I. General provisions

1. This Regulation establishes the procedure for the formation in accounting and disclosure in the financial statements of organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and state (municipal) institutions), subsoil users (hereinafter referred to as organizations) of information on the costs of developing natural resources resources.

2. These Regulations are applied by organizations that incur costs for the search, evaluation of mineral deposits and exploration of minerals (hereinafter referred to as search costs) in a certain subsoil area.

This Regulation applies to organizations in relation to prospecting costs carried out until the moment when, in relation to the subsoil area in which prospecting, evaluation of mineral deposits and exploration of mineral resources is carried out, the probability (more likely than not) that the economic benefits from mining will exceed the costs incurred, subject to the technical feasibility of mining and the organization having the resources necessary for mining (hereinafter referred to as the commercial feasibility of mining).

3. This Regulation is not applied by organizations in relation to costs:

a) for regional geological and geophysical work, geological surveys, engineering-geological surveys, scientific research, paleontological and other work aimed at the general study of the subsoil, geological work on forecasting earthquakes and studying volcanic activity, creating and maintaining monitoring of the natural environment, control for the regime of groundwater, other work carried out without significant violation of the integrity of the subsoil, carried out until the receipt of a license giving the right to carry out work on the search and assessment of mineral deposits in a given subsoil area (except for the costs specified in paragraph 15 of these Regulations);

b) for the extraction of mineral resources in relation to a subsoil plot, which are incurred after the commercial feasibility of extraction has been established;

c) for geological exploration work carried out on a subsoil plot in respect of which the commercial feasibility of production has been established.

II. Recognition of search costs

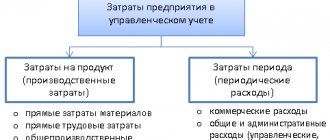

4. The organization establishes the types of search costs recognized as non-current assets. The remaining search costs are recognized as expenses for ordinary activities.

5. Exploration costs recognized as non-current assets (hereinafter referred to as exploration assets), as a rule, relate to a separate subsoil plot in respect of which the organization has a license giving the right to carry out work on the search, evaluation of mineral deposits and (or) exploration of minerals .

6. Exploration costs related primarily to the acquisition (creation) of an object that has a tangible form are recognized as tangible exploration assets. Other search assets are recognized as intangible search assets.

7. Tangible exploration assets, as a rule, include those used in the process of searching, assessing mineral deposits and mineral exploration:

a) structures (pipeline system, etc.);

b) equipment (specialized drilling rigs, pumping units, tanks, etc.);

c) vehicles.

8. Intangible exploration assets usually include:

a) the right to carry out work on the search, assessment of mineral deposits and (or) exploration of mineral resources, confirmed by the presence of an appropriate license;

b) information obtained as a result of topographical, geological and geophysical studies;

c) results of exploratory drilling;

d) results of sampling;

e) other geological information about the subsoil;

f) assessment of the commercial feasibility of production.

9. Tangible and intangible exploration assets are accounted for in separate subaccounts to the account for accounting for investments in non-current assets.

10. The accounting unit for tangible and intangible exploration assets is determined by the organization in relation to the accounting rules for fixed assets and intangible assets, respectively.

11. The accounting policy chosen by the organization for recognizing and classifying exploration assets should be applied consistently to similar costs and activities.

