What applies to financial investments?

When accounting for this category of existing assets, economic entities rely on the norms adopted by law, which are reflected in the current PBU 19/02 “Accounting for financial investments.”

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

In order for an asset owned by a subject to be recognized as a financial investment, the following basic conditions must be met:

- Documentary evidence of ownership/receipt of assets.

- Organizational risks associated with assets: insolvency, liquidity, price changes.

- Availability of potential economic benefits (interest accrual, increase in initial cost).

Based on the above signs, financial The following instruments are considered investments: securities (including government securities, bonds and bills of exchange of other enterprises), contributions to the authorized capital of other entities (except for subsidiaries), loans provided to other entities, deposits with credit institutions, receivables in the form of assignment of claims. .

The following are not recognized as financial investments:

- Own shares purchased from employees, settlements using bills of exchange.

- Property used to generate income under rental agreements.

- Works of art, jewelry purchased not for resale.

- Intangible assets of entities, fixed assets and inventories (MPI).

Financial investments in accounting policies

The list of assets that can be recognized as financial investments is not limited by law. Each organization independently decides on the possible composition of assets of this type. All information must be reflected in the accounting policies.

Formation of financial assets of the organization

| Asset criteria | Possible | Units |

| By time of use | Short term and long term | Short-term - repayment period less than 12 months; if the circulation period is longer, the assets are classified as long-term |

| Unit of account | Series, batch | The organization independently determines the unit of measurement. But at the same time, the principles of transparency in accounting and control over the movement of assets must be observed. |

| Acceptance for registration | Initial cost | Acquisition costs include the volume of actual costs, including purchase, delivery and others, excluding refundable taxes. |

| Determination of current market value | Assets with determinable and indeterminable market values | For assets with a certain market value, periodic adjustments to the existing price are required. If the current market value cannot be determined, the original cost is taken into account. |

All methods for determining financial investments should be reflected in the accounting policies. This applies to periods of use, units of measurement and other conditions.

To evaluate assets accounted for as financial investments, the actual costs of their acquisition are taken. Costs may involve more than just payments to suppliers. At the same time, the provisions of PBU 19/02 exclude general business expenses from costs to determine the initial cost, if these expenses were not directly related to the acquisition.

Wiring cannot be done: D 60 K 58

Financial investments"

58.1 - "Units and shares";

58.2 - “Debt securities”;

58.3 - “Loans provided”;

58.4 - “Deposits under a simple partnership agreement”, etc.

UNIT - a share of the capital of a company, which gives the right to participate in general meetings of shareholders, to receive dividends and part of the company’s property upon its liquidation. P. is expressed in a specific document - a certificate, to which coupons for receiving dividends are attached.

SHARES are securities issued by a joint-stock company, the owners of which are granted all property and personal rights associated with the ownership of a share: a) the right to receive dividends, depending on the size of the corporation’s profit; b) the right to participate in the management of the corporation by participating in meetings; c) the right to receive part of the property after the liquidation of the corporation. Rights are exercised in an amount proportional to the size of the shares.

D 58 K 51 –

the emergence of a financial investment object is reflected (when transferring or paying for this object from a current account);

D 58 K 76 –

the occurrence of debt to counterparties is reflected (if payment for financial investment objects will be made after obtaining ownership rights to them, for example, in the case of securities).

D 76 K 91 —

D 91 K 58

– reflects the negative difference between the purchase and par value (or between the par and purchase value) of the acquired debt securities.

In account 58, investments are accounted for at actual cost (in the amount of costs incurred for their acquisition).

Financial investments are the second most liquid after cash in hand and in current accounts.

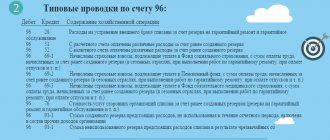

The reserve is formed at the expense of financial results (as part of operating expenses), which is reflected in the accounting entry as a debit to account 91 “Other income and expenses” and a credit to account 59 “Provisions for impairment of financial investments.” A similar entry is made when increasing reserves in the event of a further decrease in the estimated value of financial investments.

