Rules for issuing a payment order to pay a fine

The main regulatory documents defining the procedure for filling out payment slips are:

- Regulation of the Bank of Russia dated June 29, 2021 No. 762-P (from September 10, 2021);

- Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n (Appendix 2).

Let's look at the main points.

- Detail 104 indicates the KBK (20-digit budget classification code), which can be found from the list approved by the Ministry of Finance for the corresponding year. It should be noted that, according to paragraph. 7 p. 4 sec. II of the same order, for fines the income subtype code 3000 is used (14–17 digits of the code).

NOTE! From 05/01/2021, be sure to fill out field 15, which indicates the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). From this date, the details of the Treasury accounts and the name of the recipient bank also change. See details here. And from October 1, 2021, the order of filling out fields 101, 106 and 108 has been changed.

For example, KBK:

- for a fine related to income tax credited to the federal budget: 182 1 0100 110;

- fine related to income tax credited to the regional budget: 182 1 0100 110;

- fine related to personal income tax: 182 1 0100 110.

For the KBK for paying fines for all types of taxes, see the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Remember that the BCC for arrears, penalties and fines for the same tax are different, which means you need to issue separate payments to pay them.

The amount of fines can be found in the article “Responsibility for tax offenses: grounds and amount of sanctions .

- In detail 105, OKTMO is filled in - the code of the territory of the municipality where funds from paying fines are collected.

- Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, which usually occurs at the request of the Federal Tax Service (Article 69, 101.3 of the Tax Code of the Russian Federation), the letters TR are used until 10/01/2021. From 10/01/2021 you need to indicate the property code here.

- Props 107 (tax period) has a value of 0.

- Detail 108 indicates the requirement number; the symbol No. does not need to be inserted. In this case, from 10/01/2021, the code designation of the document - the basis - is indicated before the number: “TR00000000000000” - the number of the Federal Tax Service Inspectorate’s request for payment of taxes, fees, and insurance contributions; “AP0000000000000” - number of the decision to prosecute for a tax offense or to refuse to prosecute; “AR0000000000000” - number of the executive document or enforcement proceedings.

- Indicator 109 contains the date of the document, the number of which is reflected in detail 108, in the format “DD.MM.YYYY”.

- Detail 110 is not filled in.

- The “Code” detail indicates a unique accrual identifier (UIN); it must be contained in the tax demand that it made for payment of fines. If this code is not present, then 0 is entered.

IMPORTANT! When composing or reproducing a payment order on paper, you can fill out the code on 2 or more lines.

- The “Purpose of payment” detail must contain the following information: type of payment and its basis.

- Details “Payment order” - 5.

- Props 101:

- when paying fines for yourself: 01 - for legal entities, 09 - for individual entrepreneurs;

- for payments made as a tax agent: 02.

For information about filling out a payment order online, read the article “Where you can fill out a payment order online .

You can download the payment order form on our website.

KBK

It is important to take into account that different BCCs have been established for repaying arrears, paying penalties and fines. The difference lies in symbols 14-17, which show the subtype of payment. For fines, their combination is set as “3000”, for the “body” of the tax - “1000”. You can find the required code on the websites of information and legal systems; it is indicated in the request received from the Federal Tax Service.

Basis of payment

In field 106 an abbreviation is entered, depending on the document for which the fine is paid. “AP” is indicated if the basis was a decision of the tax inspectorate based on the results of an audit, or “TR” if the organization received a request.

The abbreviation “ZD” should not be indicated when listing fines. It is used in cases where the taxpayer voluntarily repays the identified debt.

Document number and date

In field 108 of the payment order, enter the number of the claim for which the fine is transferred. Field 109 indicates the date of this document.

Code

In field 22, the UIN is written if it is indicated in the request received by the taxpayer. If this information is not in the document, “0” is entered.

OKTMO

The OKTMO corresponding to the tax office where the funds are sent is indicated. For example, if a company transfers money to the Federal Tax Service, where its separate division is registered, the code must be entered not at the registration address of the parent organization, but at the location of the branch.

The taxpayer’s responsibility is to remit the fine within the time limits specified in the request. If the funds are not received by the inspectorate in a timely manner, it will foreclose on the bank accounts of the business entity and its electronic wallets.

Next you can

Sample of filling out a payment order to the tax office in 2021–2022

You can see how a payment slip for a fine will be filled out according to a tax audit report and, if necessary, a payment order to pay a fine in 2021-2022, in ConsultantPlus for free by signing up for a trial access:

For details of filling out payment orders to pay a fine at the request of the tax inspectorate or according to a tax audit report, see ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

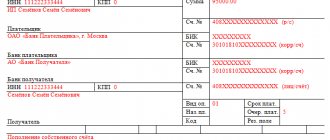

We determine the details for transferring the payment

Payments are processed only if the payer has all the necessary details. Here's how to pay a fine under an administrative offense - fill out a receipt for payment (if the penalty is transferred by an official) or a payment order (if the payment is made on behalf of the customer organization). To transfer money to the budget you will need the following details:

- TIN, KPP and OGRN of the recipient;

- name of FAS (not the name of the body, but its name and personal account in bank documents);

- bank details;

- current account number of the supervisory authority;

- BCC for a specific type of recovery;

- UIN - unique payment identification number;

- details of the basis document (resolution).

