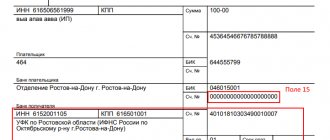

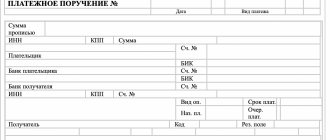

What is indicated in field 101 of the payment slip?

The field with code 101 is located in the upper right corner of the payment order. You need to enter a two-digit digital payer status code into it.

The payer can be: a legal entity, individual entrepreneur, individual, authority (for example, tax, customs, bailiff service, bank).

There are a total of 26 such codes, which can be used to determine who exactly fills out the payment order and on whose behalf the funds are transferred.

This information allows you to correctly identify the person transferring money to the budget and correctly carry out the complete transfer of money.

The need to fill out this indicator in column 101 has appeared since 2014.

How to fill out the line?

In field 101, the status of the payer is entered - the person or body from which the non-cash money is transferred.

In this column you need to indicate two numbers - from 01 to 26.

This rule applies both when filling out a payment slip manually and when generating it in electronic format.

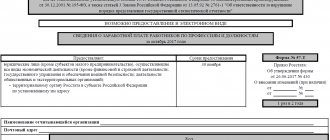

The decoding of taxpayer status codes for entering in field 101 is determined by Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on September 23, 2015).

Appendix 5 to the said order contains all the statuses.

Table with a breakdown of all payer statuses for field 101:

Compiler's indicators for individual entrepreneurs

An individual entrepreneur fills out the payer status in field 101 of the payment order when making a payment to a representative of the budget system.

That is, you need to fill out column 101 “Status of compiler” when transferring taxes, contributions, fees, duties, arrears, penalties and fines for arrears and other payments to the budget. In other cases, the IP field is left blank.

In this case, the individual entrepreneur can indicate one of the following statuses of the originator in the payment:

- 02 – if the entrepreneur acts as a tax agent, for example, when paying personal income tax for employees, VAT;

- 08 – for transfers to the budget, with the exception of payments administered by the tax office, that is, this code, for example, can be indicated by an individual entrepreneur when paying contributions to the Social Insurance Fund for injuries, state duties, which are supervised by any body other than the tax office;

- 09 – code is indicated by the individual entrepreneur when transferring funds to the Federal Tax Service (taxes, fees, contributions to compulsory medical insurance and compulsory medical insurance, VNIM, arrears, fines and penalties for arrears);

- 15 – The individual entrepreneur acts as a paying agent, drawing up a payment order for the transfer of funds received from individuals for the total amount with the register;

- 17 – if the individual entrepreneur acts as a participant in foreign economic activity (FEA);

- 18 – if an individual entrepreneur needs to transfer customs payments without being a declarant;

- 20 – the entrepreneur acts as a paying agent, drawing up an order for the transfer of funds for each individual;

- 28 – An individual entrepreneur acts as a participant in foreign trade activities and a recipient of international mail within the framework of such activities.

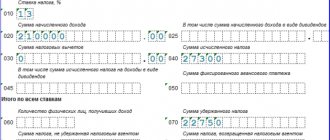

What code is used when paying personal income tax?

When paying personal income tax, field 101 “Compiler status” can be filled in using the following codes:

- 02 – if income tax is paid by an organization or individual entrepreneur who is the employer in relation to the individual for whom the personal income tax is transferred, that is, in this case the payer acts as a tax agent;

- 09 – if the tax is paid by the individual entrepreneur for himself;

- 10 – if the tax is paid by a notary engaged in private practice for himself;

- 11 – if the tax is paid by a private lawyer for himself;

- 12 – when transferring the tax amount by the head of the peasant farm for himself;

- 13 – if a payment order for the payment of personal income tax is filled out by an individual independently to transfer tax on his income;

- 26 – this status of the compiler is indicated in bankruptcy, when the personal income tax debt is repaid from the register of claims.

Filling in when transferring VAT

If a payment order is filled out for the purpose of paying VAT, then the status of the originator can take on the following values:

- 01 – if the payment form for VAT transfer is filled out by an organization – a legal entity;

- 09 – if VAT is paid by an individual entrepreneur;

- 02 – if an organization or individual entrepreneur transfers VAT, acting as a tax agent.

For the taxpayer when paying taxes

If the payment is filled out for the purpose of paying taxes, then in field 101 one of the following statuses of the originator can be indicated:

- 01 – if the tax is paid by the organization;

- 02 – if the tax is transferred by a person acting as a tax agent, this applies to the transfer of personal income tax for employees, as well as VAT;

- 09 – if the tax payment is made by an individual entrepreneur;

- 10 – if the tax is paid by a private notary;

- 11 – tax payments by a private lawyer;

- 12 – tax payments by the head of the peasant farm;

- 13 – payment of taxes by an individual without the formation of an individual entrepreneur (citizen).

Insurance premiums for yourself and employees

Insurance premiums are transferred for employees by employers to the Federal Tax Service (pension, medical, temporary disability and maternity) and to the Social Insurance Fund (injuries), as well as individual entrepreneurs for themselves.

Depending on who fills out the payment order, the field to indicate the status of the originator may indicate:

- 01 – if contributions to the Federal Tax Service are transferred by the organization for employees;

- 08 – if the payment is made for the transfer of social contributions to the Social Insurance Fund for injuries (from NS and PZ);

- 09 – if insurance premiums to the Federal Tax Service are paid by individual entrepreneurs for themselves or for employees;

- 10 – payer – private notary;

- 11 – private lawyer;

- 12 – head of peasant farm;

- 13 – an individual pays insurance premiums on his own behalf.