How to reflect the costs of field development in accounting

Good afternoon, Nadezhda. Expenses for the development of deposits should be taken into account as part of: - non-current assets; — expenses for ordinary activities. You must set out in your accounting policies what types of search costs will be taken into account as part of non-current assets; all other search costs will be recognized as expenses for ordinary activities (clause 4 of PBU 24/2011). Search assets are depreciated. If commercial feasibility is confirmed, then exploration assets must be transferred to fixed assets at their residual value, calculated using the form: Residual value = Initial cost - Accrued depreciation - Depreciation. In tax accounting, expenses for the development of deposits are classified as expenses associated with production and sales (subclause 3, clause 1, article 253 of the Tax Code of the Russian Federation). The list of expenses is given in paragraph 1 of Art. 261 of the Tax Code of the Russian Federation, it is open, so you can supplement it. Expenses that form the initial cost of the operating system must be capitalized. These expenses will be written off through depreciation after the asset is taken into account. As my colleague already wrote, the functionality of 1C: Accounting is not intended for managing your tasks; for this there are a number of industry solutions, for example, 1C: - ERP Mining industry 2; — 1C: Mining industry 2. Operational accounting; — Mining industry. Quarry management. On the 1C consultation line you will be able to offer other options for maintaining your records. You can review these configurations and make decisions about where to keep records. We do not provide advice on the methodology of accounting and tax accounting. Therefore, in order to be able to simulate your situation in a test database, you need a methodology for your accounting. Please specify: 1. Are your search costs tangible or intangible? 2. Do you form non-current assets and expenses for ordinary activities? Or do you collect all expenses into the initial cost of non-current assets? 3. If you create non-current assets, will you charge depreciation? 4, At NU, will you capitalize or immediately write off as expenses, or write off evenly over 97 years? You have a narrow topic, the specifics of an industry that you know better than us. Therefore, provide the entries with which you want to reflect your costs in the database. Based on your transactions, we will try to describe what operations need to be performed in the program. Another question about property tax, why do you think you have to pay it? As far as I understand, you want to take into account all expenses on account 08, until the commercial feasibility of expenses for field development is confirmed.

III. Valuation of exploration assets upon recognition

12. When recognized in accounting, exploration assets are valued at the amount of actual costs.

13. The actual costs of acquiring (creating) exploration assets include:

- amounts paid in accordance with the agreement to the supplier (seller);

- amounts paid to organizations for performing work under construction contracts and other contracts;

- remunerations paid to the intermediary organization and other persons through which the exploration asset was acquired;

- amounts paid for information and consulting services;

- customs duties and customs fees;

- non-refundable taxes, government and patent fees;

- depreciation of other non-current assets (including exploration assets) used directly in the creation of an exploration asset;

- remuneration to employees directly involved in the creation of the search asset;

- the organization's obligations in relation to environmental protection, land reclamation, liquidation of buildings, structures, equipment arising in connection with the performance of work on the search, evaluation of mineral deposits and mineral exploration associated with recognized exploration assets;

- other costs directly related to the acquisition (creation) of a prospecting asset, providing conditions for its use for the planned purposes.

14. The actual costs of acquiring (creating) exploration assets do not include:

- tax refunds;

- general business and other similar expenses, except for cases when they are directly related to the performance of work on the search, evaluation of mineral deposits and mineral exploration and relate to a separate subsoil area in which the organization carries out such work.

15. Costs incurred by an organization prior to obtaining a license giving the right to perform work on the search and evaluation of mineral deposits are included in the actual costs of obtaining this license only if such costs are directly related to its receipt.

IV. Subsequent evaluation of exploration assets

16. The subsequent assessment of tangible and intangible exploration assets, including depreciation, is carried out in relation to the rules for the subsequent assessment of fixed assets and intangible assets, respectively, taking into account the features established by paragraphs 17 - 20 of these Regulations.

17. The procedure for calculating depreciation on exploration assets is determined by the organization. When a prospecting asset is used to create another prospecting asset, the associated depreciation expense is included in the cost of its creation.

18. The costs of obtaining a license, which, along with the right to carry out work on the search, evaluation of mineral deposits and (or) exploration of mineral resources, gives the right to extract minerals, are not subject to depreciation until the commercial feasibility of extraction is confirmed.

