Manufacturing companies often resort to the help of third-party organizations, ordering from them services for processing customer-supplied raw materials. The costs of paying for the services of these companies are usually considered as indirect expenses in tax accounting. But are there any risks here? Let's figure it out.

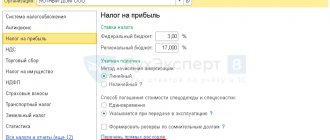

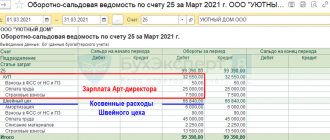

As is known, for companies using the accrual method, production and sales costs for income tax purposes are divided into direct and indirect. The main difference is that they reduce the income tax base in different ways. Direct expenses reduce it as products are sold, and indirect expenses are written off immediately in the period to which they relate (clause 2 of article 318 of the Tax Code of the Russian Federation). Therefore, for tax optimization purposes, it is more profitable to classify expenses as indirect. Moreover, organizations are allowed to independently determine the list of direct expenses in their accounting policies for tax purposes. Typically, companies that turn to third-party companies to process their raw materials prefer to classify the costs of purchasing raw material processing services as indirect costs.

Direct and indirect costs in the Tax Code of the Russian Federation

Considering the legality of such actions, let's turn to the primary source - the Tax Code. In accordance with paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, direct expenses may include, in particular:

- material costs determined in accordance with subparagraph. 1 and 4 paragraphs 1 art. 254 Tax Code of the Russian Federation;

- labor costs for personnel involved in the production of goods (works, services), as well as insurance costs accrued on the specified amounts of labor costs;

- the amount of accrued depreciation on fixed assets used in the production of goods.

All other expenses, with the exception of non-operating expenses determined in accordance with Art. 265 of the Tax Code of the Russian Federation are indirect.

In this case, the taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

Please note that the norms of paragraph 1 of Art. 318 of the Tax Code of the Russian Federation contain reference not to all material costs, but only to costs determined in accordance with subparagraph. 1 and 4 paragraphs 1 art. 254 Tax Code of the Russian Federation. These are costs, respectively, “for the acquisition of raw materials and (or) materials used in the production of goods (performance of work, provision of services) and (or) forming their basis or being a necessary component in the production of goods (performance of work, provision of services. While costs for the acquisition of work and services of a production nature, performed by third-party organizations or individual entrepreneurs, are provided for in subparagraph 6, paragraph 1, article 254 of the Tax Code of the Russian Federation.

Absence in paragraph 1 of Art. 318 of the Tax Code of the Russian Federation references to sub. 6 clause 1 art. 254 of the Tax Code of the Russian Federation can be interpreted in such a way that taxpayers can, at their discretion, include these material costs (which include the costs of purchasing services for processing customer-supplied raw materials) as indirect costs. It seems like there shouldn't be any questions.

Article 318. Procedure for determining the amount of expenses for production and sales

Article 318. Procedure for determining the amount of expenses for production and sales

[Tax Code] [Tax Code of the Russian Federation, Part 2] [Section VIII] [Chapter 25]

. If the taxpayer determines income and expenses using the accrual method, production and sales expenses are determined taking into account the provisions of this article.

For the purposes of this chapter, production and sales expenses incurred during the reporting (tax) period are divided into:

- 1) straight;

- 2) indirect.

Direct costs may include, in particular:

- material costs determined in accordance with subparagraphs 1 and 4 of paragraph 1 of Article 254 of this Code;

- expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as expenses for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against accidents at work and occupational diseases accrued on the specified amounts of labor costs;

- the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Article 265 of this Code, incurred by the taxpayer during the reporting (tax) period.

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

. In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by this Code. Non-operating expenses are included in the expenses of the current period in a similar manner.

Direct expenses relate to the expenses of the current reporting (tax) period as products, works, and services are sold, in the cost of which they are taken into account in accordance with Article 319 of this Code.

Taxpayers providing services have the right to attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress.

. If in relation to certain types of expenses in accordance with this chapter there are restrictions on the amount of expenses accepted for tax purposes, then the basis for calculating the maximum amount of such expenses is determined on an accrual basis from the beginning of the tax period. At the same time, for the taxpayer’s expenses related to voluntary insurance (pension provision) of his employees, to determine the maximum amount of expenses, the duration of the agreement in the tax period is taken into account, starting from the date of entry into force of such an agreement.

But the Ministry of Finance and the Federal Tax Service are against...

However, in practice, an approach has developed according to which the taxpayer has the right to classify specific “production” costs as indirect costs only if there is no real possibility of including them in direct costs. This conclusion is contained in many letters from officials (letters of the Ministry of Finance of Russia dated June 26, 2020 No. 03-03-07/55268, dated September 5, 2018 No. 03-03-06/1/63428, dated December 8, 2017 No. 03-03-06/ 1/81943, dated July 20, 2017 No. 03-03-06/1/46286, Federal Tax Service of Russia dated July 12, 2019 No. KCh-4-7/13613, dated February 24, 2011 No. KE-4-3/ [email protected] ) .

