Account 75 in accounting: entries for settlements with founders

Synthetic account 75 “Settlements with founders” reflects information on each type of settlements with founders. First-order subaccounts are opened for the account in the context of obligations: 75.01 “Calculations for contributions to the authorized capital” and 75.02 “Calculations for payment of income”. Analytical accounting for account 75 is carried out for each founder in the context of open sub-accounts:

- On the formation of contributions to the authorized capital during the initial creation of companies;

- To increase the size of the authorized capital;

- To reduce the size of the authorized capital;

- By repurchasing shares or shares from shareholders with payment of their actual value. Their subsequent sale or distribution among the remaining participants;

- On payment of dividends;

- To provide loans to company participants;

- Providing participants with paid copies of documents;

- And other operations.

D80 to 75

Return of funds transferred by the founder on account of his contribution upon termination of the joint activity agreement 80 81 Authorized capital is reduced by the amount of canceled shares purchased from shareholders Typical entries for the credit of account 80 “Authorized capital” D-t K-t Contents of a business transaction 04 80 A participant in a simple partnership transfers an intangible asset (the right to use a program, for example) on account of his contribution 11 80 A participant in a simple partnership makes a contribution to a simple partnership in the form of an animal 75 80 The founder’s debt for contribution to the authorized capital is accrued 83 80 Increase in the authorized capital of the company due to additional capital 84 80 Increasing the authorized capital due to the net profit remaining at the disposal of the company How to calculate vacation pay correctly and have time to rest.

We recommend reading: What are the categories of Chernobyl victims?

58 75 Assignment agreement of the management company in the form of assignment of the right to claim debt 58 75 Bill of exchange, share of the management company in the form of securities 97 75 Agreement on the use of property of the management company in the form of the right to use assets In addition, entry Dt 75.1 Kt 80 records an increase in capital by attracting additional contributions from shareholders, and Dt 75.2 Kt 80 - due to retained net profit. Read about ways to increase the authorized capital in the article “Increasing the authorized capital at the expense of retained earnings.”

Posting debit 75 credit 80 (nuances)

Debit 75 credit 80 is the very first entry in the accounting records of any newly created company. The entry debit 75 credit 80 reflects the registration of the company's authorized capital for the amount of participants' contributions. Read about who the equity holders and shareholders are, in what ways capital can be received and how to properly account for it in an LLC or JSC. Authorized capital (hereinafter referred to as the authorized capital) is the amount of monetary or material resources required to launch the primary production cycle. It refers to the personal reserves of the enterprise and is recorded in the credit of account 80 “Authorized capital”, which is passive. That is, its balance is always a credit balance and always corresponds to the amount specified in the constituent documents.

D 80 to 75 wiring what does it mean

Account 80 is passive, the balance of account 80 “Authorized capital” corresponds to the amount of the authorized capital defined in the constituent documents of the company. A decrease or increase in the authorized capital must be documented and recorded in changes to the authorized capital.

In simple partnerships, account 80 contains information about the status and movement of the share of the contribution of each participant in the partnership to the common property according to the agreement. Account 80 in this case is referred to as “Comrades' Deposits”.

Account 75 - Settlements with founders - in accounting

Within a given line, an account also implies a large number of lines with which it is combined in the accounting process. This is account 1 , 4 , 7 , 8 , 10 , 11 , 15 “Purchase of materials”, 16 “Variance in their cost”, 20 “Main production”, 41 , 50 , 51 , 52 , 55 “Items in currency”, 58 .

- 75-1. We are talking about settlement transactions for deposits in the fund. Here the accounting of settlement actions with the participants of the company on deposits is carried out. In the process of creating a joint-stock company, a debit in correspondence with line 80 takes into account the amount of debt associated with the payment of shares. If we are talking about the actual receipt of deposit amounts in the form of money, entries are made in correspondence with the accounts associated with the accounting of money. Thus, the count is often used in a system with a line of 10, 15, 08, 80, etc.

- 75-2. Here the calculation actions related to the payment of income are reflected. Records are kept of settlements with the founders of the company for the payment of interest payments to them. To fully reflect various operations, correspondence with lines 84, 70, 68 is used.

Please note => Cash Payments to Pensioners Having the Status of Children of War in the Krasnodar Territory

What does wiring Dt 99 Kt 75 mean?

