How to calculate the cost

Costs associated with the production of products should be taken into account on account 20 “Main production”. In this case, use the following costing methods or combinations thereof:

- custom;

- process-by-process;

- transverse.

The custom method is used:

- for single or small-scale production;

- when performing work under contracts or paid services;

- in the production of technically complex products. For example, in shipbuilding, aviation industry, etc.;

- when producing products with a long production cycle. In particular, in construction, power engineering, etc.

With the order-by-order method, all costs are taken into account for a specific order or for a group of similar orders. For each order, a card is opened. Since there are no standard forms of cards, you can develop them yourself. The card usually indicates the order number, description of the work, the time required to complete the order, as well as the number of units of product that need to be produced. Costs for each order are recorded as the product moves through the stages of production.

Direct costs that are directly related to the fulfillment of the order are reflected in the debit of account 20 in correspondence with the expense accounts. To ensure analytical cost accounting, it is worth opening separate sub-accounts for each open order. These subaccounts can be named, for example, by order numbers: “Order No. 1,” “Order No. 2,” etc.

Record costs as follows:

Debit 20 Credit 10 (70, 69, 60...) – direct costs of executing the production order are taken into account.

Indirect, that is, general production and general business expenses, accumulate on accounts 25 and 26 of the same name. At the end of the month in which the order was completed, write off these amounts as a debit to account 20. At the same time, distribute these expenses for each order in proportion to the indicators that must be established in the accounting policy for accounting purposes (clause 7 of PBU 1/2008). For example, in industries with a significant share of manual labor, it is advisable to distribute indirect costs in proportion to the salaries of the main production workers.

When assigning indirect costs to the cost of production, make the following entries:

Debit 20 Credit 25 (26) – general production (general business) expenses are taken into account as part of the costs of order fulfillment.

When accounting for general business expenses, do not use this procedure if you take them into account immediately into account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

An example of reflecting in accounting the costs of a structural unit of an organization to fulfill a production order. The organization uses the order method of cost accounting. The structural unit fulfills an internal order

In July, the tool shop of OJSC Proizvodstvennaya completed an in-house order for the production of 200 steel fasteners for the assembly shop. Master's accounting policy provides for the use of the order method of accounting for actual costs. To reflect the actual costs of the tool shop to complete the order, a subaccount “Order No. 1” was opened to account 20.

In July, the tool shop received 240 kg of steel from the warehouse to fulfill the order. The cost of 1 ton of steel is 11,500 rubles. (without VAT).

The direct costs of order fulfillment include:

- cost of materials used - 2760 rubles. (0.24 t × 11,500 rub./t);

- salary of production workers in the tool shop - 40,000 rubles;

- contributions for compulsory pension (social, medical) insurance, as well as insurance against accidents and occupational diseases - 12,080 rubles.

General production costs attributable to the order (depreciation on fixed assets used in production) amounted to 2,866 rubles.

The following entries were made in the “Master’s” accounting:

Debit 20 subaccount “Order No. 1” Credit 10 – 2760 rub. – materials were written off to fulfill the order;

Debit 20 subaccount “Order No. 1” Credit 70 – 40,000 rub. – wages were accrued to the workers of the tool shop;

Debit 20 subaccount “Order No. 1” Credit 69 – 12,080 rub. – contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases have been accrued;

Debit 20 subaccount “Order No. 1” Credit 25 – 2866 rub. – depreciation on fixed assets used in production is written off as costs for order fulfillment.

The actual cost of the completed order is reflected by the posting:

Debit 10 Credit 20 subaccount “Order No. 1” – 57,706 rubles. (RUB 2,760 + RUB 40,000 + RUB 12,080 + RUB 2,866) – the cost of fasteners manufactured according to order No. 1 and transferred to the warehouse was written off.

All costs for the intercompany production order were reflected in the card.

The use of the process method is typical for industries in which finished products are created as a result of sequential processing of raw materials. The process can take place in one or more technological departments. At the same time, the results of processing raw materials at intermediate stages cannot definitely be considered either finished products or semi-finished products. The method is often used in the mining and textile industries, in the production of cement, chemical fiber, plastics, paints and varnishes, etc.