The reserve is reduced (used) in the following cases: if the estimated value of the relevant assets in the reporting period has increased, if their value is no longer subject to a sustained significant decrease, as well as upon disposal of these assets. In this case, an entry is made in the debit of account 59 “Provisions for impairment of financial investments” in correspondence with the credit of account 91 “Other income and expenses”.

In the financial statements, financial investments for which an impairment reserve has been created are reflected at their book value less the amount of the reserve.

In the net balance sheet, when reflected in the asset, the difference between 58 and 59 accounts is reflected. Those. There is no account in the liabilities side of balance 59!

Reserve for depreciation of financial investments” (passive, contractual to account 58).

The reserve for impairment of financial investments is created by the following entry:

D 91.2 K 59

D 59 K 91.2 –

reserve amount restored

As soon as financial investments are disposed of, the corresponding reserve amounts are written off to other income of the enterprise (91.1).

Regulatory regulation of the accounting of bills of exchange is carried out by the “Regulations on promissory notes and bills of exchange” dated August 7, 1937.

When purchasing bills of exchange, they are accounted for at actual cost on account 58, disposal is reflected through account 91.

D 60 K 91

– we pay the supplier with a bill of exchange.

Upon disposal of this bill, we will make the following entries:

D 60, 76 K 91.1 1000

D91.2 K 58 900

A credit balance of 100 rubles is formed, and income tax is paid on it.

If we provide a loan, we make the following entries:

D 58 K 51

If our main activity is the purchase and sale of financial investments, then income and expenses are charged to account 90, otherwise - to account 91.

When transferring shares, bills, i.e. When they are disposed of and sold, the following entry is made:

D 90.1, 91.2 K 58

Wiring cannot be done: D 60 K 58

D 76 K 91.1

– interest accrued on loans is reflected;

If the loan is provided to an employee, then interest will be accrued to account 73.

D 73 K 91.1

If we have been accrued dividends on the objects of any financial investments, then we will reflect their receipt by posting:

D 51 K 91.1

58.4 — “Deposits under a simple partnership agreement”

(joint activity of enterprises, which is carried out on the books of one of the enterprises);

When depositing assets, account 58 is used.

Under the simple partnership agreement, funds were deposited from the current account:

D 58 K 51

The following materials were included under the simple partnership agreement:

D 58 K 10

And if we contribute them at a higher price, then the transfer of materials will have to be reflected as follows:

D 58 K 91.1

Valuation of securities

When purchasing securities, there are the following types of expenses: payment of the contract price to the seller and other expenses. If other expenses when purchasing securities are considered insignificant compared to the contractual value, their amount can be taken into account as part of the entity’s other expenses in the reporting period of acquisition. Institutions can determine the level of materiality independently by prescribing accepted criteria in their accounting policies.

For securities related to trading on the market, it is possible to determine the current value. It is calculated based on market trading data. In the financial statements, the timing of revaluation is determined independently. This could be a month, a quarter, etc.

If the revaluation of securities can significantly distort data on the financial condition of the enterprise, entities have the right not to adjust the value of assets. These actions must be reflected in the notes to the financial statements.

If it is not possible to determine the current market value of securities, the reporting shall indicate the initial cost of the financial investment.

The meaning of position 58 in accounting

The designated account is designed to provide detailed accounting of the company's cash investments.

Analytics for this account is carried out for separate sub-accounts, including:

- 1 – accounting for investments in shares and shares;

- 2 – investing in debt instruments.

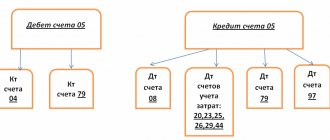

Investments of a company or organization are reflected in the debit part 58 of the account and the credit part of those positions where the values that are subject to transfer on account of such investments are recorded. Thus, the company’s purchase of securities of third-party companies is recorded in the debit part of position 58 and the credit part of position 51 or 52.

