Organizational provisions

- To formulate tax accounting regulations, the company discloses data that allows it to more accurately generate the necessary information both in general and for each of the taxes for which it is a payer.

- Data on whether the company is newly created or not is necessary to determine the edition of the UP - new or modification of the old one. According to the rules, accounting policies for tax purposes are approved no later than 90 days from the date of establishment of the company and are applied consistently from year to year.

- Next, the company must indicate the types of business activities it carries out. Depending on the specific type of activity, the organization forms the features of its accounting tax policy (primarily in terms of income tax).

- For the same purposes (for income tax), the organization must indicate information about whether it carries out transactions with securities and whether in the course of its activities it incurs R&D expenses.

- To generate information on the procedure for maintaining property tax records, an organization must indicate whether it has property subject to taxation on its balance sheet.

- For structural characteristics, it is necessary to indicate the presence (absence) of separate structural divisions, including those located on the territory of one subject of the Federation.

- What follows is a block of questions, the answers to which characterize the procedure for organizing tax accounting. The company has the right to keep records of data both with the involvement of a third-party organization or a specially authorized person (indicate their name in the text) and on its own. If tax accounting is carried out in-house, then it is necessary to indicate who is doing this - an individual employee or a specialized service. In both cases, specification is required, that is, an exact indication of the employee’s position according to the staffing table or the name of the department in accordance with the company structure.

- An essential point is the method of maintaining tax records (automated or non-automated). When choosing an automated method, you must additionally specify the specialized program with which tax accounting is maintained.

What can be included in the general part of the accounting policy?

It is recommended to include in the general provisions the basics of the procedure for maintaining tax accounting: the form and method of maintaining it.

In other words, is accounting maintained using accounting registers, accounting registers with additional details and (or) tax accounting registers. Are such registers maintained on paper and (or) electronically? Is accounting and tax calculation carried out by an accountant or a specialized organization. At the same time, accounting policies should not turn into regulations for the interaction of structural divisions of the company.

Change mid-tax period

According to the letter of the Ministry of Finance of Russia No. 03-03-06/1/45756 dated 07/03/2018, it is possible to reflect changes in accounting policies for tax accounting purposes (Article 313 of the Tax Code of the Russian Federation):

- when legislation on taxes and fees changes;

- when changing the accounting methods used.

Changing accounting methods is allowed only from the beginning of a new tax period, that is, from the beginning of the year. But if the legislation changes, it is allowed to change the accounting policy from the moment the new rules come into force. It depends on the organization on what principle to formulate its tax accounting policy. When new types of activities appear, changes must also be made to the regulations. In the middle of the tax period, the taxpayer has the right to change the accounting policy in two cases:

- the legislation has changed and these changes have entered into legal force;

- The company began to carry out a new type of activity.

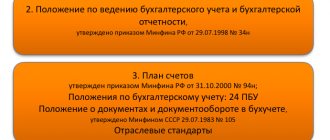

How should you approach the preparation of accounting policies?

The initial information should be about what taxation regime the organization will apply: general, special or a combination of them. In addition, you need to know the structure of the organization, since the presence or absence of separate divisions affects the procedure for paying taxes and requires reflection in the accounting policies. In addition, if there are separate divisions, the accounting policy establishes the order of numbering, compilation and execution of invoices, adjustment invoices, as well as maintaining a journal of invoices and a sales book.

It is necessary to analyze the types of activities that the organization actually engages in. In the event of the start of new types of activities, the accounting policy may be supplemented by the procedure for reflecting these types of activities for tax purposes. If necessary, such additions are made during the tax period.

You must ensure that you have special status. For example, for professional participants in the securities market there are specific features for determining the tax base, in particular, the ability to include in the costs accepted for deduction when calculating corporate income tax the amount of VAT paid to suppliers on purchased goods (works, services).

It is necessary to check the ownership of the organization of objects (land, transport, property) that recognize it as a taxpayer of the corresponding tax. As a result, for an organization applying the general taxation regime, in the accounting policy, methods (methods) of accounting for indicators for taxation can only be established in relation to corporate income tax and VAT. To calculate other taxes, no additional provisions other than the legislation on taxes and fees will be required. In this case, the structure of the accounting policy may look like this: general provisions, VAT, income tax, register forms.

