In this article, we will look at the procedure for conducting an inventory of intangible assets, briefly understand the legal provisions governing this area, take a look at the rules of procedure and find out how the results are recorded. We will also touch on all related issues, one way or another, related to these concepts.

The essence of the object

So, intangible assets are the commercial values of the company. Accordingly, they are aimed purely at obtaining benefits. Otherwise, they are not recognized as such; they also do not have a material form, they are immaterial. But they belong to the company legally. This can be either full copyright, which in fact should be equated to ownership, or use by proxy for a temporary period with restrictions. This category refers to that part of the property that is not involved in turnover. After all, their sale occurs not just once, but constantly during the period that they are owned. Receiving benefits multiple times is the main goal. Therefore, accounting is carried out as an inventory of the non-current assets of the enterprise.

But even though they do not have a material form, they are still subject to accounting, the results of which are stored in special documents. Of course, it is impossible to verify the actual availability by regular reconciliation. After all, they don’t exist in the physical world. But it is permissible to identify the documentary basis for their use, the correctness of execution, the correctness of reception or transmission, the possibility of implementation within a certain period of time and in a specific geographical area.

Moreover, often the number of such objects can even exceed the rest; accordingly, verification becomes a lengthy procedure. And it is extremely difficult to carry out it without the appropriate knowledge, as well as suitable software.

Measures taken based on the results of the inspection

Depending on what results were obtained during the inventory of intangible assets, the company’s actions will differ:

| Inventory result | What to do |

| The inventory results correspond to the data stated in the accounting | No measures required |

| An asset not shown in the accounting records was identified | Intangible assets are being registered |

| An asset taken for temporary use with an expired agreement was identified | In this case, it is necessary to write off the intangible asset |

| An asset with obsolescence has been identified | Write-off of intangible assets |

| A shortage was identified due to the fault of certain persons as a result of their incorrect actions or inaction | The loss is written off at the expense of the guilty parties |

| A shortage was identified without the possibility of identifying the perpetrators | The shortage is written off in the financial result |

Inventory list of intangible assets

In order to begin the process, it is first necessary to understand what falls into our field of vision.

And this:

- Copyright. It is generally accepted that these include only various achievements in the field of culture and art. Works of art, paintings, illustrations, musical fragments or video sequences. But the list turns out to be much wider. This should include programs, various models, plans, strategies, algorithms and much more. And the specificity from cultural easily develops into scientific.

- Patents. These rights relate to inventions. That is, some kind of device, mechanism, form, graphical shell and much more. The key difference is that in this case it is not the specific result itself, for example, a scientific article. But only a principle that is further used only by those whose action is permitted by law.

- Slogans, names, trademarks, brands and similar. The main value is in the commercial component. And also in associations that people assign to a certain name.

- The reputation of the project, infringement of which is punishable under the current legislation of the Russian Federation.

And these are just simple objects. These include those whose use is permitted on the basis of a separate document. But if one paper makes it possible to implement a mass of patents at once, these are already complex. Which also fall under the inventory.

In addition to those listed, the verified documents also include certificates of state registration and licenses. It all depends on what needs to be legalized.

Purpose and rules

In fact, the inventory of fixed assets and intangible assets is an audit, but it has its own personal characteristics and rules. Which it is better to adhere to in order to carry out the procedure as correctly as possible.

As you know, this method is the best way to control the safety of property. Constantly examine whether all title documents are in order. Enter them into the database, note their presence, and record that their service life has not yet expired. But all actions are performed according to the following rules.

- A certain frequency is established. The number of inventories is the competence of the founders and management; arbitrary is acceptable. But this is if we talk about optional events. But the audit should definitely be carried out at least once a year, before closing the annual reporting. And also in cases where the employees responsible for security left their positions and other persons took their place. The same principle works when changing the organizational structure of a company: reorganization, merger or even liquidation. Especially if the cessation of activity occurs against the backdrop of accumulated debts, not to mention bankruptcy. When detecting theft, it is also necessary to carry out an event for reliability.

- The implementation falls on the shoulders of a special commission. It must include certain links, representatives of accounting, management, experts and other employees. The appointment of the composition is carried out by the director or his authorized deputy. This is the only way to take inventory of non-financial intangible assets; for example, an assistant manager, an accountant, an appraiser, a loader and, inevitably, a storekeeper. Or another person who bears personal responsibility for the safety of the values being studied.

