The role of the balance sheet

The balance sheet characterizes the financial position of the organization as of the reporting date (clause 18 of PBU 4/99). For tax purposes, the balance sheet is compiled as of the end of the year, that is, as of December 31. For banks and owners, it can be compiled based on the results of the quarter.

The balance sheet can be used to judge the size of the organization’s assets and its debt to counterparties. That is why balance sheet data is used by economists and analysts when analyzing liquidity and solvency indicators.

The balance sheet is always prepared in conjunction with the income statement. But the balance sheet, unlike the report, shows the state of the company on a specific date.

For example, on December 31, an organization may have 1 million rubles in cash and not a ruble in accounts payable. However, on January 1, all the money will be transferred to suppliers and employees, and a loan of 10 million rubles will be issued to the bank. The situation is too exaggerated, but this is really possible.

Balance sheet asset

Assets are the various assets of an organization. It can be both material in the form of buildings, raw materials, equipment, land, money and anything that can be physically seen and touched. Or it can be intangible in the form of patents, know-how, trademarks, accounts receivable, and so on.

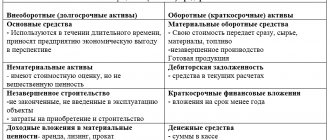

The company's assets in the balance sheet are divided into two sections depending on their turnover rate:

- fixed assets;

- current assets.

Non-current assets are the property of an organization that it uses to generate profit over a long period of time, that is, more than a year. This is for example:

- own workshop where employees work;

- a trademark that an organization uses to promote its products;

- investments in other organizations that generate recurring income;

- equipment on which employees produce products, and so on.

Turnover is assets that are also used to make a profit, but they are repaid, that is, “turned around,” within one year. For example:

- raw materials from which products are made;

- short-term loans to other organizations that will be repaid in less than 12 months;

- money that is constantly turned into various types of property: from raw materials to receivables.

Some indicators can be found in both non-current assets and current assets. For example, financial investments. This is due to the fact that there are two types of financial investments: those that return in less than 12 months and those that return in more than 1 year.

The balance sheet asset increases with the receipt of funds, purchases of raw materials, equipment, and so on. And it decreases when property is disposed of.

Asset classification

An organization's resources are classified according to various criteria. Among them are liquidity, functionality, composition, etc. The detailed classification includes the following groups:

- By the degree of liquidity - the speed of conversion of resources into money. Read more about this classification in the article “What is an asset in the balance sheet.”

- By turnover rate - the period of circulation of a resource in the process of economic activity of an organization.

- By materiality (substantiality) - the degree of materiality or reality of the value is determined.

- By sources of creation - at the expense of whose funds the resources were generated (gross or net).

- By type of ownership - own, leased, used free of charge.

- By type of tax calculations - depending on the account in which the obligation is recorded.

- When working with financial mechanisms - basic ones.

- According to the level of conditionality of estimated liabilities, they are determined in accordance with PBU 8/2010.

- OS acquired with borrowed funds are investment resources.

- Other active values - those that were not included in the previous groupings and do not have a material advantage for the organization.

Asset liquidity

Non-current and current assets are not the only grouping, although it is used in the balance sheet. Analysts divide assets into four groups according to the degree of liquidity, that is, the ability to turn into money:

- absolutely liquid assets (A1) are property that can be converted into money as quickly as possible, for example, cash and securities themselves;

- medium-liquid assets (A2) - property that can be sold without much difficulty, for example, goods, finished products and accounts receivable;

- weakly liquid assets (A3) - property with a long sale period, for example, raw materials, work in progress;

- illiquid assets (A4) - property that is difficult to sell, for example, equipment, building, long-term receivables.

This division is very conditional and depends on the specific property. For example, selling raw materials in the form of galvanized metal sheets is much easier than selling carboxymethyl cellulose. The same applies to equipment: it will be easier to sell a drilling machine than a polypropylene blowing line.

Asset gradation

The balance sheet of an enterprise, assets and liabilities of the balance sheet show the location of sources of financing activities (both current and past periods) by investing in long-term and short-term objects. When drawing up the form, you must follow the procedure established by Order No. 43n dated 07/06/1999 in PBU 4/99. Working articles are filled out by the organization in thousands/millions of rubles for account balances used in accordance with the current edition.

