How is VAT taken into account when leasing?

VAT on a leasing agreement in 2022 has rates: 0% (zero) and 20%.

They depend on the type of property that is leased. Article navigation

- VAT on leasing under the simplified tax system

- VAT on leasing from individual entrepreneurs

- VAT from the lessee

- Tax deduction for leasing

- VAT on assignment

- VAT on early repayment of leasing

- VAT from the lessor

- Postings for VAT under a leasing agreement

- VAT postings from the lessee

- VAT postings to the lessor

The lessee makes leasing payments for the possession and use of the entrusted fixed asset (FPE). They include the lessor's expenses for the acquisition of the necessary property, his commission, and other costs associated with the fulfillment of obligations. These amounts, by their characteristics, are subject to VAT, therefore the contractual value must be increased by the amount of VAT.

VAT on a leasing agreement in 2022 has rates: 0% (zero) and 20%. They depend on the type of property that is leased.

If the leasing company is on a simplified taxation system, then leasing payments are not subject to VAT. In all other cases, the corresponding VAT rate is applied.

Below we will talk about how to determine whether leasing is subject to VAT, in what order this is carried out and about other features of accounting for financial leases.

Arbitrators' position.

It is worth noting that the court of first instance satisfied the taxpayer’s claims in full. Reason: all requirements imposed on the taxpayer by current legislation (Articles 169, 171, 172 of the Tax Code of the Russian Federation) have been met. The conditions for applying the right to a VAT tax deduction have been met.

However, the courts of appeal and cassation did not agree with this conclusion. In their opinion, the transaction for the taxpayer to purchase property on lease and then lease it to an affiliate is of a formal nature. The company's actions are aimed solely at obtaining unjustified tax benefits.

The arbitrators recalled that, within the meaning of the provisions of Chapter. 21 of the Tax Code of the Russian Federation and the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006, the possibility of applying VAT deductions is due to the existence of actual business transactions. The tax authority has the right to refuse to accept for deduction the tax paid to the counterparty (contractor, supplier) if the actual performance of business transactions is not confirmed by appropriate documents or the taxpayer’s dishonesty in carrying out these transactions is revealed.

The case materials confirm that the lease payments paid by the taxpayer under the leasing agreements exceeded the amounts of lease payments he received for the same property. The company systematically claimed the corresponding difference between the amounts of tax deductions (leasing transactions) and VAT from sales (leasing transactions) for reimbursement from the budget. This difference is his tax benefit in the absence of economic effect from an obviously unprofitable transaction for leasing property.

The courts stated: the person who has a real economic interest in the use of the leased property and actually exploits it is the lessee company, which, being a simplified entity, cannot claim a refund of VAT, which is part of the lease payment. That is why she created a scheme to illegally withdraw funds from the budget by involving an organization using OSNO in it. However, the activities of such an organization, which does not have its own material and labor resources, does not receive funds from third parties not affiliated with it (in addition to borrowed funds), and does not conduct any other business (except for leasing property to an interdependent person at a loss), is formal and not has an economic effect.

As a result, the judges' verdict was as follows:

Court's conclusion:

The conclusion of controversial leasing agreements has the sole purpose of obtaining one of the interdependent persons the right to a VAT refund from the budget. This means that the company received an unjustified tax benefit in the form of a VAT deduction for expenses associated with the acquisition of vehicles on lease. The inspectorate's refusal to reimburse the tax from the budget, as well as the additional assessments it made, are legal and justified.

VAT on leasing under the simplified tax system

The simplified tax system is a special regime, exempt from VAT (Chapter 26 of the Tax Code of the Russian Federation). There are significantly more simplified lessees than lessor companies that are on the simplified tax system. This is due to the fact that there are restrictions in the application of this taxation system and they depend on the company’s income and the share of legal entities in the authorized capital.

The lessor can issue VAT invoices using the simplified tax system - in this case, he is obliged to pay the entire amount to the budget. He cannot offset VAT on the acquired property. The legislation does not provide him with such a right. A lessee who has chosen the simplified tax system “income minus expenses” takes into account the VAT received upon transfer of a fixed asset as part of its cost. The same condition applies when accounting for rental services under a leasing agreement.

