What is KBK and where should it be indicated?

The budget classification code (BCC) shows where the state receives its revenues and where its expenses are directed. The KBK system was created to regulate financial flows; with their help, a budget program is drawn up at the level of the state and constituent entities.

Organizations and entrepreneurs using the simplified tax system should also know and use KBK in payments. Whether the tax authorities will take this payment into account or not depends on the correctness of filling out the order. If the tax office does not see the tax on time, it can collect it unilaterally and charge penalties. In 2022, as in the past, field 104 is provided in the payment form for KBK.

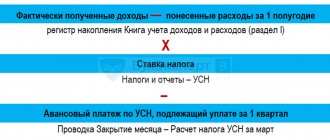

The simplified single tax is paid for the quarter in the form of advance payments until the 25th of the next month. Tax for the year is paid by organizations until March 31 and until April 30 by individual entrepreneurs. To transfer tax, fill out the payment form correctly and indicate the correct BCC depending on the object of taxation and the purpose of the payment.

When to pay payments under the simplified tax system in 2018

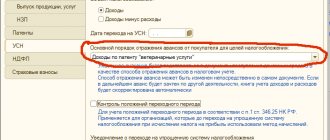

Payers of the simplified tax system in 2022 must quarterly calculate and pay advance payments for the “simplified” tax no later than the 25th day of the month following the quarter, as well as the tax for the year no later than March 31 (for organizations) and April 30 (for individual entrepreneurs). When paying the simplified tax system, you must indicate in the payment slip the budget classification code (BCC) to which the tax is transferred according to the simplified tax system. Budget classification codes according to the simplified tax system in 2022 must be indicated in field 104 of the payment order (according to the order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n as amended by order No. 90n dated June 20, 2016). For legal entities (organizations) and individual entrepreneurs (IP) on the simplified tax system, the indicators depend on:

- from the object of taxation;

- from the purpose of payment.

KBK simplified tax system "income" in 2022 and 2022

For the simplified tax system “income”, a standard rate of 6% and an increased rate of 8% are applied (the standard rate may be lower - we wrote about rates in the regions here). It only taxes the income of the organization. The Ministry of Finance made the latest changes to the list of codes by order No. 297n dated December 7, 2022, but the BCC for the simplified tax system of 6% remained the same. The codes for taxes, penalties and fines are different.

- Tax and advance payments - 182 1 0500 110

- Penalty — 182 1 0500 110

- Interest — 182 1 0500 110

- Fines - 182 1 0500 110

For tax not paid on time, the Federal Tax Service charges penalties for each day of delay. There is a special KBK for their payment, as well as for fines. The differences between these codes are only in characters 14 to 17. Tax - 1000, penalties - 2100, fine - 3000.

KBK simplified tax system “income minus expenses” in 2022 and 2021

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes. Get free access for 14 days

The simplified version with the object “income minus expenses” has other BCCs, which depend on the purpose of the payment. There have been no changes to the KBK simplified tax system of 15% in 2021, so please indicate the following codes in the payment order:

- Tax and advance payments - 182 1 0500 110

- Penalty — 182 1 0500 110

- Interest — 182 1 0500 110

- Fines - 182 1 0500 110

As you can see, the codes for different taxation objects are practically the same. 19 out of 20 digits match, the difference is only in the 10th digit. When transferring tax on the “income minus expenses” object, always make sure that the 10th digit is the number “2”.

Who uses this KBK

Taxpayers of the simplified tax system are organizations and individual entrepreneurs who have switched to a simplified tax payment system and have chosen the difference between income received and expenses incurred as the object of taxation.

When paying a single tax, such taxpayers use the simplified BCC “income minus expenses” in 2022 - 182 1 0500 110. Keep in mind that the transition to a simplified tax system is not only the desire of an organization or individual entrepreneur. The company will have to comply with certain conditions and promptly send a notification to the Federal Tax Service about the transition.

The conditions are fixed at the legislative level. To switch to simplified taxes, you must meet the following requirements:

- have no branches;

- staffing level - up to 100 people;

- cost of fixed assets - up to 150 million rubles (residual);

- revenue for the year - 150 million or 112.5 million - for 9 months.

IMPORTANT!

State and budgetary institutions do not have the right to apply a simplified taxation regime. Only autonomous government organizations have the right to switch to simplified legislation if the above conditions are met.

KBK simplified tax system 2022 for minimum tax

For simplifiers with the object “income minus expenses”, it is mandatory to pay a minimum tax. When the tax amount for the year does not exceed 1% of your income, you will have to pay a minimum tax of 1% of income.

When filling out a payment order, please note that from 2022, the same BCC is applied to transfer the minimum tax as for advance payments on the simplified tax system of 15%. Therefore, when transferring the minimum tax, in field 104 indicate KBK 182 1 0500 110. The codes have been combined to facilitate the work of the Federal Tax Service. They can now automatically count advance payments made for the year toward the minimum tax.

How to pay advance payments (tax) according to the simplified tax system

Advance payments (tax) under the simplified tax system can be paid in cash using a receipt at any Sberbank branch, via the Internet on the tax office website or from a current account.

How to pay tax according to the simplified tax system via the Internet

- Go to nalog.ru. Agree to the processing of personal data and select Fill in all payment details of the document.

- Specify Taxpayer - Individual Entrepreneur, Payment Document - Payment Document and click Next.

- Under the OKTMO Code line, check the Define by address checkbox. Please provide your residential address. Click OK. The Federal Tax Service and OKTMO codes will be determined automatically. Click Next.

- Specify KBK 18210501011011000110 (for simplified tax system income) and click Next. The remaining fields will be determined automatically.

- Indicate the status of the person: 13 - individual entrepreneur, notary engaged in private practice, lawyer who established a law office, head of a peasant (farm) enterprise.