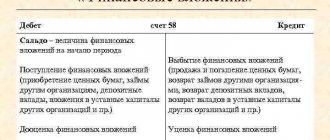

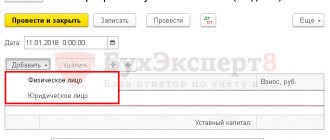

Account 75 “Settlements with founders” is intended to summarize information on all types of settlements with the founders (participants) of the organization (shareholders of a joint-stock company, participants of a general partnership, members of a cooperative, etc.): for contributions to the authorized (share) capital of the organization, for payment of income (dividends), etc. State and municipal unitary enterprises use this account to account for all types of settlements with state bodies and local governments authorized to create them. Subaccounts can be opened to account 75 “Settlements with founders”: 75-1 “Settlements for deposits in the authorized (share) capital”, 75-2 “Settlements for payment of income”, etc. On subaccount 75-1 “Settlements for deposits in authorized (share) capital” takes into account settlements with the founders (participants) of the organization for contributions to its authorized (share) capital. When creating a joint stock company, the debit of account 75 “Settlements with founders” in correspondence with account 80 “Authorized capital” takes into account the amount of debt for payment for shares. Upon actual receipt of the amounts of deposits of the founders in the form of cash, entries are made on the credit of account 75 “Settlements with founders” in correspondence with the accounts for cash accounting. Contributions of deposits in the form of material and other assets (except for cash) are recorded by entries on the credit of account 75 “Settlements with founders” in correspondence with accounts 08 “Investments in non-current assets”, 10 “Materials”, 15 “Procurement and acquisition of material assets” and etc. In a similar manner, calculations for contributions to the authorized (share) capital with the founders (participants) of organizations of other legal forms are reflected in accounting. In this case, an entry in the debit of account 75 “Settlements with founders” and in the credit of account 80 “Authorized capital” is made for the entire amount of the authorized (share) capital declared in the constituent documents. In the event that the shares of an organization created in the form of a joint stock company are sold at a price exceeding their par value, the proceeds of the difference between the sale and par value are credited to account 83 “Additional capital”. Unitary enterprises use subaccount 75-1 “Settlements on contributions to the authorized (share) capital” to account for settlements with a state body or local government body for property transferred to the balance sheet under the right of economic management or operational management (when creating an enterprise, replenishing its working capital , seizure of property). These enterprises call this subaccount “Settlements for allocated property.” Accounting entries for it are made in a manner similar to the procedure for accounting for settlements on contributions to the authorized (share) capital. Subaccount 75-2 “Settlements for the payment of income” takes into account settlements with the founders (participants) of the organization for the payment of income to them. The accrual of income from participation in the organization is reflected by an entry in the debit of account 84 “Retained earnings (uncovered loss)” and the credit of account 75 “Settlements with founders”. In this case, the accrual and payment of income to employees of the organization who are among its founders (participants) is taken into account in account 70 “Settlements with personnel for wages”. Payment of accrued amounts of income is reflected in the debit of account 75 “Settlements with founders” in correspondence with cash accounts. When paying income from participation in an organization with products (works, services) of this organization, securities, etc. In accounting, entries are made in the debit of account 75 “Settlements with founders” in correspondence with the accounts for the sale of the corresponding valuables. Amounts of tax on income from participation in an organization that are subject to withholding at the source of payment are recorded in the debit of account 75 “Settlements with founders” and the credit of account 68 “Settlements for taxes and fees”. Subaccount 75-2 “Calculations for the payment of income” is also used to reflect calculations for the distribution of profit, loss and other results under a simple partnership agreement. Accounting for these transactions is made in a similar manner. Analytical accounting for account 75 “Settlements with founders” is carried out for each founder (participant), except for accounting for settlements with shareholders - owners of bearer shares in joint-stock companies. Accounting for settlements with founders (participants) within a group of interrelated organizations, about the activities of which consolidated financial statements are prepared, is kept on account 75 “Settlements with founders” separately.