With the process-by-process method, cost accounting is carried out for each process. For this purpose, so-called calculations are opened. In practice, it is convenient to use production cost sheets as calculations. They must be maintained for the entire production output or for each division. There are no standard forms for production cost accounting sheets, so you can develop them yourself. The statements are filled out on the basis of primary accounting documents. Such as invoices, payroll statements, advance reports, etc. For example, costs for raw materials and supplies can be reflected on the basis of limit cards or invoice requirements. For which you can use standard forms No. M-8 or No. M-11.

Reflect direct costs in the debit of account 20 in correspondence with the expense accounts:

Debit 20 Credit 10 (68, 69, 70, 60...) – direct costs of the production process are taken into account.

At the end of the month, write off general production expenses accumulated on account 25 of the same name to the debit of account 20:

Debit 20 Credit 25 – general production expenses are taken into account as part of the costs of the production process.

General business expenses accumulated on account 26 of the same name are also written off to the debit of account 20 at the end of the month:

Debit 20 Credit 26 – general business expenses are taken into account as part of the costs of the production process.

This procedure is not used if costs are taken into account immediately into account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

The volume of work in progress using the process-by-process method of cost accounting can be assessed using conditionally natural indicators. For example, by the equivalent number of finished products. To calculate the equivalent quantity of finished products, you need to know the product readiness ratios at each stage of the production process. The value of these coefficients is set by the manufacturer’s technological service (i.e., yours).

An example of reflecting the costs of producing finished products in accounting. The organization carries out cost accounting and cost calculation using a process-by-process method.

OJSC "Proizvodstvennaya" is engaged in the production of cotton fabrics. Master's accounting policy provides for the use of a process-based method of cost accounting and cost calculation.

The production process includes four stages. Work in progress is valued at an equivalent quantity of finished goods (fabric). For raw materials completely processed at each of the four stages, the organization’s chief technologist has approved the following availability factors:

- primary processing of cotton – 37 percent;

- preparation of cotton fibers – 58 percent;

- spinning (production of cotton threads) – 91 percent;

- production of finished fabric – 100 percent.

The output of finished products is measured in meters. In accordance with the technical documentation, the cotton consumption rate for fabric production is 0.2 kg/m.

According to the accounting policy, the organization's general business expenses are written off as expenses in proportion to the area of production premises. The area of workshops involved in the fabric production process occupies 70 percent of the entire area of the “Master”.

In April, 2,000 kg of cotton were put into production with a total cost of 81,000 rubles. (without VAT). According to technological standards, 10,000 m of fabric should be produced from this amount of raw material (2000 kg: 0.2 kg/m). As of April 30, 8,000 m of fabric were delivered to the finished products warehouse.

Direct costs for fabric production in April were:

- cost of materials – 81,000 rubles;

- wages of production workers and contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases - 243,000 rubles.

The amount of overhead costs is RUB 96,840.

The amount of general business expenses for the organization as a whole is 230,000 rubles.

In April, the following entries were made in the “Master’s” accounting:

Debit 20 Credit 10 – 81,000 rub. – materials for fabric production were written off;

Debit 20 Credit 70 (69) – 243,000 rub. – wages for production workers and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are accrued;

Debit 20 Credit 25 – 96,840 rub. – general production expenses are written off;

Debit 20 Credit 26 – 161,000 rub. (RUB 230,000 × 70%) – part of general business expenses was written off for production.

As of April 30, the remains of raw materials that had undergone complete intermediate processing were recorded in the amount of 350 kg, including:

- at the stage of primary processing of cotton – 90 kg;

- at the stage of preparation of cotton fibers – 180 kg;

- at the spinning stage – 80 kg.

The total volume of raw materials released into production, but not undergone intermediate processing, amounted to 50 kg. Processing of this raw material will be completed next month.

