Content:

We take into account the costs of creating a website.

The website is an intangible asset.

We determine the initial cost of the site.

Letter of the law. When the exclusive right can pass to the employee.

We calculate the amount of depreciation of the site.

Register the domain name of the site.

If the site cannot be classified as an intangible asset.

Note. Since 2008, the concept of non-exclusive rights has not been used.

Costs of hosting and promoting the site.

We take into account the costs of creating a website

Today, many companies open websites on the Internet. Let's see what expenses an organization can take into account for these purposes when calculating income tax.

One or a set of several Internet pages related by a common topic and located at a specific address on the Internet is nothing more than a website. The site can contain text materials, photographs, price lists, graphic images, as well as databases, programs, etc.

As a rule, on the website, the company indicates basic information about itself, provides contact information (telephone numbers and locations of offices or stores, surname, first name and patronymic of specialists or managers, their email addresses), a list of activities (name of works and services, assortment goods), messages about ongoing promotions and discounts.

A company can conduct business directly through a website on the Internet, that is, trade through online stores.

The tax accounting procedure for the costs of developing and maintaining an Internet site depends on whether the created object is recognized as an intangible asset.

Definition of “electronic service” for purposes of the “Google tax”

It is already the second year since the term “services provided in electronic form” began to be used in tax legislation, which is significant for the purpose of determining the place of sale of electronic services by foreign companies for VAT purposes (commonly known as the Google tax). The place of sale of electronic services from 01/01/2017 is recognized as the place of activity of the buyer of these services.

That is, when foreign companies provide services in electronic form to Russian users (both individuals and organizations), this foreign company is obliged to register with the Russian tax authorities, calculate and pay VAT on the cost of the services provided[1].

First of all, in this case we are talking about services for providing content (music, video, e-books, games, etc.) and (or) access rights to programs (databases, online games, social networks, etc. .). At the same time, paragraph 1 of Art. 174.2 of the Tax Code of the Russian Federation contains, at first glance, a closed list of services in electronic form:

- granting rights to use computer programs (including computer games), databases via the Internet;

- provision of advertising;

- provision of services for placing offers for the acquisition (sale) of goods (works, services), property rights on the Internet;

- provision of services via the Internet to provide technical, organizational, information and other opportunities for establishing contacts and concluding transactions between sellers and buyers;

- ensuring and (or) maintaining a commercial or personal presence on the Internet, supporting electronic resources of users (sites and (or) pages of sites on the Internet), ensuring access to them for other network users, providing users with the ability to modify them;

- storage and processing of information, provided that the person who provided this information has access to it via the Internet;

- provision of real-time computing power for posting information in the information system;

- provision of domain names, provision of hosting services;

- provision of services for the administration of information systems and websites on the Internet;

- provision of services carried out automatically via the Internet when data is entered by the buyer of the service, automated services for searching data, selecting and sorting them according to requests (in particular, real-time stock exchange reports, real-time automated translation);

- granting rights to use electronic books (editions) and other electronic publications, information, educational materials, graphic images, musical works with or without text, audiovisual works via the Internet, including by providing remote access to them for viewing or listening via the Internet;

- provision of services for searching and (or) providing the customer with information about potential buyers;

- providing access to search engines on the Internet;

- maintaining statistics on websites on the Internet.

From the legal definition of “services in electronic form” (clause 1 of Article 174.2 of the Tax Code of the Russian Federation) [2] we can identify three main features:

- Electronic services are provided through the information and telecommunications network, including through the information and telecommunications network “Internet”;

- Electronic services are provided automatically;

- Electronic services are provided using information technology.

In connection with the listed characteristics, the question arises whether services provided online are classified as electronic if the Internet is used only as a method of transmitting information or data, and the performer takes a significant personal part in the provision of the service.

So, in Art. 174.2 of the Tax Code of the Russian Federation there are direct exceptions from the composition of electronic services, including the following types of services:

- sale of goods (work, services), if when ordering via the Internet, the delivery of goods (performance of work, provision of services) is carried out without using the Internet;

- implementation of computer programs (including computer games), databases on tangible media;

- provision of consulting services via email.

The Russian definition of an electronic service is consistent with EU practice. Directive No. 2006/112/EC of the Council of the European Union[3] provides the following definition of an electronic service - these are services delivered via the Internet or an electronic network, the nature of which allows their delivery to be carried out fully automatically or with minimal human intervention; in the absence of information technology, such services could not exist.

Essentially, the provisions of the Directive provide for three types of supplies in the field of e-commerce:

- Delivery of digital products via the Internet with the absence or minimal human intervention, in which there is no need for the physical presence of the performer at the place where the service is provided;

- Supply of other services carried out via the Internet (for example, consulting services or online training via Skype);

- Supply of goods or “material” services, the order of which is carried out online, but is carried out as usual (for example, ordering goods, online booking of tickets, hotels, etc.)[4].

The last two types of services involve the use of the Internet or other information and telecommunication networks as a means of communication between the supplier and the buyer, without changing the nature of the services provided.

In Russia, such an important feature of an electronic service as a minimum degree of human participation or its complete absence was removed from the initial text of the bill. Retention in paragraph 1 of Art. 174.2 of the Tax Code of the Russian Federation of only one sign of electronic was aimed at eliminating the possibility of subjective assessment of the degree of human participation. Thus, a literal interpretation of the norm allows us to conclude that even minimal human participation in the provision of a service is sufficient to exclude the latter from the provisions of Art. 174.2 Tax Code of the Russian Federation.

However, what to do in the case when the provision of access rights is not a separate and independent type of activity, but only part of a wider range of services provided , the provision of which is not automated? For example, in cases of online learning, in which students, in addition to interacting with the teacher, may be given access rights to videos or other educational materials.

The solution proposed in the Directive for such cases seems reasonable. In each specific case it is proposed to determine:

- whether the entire delivery is single and determine the nature of all such “package” delivery;

- whether the electronic service is an independent/main part of the service provided or only an auxiliary part of a more comprehensive service.

Moreover, in order to impose VAT on only part of the service sold (for example, transferring the right to access video recordings as part of online learning), it is necessary to accurately determine the taxable base, i.e. determine the cost of transferring such a right in the total cost of services provided. In the vast majority of cases, it is impossible to determine this part of the cost, which in turn is another layer of protection for such “package” services.

[1] You can complete VAT registration remotely through the online service “VAT Office Internet (hereinafter in this article - the Internet network), automated using information technology.”

[3] It is also useful to read the Explanatory Note to the amendments regarding the determination of the place of sale of services in the field of telecommunications, radio broadcasting, and electronic services, which came into force in 2015.

[4] The Directive specifically states that where the provider and consumer of a service communicate by email, this should not in itself mean that the service provided is an electronic service.