Value added tax (VAT)

This section must be completed only by organizations that are VAT payers.

Periodicity

As part of the general provisions on the procedure for maintaining VAT tax accounting, the organization must indicate the frequency of renewal of the numbering of invoices. There are no strict restrictions in regulatory and legislative acts on this issue, so the organization has the right to indicate any of the proposed options - monthly, quarterly, annually, or with other frequency.

Enterprises engaged in the manufacture (production) of goods, works and services with a long production cycle (more than 6 months according to the list approved by the Government of the Russian Federation) must provide in their accounting policies the moment of determining the tax base upon receipt of an advance payment on account of upcoming deliveries of goods (performance of work, provision of method, the organization fixes in its accounting policy one of the proposed dates - either on the day of shipment or on the day of receipt of payment (full or partial). If the organization provides for the use of a “separate" method, then it has the right to use both of the above dates to determine the tax base. In the text The accounting policy must indicate for which transactions the tax base is determined on the date of shipment, and for which - on the date of payment.

Separate VAT accounting

Further points disclosed in the accounting policy regarding the procedure for maintaining VAT tax accounting are related to the organization of separate VAT accounting for organizations that carry out transactions subject to and not subject to VAT, and types of activities for which different rates of this tax are applied. Accordingly, only organizations that have the above operations in their business practice should disclose in their accounting policies the specifics of tax accounting. The first point in the disclosure in the accounting policy of information on the procedure for maintaining separate accounting for VAT is an indication of the fact that the organization has business transactions that are not subject to VAT (if there is a taxable turnover) and transactions taxed at a rate of 0% (if there are transactions taxed by other rates other than 0%).

Next, the organization needs to decide for itself whether it applies the so-called “5% rule” for the purposes of separate accounting (separate accounting of “input” VAT is allowed not to be carried out in those tax periods in which the share of total expenses on transactions not subject to VAT is less or equal to 5% of the total total production costs). Accordingly, ignoring this rule means that separate accounting is carried out regardless of the proportion of the ratio between taxable and non-taxable transactions. The “5% rule” is used by those organizations whose share of VAT-exempt transactions is insignificant.

If an organization applies the 5% rule, then it needs to disclose some additional information in its accounting policies. The first point related to this concerns the expense register for the purpose of applying this rule. At the choice of the organization, this is either a special sub-account allocated in the working chart of accounts, a separate accounting register, or another independently developed method. The choice of one of the options depends on the general order of organization of the accounting process.

Next, the base is determined in proportion to which the distribution of general business expenses is made. This indicator is determined in proportion to the share of revenue from non-taxable transactions in the sales volume, in proportion to the share of direct expenses in the total amount of expenses, or in any other way adopted by the organization. The choice of method is made solely on the basis of the professional judgment of officials of the organization.

When choosing the “share of expenses” as a base indicator, the organization provides for the creation of a special form (tax accounting register) in its accounting policy.

The next point related to maintaining separate accounting for VAT is determining the period for calculating the proportion of VAT to be deducted on fixed assets and intangible assets (intangible assets) accepted for accounting in the first or second month of the quarter. The organization can choose to determine the specified ratio between taxable and non-taxable turnover under VAT either on the basis of monthly data or based on quarterly results. The choice of option depends on whether the organization generates data on sales of goods, works, and services on a monthly basis or not. If not, then you should choose the option based on the “quarterly” proportion.

An organization has the right to maintain separate accounting of “input” VAT either in a special subaccount to balance sheet account 19 “VAT on acquired values,” or in a separate register, or in another independently determined order. The choice of this procedure depends on the organization’s accounting process.

The procedure for maintaining separate accounting of transactions for the sale of goods, works and services, subject to and not subject to VAT, is provided for in the accounting policy. By analogy with the above, such accounting is electively maintained either in a special sub-account, or in a separate register, or in any other way. The choice of option is at the discretion of the company.

