When to create reserves for upcoming expenses

Create a reserve if the institution is obliged to make expenses, this obligation can be estimated, but the deadline for its fulfillment and the time when it will have to be paid are uncertain (clause, GHS “Reserves”).

The terms and procedure for creating the reserve are established in the accounting policy. Consider the specifics of the institution's activities. Determine what reserves are needed, how to evaluate them, when to record them, and what 401.60 account analytics you will use.

You can create reserves for any source of financing: 1, 2, 4, 5, 7. If you decide to create a reserve for KFO 5, the balance of the unused amount of the reserve will have to be returned to the budget. An exception is if the founder decides to leave funds for the next year for the same purposes.

The institution has the right to create reserves:

- on claims, suits;

- warranty repairs;

- unprofitable contractual obligations;

- for dismantling and decommissioning of fixed assets;

- for payment of obligations for which settlement documents have not been received;

- restructuring;

- for vacation pay;

- for doubtful debts;

- to reduce the cost of inventories.

These types of reserves are listed in paragraph 6 of the GHS “Reserves”, paragraph 11 of the GHS “Income”, paragraph 32 of the GHS “Inventories”, paragraph 302.1 of the Instructions to the Unified Chart of Accounts No. 157n, letter of the Ministry of Finance dated May 20, 2015 No. 02-07-07/28998 . The procedure for accounting for reserves is in paragraphs 302.1 of the Instructions to the Unified Chart of Accounts No. 157n, letters of the Ministry of Finance dated January 14, 2016 No. 02-07-10/604, dated October 31, 2014 No. 02-07-10/55586.

Other accounting options

- There is an approach in which the estimated liability for vacations is included in other expenses, that is, it corresponds with account 91.02. If during the month the pledged amount was used and the employees went on vacation, then the reserve is transferred to other income: Debit 96.01 Credit 91.01 “Other income”.

- The excess balance of the estimated liability is reversed by accrual posting: Debit 91.02 “Other expenses” Credit 96.01.

Both approaches are legal. The company itself chooses its accounting methodology. Analytical accounting on account 96 for each employee is not maintained; amounts are entered into the program by department or in one line.

At the end of the reporting year, an inventory of reserves for upcoming expenses for vacation pay is carried out for the purpose of reconciliation and the legality of assigning amounts to the account. There is no unified form for these purposes, so it can repeat the tabular form of calculation after modification. The results of the reconciliation must be announced in the order for the enterprise and reflected in the program.

Note from the author! Until 2011, the calculation of reserves for future company expenses was carried out at will. After amendments were made to the Accounting Regulations, the reflection of contingent debts became mandatory for everyone except enterprises using the simplified system.

Reserve for claims, claims1

Calculate the reserve for claims and suits if you have received a claim for which there will be no trial, or a claim for which there will be a judicial settlement. Also, calculate the reserve if you have received a writ of execution, from which it is unclear who to pay and according to which BCC. For example, an institution has received a claim for payment of a fine, but there are no details for its transfer.

Such rules are in paragraph 11 of the GHS “Reserves”, section 2, paragraph 4.1 of the Methodological Recommendations, communicated by letter of the Ministry of Finance dated 08/05/2019 No. 02-07-07/58716. Additional clarifications are provided by the Ministry of Finance in letters dated October 19, 2018 No. 02-07-10/75145, dated October 13, 2017 No. 02-06-10/67177, dated April 22, 2016 No. 02-06-10/23392.

Example: how to calculate the reserve for claims and claims

Institution "Alfa" is overdue for payment under the contract with LLC "Master". The LLC went to court. The trial will take place in 2020. In 2022, the institution's lawyer assessed with a high degree of probability that the court decision would not be in favor of the institution. The Alpha accountant calculated that the payment to Master LLC would be:

- 1700 rub. – fines;

- 200 rub. – legal costs of Master LLC.

The accountant calculated the amount of this reserve for claims and claims for 2022: 1,700 rubles. + 200 rub. = 1900 rub.

Keep records of the reserve for claims and suits in account 401.60 “Reserves for future expenses.” Use a separate analytics code, such as invoice 401.62. Indicate in your accounting policy that this account is used to reserve for claims and claims.

Take the reserve into account in the full amount of claims and claims, taking into account expert opinion. In case of pre-trial settlement, reflect the reserve on the date of receipt of the claim. If there is no pre-trial settlement - on the date of notification of the claim. This is discussed in paragraph 11 of the GHS “Reserves”.