We recommend reading: List of Sanatoriums of the Ministry of Internal Affairs for Pensioners

50 Cash desk 07 Equipment for installation 51 Current accounts 08 Investments in non-current assets 52 Currency accounts assets 55 Special accounts in 10 Materials banks 11 Animals in cultivation 62 Settlements with buyers and fattening customers 15 Procurement and acquisition 68 Calculations for taxes and fees of material assets 80 Statutory capital 20 Main production 83 Additional capital 41 Goods 84 Retained earnings 50 Cash (uncovered loss) 51 Current accounts 91 Other income and expenses 52 Foreign exchange accounts 55 Special bank accounts 58 Financial investments 80 Authorized capital 83 Additional capital 84 Retained earnings Dividends are accrued at the expense of 84 , not 99

Account 80: entries for authorized capital - examples of formation and increase

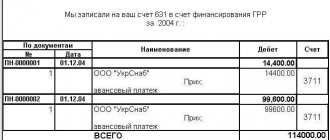

According to the decision of the board of LLC “Faza”, the authorized capital of the organization was approved at the expense of additional capital in the amount of 380,000 rubles. The amount of additional capital was formed earlier as a result of the revaluation of a group of fixed assets. For the preparation of documents, Faza LLC paid a state fee of 780 rubles. Dt Ct Description Amount Document 68 51 The amount of state duty transferred is 780 rubles. Payment order 83 80 The authorized capital of LLC “Faza” was increased due to its own property RUB 380,000. Minutes of the Board 91_2 68 The amount of state duty is included in other expenses 780 rubles. Application for state registration of changes in the charter

Changes in the number of shares

Additional issue of securities carried out at the expense of the organization’s property is distributed exclusively among shareholders. Each participant is awarded shares of the same category in the same ratio as before. The maximum amount for which securities can be issued is limited by the difference between the calculated volume of net assets from the last submitted balance sheet, confirmed by auditors, and the amount of the authorized capital.

Accountant's Directory

Task No. 2 Calculate wages to employee V.A. Petrov. for vacation (28 calendar days) if given: the total salary for the billing period was 145,000 rubles. Withhold personal income tax, the employee has 1 child, and determine the amount to be issued. Prepare all necessary accounting entries. Task No. 5. Reflect in accounting the formation of the authorized capital and the receipt of contributions from the founders: The enterprise is registered with an authorized capital of 100,000 rubles. In accordance with the constituent agreement, the 1st founder must make a contribution in cash in the amount of 50,000 rubles. The amount of the contribution of the 2nd founder is 50,000 11 rubles. The debt of the founders on contributions to the authorized capital is repaid in full. The 1st founder contributed to the current account, the 2nd contributed materials.

Other settlements with debtors

Account 75-3 reflects mutual settlements with shareholders for all other transactions. In particular, the operation to repay the loss of the partnership at the expense of contributions from participants is reflected here. The loss is written off from the balance sheet according to DT75-3 and KT84. Actual target receipts are reflected in KT75-3 and the debit of the material assets accounting accounts. Transactions with founders for which no other accounts are provided are reflected through account 75. The account balance reflects the debt of shareholders for contributions to the authorized capital.

Formation of authorized capital: accounting entries

In accordance with Art. 217 of the Tax Code of the Russian Federation, income of joint-stock companies received in the form of shares, property shares or in the form of the difference between the new and original value of the Central Bank is not subject to personal income tax. The increase in the value of shares itself does not lead to real income, provided that the changes occurred due to the revaluation of fixed assets. But if the difference is formed as a result of adding part of retained earnings to capital, then such amounts are subject to personal income tax. In this case, the amount paid can be taken into account in future periods. The date of receipt of income is considered to be the day of registration of the new amount of the capital. The first operation after the creation of an enterprise is the formation of authorized capital in the BU. Its value must be determined before the company is registered, and then enshrined in the statutory documents. Let's take a closer look at how the authorized capital is formed on the balance sheet. Postings depend on the type of contribution. But each case has its own nuances.

Please note => Types of social benefits

Legal restrictions

At the time of registration of the organization, shareholders are required to pay 75% of their share, the balance of the debt must be repaid within a year. The law provides for a minimum amount of authorized capital. It depends on the type of property, is calculated in accordance with the minimum wage and is indexed every year. You can register an enterprise if the amount of capital is at least:

- limited liability company - 10 thousand rubles,

- closed joint-stock company - 100 minimum wage,

- open joint-stock company - 1000 minimum wage,

- municipal organization - 1000 minimum wage,

- state enterprise - 5000 minimum wage.

Accounting accounts 80 and 75

Please note, count. 80 is always passive, it always has a credit balance. The cost of the authorized capital is paid there once when the enterprise is formed, and then every month this account remains invariably passive. Change account balance 80 can only in one case, if the value of capital changes, and corresponding changes are made to the constituent documents and only on the basis of these documents can any changes be made in this account. Authorized capital is the initial amount of funds (start-up capital) that the founders are willing to invest to ensure the activities of the enterprise. When registering an organization with the relevant authorities, constituent documents are drawn up, which include the cost of the authorized capital.