VAT refund upon cancellation of a transaction

The Civil Code of the Russian Federation stipulates the conditions under which a leasing agreement signed by the parties can be declared invalid and canceled (Article 166-173.1 of the Civil Code of the Russian Federation). But how the issue of taxation is regulated is not specified in the Tax Code of the Russian Federation. In paragraph 5 of Art. 171 and paragraph 4 of Art. 172 of the Tax Code of the Russian Federation we are only talking about termination of the contract at the will of the parties. They are used in practice when controversial situations arise: VAT on payments made for the period of the submitted invoice is taken into account. Photo: Helloquence/Unsplash

VAT on leasing from individual entrepreneurs

If an individual entrepreneur is under the general taxation regime, then he is a VAT payer. The accounting rules for leasing transactions are the same as for the lessee in the LLC form.

An individual entrepreneur cannot be a lessor, since leasing companies are defined by law as commercial organizations with several founders.

If an individual entrepreneur is on special regimes (UTII, simplified tax system, patent) - he is a VAT non-payer. They do not pay VAT on the sale of goods and services, therefore, there is no reason to reimburse it from the budget.

VAT on assignment

An assignment under a leasing contract allows the recipient to transfer the rights under the object of the agreement to a third party who was not included in the contract and was not a party to the transaction.

There are several stages in total when changing the recipient. First, the recipient must make a written request to obtain permission to transfer the object, as well as other rights under the terms of the leasing agreement and payment of VAT. After this, the lessor studies the offer and provides a response. If it is positive, a tripartite agreement can be concluded, which specifies the procedure for transferring property and making payments.

The list of documentation that is needed to transfer rights associated with leased property includes a lease agreement, an act of acceptance and transfer of the property, and documents on the subject of assignment. You will also need documents from the company that has become the new recipient.

According to Article 249 of the Tax Code of the Russian Federation, the primary recipient must pay a tax on profits on funds received when re-registering the contract from a new recipient, while the lessee's input VAT is excluded.

Thus, the assignment allows the recipient to transfer the property, rights and obligations arising upon its receipt to a party that was not a party to the concluded agreement. When changing the recipient, a new contract must be drawn up and related documents must be completed.

VAT from the lessee

Leasing payments include VAT, which, based on Art. Art. 171, 172 of the Tax Code of the Russian Federation, the enterprise can offset it from the budget. The monthly payment under the contract includes not only the redemption amount of the equipment, but also the services of the lessor. In this case, the amount of VAT to be offset will be higher than when applying for a loan from a bank. If supporting documents are correctly prepared, VAT on leasing is refundable in full.

However, in practice there are cases when the tax office tries to separate the VAT from the lease payment in the context of rent and payment of fixed assets. But the Ministry of Finance, in letters dated November 15, 2004 No. 03 - 04 - 11/ 203, dated November 23, 2004 No. 03 - 03 - 01 - 04/ 1/ 128, clarified the impossibility of such a division and confirmed the organization’s right to use the deduction in full . Since 2004, Russian arbitration courts have adhered to the same conclusion.

When the property under a leasing agreement is on the balance sheet of the lessee, VAT is deducted monthly. Based on the invoice, the deduction amount is entered into the purchase ledger.

Tax deduction for leasing

A tax deduction is an amount by which payments to the budget can be reduced. The deduction is mainly applied in relation to VAT. The amount of payment of value added tax is reduced by the amount of goods and materials received or services provided.

The leasing system is structured in such a way that the budget must always return VAT to the leasing companies. When paying suppliers for expensive property, they repay VAT on its full cost. After leasing the equipment, the company receives payments significantly less than its value. Thus, the VAT deduction on leasing from the lessor is always greater than the payment.

Reimbursement of VAT when leasing from a lessee in the case where the property is transferred to the recipient’s balance sheet is also fraught with problems. The condition for VAT reimbursement is the fact that inventory items are credited to the organization’s balance sheet or services are provided to it. In this case, companies constantly have VAT to reimburse under the leasing agreement until its expiration.

Problems of VAT refund from the budget arise in cases where the taxpayer cannot provide a complete package of documents or some of them do not comply with the requirements of the Tax Code of the Russian Federation.

Leased property must be fully involved in activities subject to VAT. Then the tax on rental payments is refunded in full. Sometimes an organization conducts its activities in several directions, including those that are not subject to VAT. In this case, the tax on leasing payments is subject to proportional distribution to all types of production. VAT on preferential activities is not deductible.

How to return VAT on leasing

When filling out a VAT return, VAT on leasing payments is subtracted from the amount of tax accrued on sales and advances. In the case when the amount of VAT deduction exceeds its amount payable, according to Art. 21 of the Tax Code of the Russian Federation, this amount can be submitted for reimbursement, that is, returned from the budget.