19. The organization must conduct an analysis at each reporting date of the presence of circumstances indicating possible impairment of exploration assets (hereinafter referred to as indicators of impairment). At a minimum, the following indicators of impairment must be considered:

a) the end, within 12 months after the reporting date, of the period for which the organization received a license giving the right to carry out work on the search, evaluation of mineral deposits and exploration of minerals in a certain area, in the absence of intentions and (or) the possibility of extending the corresponding rights;

b) significant costs necessary to carry out work on further search, evaluation of mineral deposits and exploration of minerals in a certain area are not taken into account in the organization’s plans;

c) making a decision to terminate activities related to the search, assessment of mineral deposits and exploration of minerals in a certain area, due to the fact that the search, assessment of mineral deposits and exploration of minerals in this area did not lead to the discovery of industrially significant minerals;

d) there are indications that, with continued exploration, evaluation of mineral deposits and exploration of minerals in a certain area, the cost of exploration assets, taking into account accumulated depreciation and impairment, is likely not to be fully recovered upon extraction of mineral resources or transfer of the right to use the subsoil plot to other persons.

20. If there are indications of impairment, the entity must test exploration assets for impairment and account for the change in the value of exploration assets due to impairment in accordance with International Financial Reporting Standards (IAS) 36 “Impairment of Assets”, (IFRS) 6 “Exploration and Evaluation of Mineral Reserves” <*>.

——————————–

<*> Put into effect for use on the territory of the Russian Federation by order of the Ministry of Finance of the Russian Federation dated November 25, 2011 No. 160n (registered by the Ministry of Justice of the Russian Federation on December 5, 2011, registration No. 22501; Rossiyskaya Gazeta, 2011, December 9).

Search assets

Search costs classified as non-current assets are recorded in account 08. Based on their content, search assets are divided into tangible and intangible. Therefore, keep their records in separate sub-accounts opened to account 08. This follows from paragraphs 6 and 9 of PBU 24/2011.

The current chart of accounts does not provide for such subaccounts. Therefore, an organization can enter them independently and stipulate this in its accounting policies for accounting purposes. For example, accounting can be done like this:

- account 08 subaccount “Intangible exploration assets”;

- account 08 sub-account “Material exploration assets”.

Tangible search assets include search costs for the acquisition of objects that have a tangible form. For example, these:

- structures (pipeline system, etc.);

- equipment that is used for searching, evaluating mineral deposits and exploring oil and gas reserves (for example, specialized drilling rigs, pumping units, tanks, etc.);

- vehicles.

This is stated in paragraph 7 of PBU 24/2011.

Intangible exploration assets are:

- the right to carry out work on the search, evaluation of mineral deposits and (or) exploration of mineral resources, confirmed by the appropriate license;

- information obtained as a result of topographical, geological and geophysical studies;

- exploration drilling results;

- sampling results;

- other geological information about the subsoil;

- assessment of the commercial feasibility of production.

This is stated in paragraph 8 of PBU 24/2011.

Take into account exploration assets separately for each licensed subsoil area (clause 5 of PBU 24/2011).

Determine the unit of accounting for exploration assets as follows:

- for material exploration assets - according to the rules of accounting for fixed assets;

- for intangible exploration assets - according to the rules of accounting for intangible assets.

This procedure is provided for in paragraph 10 of PBU 24/2011.

V. Derecognition of exploration assets

21. The organization ceases to recognize exploration assets in relation to a certain subsoil area upon confirmation of the commercial feasibility of production or recognition of mineral extraction there as unpromising.

22. The organization provides documentary evidence of the commercial feasibility of mining or recognition of the futility of mining at a subsoil site.

23. When confirming the commercial feasibility of production, the organization must carry out the following sequential actions:

a) check recognized exploration assets for impairment and, if confirmed, recognize their impairment;

b) transfer exploration assets to fixed assets, intangible or other assets at residual value (actual costs taking into account revaluations made minus accumulated depreciation and impairment);

c) stop recognizing subsequent costs on this subsoil plot as exploration assets.