To quickly and correctly draw up a document, use the free accounting policy designer for 2022 from ConsultantPlus experts.

What items regarding VAT should be reflected in the accounting policy?

There may be none if the organization carries out only transactions taxed at the rate of 18% and does not have separate divisions.

If an organization carries out transactions that are subject to taxation and transactions that are not subject to taxation (exempt from taxation), then the content of the accounting policy should be: rules for maintaining separate accounting, rules for accepting for deduction or accounting for tax amounts presented by sellers, rules for distributing tax amounts, if in the tax period the share of total expenses for the acquisition, production and (or) sale of goods (work, services), property rights, transactions for the sale of which are not subject to taxation, does not exceed 5% of the total amount of such total expenses. When formulating the rules for separate accounting, the provisions of Article 170 of the Tax Code of the Russian Federation are taken into account.

Also, if a company carries out transactions taxed at a rate of 0%, then the accounting policy includes the procedure for determining the amount of tax related to goods (work, services), property rights acquired for the production and (or) sale of goods (work, services), transactions for the sale of which are taxed at a tax rate of 0%.

Income tax

The “Profit” section in the accounting policy is filled out only by organizations that are payers of income tax. First, you need to indicate how information is generated for the purposes of calculating the taxable base for income tax:

- by filling out specially designed tax accounting registers;

- by filling out accounting registers, supplemented, if necessary, with relevant details.

The choice of one of the options depends on the organization itself, taking into account how its accounting procedures are organized and document flow is structured.

Next, the organization must indicate which reporting period it applies for income tax - monthly or quarterly. The choice depends solely on the organization itself and its desire to generate income tax indicators in one way or another.

Tax accounting policies should reflect the payment of monthly advance payments. There are no choice options, since those who are exempt from paying advance payments for income tax are indicated in clause 3 of Art. 286 Tax Code of the Russian Federation. This moment is purely ascertaining in nature.

Organizations that have separate structural divisions located on the territory of different subjects of the Federation must disclose in their accounting policies information about the basic indicator in proportion to which (in addition to the residual value of depreciable property) the share of profit attributable to the separate division is distributed. The organization chooses either a share of the average number of employees of the department, or a share of the costs of paying for their labor. The choice of one of the options depends solely on the organization itself, depending on the professional judgment of its officials.

Can there be different accounting policies for separate divisions of a company?

The adopted accounting policy for tax purposes is mandatory for all separate divisions of the organization. This means that an organization cannot have multiple accounting policies for tax purposes.

But in an organization that includes separate divisions, it is possible to provide for the specific application of accounting methods. Thus, when selling purchased goods, the taxpayer reduces income from such transactions by the cost of purchasing goods, which is determined in accordance with accounting policies. The taxpayer, when choosing a method for writing off the cost of purchased goods, has the right to determine in the accounting policy whether the corresponding method will be applied for each separate division or for the organization as a whole (letter of the Ministry of Finance of Russia dated February 16, 2012 No. 03-03-06/1/88).

Accounting for income and expenses

What follows is a large block of questions related to accounting for the organization’s income and expenses. The first and most significant issue in this block is the method of recognizing income and expenses. Only organizations whose average revenue from the sale of goods (work, services) excluding VAT over the previous four quarters did not exceed 1 million rubles for each quarter can afford to freely choose one of the two methods. That is, those who have the right to use the cash method, but want to use the accrual method. Other organizations are required to indicate the “accrual method” in their accounting policies on a non-alternative basis. The accounting policy of the organization for tax purposes does not reflect other features of accounting; there is a separate document for this.

The next question concerns only enterprises with a long technological cycle (production, the start and end dates of which fall on different tax periods, regardless of the number of days of production), for which stage-by-stage delivery of work (services) is not provided. Such organizations have the right to establish in their accounting policies the procedure for recognizing income by distributing it between reporting periods either in equal shares based on the number of periods, or in proportion to the costs incurred, or in another reasonable way. The choice of one of the options depends on the principles of tax planning determined by the organization independently.