VAT refund on leasing is possible only if the following conditions are met:

- the invoice issued by the lessor complies with the requirements of Art. 169 Tax Code of the Russian Federation;

- there is confirmation of payment;

- the property is accounted for by the lessee;

- the fixed asset is used by the organization in activities subject to VAT.

To return the amount from the budget you must:

- Write an application to the Federal Tax Service for a refund in any form indicating the amount.

- Provide a leasing agreement, a certificate of acceptance and transfer of fixed assets, documents confirming payment of monthly payments.

- Record the refund amounts in the purchase ledger.

- Submit invoices, work completion certificates, completed in accordance with the law.

An enterprise may be denied a VAT refund if it is in the process of bankruptcy, if the payment under the agreement was made with bills of exchange, assignment agreements or with loans.

VAT on assignment

The assignment of a lease is an assignment. The need for this action arises in most cases due to the insolvency of the lessee. According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, the transfer of rights to property is subject to VAT.

In case of an assignment agreement, the tax base is established on the basis of Art. 154 Tax Code of the Russian Federation. The value is defined as the difference between the amount of the original contract and all payments under it, including advance payments.

According to Art. 174 of the Tax Code of the Russian Federation, a new party to the agreement can claim VAT for deduction on the amount of remaining payments under the leasing agreement if there is an invoice.

VAT on early repayment of leasing

When purchasing leased property early, accounting features arise for both the lessee and the lessor and they depend on whose balance sheet the object was recorded on.

If the parties have agreed that the lessor accounts for fixed assets on its balance sheet, then early repayment requires postings in the following sequence:

- The lessor writes off the initial cost of the asset, depreciation charges, and residual value; carries out other sales for the amount of early repayment; allocates VAT for payment to the budget.

- The lessee reflects the transfer of ownership; calculates the amount of early payments based on the invoice, indicating the FPR (deferred expenses) on the account, and allocates VAT from it. In this case, the VAT amount is set for reimbursement, and the amounts according to the terms of the contract are debited from the RBP account to the cost accounts.

If the parties have agreed that the lessee takes fixed assets into account on its balance sheet, then early repayment is recorded as follows:

- The lessor transfers the asset to the lessee, charges early payments, issues an invoice, and charges VAT to the budget.

- The lessee performs the actions described in two paragraphs above.

In both described cases, the transaction is not an advance payment and VAT is offset from the budget or paid on the basis of an invoice.

Classic VAT refund/reset

The most common classic refund in practice means taking into account the output tax included in lease payments and comparing it with input VAT on company operations (sale of goods, provision of services). If the outgoing VAT is greater than the incoming VAT, it means that the lessor has made an overpayment to the budget, which he has the right to return. It is important to consider two points:

- The deduction is applied in the quarter for which input tax is calculated. Moreover, according to the law (clause 1.1 of Article 172 of the Tax Code of the Russian Federation), the amount of outgoing VAT can be transferred over the next three years.

- If, after filing a declaration, the Federal Tax Service discovers arrears in payment of taxes, then the overpayment of VAT, first of all, will be aimed at repaying them (clause 4 of Article 176 of the Tax Code of the Russian Federation).

Still have questions?

Get advice and a personal quote for purchasing a car on lease

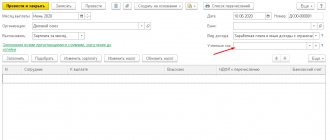

Postings for VAT under a leasing agreement

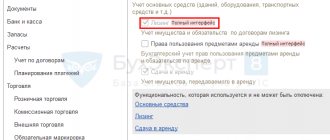

Accounting for leasing transactions is regulated by the relevant order of the Ministry of Finance of the Russian Federation dated February 17, 1997 No. 15. The leased object can be recorded on the balance sheet of one of the parties: the lessor or the lessee. This procedure is fixed in the contract or in an additional agreement to it.

In accounting, it is usually shown in the fixed assets account. If the property is accounted for on the lessor’s balance sheet (account 01 “Fixed assets”), then the lessee reflects its value on off-balance sheet account 001 (“Leased fixed assets”).

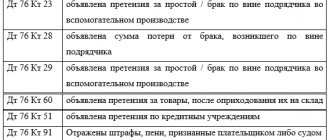

Accounting for all payments under the leasing agreement is made on account 76, with separate analytics for payments: advance payment (for accounting for advances), current payments (monthly payments), redemption value (cost of property upon redemption). Next, all the nuances of accounting for the seller and buyer of leased property are taken into account.

