Leasing traditionally raises many questions, especially for the lessee:

- how to show the receipt of fixed assets for leasing in 1C 8.3 on the lessee’s balance sheet without PBU 18/02;

- what are the postings of the advance payment under the leasing agreement in 1C 8.3;

- what are the transactions when accounting for leasing payments from the lessee in 1C 8.3;

- and many others.

In this article we will look step by step at an example of purchasing a car on lease with analysis of transactions in 1C 8.3. So, leasing is on the balance sheet of the lessee - receipt, accounting in 1C 8.3 (PROF).

Setting up the program

Setting up functionality

In the Main - Functionality - Fixed Assets section, select the Leasing .

Leasing checkbox must be checked .

Setting up accounting policies

Make the settings in the Main - Accounting Policies section.

Please indicate:

- FSBU 25 “Lease Accounting” applies - select the radio button Early, from 2021 .

Leasing in 1C 8.3 from the lessee: step-by-step instructions

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer of advance payment to the lessor | |||||||

| February 22 | 60.02 | 360 000 | 360 000 | Transfer of payment to the supplier | Debiting from the current account - Payment to the supplier | ||

| Registration of SF for advance payment from supplier | |||||||

| February 22 | 360 000 | Registration of SF for advance | Invoice received for advance payment | ||||

| 68.02 | 76.VA | 60 000 | Acceptance of VAT for deduction | ||||

| 60 000 | Reflection of VAT deduction in the purchase book | Purchase Book report | |||||

| Accounting for the leased asset on the lessee's balance sheet as part of the operating system | |||||||

| 25 February | 08.04.2 | 76.07.1 | 1 632 000 | 1 632 000 | Accounting for a non-current asset | Acceptance of rent (leasing) | |

| 01.03 | 08.04.2 | 1 632 000 | 1 200 000 | 1 200 000 | Acceptance of fixed assets for accounting | ||

| 01.K | 08.04.2 | 432 000 | 432 000 | Reflection of the difference in cost in NU | |||

| 76.07.9 | 76.07.1 | 326 400 | Acceptance for VAT accounting | ||||

| MONTHLY | |||||||

| Transfer of monthly lease payment | |||||||

| March 15th | 60.02 | 48 000 | 48 000 | Transfer of payment to the supplier | Debiting from the current account - Payment to the supplier | ||

| Calculation of monthly lease payment | |||||||

| March 31 | 76.07.2 | 60.02 | 108 000 | 108 000 | 108 000 | Advance offset | Receipt (act, invoice, UPD) – Leasing services |

| 76.07.1 | 76.07.2 | 90 000 | 90 000 | Calculation of lease payment | |||

| 19.04 | 76.07.2 | 18 000 | 18 000 | Acceptance for VAT accounting | |||

| 76.07.1 | 76.07.9 | 18 000 | Reducing input VAT calculations | ||||

| Registration of SF supplier | |||||||

| March 31 | — | — | 108 000 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 90 000 | Acceptance of VAT for deduction | ||||

| — | — | 90 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| VAT restoration when crediting an advance payment to a supplier | |||||||

| March 31 | 76.VA | 68.02 | 10 000 | Restoration of VAT payable | Generating sales ledger entries | ||

| — | — | 10 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Recognition of expenses in accounting and accounting records | |||||||

| March 31 | 44.02 | 02.03 | 27 200 | 20 000 | 20 000 | Depreciation calculation | Closing the month - Depreciation and amortization of fixed assets |

| 44.02 | 01.K | 70 000 | 70 000 | Recognition of expenses on lease payments | Closing the month - Recognition of rental payments in NU | ||

| PURCHASE OF LEASING PROPERTY in 2022 | |||||||

| Redemption of leased property, acceptance of own fixed assets for accounting | |||||||

| August 31 | 60.01 | 60.02 | 14 400 | 14 400 | 14 400 | Advance offset | Redemption of leased items |

