Groups of insurance rates

The insurance premium rate is the rate established by law by which the insurer’s obligations are calculated. Each type of contribution has its own tariff.

Conventionally, insurance premium rates can be divided into 4 groups:

- percentage - set as a percentage of the insurance premium base (for example: 22%, 5.1%, etc.);

- total - indicated in fixed amounts without reference to the base of insurance premiums (for example, fixed contributions of individual entrepreneurs for themselves);

- combined - are a combination of a percentage rate and a sum rate (for example, the rate of contributions for individual entrepreneurs for themselves with an income of more than 300,000 rubles).

Next, we will take a closer look at insurance premium rates for 2021.

Basic, reduced, additional tariffs

Tariffs for insurance premiums for 2021 are presented for clarity in the form of a table/diagram using information from the Tax Code of the Russian Federation for each type of contribution according to the following items:

- 425 (basic tariffs for the current year);

- 427 (reduced insurance premium rates);

- 428, 429 (additional tariffs).

For SMEs, from April 2022, reduced insurance premium rates apply:

Example from ConsultantPlus: In April 2021, an employee was accrued a salary for April - 20,000 rubles. and bonus for the 1st quarter - 10,000 rubles. Payments for April in excess of the minimum wage - 17,208 rubles. (30,000 rubles - 12,792 rubles). Contributions from wages for April within the minimum wage: on compulsory pension insurance... Get trial access to the K+ system and proceed to the calculation example to clearly understand the new procedure for calculating contributions. It's free.

Reduced insurance premium rates

| Policyholders | Rates |

| Non-profit organizations (except for state (municipal) institutions) on the simplified tax system, carrying out activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art, mass sports (with the exception of professional) | During 2022 - 2024: on OPS - 20.0%, in case of VNiM - 0%, for compulsory medical insurance - 0% |

| Charitable organizations on the simplified tax system | |

| Russian organizations operating in the field of information technology | Reduced rates: on OPS - 6.0%, for compulsory medical insurance - 0.1%, in case of VNiM - 1.5%, in case of temporary disability from payments to foreign citizens (stateless persons) temporarily staying in the Russian Federation (except for HQS) - 1.5% |

| Russian organizations designing and developing electronic components and electronic (radio-electronic) products | Reduced rates: on OPS - 6.0%, for compulsory medical insurance - 0.1%, in case of VNiM - 1.5% |

| Organizations that have received the status of participant in the Skolkovo project | For 10 years, starting from the 1st day of the month following the month in which the project participant status was received: on OPS - 14.0%, for compulsory medical insurance - 0%, in the case of VNiM - 0%. The benefit can be applied for less than 10 years |

| Organizations (IP) that received the status of participant in a free economic zone (FEZ) in the territories of the Republic of Crimea and Sevastopol | Reduced rates (at OPS - 6.0%, for compulsory medical insurance - 0.1%, for VNiM - 1.5%) apply to payments to employees involved in an investment project in the FEZ: - within 10 years from the date of receipt of the status of a FEZ participant - by payers who received this status before January 1, 2022 (the period is calculated from the 1st day of the month following the month of inclusion in the register of FEZ participants); - until the end of the existence of the SEZ - by payers who received the status from January 1, 2022, subject to a certain level of capital investment (tariffs apply from the 1st day of the month following the month of obtaining the status, but not earlier than January 1, 2022 G.) |

| Residents of the territory of rapid socio-economic development (TPSED), who received this status no later than three years from the date of its creation (with the exception of residents of PASED in the Far Eastern Federal District (hereinafter referred to as the Far Eastern Federal District)). Residents of PSEDA in the Far Eastern Federal District, who received their status before June 25, 2018 (inclusive) and no later than three years from the date of creation of the specified territory (provided that the volume of investments is at least 500 thousand rubles) Residents of PSEDA in the Far Eastern Federal District, who received their status from June 26, 2018 to December 31, 2025 (inclusive) (provided that the investment volume is at least 500 thousand rubles) | Reduced tariffs apply exclusively to individuals who are employed in new jobs created during the execution of an agreement on the implementation of activities. Reduced contribution rates apply for 10 years of residence: on OPS - 6.0%, for compulsory medical insurance - 0.1%, in the case of VNiM - 1.5%. 10 years are counted from the 1st day of the month following the month of registration as a TASED resident |

| Organizations (IP) that received resident status of the free port of Vladivostok (hereinafter referred to as FPV) before 06/25/2018 (inclusive) and no later than three years from the date of entry into force of the Federal Law of 07/13/2015 N 212-FZ “On the Free Port of Vladivostok” (provided that the investment volume is at least 5 million rubles). Organizations (IEs) that received FPV resident status from 06/26/2018 to 12/31/2025 (inclusive) (provided that the investment volume is at least 5 million rubles) | Reduced tariffs apply exclusively to individuals who are employed in new jobs created during the execution of an agreement on the implementation of activities. Reduced contribution rates apply for 10 years from the date of obtaining resident status: on OPS - 6.0%, for compulsory medical insurance - 0.1%, in the case of VNiM - 1.5%. 10 years are counted from the 1st day of the month following the month of registration as a resident of FPV |