The website is an intangible asset

For profit tax purposes, an Internet site can be classified as an intangible asset if it meets the requirements established in paragraph 1 of Article 256 and paragraph 3 of Article 257 of the Tax Code:

— the organization owns exclusive rights to the website;

— the site is used in the production of products, when performing work, providing services or for the management needs of the organization;

— the site is capable of bringing economic benefits (income) to the company;

— the site’s service life is over 12 months;

— the initial cost of the site is more than 20,000 rubles. (until January 1, 2008 - 10,000 rubles);

— the organization has properly executed documents confirming the existence of the intangible asset itself and (or) exclusive rights to it.

The fundamental difference between an intangible asset and other depreciable property is that the company has exclusive rights to it. From the point of view of civil law, an Internet site is a combination of two objects of copyright - a program that ensures its functioning, and a graphic solution (design).

A company can entrust the development of a website to employees who have an employment relationship with it, or to a third-party organization. If the creation of the website was carried out by one or more employees of the company and this was part of their responsibilities under the employment contract, it is considered that the company independently developed the website. In such a situation, exclusive rights to the site are assigned to the employer (unless otherwise provided in the employment or other agreement between the employer and the author), and copyrights are retained by the direct author (employee). This follows from Article 1295 of the Civil Code. Moreover, the author has the right to compensation.

An organization that has entrusted the creation of a website to a contractor is guided by the terms of the contract concluded with him, the subject of which is the development of an Internet site. In accordance with paragraph 1 of Article 1296 of the Civil Code of the Russian Federation, the exclusive right to a website (computer program or database) developed under such an agreement belongs to the customer. Of course, provided that the agreement between the contractor (performer) and the customer does not provide otherwise.

If, under an agreement to create a website, the contractor reserves exclusive rights to it, the customer organization does not have the right to classify the developed website as an intangible asset.

Inclusion in the NMA

If all exclusive rights to the site belong to the organization (and not the developers), then it can be taken into account as part of intangible assets. In this case, other conditions listed in paragraph 3 of PBU 14/2007 must be observed. Namely:

- exclusive rights to the site are confirmed by documents (for example, an agreement with an employee involved in the development of the site; an official assignment for the creation of a site; an author's order agreement with a third-party specialist; an act of acceptance and transfer of the exclusive right, etc.);

- the organization does not plan to transfer (sell) exclusive rights to the site in the next 12 months;

- the site is used in the production of products (works, services) or for management needs;

- using the site may bring economic benefits (income);

- the period of use of the site exceeds 12 months;

- the initial cost of the site can be determined.

There are no cost restrictions for including a website among intangible assets in accounting. It is also not necessary to register exclusive rights to a website with Rospatent (Article 1262 of the Civil Code of the Russian Federation).

We determine the initial cost of the site

Intangible assets are classified as depreciable property. Their cost is repaid by calculating depreciation (clause 1 of Article 256 of the Tax Code of the Russian Federation).

According to paragraph 3 of Article 257 of the Tax Code of the Russian Federation, the initial cost of a website is defined as the sum of expenses for its acquisition (creation) and bringing it to a state in which it is suitable for use. It does not include VAT and excise taxes.

The cost of a website developed by the organization’s employees is formed as the sum of the actual costs of its creation. These include, in particular:

— expenses for remuneration of workers directly involved in the creation of the site;

— patent fees, registration fees and other payments related to the execution and registration of exclusive rights;

— expenses for services of third parties;

- material costs;

- other similar costs.

The initial cost of the site is not increased by the amount of unified social tax and contributions for compulsory social insurance against accidents at work and occupational diseases, accrued from payments in favor of the workers who developed the site. The fact is that the specified tax and insurance premiums reduce the taxable profit of the current period as part of other expenses (subclauses 1 and 45 of clause 1 of Article 264 of the Tax Code of the Russian Federation, respectively). In addition, other taxes and fees taken into account in accordance with the Tax Code when calculating income tax are also not included in the cost of the site.

The initial cost of a website ordered to a contractor is formed from the amount paid for development and the costs of the customer organization for installing the resulting software package, debugging, testing, etc.

How much does website development cost?

Hi all! I would like to touch on a very important topic - how much does it cost to create a website and why exactly so much. At first glance, the website development market is oversaturated, in Tomsk alone there are currently about 150 organizations and their number is growing very rapidly, however, those who at least once in their lives have faced the problem of choosing a contractor know that normal developers can be counted on the fingers of one experienced hand milling operator Anticipating - yes, T-studio is cool, we consider ourselves “normal”.

Let's take an example - you have a small company that buys things in China and resells them in Tomsk. For a long time you have been working through groups on social networks, a certain client base has accumulated, which is growing at a good pace, and you are tired of constantly answering in messages what sizes are in stock, what has already been sold, what will be in stock soon, etc. The solution is obvious - you need your own website, where your entire assortment will be with the ability to order, pay, ask a question, in general, in appearance - a fairly standard online store. You type “website creation in Tomsk” into a search engine or open 2Gis, send your request to everyone and wait impatiently... About half will not answer you at all, because these were the guys who decided “we will make websites”, added themselves to 2Gis, but ... “The boy was going to success, it didn’t work out, it didn’t work out” (c). There are no orders and they have been doing something else for a long time. Another quarter will answer you when you have already chosen a performer. They are probably too busy to respond to incoming requests. The bottom line is you will get about 15-20 offers.

The range of prices will be simply shocking, from 5,000 rubles. up to 3,500,000 rub. Most likely, you will choose something close to the lower limit, but not the cheapest, a studio that does not have the worst portfolio, thousands for 25,000 - 30,000 rubles. and they have already made several similar stores, with the thought “yes, for 1,500,000 of course they do a very cool thing, but I don’t need something outstanding, for 25 it’s a normal option.” This is logical, we all want to save money and it’s not clear why I should pay 3,500,000 when there are better offers. Let's try to figure out why there is such a range in prices and why you can't get a good result for 30 thousand.

On the surface, everything is simple - when you contact a studio, you rent its employees in stages for several months and the entire amount is the sum of the number of personnel involved, multiplied by the number of hours spent and the cost of an hour. In turn, the cost of an hour includes all expenses, salaries, risks and margins.

The biggest influence on the cost is the number of employees involved; in each company you will receive a different set of services. For those 25-30 thousand, you will get a website on a template and a free management system like WordPress or Joomla, which will work somehow and at best will not bring you any clients, and at worst will scare you away, because for 30 thousand it’s unlikely whether 20 specialists will work for several weeks or months.

I would like to note right away that there is a category of sites for which this is a completely tolerable option - it’s called “a site for the sake of a site.” If your slogan is “everyone has it and we should have it,” then such a template solution will do just fine for you.

Let's step back a little and return to our example with the store.

You chose the option for 30 thousand, and ended up getting a store with a free management system and a modified template design. You had a huge quarrel with the performers, because in 90% of cases the deadlines are missed, the result is not at all what you expected and the work was handed over “to hell”. For 30,000, these 1-2 people who made the site are not interested in your sales, in their reputation, or in general in anything other than your money, because they need to exist, they are now “businessmen” and “don’t work for their uncle »

And now you have a store, it seems that you can add products and you can buy them, but no one buys anything or visits the site. Nobody knows about you, and those who accidentally visit the site close the site very quickly and the failure rate reaches 80-90%. It is very inconvenient to work with the site - it is impossible to create different sizes for one product, there is no unloading provided, the text does not change everywhere, etc. and so on. The problem is that this was done on a CMS and it doesn’t provide anything more and no one thought about the design, it was simply drawn by incompetent people or they even downloaded a template.