Next, the point related to the procedure for recognizing losses from the assignment of the right to claim a debt before the maturity date is revealed. The indicator on the basis of which the normalization of the amount of loss is calculated is calculated at the choice of the organization:

- based on the maximum interest rate established by type of currency;

- based on rates on debt obligations confirmed by the methods provided for in paragraph 1 of Art. 105.7 of the Tax Code of the Russian Federation (methods used in determining profit for tax purposes in transactions in which the parties are interdependent persons).

If an organization uses the comparable market prices method for these purposes, then it needs to establish comparability criteria (for example, the same currency, the same period, another similar indicator at the discretion of the organization).

For R&D expenses, an organization needs to specify how these expenses will be accounted for. There are two options:

- These expenses will form the cost of intangible assets (in this case, inclusion in expenses is made through depreciation over a certain useful life).

- As part of other expenses (in this case, inclusion in expenses is carried out within two years).

An organization has the right to apply a coefficient of 1.5 to actual R&D expenses for the purpose of including them in expenses that reduce the taxable base for income tax. An appropriate indication of this fact should be made in the accounting policy. It must be remembered that if an organization chooses to use this coefficient, it is additionally charged with the obligation to provide to the tax authority at its location a report on R&D performed, the costs of which are recognized in the amount of actual costs using a coefficient of 1.5. The report is submitted to the tax authority simultaneously with the tax return based on the results of the tax period in which the relevant R&D was completed. A progress report is provided for each R&D project.

The next question concerns the accounting treatment of rental income. At the choice of the organization, they are taken into account either as part of sales income or as part of non-operating income. The choice of option depends on how the specified income was recognized in accounting.

Is it necessary to provide a method for rationing interest on debt obligations?

From January 1, 2015, Article 269 of the Tax Code of the Russian Federation will no longer provide for the usual methods for taxpayers to classify interest on debt obligations as expenses. The accounting policy can only include provisions on the use of the range of maximum rates contained in paragraph 1.1 of Article 269 of the Tax Code of the Russian Federation for the recognition of interest in income and expenses on a controlled transaction, one of the parties to which is the bank. The absence of these provisions may result in the automatic use of market prices for transactions.

Along with this, it is necessary to stipulate the specifics of determining the amount of loss when assigning (assigning) the right to claim a debt to a third party before the payment deadline stipulated in the sales agreement (debt obligation). What indicator will be used to calculate the loss:

- the maximum interest rate established for the corresponding type of currency by paragraph 1.2 of Article 269 of the Tax Code of the Russian Federation;

- interest rate confirmed by the methods established by Section V.1 of the Tax Code of the Russian Federation.

Accounting for direct and indirect costs

What follows is a block of questions regarding the specifics of accounting for direct and indirect costs. To begin, the organization should approve the list of direct expenses, selecting them from the proposed list. At the request of the organization, this list is either reduced as much as possible or expanded as much as possible. Typically, the list of direct expenses for tax accounting purposes for income tax corresponds to a similar list accepted for accounting purposes.

With regard to direct costs associated with the provision of services, the organization has the right to provide for either their distribution to work in progress (WIP) balances, or to take them into account in full as part of current expenses. The choice of one of the options remains entirely at the discretion of the organization itself, based on its existing tax planning principles.

The organization also needs to disclose in its accounting policies the principles for the distribution of direct costs for work in progress. Depending on the characteristics of the production process and based on the professional judgment of officials, the organization has the right to choose any of the methods proposed in the list, or to approve its own method. It is possible to use different methods for distributing direct costs depending on the type of product produced. According to the rules, the procedure established by the taxpayer in the accounting policy for tax purposes for the distribution of direct expenses (formation of the cost of work in progress) is subject to application for at least one year.

If an organization has direct costs that cannot be unambiguously attributed to the production of specific products, then this fact should be indicated in the accounting policy. An indicator should be provided on the basis of which such costs will be distributed between types of products. This indicator is:

- wages of employees engaged in primary production;

- material costs;

- revenue;

- another indicator chosen by the organization.

What happens if the taxpayer does not have such a document as an accounting policy?

