2021-12-13 3891

Distribution of assets and liabilities into short-term and long-term - how important is this? This question haunts many accountants, financial managers and managers when preparing and analyzing financial and management reporting. In the case of managers, if they blindly believe the reporting, such a question does not arise. But personally, I always stick to the rule of “trust but verify,” especially in business where critical thinking is important.

In the material we will analyze whether it is necessary to report assets and liabilities according to the timing of their receipt and payment, whether such distribution is important and what reporting indicators can be potentially distorted if this is not done.

What are these - short-term liabilities on the balance sheet

Liabilities reflected in the balance sheet are recognized as short-term if their maturity period is more than 1 year (counting starts from the reporting date). These include accounts payable to:

Take our proprietary course on choosing stocks on the stock market → training course

- lenders, creditors;

- extra-budgetary funds and budget;

- founders of the enterprise;

- employees of the organization;

- consumers (debts on advance payments received);

- suppliers (goods, works, services).

Important! In addition to the types of accounts payable listed above, the company's short-term liabilities also include reserves for future expenses.

Debts with a short repayment period include the following components:

- debts with a maturity of no more than 1 year;

- conditional payment;

- loans on bills of exchange that must be repaid in less than a year;

- money borrowed for a long time, but part of which is required to be paid back within 12 months;

- dividends to shareholders;

- accounts payable;

- tax payments;

- lost income;

- deposits for a period of up to 1 year, subject to return;

- borrowed funds on demand.

Important! Taxes are always included in the structure of current liabilities. Tax deductions include all types of payments to the budget.

Let's consider the features that characterize short-term liabilities of enterprises:

- The total amount of debt financing significantly affects the duration of the company's production cycle. The more short-term liabilities on a company's balance sheet, the less funds it is willing to raise to pay for current expenses in the course of business activities.

- The amount of debt with a short maturity is difficult to estimate in the long term, since it is not possible to accurately calculate the amount underlying the debt obligations.

- Debts with a maturity of up to 1 year serve as a substitute for a free source of debt financing.

- The volume of short-term debts varies depending on the frequency of payments on them, and this allows you to quickly work with sources of financing during business.

- The total volume of debt obligations is often determined by the degree of success in the sale of the goods produced by the company. A company that operates actively spends money all the time and attracts new borrowed funds.

- Sometimes debts with a payment term of up to 1 year can be paid using current assets. This money is required to carry out operational activities, and in order to use it to pay off short-term debts, it must be returned to circulation within 1 year from the moment the debt was formed.

- Short-term debts in the Balance Sheet are Liabilities.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Transition to long-term debt

Russia differs from the generally accepted international system called IAS, so the concept of balance is “blurred”. According to the rules of the domestic system, all debts must be processed within a specific reporting period; the Russian legislative framework does not provide for the availability of the necessary monetary capital to pay debts.

Due to economic instability in the country and constant crises, a decision was made to transfer short-term debts to subsequent reporting periods.

In the process of converting short-term debt into long-term debt, it is necessary to follow the established sequence of actions. The transition occurs on the basis of an additional agreement on the extension of the contract, which was signed with the organization that issued the loan. This additional agreement to the contract is drawn up in two copies. After this, the payment schedule is updated. During the transition, the debt is transferred from line 66 to line 77, and the loan from line 51 to line 52.

The transition from short-term accounts payable to long-term ones can be carried out not by mutual agreement of the two parties, but by a court decision, but only if the organization that borrowed the money went to court and declared itself insolvent. If the debtor client does not have any property or material assets, the creditor is not able to carry out collection. After this, the debt is restructured and the permissible payment period is increased by exactly five years.