For claims and suits that are brought against a public legal entity and are subject to satisfaction at the expense of the treasury, recognize the reserve in accounting in two cases:

- Pre-trial settlement of the claims is expected;

- there are grounds for appealing the judicial act.

If these conditions are not met, reflect the obligation under a judicial act - an executive document - in accounting. Do not recognize the reserve in accounting. This is stated in paragraph 12 of the GHS “Reserves”.

The entries for how to account for the reserve for claims and claims depend on the type of institution.

In the accounting of government institutions:

The postings are contained in paragraphs 124.1–124.2, 141.2 of Instruction No. 162n.

| Contents of operation | Debit | Credit |

| A reserve has been created for claims and lawsuits | KRB.1.401.20.29Х | KRB.1.401.62.29Х |

| A deferred liability has been accepted for the amount of the created reserve | KRB.1.501.93.29Х | KRB.1.502.99.29Х |

| Accrued expenses for the used reserve: | ||

| for settlements with suppliers and contractors | KRB.1.401.62.29Х | KRB.1.302.9Х.73Х |

| for payment of other taxes and payments | KRB.1.303.05.731 | |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | KRB.1.501.13.29Х | KRB.1.501.93.29Х |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | KRB.1.502.99.29Х | KRB.1.502.11.29Х |

| See how to detail KOSGU 290 article in terms of claim requirements and apply the detailing of KOSGU 730 codes. | ||

In accounting for budgetary institutions:

The postings are contained in paragraphs 160.1, 167 of Instruction No. 174n.

| Contents of operation | Debit | Credit |

| A reserve has been created for claims and lawsuits | 0.401.20.29Х | 0.401.62.29Х |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.29Х | 0.502.99.29Х |

| Accrued expenses for the used reserve: | ||

| for settlements with suppliers and contractors | 0.401.62.29Х | 0.302.9Х.73Х |

| for payment of other taxes and payments | 0.303.05.731 | |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.29Х | 0.501.93.29Х |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.29Х | 0.502.11.29Х |

| See how to detail KOSGU 290 article in terms of claim requirements and apply the detailing of KOSGU 730 codes. | ||

In the accounting of autonomous institutions:

The postings are contained in paragraphs 189, 196 of Instruction No. 183n.

| Contents of operation | Debit | Credit |

| A reserve has been created for claims and lawsuits | 0.401.20.29Х | 0.401.62.29Х |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.29Х | 0.502.99.29Х |

| Accrued expenses for the used reserve: | ||

| for settlements with suppliers and contractors | 0.401.62.29Х | 0.302.9Х.73Х |

| for payment of other taxes and payments | 0.303.05.731 | |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.29Х | 0.501.93.29Х |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.29Х | 0.502.11.29Х |

| See how to detail KOSGU 290 article in terms of claim requirements and apply the detailing of KOSGU 730 codes. | ||

What are contingent debts in accounting?

To understand what expenses can be taken into account in this account, you need to study PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”.

Note from the author! As the name of the document suggests, debts that exist conditionally will be assessed. That is, no one will provide a certificate of completion of work or a delivery note for them. The accountant must himself or with the help of experts evaluate liabilities and assets from the point of view of future consequences.

In accounting, account 96 is classified as active-passive. This means that it can reflect both property (assets) and sources of income (liabilities) at the same time.

Reserves for future expenses include:

- costs of paying vacation pay to employees;

- estimated liabilities for loans issued;

- contingent debts in court cases;

- warranty service and repair.

Warranty repair reserve1

The procedure for calculating the reserve for warranty repairs is established in the accounting policy. Create a reserve if the institution sells goods, work, or services for which it provides a guarantee for repairs or routine maintenance. At the same time, the contract with the customer must indicate a condition regarding this and the cases when repairs will be provided. Calculate the reserve on the date when you transfer work, services, goods to the buyer.

Such rules are in paragraphs, GHS “Reserves”, sections, 4.3 of the Methodological Recommendations, communicated by letter of the Ministry of Finance dated 08/05/2019 No. 02-07-07/58716.

Example: how to calculate the reserve for warranty repairs

The educational workshop of the budgetary institution "Alpha" has been producing furniture (desks, chairs) for four years. The warranty on finished products is six months.

In the accounting policy, the accountant established that the calculation of the reserve for warranty repairs is made on the date of sale of furniture. The amount of the reserve depends on the reserve limit ratio and revenue for the period in which the expense was incurred.

On November 30, 2022, the institution entered into an agreement with the budgetary institution “Youth Sports School” for the supply of furniture in the amount of 110,000 rubles. The accountant calculated the reserve limit ratio. This indicator determines the quality of manufactured products and affects the amount of reserve.

