Status indicator in payment order

The main source of law, according to which one or another status is recorded in budget bills generated by taxpayers, is Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

Changes are made to it periodically. Thus, from October 1, 2021, by order of the Ministry of Finance dated September 14, 2020 No. 199n, the following codes were abolished:

- 09 - individual entrepreneur paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- 10 - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- 11 - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- 12 - head of the peasant farm, paying taxes, fees, insurance premiums and other payments administered by the tax authorities.

These individuals will indicate a single code 13, which is now used by ordinary “physicists”.

Also, as of October 1, 2021, the following statuses are excluded:

- 18 - a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties;

- 21 - responsible participant in the consolidated group of taxpayers;

- 22 - participant of a consolidated group of taxpayers;

- 25 - guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of VAT received in excess by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation, and excise taxes on alcoholic and (or) excisable alcohol-containing products;

- 26 - founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise, or third parties who have drawn up an order to transfer funds to repay claims against the debtor for mandatory payments included in the register of creditors' claims, during the procedures applied in a bankruptcy case.

At the same time, new statuses appeared:

- from 07/01/2021 - 29 - for political parties (electoral associations, etc.);

- from 01.10.2021 - 30 - for a foreign person who is not registered with the tax authorities of the Russian Federation (when making payments administered by customs authorities).

Previously, by order of the Ministry of Finance dated 04/05/2017 No. 58n, 2 payer statuses were updated from 10/02/2017:

- 03 - it is indicated in the payment order by the federal postal service organization when drawing up an order to transfer money for each payment by an individual (except for payment of customs duties);

- 06 - this code is provided for participants in foreign economic activity - legal entities (except for the recipient of international mail).

Also, sometimes there are clarifications on certain nuances of applying the provisions of this document. Among the key explanatory documents of recent years are letters:

- Ministry of Finance of Russia dated January 16, 2015 No. 02-08-10/800, which clarified the use of payer status indicators in correlation with the BCC used as identifiers of budget obligations;

- Ministry of Finance of Russia dated May 20, 2016 No. 02-08-12/29143, which determined the relationship between who pays where and for some codes, in particular, indicating the code number entered when paying tax by one individual for another;

- Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/19125, which noted that an error in indicating the payer’s status does not make the tax payment unpaid and can be corrected by clarification through an application sent to the tax authority.

The following articles will tell you about the nuances of filling out the fields of a payment order:

- “We correctly indicate the purpose of payment in the payment order”;

- “We indicate the order of payment in the payment order.”

ConsultantPlus experts clearly showed how to issue a payment order to pay a fine or penalty. To do everything correctly, get trial access to the system and go to the Ready solution.

Information in the document

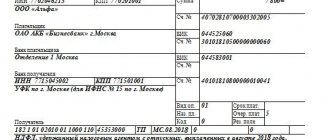

The payment receipt for penalties, including pension fees, indicates the basic details of the payer, which largely coincide with the payment slip with which the tax or fee is transferred to the Pension Fund. That is, the status of the taxpayer is indicated, the full details of the organization that will pay the penalty, including its identification number and checkpoint. The bank details of the paying organization also need to be indicated, and there is no need to reflect the posting here.

Such information is prescribed in paragraphs. (subparagraphs) and about the recipient, that is, its legal name, identification number and checkpoint are specified. In addition, in order for the payment to arrive correctly, it is necessary to indicate the correct bank details of the recipient; with their help, the money will be delivered to its intended destination. The order of payment is also specified; there is field 21 for this, and the OKTMO code is entered in column 105.

All details must be entered correctly

In addition, there are other details described above; these are the ones that differ in comparison with the main payment order. The number and date indicated in fields 108-109 also have their own nuances. In case of voluntary transfer, zeros are entered here, and in case of forced transfer, the columns are filled in with the number and date of the demand presented, or the decision to prescribe sanctions (when assigning penalties based on the results of the audit).

The sample payment slip for penalties that were calculated for insurance premiums in 2022 is practically no different from tax payments. But there are some nuances that can affect the speed of crediting funds to the FSS (Social Insurance Fund) and the success of the operation to transfer the amount as a whole to the account specified in the payment.

Status in land tax payments: nuances

How the status should be indicated in land tax payments is explained by the letter of the Ministry of Finance of Russia dated January 16, 2015 No. 02-08-10/800. It depends on who is making the transfer:

- Individual.

- Entity.

Individuals are recommended to record their status:

- 03 - when generating an order for the transfer of funds for payments by individuals through the federal postal service organization (FPS);

- 13 - for ordinary individuals who are clients of a financial institution, account holders, and from 10/01/2021 also for individual entrepreneurs, notaries who are engaged in private practice, lawyers who have their own office (instead of the previously used codes 09, 10 and 11 for them, respectively );

- 15 - for banks, their branches, payment agents, FPS organizations that generate payment orders for a certain total amount with a register for the transaction of funds accepted from payers in the status of individuals;

- 16 - for participants in foreign economic activities in the status of an individual;

- 17 - for participants in foreign economic activities in the status of individual entrepreneurs;

- 19 - for legal entities and their branches that have issued an order for the transaction of funds that are withheld from the salary of a debtor in the status of an individual to account for debts under obligations to the budget system of the Russian Federation on the basis of a received executive document;

- 20 - for credit institutions and their branches, payment agents who form orders for cash transactions for individual payments by individuals.

