, autonomous district, as well as municipal property not assigned to municipal enterprises and institutions, constituting the municipal treasury of the corresponding urban, rural settlement or other municipal entity (subparagraph 9-3 introduced by Federal Law of December 29, 2015 N 396- Federal Law - Collection of Legislation of the Russian Federation, 2016, No. 1, Article 16);

10) provision of services for the transfer for free use to non-profit organizations for the implementation of statutory activities of state property that is not assigned to state enterprises and institutions, constituting the state treasury of the Russian Federation, the treasury of a republic within the Russian Federation, the treasury of a territory, region, federal city, autonomous region , autonomous district, as well as municipal property not assigned to municipal enterprises and institutions, constituting the municipal treasury of the corresponding urban, rural settlement or other municipal entity (subparagraph 10 introduced by Federal Law of November 25, 2009 N 281-FZ - Collection of Legislation of the Russian Federation , 2009, N 48, Art. 5731);

11) performance of work (provision of services) as part of additional measures aimed at reducing tension in the labor market of the constituent entities of the Russian Federation, implemented in accordance with decisions of the Government of the Russian Federation (subparagraph 11 introduced by Federal Law of April 5, 2010 N 41-FZ - Meeting Legislation of the Russian Federation, 2010, No. 15, Article 1737);

12) operations for the sale (transfer) on the territory of the Russian Federation of state or municipal property that is not assigned to state enterprises and institutions and constitutes the state treasury of the Russian Federation, the treasury of a republic within the Russian Federation, the treasury of a territory, region, federal city, autonomous region, autonomous district, as well as municipal property not assigned to municipal enterprises and institutions and constituting the municipal treasury of the corresponding urban, rural settlement or other municipal entity, purchased in the manner established by Federal Law of July 22, 2008 N 159-FZ “On the peculiarities of the alienation of real estate property located in state or municipal ownership and leased by small and medium-sized businesses, and on amendments to certain legislative acts of the Russian Federation" (subparagraph 12 introduced by Federal Law of December 28, 2010 N 395-FZ - Collection of Legislation of the Russian Federation, 2011, N 1, art. 7; as amended by Federal Law dated November 27, 2018 N 424-FZ);

13) related to the implementation of activities provided for by the Federal Law “On the preparation and holding in the Russian Federation of the 2022 FIFA World Cup, the 2022 FIFA Confederations Cup and amendments to certain legislative acts of the Russian Federation”, operations for the sale of goods (works, services) ) and property rights by the Organizing Committee "Russia-2018", subsidiaries of the Organizing Committee "Russia-2018", the Russian Football Union, producers of FIFA media information and suppliers of goods (works, services) to FIFA, defined by the specified Federal Law and being Russian organizations (subparagraph 13 introduced by Federal Law of June 7, 2013 N 108-FZ - Collection of Legislation of the Russian Federation, 2013, No. 23, Article 2866; as amended by Federal Law of November 30, 2016 N 404-FZ - Collection of Legislation of the Russian Federation, 2016 , N 49, art. 6847);

14) sale by an autonomous non-profit organization created in accordance with the Federal Law “On the protection of the interests of individuals who have deposits in banks and separate structural divisions of banks registered and (or) operating in the territory of the Republic of Crimea and in the territory of the federal city of Sevastopol”, property and property rights and the provision by this organization of services to represent the interests of investors (subparagraph 14 introduced by Federal Law of April 20, 2014 N 78-FZ - Collection of Legislation of the Russian Federation, 2014, N 16, Art. 1835);

15) operations for the sale of property and (or) property rights of debtors recognized as insolvent (bankrupt) in accordance with the legislation of the Russian Federation (subparagraph 15 introduced by Federal Law of November 24, 2014 N 366-FZ - Collection of Legislation of the Russian Federation, 2014, N 48, Art. 6647);

16) transfer, free of charge, to state authorities of the constituent entities of the Russian Federation and local governments of property, including unfinished construction projects, by a joint-stock company that was created for the purpose of implementing agreements on the creation of special economic zones and 100 percent of the shares of which belongs to the Russian Federation, and economic companies created with the participation of such a joint stock company for the specified purposes, which are management companies of special economic zones (subparagraph 16 introduced by Federal Law of November 27, 2022 N 351-FZ - Collection of Legislation of the Russian Federation, 2022, N 49, Art. 7323);

17) transfer, free of charge, into the ownership of a non-profit organization, the main statutory goals of which are the popularization and holding of the FIA Formula 1 World Championship, an object of real estate for holding road racing of the Formula 1 series, as well as simultaneously with the specified an object of real estate, intangible assets and (or) necessary to ensure the functioning of the specified object of real estate, infrastructure, movable property (subparagraph 17 introduced by Federal Law of June 4, 2022 N 143-FZ - Collection of Legislation of the Russian Federation, 2022, N 24, Art. . 3410).