To make the calculation, the accountant took the amount of revenue from sales of products and the amount of expenses for warranty repairs for the last three years preceding the date of sale of the goods:

| Year | Revenue from sales of finished products | Costs for warranty repairs of sold furniture | The maximum amount of the reserve for the fourth quarter (group 4 = group 3 : group 2) |

| 1 | 2 | 3 | 4 |

| 2017 | 150 000,00 | 30 000,00 | 0,076 |

| 2018 | 280 000,00 | 15 000,00 | |

| 2019 | 320 000,00 | 12 000,00 | |

| Total for three years | 750 000,00 | 57 000,00 |

The reserve limit ratio was 0.076. To create a reserve in the fourth quarter of 2022, the accountant took the proceeds from the sale of furniture for the fourth quarter of 2022 - 110,000 rubles.

The amount of the reserve for warranty repairs will be 8,360 rubles. (RUB 110,000 × 0.076).

Keep records of reserve amounts for warranty repairs in account 401.60 with additional analytics, for example, 401.63. The entries for how to create and use reserves depend on the type of institution.

In the accounting of government institutions:

The postings are contained in paragraphs 124.1–124.2, 141.2 of Instruction No. 162n.

| Contents of operation | Debit | Credit |

| A reserve has been created for warranty repairs | KRB.1.401.20.22Х | KRB.1.401.63.22Х |

| A deferred liability has been accepted for the amount of the created reserve | KRB.1.501.93.22Х | KRB.1.502.99.22Х |

| Accrued expenses for the used reserve | KRB.1.401.63.22Х | KRB.1.302.9Х.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | KRB.1.501.13.22Х | KRB.1.501.93.22Х |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | KRB.1.502.99.22Х | KRB.1.502.11.22Х |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

In accounting for budgetary institutions:

The postings are contained in paragraphs 160.1, 167 of Instruction No. 174n.

| Contents of operation | Debit | Credit |

| A reserve has been created for warranty repairs | 0.401.20.22Х | 0.401.63.22Х |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.22Х | 0.502.99.22Х |

| Accrued expenses for the used reserve | 0.401.63.22Х | 0.302.9Х.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.22Х | 0.501.93.22Х |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.22Х | 0.502.11.22Х |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

In the accounting of autonomous institutions:

The postings are contained in paragraphs 189, 196 of Instruction No. 183n.

| Contents of operation | Debit | Credit |

| A reserve has been created for warranty repairs | 0.401.20.22Х | 0.401.63.22Х |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.22Х | 0.502.99.22Х |

| Accrued expenses for the used reserve | 0.401.63.22Х | 0.302.9Х.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.22Х | 0.501.93.22Х |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.22Х | 0.502.11.22Х |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

Formation goals

The only reason that forces the formation of a RPR in a manufacturing company is the need to work continuously and efficiently. A guarantee of continued activity is the availability of cash equivalent to cover expenses and losses. The accounting definition of reserving is the premature recognition of an expense item that will become such in the future.

Savings in this direction can be divided as:

- upcoming expenses;

- changes in estimates;

- conditional facts of management.

The purpose and essence of the first point is aimed at creating an account with a uniform accumulation of costs, which leads to an increase in active and passive balance sheet sections, but only for intermediate reports. In certain cases, the annual balance will show the amounts reset to zero; they will be equalized by the accrued reserve and the actual costs incurred by this item.

RPRs are formed by a reasonable economic calculation and decision of the enterprise, therefore this fact is indicated by its accounting policies. Such a reserve of funds is accumulated and spent in one financial year; it has no carryover balances, unlike repair funds, the formation of which is provided for 5 years.

Provision for unprofitable contractual obligations1

Calculate the reserve for unprofitable contractual obligations as the difference between the costs of fulfilling the contract and the proceeds from it. The basis for the calculation is a financial and economic justification for the unprofitability of further execution of the contract when the costs of its execution exceed the income under this agreement.

Calculate the reserve only if the terms of the contract have changed due to reasons beyond the control of the institution. For contracts that the institution can terminate unilaterally without penalties, do not create a reserve for unprofitable contractual obligations. Such rules are in paragraph 14 of the GHS “Reserves”, section 2, paragraph 4.4 of the Methodological Recommendations, communicated by letter of the Ministry of Finance dated 08/05/2019 No. 02-07-07/58716.

Example: how to calculate provisions for unprofitable contractual obligations

The institution entered into an agreement for the supply of manufactured products. The institution’s specialists estimated that production of the product would cost 450,000 rubles. The contract price is set at RUB 500,000.