- Even before the start of the action, the commission receives all the papers that record the acceptance, distribution or transfer of objects. To be aware of the state of affairs, to know what to compare with.

- The final result is strictly recorded in duplicate. And this does not happen at the end of the entire event, but at the end of the working day. Even if everything resumes in the morning. The reporting is certified by all those present. The storekeeper also signs, as a supervisory authority that verified the legality and absence of criminal intent during the event. After all, he has financial obligations in case of loss.

- If there are discrepancies in any plan, a special statement is drawn up. It, like the title order, the results of the inventory of intangible assets for each working day, constitutes a complete reporting package.

Regulatory regulation

From the point of view of the law, the main regulator is the order of the Russian Ministry of Finance. It was established back in 1995 at number 49. It reflects the very fact of the need for reconciliation and puts forward basic definitions of key concepts. But the specific procedure and conditions are not regulated. They were changed already in 2007. Again, by the Ministry of Finance, but in PBU (accounting regulations).

Any deviations from the norms specified in the law indicate a violation. And the results obtained are not considered true, and it is unacceptable to refer to them. If a violation of an essential condition has been identified, the procedure must be repeated.

How is it carried out?

The procedure for conducting the inventory is important; intangible assets identified as a result will have to be checked again if there is a violation of the regulations. Therefore, we will pay close attention to it.

Initiation occurs by implementing an order in a special form. This is INV-22. But it does not work in all cases. It, in fact, forms a new commission that will solve the task. But if all the required members already exist as usual and are constantly engaged in this matter, then another order is activated. This is INV-23.

The procedure also applies to storekeepers or other responsible persons. In addition to direct supervision, they also create their own small reports. Or rather, they fill out receipts. The fact that a specific object was registered was revealed during the inspection. Or written off at the end of its operational life. And besides this, they enter all the details of the papers that were handed over to the members of the commission for review. And they strictly note their return to storage.

By the way, if previously the responsible persons were given funds for the purchase of certain goods, both tangible and intangible, and reporting on sales was not carried out, this is also noted.

It is noteworthy that the commission also has an additional goal: deciding whether the things being checked are these intangible assets. Do they meet all the requirements, categories, and conditions specified in the order of the Ministry of Finance? And if something does not fit the description, a corresponding entry is made about it. And he himself is excluded from view during the procedure.

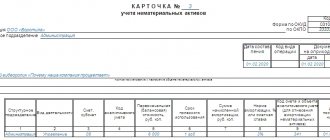

How to correctly fill out the INV-1a form

The form consists of three pages. Let's talk in detail about each of them.

First page

Here you need to enter information such as:

- Name of the company, enterprise and structural unit. The name must be the same as in all other documents.

- OKPO code.

- Activity code.

- Details of the document (number and date of preparation) on the basis of which the inventory is carried out. This is an order, decree or direction. As a rule, there is an order.

- Start and end dates of the inventory procedure.

- Type of operation (not always filled in).

- Number and date of compilation of the completed inventory.

- List of intangible assets that are subject to inventory.

- Their location. Here it is noted in which structural unit the intangible assets are located.

This is followed by a receipt stating that all intangible assets have been sent to the accounting department, and the intangible assets themselves have been accounted for or written off. The employees responsible for storing papers on the company’s right to intangible assets put their signatures.

Second page

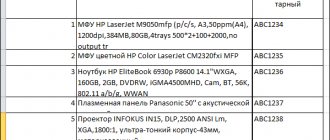

There is a table on this page. The following data is entered into it:

- Number in order.

- Intangible asset name, function and brief description.

- A document confirming its registration, with details such as name, date of preparation and number.

- Date of registration with the company.

- Actual cost according to primary data.

- Cost according to accounting data.

At the end of the table, the total value of all assets is summarized. Then they summarize the page: indicate the number of serial numbers in the table and the actual amount. These entries must be made in words.

Attention! If the organization has a lot of intangible assets, then you can add the required number of pages to the form. Then each of them will need to be summarized at the end.

