Account purpose

To account for debt obligations with a payment period of more than 12 months, account 67 is used. This account combines all possible credits, loans and other financial resources attracted from:

- in Russian rubles,

- in foreign currency,

- in securities (bills, bonds and other debt obligations).

Let us remind you that despite their identical content, credits and loans have two significant differences:

- Loans are provided exclusively by licensed credit institutions. A loan can be given by any person, both an individual and a legal entity.

- Loans are provided only on the terms of repayment with interest payment. The loan can be either interest-bearing or interest-free.

Separate accounting

Long-term loans raised by issuing and placing bonds are accounted for separately in account 67.

Typical entries for account 67 may look like this.

| Situation | Solution |

| Bonds were placed at a price exceeding their face value | Make entries on Dt 51, etc. in correspondence with accounts:

The amount allocated to account 98 is written off evenly during the circulation period of the bonds to account 91 “Other income and expenses”. |

| Bonds are placed at a price below their face value | The difference between the placement price and the nominal value of the bonds is added evenly over the period of their circulation from Kt 67 to Dt 91 |

Interest payable on loans and borrowings received is reflected in Kt 67 in correspondence with Dt 91. Accrued interest amounts are taken into account separately.

For the amounts of repaid loans and borrowings, account 67 is debited in correspondence with the cash accounts. Credits and borrowings that are not paid on time are accounted for separately.

Analytical accounting on account 67 is maintained by:

- by type of credits and loans;

- on credit institutions and other lenders who provided them;

- for individual loans and borrowings.

A separate sub-account to account 67 records settlements with banks for discounting (discounting) bills and other debt obligations with a maturity of more than 12 months.

Accounting (discount) of bills and other debt obligations is reflected by the bill holder organization according to Kt 67 (face value of the bill) and:

- Dt 51 or 52 (actual amount of money received);

- 91 (accounting interest paid to the credit institution).

Accounting (discount) of bills and other debt obligations is closed on the basis of a notification from the credit institution about payment by reflecting the amount of the bill under Dt 67 and the credit of the corresponding accounts receivable.

When the holder of the bill returns money received from a credit institution as a result of discounting (discounting) bills or other debt obligations, due to the failure of the drawer or other payer of the bill to fulfill their payment obligations on time, an entry is made under DT 67 in correspondence with the cash accounts. At the same time, debt for settlements with buyers, customers and other debtors, secured by an overdue bill of exchange, continues to be recorded in the corresponding accounts receivable.

Also see “How to manage debtors’ debts to the enterprise.”

Analytical accounting of discounted bills is carried out by:

- for credit institutions that have discounted bills of exchange or other debt obligations;

- by drawers;

- on separate bills.

Also, separately on account 67, they keep records of settlements with credit institutions, lenders and drawers within the group of companies, about the activities of which consolidated financial statements are prepared.

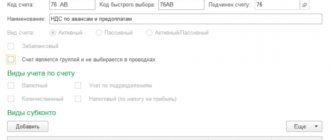

General account information

Account analytics 67 accounting extended, providing separate accounting:

- for credit institutions in the context of loan agreements;

- for lenders (companies or individuals) in the context of loan agreements;

- by currency of loans and borrowings;

- on interest accrued for the use of credit or borrowed funds;

- and according to other criteria convenient for the organization.

The account may have sub-accounts:

- 67.01 “Settlements on loans and borrowings in Russian rubles”;

- 67.02 “Settlements on loans and borrowings in foreign currency”;

- 67.03 “Calculations of interest for the use of loans and borrowings.”

Account 67 of the accounting chart of accounts is part of the sixth, settlement section. The account is passive. The credit turnover of the account shows the amount of funds received in debt, and the debit turnover shows their return.

In general, accounting account 67 is an indicator of the financial instability of the company. The greater its share in the balance sheet liability, the more the company is exposed to commercial risks. This is the unsightly characteristic of account 67.

Now let's look at the wiring in detail.

Description of the “Long-term loans” account

Subaccount 67.03 “Long-term loans” contains general information about the amounts of loans received by the organization for a period of more than 12 months. The account reflects the amounts for long-term loans that were received in national currency (rubles).

Amounts of funds received from the lender are carried out according to Kt 67.03, repayment amounts - according to Dt 67.03. Analytical accounting for subaccount 67.03 is organized in the context of counterparties from which the amounts of borrowed funds, concluded agreements were received, as well as depending on the types of funds received and the purposes for their use.

Obtaining credits and loans: transactions

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Credit or borrowed funds received in Russian rubles | 50.01, 51.01 | 67.01 | Bank statement, receipt order | Amount according to documents, excluding VAT |

| Received a loan or loan in foreign currency | 52.01 | 67.03 | Bank statement | Amount according to documents, excluding VAT |

| Calculation of interest on a loan or loan | 91 | 67.02 | Interest repayment schedule under contracts, accounting certificate | Amount of accrued interest, excluding VAT |

| Calculation of interest on a loan or loan received for the purchase of real estate (or other large investment object) | 08 | 67.02 | Interest repayment schedule, accounting certificate | Amount of accrued interest, excluding VAT |

As with all passive accounts, the transaction amounts upon receipt of funds are recorded as credit. Examples of accounts with which account 67 can correspond are given in the table above.