18) transfer, free of charge, to state authorities and (or) local governments of the results of work on the creation and (or) reconstruction of heat supply facilities, centralized hot water supply systems, cold water supply and (or) wastewater disposal, individual objects of such systems located in the state or municipal property and transferred for temporary possession and use to the taxpayer in accordance with lease agreements, as well as heating supply facilities, centralized hot water supply systems, cold water supply and (or) sanitation, individual objects of such systems created by the taxpayer during the validity period of lease agreements, in the case the conclusion by this taxpayer of concession agreements in relation to these objects in accordance with “Part 1 of Article 51” of the Federal Law of July 21, 2005 N 115-FZ “On Concession Agreements” (subparagraph 18 introduced by the Federal Law of November 12, 2018 N 414-FZ).

Return to document contents

0

What is a VAT deduction

At first glance, since VAT must be charged on the sale of goods, works, and services, it is no different from sales tax (turnover). But if we return to its full name - “value added tax”, then it becomes clear that not the entire sales amount should be subject to it, but only the added value . Added value is the difference between the cost of goods, works, services sold and the costs of purchasing materials, raw materials, goods, and other resources spent on them.

This makes clear the need to obtain a VAT tax deduction. The deduction reduces the amount of VAT accrued upon sale by the amount of VAT that was paid to the supplier when purchasing goods, works, and services. Let's look at an example.

Organization “A” purchased goods from organization “B” for resale at a cost of 7,000 rubles per unit. The VAT amount was 1,400 rubles (at a rate of 20%), the total purchase price was 8,400 rubles. Next, organization “A” sells the product to organization “C” for 10,000 rubles per unit. VAT on sales is equal to 2,000 rubles, which organization “A” must transfer to the budget. In the amount of 2,000 rubles, the VAT (1,400 rubles) that was paid during the purchase from organization “B” is already “hidden”.

In fact, the obligation of organization “A” to the budget for VAT is only 2,000 – 1,400 = 600 rubles, but this is provided that the tax authorities offset this input VAT, that is, provide the organization with a tax deduction. Receiving this deduction is accompanied by many conditions; below we will consider them in more detail.

In addition to deducting VAT amounts paid to suppliers when purchasing goods, works, services, VAT on sales can be reduced by the amounts specified in Article 171 of the Tax Code of the Russian Federation. This is VAT paid when importing goods into the territory of the Russian Federation; when returning goods or refusing to perform work or provide services; when the cost of shipped goods (work performed, services provided) decreases, etc.

Characteristics of objects subject to VAT

Almost all transactions performed in the course of the activities of an economic entity that is a tax payer are subject to mandatory VAT. This includes the sale of goods, the transfer of valuables for one’s own needs, or the performance of construction and installation work within the enterprise itself, as well as the arrival of goods into the territory of the Russian Federation from other countries.

Cases of determining taxable objects are presented in more detail in our material “Art. 146 Tax Code of the Russian Federation 2022: (questions and answers)" .

In the process of conducting business, it is important to understand which transactions must be charged tax, what documents are required to confirm the VAT deduction and for transfer to customers.

Information on this issue of the year is presented in the article “What is subject to VAT in 2017” .

Trade organizations often conduct advertising campaigns and issue gift certificates. Is it necessary to charge VAT when exchanging these certificates for goods? Read the article “Goods in exchange for a certificate—should I pay VAT?”

Many companies carry out construction work within the organization to improve their own material conditions, without setting themselves the goal of further selling the property. Is there a need to accrue and pay VAT if the work was carried out in-house without the involvement of third-party contractors? What is the position of representatives of official bodies on this matter?

From the material “What is considered construction and installation work for VAT purposes” you can obtain up-to-date information related to the performance of work for your own consumption.