The composition and rules for assessing receivables and payables in accounting and reporting - on video:

Short-term liabilities on the balance sheet: varieties

Debts with a short repayment period can be divided into 3 groups:

| Type of short-term liabilities | Details |

| Debts that must be paid within 1 year | The 12 month count starts from the date of reporting. |

| Operating | This may include: - tax payments, - advances received, - current payments to the budget, - rental payments, - advances paid, - debts for materials received for production activities, — accrued wages to staff (not yet paid). |

| Money to pay off debts with a repayment period of up to 1 year | This group includes: — staff vacation payments, - bonuses to salaries, - other short-term debts. |

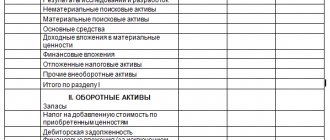

Formation of indicators according to the lines of section V of the liabilities side of the balance sheet

The obligations of the enterprise are listed in 2 sections of the Liabilities of the Balance Sheet. The company's borrowed capital, which requires quick repayment (maximum 12 months from the date of inclusion in Liability), belongs to Section V. Let's break it down line by line:

| Line of section V “Current liabilities” of the balance sheet | Line Formation |

| 1510 "Borrowed funds" | Credit balance account 66 “Settlements on short-term loans and borrowings.” Part of the amounts from the loan account 67 “Settlements for long-term loans and borrowings” (only in the part that must be repaid within the next 1 year). |

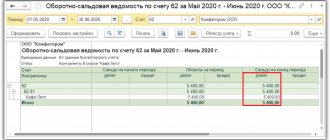

| 1520 "Accounts payable" | The company has the right to split this line into several clarifying lines, for example: “Short-term debt to the budget”, “...suppliers”, “...employees”, etc. The total amount of short-term debts of all types (to the budget, extra-budgetary funds, individuals and legal entities). This is the sum of the credit balances of nine accounts in terms of “short” debts: 60, 62 (only in terms of short-term accounts payable for prepayments and advances received), 68-71, 73, 75 (account 2), 76. |

| 1530 "Revenue of the future periods" | To be completed only if the recognition of this accounting object is provided for by the accounting regulations of the enterprise. For commercial companies: the sum of credit balances account 98 and account 86. |

| 1540 “Estimated Liabilities” | Credit balance account 96 (except for long-term debts). |

| 1550 “Other obligations” | Other short-term debts that were not mentioned elsewhere in Section V. |

| 1500 “Total for Section V” | Sum of lines 1510-1550 (total volume of company loans). |

Important! In order to detail the indicator on line 1520, the company has the right to add decoding lines, because Accounting rules allow independent approval of details for financial reporting items.

So, the algorithm for calculating the above indicators is presented below:

| Index | Line code | Calculation formula |

| Borrowed funds | 1510 | K66+K67 (only debts with a maturity of up to 1 year) |

| Accounts payable | 1520 | K60+K62+K68+K69+K70+K71+K73+K75+K76 (only debts with a maturity of up to a year, less VAT taken into account on advances received and issued) |

| revenue of the future periods | 1530 | K98 |

| Estimated liabilities | 1540 | K96 (only estimated liabilities with fulfillment up to 1 year) |

| Other obligations | 1550 | K86 (except for long-term debts) |

Maximum permissible period for repayment of short-term debt

Repayment of this debt during the current activities of companies is often carried out from the income available or in circulation of the company. The time for closing debts is determined by the legislation of the country or is negotiated and prescribed when signing the contract.

Debt repayment

In accordance with the current provisions of the legislative framework, the time for repayment of short-term accounts payable should not exceed 20 months from the date of its occurrence. If the above conditions are not met, such debt receives the status of long-term. Timely repayment will help avoid unpleasant consequences, fines and the need to pay penalties under the contract.

How to calculate the amount of current liabilities of an enterprise

Now that we know what data is reflected in the lines under code 1510-1550, we can move on to the algorithm for calculating the value of the enterprise’s current liabilities. Knowing the volume of total debt with a maturity of less than a year is important for assessing the solvency of a company :

- if it turns out that the company is unable to cope with the repayment of short-term (current) obligations, then it can be considered insolvent;

- the lower the indicator of short-term liabilities, the higher the solvency and liquidity of the organization.

So, below is a diagram for calculating the amount of short-term (current) liabilities of the company:

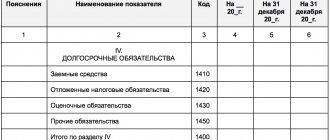

Long-term liabilities of the enterprise in the balance sheet

Long-term liabilities of the enterprise in the balance sheet are represented by such elements as:

- loans and credits of the organization;

- deferred tax liabilities;

- other long-term liabilities.

