There are many ideas for starting your own business. You have finally made up your mind and opened a car service center. You have just registered a business, your head is spinning, and you immediately have questions about how to properly and how best to maintain accounting records for a car service center. After all, you want to plan your expenses wisely and, of course, optimize your tax burden.

There are nuances to maintaining accounting records in a car service center. Let's talk about them.

Most often, a car service provides a wide variety of services. At the same time, it is possible to provide them to both individuals and legal entities.

Documents required for work

To be able to reflect the sale of services in accounting, primary documents are used:

- contract for services;

- act of completed work or;

- invoice if you work with VAT.

There are other important documents. To place an order, for example, for vehicle repair at a car service center for an individual, you will need to fill out an order form in the BO-1 form.

In order to timely keep records of services provided, display and conduct them correctly, use the accepted and approved forms:

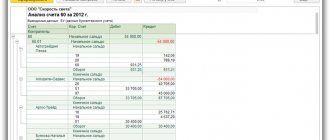

- Car repair services were provided by car service center Dt 62.01 Kt 90.01

- Paid for car repair services by individuals Dt 50 Kt 62.01

- Paid for car repair services by legal entities Dt 51 Kt 62.01

When you provide repair services, after the work is completed, the car service must correctly write off the used spare parts:

- The car service received spare parts from suppliers Dt 41 Kt 60

- Spare parts were paid to the supplier according to the invoice and delivery note Dt 60 Kt 51

- Spare parts were written off during the provision of car service services Dt 90 Kt 41.

Taxation of organizations (IP) working in the car service system

The costs of fees, contributions and the actual principle of operation in the car service system depend on the special tax regime applied in the organization (IP).

| Tax regime | Features of application | The tax burden |

| simplified tax system (6% of profit) | The staff does not exceed 100 people; annual profit up to 60 million; BSO for repairs with individuals; work with legal entities via cash register, current account | Property tax is not paid; the basic tax is reduced by insurance fees; mandatory KKM when selling spare parts |

| USN (profit - expenses) | Features of the application as with the simplified tax system with 6% of profit | There is no property tax; KKM is obligatory when selling spare parts; if there is no income, 1% of income is paid |

| UTII | Only staffing limits of 100 people; BSO for repairs with individuals, and spare parts by check; work is carried out through cash register, current account - with legal entities; spare parts by receipt | They do not pay property tax; the basic tax is paid quarterly in any case, it is calculated taking into account the number of employees; paid insurance fees for employees reduce the basic tax by 50% |

| OSN with VAT | No limit; BSO with individuals for repairs; with legal entities - cash register, current account | Lots of taxes, including VAT; if there is no income, taxes are not paid or their amount is minimal |

| OSN without VAT | Limitation only on part of the profit - up to 2 million per quarter; BSO with individuals, and with legal entities - an account or cash register | Heavy tax burden; if there is no profit, the amount of taxes is significantly reduced or they are not paid |

Thus, organizations and individual entrepreneurs can carry out their activities in the car service system while being on the simplified tax system or the special tax system. At the same time, some types of activities may fall under UTII (Tax Code of the Russian Federation, Article 346.26, clause 2, clause 3). The choice of tax regime should be made taking into account the above-mentioned features of their application and tax burden.

Organization of accounting for a car service center

The accounting department of a car service center is required not only to keep separate records for each service provided, but also to record cash flows and payments with suppliers.

Thus, in order to comply with all legal requirements, it is necessary:

- take into account the authorized capital of the service and monitor its changes;

- understand settlement data with suppliers;

- be able to work with the main available funds and intangible assets.

If a car service purchases spare parts and various materials, equipment and other necessary tools for work, then the resources used must be written off in accordance with legal requirements.

It does not matter what type of accounting will be kept: accounting of clients, vehicles or spare parts. In any case, it is better to entrust all these questions to a specialist.

Primary documentation used in the car service system

Activities in a car service include:

- accepting orders;

- execution of received orders;

- bringing actual services to the clientele.