| 76.07.1 | 60.01 | 12 000 | 12 000 | Redemption of leased property | |||

| 19.01 | 60.01 | 2 400 | 2 400 | Acceptance for VAT accounting | |||

| 76.07.1 | 76.07.9 | 2 400 | Reducing input VAT calculations | ||||

| 44.02 | 02.03 | 27 200 | 20 000 | 20 000 | Calculation of the latest depreciation | ||

| 44.02 | 01.K | 70 000 | 70 000 | Recognition of expenses on lease payments | |||

| 01.01 | 01.03 | 1 632 000 | Moving the OS to your own | ||||

| 02.03 | 02.01 | 489 600 | Transfer of depreciation | ||||

| 01.09 | 01.03 | 1 200 000 | 1 200 000 | Formation of redemption value in NU | |||

| 02.03 | 01.09 | 360 000 | 360 000 | Adjustment of redemption value due to depreciation in NU | |||

| 01.09 | 01.K | -828 000 | -828 000 | Adjustment of the redemption value due to the non-depreciable part in NU | |||

| 44.02 | 01.09 | 12 000 | 12 000 | Recognition of non-depreciable property in current expenses | |||

| Registration of SF supplier | |||||||

| August 31 | — | — | 14 400 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.01 | 2 400 | Acceptance of VAT for deduction | ||||

| — | — | 2 400 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

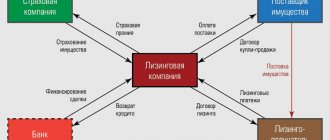

Important components of a leasing agreement

The leasing agreement is always drawn up in writing. It reflects all the terms of the transaction, including:

- Name of the parties involved.

- Detailed description of the leased item.

- Cost of the leasing agreement.

- The period of validity of the transaction.

- Procedure and terms for making payments.

- Conditions for the return or redemption of property into the client's ownership.

- The amount of the redemption price.

In addition, the leasing agreement specifies the amount of the advance payment (down payment), if the agreement is drawn up taking into account its payment.

The down payment performs several functions simultaneously. Payment of an advance is one of the confirmations of the borrower’s reliability and solvency. Additionally, such a contribution allows you to reduce the financial burden of further payments.

The larger the down payment, the smaller your monthly payments will be.

Registration of SF for advance payment from supplier

The lessee can deduct VAT from an advance to the lessor if the following is required:

- correctly executed SF;

- agreement providing for prepayment;

- documents for transfer of advance payment.

You can register an invoice issued for an advance payment from the document Write-off from a current account by clicking the Create based on and selecting Invoice received.

The Invoice document received for an advance payment is automatically filled in with the data from the document Write-off from the current account . Operation type code—value 02 “Advances issued.”

Leasing: accounting features for legal entities

Currently, both individuals and legal entities can lease a car. But the obligation to record transactions with such a car in accounting and tax accounting arises only for legal entities.

At the same time, legal entities can take advantage of certain preferences that individuals do not have, in particular, reduce the tax base for profits on leasing payments and deduct VAT paid to the lessor. It is important to remember that these preferences are applicable under the general taxation system. The use of special modes by legal entities is characterized by its own nuances, for example:

- when applying the simplified tax system “income”, leasing expenses cannot be written off as a reduction in the tax base in the same way as other expenses for conducting business;

- when applying UTII, the calculation of tax payable is also carried out according to certain principles, which do not include the deduction from the tax base of the costs of payments under the leasing agreement.

Further in the material we will talk about accounting for car leasing from legal entities located on OSNO. We will not touch upon tax accounting issues, since there are some discrepancies in the professional literature and publications due to the fact that the legal issues of leasing accounting in the Russian Federation are not fully regulated.

The issues of distinguishing between accounting and tax entries are presented in detail in the articles:

Receipt of OS for leasing in 1C 8.3 on the balance of the lessee

At the time of transfer of property for leasing, the lessor does not issue an invoice to the lessee and does not present the VAT amount. Consequently, at the time of transfer of property for leasing, the lessee does not have the right to deduct VAT from the cost of the leased property.

The lessee's right to deduct VAT arises when:

- the lessor issues an invoice for lease payments;

- The lessor issues an invoice for the redemption price at the time of redemption of the property.

