Why do you need to confirm the debt?

It is obvious that the debtor agrees with his debt and - most importantly - pays it off.

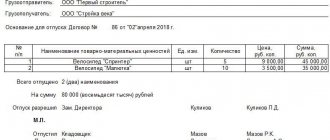

This is required by the norms of civil legislation regulating business activities. In particular, by virtue of paragraph 3 of Art. 1 of the Civil Code of the Russian Federation, when establishing, exercising and protecting civil rights and when performing civil duties, participants in civil legal relations must act in good faith. According to paragraph 4 of Art. 1 of the Civil Code of the Russian Federation, no one has the right to take advantage of their illegal or dishonest behavior. In the process of transactions (execution of contract terms), the parties have rights, requirements and obligations. The latter must be executed properly in accordance with their terms and provisions of the law (Article 309 of the Civil Code of the Russian Federation). The debtor bears the costs of fulfilling the obligation based on its terms. In particular, upon receiving the goods, the buyer must pay for it. Likewise, the seller must ship the goods upon receipt of advance payment. Documents confirming the occurrence of obligations are shipping (waybills, waybills) and banking (payment orders, bank account statements) documents.

With services it is more difficult. It is more difficult to confirm the fact of their provision, and, accordingly, the emergence of an obligation to the customer to the contractor, especially if there is no tangible result. In civil legislation (neither in Chapter 37 “Contracting”, nor in Chapter 39 “Paid provision of services”) there are no clear instructions on how a contractor (performer) can record the volume and cost of work performed (services provided) and confirm them with documents. It all depends on the specific situation.

Tax accounting for writing off accounts receivable

In tax accounting, receivables can be written off in the following ways:

- At the expense of the reserve for doubtful debts (procedure under clause 5 of Article 266 of the Tax Code of the Russian Federation).

- By reflecting it in non-operating expenses.

The amount of debt that cannot be covered by the reserve is included in non-operating expenses.

When a company uses the cash method, debt cannot be included as an expense. Under this method, revenues are recognized only after they are received, and all costs only after they are paid. Payment for goods is understood as the moment at which the buyer’s obligations to the supplier cease. That is, if goods already sold have not been paid for, then the obligation is considered unfulfilled. This means that expenses cannot be recognized.

Important! Uncollectible accounts receivable, including VAT, reduce the company's profit.

When might debt documents not be enough?

Communication services are quite specific and evidence of their provision must be data from special certified equipment.

In the absence of such proper confirmation, the service provider may be refused to collect the debt. Example - Resolution of the Ninth Arbitration Court of Appeal dated January 17, 2017 No. 09AP-60602/2016. As evidence of the stated demand for debt repayment, the contractor presented invoices, details of the invoice for communication services, invoices, certificates of work performed (services rendered) indicating their cost for the reporting period.

The basis for making payments for communication services is the readings of communication equipment, which takes into account the volume of communication services provided by the operator (Article 54 of the Communications Law). Equipment used by the telecom operator to record the volume of services provided and automated payment systems are subject to mandatory certification (Resolution of the Government of the Russian Federation dated June 25, 2009 No. 532).

During the trial, the plaintiff did not provide information about which equipment was used to record the services provided, and the connection certificates, the obligation to sign which are specified in the contract, were not presented. In particular, telephone services were provided as part of separate orders. Each of them comes into force after signing by the customer - the user of telephone services.

The operator did not submit these documents; instead, the arbitrators were offered evidence of sending primary documents through a specialized Internet resource and details of the communication services provided, which, according to the terms of the contract and the requirements of the legislation in the field of communications, was not evidence of the provision of communication services to their customer.

For comparison, in the Decree of AS PO dated December 19, 2016 No. F06-15147/2016, the operator had to submit the following documents confirming the accuracy of the information contained in the details of the provision of services: permission to operate a communication facility with an application, a certificate of conformity of equipment with an application, as well as a response Department of the Federal Service for Supervision of Communications, Information Technology and Mass Communications on the extension of permits to operate the equipment specified in the appendix to the letter. These documents confirmed the fact that the plaintiff used certified equipment to record the volume of services provided, ensuring the correct recording of connections and their duration.

