What are the features of a payment order to bailiffs of the 2022 - 2022 model?

The procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, court penalties).

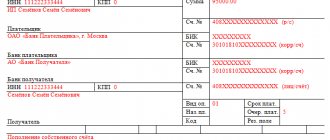

If you are transferring tax debts for an employee, in the payment order in the section about the payer you must indicate (clauses 4, 10 of Appendix No. 1, Appendix No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, Appendix 1 to the Regulations of the Bank of Russia dated June 29, 2021 No. 762-P):

- in field 101 - code 19;

- field 60 - INN of the employee for whom you are transferring the tax (not yours!!!);

- field 102 - “0”;

- field 8 - your data: by organization - full or abbreviated name; for an individual entrepreneur - full name, in brackets the status is “IP”, then - the registration address (the address is marked with “//” signs). For example, “Sergeev Alexey Alekseevich (IP) // 115419, Moscow, st. Donskaya, 28A, apt. 76 //";

- fields 9-12 - your payment details.

The recipient's details must be taken from the document from the bailiffs.

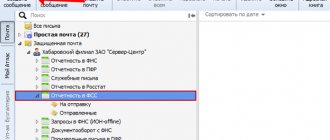

Payment information must be filled out as in a tax bill - indicating the UIN, KBK, OKTMO, etc. More details about this are written in the ready-made solution from ConsultantPlus. You can view the material for free by signing up for trial access to the system.

A similar procedure for filling out the section on the payer has been in effect since July 17, 2021 in relation to going to the budget , for example, administrative fines, etc. (Order of the Ministry of Finance dated September 14, 2020 No. 199n, letter of the Federal Treasury dated April 29, 2021 No. 01- 00-07/9973). Such payments indicate:

- in detail 60 TIN of an individual whose obligation to pay other payments is fulfilled by the organization (until July 17, it was possible to indicate the TIN of the company);

- in the checkpoint field - 0;

- in detail 108 “Document number” - identifier of information about an individual (this can be a SNILS number, series and number of a passport or driver’s license, etc.).

Until July 17, there were no special rules, as well as official instructions on the procedure for issuing payments to bailiffs for non-tax debts of employees to the budget. Therefore, a regular payment order was issued using them, without filling out the “tax” fields. In this case, all information identifying the payment was provided in the “Purpose of payment” field, where the type of deduction, details of the writ of execution, etc. were indicated. The specific composition of the information could be clarified with the bailiffs.

For more information about the details indicated in the payment document, read the material “Basic details of a payment order” .

You can view a sample of filling out a payment order to bailiffs for the transfer of an employee’s tax debt with expert comments in K+ by signing up for a free trial access:

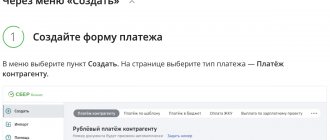

How to fill out a payment order

The FSSP is a budgetary organization, but alimony payments are not classified as taxes, so budget classification codes are not required. To understand how to correctly fill out a payment order when transferring alimony, you should consider some nuances:

- If funds are transferred in favor of an individual, then in the “Recipient's Account” field, indicate the account number that is linked to the bank card. The card or personal account number and the number of the writ of execution should be indicated in the payment purpose.

- From June 2022 in field 20 “Naz.pl.” income code 2 is indicated.

Use free instructions from ConsultantPlus experts. A detailed guide will help you fill out any payment slip correctly.

to read.

Payment order to bailiffs for other debts of employees

If the employer received a writ of execution from the bailiffs to withhold the employee’s non-budgetary debts (alimony, loans, etc.), the payment slip is filled out a little differently: obviously, the tax fields are not filled in, and all information about the debt is given in the purpose of the payment.

As for fields 60 and 102 (remember, this is the payer’s tax identification number and checkpoint), there is currently ambiguity and two points of view:

1. In this situation, the rules introduced from July 17, 2021 for non-tax debts paid to the budget also apply; after all, FSSP accounts are opened in the UFK, and this is the budget. That is, in field 60 the employee’s TIN is indicated, and in field 102 a 0 is entered.

For a sample payment order filled out in accordance with this item, see K+ by signing up for a free trial access:

2. In fields 60 and 102, the employer’s (not the employee’s) TIN and his checkpoint are given. Her explanation is as follows. The requirement to indicate the TIN of the debtor (individual) is expressly established only for cases when the funds withheld from him go to repay debts on payments to the budget. The fact that this other debt is paid to the FSSP account does not make it a debt to the budget, since the final recipient here is non-budgetary (an individual for alimony, a bank if it is a loan, etc.).

We believe that this issue will have to be resolved with the bailiffs and the bank.

If you need to fill out a payment order for the transfer of alimony from an employee’s income, then a ready-made solution from ConsultantPlus experts will help you. Get trial online access to K+ for free and proceed to the sample.

Results

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. The rules for filling out a payment order to bailiffs for budget and non-budget payments differ.

How to fill out correctly when transferring according to a writ of execution?

Deductions directly addressed to bailiffs are transferred according to the writ of execution on the basis of the relevant payment orders, the execution of which must always be carried out properly.

For the FSSP, however, there is no special form of payment approved by any regulations.