Based on these data, the accountant determined the equivalent amount of finished goods in the balances at each stage of the production process. The volume of work in progress in equivalent units was:

- at the stage of primary processing of cotton - 167 m (90 kg: 0.2 kg/m × 37%);

- at the stage of preparation of cotton fibers - 522 m (180 kg: 0.2 kg/m × 58%);

- at the spinning stage – 364 m (80 kg: 0.2 kg/m × 91%).

The volume of work in progress in equivalent units as of April 30 was: 167 m + 522 m + 364 m = 1053 m.

Total production output for April (including work in progress) is equal to: 8000 m + 1053 m = 9053 m.

The total amount of production costs (including the cost of purchasing raw materials that have not undergone intermediate processing) for April is: 81,000 rubles. + 243,000 rub. + 96,840 rub. + 161,000 rub. = 581,840 rub.

The actual cost of finished products delivered to the warehouse is reflected by the posting:

Debit 43 Credit 20 – 514,163 rub. (RUB 581,840: 9053 m × 8000 m) – the actual cost of finished products for April was written off.

The cost of work in progress balances at the end of April is equal to: 581,840 rubles. – 514,163 rub. = 67,677 rub.

In May, 500 kg of cotton worth 20,250 rubles were transferred to production. At the end of the month, 4,500 m of fabric were delivered to the finished products warehouse. Thus, in May, all released raw materials were processed, including raw materials, the processing of which began in April: 8000 m + 4500 m = (2000 kg + 500 kg): 0.2 kg/m.

Direct costs for fabric production in May were (the cost of purchasing raw materials that did not undergo intermediate processing in April is not taken into account):

- cost of materials – 20,250 rubles;

- wages of production workers and contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases - 100,000 rubles.

The amount of overhead costs is RUB 73,800. The amount of general business expenses for the organization as a whole is 150,000 rubles.

As of the end of May, there were no balances of work in progress in the “Master” workshops.

The following entries were made in the organization’s accounting records in May:

Debit 20 Credit 10 – 20 250 rub. – materials for fabric production were written off;

Debit 20 Credit 70 (69) – 100,000 rub. – wages for production workers and contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are accrued;

Debit 20 Credit 25 – 73,800 rub. – general production expenses are written off;

Debit 20 Credit 26 – 105,000 rub. (RUB 150,000 × 70%) – part of general business expenses was written off for production;

Debit 43 Credit 20 – 366,727 rub. (RUB 20,250 + RUB 100,000 + RUB 73,800 + RUB 105,000 + RUB 67,677) – the actual cost of finished products for May was written off.

The actual cost of a batch of fabric produced in April–May (12,500 m) is equal to 880,890 rubles. (RUB 514,163 + RUB 366,727). The cost of 1 m of finished fabric is 70.47 rubles. (RUB 880,890: 12,500 m).

The object of cost calculation when using the incremental cost accounting method is one or another stage of the production process. That is, redistribution. If the production structure is organized in such a way that each processing stage is performed by a specialized workshop, section or team, then determine the cost for each of them. Thus, the object of cost calculation using the step-by-step method can be both finished products and semi-finished products manufactured at each technological stage.

The step-by-step method is usually used for production processes in which groups of constantly repeating technological operations can be distinguished. For example, in metallurgy, oil refining, chemical, food industries.

With the transfer method, take into account direct expenses on account 20:

Debit 20 Credit 10 (21, 23, 29, 69, 70...) – direct costs of production are taken into account.

Write off general production expenses accumulated on account 25 of the same name to the debit of account 20 at the end of the month:

Debit 20 Credit 25 – general production expenses are taken into account as part of the costs of the production stage (process).

General business expenses accumulated on account 26 of the same name are also written off to the debit of account 20 at the end of the month:

Debit 20 Credit 26 – general business expenses are taken into account as part of the costs of the production stage (process).

Take into account general business expenses this way if you do not immediately reflect them on account 90 “Sales”. Such an indication is in paragraph 9 of PBU 10/99. For more information about this, see How to write off general production and general business expenses.