We are approaching the end...

You cannot make a functioning online store for less than 150-200 thousand. This is the lower limit. Why?

You need to clearly analyze your business. Understand your target audience, their behavior, habits. Taking this into account, design the structure, usability, make prototypes of all pages and elements, place emphasis, laying there the fundamental foundations of marketing and the psychology of buyer behavior. Draw the design of the entire site, including seemingly unnoticeable things like icons and other little things that have a lot of meaning. Give all the text to copywriters so that they can put them in order. Create an adaptive layout or simply a different display for different devices, supporting it with trending solutions. Program the entire Backend of the site, test the site on real data, optimize its operation. Do SEO optimization, think about how to further promote your site, where to advertise, what steps to take.

All this will take about two months of work by more than ten specialists in different fields. How much could it cost? Using our studio as an example, the amount would be about 200-300 thousand at the moment, but we are growing and developing and the cost is rising.

To a person who has never encountered website creation before, it may seem like a lot. This year, T-studio received a bunch of diplomas for developing online stores. We rank 9th in Siberia and 74th in Russia. With one interesting amendment - in the lower price segment. The entire rating was divided into 4 main parts, 4 price segments:

- premium - stores costing from 1.5 million

- top - from 750 thousand to 1.5 million

- average - from 200 to 750 thousand

- lower - up to 200 thousand

Our studio is in the lower price segment.

The Russian rating believes that for 200 thousand you can only make stores based on templates. Why do others do for 1.5 million what we do for 300 thousand? We return to the formula “the number of personnel involved, multiplied by the number of hours spent and the cost of the hour.” If we have 10 people making your website, then in another studio there will be 50 and the range of services provided will be much wider. Most often, their cost includes full further support, advertising budgets, corporate identity, brand output and positioning, naming, etc.

And not the least role in determining the price, as in any field, is played by the brand of the studio itself and its experience. After all, we sell our experience, acting as experts in this field. Hence the formation of the cost of an employee’s hour. Small companies are ready to work for 200 rubles per hour, as long as there are clients and “food”. Major market players sell their brains for much more

Well, of course, the number of hours directly depends on the functionality you need. Each customer includes a different set of capabilities in the same terms.

First results

No matter how trivial it may sound, in most cases, the cost of development is directly proportional to the result and savings are not appropriate here. You can spend 300 thousand, and the site will work for you, becoming an additional business tool, easy to use and improve, which will ultimately pay for itself very quickly. Or you will first spend 30 thousand on the site, then another 30 on improving it, 20 on optimization, 40 on promotion and advertising, and in the end, after a year or two, you still order a normal site, because what you got before No one will undertake to improve this.

Always check with the contractor what exactly they will do for this money, carefully look at their portfolio, how they implemented similar tasks and, if possible, communicate with clients. Just communicate, you and I understand perfectly well that reviews should be listened to, not read.

Of course, there are exceptions in the form of studios that ask for a lot of money for outright poop, but our little tips will help you avoid such comrades as much as possible.

Most often, beginning entrepreneurs, like our example, forget that it is not enough to make a website - it needs to be made convenient, functional, promoted, advertised, set up a huge business process associated with it, hone logistics and constantly support it. We include continuous improvement in our support. You can’t make a “candy” right away; inevitably, as you use it, a lot of functionality is replayed, the project acquires new capabilities.

And finally the finale

Remember that almost any company, not just studios, goes through several stages of formation:

We work as long as we have money, we take on any job at a reasonable cost. We work not for money, but for reputation, sometimes doing work at a loss or for free. By accumulating experience and making headway, we begin to do more or less worthwhile things. More expensive orders are coming because... I already have experience and the company is well-known. We don’t take on extra work, we do what we know how to do and constantly improve. Experts in their field. The main goal is to make cool and convenient things, and money is now just a big, pleasant bonus to the product being released. As a result, the cost of projects is very high, the studio is very busy and popular. 90% of the development market is at the first stage and will never cross it, these “companies” close early. This is where there is such a range of prices and all the slogans “website for 5,000”, “store for 9,999 rubles.” and the newfangled “conversion-guaranteed sales pages.” They only sell them to you.

T-studio has just entered the fourth stage and is improving, and maybe even at the very end of the third. Companies offering solutions worth more than 1 million. rubles have long been in the fifth

That's all.

Have we found out how much a website costs? I think yes. There are no exact figures, each project is unique, but there is an understanding that it is not cheap even for 20,000 rubles. They are trying to “sell” you outright shit.

How to choose the right studio? Carefully analyze the portfolio, communicate with former and current clients, look for it in popular ratings and search for information.

Can there be a studio with an impeccable reputation? No, there is nothing bad about it. There are always clients with whom disagreements arise during the work process. For various reasons, there is no point in listing them.

PS

I would also like to add that most customers think according to the principle “more is better”, adding unnecessary functionality and taking up useful space on the site, creating a bunch of unnecessary text, reducing indents, etc.

In fact, making a simple and understandable interface is much more difficult than piling up a mess of elements, pictures and icons. And “air” on the site is now trending

“Good design is the absence of design” (c)

Letter of the law. When can an exclusive right pass to an employee?

The exclusive right to a work created within the scope of the employee’s job duties (official work) belongs to the author if the employer, within three years from the day the official work was placed at his disposal, does not perform one of the actions (Clause 2 of Art. 1295 Civil Code of the Russian Federation):

- will not start using this work;

- will not transfer the exclusive right to it to another person;

- will not inform the author about keeping the work secret.

We calculate the amount of depreciation of the site

To calculate depreciation of an intangible asset, it is necessary to determine its useful life. This is recognized as the period during which the object serves to fulfill the goals of the organization’s activities (clause 1 of Article 258 of the Tax Code of the Russian Federation). The taxpayer determines the useful life of an intangible asset independently on the date of its commissioning based on the validity period of the patent or certificate or the period of use of the object stipulated by the relevant agreements.

This means that if the contract for the development of an Internet site stipulates the expected useful life of its use, the organization, when calculating depreciation of the site, is guided by exactly this period.

Let’s say this period is not specified in the contract with the contractor, or the company developed the site on its own. Then she has the right to independently set the useful life of the site and consolidate it in the tax accounting policy.

If the useful life cannot be determined, then, according to paragraph 2 of Article 258 of the Tax Code of the Russian Federation, the object of intangible assets will have to be amortized over ten years, but not more than the period of activity of the taxpayer. Therefore, in order to avoid problems with justifying the useful life of the site, it is advisable to indicate this period in the contract with the developers or in the technical specifications drawn up for employees.