- Basis of payment: TP - payments of the current year.

- Tax period: Quarterly payments, then quarter and year (for payment of advance payments under the simplified tax system) or Annual payments and year (for payment of tax under the simplified tax system).

- Enter the payment amount.

- Please indicate your full name and tax identification number. Under the Residence address line, select Same as the property's location address. Click Next and then Pay.

- To pay online, select the payment method by Bank card. To pay in cash through Sberbank, select - Generate a receipt. To pay via online banking, select - Via the credit institution’s website and then your bank.

Attention ! You can pay advance payments (tax) under the simplified tax system via the Internet on the tax website only from a personal card or account. To pay from an individual entrepreneur’s current account, create payments on our website

How to fill out a payment order

Attention ! From October 1, 2022, the rules for filling out payment orders for paying taxes and contributions have changed. Read more about the changes on our Telegram channel.

To pay advance payments and tax according to the simplified tax system from a current account, indicate the following details in the payment order:

- Payer status - 13

- Gearbox - 0

- Your data: Full name (IP) //Residence address//

- Tax details

- KBK code

- OKTMO code

- Basis of payment - TP

- Taxable period

- Payment order: 5

- Code - 0

- Fields 108, 109, 110

- Purpose of payment

- In the Payer Status field, enter 13.

- Enter 0 in the checkpoint field.

- In the Payer field, indicate your full name (IP) //Residence address//.

- In the Recipient field, enter the details of the tax office.

- In field 104, enter the KBK code 18210501011011000110 (for the simplified tax system for income).

- In field 105, enter the OKTMO code (municipality code) for your address.

- In the Reason for payment field, enter the TP.

- In the Tax period field, enter:

- KV.01.2021 - to pay the advance payment under the simplified tax system for the 1st quarter,

- GD.00.2021 - to pay tax according to the simplified tax system for the year.

- In the Payment sequence field, enter 5.

- In the Code field, enter 0.

- In fields 108, 110, enter 0. In field 109 (document date), enter:

- 0 - when paying an advance payment according to the simplified tax system or tax according to the simplified tax system before filing a declaration,

- date of the declaration under the simplified tax system - when paying tax under the simplified tax system after filing the declaration.

- In the payment purpose please indicate:

- Tax levied on taxpayers who have chosen income as an object of taxation for the 1st quarter of 2022 - upon payment of an advance payment under the simplified tax system for the 1st quarter,

- Tax levied on taxpayers who have chosen income as an object of taxation for 2022 - when paying tax according to the simplified tax system for the year.

KBK simplified tax system for individual entrepreneurs

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes. Get free access for 14 days

Individual entrepreneurs using the simplified tax system are wondering which KBK they should use to pay a single tax. According to Art. 346.21 of the Tax Code of the Russian Federation, individual entrepreneurs pay tax in the general manner. For individual entrepreneurs, the simplified tax system does not provide for separate BCCs; they are the same for individuals and legal entities. The only difference is the timing of tax payment; individual entrepreneurs can pay the final tax payment for the year before April 30, and not until March 31, like an organization.

Sample of filling out a payment order

Samples of payment orders under the simplified tax system for 2022 with expert comments can be downloaded for free from ConsultantPlus by signing up for trial demo access to the system. Just click on the image you need below.

- payment order according to the simplified tax system with the object “income”:

- payment slip according to the simplified tax system with the object “income minus expenses”:

Read about the consequences of errors in a payment document in the article “Errors in a payment order for the payment of taxes.”

What are the consequences of an incorrect KBK in a payment order?

The absence or incorrect indication of the code may result in the payment being among the unknown. The responsibility for indicating the correct BCC lies with the taxpayer, since the codes are enshrined in law. If you indicated the wrong code, but the payment was received by the budget, send an application to the Federal Tax Service to clarify the payment. The tax authority will recalculate penalties for the period from the date of payment until the payment is clarified. In Art. 45 clause 4 of the Tax Code of the Russian Federation specifies two types of errors in which the payment will not be counted: an incorrect treasury account number or an error in the name of the recipient bank. In this case, a different procedure for correctly determining the payment applies.

Errors in payments

To avoid penalties, carry out systematic reconciliations with the Federal Tax Service. Oblige your accountant to conduct quarterly reconciliations of settlements with the Federal Tax Service (more often).

If you filled out the payment slip incorrectly, determine the nature of the error. Evaluate two indicators: the recipient (Federal Tax Service) and the KBK. The first three digits of the budget encoding are the chapter code. For the tax office it has a constant value of 182.

So, if both indicators are correct, then we write a letter to the Federal Tax Service about changing the payment details. We indicate the number and date of the payment, and report the error (indicate which details were entered incorrectly). Then enter the correct data. We put the signatures of the manager and chief accountant and the seal of the organization.

If the error is in the recipient and in the code of the head of the revenue administrator, then you will have to look for the money. First of all, contact the Federal Tax Service. If the payment is still stuck in the budget system (credited to the tax office accounts), then follow the instructions described above. If there is no money in the budget, then contact the bank to find funds. This will take quite a long time. We recommend that you pay your debt to the budget without waiting for a refund.

How to check the KBK for correctness

You can see the current BCCs on the Federal Tax Service website in the “Taxation in the Russian Federation” / “Budget Revenue Classification Codes” section. Select individual entrepreneur, legal entity or individual and the required tax.

The Federal Tax Service website also has a service for filling out a payment document. Specify the taxpayer and the payment document, then enter the BCC in the special field. This way you can find out for which payments this code is used.

The cloud service Kontur.Accounting helps generate payment orders for paying taxes - all that remains is to transfer them to the Internet bank and pay. Keep records, submit reports and pay salaries with us. Calculate taxes and generate payment slips for free.

Try for free