VAT postings from the lessee

Under a leasing agreement, the lessee's property will be accounted for in an off-balance sheet account. He will not make depreciation deductions, since off-balance sheet accounts do not provide for changes in value before the transfer of ownership. Other transactions under the agreement are reflected in accordance with the documents provided by the lessor. Accounting entries:

- Debit 001 - the fixed assets received under the leasing agreement were placed in an off-balance sheet account.

- Debit 20 Credit 76 - payment under the leasing agreement is reflected in expenses (posting is done monthly).

- Debit 19 Credit 76 - VAT is reflected on the monthly lease payment.

- Debit 68 Credit 19 - VAT is accepted for deduction (monthly posting).

- Debit 76 Credit 51 - transfer of the obligatory lease payment.

After making all mandatory payments, the lessee reverses the amount from the off-balance sheet account, making an entry to credit 001. At the same time, the property is placed on the lessee’s balance sheet account (Debit 01 Credit 02 - the amount of the fixed asset minus VAT, since the amount of VAT on the property was accepted for offset against the issued lessor's invoices).

Tax claims VS Company position

In the notice of summons to the tax inspector, he clearly listed all the questions that the Federal Tax Service Inspectorate had. This gave Romashka the opportunity to prepare for a visit to the tax authority and work out her position. We have highlighted the main complaints of the inspectors and will show Romashka’s answers, which helped to avoid additional charges.

Federal Tax Service claim No. 1. The lease payment can only be partially taken into account as part of other expenses

The Inspector states that the leasing agreement is a combination of sales and rental agreements. The lessee's expenses in the form of the redemption price are expenses for the purchase of depreciable property and are not taken into account for the purpose of calculating income tax. Thus, since the lease payment includes part of the redemption price and the rental payment, it can be taken into account as part of other expenses only in the part paid for receiving the car for temporary possession and use.

The inspector refers to the following documents and articles:

- Article 270 of the Tax Code of the Russian Federation;

- Letter of the Ministry of Finance of the Russian Federation dated June 2, 2010 No. 03-03-06/1/368;

- Letter of the Ministry of Finance of the Russian Federation dated June 25, 2009 No. 03-03-06/1/428;

- Letter of the Ministry of Finance of the Russian Federation dated April 27, 2007 No. 03-03-05/104.

Answer #1: Monthly payments were "rental"

Within the meaning of paragraph 5 of Art. 270 of the Tax Code of the Russian Federation, the “redemption” part of the lease payment is the cost of acquiring depreciable property, which is not taken into account when calculating income tax.

The Federal Tax Service absolutely correctly interprets Art. 270 Tax Code of the Russian Federation. However, in our case under the leasing agreement, the redemption payment is allocated separately, therefore all monthly payments were payments for temporary use (rent). And only 15,000 rubles is the redemption payment, which is included in expenses under Art. 270 of the Tax Code of the Russian Federation cannot be included. But Romashka refused the ransom, which means she did not violate Art. 270 Tax Code of the Russian Federation.

Maintain accounting and tax records in a web service

Answer No. 2. Letters from the Ministry of Finance do not apply to the situation under consideration

In two of the three letters from the Ministry of Finance cited, the situation is considered when the property is listed on the balance sheet of the lessee, which has nothing to do with our case. And the third letter specifically says:

Thus, the lease payment can be classified as other expenses in accordance with paragraphs. 10 p. 1 art. 264 of the Tax Code of the Russian Federation only in the part in which it is paid for receiving the leased asset for temporary possession and use, and the redemption price of the leased asset is not taken into account for profit tax purposes.

Chamomile did just that - the monthly payments were payments for the temporary use of a car. They were fully taken into account as expenses. But Romashka didn’t even pay the ransom payment of 15,000 rubles, so it wasn’t included in expenses.

Federal Tax Service claim No. 2 - Leasing payments must be divided into 2 parts

In direct text, the inspector writes that the total amount of lease payments should separate the amounts of lease payments and the purchase price. Therefore, it is necessary to keep separate records of two different amounts.

The inspector refers to the following documents:

- Letter of the Ministry of Finance of the Russian Federation dated June 25, 2009 No. 03-03-06/1/428;

- Letter of the Ministry of Finance of the Russian Federation dated March 4, 2008 No. 03-03-06/1/138;

- Letter of the Ministry of Finance of the Russian Federation dated March 30, 2007 No. 03-03-06/1/194.

Answer #1 - “Should I?”