Asset balance sheet - table

| Type of asset | Line number | Note for entering information |

| Non-negotiable | ||

| Intangible assets | 1110 | The residual value is entered (the difference between accounts 04 and 05) |

| Results of research or development | 1120 | Information on R&D expenses is entered |

| Search engines ON | 1130 | Information is entered in the case of the use of natural subsoil/resources |

| Search MA | 1140 | Same as page 1130 |

| Fixed assets | 1150 | The residual value is indicated (the difference between accounts 01 and 02) |

| Profitable investments in valuables | 1160 | The difference between accounts 03 and 02 is indicated |

| Long-term financial investments | 1170 | Data is entered when placing investments for a period of more than a year, account balances 55, 58 (minus account 59), 73 are used |

| OTA (deferred tax assets) | 1180 | Filled out when applying PBU 18/02, account balance 09 is taken |

| Other types of non-current assets (VA) | 1190 | All other VA significant for reflection |

| Negotiable | ||

| Reserves | 1210 | Balances for accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 46, 97 are indicated |

| VAT | 1220 | Account balance is deposited 19 |

| Accounts receivable | 1230 | Debit balances on accounts 60, 62, 66, 67, 68, 69, 70, 71, 73, 75, 76 are indicated. Reserves on account 63 are deducted from accounts 60, 62. |

| Short-term financial investments | 1240 | Filled out if there are investments for a period of less than a year, balances on accounts 55, 58 (minus accounts 59), 73 are taken |

| Cash and various equivalents | 1250 | Funds in the balance sheet assets are deposited by summing up the balances on accounts 50, 51, 52, 55 (minus deposits), 57 |

| Other types of current assets | 1260 | All other OA significant for reflection |

| Total assets on balance sheet | 1600 | |

Important! In the company's balance sheet, the asset is not profit/loss - the resulting financial result is reflected in Liabilities on page 1370, as it relates to sources of business financing.

Balance sheet liabilities

Liabilities are the sources of an organization's assets. In this case, sources can be either your own or attracted. Liabilities in the balance sheet are divided into three sections:

- capital and reserves;

- long term duties;

- Short-term liabilities.

Capital and reserves are the company’s own funds: authorized capital, reserve funds, retained earnings.

The remaining two groups are the company's obligations. This includes debt to banks, tax authorities, suppliers, employees, and so on. Short-term liabilities have a maturity of up to 12 months, and long-term liabilities have a maturity of more than 1 year. Borrowed funds fall into two sections at once: long-term and short-term liabilities. This depends on the loan repayment period.

Liability increases when attracting loans and borrowings, increasing debt to suppliers, making a contribution to the authorized capital, making a profit, and so on. Decreases when paying off debts, distributing profits and similar situations.

Company assets: what they are and why they are important

The assets of an organization are the value of all the property that the company has that is used for the purposes of production and making a profit from the services provided.

There are three sources of enterprise resources based on the form of functioning:

- Material (real) things can be felt by the literal touch of the hand: apartment and garage, buildings and factories, tools and equipment, land, transport, raw materials, final product, jewelry.

- Intangible (immaterial) cannot be touched, but only the copyright holder can use them for free; the rest will have to pay: intellectual development, patent, computer program, trademark, logo, business reputation, technology, organizational ideas, privileges.

- Financial (monetary) means all non-cash and cash resources: money, currency, insurance policy, securities, shares, bonds, issued loans, deposits, cash.

The assets of an enterprise are characterized by three main parameters:

- they make a profit in any case: sooner or later, a lot or a little,

- increase their value over time,

- the company has the ability to control the use of resources,

- the asset already legally, on paper, and not in words, belongs to the company.

Liquidity of the enterprise

Liquidity is the ability to quickly turn any property into “real” money if it is urgently needed.

The resources themselves can be classified according to the degree of their liquidity:

- illiquid (transport, equipment, buildings),

- low-liquidity (raw materials, goods, materials),

- medium liquid (deposits up to six months, loans),

- highly liquid (own money in cash, cash on hand, currency, current accounts).

How to determine the most liquid, that is, convertible into money, resource of the company? Make a comparison: the one that will bring the maximum income in the shortest period of time will become the most liquid.

Note that the most highly liquid resources are at the same time the most short-term and circulating, and the illiquid ones are non-current assets.