During the production process, prices for materials increased; production costs will amount to 550,000 rubles. The fine for early termination of the contract is RUB 80,000.

The institution recognizes the contract as obviously unprofitable, since the costs of it exceed the expected income, and in order to terminate it, you will have to pay a fine.

The accountant calculated the amount of the reserve:

500,000 rub. – 550,000 rub. = 50,000 rub.

The provision is recognized in the lesser amount of the loss. Therefore, the accountant accepted a reserve in the amount of 50,000 rubles.

Keep records of reserve amounts for unprofitable contractual obligations in account 401.60 with additional analytics, for example, 401.64. The entries for how to create and use reserves depend on the type of institution.

In the accounting of government institutions:

The postings are contained in paragraphs 124.1–124.2, 141.2 of Instruction No. 162n.

| Contents of operation | Debit | Credit |

| A reserve has been created for unprofitable contractual obligations | KRB.1.401.20.2ХХ | KRB.1.401.64.2ХХ |

| A deferred liability has been accepted for the amount of the created reserve | KRB.1.501.93.2ХХ | KRB.1.502.99.2ХХ |

| Accrued expenses for the used reserve | KRB.1.401.64.2ХХ | KRB.1.302.ХХ.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | KRB.1.501.13.2ХХ | KRB.1.501.93.2ХХ |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | KRB.1.502.99.2ХХ | KRB.1.502.11.2ХХ |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

In accounting for budgetary institutions:

The postings are contained in paragraphs 160.1, 167 of Instruction No. 174n.

| Contents of operation | Debit | Credit |

| A reserve has been created for unprofitable contractual obligations | 0.401.20.2ХХ | 0.401.64.2ХХ |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.2ХХ | 0.502.99.2ХХ |

| Accrued expenses for the used reserve | 0.401.64.2ХХ | 0.302.ХХ.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.2ХХ | 0.501.93.2ХХ |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.2ХХ | 0.502.11.2ХХ |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

In the accounting of autonomous institutions:

The postings are contained in paragraphs 189, 196 of Instruction No. 183n.

| Contents of operation | Debit | Credit |

| A reserve has been created for unprofitable contractual obligations | 0.401.20.2ХХ | 0.401.64.2ХХ |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.2ХХ | 0.502.99.2ХХ |

| Accrued expenses for the used reserve | 0.401.64.2ХХ | 0.302.9Х.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.2ХХ | 0.501.93.2ХХ |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.2ХХ | 0.502.11.2ХХ |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

New PBU 8/2010 on estimated liabilities

The new PBU regulates the accounting procedure for estimated liabilities, as well as contingent liabilities and assets. (!) PBU 8/2010 does not apply to contracts under which at least one party has not fully fulfilled its obligations as of the reporting date, with the exception of obviously unprofitable contracts (Subclause “a”, clause 2 of PBU 8/2010). A deliberately unprofitable contract is such a contract, the inevitable costs of execution of which exceed the proceeds from it, and refusal of the contract entails the payment of significant sanctions. For example, revenue under a contract is 1,000,000 rubles. It was assumed that the cost of executing the contract would be 800,000 rubles. However, due to rising prices for raw materials, production costs increased to 1,200,000 rubles. Loss from execution of the contract - 200,000 rubles. If the sanctions for terminating the contract exceed the loss from its execution, for example, amount to 300,000 rubles, such a contract is obviously unprofitable (Examples 5, 6 from Appendix No. 1 to PBU 8/2010). When an organization decides not to cancel such an agreement, an estimated liability in the amount of loss from its execution must be recognized in accounting. The question arises: can a contract be called obviously unprofitable if there are sanctions for refusing to perform the contract, but they are less than the loss from the execution of the contract itself? The Ministry of Finance answered this question.

From authoritative sources Igor Robertovich Sukharev, Head of the Accounting and Reporting Methodology Department of the Department for Regulation of State Financial Control, Auditing, Accounting and Reporting of the Ministry of Finance of the Russian Federation “Even if the sanctions for refusal of a contract are less than the amount of losses from its execution, the contract can be considered deliberately unprofitable."

(!) Also, PBU 8/2010 does not apply to: - reserve capital and reserves formed from retained earnings (Subclause “b”, clause 2 of PBU 8/2010); — estimated reserves (Subclause “c” of clause 2 of PBU 8/2010), that is, reserves for the depreciation of financial investments, inventories; — reserve for doubtful debts; — amounts that affect the amount of income tax payable in the following reporting periods (Subclause “d”, paragraph 2 of PBU 8/2010), that is, the amounts of deferred tax assets and liabilities.