The position of the Federal Tax Service that the lease payment should separate “rental” and “redemption” amounts contradicts the provisions of Art. 28 of the Federal Law of October 29, 1998 No. 164-FZ:

The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee.

That is, there may not be a redemption payment if the transfer of ownership is not provided. In addition, it does not follow from the law that the monthly payment must be split into two parts. That is, when transferring ownership of the property, the redemption payment can be either “wired” into a monthly payment or allocated separately at the end of the lease agreement.

Answer No. 2 - In fact, payments are divided

The leasing agreement clearly states monthly payments for the right to use the leased property and separately specifies the redemption payment. Therefore, the amounts are separate. Lease payments were written off as expenses in accordance with the Tax Code of the Russian Federation, and the company refused to buy out, so it did not make a buyout payment.

Stay up to date with the latest changes in legislation and accounting

Federal Tax Service claim No. 3 - Unfavorable conditions for the purchase and sale of a car

The inspector refers to the fact that the company sold the car on unfavorable terms. To do this, an analysis of offers for the sale of similar cars on the Internet was carried out. The estimated price is 1,300,000 rubles, but in fact the car was sold for 15,000 rubles.

Answer No. 1 - Chamomile didn’t sell anything

The lessor provides the lessee with property for temporary possession and use for a fee. In this case, the lessee himself decides whether to buy the property or not.

Romashka refused the ransom and returned the car to the leasing company. Within the meaning of paragraph 1 of Art. 39 of the Tax Code of the Russian Federation and clause 1 of Art. 11 Federal Law dated October 29, 1998 No. 164-FZ, upon return of leased property, no sale occurs.

The lessee is not the owner of the leased property until the redemption payment is made. In our case, the car belonged only to the leasing company throughout the entire period of the leasing agreement. Consequently, it was the leasing company that sold the car to an individual.

Answer No. 2 - Chamomile had the legal right to refuse the ransom

The car was originally purchased for business purposes. The LLC specialist visited customers and instructed users. Thanks to the availability of the car, the number of completed contracts increased and the company’s revenue increased.

They refused the buyout, since it was not planned for the specialist to travel further to train users. As practice has shown, during the COVID-19 pandemic, most clients began to switch to online training.

Leaving a car that is actually not needed meant:

- continue to pay transport tax;

- continue to pay for secure parking;

- continue to pay insurance;

- continue to service the vehicle.

The company did not need all these costs.

Answer No. 3 - Economic justification

Romashka presented an economic analysis to the Federal Tax Service for 2022 and 2020 to clearly demonstrate the growth of financial indicators: revenue, sales profit, net profit, net asset value, liquidity ratios, solvency, profitability, etc.

All indicators can be calculated manually based on financial statements, or you can use online services. To save effort and time, Chamomile downloaded reports from Contour.Focus.

Order a report on the financial condition of your company or counterparty

During the inspection, Romashka representatives showed that in 2022, compared to 2022, revenue and sales profits increased by more than 70%, and net profit by 90%.

Next, the company turned to the official service of the Federal Tax Service “Tax Calculator”. Here you just need to select the tax period, OKVED, region and scale of activity, after which the site will show the industry average profitability in the region.

An example of how the Tax Calculator works. It’s convenient that you can enter your actual data and the calculator will calculate the deviation from the average

The profitability of Romashka in 2022 turned out to be almost 3 times higher than the industry average for the region. Therefore, it is difficult to call Romashka’s decision to return a leased car ineffective or unprofitable.

Answer No. 4 - Tax burden

The “Tax Calculator” shows not only the industry average profitability, but also the average tax burden for income tax and VAT. In our case, the average tax burden in the Romashka industry is 1.5%. And for our company this figure is 4 times higher.

Comparing the actual tax burden with the average helps prove that the taxpayer is not trying to save on taxes or underestimate them. On the contrary, Romashka showed herself to be a decent taxpayer. And when returning the car, I was guided purely by business logic.

Answer No. 5 - The immateriality of the sane amount

The tax office actually charged Romashka with tax savings in the amount of 260,000 rubles (20% of the cost of the car). Company representatives drew the inspector's attention to the total amount of tax payments for the past year.

The share of the imputed amount in the total amount of taxes and contributions paid (in the form of income tax, VAT, contributions from employee salaries) did not even exceed 3%.

Answer No. 6 - Lack of similar offers

Leasing without purchase is actually a rental. The company used the car and then returned it to the leasing company. This prompted the tax authorities to deliberately inflate expenses by replacing rent with leasing.