24. The cost of a tangible or intangible exploration asset that is retired or is not capable of bringing economic benefits to the organization in the future is written off in the manner established for writing off fixed assets or intangible assets, respectively.

25. If during the reporting period the extraction of minerals at a subsoil site is recognized by the organization as unpromising, exploration assets related to this subsoil site are written off, except for cases where they continue to be used in the organization’s activities. Income or expenses from the write-off of exploration assets are included in the financial results of the organization.

26. In the cases established by paragraphs 23 and 25 of these Regulations, subject to further use in the organization’s activities, exploration assets are transferred to fixed assets, intangible and other assets (including exploration assets intended for use in other subsoil areas) based on their compliance with the criteria (conditions) of recognition established by regulatory legal acts on accounting for this type of assets.

Tangible search assets, as a rule, are transferred to fixed assets, intangible search assets - to the intangible assets of the organization.

In some cases, the value of an intangible exploration asset may form the actual cost of an organization's fixed assets. For example, the costs of geological exploration related to specific wells, recognized as part of intangible exploration assets, can be included in the actual cost of wells when they are recognized as objects of property, plant and equipment of the organization.

Derecognition in accounting

Terminate recognition of exploration assets in relation to a licensed subsoil area if there is documentary evidence of:

- or commercial feasibility of production;

- or the futility of mining.

This procedure is provided for in paragraph 21 of PBU 24/2011.

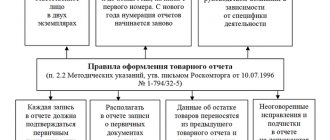

Situation: what documents should be used to confirm the commercial feasibility of mining?

The organization establishes the list of supporting documents independently. This follows from paragraph 22 of PBU 24/2011.

From the determination of the commercial feasibility of production it follows that documents confirming it must contain the following information:

- calculations confirming the likelihood that mining will bring economic benefits;

- confirmation that the organization has the resources necessary to carry out production;

- information on the availability of legal rights to extract minerals.

In this case, the economic benefits of production can be justified, for example:

- minutes of the meeting of the Central Commission for the Development of Rosnedra (clauses 4.1 and 6.9 of the Temporary Regulations, approved by Order of Rosnedra dated August 15, 2005 No. 877);

- independent appraiser's report;

- by order (instruction) of the head of the organization to begin development of a specific subsoil plot;

- a justified conclusion of specialists (or departments) of the organization planning the development of a subsoil plot, responsible for making decisions on the need to develop a specific subsoil plot (based on the productivity of the deposit, the cost of minerals, the amount of possible costs, the availability of the necessary infrastructure). Such a conclusion may be based on calculations by specialists, conclusions of government bodies or independent experts.

If the commercial feasibility of mining is confirmed, then do the following. Check exploration assets for impairment. If an impairment is confirmed, then recognize the results. Then transfer the search assets to fixed assets (intangible assets) at their residual value calculated using the formula:

| Residual value of the exploration asset | = | Actual costs of creating an asset (including revaluations) | – | Accumulated depreciation | – | Impairment |

This is stated in paragraph 23 of PBU 24/2011.

Conduct the transfer of exploration assets into fixed assets and intangible assets in accordance with the norms of PBU 6/01 and PBU 14/2007. Please note that some of the intangible exploration assets in such an operation may not act as independent accounting units, but will be recognized as part of capital investments in another non-current asset. For example, exploration costs that relate to specific wells may be included in the actual cost of wells when they are recognized as property, plant and equipment.

This procedure is provided for in paragraph 26 of PBU 24/2011.

Exploration assets that are being retired or are not capable of bringing economic benefits to the organization in the future, write off according to the general rules for fixed assets and intangible assets (clause 24 of PBU 24/2011).

For more information, see:

- How to reflect in accounting the gratuitous transfer of fixed assets;

- How to reflect the liquidation of fixed assets in accounting;

- How to reflect the sale of fixed assets in accounting;

- How to reflect the sale of fixed assets in tax accounting.