Document the receipt of leased property on the balance sheet of the lessee using the document Receipt into leasing from the section Fixed assets and intangible assets – Receipt into leasing.

In accounting , the leased property recorded on the balance sheet by the lessee is recognized by him as a fixed asset. Its initial cost is formed depending on the contract (clause 8 of PBU 6/01, Order of the Ministry of Finance dated February 17, 1997 N 15):

- from the sum of all leasing payments and the purchase price, i.e. the full cost of the transaction, including VAT, if the purchase price is specified in the leasing agreement or purchase and sale agreement, even if the leasing agreement states that the purchase is made under a separate agreement;

- from the sum of all leasing payments without the redemption price, i.e. the full cost of the contract, including VAT, if the leasing agreement does not provide for redemption, and therefore there is no redemption value in the agreement.

Fill in:

- Settlement account - 76.07.1 “Rental obligations”;

- Acceptance for accounting - switch This document - the asset will simultaneously be accepted for accounting;

- Later , you will need to additionally enter the document Acceptance for accounting of fixed assets with the transaction type Leased Items ;

Use the option Acceptance for accounting - Later , if available

- additional costs for the rental item;

- non-linear depreciation method;

- special depreciation rate.

- End date - the end date of the leasing agreement (in our example, 08/31/2022 ).

In the table section, indicate:

- Term of use - the expected life of the leased asset (clause 4, clause 20 of PBU 6/01).

Postings

The document generates transactions:

- Dt 08.04.2 Kt 76.07.1 - lease liabilities in the amount of the cost of the asset taken onto the balance sheet;

- Dt 01.03 Kt 08.04.2 - registration of the asset;

- Dt 01.K Kt 08.04.2 - taking into account the difference between the cost of fixed assets in the BU and NU;

- Dt 76.07.9 Kt 76.07.1 - rental obligations in the amount of VAT.

The purpose of account 01.K is to account for the non-depreciable part of the cost of fixed assets in tax accounting, i.e., the difference between the cost of fixed assets in accounting and tax accounting.

Leasing on the balance sheet of the lessor - legislation

If the leasing agreement provides for the accounting of an item on the lessor’s balance sheet, the lessee does not reflect such property on its balance sheet and accepts it into off-balance sheet account 001 “Leased fixed assets” at the cost specified in the leasing agreement (clause 8 of Order of the Ministry of Finance dated February 17, 1997 N 15 ).

The lessee reflects leasing payments during the term of the agreement as:

- expenses for ordinary activities - in the accounting system (clause 5 of PBU 10/99);

- other expenses associated with production and (or) sales - in NU (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

After the repurchase, the lessee records the leased asset on the balance sheet as part of its own fixed assets at its original cost, which consists of:

- leasing payments and redemption value - in the accounting system (clause 8 of PBU 6/01, Order of the Ministry of Finance dated February 17, 1997 N 15);

- redemption value - in NU (Clause 1 of Article 257 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 05/17/2021 N 07-01-09/37253).

It is a mistake to accept the purchase price as the initial cost without taking into account lease payments. This may lead to incorrect classification of the asset as immaterial, or accounted for as part of inventory instead of fixed assets.

Upon completion of the leasing agreement, the repurchase is formalized in a separate purchase and sale agreement, and the asset is registered in the accounting system:

- as an object of fixed assets;

- as an asset with immaterial value, if determined by accounting policies.

Organizations entitled to simplified accounting reflect transactions under a leasing agreement in the usual manner.

Calculation of monthly lease payment

The monthly leasing payment (from 03/01/21 to 08/31/22) is 108,000 rubles. (incl. VAT 20%), including:

- offset of the advance payment dated February 22, 2021 - 60,000 rubles;

- offset of the advance payment from the 15th day of the month - 48,000 rubles.

The amount of the leasing payment is 108,000 rubles. The lessor issues a monthly invoice.