For legal entities, the status may be as follows:

- 01 - for taxpayers with the status of a legal entity;

- 02 - for tax agents;

- 04 - for tax authorities;

- 05 - for territorial structures of the Federal Bailiff Service;

- 06 - for participants in foreign economic activities in the status of legal entities;

- 07 - for customs structures.

For information on preparing a land tax payment, see the article “Payment order for payment of land tax (sample)” .

Compiler status when paying income tax to individual entrepreneurs

Tax can be paid both on the income of individual entrepreneurs and on the income of employees. This also affects the choice of value for field 101.

If an individual entrepreneur issues a payment order to pay tax on his income, then he must select value 09 (taxpayer, payer of fees).

IMPORTANT! For notaries, lawyers, farmers, until October 2022, their own codes must be used - 10, 11, 12, respectively.

If you need to pay personal income tax on employee income, then the individual entrepreneur in this case becomes a tax agent. And when submitting an order to the bank, select the status indicator 02.

Filling out a payment form for taxes, fees and insurance premiums: current standards

The main source of law, which sets out the rules for indicating the status in payment orders sent to the bank in order to fulfill budget obligations, is Appendix 5 to Order No. 107. In accordance with these rules, the status of the payer should be considered as the key identifier of the person generating the order for the transfer of financial funds into the budget system of the Russian Federation.

The relevant information must be indicated in details 101 of the payment order. It can record statuses such as:

- 01 - indicated by the taxpayer in the status of a legal entity (this could be, for example, LLC, JSC, PJSC);

- 02 - indicated by the tax agent (this can be a legal entity or individual entrepreneur, who, for example, are required to calculate personal income tax from the salaries of employees and transfer it to the budget);

- 03 - indicated by the FPS organization (actually, this is the Federal State Unitary Enterprise “Russian Post”);

- 04 - indicated by the tax authority (these are the Federal Tax Service of Russia and its territorial divisions);

- 05 - indicated by the territorial structure of the Federal Bailiff Service;

- 06 - indicated by the legal entity carrying out foreign economic activities;

- 07 - indicated by the customs authority (that is, the Federal Customs Service);

- 08 - indicated by a legal entity, individual entrepreneur, notary, lawyer, head of a farm who transfer funds to pay insurance premiums and other payments to the Russian budget system;

- 13 - indicated by the payer in the status of an individual who owns a bank account, and also from 10/01/2021 in the status of an individual entrepreneur, notary, lawyer, head of a peasant farm;

- 14 - indicated by the payer who carries out transactions in favor of individuals;

- 15 - indicated by the credit structure or its branch, paying agent, FPS when drawing up orders with a register for a transfer accepted from an individual;

- 16, 17 - indicated respectively by individuals and individual entrepreneurs carrying out foreign economic activities;

- 19 - indicated by legal entities that collect debts to the budget from the salaries of hired employees on the basis of a received executive document;

- 20 - indicated by credit institutions, as well as their branches that issue orders for the transfer of funds for individual payments by individuals;

- 23 - indicated by the body monitoring the payment of contributions to extra-budgetary funds;

- 24 - indicated by an individual who pays insurance premiums, taxes, fees and other payments to the budget of the Russian Federation.

Features of the order

Payment of penalties to the tax office on a separate payment order in 2019 is carried out if there is a delay in payment and there are no rules allowing the subject to be exempt from tax. At the same time, the document has its own design features, which are related to the fact that the penalty ensures the timely transfer of mandatory budget revenues, which include the transport fee. Moreover, they are not a sanction, but a measure to ensure the proper fulfillment of obligations, the same occurs with UTII, VAT or work under the simplified tax system; even individual entrepreneurs must send them to the state. Even contributions to compulsory medical insurance and compulsory health insurance may be subject to penalties if they are not transferred on time, the cost of which is calculated using approximately the same algorithm.

Comparing the payment order issued for penalties, one can note its similarity to a receipt allowing payment of the principal amount. This is achieved by the fact that it is also necessary to stipulate the status of the payer; the details of the party accepting the money and the income administrator will be indicated. But there are also differences, they are noticeable, including in the KBK, where information must be added.

For example, there are discrepancies in field 104, because tax penalties have a separate BCC; in categories 14-17 a subtype of profit is indicated under the designation 2100. Also, the code contributed to a change in the process of filling out the payment slip, so field 110, which is responsible for the type of payment, is not filled in. There are also slight differences in field 106, because for current payments the TP indicator is set here.

When filling out a payment order, you should be especially careful

There may be different variations when it comes to penalties, for example, a voluntary transfer of the amount is accompanied by a tax code, but it is used in a situation in which the subject has not received a demand from the Federal Tax Service. When such a request is received, where the basis for payment should be indicated when paying the previously accrued penalty in 2022, the designation TR is placed, and the money collected as a result of the sanctions prescribed as a result of the audit is designated as AP. In field 107, which is responsible for the tax period, the amounts are also indicated differently.