In our case, there were practically no offers for renting cars in the Romashki region. You could only rent a car from local taxi companies.

The cars offered by taxi companies were not new and almost all were in poor condition. In addition, they were offered only for daily rental. According to Romashka’s representatives, such a car was not suitable for intercity travel. And investing in repairs of a rented car is not economically feasible.

An analogue of leasing without subsequent repurchase could be considered a car subscription, but there were no such programs in 2022, and they have not yet reached the Romashki region.

Therefore, leasing remained the only way to rent a new car in excellent technical condition. In addition, the leasing company insures it under the CASCO program. For the company, this means minimal repair and maintenance costs. The only expenses for the year are fuel, lubricants, renting a parking space and buying seasonal tires.

Income tax on leasing and rental

The leased asset transferred to the lessee under a leasing agreement is recorded on the balance sheet of the lessor or lessee by mutual agreement (Clause 1, Article 31 of Federal Law No. 164-FZ of October 29, 1998 (hereinafter referred to as Law No. 164-FZ)).

Based on paragraph 10 of Article 258 of the Tax Code, property received (transferred) for financial lease under a financial lease agreement (leasing agreement) is included in the appropriate depreciation group by the party for which this property should be accounted for in accordance with the terms of the financial lease agreement (leasing agreement ). The procedure for accounting for leasing payments for profit tax purposes depends on which party to the agreement takes into account the leased asset. When concluding a lease agreement, the property is always taken into account on the balance sheet of the lessor. Accounting for transactions under a lease agreement with a lessee for profit tax purposes fully corresponds to accounting for leasing operations with a lessee when concluding a leasing agreement with the condition that the leased asset be recorded on the lessor’s balance sheet.

The property is recorded on the lessor's balance sheet

In this situation, the lessee includes as expenses for income tax purposes the entire amount of the accrued lease payment (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation). Similarly, the tenant includes the amount of rent as tax expenses.

Example

The leasing agreement was concluded for 30 months. The total amount of leasing payments excluding VAT is RUB 375,000. The monthly lease payment amount is:

375,000 rub. : 30 months = 12,500 rub.

The lessee monthly includes the specified amount in the expenses of the current period as other expenses associated with production and sales (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

The property is recorded on the lessee's balance sheet

In this situation, tax accounting for the lessee is more complicated. First of all, the lessee must include the leased property in the appropriate depreciation group at a cost equal to the lessor’s costs for its acquisition and bringing it to a condition suitable for use (clause 1 of Article 257 of the Tax Code of the Russian Federation). The lessee has the right to include in tax expenses depreciation on such property, accrued by the linear or non-linear method using an increasing factor, but not higher than 3. The increasing factor does not apply to leased property belonging to the first, second and third depreciation groups (subclause 1, paragraph. 2 Article 259.3 of the Tax Code of the Russian Federation).

It is desirable that the possibility of applying the coefficient and its size be provided for both in the leasing agreement itself (clause 1 of Article 31 of Law No. 164-FZ) and in the accounting policy of the lessee for tax purposes (letter from the Federal Tax Service of Russia for Moscow dated December 14. 2005 No. 20-12/92338).

In addition to depreciation of the leased asset, the lessee includes in income tax expenses the lease payment accrued for the corresponding period minus the amount of depreciation of the leased asset in this period.

Example

The leasing agreement was concluded for 30 months. The total amount of leasing payments excluding VAT is RUB 375,000. The amount of the monthly accrued lease payment is equal to:

375,000 rub. : 30 months = 12,500 rub.

The cost of the leased item (CNC machine), according to the tax accounting data of the lessor (brought to the lessee by a certificate with copies of primary documents confirming the declared value), is 200,000 rubles. The CNC machine, according to the lessee, belongs to the 5th depreciation group (OKOF code 14 0001010). In accordance with the accounting tax policy of the lessee for depreciable property, the minimum useful life for the corresponding group is established, that is, 85 months, and the straight-line depreciation method is used. In accordance with the leasing agreement and the accounting policy of the lessee, for tax purposes on leased property, a depreciation acceleration factor of 3 is applied. The monthly amount of depreciation of the leased asset accrued by the lessee is equal to:

200,000 rub. : 85 months × 3 = 7059 rub.

Thus, the lessee includes RUB 7,059 as expenses for the current period. as depreciation under Article 259 of the Tax Code and the amount of the lease payment (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation) in the amount of:

12,500 – 7059 = 5441 rub.