All long-term loans and credits that were provided to the organization are recorded in accounting account 67 “Long-term loans and borrowings” with an analytical breakdown by type. Long-term are loans or credits whose repayment period exceeds 12 calendar months. The credit balances of this account are an indicator as part of the company's long-term liabilities for loans and credits.

Deferred tax liabilities also represent long-term liabilities of the organization. Such obligations arise in an organization in the presence of tax permanent differences. Data on such differences are recorded in account 77 “Deferred tax liabilities”.

Can not understand anything?

Try asking your teachers for help

Note 1

If the organization has other long-term liabilities, then they are taken into account in the line “Other long-term liabilities”. For example, this may be debt to suppliers for goods, the repayment period of which is more than one calendar year.

How do short-term liabilities appear on the balance sheet?

Obligations with a short period of fulfillment arise in the balance sheet for the reason that the accountant cannot predict the amount of income for future periods, as well as the amount of projected losses . For example, due to a man-made disaster, production disruptions and, accordingly, monetary losses may occur. The probability of such events can be assessed as small, medium or large.

Company accountants divide short-term debts into 2 groups:

- Precisely definable . These are payments planned for the future and subject to precise calculation (thanks to a calculation algorithm in a legislative act or the presence of an exact amount in an agreement with the borrower). If you have such debts, you should always check your capital to see if you have the means to pay them. Examples: dividends, bills, bills, bank loans.

- Calculated . Such obligations include debts, the amount of which cannot be determined until the payment date. And since the settlement date will come in any case, the accountant is required to accurately determine the amount to be transferred to the borrower. Examples: income tax, property tax, warranty claims, vacation pay.

Answers to frequently asked questions on the topic “Current liabilities on the balance sheet”

Question: Do budgetary commercial organizations fill in line 1530 of Section V of the balance sheet if the enterprise has short-term liabilities?

Answer: No. If a commercial enterprise is financed from the budget, the funds allocated to it, which will be spent on the purchase of inventories or non-current assets, must be reflected in deferred income. If funds remain unclaimed (remains), they will be taken into account in the same way. Therefore, line 1530 is not filled in.

Question: What short-term liabilities of an enterprise can be reflected in line 1550 “Other liabilities”?

Answer: These may be amounts of value added tax (VAT) that were taken for deduction at the time of payment of the advance/prepayment, and which now need to be restored and transferred to the budget at the time of actual receipt of products, services, and works. Such funds are usually accepted for accounting on account 76. It may also be amounts of targeted financing that were received by the developer, and which now oblige him to deliver the completed construction project within 1 year from the reporting date (finances are taken into account on account 86)

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Postings for Accounts Receivable Accounting

Let's look at the main transactions with accounts receivable and the postings that should be made in each case.

The supplier's receivables have arisen and been repaid:

- Dt 60 Kt 51, 50, 52 - an advance is transferred to pay for future supplies of goods (work, services);

- Dt 08, 10, 41, 91-2, etc. Kt 60 - goods (work, services) in advance are accepted for accounting

The buyer's receivables have arisen and been repaid:

- Dt 62 Kt 90-1 - goods (work, services) were shipped;

- Dt 51, 50, 52 Kt 62 - amount received in payment of accounts receivable for shipped goods (work, services).

Employees' wages receivables have arisen and been repaid:

- Dt 70 Kt 50, 51 - advance payment was paid to employees for the first half of the month;

- Dt 20, 26, 91-2, etc. Kt 70 - monthly salary accrued.

Accounts receivables of accountable persons arose and were repaid:

- Dt 71 Kt 50, 51.52 - accountable funds have been paid;

- Dt 60.76 Kt 70 - the expenditure of accountable funds is reflected;

- Dt 50, 51, 52 Kt 71 - a refund was received of the unspent amount of the accountables.

Employees' receivables for material damage arose and were repaid:

- Dt 73 Kt 94, 28 - reflects the employee’s debt for damages;

- Dt 52, 51, 70 Kt 73 - full or partial compensation for damage received.

The receivables of the founders arose and were repaid:

- Dt 75 Kt 80 - reflects the debt of the founder for the contribution to the management company;

- Dt 51, 52, 08 Kt 75 - a contribution to the authorized capital was received.