In a situation with voluntary payment, you will need to enter the number 0 in this field, since penalties do not have the frequency characteristic of current payments. But at the time of transfer for any period, it must be indicated in the MS.11.2018 format - this is how penalties for November of last year will be displayed. Payment on demand is accompanied by an indication of the issuance period, which is specified in the document, and the verification act on the basis of which payment is made will require the indication of the number 0. You can find out how much the entity has fulfilled its obligations if it has a certificate about the current status of payments for taxes, as well as fees, penalties and previously imposed fines.

Results

In a payment order for payments to the budget system of the Russian Federation, the payer's status is indicated in field 101. It is a two-digit code from Appendix 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

For example, when a company transfers taxes from its own activities, code 01 “Taxpayer (payer of fees) is a legal entity” is indicated.

And when transferring insurance premiums for injuries, code 08 is entered in field 101. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to indicate the number and date of the document - grounds for paying penalties

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

A sample payment order for the payment of penalties in 2019-2020 can be viewed and downloaded on our website:

About payer status

Since 2012, on the basis of a decree of the Central Bank, the concept of requisites is no longer used in the field of banking records management. It was proposed to replace this concept with the term “person status”.

Taxpayer status is the fixed position of an object in the tax system, which is under consideration as a systemic or structural entity. Simply put, this tool serves to identify the payer.

Based on the status, operations related to the execution of payments, regarding the transfer of cash payments to the budget, for example, taxes and fees, are determined, which is expressed in a certain numeric code.

Important! The code is the same for all financial institutions.

According to the new rules, field 101 indicates data that meets the requirements of the law and is enshrined in regulations issued by the executive and federal services of the Russian Federation. The information placed in the column includes information identifying the entity whose actions are aimed at making a payment to the budget.

Consolidated group of taxpayers

The consolidated group of taxpayers in Appendix 5 to Order No. 107n includes 2 meanings:

- 21 – responsible participant of the consolidated group of taxpayers (CGT);

- 22 – participant of the KGN.

In accordance with clause 4 of the rules for indicating information in payment documents (Appendix 1 to Order No. 107n), taxes are paid by the responsible participant on behalf of the group. This means that the payroll of the organization - the responsible participant should contain indicator 21.

If organizations that are members of the CGN fill out settlement documents for the responsible participant, then they use code 22.

Compiler status for organizations

For organizations in standard situations, everything is quite stable and transparent:

- 01 - taxes of a legal entity, insurance premiums for employees;

- 02 - personal income tax on employee income;

- 08 - insurance premiums for employees transferred to the Social Insurance Fund.

For an example of filling out a payment order with status 01, see the material “How to fill out payments for insurance premiums in 2021?”

In 2022, when sending budget payments, you must check the details very carefully, because from January 1 they change and there will be a transition period until May 1. A ready-made solution from ConsultantPlus experts will help you fill out your tax payment form correctly. To use the tips, sign up for free online access to the legal reference system.

If an organization acts as a tax agent for VAT, i.e. calculates VAT and pays it for another taxpayer, then select status 02 for the payment order. If status 01 is used during registration, the tax office may consider that the organization has not fulfilled its tax duties VAT transfer agent. The courts, of course, side with the taxpayer. But why go to court when you can fill out the payment form correctly?

Read more about tax agents in the articles:

- “Who is recognized as a tax agent for VAT (responsibilities, nuances)”;

- “Who is a tax agent for income tax (responsibilities)”.

A separate status has been allocated for companies (or their branches) for cases when the organization receives a writ of execution against an employee, according to which it is necessary to withhold from the salary arrears of payments to the budget. The amount withheld is transferred using code 19.

Conditions for filling out the field by organization

When indicating your taxpayer status, you need to take into account some features. If insurance premiums are paid by individual entrepreneurs, lawyers, notaries, then the procedure is as follows:

- for employees, 01 is indicated (instead of 14, as was originally);

- Individual entrepreneur – 09, notary – 10, lawyer – 11.

If the organization’s account is opened in the largest bank in the country, then payment can be made through Internet banking. When transferring funds through Sberbank Online, filling out the payer status is mandatory.

Filling out a payment slip in Sberbank Online

The payment order is filled out either at the bank office or through the Sberbank Business online system. The document states:

- details and name of the recipient;

- bank of the sender and addressee;

- required amount.

For the payer status, there is a special field in the upper right corner, next to the “Type of payment”. If money is transferred to the treasury of the Russian Federation, then you need to indicate the appropriate code. In cases where the transaction is carried out between private individuals, the column should be left empty.

For remote translation, you need:

- log in to the system;

- go to the “Payment orders” section through the “Ruble transactions” tab;

- create a “New Document”;

- fill in the required fields;

- Confirm the operation via SMS.

The document will be sent to the bank for processing. If you are transferring money to your account again, you don’t have to enter the recipient’s details again, but choose from those offered.

Important: if the sender’s account is opened with Sberbank, then when registering a document online, the sender’s code will be determined automatically.