Attention! Provisions for contingent liabilities cannot be created in accounting.

Contingent liabilities and assets

Contingent liabilities or assets are determined by any past events in the economic life of the organization, but they always arise as a result of the occurrence (or non-occurrence) of some event beyond the control of the organization (Clause 9, 13 PBU 8/2010). There is no need to reflect contingent liabilities and assets in accounting (Clause 14 of PBU 8/2010). Information about contingent liabilities and assets must be disclosed only in the explanatory note to the financial statements. This is due to the conditionality of the liability or asset. That is, with the fact that at the reporting date the organization cannot (Clause 9 of PBU 8/2010): - determine whether this asset or liability exists; — make a reasonable estimate of the asset or liability; - be sure that the fulfillment of the obligation will lead to a decrease in its economic benefits, and the asset will lead to their increase. But as soon as the organization decides that the obligation still exists and is able to evaluate it, it will meet the conditions for recognizing an estimated liability, which must be shown in accounting and reporting. An example of a contingent obligation may be the obligation to pay interest for the use of someone else’s funds (Article 395 of the Civil Code of the Russian Federation) if the organization is late in paying under the contract. After all, despite the fact that the organization was late, the counterparty may not make a demand for payment of these interests. Many accountants are confused by the fact that in the new form of the balance sheet in Sec. IV “Long-term liabilities” is the line “Reserves for contingent liabilities”. The appearance of such a line contradicts the rules of PBU 8/2010. And, of course, the PBU rules are more important in this case. Reserves according to PBU 8/2010 cannot be created against contingent liabilities. They can be created only for estimated obligations. Which is what we'll talk about next.

Estimated liabilities

An estimated liability, like a contingent liability, is a consequence of the organization's past activities . This is an obligation with an uncertain amount or deadline that arises (Clause 4 of PBU 8/2010): - from the norms of legislation (in particular, such obligations include fines that an organization will have to pay in case of violation of tax or administrative legislation. They can also include include payment of vacation pay to employees); — from court decisions (for example, the obligation to compensate losses to a person to whom the organization caused harm); — from previously concluded contracts (for example, contractual penalties for late delivery); - from statements of the organization itself (for example, obligations for warranty repairs, when the law does not oblige the provision of guarantees). Such an obligation must be reflected in accounting in account 96 “Reserves for future expenses” (Clause 8 of PBU 8/2010), if: - the organization has an obligation to third parties, the fulfillment of which cannot be avoided. Even if there is doubt that an obligation exists at all, a provision must be recognized if the probability of its existence is at least 50%; — as a result of fulfilling this obligation, the organization is likely to have a decrease in economic benefits; — it can be reasonably assessed. The estimated costs of fulfilling estimated obligations must be determined for each obligation separately. Sometimes this can be done for a set of homogeneous obligations, for example, for guarantees provided for one type of product (Example 3 from Appendix 2 to PBU 8/2010). But the Ministry of Finance told us in what amount to recognize an estimated liability under an obviously unprofitable contract, when the sanctions for its termination are less than the loss from its execution.

From authoritative sources Sukharev I.R., Ministry of Finance of Russia “Until the organization has made a decision whether it will refuse an obviously unprofitable contract or not, the estimated liability is recognized for the lesser of the amounts - either sanctions for refusal to perform the contract, or the loss that will be received during its execution."

Some provisions for future expenses are now estimated liabilities

As you can see, expenses for warranty repairs, expenses for paying vacation pay and employee benefits at the end of the year fit very well into the definition of an estimated liability. This means that you will simply take into account such reserves as estimated liabilities in the same account 96 “Reserves for future expenses”. This was confirmed to us by the Ministry of Finance.

From authoritative sources Sukharev I.R., Ministry of Finance of Russia “In connection with the release of PBU 8/2010 on estimated liabilities and amendments to Order No. 34n, organizations no longer have the right to choose whether to create this or that reserve. They are either obliged to create a specific reserve, or, conversely, do not have the right to create it. Obligations to pay for vacations are, of course, estimated liabilities. After all, the right to paid leave arises as the employee works for the organization. This means that an organization can calculate what obligations it has to pay vacation pay as of the reporting date. The same applies to the reserve for warranty repairs. We are obliged to recognize obligations under issued guarantees at the time of sale of the goods.”