| Organizations that are included in the unified register of residents of the Special Economic Zone (SEZ) in the Kaliningrad region in the period from 01/01/2018 to 12/31/2022 (inclusive) | Within seven years from the date of obtaining resident status (deadline - December 31, 2025): on OPS - 6.0%, for compulsory medical insurance - 0.1%, in the case of VNiM - 1.5%. Seven years are counted from the 1st day of the month following the month of inclusion in register of SEZ residents |

In addition to reduced contributions, the Tax Code provides for increased contributions for a number of taxpayers:

Separate additional tariffs are provided for in Art. 429 of the Tax Code of the Russian Federation for social security of flight crew members of civil aviation aircraft and certain categories of employees of coal industry companies.

The completeness, correctness and timeliness of payment of the above insurance premiums are supervised by tax officials.

Limit base for calculating contributions

Decree of the Government of the Russian Federation dated November 6, 2019 No. 1407 from January 1, 2020 established the maximum base for insurance premiums:

- 912,000 rub. - for compulsory social insurance in case of temporary disability and in connection with maternity;

- RUB 1,292,000 _ - for compulsory pension insurance.

For contributions to compulsory health insurance, the maximum base has not been established since 2015.

If the amount of payments to the employee exceeds the maximum base amount ( Article 421 of the Tax Code of the Russian Federation ):

· contributions for compulsory social insurance in case of temporary disability and in connection with maternity are not charged;

· contributions to compulsory pension insurance are charged at a rate of 10?%.

Insurance premium rates

Article 426 of the Tax Code of the Russian Federation provides that in 2022 - 2020, for persons who make payments and rewards to individuals (with the exception of payers for whom reduced insurance premium rates are established), the following insurance premium rates apply:

1) for compulsory pension insurance: - 22% - within the established maximum value of the base for calculating insurance premiums for this type of insurance; -10% - above the established limit value of the base.

These tariffs apply to payments to both Russian citizens and foreign citizens (with the exception of highly qualified specialists). In relation to workers (on the basis of an employment or civil law contract) citizens from member states of the EAEU, the tariff in force on the territory of Russia is applied in relation to payments to foreign citizens (temporarily residing or staying in Russia);

2) for compulsory social insurance in case of temporary disability and in connection with maternity within the established maximum base for calculating insurance premiums for this type of insurance - 2.9%, in relation to payments and other remuneration in favor of foreign citizens and stateless persons, temporarily staying in the Russian Federation (with the exception of highly qualified specialists in accordance with Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation”) - 1.8%;

3) for compulsory health insurance - 5.1%.

For the main category of payers, insurance premiums in the aggregate amount will be 30%.

Contribution rates according to Law No. 125-FZ

According to the law on compulsory insurance against industrial accidents and occupational diseases dated July 24, 1998 No. 125-FZ, contributions “for injuries” are paid.

These are mandatory payments transferred by policyholders to the Social Insurance Fund. Of these, individuals are paid compensation for harm to health (received while performing work duties).

This type of insurance premium (unlike those listed above) is not controlled by the tax authorities. They are supervised by social insurance.

The difference between this type of contribution and other mandatory insurance premiums lies in the special technology for determining them (individual approach).

The rates of insurance premiums for 2022 “for injuries” can be found in Art. 1 of the Law of December 22, 2005 No. 179-FZ.

In 2022 (as in previous years), 32 contribution rates “for injuries” are in effect - a separate rate for each class of professional risk.

The rate of contributions “for injuries” differs from other insurance premiums in the specific way they are established:

- for each policyholder, tariffs are set annually by social insurance specialists;

- their value depends on the occupational risk class of the organization’s main activity;

- the main type of activity must be confirmed by submitting to the Social Insurance Fund (annually no later than April 15) a package of documents (application for confirmation of the main type of activity, a confirmation certificate and a copy of the explanations to the balance sheet);

- in the absence of this package of documents, the fund’s specialists will independently set the contribution rate based on the type of activity with the highest class of professional risk.

Let's look at an example of how the rate of contributions “for injuries” depends on the presence/absence of confirmation of the main type of activity.

How is payment of insurance premiums verified?

The correctness and timeliness of payment of contributions is carried out through desk and on-site inspections. Since 2022, control over the payment of insurance premiums is carried out by the tax authorities, with the exception of contributions for injuries, these contributions are controlled by the Social Insurance Fund. We talked about this in detail in the article “Insurance Premium Reform.”