Third page

First of all, sum up the overall inventory. Then the chairman and members of the commission put their signatures, after which the persons responsible for the safety of documents on the right to intangible assets sign that all intangible assets were checked in their presence and there are no claims against the commission.

At the end, the accountant signs that he has checked all the calculations in this inventory.

If, based on the results of the inventory, discrepancies were identified between accounting and actual data, then fill out a matching statement in the INV-18 form.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Inventory of intangible assets, documentation of intangible assets

The main final document is the statement. It is formed strictly according to the INV-1A model. And although it is often led by only one person, all members of the commission must confirm the fact of their participation and agreement with the indicated results. And the responsible persons, of course, including.

But, as we have already clarified, there is also a second statement, a comparison statement. It is not always initiated, but only in cases where there are discrepancies. Unaccounted for values or, on the contrary, the absence of such when they are noted on papers. Its form sounds like INV-18.

All results obtained are sent to the accounting department. What is noteworthy is that now, or rather, since 2013, the requirement for strict compliance with the form has been abolished. Of course, in many companies the surplus of intangible assets (INA) identified during the inventory and their reflection is also shown in the matching statement INV-18. But with amendments, companies have the right to develop their own personal form. And act on it, marking documents in your own way. Of course, if the variation does not in any way contradict the legal norms established by the Ministry of Finance. Otherwise, such a form will be excluded and not taken into account.

It’s easier to adapt your own form to automated verification. Which is ten times superior to manual in both speed and quality. , offers various software solutions. They will make the procedure an easy task. With the help of mobile applications adapted to all amendments of the Ministry of Finance, reconciliation is much easier, and recording a report does not require a lot of fiddling with papers and studying reports.

Frequency of inventory of intangible assets

The timing and frequency of the inventory are set by the manager. It is mandatory to audit assets in the 4th quarter before preparing annual reports. In other cases, the need for control measures is determined by the head of the enterprise.

Let's consider cases that require checking the status of intangible assets in the table below.

| Inventory frequency | Reasons for need |

| Once a year | Preparation of data for annual reporting |

| Once every six months | Checking the status of intangible assets and documents in accounting for semi-annual and annual balances |

| Several times, as necessary (except for cases of mandatory inventory) | Change of the financially responsible person whose responsibilities include accounting and storage of intangible assets, or dismissal of more than half of the group of responsible persons |

| Changing the structure of an enterprise - merger, liquidation, change of owner | |

| Revaluation of assets at market value | |

| Detection of theft or damage to an asset | |

| The occurrence of a force majeure circumstance - fire, flooding, leading to complete or partial loss of property |

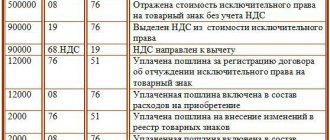

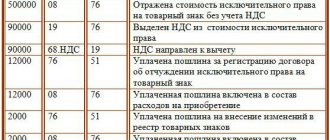

Surpluses and disadvantages

For clarity, we will show what the final table looks like. After all, checking the accounting of the results of the inventory of intangible assets is an important part, which is mandatory before the commission members add their signatures.

| Action | D-t | Kit |

| Accounting for surplus | 05 | 92 |

| Written off depreciation due to surplus valuables | 06 | 05 |

| Write-off with value terms | 93 | 05 |

| Transferred to the repayment account at the expense of the financial responsible person | 70 | 93 |

| Difference from the market price and the potential balance when written off at the expense of the financial responsible person | 72 | 73 |

| The amount of potential income after the compensation is realized | 70 | 72 |

| Total losses based on findings | 98 | 95 |

Postings when identifying surplus during inventory

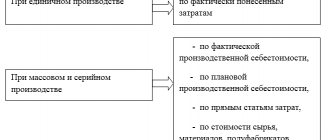

Accounting for identified fixed assets and inventory items

First, you need to assess the condition of the identified asset. If it can be used without any additional investments or the company already uses it in its activities, then the asset should be recorded in account 01 “Fixed Assets” or 03 “Profitable Investments in Material Assets”.

If the object is not yet ready for use in its current state and its initial value has not been fully formed, then it should be taken into account in account 08 “Investments in non-current assets”.

Identified surpluses of materials, goods and other valuables are received and reflected in the corresponding accounts 10 “Materials”, 41 “Goods”, 43 “Finished Products” and so on.