An example of reflecting in accounting the costs of producing finished products using the incremental costing method. The organization uses the semi-finished method of consolidated cost accounting

The Master oil refining organization produces straight-run and high-octane gasoline. The organization has certificates for the production and processing of straight-run gasoline. The accounting policy of “Master” provides for the use of a semi-finished method of cost accounting using account 21.

“Master” has a workshop production structure. In shop No. 1, straight-run gasoline is produced (processing unit No. 1). Workshop No. 2 produces Premium-95 gasoline (processing unit No. 2). Straight-run gasoline is used as the feedstock for the production of Premium-95 gasoline, to which various additives are added at processing stage No. 2. To reflect the actual costs of production stages, sub-accounts “Workshop No. 1” and “Workshop No. 2” were opened to accounts 20, 21 and 25.

In the reporting period, Master produced 1,250 tons of straight-run gasoline:

- 500 tons (40% of production) were sold to an organization that has a certificate for processing straight-run gasoline, at a price of 15,000 rubles/t (including VAT and excise tax);

- 750 tons (60% straight-run gasoline) were transferred to workshop No. 2 for further processing.

Direct costs for the production of straight-run gasoline in workshop No. 1 during the reporting period amounted to RUB 9,602,000.

Direct costs for the production of Premium-95 gasoline in workshop No. 2 amounted to RUB 3,517,800.

The total amount of direct costs for two workshops is 13,119,800 rubles. (RUB 9,602,000 + RUB 3,517,800).

The amount of overhead costs is:

- for workshop No. 1 – 391,280 rubles;

- for workshop No. 2 – 144,720 rubles.

The amount of general business expenses is RUB 360,000.

The accounting policy of “Master” provides for the distribution of general business expenses between production areas (shops) in proportion to direct costs. The share of direct costs for each stage in the total amount of direct costs is:

- for workshop No. 1: RUB 9,602,000. : RUB 13,119,800 = 0.73;

- for workshop No. 2: RUB 3,517,800. : RUB 13,119,800 = 0.27.

The organization's accountant distributed the amount of general business expenses for the reporting period between divisions in the following proportion:

- for workshop No. 1: RUB 360,000. × 0.73 = 262,800 rubles;

- for workshop No. 2: RUB 360,000. × 0.27 = 97,200 rub.

The following entries were made in the organization's accounting:

Debit 20 subaccount “Workshop No. 1” Credit 10 (69, 70...) – RUB 9,602,000. – expenses for the production of straight-run gasoline were written off;

Debit 20 sub-account “Workshop No. 1” Credit 25 sub-account “Workshop No. 1” – 391,280 rubles. – general production expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 20 subaccount “Workshop No. 1” Credit 26 – 262,800 rub. – general business expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 21 sub-account “Workshop No. 1” Credit 20 sub-account “Workshop No. 1” – 10,256,080 rubles. – straight-run gasoline was capitalized at actual cost;

Debit 62 Credit 90-1 – 7,500,000 rub. (500 t × 15,000 rubles/t) – revenue from the sale of straight-run gasoline of our own production is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1,144,068 rubles. (RUB 7,500,000 × 18/118) – VAT is charged on the sale of straight-run gasoline;

Debit 90-4 subaccount “Excise taxes” Credit 68 subaccount “Calculations for excise taxes” - 2,359,500 rubles. (500 t × 4719 rub./t) – excise duty is charged;

Debit 90-2 Credit 21 subaccount “Workshop No. 1” – 4,102,432 rubles. (RUB 10,256,080 × 40%) – the cost of straight-run gasoline sold was written off;

Debit 20 sub-account “Workshop No. 2” Credit 21 sub-account “Workshop No. 1” - 6,153,648 rubles. (RUB 10,256,080 – RUB 4,102,432) – straight-run gasoline was transferred for further processing;

Debit 20 subaccount “Workshop No. 2” Credit 10 (69, 70...) – RUB 3,517,800. – expenses for the production of Premium-95 gasoline (processing unit No. 2) were written off;

Debit 20 subaccount “Workshop No. 2” Credit 25 subaccount “Workshop No. 2” – 144,720 rubles. – general production expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 20 subaccount “Workshop No. 2” Credit 26 – 97,200 rub. – general business expenses are taken into account as part of the costs for the production of straight-run gasoline;

Debit 43 Credit 20 subaccount “Workshop No. 2” – 9,913,368 rubles. (RUB 6,153,648 + RUB 3,517,800 + RUB 144,720 + RUB 97,200) – Premium-95 gasoline was credited to the finished products warehouse at actual cost.