You will have to say goodbye to the reserve for repairs of fixed assets

But the reserve for expenses for upcoming repairs of fixed assets does not qualify for the estimated liability. The organization does not and cannot have any obligations to carry out repairs of its own operating systems to third parties (Clause 4 of PBU 8/2010). In principle, instead of repairing the OS, an organization can buy a new one. So the cost of repairing fixed assets can be avoided. In the commentary to account 96 “Reserves for future expenses” of the Instructions for using the Chart of Accounts, expenses in the form of deductions to this reserve are still mentioned. However, the Chart of Accounts and Instructions for its use are technical documents. They only regulate the technical side of the implementation of the rules and accounting methods established in PBU and other regulatory acts on accounting. Therefore, you will have to say goodbye to the reserve for OS repairs in accounting. The Ministry of Finance thinks so too.

From authoritative sources Sukharev I.R., Ministry of Finance of Russia “Ordinary repairs of fixed assets are not among the organization’s obligations, therefore a reserve for it is not created. It cannot be taken into account as an estimated liability. And now there are no other grounds for its creation in accounting.”

If you have reserved amounts for OS repairs, now you will have to restore them, writing them off as other income in the first quarter of 2011. However, in tax accounting, a reserve for OS repairs can still be created (Article 260 of the Tax Code of the Russian Federation). This means that if you make such a decision, you will have to reflect the differences according to PBU 18/02.

We reflect estimated liabilities in reporting

To reflect reserves for short-term estimated liabilities in Sec. V “Short-term liabilities” of the new balance sheet form includes the line “Reserves for future expenses”. If your estimated liabilities are long-term, then the amounts reserved for them should be reflected in section. IV “Long-term liabilities”.

Small businesses decide for themselves whether they need PBU 8/2010

Small enterprises may not apply PBU 8/2010 (unless they issue publicly offered securities, which is unlikely) (Clause 3 of PBU 8/2010). But it turns out that then they will have to refuse to create reserves for upcoming expenses.

Provision for dismantling fixed assets 1

Calculate the reserve for dismantling and decommissioning of fixed assets if two conditions are met. First, the institution will pay for the disassembly and disposal of the fixed asset. Secondly, the area where the object was located will need to be restored, for example, garbage removed, grass planted.

Calculate the reserve on the date of acceptance for accounting of the fixed asset item for which you are planning costs. Reason for calculating the reserve: the obligation to dismantle is specified in the contract.

For example, when decommissioning a fixed asset object, the institution is obliged to dismantle it and restore the site on which this object was located. Such rules are in paragraph 15 of the GHS “Reserves”, section 2 of the Methodological Recommendations, communicated by letter of the Ministry of Finance dated 08/05/2019 No. 02-07-07/58716.

Example: how to calculate the reserve for dismantling and decommissioning of fixed assets

The institution conducts military training. For this purpose, it builds summer houses on the territory of the sanatorium. Commissioning and acceptance for accounting - June 1. The terms of the agreement stipulate that at the end of the training camp, the houses must be demolished and the area landscaped. The cost of such work will be 200,000 rubles, which is confirmed by an expert’s opinion.

On June 1, the accountant accepted the objects for accounting and calculates the reserve in the amount of planned expenses for dismantling and restoring the site - 200,000 rubles.

Keep records of reserve amounts for dismantling and decommissioning of fixed assets in account 401.60 with additional analytics, for example, 401.65. Along with the reserve, take into account future expenses for dismantling and decommissioning of the operating system as part of non-financial assets. The entries for how to create and use reserves depend on the type of institution.

In the accounting of government institutions:

The postings are contained in paragraphs 124.1–124.2, 141.2 of Instruction No. 162n.

| Contents of operation | Debit | Credit |

| A reserve has been created for the dismantling and decommissioning of fixed assets | KRB.1.401.20.2ХХ | KRB.1.401.65.2ХХ |

| A deferred liability has been accepted for the amount of the created reserve | KRB.1.501.93.2ХХ | KRB.1.502.99.2ХХ |

| Future expenses for dismantling and decommissioning of fixed assets are reflected | KRB.106.ХХ.310 | KRB.1.401.60.310 |

| Accrued expenses for the used reserve | KRB.1.401.65.2ХХ | KRB.1.302.ХХ.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | KRB.1.501.13.2ХХ | KRB.1.501.93.2ХХ |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | KRB.1.502.99.2ХХ | KRB.1.502.11.2ХХ |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

In accounting for budgetary institutions:

The postings are contained in paragraphs 160.1, 167 of Instruction No. 174n.

