Can the Federal Tax Service re-request previously provided documents?

If an inspected person or a consolidated group of taxpayers was previously subjected to a desk or field audit by tax authorities, during which the documents requested by FTS specialists were transferred to the Federal Tax Service, the tax authorities do not have the right to request from this person during a new audit or other tax control activities persons (groups of persons) the same papers or documents that were provided during the inspection in the form of certified photocopies (clause 5 of Article 93 of the Tax Code of the Russian Federation).

However, such a restriction does not apply to all cases. The tax office has the legal right to submit a second request if:

- documents transferred to the Federal Tax Service employees were lost due to force majeure circumstances (for example, a natural disaster, a fire in the tax office building);

- the requested papers were transferred to the Federal Tax Service in the form of originals, and tax authority specialists returned them back to the taxpayer.

It should also be borne in mind that the norms of paragraph 5 of Art. 93 of the Tax Code of the Russian Federation do not apply to cases where the taxpayer transfers papers to the Federal Tax Service outside the framework of organizing tax monitoring. That is, paragraph 5 of Art. 93 of the Tax Code of the Russian Federation is not subject to broad interpretation. This is stated in the Letter of the Federal Tax Service of the Russian Federation dated December 4, 2015 No. ED-16-2/304.

Important!

The provisions of the Tax Code of the Russian Federation do not contain a ban on conducting an on-site tax audit after the completion of a desk audit. But the taxpayer is not required to provide the same documents that were previously provided during the first audit.

The tax inspectorate does not have the right to demand that the person being inspected re-send the following documents to the Federal Tax Service:

- previously submitted to the tax authorities in the form of certified copies as part of the organization of a tax audit;

- previously sent to employees of the Federal Tax Service when the tax service conducted an on-site or desk audit of the person in question (consolidated group of taxpayers).

At the same time, current Russian laws on taxes and fees do not limit the tax authorities from sending a repeated request for the person being inspected to provide the following documents:

- relating to the work of the counterparty, previously requested from the taxpayer (tax agent, payer of the fee) during an audit of his counterparty and provided to the tax service on the basis of clause 1 of Art. 93.1 Tax Code of the Russian Federation;

- for a specific transaction, provided earlier after receiving a request from the Federal Tax Service outside the framework of tax monitoring (in accordance with clause 2 of Article 93.1 of the Tax Code of the Russian Federation);

- previously requested in connection with any other tax control measures (for example, the cashier-operator’s journal, previously provided when deregistering the cash register machine).

Court verdict: tax authorities can re-request the same documents

The Supreme Court of the Russian Federation, in Ruling No. 304-ES19-21776 dated November 25, 2019, confirmed that the tax inspectorate has the right to fine for failure to provide documents that were previously requested and presented by taxpayers.

Subject of dispute

: During a tax audit, organizations were sent a request to submit invoices. The organization had already sent all original invoices to the tax office, but they were returned to it due to the suspension of the audit. She refused to resubmit these documents and was fined under Art. 126 of the Tax Code of the Russian Federation. The fine was challenged in court.

What were they arguing about?

: 596,800 rubles.

Who did win

: tax office.

In court, the organization referred to the illegality of the tax authority repeatedly requesting documents. In her opinion, tax authorities do not have the right to demand the same documents several times, and taxpayers are not obliged to comply with such requirements. In this regard, the Federal Tax Service had no grounds to impose a fine for failure to submit documents under Art. 126 of the Tax Code of the Russian Federation.

Having considered the arguments of the parties, the Supreme Court of the Russian Federation recognized the fine as legal and the actions of the tax authorities as justified.

The Supreme Court of the Russian Federation explained that in order to hold the payer accountable for failure to submit documents under Art. 126 of the Tax Code of the Russian Federation, it is necessary that he has the requested documents and does not submit them within the prescribed period.

Tax authorities really do not have the right to request from the person being inspected documents previously submitted during desk or field tax audits (clause 5 of Article 93 of the Tax Code of the Russian Federation).

However, this restriction does not apply to cases where documents were previously submitted to the tax authority in the form of originals, which were subsequently returned to the person being inspected, as well as to cases where documents were lost by the inspectorate due to force majeure circumstances.

In a controversial case, the original invoices were returned to the taxpayer due to the suspension of the tax audit. The inspection did not make copies of the original invoices. At least the organization has not proven otherwise.

Therefore, repeated request for invoices from the organization in the case under consideration does not contradict Art. 93 Tax Code of the Russian Federation.

Since the organization had the requested documents and could submit them within the time period specified in the request, the Federal Tax Service Lawfull Fence fined it for failure to provide documents.

Repeated requests for documents cannot be left unanswered

Despite the fact that it is not necessary to submit documents that were previously requested to the tax service, taxpayers from September 3, 2022

are obliged to inform the inspectors when and to which Federal Tax Service he previously submitted the newly requested papers.

It is also necessary to provide the details of the document to which such documents were attached. Repeated requests for documents cannot be left unanswered.

The Federal Tax Service’s request must be responded to within 10 working days from the date of receipt of the request (according to paragraph 5 of Article 93 of the Tax Code of the Russian Federation as amended by Federal Law No. 302-FZ dated August 3, 2022).

When is it necessary to resubmit documents during a “counter inspection”?