Examples of transactions with transactions on account 67

Example 1. Accounting for a long-term loan received from a bank

LLC "Vesna" received a loan from the bank OJSC "Osen" for 3 years in the amount of 2,500,000 rubles. Principal and interest are calculated monthly in equal installments at a rate of 13.5% per annum.

Table of transactions for account 67 - Long-term loan:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 51 | 67 | 2 500 000,00 | Obtaining a loan from OJSC "Osen" | Bank statement |

| 91.02 | 67 | 28 125,00 | The amount of interest on the loan for the month is reflected | Loan agreement, accounting certificate |

| 67 | 51 | 69 444,44 | Monthly principal payment | Payment order |

| 67 | 51 | 28 125,00 | Payment of interest | Payment order |

Example 2. Issue of a bond with a value higher than its par value

Let’s say an organization placed a bond on the secondary market worth 16,000 rubles, par value – 10,000 rubles. with a maturity of 24 months.

Posting table – Issue of a bond with a value greater than the par value:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 51 | 67 | 10 000 | Reflection of the nominal value of the bond | Bank statement |

| 51 | 98 | 6 000 | Cash above par is reflected in accounting | Bank statement |

| 98 | 91.01 | 250 | Every month | Accounting certificate-calculation |

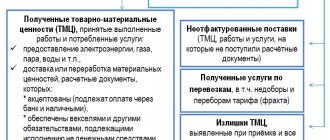

Obtaining credits and loans in non-monetary form

The law allows for loans or borrowings in the form of goods or raw materials (materials). These are so-called commercial (commodity) loans. The postings for obtaining a commercial loan will be as follows.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Receipt of goods under a commercial loan agreement | 41.01 (10.01) | 67.01 | Consignment note, loan agreement | Amount according to the document, excluding VAT |

| Amount of VAT on goods received under a commercial loan agreement | 19 | 67.01 | Invoice for delivery note for receipt of goods under a loan agreement | VAT amount on the document |

Posting for accrual of interest under a commercial (commodity) loan agreement.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Interest accrued for using a commercial loan | 91 | 67.03 | Commercial loan agreement, payment schedule | Amount according to the document, excluding VAT |

Repayment of loans and loans: postings

Return (payment) of loans or borrowings is recorded in the debit of account 67. We will also present the transactions in table form.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Funds were transferred to repay a loan or loan in Russian rubles | 67.01 | 51.01 | Bank statement, payment order | Amount according to the document, excluding VAT |

| Funds were transferred to repay a loan or loan in foreign currency | 67.03 | 52.01 | Bank statement, payment order | Amount according to the document, excluding VAT |

| Interest paid for the use of loans or borrowings | 67.02 | 51.01, 52.01 | Bank statement, payment order | Amount according to the document, excluding VAT |

Account 67 “Settlements for long-term loans and borrowings” Postings

Interest on loans and borrowings Chart of accounts Active accounts Passive accounts

Score 66

Account 67 in accounting

Account 67 is used to collect and process data on loans and borrowings whose repayment period exceeds one year.

Among them:

- amounts of loans and borrowings by their types;

- percentage part;

- repayment transactions;

- fines for late payments.

Information on account 67 is recorded according to:

- loans and credits;

- credit institutions;

- institutions that issued the loan;

- specific funds issued at interest;

- credit institutions that purchased securities, and other credit obligations on bills.

In terms of structure, count 67 is similar to count 66.

Their main and only difference is the length of the credit period. Account 66 is intended to record information about short-term credit relationships, the payment period of which is less than one year.

Account 67 reflects the financial balance of the enterprise, expressed in its debt obligations and income for the current period. This allows the designated account to be considered passive - its balances for a specific period are included in the organization’s sources of profit for this period.

If the loan repayment period is reduced to a year or less, the debt can be transferred to short-term status.

Subaccounts and analytics for account 67

Additional subaccounts can be opened for account 67:

- 67.1 - long-term loans;

- 67.2 - long-term loans;

- 67.3 - interest on payments of loans and credits;

- 67.4 - fines and penalties for the payment of loans and borrowings;

- 67.5 - overdue loans and borrowings;

- 67.6 - loans for the issue of securities;

- 67.7 - loans and credits for employees.

Analytics is carried out separately within each subaccount.

In addition, separate sub-accounts can be created for loans in foreign currency (by each type of currency).

The number and composition of subaccounts are determined by the accounting policy of the enterprise.

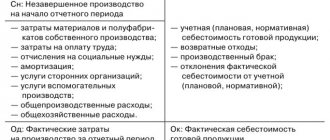

What is reflected in the Debit and Credit of account 67

Accounting entries compiled from the debit entries of account 67 indicate a decrease in the amount of debt on loans with a long repayment period. This happens after:

- debt repayment;

- fulfillment of obligations by both parties to the loan agreement;

- transition of debt from the status of long-term to the status of debt with a short payment period;

- crediting an outstanding loan or loan to other profits;

- crediting to other profits an increase in the cost of goods or services associated with an increase in the rate of a loan or loan with a long period of payment in foreign currency.