| Contents of operation | Debit | Credit |

| A reserve has been created for the dismantling and decommissioning of fixed assets | 0.401.20.2ХХ | 0.401.64.2ХХ |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.2ХХ | 0.502.99.2ХХ |

| Future expenses for dismantling and decommissioning of fixed assets are reflected | 0.106.ХХ.310 | 0.401.60.310 |

| Accrued expenses for the used reserve | 0.401.64.2ХХ | 0.302.ХХ.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.2ХХ | 0.501.93.2ХХ |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.2ХХ | 0.502.11.2ХХ |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

In the accounting of autonomous institutions:

The postings are contained in paragraphs 189, 196 of Instruction No. 183n.

| Contents of operation | Debit | Credit |

| A reserve has been created for the dismantling and decommissioning of fixed assets | 0.401.20.2ХХ | 0.401.64.2ХХ |

| A deferred liability has been accepted for the amount of the created reserve | 0.501.93.2ХХ | 0.502.99.2ХХ |

| Future expenses for dismantling and decommissioning of fixed assets are reflected | 0.106.ХХ.310 | 0.401.60.310 |

| Accrued expenses for the used reserve | 0.401.64.2ХХ | 0.302.9Х.73Х |

| Expenditure obligations are reflected in the accounting at the expense of the previously created reserve for payment of obligations | 0.501.13.2ХХ | 0.501.93.2ХХ |

| Previously recorded deferred liabilities were reduced using the “Red reversal” method | 0.502.99.2ХХ | 0.502.11.2ХХ |

| See how to detail KOSGU codes by expenses and apply detailing of KOSGU codes 730. | ||

Reserve for payment of obligations for which there are no documents1

Calculate the reserve for unreceived documents based on outstanding payments. Use agreements, contracts and other documents according to which you post expenses in the next period: month, quarter, year. The timing of when to create a reserve is fixed in the accounting policy.

This reserve is relevant if services were provided on the last date of the current month, and you pay for them in the next month. For example, you can calculate it quarterly to avoid the occurrence of events after the reporting date during the submission of financial statements. Such rules are in paragraph 302.1 of the Instructions to the Unified Chart of Accounts No. 157n and the letter of the Ministry of Finance dated May 20, 2015 No. 02-07-07/28998.

Example: how to calculate the reserve for payment of obligations for which settlement documents have not been received

According to the agreement between Alfa and Intersvyaz LLC, payment for Internet services is made on the 2nd day of each month in the amount of 2,500 rubles. using funds from income-generating activities.

In the accounting policy, the chief accountant stated that the reserve for payment of obligations for which settlement documents have not been received is formed quarterly.

The actual services rendered for December 2022 amounted to 2,550 rubles; the invoice for services rendered in December 2022 will be received in January 2022. The accountant has accrued a reserve for payment of obligations in the amount of services actually rendered. The money to pay for services in 2020 remains in the institution’s personal account.

The accountant will accrue the creditor on account 302.21 after receiving the documents - in 2022. Therefore, accounts payable are not reflected in the financial statements.

Keep account of the reserve in account 401.60 with additional analytics, for example, in account 401.66. Postings for accounting for reserves for documents not received depend on the type of institution and the type of expense. For example, if you are calculating a reserve for communication services, reflect its amount in the debit of account 401.21, if for transportation expenses - 401.22. See wiring for:

- government institutions;

- budgetary institutions;

- autonomous institutions.

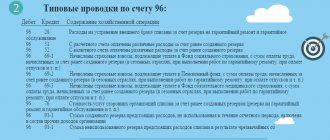

Postings and correspondence

Funds that have passed through documentary evidence, reflected in the credit of account 96 as created savings for future expenses, correspond in debit with registers intended to account for the production and sale of goods.

It looks like this: Dt 20, 51, 70, 91, 99 Kt 96.

Everything that is spent from the RPR is reflected in the invoice receipts, and is written off as production costs in accordance with the accounts that are intended to correspond with them.

Using typical transactions as an example, we can imagine the following operations:

- Dt 96 Kt 70 – reflection of the reserve amount for accrual of vacations;

- Dt 96 Kt 69 – accrued value for social payments;

- Dt 96 Kt 76 – write-offs from the reserve for repairs of warranty mechanisms;

- Dt 96 Kt 91 - unused funds are transferred to other income;

- Dt 08 Kt 96 - reserve of money for investments in non-current assets used for construction;

- Dt 20 Kt 96 - estimated amount for costs required for auxiliary production;

- Dt 25 Kt 96 – reserve of funds required for general economic tasks;

- Dt 44 Kt 96 – sales expenses.