The Tax Code of the Russian Federation provides for the mandatory presence in an organization of an accounting policy for tax purposes, and as an independent document. This document does not replace the accounting policy for accounting purposes.

If the taxpayer does not have tax accounting registers, which Article 314 of the Tax Code of the Russian Federation requires to be established as appendices to the accounting policy, then liability arises under Article 120 of the Tax Code of the Russian Federation (a fine of 10 thousand rubles).

The absence of an accounting policy, or more precisely, the absence of selected indicators for calculation, simply will not allow a taxpayer applying the general taxation regime to pay taxes in most cases. For example, a taxpayer will not be able to take into account the costs of acquiring fixed assets if he does not choose the depreciation method, etc.

Inventory accounting

Let's move on to the block within which issues related to accounting for inventory items (TMV) are considered. First, let's look at the accounting of goods.

In relation to purchased goods, an organization has the right to establish the formation of their value in tax accounting both without taking into account additional costs for their acquisition, and taking them into account. The organization decides whether all additional costs are included in the cost of purchased goods or only certain types of them. The list of additional expenses included in the cost of purchasing goods is established in the accounting policy. Typically, the choice in favor of one or another method of forming the value of goods depends on how their value was formed in accounting.

The next point is an indication of the method of evaluating the product during its sale. One of three methods is selected: unit cost, average cost, FIFO method. It is possible to use a single method for all types of goods, or to select an individual method for each group.

In relation to raw materials and materials, the organization indicates the method of their valuation when written off. The same methods that were used to evaluate goods are offered to choose from. Similarly, it is possible to use different assessment methods for different groups of raw materials and supplies.

In relation to low-value property (tangible assets of durable use that do not fall into the category of depreciable property), the organization must indicate how its value is included in current expenses: at a time (by analogy with raw materials) or in equal shares over more than one reporting period (based on useful life or other economically justified indicator).

What does it mean?

For example, the Tax Code provides that the taxpayer has the right to determine the depreciation rate for used fixed assets, taking into account the useful life reduced by the number of years (months) of operation of this property by the previous owners. It is advisable to fix these provisions in the accounting policy affirmatively: “the company determines the depreciation rate”, “the company determines the useful life of these fixed assets as their useful life established by the previous owner of these fixed assets, reduced by the number of years (months) of operation of the property by the previous owner” and etc.

It is recommended in the accounting policy to confirm the taxpayer’s accounting for losses: “The tax base of the current reporting (tax) period is reduced by the entire amount of loss (losses) received by the Company in the previous tax period or in previous tax periods or by a part of this amount.”

You can try to consolidate in the accounting policy some universal formulation about accepting expenses within the maximum limits established by the Tax Code, if we are talking, for example, about standardized expenses.

Depreciation

Now let's turn to the procedure for accounting for depreciable property (fixed assets and intangible assets). The first question concerns the procedure for forming the initial cost of fixed assets. The organization has the right to establish a list of expenses for the creation of fixed assets that are not included in their initial cost. Refusal to include any type of expense in the initial cost of fixed assets will lead to disagreements with regulatory authorities. Disclosure of this information in accounting policies is associated with additional risks.

If an organization operates in the field of IT technologies and meets the criteria established by paragraph 6 of Article 259 of the Tax Code of the Russian Federation, then it has the right to choose the option of accounting for the cost of electronic computer equipment as expenses: either as part of material expenses or in the form of depreciation. If the option of accounting as part of material expenses is chosen, then inclusion in current expenses occurs electively either at a time or in certain shares over more than one reporting period, based on the service life or other economically justified indicator.

If an organization leases or plans to lease fixed assets, then it needs to indicate how depreciation of non-refundable capital investments in leased fixed assets (inseparable improvements) is carried out. Such depreciation is based on either the useful life of the leased asset or the useful life of the permanent improvement itself. The choice of one of the options is made by the organization independently.

The organization has the right to provide for a review of the useful life of an object of depreciable property based on the results of its reconstruction, modernization or technical re-equipment, as well as not to carry out such a review.