Do not forget about the statement of reconciliation of calculations

The arbitrators recalled this important document in the Resolution of the Ninth Arbitration Court of Appeal dated January 11, 2017 No. 09AP-61172/2016-GK.

In this case, the operator provided not entirely traditional services: reserving places in line cable structures (LCS) for placing the user’s communication cables, couplings for optical communication cables, and operating the LCS for the specified purposes. In accordance with the terms of the concluded agreement, the contractor presents to the user after the end of each month of provision of services an invoice and an act of provision of services (performance of work) in two copies. The named documents were submitted in full to the case file, but the defendant considered them illegitimate, since he considered the agreement itself to be invalid. The customer transferred the cables to third parties without properly notifying the contractor in whose LCS the cables were located.

The operator, as the plaintiff, presented a statement of reconciliation of accounts, signed by both parties to the case, which confirms the defendant’s recognition of the existence of a debt for the disputed period. The defendant’s argument that the lines were on the balance sheet not only of him, but also of third parties, does not refute the plaintiff’s arguments that services were provided to the defendant. The defendant did not submit a reasoned refusal to sign certificates of services rendered (work performed) in the case file.

For your information

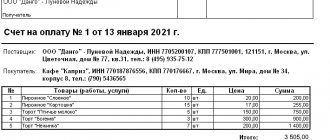

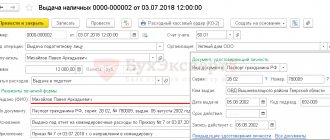

The act of reconciliation of settlements with counterparties does not apply to primary documents. Calculations are confirmed by acts of services rendered (work performed) and payment documents. Therefore, the accountant has the right to draw up a reconciliation report in any form and with details convenient for him. Their set is minimal, as evidenced by the documents provided in many software and application products - reconciliation acts. They include information about the counterparty with whom the reconciliation is being carried out, as well as dates and numbers of primary documents confirming business transactions, including the amounts for which they were made when the parties executed the transaction.

It turns out that a reconciliation act can help not only confirm settlements with the counterparty, but also justify and correctly calculate penalties in the event of a partner’s failure to fulfill its obligations. Let us remind you: according to paragraph 1 of Art. 330 of the Civil Code of the Russian Federation, a penalty (fine, penalty) is a sum of money determined by law or contract, which the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in case of delay in fulfillment.

The date of receipt of income in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage) is the date of their recognition by the debtor or the date of entry into legal force of the court decision. If the creditor takes into account the specified amounts on the date of their recognition by the borrower, a document indicating the recognition by the debtor of the obligation to pay the creditor in full or in a lesser amount of fines, penalties, and other sanctions for violation of contractual obligations may be a bilateral act signed by the parties (agreement on termination of the contract , reconciliation act, etc.) (letter of the Federal Tax Service of the Russian Federation dated January 10, 2014 No. GD-4-3/ [email protected] , Ministry of Finance of the Russian Federation dated October 30, 2014 No. 03‑03‑06/1/54946).

In the absence of a signed reconciliation report or full or partial actual payment to the creditor of the amounts of sanctions indicating the debtor’s recognition of the obligation to pay fines, penalties, and other sanctions, there are no grounds for recognizing the corresponding amounts as part of the creditor’s income (Letter of the Federal Tax Service of the Russian Federation dated June 23, 2016 No. SD -4-3/ [email protected] ). Consequently, the debtor in such a situation can make claims regarding the correctness of the calculation of penalties.

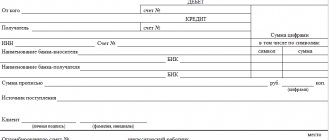

Elements of writing

Business correspondence is mostly the same type. A specific document has three parts: the head, the body of the document and the final one. At the top of the sheet there are usually details of the organization that sends the document and is the creditor. Ideally, the letter is printed on the organization’s letterhead, which contains its full name, address, contact numbers, tax identification number and other fundamentally important information.