Accrue the monthly lease payment using the document Receipt (act, invoice, UPD) transaction type Leasing services from the section Purchases - Receipt (acts, invoices, UPD) - button Receipt - Leasing services.

Postings according to the document

Advance payment under a leasing agreement

Payment under leasing transactions is used by the lender to ensure the fulfillment of all obligations by the lessee.

The amount of the down payment varies from 5 to 50%, depending on the requirements set by the leasing company.

The advance payment is made by the borrower immediately after execution of the contract. The down payment can be paid in one lump sum or in installments, as previously agreed upon by the parties involved. In the case of gradual payment, a schedule for offset of such payments is drawn up, which is displayed in the agreement itself or is provided in a separate application.

The advance payment can be credited in several ways:

- The full agreed amount when paying the first installment of the lease payment.

- One-time in the process of making the last part of the payment under the leasing agreement.

- In equal parts during the validity period of the transaction itself.

If the down payment is made in one payment, then the lender immediately after receiving it pays the full cost of the property to the seller. Next, the necessary documents are completed, after which the subject of the transaction is placed at the disposal of the borrower.

Registration of SF supplier

To register an incoming invoice, indicate its number and date at the bottom of the Receipt document form (act, invoice, UPD) , click the Register button.

The Invoice document received is automatically filled with data from the Receipt document (act, invoice, UPD) . Operation type code—value 01 “Receipt of goods, works, services.”

VAT restoration when crediting an advance payment to a supplier

The amount of VAT offset on the advance payment is subject to restoration (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

VAT recovery when crediting an advance payment to a supplier is carried out using the document Generating sales ledger entries at the end of the month or quarter. The document is available from the Operations section - VAT routine operations.

In our example, it is subject to restoration from the offset advance - 60,000 rubles.

- VAT at the rate of 20/120% - 10,000 rubles.

Postings

Important nuances of accounting for advance payments

An advance payment is provided for in most leasing agreements, and its offset can be made in any of the provided ways. For example, against the starting payment, against several starting payments until the advance amount is fully repaid, evenly during the repayment of the main debt, against the last payment under the leasing agreement, etc.

The lender, in the process of transferring the property to the lessor, provides an invoice for the entire amount of the advance payment. In this case, this amount, excluding VAT in tax reports, can be taken into account as expenses when taxing profits.

As part of leasing transactions, services are provided until the end of the agreement, so tax structures do not need to compare such payments with the norms of the Tax Code of the Russian Federation. And you don’t have to worry about how to reflect the down payment in the leasing company’s turnover.

As for the partial payment of the advance, borrowers often have a question about whether these payments can be immediately attributed to expenses. The answer will be negative, since in this case the amount of the down payment will be counted as an expense in accounting for income taxation. Similar conditions are met if the lessor accepted the advance payment not according to the current schedule.

Recognition of expenses in accounting and accounting records

Recognition of expenses in accounting and accounting at the end of the month is carried out by routine operations in the Monthly Closing assistant, section Operations - Monthly Closing.

Depreciation calculation

Depreciation deductions are made by the party to the leasing agreement on whose balance sheet the leased asset is located (clause 2 of Article 31 of Law No. 164-FZ of October 29, 1998).

Depreciation is accrued in the generally established manner (clause 17 of PBU 6/01), with the straight-line method - based on the useful life of the asset.

For tax accounting purposes, the lessee charges depreciation in the general manner.

In NU, the amount of monthly depreciation is included in expenses that reduce the tax base (clause 3 of Article 272 of the Tax Code of the Russian Federation).

Postings

Accounting with the lessor

Let's take a closer look at leasing in transactions with the lessor.

Spusk LLC leased hydroelectric power station A187 to Tekhnik LLC under agreement No. 25 dated January 1, 2019, with an initial cost of 1,296,000 rubles, including VAT of 216,000 rubles. The total rental period is 36 months. The monthly payment is 36,000 rubles, including VAT of 6,000 rubles. After three years, the equipment is purchased by the lessee for 20,000 rubles. The redemption price is included in the monthly payments of Tekhnik LLC.