Initial, initial documents in this process play a paramount role, since each component of the process requires proper execution. Paid services can be documented both with original documents and with the help of tokens, cash receipts (hereinafter referred to as CC), etc.

| Source documentation | What does it represent? |

| Maintenance and repair agreement | Includes: data of the customer (legal address) and contractor (full name, contacts, address), information about transport (make, number, model), time of receipt of the order, deadlines for its completion, cost of work, a list of services provided with a listing of the materials and spare parts involved with their prices, guarantee, liability of the parties; a copy is given to the client |

| Order form | Filled out by the client (individual) according to the BO-1 model |

| Order log | Required for registration of orders accepted for execution |

| Claimation act | Compiled upon acceptance for repairs under warranty |

| Record of acceptance | Issued when the owner leaves his vehicle for repairs; records the condition of the vehicle, existing damage, equipment, supplied spare parts and materials; a copy is given to the customer |

| Number coupon | Issued for diagnostics, washing, certain types of maintenance work, etc. |

| CC | Includes:

|

| Cash register tape, cashier-operator’s journal certified by tax authorities (KM-4), etc. | These are documents evidencing customer payments and remain in storage for up to 5 years. |

| Cash report | Compiled by the cashier at the end of the working day and returned with the proceeds |

| Receipt cash order | Shows transfer of proceeds and cash report |

| Accounting statement for the movement of money and services | Necessary for controlling the movement of money (arrival, spending, balance); drawn up every day according to form No. 4 in 2 copies (for accounting and the receiving point) |

| Supplier's invoices, invoices, shipping documentation, acceptance certificate for subsequent use | Used for OS accounting |

Such documentation and quick recording of incoming orders are mandatory for carrying out full-fledged activities in a car service center, ensuring control over the safety, movement of orders and settlements with clients.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Automation of car service work

To help the accountant and owner, a large number of programs have been created to facilitate accounting.

The BIT.Avtoservice program was created on the basis of 1C: Trade Management 8.3., ed. 11. Thus, users receive all the advantages and functionality of the well-known 1C product. Another plus: an accountant does not need to study and understand the system for a long time; standard mechanisms are used to exchange data with 1C: Accounting.

The BIT.Avtoservice solution automates an enterprise of any size: from a small service station with two lifts to network car services.

What benefits does the program provide?

You can:

- see a detailed history of interaction with each client and partner;

- promptly receive data on the need and status of spare parts orders;

- see and analyze all types of mutual settlements with suppliers.

The solution has a built-in separate reporting block, which contains all the reports on warehouse, sales, suppliers and clients, which are available in the familiar 1C: Trade Management program.

Accounting in a car service center, from practical experience

Vasily Dudkin [dv19621]

23.08.2016,

Over the course of my life, I have managed to work at various automobile enterprises and several car services, large and small. Of course, their level differs significantly - in reputable companies there is much more order, accounting is strict, all sorts of misunderstandings and losses happen infrequently. In small offices there can be complete anarchy, each worker is left to his own devices.

Taxi park

I worked in a taxi company from 1983 to 1995, although since 1995 I worked in the commercial division.

I was on a deal and on a salary, but in Soviet times the form of remuneration had practically no meaning - the taxi fleet was entirely hand-held, and very often the monthly tip was more than the salary plus the bonus. The workers were provided with overalls and shoes, but I don’t remember that we were given tools. We ourselves also rarely bought keys - taxi drivers helped out, they lived even more prosperously than car mechanics. In the engine shop there was a section manager, and another of our immediate supervisors was the production manager. They probably kept some kind of documentation, but I never saw any work orders, and it wasn’t interesting to me.

In 1995, I moved to the tuning shop - I built luxury Volgas and repaired engines based on complaints. Workers received piecework pay; who did how much was recorded in a notebook. The accounting of spare parts in the warehouse was carried out approximately; I myself saw how two 5-speed GAZ-31029 gearboxes “grew legs.” Surprisingly, no one noticed the loss; our top management lived well!

Car service in Leninsky district

After working in one place for about 17 years, I decided to change jobs and got a job at a car service center, where they promised a deal - 40% of the earnings earned. The service was located in the neighboring Leninsky district; I had to travel to work from the Automobile Plant. I'm used to some kind of order, so this organization really surprised me:

- I saw the director only once, when I was settling in;

- the section chief only accepted money, he was not interested in anything else;

- The car mechanic received payment for the work in person, and only then handed it over to the boss; it is not clear how the percentage was calculated;

- no one cared about finding clients; the mechanic had to look for a job himself.

It would seem that I needed to take advantage of such anarchy and work for my own pocket. But this state of affairs did not suit me, and besides, no one even once inquired about my work record. I lasted exactly two months, took my things and never showed up there again.