Payments under writ of execution

When transferring withheld amounts from an individual’s income under a writ of execution in favor of a budgetary authority (bailiff service), it is necessary to indicate the compiler’s status code “19” in field 101.

State duties

The state duty is credited to the budget, so field 101 in the payment order must be filled in. Depending on who pays the state fee and to which government body, the status number of the compiler depends.

The transfer can be made by both an organization and an individual with or without the formation of an individual entrepreneur, as well as a person engaged in private practice, the head of a peasant farm.

Based on this, column 101 can be filled in with the following code;

- 01 – if the state duty is paid by a legal entity, it goes to the Federal Tax Service;

- 08 – if the duty is sent to structures other than the Federal Tax Service (the payer can be any person except an ordinary citizen);

- 09 – if the payment is transferred to the Federal Tax Service by an individual entrepreneur;

- 10 – the notary pays the state fee in favor of the Federal Tax Service;

- 11 – lawyer, payment is supervised by the Federal Tax Service;

- 12 – head of the peasant farm, payment is supervised by the Federal Tax Service;

- 13 – citizen – individual.

What to do if it is indicated incorrectly?

If money is transferred to the budgetary sector, then field 101 must be filled out.

You cannot leave the column empty or enter 0 in it.

The compiler status code is taken from Appendix 5 to Order No. 107n of the Ministry of Finance of Russia.

If this code is indicated incorrectly in the payment order, the money may not reach the recipient.

The result of such an error will be late payment of a tax, fee or contribution, which may, in turn, entail penalties and fines.

The Treasury will classify such a payment as unclear and will look into its purpose, which will take some time.

When filling out a payment slip, you can find out in different ways that the status in field 101 has been filled out incorrectly. You can receive an order back from the bank due to non-fulfillment, you can independently understand your mistake after sending the payment slip, you can after some time receive requests from the Federal Tax Service or the fund about the presence of arrears .

If it turns out that the status was indicated incorrectly in the payment order, then first you should request a reconciliation with the budgetary authority in whose favor the money was transferred.

If during the reconciliation it turns out that the money has not arrived, then you should write a statement to clarify the payment and the status of the originator in it.

The text is written in any form; there are no standard forms.

The application must be accompanied by documentation confirming the previously made payment - a copy of the payment order where the incorrect status is indicated, a copy of the bank statement where the debit transaction is indicated.

If the clarification is confirmed, the accrued penalties will be reversed.

What values are indicated in the originator status in a payment order?

In accordance with the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-, when filling out field 101 of the payment order, the status codes of the originator are indicated:

| Status code | Explanation |

| 01 | Taxpayer – legal entity |

| 02 | Tax agent |

| 03 | The federal postal service organization that drew up the order for the transfer of funds for each payment by an individual |

| 04 | Tax authority |

| 05 | Federal Bailiff Service and its territorial bodies |

| 06 | Participant in foreign economic activity – legal entity |

| 07 | customs Department |

| 08 | A legal entity (an individual entrepreneur, a notary engaged in private practice, a lawyer who has established a law office, the head of a peasant (farm) enterprise) that transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation |

| 09 | Individual entrepreneur |

| 10 | Notary in private practice |

| 11 | Lawyer who established a law office |

| 12 | Head of a peasant (farm) enterprise |

| 13 | Another individual – bank client (account holder) |

| 14 | Taxpayer making payments to individuals |

| 15 | A credit organization (a branch of a credit organization), a payment agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals |

| 16 | Participant in foreign economic activity – individual |

| 17 | Participant in foreign economic activity - individual entrepreneur |

| 18 | A payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties |

| 19 | Organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears of payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in the prescribed manner |

| 20 | Credit organization (branch of a credit organization), payment agent, drawing up an order for the transfer of funds for each payment by an individual |

| 21 | Responsible participant of a consolidated group of taxpayers |

| 22 | Member of a consolidated group of taxpayers |

| 23 | Bodies monitoring the payment of insurance premiums |

| 24 | Payer - an individual who transfers funds to pay insurance premiums and other payments to the budget system of the Russian Federation |

| 25 | Guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax excessively received by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation , and excise taxes on alcohol and (or) excisable alcohol-containing products |

| 26 | Individual, legal entity for repayment of claims against the debtor |

| 27 | Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation |

| 28 | Participant in foreign economic activity - recipient of international mail |

If an individual entrepreneur makes deductions for himself, code 09 is indicated, if the document is drawn up for the purpose of making deductions for employees, code 14, because in this case, an individual entrepreneur acts as a person making payments to individuals.

Status codes 27 and 28 came into force on October 2, 2017 on the basis of Order of the Ministry of Finance of the Russian Federation dated April 5, 2017 No. 58n “On amendments to the Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.”

conclusions

The payment order contains many details that must be filled out. Field 101 contains information about the originator of the document. This code is filled in only for payments made to the budget.

At the legislative level, there are 26 statuses to be indicated in this column. It is necessary to choose the right status depending on who is transferring the money.

If the status is incorrectly indicated, the money may not reach the recipient, causing a debt.

In such cases, it is necessary to verify mutual settlements with the government agency where the money was sent, and if a debt is identified in connection with an unpaid payment, it is necessary to write a statement requesting clarification.

Questions and answers

- An error was made when filling out field 101. What consequences does this have for us?

Answer: The payment order may be returned from the bank unexecuted. To avoid troubles, carefully check the document provided to the bank.

- When paying personal income tax for employees, I indicated code 09 in field 101, because I am an individual entrepreneur. The other day I received a letter from the tax office demanding that I pay personal income tax, taking into account the fine. I paid everything, I have a payment order. Why such a requirement?

Answer: When paying personal income tax for employees, an individual entrepreneur acts as a person making payments to individuals. In this regard, it is necessary to indicate code 14 in field 101, because make deductions for employees.