Based on paragraph 9 of Article 258 of the Tax Code, the company has the right to include in the expenses of the reporting (tax) period expenses for capital investments in the amount of no more than 10 percent (no more than 30% in relation to fixed assets belonging to the third - seventh depreciation groups) of the original the cost of fixed assets (except for fixed assets received free of charge), as well as no more than 10 percent (no more than 30% in relation to fixed assets belonging to the third to seventh depreciation groups) of expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of fixed assets and the amounts of which are determined in accordance with Article 257 of the Tax Code.

According to the tax department (letter of the Federal Tax Service of Russia dated 04/08/2009 No. ShS-22-3/267), which found support from the judges of the Moscow District (registered by the Federal Antimonopoly Service of the Moscow Region dated 04/11/2012 No. A40-23166/11-116-67), this The provision does not apply to lessees who record the leased asset on their balance sheet. In my opinion, the position of the tax authorities does not correspond to the Tax Code, since the commented paragraph of the Code does not establish such a restriction in relation to lessees. This conclusion is confirmed by the court (decision of the Federal Antimonopoly Service of the Central Election Commission dated November 11, 2011 No. A64-5786/2010).

Updated procedure for accounting for leasing payments

The essence of a financial lease is that the lessee uses the leased property and makes monthly payments to the lessor under the agreement.

Sometimes, under the terms of the agreement, the tenant gradually buys the property, subsequently registering ownership of it. In this case, the redemption price is added to the monthly payment.

Rent under a leasing agreement

The lessor classifies rent payments as income, and the lessee classifies them as expenses. This procedure is in effect now and will continue to be applied from 2022.

Redemption value under a leasing agreement (current rules)

The current version of the Tax Code of the Russian Federation does not provide clear instructions on how to indicate the redemption value in tax accounting. In other words, it is not clear whether it should be included in the lessor’s income and in the lessee’s expenses.

Government agencies believe that payments every month in the form of redemption value are advances. They cannot be shown in tax accounting until the ownership of the leased object passes from the lessor to the lessee.

When this happens, the lessor records the redemption value as proceeds from the sale of the property. And the lessee includes the redemption price in the initial cost of the object and begins to write it off through depreciation (Letter of the Ministry of Finance dated February 18, 2019 No. 03-03-06/1/10341).

Purchase price under a leasing agreement (new rules)

From 2022, the Tax Code of the Russian Federation will specify the rules for accounting for redemption value, for which paragraphs will be edited. 10 p. 1 art. 264 NK. According to the adjustments, if the lease payment includes the redemption value, then the lessee's expenses will be formed minus the redemption value.

Accordingly, the approach set out in the explanations of the Ministry of Finance was enshrined in legislation.

Important! The updates apply only to OSNO taxpayers. For simplified taxation system payers everything will be the same. In simplified form, lessors indicate the entire lease payment in income, incl. and redemption price (Letter of the Ministry of Finance dated 08/04/2017 No. 03-11-11/49896). Lessees use the simplified tax system “income-expenses” to include the redemption value as expenses (Letter of the Ministry of Finance dated October 2, 2015 No. 03-11-06/2/56616).

New in taxation of leasing transactions from 2022

New year with new rules

On November 29, 2022, Federal Law No. 382-FZ was adopted, which, among other things, clarified the taxation procedure for financial leasing transactions1 (hereinafter referred to as the “ Law ”).

Amendments to the Tax Code of the Russian Federation (hereinafter referred to as the “Tax Code of the Russian Federation ”) were provided for by the Main Directions of Budget, Tax and Customs Tariff Policy for 2022 and for the planning period of 2023 and 20242.

The introduction of these changes was also due to the entry into force of the Federal Accounting Standard FSBU 25/2018 “Lease Accounting”. The new FSB-25 standard no longer uses the term “fixed asset” in relation to financial lease (leasing) transactions, but indicates the need to account for the leased asset as (1) a net investment in leasing from the lessor and (2) an asset in the form of a right of use from lessee. These changes raised a number of questions regarding the procedure for determining the property tax base in relation to leased items.

The law provides for transitional provisions (“grandfathering clause”) in relation to existing leasing transactions.

Income tax

Depreciation of leased items

In accordance with Article 256 of the Tax Code of the Russian Federation, depreciable property for income tax purposes is property that is owned by the taxpayer.