Consequently, the payment order to the bailiffs is drawn up according to a standard template, usually used for any bank transfers.

When filling out such payments, it is important to take into account some differences between orders for tax collections and orders for non-tax withholdings.

Non-tax debts

If a payment directly addressed to the FSSP authorities is drawn up to collect non-tax debts, it does not provide for filling out the so-called tax fields.

In other words, it does not indicate the BCC, payer status, or other information related to tax specifics.

All key data characterizing a non-cash payment for the collection of non-tax debt is reflected in the payment purpose field.

The necessary information of the writ of execution, the paid period and other identifying information are indicated here.

Tax debts

If a payment order to bailiffs is issued for the purpose of collecting tax debts, it should be drawn up according to the rules provided for transfers to the budget.

So, when filling out the payment form, the following mandatory details must be indicated:

- If the amount of tax debt is withheld from the salary of the debtor employee, field 101 (user status) in the payment order is assigned the value 19.

- In field 60, where the payer’s TIN is indicated, the TIN of the citizen (employee) against whom enforcement proceedings are applied is entered. If this individual does not have a TIN, the value 0 is entered.

- In field 102, where the payer’s checkpoint is indicated, the value 0 is reflected, since the funds are transferred for the hired employee.

- The short name of the business entity (employer) withholding and transferring funds under the writ of execution is written in field 8 of the payment order, where the name of the payer is reflected.

- Field 22 is intended to indicate the UIN code (unique accrual identifier). If such a code is not included in the bailiff’s order, 0 is entered.

- In field 105 you should enter the OKTMO code, which determines the location of the territorial body of the FSSP, which collects the debt by court decision.

- Field 108 properly reflects the number of the document that uniquely identifies the payer (debtor employee). Before the identifying information, the identification code of the corresponding document is written in the line (for example, a civil passport - 01, a military ID - 05).

- In the KBK field (104) – value 0.

- In the fields of document date (109), tax period (107) and document basis (106) the value 0 is entered.

Sample payment order when transferring tax debts to bailiffs -

Sample payment form to the FSSP for non-tax debts -

Common Questions

In what cases should I fill out the KBK when transferring funds to bailiffs?

The BCC needs to be indicated only if you are transferring a payment to the budget and its administrator is the Federal Bailiff Service - FSSP. The budget classification code must be reported by the bailiff. When transferring money to bailiffs that they collect under enforcement documents (debts, alimony), there is no need to indicate the CBC.

Is it legal to require the employee’s income to be indicated in the payment order?

Yes, such a demand from the bailiff is legal.

An indication of the total amount of income is necessary for the bailiff to determine the correctness of the deductions made by the employer. Imposing such an obligation on the employer can be regarded as a legal requirement of the bailiff.

If the employer does not indicate the total amount of the employee’s income, and also does not withhold the enforcement fee, the bailiff can (Article 6, 113 of Law No. 229-FZ):

- take enforcement measures provided for in Art. 68 of Law No. 229-FZ;

- initiate bringing the employer to administrative liability under Art. 17.8 Code of Administrative Offences.

Is it possible to deduct amounts under a writ of execution from an advance payment?

Yes, you can. After all, amounts under writs of execution are withheld and transferred to the claimant or to the deposit account of the bailiff service with each payment of wages, observing the maximum amount of deductions. And an advance is payment of wages for the first half of the month. An advance on wages does not apply to income that cannot be levied. A different approach may make it impossible to withhold the required amount, even though the employee’s income for the entire month allows this to be done.

Sources:

Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

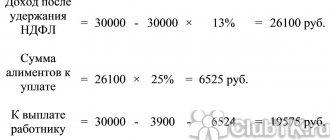

General rules for withholding alimony

Funds for the maintenance of minor children or full-time students under 24 years of age are withheld from wages and other types of income under the employment agreement (sick leave, vacation pay, bonuses, etc.). The basis for withholding is a writ of execution, which the bailiff service sends to the accounting department of the enterprise. Such a document contains the required details:

- Full name of the debtor.

- Percentage of deductions from income.

- Full name or name of the recipient of funds. The recipient is an individual (for example, the second parent of a child) or the bailiff service (FSSP).

- Recipient's bank details.

Withholdings typically range from 25 to 50% of income. In some cases, for example, if the debtor has overdue debt, a maximum withholding amount of 70% is applied. The debt is transferred by non-cash payment from the organization's current account. To avoid checks by the FSSP, you should correctly fill out the payment order when transferring alimony and transfer the funds to the recipient in a timely manner. If violations are discovered during such inspections, fines may be applied to the manager and chief accountant.

Questions and answers

- We hired an employee, and a week later we received a writ of execution for alimony. The problem is that this person does not have a Taxpayer Identification Number. What to do with a payment order?

Answer: Actually there is no problem with this. If an individual does not have a TIN, the value “0” is indicated in field 60. All necessary information is indicated in the “Purpose of payment” field, where information about the writ of execution and the purpose of payment (alimony) will be indicated.

- Is it necessary to indicate the short name of our organization when generating a payment order to bailiffs?

Answer: The short name of the organization is required to be indicated, because It is your organization that acts as the payer for the payment order.