The organization begins to calculate depreciation from the 1st day of the month following the month in which the site was put into operation (clause 2 of Article 259 of the Tax Code of the Russian Federation). The date of commissioning of the site is the moment of its placement on the Internet. By this time, all work on creating, testing and setting up the site should be completed. The company independently calculates the amount of depreciation charges based on the initial cost of the site and its useful life.

Accounting for website costs

Author of the publication

Lesnova Yulia Vyacheslavovna

Director of LLC AF "Audit and Consulting Center".

Currently, many companies, in order to attract the attention of potential customers and expand sales markets, create their virtual representative offices on the Internet - Internet sites. An Internet site can be used to increase sales, reduce costs, communicate with employees, strengthen business reputation, advertising and other purposes.

For companies that use Internet sites to promote and advertise their own goods, works and services, several types can be distinguished:

- business card. This is an Internet page that contains information about the company, its data, a short list of services, works, goods;

– promotional site. The most common type of website. Its goal is to promote a brand, product, or service via the Internet. The site contains advertising information, images of product samples, conditions for purchasing goods, services, prices and reference data;

– Internet representation. This type of site has greater technical capabilities than the previous one. An online ordering function has been added, so the site contains a complete catalog of products with the ability to quickly and efficiently update;

- Corporate website. Allows you to fully use the Internet to conduct business. Such a site has a complex structure, web design, it contains a maximum of information, and various service applications.

In the IFRS system, there is an interpretation of PKI (SIC)-32 “Intangible assets - costs of a website”, which explains the procedure for accounting for costs associated with the development of a website.

Stages of creating a website

SIC-32 outlines the following five stages when working on an Internet site (Table 1).

Table 1

| Stage | List of works |

| 1 | 2 |

| 1. Planning stage | Formulating the goals of the website. Description: – factors influencing the feasibility of the selected goals; – main risks during project implementation; – an effective website concept. Review of Internet resources of the company's competitors. Determination of key phrases that are most relevant to the business area, indicating the frequency of queries. Recommendations on the main factors that create a site’s advantages over competitor sites. Development of a functional specification covering all aspects of the project and being the basis of the technical specifications |

| 2. Application and infrastructure development stage | Development of an information and functional structure of the project, involving: – obtaining a domain name; – development of the project concept; – interface design (page structure and navigation). The result of the work will be a website prototype. It includes a list of the main pages of the site with a description of the structure of information placement, functional elements (search, registration forms), graphic and navigation elements for each page |

| 3. Graphic design stage | Development of website design in accordance with the corporate style of the customer company |

| 4. Content development stage | Filling the website with materials that are of particular value to its visitors. The information on the website should reflect the competitive advantages of the company and contain a description of the qualities and advantages of the products and services offered. A copywriter – a compiler of advertising and presentation texts – should work on this |

| 5. Operational stage | Site support and administration. Includes a whole range of measures aimed at maintaining the functionality of the site. Website support services include: – backup of site information; – registration of the site in new search engines, on message boards, in specialized directories; – creation of new pages on the site and individual modules; – updating information on the website; – monitoring of the ongoing advertising campaign on the Internet and its optimization; – collection of website traffic statistics; – extension of the domain name registration period; – consultations |

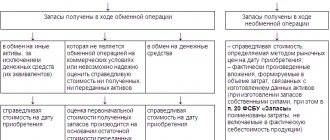

The SIC-32 interpretation states that a company may incur internal costs to develop and maintain an Internet site intended for internal or external access. A website intended for external access can be used for various purposes, such as promoting and advertising the company's own goods and services, providing electronic services, selling goods and services. A site intended for internal access can be used to store company documents, client databases and search for relevant information.

Websites can either be developed by the company itself or ordered from a third-party company. A company's own website, whether developed for internal or external access, is an internally generated intangible asset subject to the requirements of IAS 38 Intangible Assets, subject to the specifics set out in SIC-32 Intangible Assets - Costs to the website."

According to paragraph 8 of PKI (SIC)-32 , a website resulting from development should be recognized as an intangible asset only if, in addition to meeting the general requirements for the recognition and initial measurement of intangible assets, the company can prove that its website will generate probable future economic benefits, for example in the form of direct revenue from placing orders on it. If the site is developed solely or primarily for the promotion and advertising of its own products and services, then all costs of its development should be recognized as expenses when incurred.

Example 1

The company posts information about its promotions or new product on its website. In this case, it is unable to demonstrate how such information will generate future economic benefits. Paragraph 17 of IAS 38 Intangible Assets states that future economic benefits may include revenue from the sale of goods or services, cost savings or other benefits derived from the use of such an intangible asset.

Example 2

Many consulting companies create specialized information and legal systems and place them on websites with online access. Clients pay a monthly fee and use the resource to obtain the necessary information, legislation, and legal materials. Thus, this company’s website directly contributes to revenue generation, i.e., generates cash flows. Therefore, such a site will be an intangible asset.

Example 3

Currently, due to the economic crisis, many companies are forced to reduce their costs associated with renting store premises and paying sales consultants. They open online stores and make sales through the created Internet sites. Consequently, these sites will also be classified as intangible assets, as they are capable of generating future economic benefits and at the same time allow for significant cost savings.

Cost accounting procedure

To determine the appropriate accounting procedure for the costs of creating and maintaining an Internet site, it is necessary to evaluate the nature of each type of activity for which costs are incurred, and the stage of development or activities after the development of the Internet site is completed:

– planning stage. Similar in nature to the research phase and, therefore, costs incurred during this phase should be recognized as expenses when incurred;

– application and infrastructure development phases, graphic design and content to the extent that the content is not developed for advertising or marketing purposes. Similar to the development stage and subject to classification as an intangible asset, i.e. capitalization. Costs incurred during these stages are included in the cost of the website as an intangible asset when they can be directly attributed or allocated on a reasonable and consistent basis to preparing the website for its intended use. However, the cost of an intangible item that was initially recognized as an expense in the previous financial statements should not be recognized as part of the cost of the intangible asset at any future date;

– costs incurred during the development of content materials to the extent that these materials are developed for the purpose of advertising and promoting the company’s own goods and services. Should be recognized as an expense when incurred;

– maintenance stage. Begins upon completion of website development. Costs incurred at this stage should be recognized as expenses when incurred.

The cost of an Internet site created by a company independently includes all direct costs necessary to create and prepare the asset for use:

– costs of materials and services used or consumed in creating an intangible asset;

– employee remuneration costs arising in connection with the creation of an intangible asset;

– fees for registration of legal rights;

– amortization of patents and licenses used to create an intangible asset.

Example 4

I decided to organize an online store where you can purchase any office and household appliances. The site will be developed by the IT department. The following information on this development was received:

– planning and marketing research costs amounted to $10,000;

– the cost of developing applications and infrastructure includes, among other things, salaries of employees - application developers of $20,000, a fee to a third-party company for a domain name of $1,000, a fee to a third-party company for application development of $4,000;

– the cost of developing graphic design includes, among other things, the wages of employees - graphic design developers - USD 17,000, the fee of a third-party company for developing graphic design - USD 7,000;

– the cost of information content of the site until the completion of site development (photos of goods and prices) amounted to $2,000;

– the cost of monthly updating and information content of the site (photos of goods and prices) amounted to $800.