The transfer of funds provided at interest for a long period (as well as the amount of interest) is expressed as a loan.

Accounting entries for account 67

The main accounting entries for account 67 include:

- crediting long-term credits and loans - Dt 50, 52, 55 - Kt 67 ;

- fulfillment of the terms of the loan agreement for long-term loans and borrowings after depositing funds - Dt 67 - Kt 50, 52, 55 ;

- change of data on the loan after its renewal - Dt 66 ‒ Kt 67 ;

- transfer of credits or loans to a bank account - Dt 67 - Kt 51, 52, 55 ;

- payment to the supplier from funds issued at interest for a long period - Dt ‒ Kt 67 .

Typical accounting entries for account 67

| Operation | Account debit | Account credit |

| Received a long-term loan or cash loan | 50 “Cash” 51 “Currency accounts” 52 “Currency accounts” 55 “Special bank accounts” | 67 |

| Obtained a long-term loan for materials and goods | 10 “Materials” 41 “Products” | |

| Expenses on loans and borrowings are recognized as part of other expenses | 91 “Other income and expenses” | |

| Interest on long-term loans and borrowings is attributed to the increase in the value of the investment asset | 08 “Investments in non-current assets” | |

| The debt on a long-term loan or loan has been repaid | 67 | 50, 51, 52, 55, 10, 41 |

Interest on loans and borrowings Chart of accounts Active accounts Passive accounts

What does the account balance indicate?

The balance of account 67 is always a credit balance and shows the balance of the debt payable.

But there are also exceptional cases when, for unknown reasons, the transferred amount turns out to be more than the amount that the company must return. Then quickly sign a reconciliation report with the payee, write a letter to return the overpaid amount and make corrective entries.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Debt adjustment | 76.05 | 67.01 | Reconciliation report with the payee, accounting certificate | Overpayment amount, excluding VAT |

There comes a time when the period of time until full repayment of the loan or loan has become less than 12 months. For accounting purposes, such liabilities became short-term. It would be more correct to transfer such debts to account 66 using such an entry.

| Contents of operation | Account debit | Account credit | Document | Transaction amount |

| Transfer of the balance of a long-term dog into a short-term one | 66.01 | 67.01 | An inventory report of debt obligations, an accounting certificate, a reconciliation report with the organization that issued the loan or loan | Amount of remaining debt, excluding VAT |

But you can leave everything as it is.

Accounting information about the account

The reference document on the balances and turnover of account 67 is the account balance sheet for the period. It will show the total total amounts of receipts and payments of loans and borrowings for the period, as well as account balances.

Analytical accounting data for account 67 can be seen in the balance sheets broken down by subaccounts.

And more detailed information on all operations of the period is provided by the statement of account transactions. If information is needed on a specific organization or agreement, then a statement of transactions for the counterparty or agreement is generated.

Reflection in the organization's balance sheet

To determine the position on the balance sheet, let’s find out which account is active or passive. The result of obtaining long-term loans and credits is the creation of values to obtain economic benefits. That is, loans are characterized as sources of financial investment, and this is the first sign of liability.

The second proof of the passive nature of the register follows from the analysis of transactions - until the repayment of borrowed funds, the balance sheet for account 67 has a credit balance or zero in the absence of attracted third-party investments.

In the balance sheet, settlements for long-term loans and credits are shown on line 1410 in the context of the principal debt until 365 (366) days remain until repayment.

After this, for the purpose of reliability of the indicators, they are reclassified as short-term loan debt and reflected in column 1510. It is more appropriate to indicate monthly interest on line 1520, since they have the sign of short-termism. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What an accountant needs to know about a loan agreement

Of course, the accountant must have a copy of the document - a credit agreement or loan agreement with a payment schedule for them. To correctly reflect transactions on loans and borrowings in an accounting program, you need to know:

- conditions and form of credit (loan);

- term and procedure for repayment of the principal debt;

- term and procedure for payment of interest.

If you immediately accrue all payments in the accounting program for the future, you will not have to remember them at the end of the reporting period or at the time of their payment. Just remember to adjust all future postings if the conditions for repayment of credit or borrowed funds change.

Types of borrowed funds

The legislation provides for two methods of legal registration of provided borrowed funds. This is a credit agreement and a loan agreement. When concluding them, two parties are involved - the lender and the borrower. A legally fixed transaction is made, according to which the lender provides the borrower with a certain amount of material assets for a specified period. Upon its expiration, the borrower undertakes to return the original amount of funds provided and pay interest (if provided for in the agreement). After the transfer of valuables from the lender to the borrower, the agreement is considered active.

Depending on the terms of the agreement and the categories of persons who take part in it, there are two main types of borrowed funds: credits and borrowings. Taken together, they form one of the most important elements in the formation of enterprise sources. Borrowed funds, along with own funds, significantly influence the well-being and development of the economic activity of a legal entity.