Where is the authorized capital reflected in the financial statements?

Indicators counting 80 are used:

- When filling out the balance sheet. Line 1310 of the balance sheet corresponds to the amount of the authorized capital.

- Completing the capital flow statement.

Field 3100 reflects data for the year preceding the one before the reporting year. For example, if the report is for 2022, then the credit balance as of December 31, 2015 is shown.

The following fields reflect data for the year preceding the reporting year:

1. Credit turnover: 3210-3213 - increase in capital (now and further - only according to the accounting account of the authorized capital); 3214 — credit turnover within the framework of correspondence with account 75.1 (additional issue of shares); 3215 - credit turnover with accounts 83 or 84; 3216 - loan balance during enterprise reorganization.

2. Debit turnover: 3220–3223 - decrease in capital; 3224 - debit turnover with accounts 75 or 84; 3225 - debit turnover with account 81; 3226 - loan balance during enterprise reorganization.

The indicator for line 3200 is the sum of lines 3100 and 3210 minus the indicator for line 3220.

The following fields reflect data for the reporting year:

1. Credit turnover: 3310–3313 - increase in capital; 3314 — credit turnover on account 75.1; 3315 - credit turnover on accounts 83 or 84; 3316 - loan balance on the account of the affiliated company. 2. Debit turnover: 3320 - decrease in capital; 3324 - debit turnover with accounts 75 or 84; 3325 - debit turnover with account 81; 3326 - loan balance on the account of the selected company.

The indicator for line 3300 is the sum of lines 3200 and 3310, reduced by the value of the indicator for line 3320. ***

The authorized capital is formed on account 80. A credit shows its increase, and a debit shows a decrease. Turnovers and account balances are taken into account when calculating indicators for financial statements.

Source: "People's Adviser"

Account 81 in accounting

A decrease in the size of the authorized capital must be reflected in the organization’s constituent documents (read more about amending the Charter using the example of an LLC). Adjustments to constituent documents must also be registered with the Federal Tax Service (the information will be reflected in the Unified State Register of Legal Entities). The use of account 81 to display information on activities with purchased own shares of joint-stock companies (shares of participants in other companies and partnerships) is carried out in accordance with the current Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94 and other legally approved documents (for example, Federal Law 208 dated December 26, 1995 as amended on July 29, 2019 for JSC).

Withdrawal of a participant from the LLC: accounting entries

Need to. See Art. 14 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”: the actual value of the share of a company participant corresponds to part of the value of the company’s net assets, proportional to the size of its share.

The company's net assets are calculated based on the requirements set out in Order of the Ministry of Finance of Russia N 10n and the Federal Commission for the Securities Market of Russia and N 03-6/pz dated January 29, 2003. The Ministry of Finance of Russia considers it legitimate to use the Procedure for calculating net assets contained in this document and established for joint-stock companies by limited liability companies (see, for example, Letters dated December 7, 2022 N 03-03-06/1/791, dated October 29, 2022 N 03-03-06/1/737, dated 01/26/2022 N 03-03-06/1/39).

Accounting and audit of settlements with founders

Accounting involves performing an assessment of deposits. This is not always easy to do. For example, it is difficult to value an intangible asset. The evaluation is carried out on the basis of mutual consent of the creators. The corresponding agreement is recorded in the constituent documents. If the asset is not in cash form, the valuation is carried out by an independent appraiser. The amount received as a result of a professional assessment may be reduced by the founders. However, it cannot be increased on the basis of paragraph 2 of Article 66 of the Civil Code of the Russian Federation. The founders of a unitary entity can be state or municipal structures. To record settlements, you need to open subaccount 1 to account 75. Replenishment of the fund is recorded with this posting: DT75/1 KT80. Formation of a fund of a unitary structure.

Please note => What do you need to get a job as a nanny in a kindergarten?

Account 81 in accounting

Agricultural joint-stock companies with more than 50 shareholders are required to entrust the maintenance of the register to a specialized organization (registrar) - a depositary bank or other investment institution. Maintaining the register of shareholders begins no later than one month from the date of state registration of the company. At the same time, the company is not relieved of responsibility for maintaining and storing the register of shareholders. Both problems can be solved by accounting for shares sold to shareholders, maintaining a register of shareholders directly by the joint-stock company or with the help of a specialized professional organization engaged for this purpose. In this case, the organization maintaining the register of shareholders (a joint stock company or a professional participant in the securities market) is the holder of the register of shareholders.