Also, the hat, according to existing standards, must contain a number, date, polite, and most importantly, a specific address to the business partner.

If the letter is titled, for example, Romashka LLC, then it will not be clear who the recipient is. Therefore, it is better to formulate the appeal in accordance with the requirements, addressing the manager or other person responsible for repaying the debt by name and patronymic.

In most cases, the main part of the document states:

- A reference to the number of the contract that was concluded and according to which the goods were delivered or services were provided. You can refer to a specific clause of the contract, if possible. Quoting is not prohibited if it clarifies the situation.

- What organizations participated?

- The specific amount of debt, as well as for what goods or services it is due to be paid.

- What actions are required by the debtor company. Usually this is a transfer of funds to an account. If the account data is specified in the agreement, then it will be enough to refer to the agreement signed by both parties.

- What happens if the debt is not paid. Measures can be either soft (forfeits, penalties) or hard (appeal to the Arbitration Court). Basically, organizations resort to combined measures of influence on the debtor.

When going to court, a letter of demand for payment of debt is a prerequisite for filing a claim. Without it, the case will most likely be lost, especially if the debtor does not admit the existence of the debt.

As an addition, you can attach calculations of the penalty that is due for non-payment of the debt. However, this is not necessary for this type of business correspondence. In addition, if you refuse to pay the debt and after a long period of time, when going to court, penalties can increase significantly.

How to prove the existence of a debt for excess traffic?

The need for this arises when using fixed payments in calculations, as, for example, happened in the case considered in the Resolution of the AS SZO dated January 16, 2017 No. F07-12700/2016.

The subject of the agreement concluded between the operators was interconnection. The Contractor agreed to provide the customer with services for connecting networks, as well as for transmitting traffic. The parties agreed that invoices for the service of connecting the parties’ networks and other one-time payments are issued by the contractor before the start of the provision of services. Invoices for the monthly traffic fee (and all other periodic payments) are issued by the contractor prior to the start of the period in which the services will be provided.

Payment for excess traffic volume or additionally paid traffic is made monthly after the provision of services and the signing of the acceptance certificate for the services provided. The Contractor issues a separate invoice to the customer for excess traffic or includes the price of excess traffic as a separate line in the next invoice.

In support of the demand for debt collection, the contractor presented the following evidence: an extract from the automated system about the excess traffic volume, copies of invoices and acceptance certificates for services provided, lists of postal items, electronic correspondence between the parties. At first, the judges did not accept this correspondence, since the parties did not agree on the possibility of sending documents by e-mail.

Meanwhile, the electronic correspondence is presented by the operator not as evidence of sending documents to the subscriber (acts and invoices were sent by mail), but as confirmation of receipt of the said documents. Moreover, the subscriber did not dispute the existence of email correspondence between the parties, as well as the authority of the person conducting this correspondence. The authority of the chief accountant, who signed and thereby certified the extract from the automated system, was also questioned. We believe that this does not deprive the document of legitimacy.

The case has been sent for new consideration, and there is every reason to believe that the documents presented by the operator will be sufficient to confirm the debt for services provided that exceed the established traffic “quota”.

Sample certificate of accounts receivable

As noted above, as a basis for an order to write off receivables, you will need to draw up an inventory report, as well as an accounting certificate. For convenience, we provide a sample of the latest document.

SAMPLE CERTIFICATE ON ACCOUNTS RECEIVABLE

Documents are attached to the accounts receivable inventory report that confirm the occurrence of this debt. Such a document, for example, could be an agreement that will contain the terms for the repayment of their obligations by counterparties (

Are contractual relationships required?

In the process of commercial activity, subjects of legal relations formalize them among themselves in order to be able to protect their rights and interests.