If mining is deemed unpromising, then write off exploration assets as other expenses. The exception is cases when the organization continues to use search assets in its activities (clause 25 of PBU 24/2011).

VI. Disclosure of information in financial statements

27. Significant information about exploration assets, as well as liabilities arising from the search, evaluation of mineral deposits and exploration of mineral resources, income, expenses, cash flows from current and investment operations is reflected in separate groups of balance sheet items, as well as individual indicators of the income statement and cash flow statement, respectively.

28. Information about tangible and intangible exploration assets is subject to disclosure in relation to the requirements established for the disclosure of information, respectively, about fixed assets and intangible assets of the organization.

In addition, with respect to groups of tangible exploration assets, the organization must disclose in its financial statements information about:

- actual costs taking into account the revaluations made, the amounts of accumulated depreciation and accumulated impairment at the beginning and end of the reporting period;

- the residual value of assets impaired in the reporting year at the beginning and end of the reporting period and impairment recognized during the reporting period.

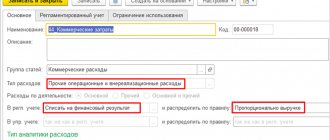

Expenses from the write-off of exploration assets related to a subsoil area in which mineral extraction is recognized by the organization as unpromising are disclosed in the income statement separately from exploration costs recognized as expenses for ordinary activities (taking into account materiality).

29. At a minimum, the following information is subject to disclosure as part of information about the organization’s accounting policies:

- a list of types of search costs recognized as non-current assets, or an indication that all search costs are recognized as expenses for ordinary activities;

- features of the classification of tangible and intangible exploration assets;

- the procedure for calculating depreciation on exploration assets;

- grouping of exploration assets in order to test them for impairment;

- conditions for transferring search assets to fixed assets, intangible and other assets of the organization.

An example of disclosure in the financial statements of an organization of information on the accounting policy in relation to the costs of searching, evaluating mineral deposits and exploring mineral resources is given in the appendix to this Regulation.

Appendix to the Accounting Regulations “Accounting for costs for the development of natural resources” (PBU 24/2011), approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2011 No. 125n

Features of cost accounting for the development of natural resources

Ovchinnikova I.V., Golubeva K.S., Popova O.S.

Starting with the financial statements of 2012, Order of the Ministry of Finance of Russia dated October 6, 2011 N 125n “On approval of PBU “Accounting for the costs of developing natural resources” (PBU 24/2011) comes into force.” The order was registered with the Ministry of Justice of Russia on December 30, 2011. The Regulation is based on International Financial Reporting Standard (IFRS) 6 “Exploration and evaluation of mineral reserves”

Any new accounting provision requires clarification. In this work we will look at the main provisions and get acquainted with the new accounting requirements set out in PBU 24/2011.

The Regulations do not apply to the following costs:

a) for regional geological and geophysical work, geological surveys, geotechnical surveys, scientific research, paleontological and other work aimed at the general study of the subsoil, geological work on forecasting earthquakes and studying volcanic activity, creating and maintaining monitoring of the natural environment.

b) for the extraction of mineral resources in relation to a subsoil plot, which are incurred after the commercial feasibility of extraction has been established;

c) for geological exploration work carried out in a subsoil area for which the commercial feasibility of production has been established [2].

We previously noted that exploration costs relate to a specific subsoil area and arise in conditions where the company has not yet made a decision on the commercial feasibility of mining in this area. This stage may temporarily not generate income or even be completely ineffective.

Under such circumstances, until 2011, subsoil users accumulated their preparatory costs in account 97 “Deferred expenses”. But it turned out to be impossible to maintain this accounting policy due to the change in clause 65 of the Regulations on Accounting and Reporting in the Russian Federation (as amended by Order of the Ministry of Finance of Russia dated December 24, 2010 N 186n). In particular, last year, even the cost of licenses on the basis of which the company conducted prospecting, evaluation and exploration was not subject to inclusion in the RBP (Article 11 of the Law “On Subsoil”).