Although in their earlier explanations the department, answering in the affirmative to the question about classifying material costs determined in accordance with subparagraph as indirect costs. 6 clause 1 art. 254 of the Tax Code of the Russian Federation, did not specify that this is possible only if there is no real opportunity to include costs in direct expenses (Letters of the Ministry of Finance of the Russian Federation dated November 13, 2010 No. 03-03-05/251, dated October 9, 2012 No. 03-03-06/ 1/531, UMNS for Moscow dated 04/08/2004 No. 26-12/31775).

Considering that more recent clarifications contain an additional condition, organizations that decide to classify the services of processing companies as indirect expenses face tax risks.

Accordingly, the question arises: is it possible to defend one’s position in court?

Tax Code of the Russian Federation, Article 318 of the Tax Code of the Russian Federation

1. If a taxpayer determines income and expenses using the accrual method, production and sales expenses are determined taking into account the provisions of this article.

For the purposes of this chapter, production and sales expenses incurred during the reporting (tax) period are divided into:

- 1) straight;

- 2) indirect.

Direct costs may include, in particular:

- material costs determined in accordance with subparagraphs 1 and 4 of paragraph 1 of Article 254 of this Code;

- expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as expenses for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against accidents at work and occupational diseases accrued on the specified amounts of labor costs;

- the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Article 265 of this Code, incurred by the taxpayer during the reporting (tax) period.

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

2. In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by this Code. Non-operating expenses are included in the expenses of the current period in a similar manner.

Direct expenses relate to expenses of the current reporting (tax) period as products, works, and services are sold, in the cost of which they are taken into account in accordance with Article 319 of this Code.

Taxpayers providing services have the right to attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress.

3. If in relation to certain types of expenses in accordance with this chapter there are restrictions on the amount of expenses accepted for tax purposes, then the basis for calculating the maximum amount of such expenses is determined on an accrual basis from the beginning of the tax period. At the same time, for the taxpayer’s expenses related to voluntary insurance (pension provision) of his employees, to determine the maximum amount of expenses, the duration of the agreement in the tax period is taken into account, starting from the date of entry into force of such an agreement.

Accrual method

To calculate income tax, the Tax Code of the Russian Federation provides for the transition of business entities to determining income using the accrual method. This means that the date of their receipt is recognized as the day of transfer/shipment of works, services, products, property rights. This, in turn, is considered the day of sale, which is determined in accordance with paragraph 1 of Art. 39 NK. In this case, the actual receipt of money or other benefits in payment does not matter.

When applying this norm in practice, a conflict arises with the provisions of Art. 167 ch. 21 of the Code. It recognizes the choice of the accrual method as one of the elements of the financial policy of the enterprise. According to experts, situations may arise when the majority of business entities will have different profit tax and VAT bases. However, this will not simplify tax accounting in any way.

UrDela.ru

Part 1. If the taxpayer determines income and expenses using the accrual method, production and sales expenses are determined taking into account the provisions of this article.

For the purposes of this chapter, production and sales expenses incurred during the reporting (tax) period are divided into:

1) straight;

2) indirect.

Direct costs may include, in particular:

material costs determined in accordance with subparagraphs 1 and 4 of paragraph 1 of Article 254 of this Code;

expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as expenses for compulsory pension insurance, used to finance the insurance and funded part of the labor pension for compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, accrued on the specified amounts of labor costs;

the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Article 265 of this Code, incurred by the taxpayer during the reporting (tax) period.

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

Part 2. In this case, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully related to the expenses of the current reporting (tax) period, taking into account the requirements provided for by this Code. Non-operating expenses are included in the expenses of the current period in a similar manner.

Direct expenses relate to expenses of the current reporting (tax) period as products, works, and services are sold, in the cost of which they are taken into account in accordance with Article 319 of this Code.

Taxpayers providing services have the right to attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress.

Part 3. If in relation to certain types of expenses in accordance with this chapter there are restrictions on the amount of expenses accepted for tax purposes, then the base for calculating the maximum amount of such expenses is determined on an accrual basis from the beginning of the tax period.

At the same time, for the taxpayer’s expenses related to voluntary insurance (pension provision) of his employees, to determine the maximum amount of expenses, the duration of the agreement in the tax period is taken into account, starting from the date of entry into force of such an agreement. ‹ Article 317 (Tax Code of the Russian Federation). The procedure for tax accounting of certain types of non-operating income Up Article 319 (Tax Code of the Russian Federation). The procedure for assessing work in progress balances, finished product balances, and shipped goods ›