In relation to fixed assets that were previously operated by previous owners in the same capacity, the organization establishes a special procedure for determining the useful life - taking into account the service life of the previous owner. This option is optional. The organization has the right to determine the general procedure for determining such a period (that is, without taking into account the period of previous operation).

In the next block, we will consider the information that needs to be disclosed regarding the procedure for calculating depreciation. To begin with, one of two methods is selected: linear (even distribution over the useful life) or non-linear (accelerated write-off in the first years of operation). With the non-linear method, depreciation is calculated not individually for each fixed asset object, but in groups.

The organization has the right to provide for the use of a “depreciation bonus” (one-time inclusion in expenses of part of the cost of depreciable property). Its use (subject to the restrictions imposed by the Tax Code of the Russian Federation) is permitted both in relation to the initial cost and the costs of increasing it. It is possible to apply a depreciation bonus only in one of the two indicated areas.

With regard to the depreciation bonus, it is possible to either establish a lower threshold for the initial cost of fixed assets and expenses for its increase to which it applies, or waive such a limitation. In the latter case, it is applied to all fixed assets (except for those for which the Tax Code of the Russian Federation directly prohibits its use).

Organizations that have fixed assets that meet the criteria given in paragraphs 1–3 of Art. 259.3 of the Tax Code of the Russian Federation, has the right to apply appropriate increasing factors to depreciation rates.

If several increasing factors are applied to a fixed asset for different reasons, then the organization must choose only one. This is the maximum, minimum or other intermediate coefficient.

In relation to absolutely any fixed depreciable assets, the organization establishes the use of coefficients that reduce the depreciation rate. The accounting policy should indicate a list of groups of depreciable property for which such coefficients are applied, and a link to the document containing this list.

For management purposes, we have our own accounting policies

The above types of accounting (BU and NU) are intended not only and not so much for the internal purposes of the company, but are designed for external users: owners, investors, tax authorities. And for their own interests, some companies also maintain management accounting. It also requires special rules and methodology. This means that accounting policies are also necessary—only managerial ones. Here is the 3rd type of accounting policy - optional, but also extremely important.

For more information about it, see the material “Accounting policies for management accounting purposes.”

Expense reserve

The next block of this section concerns the formation of expense reserves. The organization has the right to create the reserves listed in the list or not to form them. When choosing to “form” in the accounting policy, additional information must be disclosed.

Organizations that form a reserve for the repair of fixed assets must additionally indicate whether they accumulate funds for particularly complex and expensive repairs of fixed assets over more than one reporting period or not.

Organizations that form a reserve for warranty repairs and warranty service are required to indicate the period during which they sold goods (work) with a warranty period. The size of this period, depending on the characteristics of the organization, is:

- 3 or more years;

- less than 3 years.

This information is necessary to calculate the maximum percentage of deductions to the reserve for warranty repairs and warranty service.

Also, with regard to the reserve for warranty repairs and warranty service, it is necessary to indicate the direction of use of the unspent part of the reserve, that is, whether its balance is transferred to the next year or not. The choice is up to the organization.

Organizations that create a vacation reserve must disclose the methodology for its formation: is it formed in a uniform manner throughout the organization or is it carried out individually for each employee. You can freely choose any of the proposed options, based on the organization’s accepted accounting process scheme.

Organizations that form a reserve for the payment of remuneration for long service must provide a criterion for clarifying its unspent balance carried over to the next reporting year. This criterion is the amount of remuneration per employee, or some other method justified by the organization. The choice of criterion is at the discretion of the organization.

The question regarding the criterion for clarifying the unspent balance of the reserve that is carried over to the next reporting year must also be answered by organizations that form a reserve for the payment of remunerations based on the results of work for the year. Such criteria are:

- amount per employee;

- percentage of the profit received;

- another economically feasible indicator.

The choice of criterion is at the discretion of the organization.

How to formalize changes in accounting policies

Changes must be confirmed by order or directive of the head of the organization (clause 8 of PBU 1/2008). Examples of orders and accounting policy options are available at the following links:

- trade for accounting;

- trade for tax accounting;

- production for accounting;

- production for tax accounting;

- accounting services;

- tax accounting services.