Accounting in your car service

It so happened that in 2003 I had the opportunity to manage my own car service center, and we already had our own procedures there, our own accounting of spare parts, work done by car mechanics, and revenue received.

Of course, it was far from the order that exists in a reputable organization, but I have something to compare with - there was, of course, no such bedlam as in the car service center of the Leninsky district. All the documentation was kept by a girl accountant; later, when the car dismantling shop appeared, we hired two cashiers, four storekeepers were also salespeople. New spare parts were stored in a warehouse and were taken into account; used parts were taken into account only large and significant ones; it was almost impossible to rewrite all the little things.

When there was a turnover of car mechanics in the service, there was simply no time to employ people - there was no point. But as soon as our team stabilized, everyone was officially hired. We had a probationary period of one month, and if the employee managed to prove himself well, it was formalized - we tried very hard to ensure that everything was as it should be.

They also tried to properly register the car that arrived for repairs. When a car entered the repair zone, we always sent the client to the girl, she:

- filled out the work order form;

- wrote down the customer’s contacts (phone number);

- I took an advance payment if the materials or spare parts were ours.

Upon completion of the work, the work order was completed in full, the client received his copy, in which the warranty record was confirmed by a seal and signature. I don’t remember exactly, but it seems that we had a two-month warranty on engines, and one month on gearbox repairs. During this time, the client could check the unit, and if deficiencies were identified, file a claim with the car service center.

Prices for auto repair work

We had price lists with fixed prices for many types of work; a sheet with prices hung in the repair box, and anyone could see the cost of repairs.

We never raised our prices and tried to work as honestly as possible. There were negotiated prices for painting and straightening cars; the craftsmen pre-estimated the cost of the upcoming body repair themselves. The auto electrician charged an hourly rate for many types of work, but the cost of replacing and repairing the generator and starter was fixed. Now I don’t remember the exact prices, so I won’t announce the numbers.

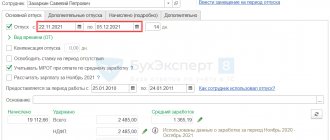

Time tracking

We were paid primarily by piecework, so we mainly controlled discipline when recording working hours - the employee had to arrive on time.

My business partner Andrei and I told the accountant who was not at work or who was late, and the girl entered all the data into a separate timesheet. I would like to note that our guys violated discipline infrequently, and if they had to be late or leave early, they said it in advance. We, too, almost always met halfway, but we still had one malicious offender. Alexander could skip a day after a stormy celebration of some holiday, but to his credit, he always warned about his absence in advance - he himself knew his weaknesses. For us, the most important thing was not to let the client down, and if Sanya was going to “take a break,” he and we planned the work so that there would be no delays in repairs. It must be said that time sheets were also kept for workers who were given money for hours worked - time-based wages were received by students who worked part-time in their free time, and workers who helped with housework. For example, we needed to equip a room for a spare parts warehouse and install wooden shelving. We did not involve car mechanics and storekeepers in this matter; we hired temporary workers.

Warehouse accounting, accounting of units in 1C UAT

In the 1C: UAT program, the following four accounting options are possible:

- Warehouse records are maintained and, in parallel, units are recorded.

- Warehouse records are maintained, but units are not accounted for.

- Warehouse accounting in 1C: UAT is disabled, maintained in the main configuration. Only units are accounted for.

- Neither warehouse records nor units are kept.

At the organization level, you can make settings for warehouse accounting, namely, indicate whether it is maintained using UAT and indicate the method for valuing inventory (Administration—Setting rights and settings).

Warehouse accounting documents are uploaded to the main working database using standard synchronization.

In the article we will consider double accounting, i.e. maintaining warehouse records together with keeping records of units.

Inventory control

The warehouse accounting subsystem allows you to capitalize, move materials and carry out inventory.

In the 1C: UAT program, the receipt of goods and materials is reflected in the document “Receipt of materials and services”; from this document you can generate the necessary printed forms:

Let's look at the inventory document, the tabular part can be filled out:

- accounting quantity (quantity reflected in the program), in this case it is necessary to manually enter the actual quantity of material in the warehouse.

- according to warehouse balances, then the actual quantity is equal to the accounting data; if necessary, the actual quantity can be adjusted manually.

Based on the inventory, you can register surpluses or write off shortages of materials.