Postings during site development will be as follows:

Dr. “Expenses for planning and marketing research” (operating) – 10,000

CT “Money” – 10,000

DT “Intangible asset” (website) – 25,000

CT “Money” – 20,000

CT “Money” – 1000

CT “Money” – 4000

DT “Intangible asset” (website) – 24,000

CT “Money” – 17,000

CT “Money” – 7000

DT “Intangible asset” (website) – 2000

CT “Money” – 2000

The site maintenance stage will be reflected monthly by posting:

Dr. “Costs for maintaining the site” (operating) – 800

CT “Money” – 800

The cost of a separately purchased website includes:

– its purchase price;

– employee remuneration costs arising in connection with bringing the asset into working condition;

– the cost of verifying the proper operation of the asset.

Example 5

I decided to organize an online store where you can purchase any office and household appliances. The site will be developed. The cost of work under the contract is determined in the amount of $50,000. The cost of monthly updating and information content of the site (photos of products and prices) will be $800.

Since this site will generate economic benefits in the future, the costs incurred are capitalized and the site is recognized as an intangible asset.

DT “Intangible asset” (website) – 50,000

CT “Money” – 50,000

The site maintenance stage will be reflected monthly by posting:

Dr. “Costs for maintaining the site” (operating) – 800

CT “Money” – 800

Follow-up assessment

The recognized intangible asset is subject to amortization. SIC-32 states that for a website to be recognized as an intangible asset, the useful life must be short. Internet sites, like computer programs, are subject to technological obsolescence. Therefore, given the rapid changes in technology, the depreciation period of an Internet site will not be long. Accrued depreciation is included in the company's operating expenses.

IFRS 38 Intangible Assets specifies that the subsequent recognition of an intangible asset is carried out either at cost or at a revalued amount. However, since there is no active market for Internet sites, since these assets are unique in nature, the intangible asset must be stated at its cost less accumulated depreciation and impairment losses. To determine whether an asset is impaired, the company applies IAS 36 Impairment of Assets.

A decrease in the usefulness of the website may be recognized in the following cases:

– it is expected that the website will not bring the planned economic benefits;

– there are significant changes in the use of the website;

– the costs of developing a website significantly exceeded initial expectations;

– losses are expected from using the website.

The finished website is hosted on a so-called virtual server - a server of a company that has free areas on the disk (Internet provider). Services for providing disk space and a communication channel for placing an Internet site on a server, and maintaining this Internet resource are called hosting. Hosting providers provide the user with a “place” on the network and uninterrupted operation of the resource. Placing someone else's website on disk space owned by the provider with the allocation of a communication channel comes down to providing, for a fee, temporary use of property owned by property or other right, as well as the provision of communication services. Therefore, fees for such services are recognized as an expense when incurred.

As the company expands its work via the Internet, it may need to create its own web server, which is associated with additional costs. Additional software, communication equipment to support the communication channel, a video adapter, a storage device, and possibly upgrading computers will be required. Costs for the acquisition of additional components associated with improving the operation of hardware and improving the functionality of equipment are costs that must be accounted for in accordance with IAS 16 Property, Plant and Equipment.

Share a link to the article on social networks:

Registering a website domain name

After completing the creation of the site, you must assign it a domain name and register it in the prescribed manner.

The domain name of a site is its unique name and address on the Internet (for example, the website of the Russian Tax Courier magazine is www. rnk. ru). The domain name is registered to ensure its uniqueness at the Russian Research Institute for the Development of Public Networks (RosNIIROS) or with registrars authorized by it. Services for registering a domain name are considered provided from the moment the information is entered into the domain name register.

The website domain name is not recognized as an independent intangible asset, since it is not the result of intellectual activity. But if the site is accounted for as an intangible asset, the costs of the initial registration of its domain name are included in the initial cost of the site (clause 3 of Article 257 of the Tax Code of the Russian Federation). After all, the initial cost of an intangible asset is defined as the amount of expenses not only for its acquisition or creation, but also for bringing it to a state in which it is suitable for use. Without registering a domain name, a website cannot function.

Primary means the registration of a domain name, carried out when creating a website. Typically it is valid for one year. Subsequently, the domain name must be re-registered annually. It does not lead to changes in the quality characteristics of the website and does not affect its initial cost.

The costs of renewing registration are included in other expenses associated with production and sales (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). They are taken into account gradually during the validity period of the domain name registration specified in the relevant agreement (Clause 1 of Article 272 of the Tax Code of the Russian Federation). If the registration period is not specified in the contract, the organization distributes the costs independently.

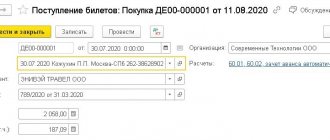

Example 1

CJSC Fragment decided to place its own website on the Internet. The organization entrusted the development of the website to its specialists working under employment contracts. The work was carried out from February to March 2008. In April 2008, the company's website was posted on the Internet. The costs for creating the site were:

— programmers’ salary — 80,000 rubles;

— UST, insurance contributions to the Pension Fund and for injuries from the salaries of programmers — 20,960 rubles;

— depreciation of computers and other fixed assets that were used in the development of the site — 3,900 rubles;

— design layout of the website performed by a third party — 23,600 rubles, including VAT 3,600 rubles;

— initial registration of a website domain name — 2006 rubles, including VAT 306 rubles.

Exclusive rights to the site belong to CJSC Fragment, since the organization independently developed the site and the employment contracts with the employees involved did not provide for a special procedure for the transfer of these rights. In addition, the created site meets the requirements for intangible assets. Therefore, the company takes into account the developed website as part of intangible assets. The organization established its useful life as a general rule - ten years (120 months).

The initial cost of the site in tax accounting is 105,600 rubles. (80,000 rub. + 3,900 rub. + (23,600 rub. - 3,600 rub.) + (2,006 rub. - 306 rub.)). Amounts of unified social tax, insurance contributions to the Pension Fund and for injuries from programmers' salaries are not included in the initial cost of the site. They relate to other expenses associated with production and sales, and reduce the taxable profit of current periods.

Since the site was posted on the Internet in April 2008, JSC Fragment begins to accrue its depreciation in May. The amount of monthly depreciation recognized for profit tax purposes is 880 rubles. (RUB 105,600: 120 months).

Creation of a website for the simplified tax system. Accounting and Taxation

Today, most companies have their own websites.

This allows organizations to sell their goods (works, services), as well as attract new customers and thereby increase their profits.

Let's consider the procedure for accounting and tax accounting:

— costs of creating the site itself;

-payment of necessary expenses for the site to operate;

— and expenses for website promotion;

In organizations using a simplified taxation system.

Legal aspects

According to paragraph 13 of Art. 2 of the Federal Law of July 27, 2006 N 149-FZ “On information, information technologies and information protection,” an Internet site is a set of programs for electronic computers and other information contained in an information system, access to which is provided through information and telecommunications the Internet by domain names and (or) network addresses that allow you to identify sites on the Internet.