In cases where the transfer of goods is gratuitous, the amount of the VAT taxable item is calculated based on the average market price. The seller has the right to take into account the amount of input VAT subject to certain conditions:

- goods (services) were purchased for the purpose of their subsequent use in taxable transactions;

- they are accepted for accounting according to primary documentation;

- there is an invoice.

The buyer, in turn, cannot accept the amount of tax according to the issued invoice, since the object is subject to VAT in this case (clause 2 of Article 171 of the Tax Code of the Russian Federation), and the amount of tax when accounting for the goods is included in its original cost. Invoices from sellers when transferring goods free of charge are not recorded in the purchase book.

However, VAT is not always charged when transferring goods without receiving a material benefit.

More information about these cases can be found in the publication “Is VAT paid when transferring property free of charge?” .

Almost every enterprise is faced with the need to issue workers with forms of work books or inserts for them. The article “The Ministry of Finance reminded how to deal with VAT and profit when issuing work books” explains why VAT must be charged when issuing these forms. Another object of VAT taxation is the transfer of goods for one’s own needs within the enterprise itself (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation). But in this case, it is necessary to observe certain points related mainly to the occurrence of expenses when determining income tax.

Under what conditions does an organization become subject to taxation when transferring goods for its own needs? How does the further use of the received property affect income? Under what circumstances is there no need to charge VAT?

You will find answers to these questions in the material “Transfer of goods between structural divisions is not an object for VAT” .

If an organization transfers property as compensation to repay a loan, then it becomes obligated to calculate VAT. Read more about this in our materials:

- “Repayment of a loan with compensation entails the payment of VAT”;

- “Paying off a loan with compensation is unprofitable for VAT”;

- “Tax officials will allow VAT deduction when receiving compensation on a loan”.

Conditions for obtaining input VAT deduction

So, what conditions must a taxpayer fulfill in order to reduce the amount of VAT upon sale by the amount of VAT that was paid to suppliers or when importing goods into the territory of the Russian Federation?

1. Purchased goods, works, services must have a connection with objects of taxation (Article 171(2) of the Tax Code of the Russian Federation). Tax authorities often ask the question: will these purchased goods actually be used in transactions subject to VAT? Another similar question is whether there is an economic justification (orientation to making a profit) when purchasing these goods, works, services? That is, the tax authority is trying to refuse to receive a tax deduction for VAT, based on its assessment of the feasibility of the taxpayer’s activities, although this does not apply to the mandatory conditions for deducting input VAT. As a result, VAT payers file many lawsuits against unfounded refusals to receive deductions in this regard.

2. Purchased goods, works, and services must be registered (Article 172(1) of the Tax Code of the Russian Federation).

3. Availability of a correctly executed invoice . Article 169 of the Tax Code of the Russian Federation provides requirements for the information that must be indicated in this document. When importing, instead of an invoice, the fact of VAT payment is confirmed by documents issued by the customs service.

4. Until 2006, in order to receive a deduction, there was a mandatory condition for the actual payment of the VAT amount. Now, Article 171 of the Tax Code of the Russian Federation provides only three situations in which the right to deduction arises in relation to the VAT paid: when importing goods; on business travel and entertainment expenses; paid by tax agent buyers. For other situations, the turnover of “tax amounts presented by sellers” applies.

5. Prudence and caution when choosing a counterparty. About “Who is responsible for an unscrupulous counterparty?” we have already told you. Refusal to receive a VAT tax deduction may also be caused by your connection with a suspicious counterparty. If you want to reduce the VAT that you must pay to the budget, we recommend that you conduct a preliminary check of your transaction partner.

6. Isolation of VAT as a separate line. Article 168 (4) of the Tax Code of the Russian Federation requires that the amount of VAT in settlement and primary accounting documents, as well as in invoices, be highlighted as a separate line. Although this condition is not mandatory to receive a tax deduction, it is necessary to monitor its presence in the documents so as not to cause tax disputes.

7. Timely issuance of invoices by the supplier. According to Article 168 (3) of the Tax Code of the Russian Federation, an invoice must be issued to the buyer no later than five calendar days, counting from the day of shipment of goods, performance of work, provision of services. Surprisingly, even here the tax authorities see a reason for refusing the buyer a tax deduction, although this requirement applies only to the seller (supplier). The courts on this issue take the position of the taxpayer, reasonably noting that the five-day period for issuing an invoice is not a prerequisite for a deduction.