Finding out all this data is very easy. They are in the administrative document about the administrative offense. They also provide the budget classification code and the UIN.

The customer has many payment options available: through applications, a government services portal, a terminal or a bank whose client is the payer. The method of calculation depends on whose name the fine was issued.

How to issue a payment order to pay a fine on contributions

The option for filling out a payment form to pay a fine on contributions depends on who issued the sanctions:

- Federal Tax Service, due to late submission of reports;

- FSS for late payment of accident contributions.

Let's take a closer look.

If a taxpayer fails to submit reporting on contributions on time, he or she will be subject to sanctions in the amount of 5% of the amount of contributions for each month of delay, but not more than 30% of this amount and not less than 1 thousand rubles.

The algorithm for filling out a payment form for a fine is similar to the procedure established for tax fines, with the exception of the KBK. In 2021-2022, the following codes should be indicated:

| for compulsory pension insurance | for health insurance | for social insurance due to illness or maternity | |

| KBK for a fine | 182 1 0210 160 | 182 1 0213 160 | 182 1 0210 160 |

At the same time, the fine amounted to 1 thousand rubles. should be distributed among the KBK in proportion to the tariffs (letter of the Federal Tax Service dated 05.05.2017 No. PA-4-11/8641):

- to the Pension Fund of Russia 733.33 rubles. (22 / 30 * 1000);

- in FFOMS 170 rub. (5.1 / 30 * 1000);

- in the Social Insurance Fund 96.67 rubles. (2.9 / 30 * 1000).

SMP entities pay contributions at reduced rates. What exactly, ConsultantPlus experts explained. Study the material by getting trial access to the K+ system for free.

The FSS also has the right to impose penalties for late submission of Form 4-FSS (5% of the amount of contributions, but not less than 1 thousand rubles and no more than 30%) or for violating the procedure for submitting the form (200 rubles).

The procedure for filling out a payment form is slightly different from that established for tax fines:

- Fields 106 – 109 are not filled in;

- KBK — 393 1 0200 160

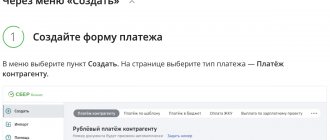

We pay through the government services portal

Payment of an administrative fine through the public services portal is available for officials and organizations. The payer logs into his personal account (personal or institutional), selects the desired action, enters the data and sends the payment. The only caveat is that if you are not registered in the system, this option of settlements with the FAS for an administrative offense will not suit you. A registered account requires verification, and this is additional time, which delays the transfer of funds to the account of the Antimonopoly Service.

If the account is active, the fine is paid according to the following scheme:

Step 1. Log in to your personal account.

Step 2. Select the “Payment” action. In the menu that opens, look for “Payment by receipt number.” For the convenience of users, the “Payment by receipt” section is displayed in a separate icon in the lower right corner.

Step 3. Enter all the details, fill in the required fields and pay the FAS fine. There is no commission for this type of transaction.

In addition to the mutual settlements themselves, State Services also check the receipt of funds to the account of the Federal Antimonopoly Service. Instructions on how to check payment of a fine:

Step 1. Log in to your personal account.

Step 2. Select the “Debts” section.

Step 3. Request information about existing fines and debts to the budget.

If the certificate does not display the amount of the fine in the FAS, it means that the money has been transferred to the bank account of the regulatory authority.

Results

The rules for filling out payment order details for paying fines are listed in Appendix 2 to Order No. 107n of the Ministry of Finance of the Russian Federation. The payment for the fine must be filled out correctly, otherwise the bank may not accept it. And in case of errors in the details that are significant for crediting the payment, the Federal Tax Service may classify it as unclear.

If you doubt the correctness of filling out the details of the payment order, then remember that the Tax Code of the Russian Federation in paragraph 6 of Art.

32 obligated the tax authorities to provide all the necessary information to fill out orders for the purpose of paying taxes, fees, penalties and fines. Therefore, you can request all the necessary information from your tax office. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for paying fines

The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in the Tax Code of the Russian Federation. Such offenses include failure to meet reporting deadlines, failure to pay taxes on time, refusal to provide tax authorities with requested information, errors in registration procedures, etc. The amount of the fine is indicated in the decision or demand sent to the business entity.

Transfer of taxes, penalties and fines according to the decision of the Federal Tax Service is made in separate payments. It is unacceptable to combine these amounts in one order.

The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay. The latter can be sent a fine, the main thing is to meet the deadlines specified in the demand.