The document “Receipt of materials” can be used as an entry for balances if no records were previously kept in the information base; “Write-off of materials” can be used, for example, when there was a theft.

The program provides the ability to enter minimum balances. The minimum balance is set manually for each product item by department. The parameter is used when generating the Order to Supplier document.

You can analyze whether it is necessary to purchase additional materials or whether there are balances below the minimum using the “Minimum item balances” report.

For an item, you can specify an analogue; in order to analyze the balances of goods and their analogues in warehouses, there is a report in the program.

It is also possible to generate a report: Materials Flow Sheet (which displays the initial balance, receipt, consumption and final balance of materials) and a report: Remaining goods in warehouses (displays the balance of goods as of the date).

Let's move on to the "Repairs and units" section.

Accounting for units in 1C UAT

Let's start by entering balances; if accounting has not been previously maintained in the program, then balances for units are entered using the document “Entering initial data for units.” There are two types of operations in the document

- “Installation on a vehicle”—the “remaining” units are entered directly onto the vehicle. In this case, the details of the tabular part “Vehicle”, “State” and “Installation location” are added

- “Entering warehouse balances” - balances are entered into the warehouse as usual. The details of the tabular section indicated above are hidden. The “Warehouse” header prop is added.

Important! Tires, batteries and other units are accounted for by serial number. If the unit has already been registered with one serial number, then when the same unit is received again, a new card with a new serial number is created.

For the receipt of tires, batteries and other units at the warehouse, the document “Receipt of units” is used.

Let’s create the document “Receipt of units”, we see that in the name of the tires the serial numbers 3Ш1 and 3Ш2 differ.

To automatically generate the name of the unit, you can configure a template; the configured template contains a serial number:

Units can also be moved from warehouse to warehouse using the "Unit Transfer" document.

Document “Decommissioning of units”. The write-off according to accounting data is slightly different, for example, when tires and spare parts are issued for repairs, then when a repair sheet is carried out, these materials are written off as vehicle costs. And according to ex. accounting, the units will be registered with a specific car and they will be written off only when they are no longer suitable for use (they have deteriorated, the expiration date has passed, etc.).

Thus, in order to write off a unit, it must first be removed from the vehicle using the documents “Repair List” and “Operations with Units” (other units).

Let's look at the document “Operations with units” - the document is intended for operations of installing and removing units other than tires and batteries from the vehicle.

You can also carry out inventory by units. Each serial number of the unit corresponds to a separate line in the tabular section. The “Availability” column reflects the actual availability of this unit. If a shortage is identified, it is necessary to remove the sign opposite the corresponding unit. Based on this, you can enter Operations with units (to remove/install an unit), Write-off of units and Receipt of units.

Let us recall that the parameters for calculating tire wear are indicated in the reference element Models of units (discussed in the previous article).

The generation parameters are indicated in the “Units” directory.

Based on the vehicle mileage data, the current wear of the tires installed on it is calculated. This allows you to predict the timing of their replacement in advance.

Let's look at the main reports on units

:

- Unit production – reflects information about the type (tire, battery), model and generation of units.

- History of installation of units on a vehicle - in this report you can see which units were installed on the vehicle and analyze the history of their installation.

- Car tire performance card – used as a printed form of a card, which reflects information on the mileage of the tire for the month and from the start of operation.

- Battery performance card – a similar report to the one discussed above.

- Remains of units in warehouses - in this report, in addition to the remains of units in 1C UAT, you can see information about the mileage for a tire, if there is a tire in the warehouse for which the mileage was previously calculated. The report does not display the tires that are on the vehicle.

- Remains and turnover of units in warehouses - designed to analyze the turnover (receipt, consumption) and balances of units in the context of warehouses.

- Approaching the wear-out period of units - allows you to analyze the list of units that will be completely worn out in the near future. In the picture below we see that if you set this selection, there will be one unit left in the list.

- Approximation of tire wear - also allows you to analyze tires that have a specified number of days/mileage remaining until they are completely worn out.

- Mileage and tire wear - designed to analyze the mileage and wear of tires over a certain period in the context of vehicles, tire models and the tires themselves.

- Rating of reasons for writing off units - reflects information on the reasons for writing off units and the rating of reasons in the general list.

- Units installed on vehicles - in this report we can always quickly obtain information on which vehicles have which units installed.

We have looked at the work of accounting for units in 1C UAT, now we move on to the Repair subsystem.