8. Conscientiousness of the taxpayer himself. Here it is already necessary to prove that the VAT payer himself, who wants to receive a deduction, is a bona fide taxpayer. The reason for this is the same resolution of the Plenum of the Supreme Arbitration Court of October 12, 2006 N 53, which defines the “defects” of the counterparty. Paragraphs 5 and 6 of this document contain a list of circumstances that may indicate the unjustification of a tax benefit (and the deduction of input VAT is also a tax benefit). Suspicious, in the opinion of YOU, are:

- the impossibility of the taxpayer actually carrying out business transactions;

- lack of conditions for achieving the results of relevant economic activities;

- carrying out transactions with goods that were not produced or could not be produced in the specified volume;

- accounting for tax purposes only those business transactions that are associated with obtaining tax benefits.

These are conditions that are quite harmless at first glance, such as: the creation of an organization shortly before a business transaction; one-time nature of the operation; use of intermediaries in transactions; carrying out the transaction at a location other than the taxpayer's location.

Based on this resolution, tax inspectors acted very simply - they refused to receive a VAT deduction, simply listing these conditions. The zeal of its employees had to be restrained by the Federal Tax Service itself, because... the number of those “unworthy” of receiving tax benefits simply went off scale. In the letter dated 05.24.11 No. SA-4-9/8250 FTS about

9. Additional conditions for obtaining a VAT tax deduction may include a number of requirements from tax authorities for the preparation of documents (accusations of incompleteness, unreliability, and contradiction of the specified information are typical); to the profitability of the activities of the VAT payer; an attempt to re-qualify contracts, etc. If you are sure that you are right, in all these cases it is worth at least appealing the decisions of the tax authorities to refuse to receive a VAT tax deduction in a higher tax authority.

Possible VAT recovery situations

The list of cases when tax restoration is required is contained in paragraph 3 of Art. 170 Tax Code of the Russian Federation. So, you must restore VAT if:

- switched to tax exemption under Art. 145 Tax Code of the Russian Federation;

- switched to special modes of the simplified tax system, UTII, PSN - completely for all activities or in part (you combine the special mode with OSNO);

- carry out VAT-free transactions - exempt from tax under Art. 149 of the Tax Code of the Russian Federation, which do not form an object of VAT taxation (clause 2 of Article 146 of the Tax Code of the Russian Federation), or with a place of implementation outside the Russian Federation (Articles 147, 148 of the Tax Code of the Russian Federation);

- received goods, works, services for which an advance was previously transferred, VAT on which was deducted;

- received a refund of the advance if the contract was terminated or its terms were changed;

- received an adjustment invoice to reduce the cost of previously purchased GWS;

- transferred property as a contribution to the charter, etc. capital;

- received budget investments or a subsidy to compensate for the costs of purchasing goods and equipment, fixed assets, intangible assets and property rights, as well as to reimburse the costs of paying tax when importing goods;

- do not keep separate records of costs provided for in clause 2.1 of Art. 170 Tax Code of the Russian Federation;

- you are the legal successor of the reorganized organization - in the cases specified in clause 3.1 of Art. 170 Tax Code of the Russian Federation.

This list is considered closed. However, there are a number of situations that are not named in it, but in which officials also demand that VAT be restored. For example, when writing off defective goods, shortages, disposal of fixed assets, etc. There is no need to blindly follow these explanations. First, look at the recommendations and arguments of ConsultantPlus experts. They will help you save money. You can get trial access to K+ for free.

VAT on export

As we have already said, when exporting goods, their sale is taxed at a rate of 0%. The company must justify the right to such a rate by documenting the fact of export. To do this, along with the VAT return, you must submit a package of documents to the tax office (copies of the export contract, customs declarations, transport and shipping documents with customs marks).

The VAT payer is given 180 days from the date the goods are placed under export customs procedures to submit these documents. If the necessary documents are not collected within this period, then VAT will have to be paid at a rate of 10% or 20%.

VAT on import

When importing goods into the territory of the Russian Federation, importers pay VAT at customs, which is calculated as part of customs payments (Article 318 of the Customs Code of the Russian Federation). An exception is the import of goods from the Republic of Belarus and the Republic of Kazakhstan; in these cases, payment of VAT is formalized at the tax office in Russia.