Recognition of leasing payments in NU

The expenses that reduce the tax base when leasing property include:

- depreciation;

- the difference between leasing payments and depreciation, which is included in other expenses (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation) on the last day of the month (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

Recognition of expenses on leasing payments is carried out by the regulatory operation Recognition of lease payments in the accounting system.

Postings

The document generates the posting:

- Dt 44.02 Kt 01.K - write-off of leasing payments to NU expenses at the expense of the non-depreciable part of the cost of the leased property.

In subsequent months, leasing payments are accrued and recognized as expenses according to the same scheme.

Accounting for advance payments from the lessee

The down payment for a leasing transaction in the borrower's accounting (transfer and offset) is made in the agreed amount and the period for offset of the advance by the lender, as part of the amount of leasing payments. The transfer of the advance is recorded as follows: to the debit of account 76 to the subaccount of advances issued from the credit of account 51.

VAT on the advance payment under the leasing agreement is taken into account by the lessee as follows:

| Debit | Credit |

| 68 (VAT subaccount) | 76 |

The borrower records the amount of the advance as follows:

| Debit | Credit |

| 76 (sub-account of debt for leasing payments) | 76 (sub-account of advances issued) |

Advance payments are an important condition of any contract, including leasing agreements. Therefore, a detailed description and, in general, recording of its terms in the document will help to avoid controversial and unforeseen situations, including fraudulent actions.

Redemption of leased property

At the end of the contract, carry out the redemption of the property using the document Redemption of leased items , from the section Fixed assets and intangible assets - Redemption of leased items - Create button.

Indicate in the header:

- Event - Transfer of ownership .

On the Leasing Items click the Fill button to reflect the fixed assets leased under the specified agreement.

On the Accounting , the accounting accounts will be filled in automatically.

On the Tax Accounting , specify:

- The procedure for including the redemption value in expenses - you can choose from 3 options: Depreciation - if the redemption value of the fixed asset is more than 100 thousand rubles;

- Inclusion in expenses upon acceptance for accounting - if the redemption value of the fixed asset is 100 thousand rubles. and less - in our example we choose this option;

- The cost is not included in expenses - if the cost of the OS cannot be taken into account in the NU.

Postings

The document generates transactions:

- Dt 60.01 Kt 60.02 - offset of the advance payment to the supplier at the purchase price;

- Dt 76.07.1 Kt 60.01 - repurchase of leased property;

- Dt 19.01 Kt 60.01 - acceptance of VAT for accounting;

- Dt 76.07.1 Kt 76.07.9 - write-off of lease liability in terms of VAT;

- Dt 44.02 Kt 02.03 - accrual of depreciation on fixed assets in leasing for the last time;

- Dt 44.02 Kt 01.K - recognition of lease payments in expenses;

- Dt 01.01 Kt 01.03 - transfer of fixed assets to the composition of our own;

- Dt 02.03 Kt 02.01 - transfer of depreciation accrued during the period of the leasing agreement;

- Dt 01.09 Kt 01.03 - formation of the redemption value in NU;

- Dt 02.03 Kt 01.09 - adjustment of the redemption value due to depreciation in the NU;

- Dt 01.09 Kt 01.K - adjustment of the redemption value due to the non-depreciable part in the NU;

- Dt 44.02 Kt 01.09 - recognition of non-depreciable property in current expenses.

Acceptance of the leased asset for off-balance sheet accounting

The acceptance of fixed assets for off-balance sheet accounting at the contractual value is reflected in the Transaction document (Transactions - Transactions entered manually).

In the document Operation :

- Debit - 001 “Leased fixed assets”;

- Subconto 1 - lessor from the Counterparties directory;

- Subconto 2 - leased item from the Fixed Assets directory;

- Amount - the amount under the leasing agreement.

Registration of SF supplier

To register an incoming invoice, indicate its number and date at the bottom of the form of the document Redemption of leased items , click the Register button.

The Invoice document received is automatically filled in with the data from the document Redemption of leased items .

- Operation type code —value 01 “Receipt of goods, works, services.”