Cost of finished products

All costs collected in the debit of account 20 form the cost of finished products. When releasing finished products to the warehouse, reflect the cost on the credit of this account in correspondence with the finished product accounts. At the same time, the procedure for accounting for the output of finished products for each stage, order, process depends not only on the method of accounting for production costs, but also on the options for its assessment:

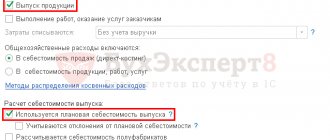

- at standard cost using account 40 “Output of products (works, services)”. In this case, the standard cost is indicated in the debit of account 43 “Finished products”, and account 40 is used to reflect the actual cost;

- at standard cost without using account 40 “Output of products (works, services)”. In this case, the debit and credit of account 43 of the sub-account “Finished products at standard cost” reflect the standard cost, and at the end of the month, the excess of the actual cost over the standard is written off in the debit of account 43 of the sub-account “Deviations of the actual cost of finished products from the standard”;

- at actual cost, that is, without using account 40 “Output of products (works, services).” In this case, the actual cost is indicated in the debit of account 43 “Finished products”.

When using the standard cost accounting method, form the cost of products, works or services as follows. Determine the cost norms for each type of manufactured product in advance. Involve production technology services for this. Based on these data, make a standard calculation. During production, keep costs within established limits.

Separately, keep operational records of deviations of actual expenses from current standards and changes. Do not forget to indicate the places and reasons for deviations. At the end of the month, write off all deviations as financial results. If there are significant volumes of work in progress and insignificant output of finished goods, distribute the deviations. Thus, form the actual cost.

This procedure follows from paragraph 9 of PBU 10/99 and the Instructions for the chart of accounts.

Regardless of the method of calculating costs, at the end of the month, account 43 “Finished Products” must reflect the actual cost of all manufactured products.

Collect all direct and indirect expenses during the month on account 20 “Main production”. The part of the costs that relates to the cost of finished products, as they are transferred to the warehouse, is written off to account 43.

That part of the costs that is not included in the cost of finished products (debit balance of account 20 at the end of the month) is the cost of work in progress.

For more information on valuing work-in-process balances, see How to Determine the Value of Work-in-Process Inventory.

Formula for calculating actual cost

To determine the actual cost of accounting objects, a method called “normative” is used. This method is based on the formation of the cost at the beginning of the reporting period according to the standards in force for this period. And then, at the end of the reporting period, the planned cost is adjusted for the amount of deviations from the standards identified during the production process of manufacturing finished products.

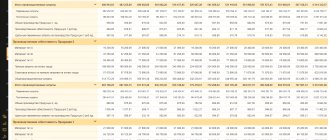

The actual cost of finished products, the calculation formula and an example are presented in Table 2.

Table 2. Example of calculating actual cost

| Index | Designations | 2015, thousand rubles | 2016, thousand rubles |

| 1) Planned cost of production | C\C plan | 456 789 | 512 654 |

| 2) Deviations of the obtained actual values from the planned ones established by the standards, incl. | Otk | —35 674 | +65 438 |

| 2a) - deviations with a “-“ sign, this is savings | Otk "-" | 35 674 | — |

| 2b) - deviations with a “+” sign, this is an overrun | Open "+" | — | +65 438 |

| 3) Actual cost of production (1 ± 2) | S/S fact | 421 115 | 578 092 |

From the calculations presented in Table 2, we can conclude that the actual cost indicator (indicator 3) is found by adding the planned cost, calculated on the basis of established consumption rates (indicator 1) and deviations of the actual cost data obtained from the planned ones (indicator 2, which can be presented in in the form of savings and have a negative sign (indicator 2a) or in the form of overexpenditure and have a positive sign (indicator 2b)).