Assets other than cash are accepted for accounting at their current market value (clause “a”, clause 28 of the regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). The market value of an asset must be determined taking into account its technical condition (clause 3.3 of the guidelines for inventory of property and financial liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49). To do this, the company can use the services of an independent appraiser.

In the same amount, other income is recognized in accounting, which is reflected in the credit of account 91 “Other income and expenses”, subaccount 91-1 “Other income” (clause 7 of PBU 9/99 “Income of the organization”, instructions for using the chart of accounts ).

In the reporting period to which the date as of which the inventory was carried out applies, entries must be made (Part 4 of Article 11 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, paragraph 7 of PBU 9/99).

| Operation | Debit | Credit |

| Fixed assets identified during inventory were accepted for accounting | 01 (03) | 91-1 |

| Capital investments identified during inventory were taken into account | 08 | 91-1 |

| Material assets identified during inventory were taken into account | 10 (41, 43) | 91-1 |

Accounting for excess cash

The capitalization of excess funds is reflected in the accounting entry in the debit of account 50 “Cash” in correspondence with the credit of account 91, subaccount 91-1.

| Operation | Debit | Credit |

| The funds (monetary documents) identified as a result of the inventory were capitalized | 50 | 91-1 |

What is checked during the process, inventory object of intangible assets

As we have already clarified above, the main task is the reconciliation of documents. But at the same time, it is not just the availability of the necessary paper that is calculated. There are a lot of factors that the commission pays attention to.

First of all, the place of application is studied. Everything is permissible for use only in a certain area. Of course, sometimes the entire Russian Federation is a territory. But often this location is much narrower.

Attention is also drawn to the correctness of the design. If an error was made in the preliminary records, for example, about capitalization, then now the assessment is not made as such. After all, there was no receipt. First you need to correct the mistake.

Next, each object is checked for compliance with the definition of intangible assets, focusing on legal norms in the form of orders of the Ministry of Finance. And only if the value, in principle, fits the given definition, the title documentation is checked.

The depreciation period is determined, as well as the permissible maximum period of use.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Creating a new consumable type KPS in BSU 2.0

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.

How often to initiate the procedure

As we have already clarified, it is necessary to carry out this once a year, when changing the organizational structure or when replacing the person responsible for storage. The rest depends specifically on the organization and the amount of valuables in the property. For small volumes and constant use, it is, in principle, permissible not to carry out additional measures. But if the quantitative factor goes off scale, then it is better to issue a corresponding order at least once every 3 months. And if there is an opportunity and free employees, then even more often.

Documents used during the inventory of intangible assets

All data that the commission receives during the inventory process is recorded in a special statement INV-1a. Authorized persons responsible for the safety of documents regarding the state of intangible assets put their signature in the header of the statement. If unaccounted for assets are discovered, they must be included in the inventory compiled during the audit. Such a document is drawn up in two copies, one of which will be kept by the person responsible for storing the documents, and the second is transferred to the accounting department. All members of the inventory commission sign the inventory.

During the inspection, a matching statement is also drawn up in the INV-18 form. Such a statement is required in order to record the differences between the information obtained during the audit and the data specified in the accounting documents. The statement is also drawn up in two copies.

All results obtained during the inventory of intangible assets are reflected in accounting documents. If, as a result of the audit, surpluses are identified, they are indicated at the market price and entered in the financial result line. Identified deficiencies are subject to recovery from the guilty parties, and their accounting occurs in the same way.

Important! Since 2013, companies have the right not to use unified forms of documents. Therefore, in order to carry out verification, they have the right to independently develop forms of documents, as well as approve them in their internal policies. The main requirement when drawing up document forms is to indicate all the details regulated by law.

conclusions

To summarize, this process is extremely important for almost any commercial project. After all, there is not a single person who does not use such intangible assets to at least some extent.

The main thing is to understand that not only knowing how to conduct an inventory of intangible assets will allow you to obtain effective results. But also the appropriate software, which will also simplify the task. And for exclusive offers developed specifically for the needs of a specific company, you should contact us. Cleverence software will always help you solve a problem faster, easier and more productively.

Here you can download the necessary documentation layouts.

Number of impressions: 7849