The degree to which an organization’s liabilities are covered by its assets is the liquidity of balance sheet indicators, according to which we can conclude: how much the company’s income keeps pace with its expenses.

Balance sheet liquidity symbols for assets and liabilities

Assets and liabilities

To understand what a company's assets are, you need to understand the concept of liabilities. Assets and liabilities always go together on a balance sheet.

If assets are property (things or finances) that always generate and increase income (stocks, deposits), then liabilities are property that, although it satisfies daily needs, still requires expenses for repairs and depreciation (apartment, car) .

Let's give an example of how an asset and a liability work. You have 2 million rubles, which you plan to use as you wish. There are two available options for implementing these funds. (All figures are conditional and selected for ease of calculation.)

Option #1. You deposit 2 million rubles at an annual interest rate of 10. Then, after a year, your 2 million will become 2,200 million rubles. In other words, your source of 2 million brought you 200 thousand in additional income.

Option #2. For 2 million you buy a one-room apartment in a new building and move into it. You spend 200 thousand rubles on repairs, and another 200 thousand rubles on arrangement and furnishings. The monthly payment for housing and communal services will be about 4 thousand rubles, which means that 48 thousand rubles will be spent on utility needs per year. That is, buying an apartment brought you an expense equal to 448 thousand rubles.

Results: the asset increases itself (if 2,200 million rubles are put back at the same interest rate, in a year the amount will be 2,420 million rubles, and so on), and the liability spends money irrevocably (no one will return the costs of repairs and utility bills)..

However, it should be said about liabilities that they are inevitable, since they satisfy our current needs and generally accompany human or industrial activity.

The liabilities of an enterprise are 1) obligations towards other persons that the businessman must fulfill (pay a bank loan, buy raw materials from a supplier, pay salaries to employees, make contributions to government agencies) and 2) contributions to his own authorized capital for the further operation of the company .

Examples of assets and liabilities

Ideally, indicators for resources at the end of the billing period should exceed indicators for liabilities or at least be equal to them. In this case, we can talk about successful business development. Otherwise, it is worth taking care to analyze the effectiveness of the strategy being pursued, since when the income from active resources remains negative over a long period of time, the company may sooner or later go bankrupt.

Current and non-current assets

An organization's assets are used in the course of its activities. Based on involvement in the process of production itself, accounting reports allocate current and non-current resources.

Non-current assets of an enterprise are property and financial assets that indirectly support the process of production of goods, but are not fully involved in it. In other words, they are outside the circulation, or production cycle, and therefore can serve in the long term. If we take one calendar year as a conditional calculation period, as is usually done, then non-current long-term resources will last more than 12 months.

Non-current (or basic) resources include both tangible and intangible resources, as well as financial resources:

- land,

- private reservoirs and subsoil,

- forests,

- structures and buildings,

- transport,

- equipment,

- trade marks,

- patents,

- securities,

- financial obligations.

That is, non-current resources are the very solid foundation thanks to which it was possible to create a company (authorized capital, property owned, workers) and organize its production activities.

When an organization already exists and is ready to start working, working resources come into play.

The current assets of an enterprise are property and finances, thanks to which the current production process is implemented. Because of their full involvement in the operations of creating a product, they are often called operational and short-term, because they are consumed within one year.

What is included in current assets

Current (or current) resources include tangible and intangible property:

- machines,

- equipment,

- transport,

- technologies,

- organizational ideas.

Financial assets among current assets are found only of a short-term nature, that is, those that can be quickly withdrawn and spent on production needs: for example, inventories, cash on hand, securities, loans. But all long-term financial resources (stocks, bonds, deposits) cannot be considered among current assets.

Core and non-core assets

Depending on the direction of business and the type of activity of the enterprise, core and non-core resources are distinguished.

Core assets are those property and finances that are directly used to implement production and marketing activities. These are almost all the savings of an enterprise, since they correspond to the type of activity, and therefore without them it will be impossible to develop and make a profit.

Non-core assets are any property and finances that are not currently used by the organization and generate only expenses. A similar situation exists as consequences:

- privatization,

- re-profiling, transition to a new market segment,

- buying property at a low price from a bankrupt entrepreneur.

Most often, non-core resources are property (buildings and premises of former factories, kindergartens and camps, schools, clinics, sanatoriums, recreational facilities).