If an amount is written off that exceeds the purchase price of debt obligations over their nominal price, then the accounting department reflects these funds as a debit of 76 and a credit of 58 positions.

If the company decides to sell existing securities or pay off their value, then these funds are recorded in debit 91 and credit 58 positions.

Account 59 in accounting “Creation of reserves for the depreciation of investments in securities.” Postings

To record changes in the value of securities in organizations, account 59 is used. It is intended to summarize information about impairment for each asset position.

Impairment of securities is recognized as a sustainable decrease in their original value, which does not allow obtaining further economic benefits. Account 59 reflects the difference between the accounting and initial prices for available financial investments.

The formation of the reserve occurs after analyzing the financial condition of the securities. It is preferable to create in cases where there is a steady decrease in value, at the reporting date the price is significantly lower than the original one, or there is information about an inevitable decrease in the value of the asset in question in the future.

The creation of reserves, as well as an increase in the value of financial assets, is accompanied by the posting:

Debit 91 - Credit 59.

The basis for reducing the volume of newly accepted reserves is considered to be an increase in the value of these assets, as well as their disposal partially or entirely as a result of sale.

If the amount of the previously established reserve decreases or a disposal of financial investments occurs, the posting takes the following form:

Debit 59 - Credit 91.

About account 91, read the article: “Accounting for other income and expenses (account 91). Postings.”

Examples of transactions and postings on account 59

Let's consider an example when an organization made a contribution to the authorized capital of an LLC. What subsequently happened in the LLC:

- Decrease in net assets;

- And later it was liquidated.

Example 1. Creation of a reserve for impairment of the deposit made

Let’s say an organization made a contribution to the authorized capital of an LLC - 200,000 rubles. The net assets of the LLC at the time of making the contribution are 56 million rubles. Authorized capital - 1 million rubles. For two years, the LLC participant did not receive income. Having requested the balance of the LLC, the participant discovered a decrease in net assets to 20 million rubles. As a result, it was decided to create a reserve for the impairment of financial investments in proportion to the decrease in the value of the LLC’s net assets.

The following transactions should be reflected in the accounting:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| 91.2 | 59 | 128 600 | A reserve has been created for impairment of the deposit made | Accounting certificate calculation 20/56=35,7% (200 000-(200 000*35,7%)=128600 |

Example 2. Write-off of the reserve for impairment of the deposit made

Then, after another two years, the organization requested reporting from the LLC, but received no response. Then the organization on the Federal Tax Service website in the Electronic Services section, going to the “Business Risks: Check Yourself and the Counterparty” section, searching for an LLC by TIN, discovered that the LLC had ceased its activities.

The following transactions should be reflected in the accounting:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| 91.2 | 58 | 200000 | The amount of the contribution invested in the authorized capital of the liquidated LLC was written off | Extract from the Unified State Register of Legal Entities |

| 59 | 91.1 | 128600 | The reserve formed for the disposed deposit is written off | Extract from the Unified State Register of Legal Entities |

Example 3. Provision for impairment of shares

Next, consider an example when an organization acquired shares of a joint-stock company that are not traded on the organized securities market and subsequently there was a decrease and increase in net assets.

Suppose an organization owns 250 shares of a joint stock company with a purchase (accounting) value of 400 rubles. per share. The shares are not traded on an organized securities market. JSC net asset value per share for 2015. amounted to 300 rubles for 2016. amounted to 420 rubles.

The accounting records for 2015 should reflect the entries for account 59:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| 91.2 | 59 | 25000 | A reserve has been created for the depreciation of shares | Accounting certificate calculation (400-300)*250=25000 |

For 2016, the following transactions should be reflected:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| 59 | 91.1 | 25000 | Reserve amount written off | Accounting information |