In addition, as long as the prospects for organizing production and generating income at a subsoil site remain unclear, classifying the equipment used as fixed assets is problematic (clause 4 of PBU 6/01 “Accounting for fixed assets”). PBU 24/2011 solves the listed accounting problems.

Non-current assets of a subsoil user during the development of natural resources are called exploration assets and are divided into tangible exploration assets (MPA) and intangible exploration assets (IPA).

An idea of the classification of search costs can be seen in table [1]:

| Investments in non-current assets (search assets) | Expenses for ordinary activities | |

| search assets | Intangible search assets | |

| – structures (pipeline system, etc.); – equipment (specialized drilling rigs, pumping units, tanks, etc.); – vehicles | – the right to carry out work on the search, assessment of mineral deposits and (or) exploration of mineral resources, confirmed by the presence of an appropriate license; – acquired geological information; – costs for 3-D and 4-D seismic exploration; – assessment of the technical feasibility and commercial feasibility of production at a subsoil site, carried out by third parties | – costs for topographical, geological, geochemical and geophysical research; – costs of maintaining services conducting these studies; – other costs not attributed to exploration assets |

Now we need to consider the organization of accounting.

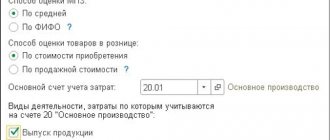

Exploration assets are accounted for in special subaccounts of account 08 “Investments in non-current assets”. They are depreciated according to the same rules as fixed assets or intangible assets. And they are revalued in the same order (clause 16 of PBU 24/2011).

Upon initial recognition, exploration assets are valued at the amount of the company’s actual costs (clauses 11 and 12 of PBU 24/2011). Such business transactions are reflected in the following entries:

1) D08 subaccount “Investments in exploration assets” K60,70,69,02,10 - the initial cost of the exploration asset is formed;

2) D08 subaccount “Tangible (intangible) exploration assets” K08 subaccount “Investments in exploration assets” - the exploration asset is recognized as suitable for use for the planned purposes.

It should be noted that it is not necessary to establish a useful life for intangible assets. Assets with an indefinite life are not subject to depreciation (PBU 14/2007 “Accounting for intangible assets”). This rule also applies to legal entities.

When the commercial feasibility of production is confirmed, exploration assets are transferred to fixed assets or intangible assets at their residual value. This is reflected by the following entries:

1) D23 subaccount “Expenses for ordinary activities” K02 subaccount “Depreciation of exploration assets” - depreciation of exploration assets that directly support search, assessment and exploration is accrued;

2) D02 subaccount “Depreciation of exploration assets” K08 subaccount “Tangible (intangible) exploration assets” - depreciation of exploration assets is written off when the commercial feasibility of production is confirmed;

3) D01(04) K08 subaccount “Tangible (intangible) exploration assets” - exploration assets are transferred to fixed assets and intangible assets at their residual value.

For a new (accepted for accounting for the first time) fixed asset or intangible asset, the accountant must determine the useful life and choose the depreciation method in the generally established manner. If the extraction of minerals at a subsoil site is recognized as unpromising or the exploration asset is retired or is not capable of generating economic benefits in the future, it is written off as a financial result (clause 25 of PBU 24/2011):

1) D91 subaccount “Expenses of unpromising production” K08 subaccount “Tangible (intangible) exploration assets” - the exploration asset is written off from the balance sheet at its residual value due to the impossibility of use [2].

The cost of exploration assets includes the company’s future obligations in relation to environmental protection, land reclamation, and liquidation of structures (clause 13 of PBU 24/2011). This operation will be reflected by the following posting:

1) D08 subaccount “Investments in exploration assets” K96 subaccount “Liabilities for environmental restoration” - estimated liabilities arising upon completion of assessment, search and exploration are recognized.