Article 259.3 of the Tax Code of the Russian Federation, as amended before the entry into force of the Law, provided for the possibility of choosing the balance holder of the leased asset for the purposes of applying the accelerated depreciation rate, that is, the lessor (owner) or the lessee could actually depreciate the leased asset, depending on the choice enshrined in the leasing agreement . The new edition of this rule eliminates this variability and provides the right to use increased depreciation rates only for the lessor as the owner of the leased asset.

These changes in the Tax Code of the Russian Federation give rise to significant differences between tax and accounting accounting (for accounting purposes, the leased asset is subject to accounting and depreciation by the lessee, and in tax accounting – by the lessor).

Accounting for leasing payments

Another change provided for by the Law relates to the procedure for recognizing expenses under leasing agreements for income tax purposes.

The new version of Article 264 of the Tax Code of the Russian Federation excludes the possibility of accounting for depreciation of leased items as expenses at the lessee level (this amendment correlates with the changes to Article 259.3 mentioned above).

The Law also introduces a new procedure for accounting for lease payments in the lessee's expenses - lease payments are taken into account as expenses minus the redemption value.

At the same time, the term “redemption value” is not defined in any way in the Tax Code of the Russian Federation. The question arises, what should be understood by “redemption value” - the final payment at the end of the contract or part of the redemption value of the leased asset as part of the lease payment? And how to take it into account for tax purposes?

Taking into account the emerging law enforcement practice, indicating that “leasing payments cannot be divided into payment for the use of the leased asset and its redemption value”3, we believe that when developing this rule, the legislator had no intention of limiting the deduction of any part of the lease payment.

However, in the absence of any official written clarification from the Ministry of Finance on this issue, this amendment introduces uncertainty regarding the calculation of the amounts of expenses that the lessee can deduct.

It would be advisable to receive written explanations from the Ministry of Finance regarding how this norm should be interpreted. It would also be useful to clarify the wording of this article to avoid ambiguous interpretation and related disputes between tax authorities and taxpayers.

Property tax

The law also introduced amendments to Chapter 30 of the Tax Code of the Russian Federation “Property Tax of Organizations”, in particular, the possibility of choosing a balance holder for the purposes of paying property tax in relation to financial lease (leasing) items was limited. The new edition of the Tax Code of the Russian Federation establishes that, regardless of the terms of the agreement, the taxpayer for property tax will be the lessor (as the owner of the asset).

Taking into account the new accounting procedure for leased assets, this amendment creates uncertainty regarding the determination of the tax base for assets taxed at their average annual value.

Entry into force/grandfather clause

Article 3 of the Law establishes that the above changes come into force after one month from the date of official publication of the Law, but not earlier than the 1st day of the next tax period for the relevant taxes.

The law also includes special provisions for existing finance leases (“grandfathering clauses”). In particular, under such agreements concluded before the date of entry into force of the Law, Russian taxpayers have the right to account for property that is the subject of leasing according to the old rules of Chapter 25 of the Tax Code of the Russian Federation and the old accounting rules.

Despite the fact that this grandfather clause was introduced into the Tax Code of the Russian Federation at the last moment at the suggestion of business representatives in order to ensure the most painless transition to the new rules for taxation of financial leasing transactions, the following questions remain open:

- Does the “grandfather clause” apply in relation to property tax in the absence of a reference to Chapter 30 of the Tax Code of the Russian Federation in Article 2 of the Law?

- What tax accounting rules should apply to financial lease agreements concluded between the date of publication of the Law and the date of entry into force of the relevant provisions? At what point can a grandfather clause not be applied to new contracts?

What does this mean?

With the adoption of the Law, the problem of inconsistency between accounting and tax accounting has worsened, which could potentially lead to a number of difficulties and issues related to accounting for financial lease (leasing) transactions in practice.

Taking into account the short time remaining until 2022, taxpayers need to develop a methodological position on a number of issues. In addition, these amendments to the Tax Code of the Russian Federation may require changes to leasing agreements and a revision of some conditions of concluded transactions. Participants in leasing transactions will have to bring their accounting policies for tax purposes into line with the new rules.

We must be prepared for the fact that there will be further refinement and clarification of these rules in order to remove any questions that have arisen regarding how parties to transactions should calculate taxes. We hope that the Ministry of Finance will soon express its position on this issue.

We are ready to help you understand the current situation, including by preparing relevant requests to the Ministry of Finance of the Russian Federation, assisting in the development of recommendations in specific situations related to the taxation of transactions under financial lease agreements, both already concluded and planned for conclusion.

Authors: Alexey Kuznetsov Tatyana Alikina Artem Chistilin