Please note that when importing goods into Russia, VAT is paid by all importers, including those working under special tax regimes (USN, Unified Agricultural Tax, PSN), and those who are exempt from paying VAT under Article 145 of the Tax Code of the Russian Federation.

The VAT rate for imports is 10% or 20%, depending on the type of goods. An exception is the goods specified in Article 150 of the Tax Code of the Russian Federation, for the import of which VAT is not charged. The tax base on which VAT will be charged when importing goods is calculated as the total sum of the customs value of goods, customs duties and excise taxes (for excisable goods).

Basic concepts of VAT

Object of VAT taxation:

- sale of goods, works, services on the territory of Russia, transfer of property rights (the right to claim debt, intellectual rights, lease rights, the right to permanent use of land, etc.), as well as gratuitous transfer of ownership of goods, results of work and provision of services;

- carrying out construction and installation work for own consumption;

- transfer for one’s own needs of goods, works, services, the costs of which are not taken into account when calculating income tax;

- import of goods into the territory of the Russian Federation.

VAT payers

are Russian organizations and individual entrepreneurs, as well as importers and exporters.

Tax rate VAT

can be equal to 0%, 10% and 20%. There are also “settlement rates” equal to 10/110 or 20/120. They are used for operations specified in paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, for example, when receiving an advance payment for goods, work, services.

Tax base for VAT

in the general case, it consists of the cost of goods, works, and services sold, taking into account excise taxes for excisable goods.

Tax period for VAT

- quarter.

Input VAT

— tax paid to suppliers and subject to deduction.

Output VAT

- a tax received from consumers on the sale of goods and services.

VAT under simplified tax system

Although simplifiers are not VAT payers, issues related to this tax nevertheless arise in their activities.

First of all, why do OSNO taxpayers not want to work with suppliers on the simplified tax system? The answer here is that the supplier on the simplified tax system cannot issue an invoice to the buyer with allocated VAT, which is why the buyer on the OSNO will not be able to apply a tax deduction for the amount of input VAT. The solution here is possible in reducing the selling price, because unlike suppliers on the general taxation system, simplifiers do not have to charge VAT on sales.

Sometimes simplifiers still issue the buyer an invoice with a allocated VAT, which obliges them to pay this VAT and submit a declaration. The fate of such an invoice may be controversial. Inspections often deny buyers a tax deduction, citing the fact that simplifiers are not VAT payers (even though they actually paid VAT). True, most courts in such disputes support the right of buyers to deduct VAT.

If, on the contrary, a simplifier buys goods from a supplier working on OSNO, then he pays VAT, for which he cannot receive a deduction. But, according to Article 346.16 of the Tax Code of the Russian Federation, a taxpayer using a simplified system can take into account input VAT in his expenses. This, however, only applies to payers of the simplified tax system Income minus expenses, because On the simplified tax system, income does not take into account any expenses.

VAT return and tax payment

The VAT return must be submitted at the end of each quarter, no later than the 25th day of the next month, that is, no later than the 25th of April, July, October and January, respectively. Reporting is accepted only in electronic form; if it is presented on paper, it is not considered submitted.

The procedure for paying VAT differs from other taxes. The tax amount calculated for the reporting quarter must be divided into three equal parts, each of which must be paid no later than the 25th day of each of the three months of the next quarter. For example, according to the results of the first quarter, the amount of VAT payable amounted to 90 thousand rubles. We divide the tax amount into three equal parts of 30 thousand rubles each, and pay it within the following deadlines: no later than April 25, May, June, respectively.

We draw the attention of all LLC-organizations can pay taxes only by non-cash transfer. This is a requirement of Art. 45 of the Tax Code of the Russian Federation, according to which the organization’s obligation to pay tax is considered fulfilled only after presentation of a payment order to the bank. The Ministry of Finance prohibits paying LLC taxes in cash.

Choose a profitable current account

If you did not manage to pay taxes or contributions on time, then in addition to the tax itself, you will also have to pay a penalty in the form of a penalty, which can be calculated using our calculator:

In this article we tried to give basic concepts about VAT. Unfortunately, this tax, like no other, is endless in its complexity. We recommend that you contact specialists when calculating and paying VAT. For example, get a free one-hour consultation from our partners from 1SBO.