We have presented the most typical correspondence of accounts.

PBU 24/2011 establishes that search costs not classified by the company as search assets are recognized as expenses for ordinary activities. It should be noted that this position does not correspond to the definition contained in clause 5 of PBU 10/99 “Expenses of the organization”. After all, a company, while developing natural resources at a subsoil site, does not manufacture and sell products, perform work or provide services for customers. But in essence, we can say that PBU 24/2011 only expanded the concept of expenses for ordinary activities.

For administrative expenses at the preparatory stage, account 23 “Auxiliary production” is used. It will have to be closed monthly and directly to account 99 “Profit and Loss”. These transactions can be reflected in the following entries:

1) D23 subaccount “Current search costs” K02,10,70,69,71,60,76 - expenses for ordinary activities are recognized, including depreciation of search assets;

2) D99 K23 subaccount “Current search costs” - at the end of the month losses in connection with preparatory activities were recognized.

Thus, exploration costs are, in principle, included in losses, with the exception of the residual value of those MPAs and NPAs that the company will use in commercial production.

It is interesting that the subsoil user company is not obliged to recognize exploration assets, but has the right to write off all exploration costs through the income statement. However, this approach is not consistent with IFRS 6, which focuses on exploration assets and only mentions non-capital costs in passing. This accounting policy generates a zero balance with losses, which does not correspond to the real state of affairs of the company [1].

It should also be noted that the last section of PBU 24/2011 is devoted to the issues of disclosing information about search costs in the financial statements of an organization. By Order of the Ministry of Finance of Russia dated October 5, 2011 N 124n, changes were made to the forms of financial statements of organizations approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n.

According to the changes, to reflect tangible and intangible exploration assets in the “Non-current assets” section of the balance sheet, after the line “Results of research and development”, separate groups of articles “Tangible exploration assets” and “Intangible exploration assets” (codes 1140 and 1130) were introduced. It is necessary to provide appropriate explanations for these groups of articles, which can be presented in tabular form in a manner similar to the explanations for intangible assets and fixed assets of the organization. In addition, it is advisable to disclose in the explanations information about the transfer of exploration assets to assets of another type.

In the income statement, the organization discloses search costs recognized as expenses for ordinary activities. However, a special line for them in this reporting form is not yet provided. According to the authors (E. Dirkova, I. Pyleva), these expenses can be shown in the line “Administrative expenses” (code 2220). The company must consolidate such a decision in its accounting policy (clause 20 of PBU 10/99).

Summarizing the above, we can conclude that the following should be disclosed as part of information about an organization’s accounting policies:

— a list of types of search costs recognized as non-current assets, or an indication that all search costs are recognized as expenses for ordinary activities;

— features of the classification of tangible and intangible search assets;

— the procedure for calculating depreciation on exploration assets;

— grouping of exploration assets in order to check for impairment;

— conditions for transferring search assets to fixed assets, intangible and other assets of the organization [3].

The adoption of PBU 24/2011 is an important step towards improving legislation and the transition to international financial reporting standards. Also, the introduction of this Regulation is relevant for many regions of Russia, especially for those regions where the development of natural resources is actively underway (for example, for the Kemerovo region).

Thus, the application of PBU 24/2011 will require subsoil user organizations to revise their accounting policies regarding the costs of prospecting, evaluation and exploration of mineral resources, revise the organization of accounting, apply a mandatory procedure for checking exploration assets for impairment, as well as clarify the scope and procedure for disclosure information about search costs in financial statements.

Literature:

1. Dirkova, E. New PBU for subsoil users // Practical accounting. – 2012. – No. 2.

2. Accounting regulations “Accounting for costs for the development of natural resources” (PBU 24/2011), approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2011 No. 125n.

3. Pyleva, I. New accounting regulations // Financial newspaper. – 2012. – No. 4.