By the way, the “My Business Professional Accountant” service has a built-in accounting policy designer that helps you create a management system for accounting and tax accounting that is suitable for your tax regime. The finished UP can be downloaded, printed, approved by the manager and stored in the organization.

Accounting for transactions with securities

Next comes the block related to accounting for securities transactions.

If a transaction with securities meets the criteria for a transaction with financial instruments of futures transactions, then the organization independently classifies the specified transaction for tax purposes as a transaction with securities or a transaction with financial instruments of futures transactions and makes an appropriate note about this in its accounting policy. The selection is based on the professional judgment of authorized personnel within the organization.

In relation to securities that are not traded on the organized securities market, the organization must indicate in its accounting policies the methods for determining their settlement prices. The selection options are presented in the attached list. The organization has the right to choose absolutely any option. It is allowed to use different methods for determining the settlement price depending on the type of securities.

For securities being disposed of, the entity must indicate the method of write-off: either the FIFO method or the unit cost method. It is advisable to apply the unit value valuation method to non-equity securities that assign an individual volume of rights to their owner (check, bill, bill of lading, etc.). On the contrary, the FIFO method is more suitable for equity securities (stocks, bonds, options). They are placed in issues, within each issue they all have the same denomination and provide the same set of rights. The FIFO method is preferably used when the prices of securities being sold are expected to decline.

If an organization carries out transactions for the sale of securities with the opening of short positions on them (that is, the taxpayer sells a security in the presence of obligations to return securities received under the first part of the repo), then the organization must indicate the sequence of closing these positions (purchase of securities of the same issue (additional issue) for which a short position is opened). Closing short positions is done either using the FIFO method or at the cost of the securities for a specific open short position. The organization chooses independently.

If an organization has transactions with non-negotiable securities for which it is impossible to determine the place of conclusion of the transaction, then it has the right to pre-fix in its accounting policies the place of conclusion of the transaction. This is the territory of the Russian Federation, the location of the buyer, seller or another agreed place. If, nevertheless, it is possible to determine the place of the transaction, then the right of choice for the organization is not granted.

The Tax Code provides for the use of methods for assessing previously incurred expenses...

Yes, and in all cases where such an assessment is provided, the accounting policy must state the chosen assessment method. Among the methods for assessing raw materials and materials when they are written off for production, the cost of purchased goods during their subsequent sale, the following apply:

- valuation method based on the cost of a unit of inventory (product);

- average cost valuation method;

- valuation method based on the cost of first acquisitions (FIFO).

It would not be amiss to confirm with the accounting policy that when selling property and (or) property rights, the company reduces income from such operations by the amount of expenses directly related to such sale, in particular the costs of evaluating, storing, servicing and transporting the property being sold.

Be careful, since 2015 the LIFO method has not been used in tax accounting.

In addition, do not confuse the concepts of accounting and tax accounting when describing cost accounting methods.

Personal income tax and insurance premiums

With regard to this tax, the organization only needs to indicate in its accounting policy the form of the tax register for accounting for accruals and deductions on the income of an individual in respect of whom the organization acts as a tax agent. This point must be taken into account, since there are no unified forms of tax registers for personal income tax, and organizations approve them independently.

And here’s what to set up in the accounting tax policy for insurance premiums for a company on OSNO:

How extensive should the narrative of accounting policies be?

In my opinion, one should not approach the preparation of accounting policies as a collection of quotes from the Tax Code, comments and judicial practice on tax issues. The accounting policy is not a manual on the procedure for calculating and paying taxes.

In the accounting policy, it is unnecessary to reproduce or duplicate provisions of the Tax Code that do not provide for the taxpayer to choose a behavior option or are not needed to describe the method (method) chosen by the organization for recording indicators.

Although in practice there are accounting policies, the text of which is more than 100 pages without taking into account applications. At the same time, in addition to taxes, the accounting policy includes provisions on insurance contributions to extra-budgetary funds and other payments that are not taxes, which is not the subject of the accounting policy.