The Social Insurance Fund also retains:

- desk audits for reimbursement of social insurance funds at the request of the employer;

- Conducting on-site audits together with tax inspectors;

- consideration of complaints based on inspection reports.

Tax authorities monitor the correctness and timeliness of payment of insurance premiums using:

- desk audit of calculations of insurance premiums;

- reconciliation of accrued and paid amounts of insurance premiums;

- conducting on-site inspections, together with the Social Insurance Fund.

Example 4. What documents may be required when checking insurance premiums

The organization Karat LLC (general taxation system, type of activity - wholesale trade in automobile parts) received a decision to conduct an on-site inspection, the subject of which is the correctness of calculation and timely payment of insurance premiums, as well as the legality of the expenses incurred by the policyholder for the payment of insurance coverage for 2014-2017 year.

The following documents were required for the verification:

- labor and civil contracts;

- employment orders;

- work books;

- time sheets;

- payroll, payslips for wages;

- personal cards of employees;

- certificates of incapacity for work;

- application and order for maternity leave, calculation of the amount of benefits;

- documents confirming payment of monthly maternity benefits (copy of birth certificate, application for leave, order, calculation of the amount of benefits, certificate from the father’s place of work stating that he does not receive benefits);

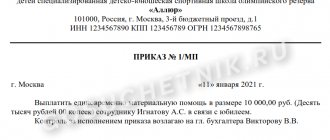

- orders for financial assistance and documents confirming the basis for its payment.

Also, the tax office and the Social Insurance Fund may request other documents related to the audit being carried out. On the day the inspection was completed, a certificate of the inspection was signed.

How to save on your tariff?

See how timely confirmation of the company’s main activity affects the rate.

Example 1

StroyProekt LLC received revenue last year in the following amount (by type of activity):

* The specialists of StroyProekt LLC took the occupational risk class from the appendix to the Order of the Ministry of Labor dated December 30, 2016 No. 851n.

** The rate of contributions “for injuries” is indicated in accordance with Art. 1 of the Law of December 22, 2005 No. 179-FZ.

Conclusion: the main activity of StroyProekt LLC is construction design - OKVED 41.10 (largest share of revenue: 31.24%). The insurance premium rate is 0.2.

No later than April 15, 2021, StroyProekt LLC should send the necessary papers to the Social Insurance Fund to confirm the main type of activity.

Find out how the Social Insurance Fund feels about postponing reporting deadlines from the publication.

Example 2

Let's change the conditions of example 1: StroyProekt LLC did not confirm the main type of activity.

As a result, the fund’s specialists independently established the insurance premium rate “for injuries” for StroyProekt LLC, choosing the maximum rate - 1.2.

Conclusion: the absence in the Social Insurance Fund of documents confirming the main activity of StroyProekt LLC has led to a situation where the company will have to pay contributions in an amount 6 times higher than the “confirmed” tariff.

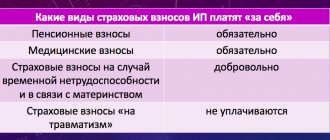

Tariffs for entrepreneurs

Individual entrepreneurs calculate and pay contributions according to two schemes:

- as employers (calculating insurance premiums from the income of their employees);

- for yourself (regardless of whether the individual entrepreneur has employees or not).

At the same time, the individual entrepreneur pays contributions to compulsory health insurance and contributions to health insurance for himself. This concludes the mandatory part for insurance premiums for individual entrepreneurs. But there remains the possibility of voluntarily paying contributions as part of insurance in the event of disability or in connection with maternity. When paying such contributions, the entrepreneur has the right to receive benefits upon the occurrence of an insured event (illness or childbirth).

Find out more about insurance premium rates for 2022 for individual entrepreneurs in the next section.

What responsibility does an employer bear for non-payment of insurance premiums?

In case of non-payment of insurance premiums, the employer bears tax, administrative and criminal liability.

Administrative liability for non-payment of insurance premiums - fine

Administrative liability for non-payment of insurance premiums is established only for officials of government agencies, as well as other organizations and institutions that keep budget records (Article 15.15.6 of the Code of Administrative Offenses of the Russian Federation). Administrative punishment is not directly provided for directors and other responsible persons of other organizations, although there is an opinion that they can be prosecuted under Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, which establishes liability for non-payment of taxes and fees.