Recently a company approached us with a request that at first glance seemed elementary. However, having delved into the topic, we saw that not everything is so simple. We, of course, prepared a response to the client, but the idea arose to make something like a memo on situations so that it would be easier for our readers and clients to navigate these links and transfers of the Tax Code of the Russian Federation when it comes to restrictions on requesting documents within the framework of a “counter check” "

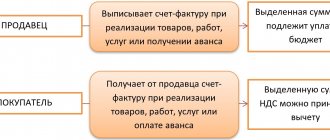

According to paragraph 1 of Art. 93.1. of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the official conducting a tax audit has the right to conduct a “counter audit” and request from the counterparty or other persons documents (information) relating to the activities of the taxpayer being audited.

Moreover, paragraph 2. Art. 93.1. The Tax Code of the Russian Federation gives the tax authority the right to request documents (information) from the taxpayer regarding a specific transaction outside the scope of the audit.

When requesting documents (information) under Art. 93.1. Tax Code of the Russian Federation, the tax authority is limited only by the period of the audit or the specific transaction indicated in the requirement.

However, in some cases, the tax authority requests such a large volume of documents that some of them may have already been requested and submitted.

At the same time, very often in practice questions arise regarding the proper interpretation of the provisions of paragraph 5 of Art. 93.1 of the Tax Code of the Russian Federation, according to which the documents requested by the tax authority are presented taking into account the provisions provided for in paragraphs. 2 and 5 tbsp. 93 Tax Code of the Russian Federation.

At the same time, in accordance with paragraph 5 of Art. 93 of the Tax Code of the Russian Federation, during a tax audit or other tax control activities, tax authorities do not have the right to request from the inspected person documents previously submitted to the tax authorities during desk or field tax audits of this inspected person (and this restriction does not apply to cases where the documents were previously were submitted to the tax authority in the form of originals, which were subsequently returned to the person being inspected, as well as in cases where the documents submitted to the tax authority were lost due to force majeure).

In this regard, we would like to consider in detail the question in which cases, when conducting a “counter audit”, a person is obliged to re-submit the requested documents to the tax authority, and when he has the right to refuse with reference to clause 5 of Art. 93.1 Tax Code of the Russian Federation.

Let's look at several independent situations one by one.

1. As part of a “counter check”, documents are requested from a person that were not previously requested by the tax authority and, accordingly, were not provided.

In this situation, if the requirement of the tax authority does not contradict other norms of the Tax Code of the Russian Federation (the documents requested by the tax authority are specified, were drawn up or executed during the audited period, on their basis the inspected taxpayer calculates and pays taxes, the tax authority does not require the preparation of calculations, and .etc.) the person is obliged to submit to the tax authority the documents (information) required by the tax authority regarding the transaction within the established time frame.

2. As part of a “counter audit”, documents are requested from a person that they previously provided to the tax authority when conducting a desk or field tax audit against this person.

In such a situation, the person is not obliged to submit the requested documents (information) to the tax authority since, in accordance with paragraph 5 of Art. 93.1. of the Tax Code of the Russian Federation, the requested documents are submitted taking into account the provisions provided for in paragraphs. 2 and 5 tbsp. 93 Tax Code of the Russian Federation. In turn, as we indicated above, in accordance with paragraph 5 of Art. 93 of the Tax Code of the Russian Federation, tax authorities do not have the right to request documents previously submitted to the tax authorities during desk or field tax audits.

Similar conclusions are contained in letters from the Ministry of Finance of the Russian Federation dated August 26, 2013 No. 03-03-07/35025 and dated February 11, 2015 No. 03-02-07/1/5991, as well as the Resolution of the Federal Antimonopoly Service of the North-Western District dated January 31, 2012 in case No. A05 -4408/2011.

3. As part of a “counter check”, documents are requested from a person that this person had previously provided to the tax authorities, but as part of another “counter check”, i.e. also in order in accordance with Art. 93.1. Tax Code of the Russian Federation.

In this situation, in our opinion, the person is also obliged to submit documents (information) to the tax authority, provided that the tax authority’s requirement does not violate other norms of the Tax Code (as we noted earlier).

This conclusion can be justified by the fact that clause 5 of Art. 93 of the Tax Code of the Russian Federation is not subject to a broad interpretation and does not apply to cases where a taxpayer submits documents as part of “counter audits” or submits documents outside the framework of a tax audit. This conclusion is also supported by the fact that in some cases the request for documents (information) under Art. 93.1. The Tax Code of the Russian Federation is carried out in pursuance of instructions from other tax authorities. In this case, the documents (information) received from the taxpayer are not stored by the tax authority, but are transferred to the inspectorate, in pursuance of whose instructions they were requested.

At the same time, such legal regulation does not exclude cases of re-request of documents previously submitted to the tax authority as part of counter-inspections of taxpayers registered with the same inspection. However, refusal to submit documents (information) in this case may result in the taxpayer being brought to tax liability under Art. 126 of the Tax Code of the Russian Federation, as well as 129.1. Tax Code of the Russian Federation.

In conclusion, I would like to note that if the tax authority refuses to re-submit documents, we recommend indicating in response to which requirement, within the framework of which activities, the taxpayer has already submitted the requested documents to the tax authority.

Common mistakes

Error:

The documents were provided by the taxpayer during a counter-inspection of the taxpayer's counterparty. He refuses to provide these documents to the Federal Tax Service again.

A comment:

Documents must be provided. See Resolution of the Eleventh AAS dated 08/05/2014 No. 11AP-10085/14.

Error:

On September 1, 2022, the taxpayer received from the Federal Tax Service a request to provide documents previously provided to inspectors. The taxpayer left the request unanswered.

A comment:

Repeated requests for documents cannot be left unanswered starting from September 3, 2022.