Let us consider how to determine the actual cost of finished products using the example presented in Table 2. When examining the example, it is clear that in 2015 negative deviations of 36,674 thousand rubles were received, which means cost savings of this amount. And in 2016, positive deviations were received in the amount of 65,438 thousand rubles, which means the actual overexpenditure of resources compared to planned values.

The actual cost is calculated using the example given in Table 2:

20154 = 421,115 thousand rubles;

2016: 512,654 +65,438 = 578,092 thousand rubles.

Using this example, you can calculate how much the actual cost differs from the planned cost for the reporting period, which is the difference between the actual cost and the planned one.

The deviation of the actual cost from the planned one can be positive, in which case it means that more resources were spent on production than planned, i.e. there was an overrun, or this indicator can be negative if resources were spent on production production is less than planned, i.e. these resources were saved.

Accounting at standard cost using account 40

Within a month, as finished products are released from the workshops to the warehouse, receive them at standard cost. In this case, do the wiring:

Debit 43 Credit 40 – reflects the standard cost of finished products produced and delivered to the warehouse.

At the end of the month, when the actual cost of finished products is known, reflect it in the debit of account 40. At the same time, write off the deviations of the actual cost from the standard cost. In this case, make the following entries:

Debit 40 Credit 20 (23) – reflects the actual cost of finished products;

Debit 90-2 Credit 40 – reversed, the amount of excess of the standard cost of manufactured products over the actual cost is written off;

or

Debit 90-2 Credit 40 – the amount of excess of the actual cost of manufactured products over the standard cost is written off.

This procedure is provided for in the Instructions for the chart of accounts (accounts 40 and 43).

Accounting at standard cost without using account 40

Within a month, as finished products are released from the workshops to the warehouse, the products arrive at standard cost. In this case, do the wiring:

Debit 43 subaccount “Finished products at standard cost” Credit 20 - reflects the standard cost of finished products produced and delivered to the warehouse.

When selling products:

Debit 90-2 Credit 43 subaccount “Finished products at standard cost” - the sold part of finished products is written off at standard cost.

At the end of the month, when the actual cost of manufactured products is known, determine the deviations from the standard cost:

Debit 20 Credit 10 (70, 68, 69, 25, 26...) – reflects the actual cost of manufactured products.

If the standard cost is greater than the actual cost, make reversal entries:

Debit 43 subaccount “Finished products at standard cost” Credit 20 – the cost of finished products manufactured per month is reduced;

Debit 90-2 Credit 43 subaccount “Finished products at standard cost” - the cost of finished products sold in the current month is reduced.

If the actual cost is higher than the standard cost, the postings will be as follows:

Debit 43 subaccount “Deviations of the actual cost of finished products from the standard” Credit 20 - reflects the deviation of the actual cost of finished products from the standard;

Debit 43 subaccount “Finished products at standard cost” Credit 43 subaccount “Deviation of the actual cost of finished products from the standard” - the deviation of the actual cost of finished products from the standard in terms of products in the warehouse is written off;

Debit 90-2 Credit 43 subaccount “Deviations of the actual cost of finished products from the standard” - the deviation of the actual cost of finished products from the standard in terms of products sold is written off.

Write-off of deviations from planned cost

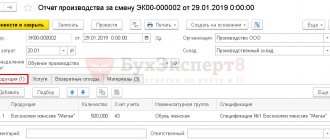

During the production period, deviations from the planned cost are written off using the routine operation Closing accounts 20, 23, 25, 26, 28 and 29 in the Month Closing procedure (Operations – Month Closing).

Wiring is generated:

- Dt 90.02.1 Kt - writing off deviations from the planned cost to the cost of sales.

Check the result using the report Help-calculation of the cost of manufactured products and services provided .

The difference between plan and actual is not distributed, but is included in the cost of sales - in Dt 90.02.