As the Federal Tax Service of Russia for Moscow indicated in Letter No. 20-12/004121 dated January 17, 2007, in essence, an Internet site is a combination of two objects of copyright: a program that ensures its functioning, and a graphic solution (design).

According to the Russian Federation, the website is subject to copyright.

It is considered a composite work - a work that is the result of creative work in the selection or arrangement of materials (clause 2 of Article 1259, clause 2 of Article 1260 of the Civil Code of the Russian Federation).

Most often, specialized companies are involved in the development of a website on the basis of a mixed agreement (with elements of contracts for paid services, contractors, and copyright agreements).

So, by virtue of Art. 1255 of the Civil Code of the Russian Federation, the author of a work (including a composite work) has the exclusive right to it.

The author of a work is its creator (the citizen whose creative work it was created).

If the work arose as a result of the author performing an official task, the exclusive right to it, as a general rule, belongs to the employer (see Article 1295 of the Civil Code of the Russian Federation).

As a rule, the exclusive right belongs to the organization that carries out the work to create the site.

According to Art. 1233 of the Civil Code of the Russian Federation, the copyright holder can dispose of the exclusive right to the result of intellectual activity that belongs to him by:

— its alienation under an agreement to another person (agreement on the alienation of an exclusive right);

— granting another person the right to use the corresponding result of intellectual activity or means of individualization within the limits established by the agreement (licensing agreement).

In the first case, the customer receives exclusive rights to the created site, in the second - not, since the conclusion of a license agreement does not entail the transfer of the exclusive right to the licensee (see Article 1233 of the Civil Code of the Russian Federation).

Note that in most cases, an organization ordering the creation of an Internet site does not receive exclusive rights to the Internet site created on its order.

Expenses for work (services) to create an Internet site

The organization does not receive exclusive rights to the website created on its order.

Accounting

The customer’s lack of exclusive rights to the website means that the costs associated with its creation do not form an intangible asset in accounting, since the condition of paragraphs is not met. “b” clause 3 PBU 14/2007 “Accounting for intangible assets”.

Moreover, in our opinion, there is no basis for uniform recognition of the contract price (through the mechanism for making deferred expenses - clause 39 of PBU 14/2007), since it is not a payment for the use of the results of the intellectual activity of the performer.

The costs incurred should be recognized as other expenses at a time according to the rules of PBU 10/99 “Costs of the organization” (see clause 11) - on the date of signing the certificate of completion of work on the production of the website.

Costs for the website can be shown as part of general business expenses on account 26.

Tax under a simplified taxation system

Organizations that use the simplified tax system will be able to write off website expenses according to clause. 19 clause 1 art. 346.16 Tax Code of the Russian Federation.

According to this paragraph:

For tax purposes, expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (under license agreements) are recognized. These costs also include costs for updating computer programs and databases;

Thus, this rule allows for the recognition for tax purposes of expenses for the acquisition of non-exclusive rights to computer programs and databases, as well as for their updating.

Along with this, the costs of website development can be written off as a lump sum immediately after payment. These will be advertising expenses (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation and Letter of the Ministry of Finance of Russia dated 09.09.2011 N 03-03-10/86).

Example.

An organization on the simplified tax system entered into a contract for the creation of a website.

According to the terms of the agreement, the exclusive rights to the created website belong to the contractor.

The cost of work under the contract amounted to 600,000 rubles.

The organization set the useful life of the created website at five years.

The site was created for the purpose of online trading.

The site was created and paid for in September.

In accounting, operations to create a website should be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| The costs of creating a website are reflected | (, etc.) | 600 000 | Agreement on the creation of the site, Certificate of completion | |

| Payment transferred to the counterparty | 600 000 | Bank account statement |

In tax accounting, website development costs are written off as a lump sum immediately after payment.

The organization receives exclusive rights to a website created for it

Accounting

The website is an intangible asset

For accounting purposes, the procedure for reflecting the costs of creating an Internet site in this case will be regulated by the rules of the Accounting Regulations “Accounting for Intangible Assets” (PBU 14/2007), approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n (hereinafter referred to as PBU 14/ 2007).

Paragraph 4 of PBU 14/2007 establishes that programs for electronic computers are classified as intangible assets.

In accordance with clause 3 of PBU 14/2007, in order to accept an object for accounting as an intangible asset, the following conditions must be simultaneously met:

a) the object is capable of bringing economic benefits to the organization in the future, in particular, the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization or for use in activities aimed at achieving the goals of creating a non-profit organization (including in business activities carried out in accordance with the legislation of the Russian Federation);

b) the organization has the right to receive economic benefits that this object is capable of bringing in the future (including the organization has properly executed documents confirming the existence of the asset itself and the rights of this organization to the result of intellectual activity or a means of individualization - patents, certificates, other security documents , an agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization, documents confirming the transfer of the exclusive right without an agreement, etc.), and there are also restrictions on the access of other persons to such economic benefits (hereinafter referred to as control over the object);

c) the possibility of separating or separating (identifying) an object from other assets;

d) the object is intended to be used for a long time, that is, a useful life of more than 12 months or a normal operating cycle if it exceeds 12 months;

e) the organization does not intend to sell the object within 12 months or the normal operating cycle if it exceeds 12 months;

f) the actual (initial) cost of the object can be reliably determined;

g) the object’s lack of material form.

Formation of the initial cost of the site, which is an intangible asset

The actual (initial) cost of an intangible asset is recognized as an amount calculated in monetary terms, equal to the amount of payment in cash and other forms or the amount of accounts payable, paid or accrued by the organization upon acquisition, creation of the asset and provision of conditions for using the asset for the planned purposes.

The expenses for the acquisition of an intangible asset are (clause 8 of PBU 14/2007):

- amounts paid in accordance with the agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization to the copyright holder (seller);

— customs duties and customs fees;

— non-refundable amounts of taxes, state, patent and other duties paid in connection with the acquisition of an intangible asset;

— remunerations paid to the intermediary organization and other persons through which the intangible asset was acquired;

— amounts paid for information and consulting services related to the acquisition of an intangible asset;

— other expenses directly related to the acquisition of an intangible asset and providing conditions for using the asset for the intended purposes.

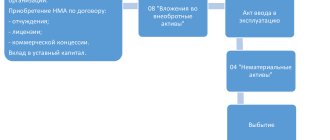

Consequently, all the organization’s costs associated with the creation of an Internet site (in particular, the costs of the contract for its creation) will form the initial cost of the intangible asset. Based on the Instructions for using the chart of accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, these expenses will initially be collected on account 08, subaccount 08-5 “Acquisition of intangible assets”, with subsequent reflection on the account 04 “Intangible assets”.

In this regard, the accounting should reflect:

Debit 08-5, sub-account “Site”, Credit 60, sub-account “Settlements with the Contractor”,

— work has been accepted to create a website under a contract;

Debit 60, subaccount “Settlements with the Contractor”, Credit 51

— paid for work under the contract;

Debit 04, sub-account “Site”, Credit 08-5, sub-account “Site”,

— the site has been accepted into the NMA.