This is required not only by the requirements of civil law, but also by business customs. In addition, there is a direct rule obliging operators to provide communication services to users on the territory of the Russian Federation on the basis of an agreement on the provision of communication services. The user with whom the contractual relationship is concluded is a subscriber who is obliged to pay for the services provided to him. However, in practice, not everyone who uses communication services is a subscriber. Sometimes services are consumed by persons with whom contractual relations have not been formalized in the prescribed manner. Does this give them the right not to pay bills for consumed communication services?

A systemic interpretation of the provisions of the Communications Law leads to the conclusion that users of communication services are required to pay (regardless of whether or not telecom operators have formalized relations with them). This is confirmed by court decisions. One of the situations encountered is the lack of contractual relations among government customers. Or rather, there were initially contractual relations, but then the contract expired, nevertheless, the operator continues to provide communication services even without a contract.

He is obligated to do this by the aforementioned law, according to which telecom operators do not have the right to unilaterally suspend and (or) terminate the provision of communication services for the needs of defense, state security and law enforcement. Therefore, operators cannot stop providing services due to the lack of a government contract, which does not relieve the customer who has consumed the services from the obligation to pay for them. Resolution of the AS SZO dated January 13, 2017 No. F07-12336/2016 is further proof of this.

The provision of services to a military institution as a government customer is confirmed by data obtained using the plaintiff’s equipment used to record the volume of communication services provided, invoices, and invoices for payment. This is enough to satisfy the claim of the service provider even without a valid contract. Moreover, even in the described case, relations between the parties took place (business transactions were carried out), they were simply not formalized in the prescribed manner.

When do documents fail to prove a debt?

It turns out that such situations occur in the practice of operators, one of them is unauthorized access to the network by third parties.

The obligation to counteract this lies with the operators, and therefore if they treat it negligently, then their attempts to collect the debt from the subscriber for communication services that he did not actually consume (due to access to them by third parties) will be unsuccessful. Let us turn to the Resolution of the AS UO dated December 16, 2016 No. F09-10392/16. The subscriber was billed for international communication services that he did not order or consume. Based on the fact of an unauthorized connection, the subscriber contacted the investigative authorities, but the initiation of a criminal case was refused due to the fact that access to the subscriber line was free for a sufficiently long distance.

Thus, proper measures were not taken by the telecom operator to protect telephone lines. Moreover, actions to prevent unauthorized access were carried out by the subscriber himself, who demanded that the provision of long-distance communication services be stopped in advance. However, the operator continued to provide these services without ensuring adequate protection of the communication line. The inspection reports submitted by the operator, refuting what was said and drawn up unilaterally, were not taken into account by the arbitrators. As a result, the telecom operator was unable to prove the subscriber’s debt for the disputed services.

For comparison: in a similar situation, the operator was able to prove the subscriber’s debt for significantly exceeded consumed services. But the consumer of mobile communications services was largely to blame for this. As follows from the Resolution of the Ninth Arbitration Court of Appeal dated December 8, 2016 No. 09AP-55053/2016-GK, the operator provided the enterprise with corporate communications. An employee of the enterprise lost one of the identification modules (SIM card), which was not reported to the operator in a timely manner, and communication services continued to be provided.

The Rules for the Provision of Telephone Services[1] clearly state that the subscriber is obligated to pay for mobile services provided by the telecom operator until the telecom operator receives notification of the loss of the identification module. This was also stated in the agreement concluded by the enterprise with the telecom operator. Actions aimed at obtaining services performed with subscriber equipment - with a working SIM card of the subscriber - are considered to be performed on his behalf and in his interests.

The fact that the operator did not pay attention to the significant increase in consumption of communication services does not constitute grounds for the subscriber’s unilateral refusal to fulfill the payment obligation. The terms of the agreement provide for the operator’s right to restrict the provision of services in case of exceeding the credit limit, but not the obligation to introduce such a restriction. In itself, the consumption of mobile communication services specifically in the interests of the subscriber is not a significant circumstance in the case, since the lost SIM card was registered with the enterprise until the loss was reported.

As a result, the negligence of the employee, who did not promptly report the loss of the identification module, cost the enterprise dearly, which had to repay the debt for communication services before the lost SIM card was blocked.