From accounting practice, several examples can be identified with the necessary calculations.

The accounting policy of November LLC reflected the need for reserve education in order to pay for vacation, the basis is payment for labor. The calculator makes the accrual on a monthly basis. The calculation is performed according to the formula:

(health + insurance) / 28 * 2.33, where

- OZ - total earnings;

- 28 – vacation days assigned to each person under the contract;

- 2.33 – this value expresses vacation in each month worked;

- 30.2% - this interest rate belongs to insurance premiums;

- January labor was paid in the amount of 300,000 rubles;

- for calculation they put a digital designation: (300,000 + 90600) / 28 * 2.33;

- LLC "Noyabr" created a reserve amount to pay for January holidays, equal to 32,503 rubles.

The entries in the accounting documentation of this enterprise will be reflected as follows: Dt 20 Kt 96 - 32,503 rubles.

In another case, the obligation of individual entrepreneur “Zima” is presented, which repairs sold products on the basis of an annual warranty.

The accountant analyzed the products sold and revealed:

- repairs require sold goods in the amount of 10%;

- Products should be replaced – 5%;

- the price for repairing one mechanism is 880 rubles;

- it was calculated how much is spent on average on replacing items - 5,000 rubles;

- In 2022, according to the plan, 7,000 commercial products will be produced.

The reserve from the calculation will be determined:

(7000 * 10% / 100% * 880) + (7000 * 5% / 100% * 5000) = RUB 2,366,000.

Monthly charges are equal to the amount:

Restructuring reserve1

Calculate the restructuring reserve if the institution changes its activities or is liquidated. The basis for calculating the reserve is a business restructuring plan with a restructuring period of at least four years, starting from the year for which the last financial statements were prepared.

Calculate the reserve in the amount of expenses for implementing restructuring measures. However, do not include expenses for current activities in the calculation. For example, do not include marketing costs, administrative costs, or salaries of employees who will work as usual. Such rules are in paragraph 13 of the GHS “Reserves”, section 2, paragraph 4.2 of the Methodological Recommendations, communicated by letter of the Ministry of Finance dated 08/05/2019 No. 02-07-07/58716.

Determine how much cash will be needed to carry out restructuring activities. For example, payment of severance pay in case of staff reduction, moving expenses, compensation of average earnings for those laid off during two months of reduction. See how to calculate severance pay, average earnings for the period of employment and compensation upon dismissal.

Example: how to calculate the restructuring reserve

The founder decided to change the type of his subordinate institution from budgetary to autonomous. The restructuring plan sets a transition period of 3 months. The accountant of the subordinate institution calculated the planned payments:

- for severance pay, including vacation compensation upon dismissal, in the amount of RUB 1,800,000;

- average earnings for the period of employment – 350,000 rubles;

- payment for the Internet – in the amount of 1500 rubles.

The institution will not bear any other expenses. The accountant of a subordinate institution calculated the reserve for restructuring:

RUB 1,800,000 + 350,000 rub. + 1500 rub. = 2,151,500 rub.

The accountant reflected the reserve in accounting by type of payment.

Keep account of the reserve in account 401.60 with additional analytics, for example, account 401.67. Take into account the earliest of dates: the date of announcement of restructuring or the date of commencement of implementation of restructuring measures.

The entries for how to take into account the restructuring reserve depend on the type of institution and the type of payment: salary, insurance premiums, other expenses. See wiring for:

- government institutions;

- budgetary institutions;

- autonomous institutions.

Provision for doubtful debts 1

Calculate the reserve for doubtful debts if the institution has doubtful accounts receivable. See how to recognize receivables as doubtful. Create a reserve for the amount that you record in off-balance sheet account 04. Additionally, there is no need to record the reserve on balance sheet accounts. Read more about how to keep records on off-balance sheet account 04.

The rules for calculating the reserve are established in paragraph 11 of the GHS “Revenue”. See more details on how to reflect the provision for doubtful debts.

Provision for impairment of inventory value1

Create a reserve for reduction in cost if you use the “Goods” and “Finished products, biological products” accounts. Calculate the reserve as the difference between the sales price and the book value of inventories. The main condition for the calculation is that the book value of inventories is higher than the standard-plan value and is included in the financial result of the current period.

The rules for calculating the reserve are established in paragraph 32 of the GHS “Inventories”, paragraph 5 of the Methodological Recommendations, which were communicated by the Ministry of Finance by letter dated 08/01/2019 No. 02-07-07/58075. See in more detail how to take into account and calculate the reserve for reduction in the value of inventories.

Irtaeva E.P.