Determining the useful life of a website - an object of intangible assets

According to the standards established by PBU 14/2007, when accepting an intangible asset for accounting, an organization must determine its useful life.

In this case, the useful life is the period expressed in months during which the organization intends to use the intangible asset in order to obtain economic benefits (clause 25 of PBU 14/2007).

The useful life of an intangible asset is determined based on the validity period of the organization's rights to the result of intellectual activity or the expected period of use of the asset, during which the organization expects to receive economic benefits (clause 26 of PBU 14/2007).

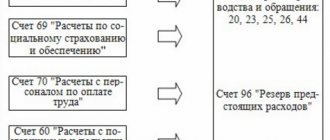

The procedure for calculating depreciation for a site - an object of intangible assets

Accrual of depreciation on intangible assets in accounting in accordance with clause 31 of PBU 14/2007 begins on the first day of the month following the month of transfer to the organization of exclusive rights to the object of intangible assets, and continues until the cost is fully repaid or the asset is written off from accounting.

In accordance with clause 28 of PBU 14/2007, the determination of the monthly amount of depreciation charges for an intangible asset is carried out by the organization in accordance with the chosen method (linear method, reducing balance method or method of writing off the cost in proportion to the volume of production (work)).

Thus, in accounting, the organization sets the useful life of a website independently or based on the validity period of the organization’s rights to the result of intellectual activity or on the expected life of the asset.

It is advisable to establish the useful life by order of the manager, drawn up in any form.

Moreover, since in this case the order will not be a primary document, it may not contain all the mandatory details established in Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”.

Depreciation on intangible assets is reflected using account 05 “Depreciation of intangible assets”.

In monthly accounting, based on the established useful life, the following should be reflected:

Debit 20 (26, 44) Credit 05, subaccount “Site”,

— depreciation has been calculated for the website.

Tax paid when applying the simplified taxation system

If the total expenses turned out to be 100,000 rubles. or less, then you can write off all costs for website development at a time immediately after payment. These will be advertising expenses (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation and Letter of the Ministry of Finance of Russia dated 09.09.2011 N 03-03-10/86).

If more than 100,000 rubles are invested in the site, then it is recognized as an intangible asset (IMA) and the costs of its development can be taken into account during the current calendar year in quarterly equal shares (clauses 1 and 4 of Article 346.16 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance Russia dated July 28, 2009 N 03-11-06/2/136 and dated January 17, 2008 N 03-04-06-01/6).

Please note: the initial cost of intangible assets includes all costs of creating a website and bringing it to a state in which it is suitable for use, with the exception of taxes (clause 3 of article 346.16 of the Tax Code of the Russian Federation).

That is, this includes salaries for developers (full-time programmers or those hired under a civil contract), and payment for a domain name and hosting services for the first time of service, and insurance premiums from the salaries of performers - individuals (Letter of the Ministry of Finance of Russia dated March 25, 2011 N 03 -03-06/1/173).

Example.

An organization on the simplified tax system entered into a contract for the creation of a website.

According to the terms of the contract, exclusive rights to the created website belong to the customer.

The cost of work under the contract amounted to 600,000 rubles.

The organization set the useful life of the created website at five years.

The site was created for the purpose of online trading.

The site was created and paid for in September.

In accounting, operations to create a website should be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| The costs of creating a website are reflected | 08-5 | 600 000 | Agreement on the creation of the site; Certificate of completion | |

| The website has been accepted for registration as part of the intangible assets | 08-5 | 600 000 | Website creation agreement Intangible asset accounting card | |

| Payment transferred to the counterparty | 600 000 | Bank account statement | ||

| Monthly starting October for 60 months | ||||

| The amount of depreciation on the purchased intangible asset is reflected (RUB 600,000/60 months) | (, etc.) | 10 000 | Accounting certificate-calculation | |

In tax accounting, the cost of intangible assets is included in expenses from the moment it is accepted for accounting in equal shares at the end of each reporting period during the tax period, provided that the intangible asset is used in business activities (clause 2, paragraph 8, clause 3, art. 346.16, paragraph 4, paragraph 2, article 346.17 of the Tax Code of the Russian Federation).

This means that after transferring funds, the organization has the right to recognize expenses for the acquisition of intangible assets in equal shares as of September 30 and December 31 in the amount of RUB 300,000. ((RUB 600,000) / 2).

Taking into account the above circumstances, we conclude that, depending on whether the company that customer of the site ultimately has exclusive rights to it as an object of copyright in the form of a composite work, in accounting the costs are accounted for as intangible assets or as other expenses.

This justification is also suitable for tax under the simplified tax system.

Domain name costs

A domain name is a symbol designation intended for addressing sites on the Internet in order to provide access to information posted on the Internet. This definition is given in paragraph 15 of Art. 2 of the Federal Law of July 27, 2006 N 149-FZ.

As one might assume, without paying for a domain name, it is impossible for a website to operate to make a profit for an organization; therefore, one can assume that before paying for a domain name, the site cannot be put into operation.

As a rule, a domain name is paid once a year.

Accounting

As can be seen from the definition above, without a domain name, an Internet site cannot function.

Therefore, if an organization has exclusive rights to a website, then the costs of the initial registration of a domain name on the basis of clause 9 of PBU 14/2007 can be included in the initial cost of the website as an intangible asset.

The costs of the initial payment for a domain name should be reflected in the accounting:

Debit 08-5, subaccount “Site”, Credit 60 (76)

— the costs of registering a domain name are reflected.

Note that there is a point of view according to which the costs of registering a domain do not relate to the creation of a website, but are periodic expenses necessary for its functioning.

Therefore, these expenses can be taken into account as part of general business expenses (Instructions for the use of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

In this case, the costs of registering a domain are recognized as general business expenses on a monthly basis in accordance with the provided acts of the counterparty on the provision of services.

If the organization does not have exclusive rights to the website, then the costs of paying for the domain name in accounting should be taken into account as part of expenses for ordinary activities.

In this case, the following entries are made in accounting:

Debit of account 20 “Main production” (“General business expenses”, “Sales expenses”) Credit of account 60 “Settlements with suppliers and contractors” (“Settlements with various debtors and creditors”) - expenses for the domain name are taken into account (based on the act ( report) on the provision of services).

In the future, the costs of paying for a domain name are taken into account in accounting as a lump sum as part of expenses for ordinary activities.

Expenses for paying for a domain name in subsequent periods should be reflected as current expenses:

Debit 20 (26, 44) Credit 76, subaccount “Expenses for a domain name”,

— costs for a domain name are included in the organization’s costs;

Debit 76, subaccount “Expenses for a domain name”, Credit 51

— paid for domain name.

Tax paid when applying the simplified taxation system

Let us note that this type of cost, such as the cost of paying for domain name registration, is not provided for in Art. 346.16 of the Tax Code of the Russian Federation.

However, as a rule, advertising information is posted on the site.