Possible accounting entries for authorized capital

Let's consider the situation with the given conditions: the authorized capital of JSC NNN is 300 thousand rubles and is divided into 125 shares (the par value of one is 2 thousand rubles). During the revaluation of fixed assets, it was found that their value increased by 50 thousand rubles, and the accumulation of depreciation charges by 10 thousand. As a result, the accountant increased additional capital by 35 thousand rubles. Postings are made: An important point in accepting and recognizing a contribution is entering data on changes into the constituent documents. Only after completing this procedure can you begin to formalize a business transaction on the authorized capital account. Postings are compiled according to the type of capital formation: Dt “Settlements with founders” Kt “Authorized capital”. In this case, only the debited account changes depending on who the funds come from:

Capital increase

One way to increase the attractiveness of a company and introduce additional funds without tax deductions is to increase the authorized capital. The process is carried out through additional contributions from shareholders in the form of cash and property, which is assessed by an independent expert. The capital of joint-stock companies is increased by increasing the par value of shares or issuing new securities. A JSC that has decided to increase capital, before registering changes in the Unified State Register of Legal Entities, is required to register an additional issue of securities with the Central Bank Security Service (FSFM). Process steps:

1. To register changes you need to collect and provide:

- shareholders' decision to increase capital;

- publication of an advertisement in the State Registration Bulletin.

- a copy of the Charter;

- a copy of the Unified State Register of Legal Entities;

- copy of TIN;

- extract from the Unified State Register of Legal Entities;

- a copy of the manager’s passport;

- contact number.

2. Registration of changes to the territorial branch of the Federal Tax Service.

3. Obtaining a certificate of registration of changes.

4. Registration of a new Unified State Register of Legal Entities.

The legislation does not stipulate the maximum amount of capital. But at the time of making a decision to increase the authorized capital, the following conditions must be met:

- the initial capital has been fully paid, even if less than a year has passed since registration;

- at the end of the second and subsequent years, the volume of net assets should not be less than the registered capital, the minimum size of the fund allowed by law;

- if the fund is increased through the contribution of only one participant, then the corresponding decision must be made by 2/3 of the shareholders.

Accounting for authorized capital and settlements with founders (account 80 and 75)

To check whether we are debiting the account correctly, let’s do a little analysis. In this case, debit 75 will reflect the debt of the founders to the organization, that is, accounts receivable. Accounts receivable is an asset of the enterprise, an increase in assets is reflected in the debit of the account, which means that everything is correct, we entered the amount in the debit correctly. But that is not all. The formation of authorized capital is a business transaction, and for each operation we must carry out accounting entries using the double entry principle. Details on how to make postings are written here. In short, from the Chart of Accounts you need to select two accounts involved in the business transaction associated with the formation of the authorized capital, and make a simultaneous entry for the debit of one and the credit of the other.

21 Dec 2022 marketur 432

Share this post

- Related Posts

- In this regard, they provide an address certificate

- Is Diosmin Included in the List of Preferential Medicines for Disabled People for 2019

- Will a Pension be added to Non-Disabled Person and Liquidator for Chaes category 2 from July 1, 2022

- How to get a room in a communal apartment from the state

Test of intermediate control in the discipline "Accounting" Section "Financial accounting"

14. When new fixed assets are received free of charge, an accounting entry is made: 1) D-t. 80 “Authorized Capital” K-t. 01 “Fixed Assets” 2) D-t. 01 “Fixed Assets” K-t account 80 “Authorized capital” 3) D-t account.08 “Investments in non-current assets” Set account 98 “Deferred income” 4) D-t account 01 “Fixed assets” Set account 98 “Future income” 5) D-t. 08 “Investments in non-current assets” K-t. 99 “Profits and losses”

21. The total cost of goods sold represents: 1) the actual cost of manufactured finished products 2) the sum of the actual production cost of goods sold and commercial expenses 3) the sum of the actual production cost of goods shipped and transportation costs 4) the sum of the costs of manufacturing products and expenses for its transportation 5) there is no correct answer

07 Jul 2022 glavurist 786

Share this post

- Related Posts

- If a Mother Gave a House to her Son and Her Debts to the Bank Pass on to her Son

- Employment under contract - what does it mean?

- Quiet Mode in the Saratov Region 2020

- How to check debts before traveling abroad