The best example of a non-core resource is the property of debtors, which the bank seizes in order to pay off debts on financial obligations. Often banks strive to sell newly acquired property as quickly as possible, but sometimes it is difficult to do this in a short time, so banks are forced to maintain ballast for some time.

Although the state reserves the right of further actions for the owners of such property, the long-term maintenance of non-core assets that do not work for the company and do not generate income can be costly for the entrepreneur: they have to pay property taxes, as well as make payments to housing and communal services.

Thus, the most rational solution would be to sell or transfer ownership of the object. But owners of non-core property should be prepared for the lowest price to be offered for them.

Grouping liabilities by urgency

Like assets, liabilities play an important role in determining liquidity, so they are divided into four groups:

- current liabilities (P1) are short-term accounts payable that need to be repaid in the near future;

- short-term liabilities (P2) are short-term borrowed funds and other obligations to be repaid in the near future;

- long-term liabilities are liabilities whose maturity exceeds 12 months;

- permanent liabilities - liabilities that do not need to be repaid, such as capital and reserves, deferred income and estimated liabilities.

How to classify an acquisition: business or assets?

Before we begin to assess whether the activity being acquired is a business or a group of assets, we must clarify the following:

According to the new amendment, a business does not have to produce returns.

Yes, he usually does, but business can involve, at a minimum, input and a fundamentally significant process.

[Cm. IFRS paragraph 3:B8]

“Substantive” is an important characteristic because if you only have inputs and a secondary process, then it is not a business, but an asset.

In fact, we must evaluate whether the business process is fundamentally significant - this is perhaps the main issue in classifying an acquisition as a business or an asset.

When you evaluate whether a business has inputs and a fundamentally significant process, you first need to find out whether the business has an output or not.

We will not go into detail here as IFRS 3:B12 provides comprehensive guidance on assessing whether an acquired process is fundamentally significant.

In general, a process is fundamentally significant when it contributes decisively or significantly to an output (or at least the ability to generate an output).

Moreover, when a business has no output, inputs must include organized labor and other resources that labor can convert or transform into output.

This is a very simplified explanation. The concentration test diagram below explains the specific conditions.

The relationship between assets and liabilities of the balance sheet

An asset is always equal to a liability on a balance sheet. The value of the property must be equal to the sum of the sources of this property. If the asset does not equal the liability, the balance sheet is incorrect. There are no exceptions.

Let's say the organization has no property or liabilities. But you need to buy raw materials for production for 100,000 rubles. To purchase, you need money - you can take out a loan of 100,000 rubles. As a result, the company will have 100,000 rubles recorded in its assets, and 100,000 rubles will be recorded in its liabilities.

Because asset and liability are equal, they are related. A change in one section entails a change in another. Here are some options:

- an increase in an asset and an increase in a liability - for example, the bank transferred credit money to the current account, the liability in the form of debt to the bank increased, and the asset in the form of cash in the current account increased;

- a decrease in an asset and a decrease in a liability - for example, repaying a loan, the liability in the form of debt to the bank decreases, and the asset in the form of cash in the account decreases;

- movement within an asset without changing the amount - for example, collection of receivables, in fact, an asset in the form of a receivable turns into an asset in the form of money, but the total amount does not change;

- movement within a liability without changing the amount - for example, a loan was transferred from short-term to long-term.

But there cannot be an increase in assets and a decrease in liabilities, or vice versa. Since this will lead to a lack of balance of indicators.

Fill out your balance sheet in the Kontur.Accounting cloud service. The system will automatically distribute account balances according to balance sheet items and check the correctness of its completion. We provide all newbies with a free trial period of 14 days.

New definition of business in IFRS 3.

In 2022, IFRS 3 was amended to change the definition of a business.

The new definition applies to all acquisitions made after January 1, 2022.

In accordance with IFRS 3 (Appendix A), a business is an integrated set of activities and assets, the implementation and management of which can lead to:

- providing goods or services to customers;

- generating investment income; or

- generating other income from ordinary activities.

Business elements.

IFRS 3 also states that any business must contain three elements:

- Input : is a resource (for example, fixed assets, intangible assets, etc.) that creates an output or can contribute to the creation of an output;

- Process : this is what you apply to the input and, as a result, the process can help create output (for example, any business processes, production methods, etc.);

- Output : This is the result of applying a process to an input (for example, goods or services provided to customers and other results).