Advertising expenses can also include the cost of registering a domain name, since without these services the site with advertising information will not work.

Consequently, an organization can rightfully include the costs of paying for domain name registration as part of advertising expenses (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation) and take it into account for tax purposes as a single tax.

At the same time, the costs of the initial registration of a domain name for tax purposes are included in the initial cost of the site if it is an intangible asset (Letter of the Federal Tax Service of Russia for Moscow dated January 17, 2007 N 20-12/004121).

Hosting costs

First, let's define what is meant by hosting.

So, the finished website is hosted on a so-called virtual server - a web server of a specialized organization (provider) that has free areas on its disk.

Services for providing (renting) disk space and a communication channel for placing a website on an Internet server, technical support for this web resource are called hosting.

When providing hosting services, the provider not only leases out its own hardware resources (disk space, RAM, processor time, etc.), it provides support and maintenance for the performance of the client’s information resource, including ensuring its registration in various Internet search engines .

Thus, the hosting service consists of paying for the rental of space on the provider’s server where the Internet site will be physically located.

Accounting

Considering the definition of hosting, we can conclude that for accounting and tax purposes, hosting costs are subject to accounting in a manner similar to accounting for domain name costs.

That is, if an organization has exclusive rights to a website, then the primary costs of hosting based on clause 9 of PBU 14/2007 can be included in the initial cost of the website as an intangible asset.

The following should be reflected in the accounting of primary hosting costs:

Debit 08-5, subaccount “Site”, Credit 60 (76)

— hosting costs are reflected, which are to be included in the initial cost of the site.

Note that there is a point of view according to which the costs of hosting services do not relate to the creation of a website, but are periodic expenses necessary for its functioning.

Therefore, these expenses can be taken into account as part of general business expenses (Instructions for the use of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

In this case, the costs of hosting services are recognized as general business expenses on a monthly basis in accordance with the provided acts of the counterparty on the provision of services.

If the organization does not have exclusive rights to the site, then the primary costs of hosting in accounting should be taken into account as part of expenses for ordinary activities.

In this case, the following entries are made in accounting:

Debit of account 20 “Main production” (“General business expenses”, “Sales expenses”) Credit of account 60 “Settlements with suppliers and contractors” (“Settlements with various debtors and creditors”) - the primary costs of hosting are taken into account based on the act (report ) about the provision of services.

As a rule, after concluding a hosting agreement, the organization transfers a monthly fee to the provider for services, and at the end of the month the provider provides the organization with an act (report) on the provision of hosting services.

In the accounting of an organization, current expenses for payment for services for hosting and administering a website (hosting) and obtaining Internet access are considered expenses for ordinary activities (clause 5 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n) (hereinafter referred to as PBU 10/99).

Expenses for payment for hosting services are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other forms of implementation (assuming the temporary certainty of the facts of economic activity) (clause 18 of PBU 10/99).

To recognize expenses, it is necessary to fulfill the conditions of clause 16 of PBU 10/99, namely:

— the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

— the amount of expense can be determined;

- there is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization. There is certainty that a particular transaction will result in a reduction in the entity's economic benefits when the entity has transferred an asset or there is no uncertainty about the transfer of the asset.

If at least one of the above conditions is not met in relation to any expenses incurred by the organization, then receivables are recognized in the organization’s accounting records.

According to the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, when reflecting the costs of paying for hosting services (expenses for ordinary activities), an entry is made in the organization’s accounting records:

Debit of account 20 “Main production” (“General business expenses”, “Sales expenses”) Credit of account 60 “Settlements with suppliers and contractors” (“Settlements with various debtors and creditors”) - hosting services are taken into account (based on the act (report) provider about the provision of services).

Thus, further hosting costs in subsequent periods should be reflected as current expenses:

Debit 20 (26, 44) Credit 76, subaccount “Hosting expenses”,

— hosting costs are included in the organization’s costs;

Debit 76, subaccount “Hosting expenses”, Credit 51

— paid hosting.

Tax paid when applying the simplified taxation system

This type of cost, such as hosting costs, is not provided for in Art. 346.16 of the Tax Code of the Russian Federation.

However, as a rule, advertising information is posted on the site.

Advertising expenses can also include hosting services, since without these services a site with advertising information will not work.

Consequently, an organization can rightfully include the cost of paying for hosting as part of advertising expenses (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation) and take it into account for tax purposes as a single tax.

Moreover, if an organization has exclusive rights to a website, then the primary costs of paying for hosting, in our opinion, can be included in the initial cost of an intangible asset (website).

It should be noted here that, according to a number of experts, the primary costs of paying for hosting are not included in the initial cost of an intangible asset (website).

This is due to the fact that hosting can be provided for a month, a quarter, or a year.

In other words, the useful life of an intangible asset (website) and these services differ.

Therefore, according to this position, the primary costs of paying for hosting are also taken into account for tax purposes as advertising expenses (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Thus, your decision to account for the primary costs of paying for hosting must be fixed in the Accounting Policy.

Website promotion costs

Having created a website, many organizations enter into agreements with third parties to provide services for promoting websites on the Internet, optimizing websites for search engines, bringing websites to high positions in search engines, correctly designing and setting up websites for indexing by search engines.

It should be noted that in accordance with paragraph 1 of Art. 3 of the Federal Law of March 13, 2006 N 38-FZ “On Advertising” advertising is information disseminated in any way, in any form and using any means, addressed to an indefinite number of persons and aimed at attracting attention to the object of advertising, generating or maintaining interest in him and his promotion on the market.

Advertising is brought to the consumer through the publication of information in the media and (or) placement in public information and telecommunication networks (including the Internet).

Thus, we can conclude that the organization’s costs for promoting its website on the Internet can be equated to advertising costs.

Accounting

For accounting purposes, based on clause 5 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, expenses for promoting a website used in the ordinary activities of the organization will be recognized as expenses of ordinary types activities in the periods to which they relate.

Debit 26.44 Credit 60

— costs associated with website promotion are reflected;

Debit 60 Credit 51

— paid expenses for website promotion.

Tax paid when applying the simplified taxation system

The cost of services for promoting sites on the Internet can be taken into account in advertising costs based on the following (see Letters of the Ministry of Finance of Russia dated December 16, 2011 N 03-11-11/317, dated July 28, 2009 N 03-11-06/2/ 136):

According to paragraphs. 20 clause 1, clause 2 art. 346.16 of the Tax Code of the Russian Federation, expenses for advertising of goods sold, trademarks and service marks for tax purposes are taken into account in the manner prescribed for calculating corporate income tax, art. 264 Tax Code of the Russian Federation.

By virtue of clause 4 of Art. 264 of the Tax Code of the Russian Federation, an organization’s advertising expenses include, in particular, expenses for advertising events through the media (including advertisements in the press, radio and television broadcasts) and telecommunication networks. As stated in para. 3 tbsp. 2 of the Law of the Russian Federation of December 27, 1991 N 2124-1 “On the Mass Media”, the media, in particular, include online publications, which are understood as sites on the Internet.