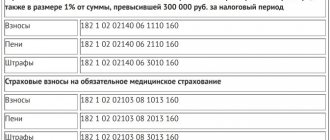

Tax liability for non-payment of insurance premiums - arrears, penalties, fines

They are brought to tax liability for non-payment, incomplete payment of contributions as a result of understating the base for calculating insurance premiums, and other illegal actions. This type of liability is the most common type of liability for non-payment of insurance premiums. And, as a rule, it entails simultaneously the collection of arrears (the amount of unpaid tax) from the employer and the accrual of penalties for each day of delay in payment, and also, at the same time, it is possible to impose a fine in the amount of 20% of the amount of unpaid insurance premiums, and if intentional non-payment - 40% of this amount. However, this penalty can be avoided. The Ministry of Finance clarifies the imposition of a fine for non-payment of insurance premiums in Letter No. 03-02-07/1/31912 dated May 24, 2017: “The inaction of the taxpayer, expressed solely in the failure to transfer to the budget the amount of tax specified in the tax return, does not constitute an offense, established by Article 122 of the Tax Code. In this case, penalties will be collected from the taxpayer.”

Thus, if you did not pay insurance premiums on time, but correctly reflected the accruals and submitted the calculation on time, no fine is imposed. You will only need to pay the arrears and accrued penalties. You can also avoid a fine if you incorrectly reflected the accruals, which led to an understatement of the tax base. To do this, you must first pay off the arrears and penalties that have arisen, and then submit an updated Calculation of insurance premiums. At the same time, the organization must detect the error before the tax office finds it and before it finds out that the inspectorate has ordered an on-site inspection (Article 81 of the Tax Code of the Russian Federation).

Example 5. What happens if the LLC does not pay insurance premiums

The organization LLC "Ikra" (general taxation system, type of activity - wholesale trade in fish, seafood and canned fish) paid insurance premiums for March 2022 in the amount of 10,000 rubles. 05/17/2018 (instead of 04/16/2018), thereby delaying payment by 30 days. The tax office sent a demand for payment of arrears in the amount of debt - 10,000 rubles. and a penalty. In this case, the penalties will be equal to: 10,000 rubles. x 7.25% (refinancing rate in effect during the period of delay) x 1/300 x 30 days. = 72.50 rub. The employer incurred tax liability for non-payment of insurance premiums in the form of penalties. Arrears and penalties have different BCCs, so they must be paid using different payment documents.

Criminal liability for non-payment of insurance premiums - fine, arrest, imprisonment

Criminal liability is borne by employers who, as in the case of tax liability, did not pay (did not pay in full) insurance premiums, did not submit a calculation, or included knowingly false information in it, which resulted in a distortion of the tax base on a large or especially large scale . If the employer committed this crime for the first time and fully paid the fine, all amounts of arrears and penalties, then he is released from criminal liability.

This type of responsibility is quite young. The prospects for introducing criminal liability for non-payment of insurance premiums have been considered since 2013, however, the article defining this type of liability was introduced by Federal Law No. 250 - FZ only on July 29, 2022.

Criminal liability for individuals for insurance premiums (Article 198 of the Criminal Code of the Russian Federation):

- imposition of a fine from 100 to 300 thousand rubles or in the amount of wages for a period of up to 2 years;

- compulsory work for up to one year;

- arrest up to 6 months;

- imprisonment for up to one year.

If this act is committed on an especially large scale, then the individual is punished:

- a fine of 200 to 500 thousand rubles. or in the amount of wages for a period of up to 3 years;

- compulsory work for up to 3 years;

- imprisonment for up to 3 years.

Combined tariff formula for individual entrepreneurs

Tariffs for compulsory pension insurance (OPI) in 2021:

- established in the form of a fixed payment (if the individual entrepreneur’s income does not exceed 300,000 rubles);

- are calculated in a combined way for income over 300,000 rubles. (fixed payment + percentage of excess income over the amount of 300,000 rubles).

In 2022, insurance premiums for OPS (SVOPS) are calculated as follows (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation):

If D ≤ 300,000 rub. → SVOPS = 32,448 rub.

If D > 300,000 rub. → SVOPS = 32,448 rub. + 1% × [D – 300,000 rub.]

At the same time, SVOPS for the billing period cannot exceed 8 times the fixed amount of insurance premiums for compulsory health insurance.

In other words, if the income of an individual entrepreneur for 2022 did not exceed 300,000 rubles, he does not need any calculations. He will take the amount of insurance premiums for compulsory insurance from the Tax Code of the Russian Federation: 32,448 rubles. If the limit is 300,000 rubles. exceeded, it is impossible to do without calculation. For an example of such a calculation, see below.

Who is required to pay insurance premiums

The policyholder who pays wages and other payments in favor of the insured persons is obliged to pay insurance premiums (clause 1 of Article 419 of the Tax Code). The policyholder pays insurance premiums from the organization’s funds, without deducting this amount from the employee’s salary.

In this case, the insurers include:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

For example, individual entrepreneurs who have employees on their staff are required to pay insurance premiums from employee payments at generally accepted rates. Please note that in addition to insurance premiums for employees, individual entrepreneurs are required to pay insurance premiums for themselves (clause 2 of Article 419 of the Tax Code of the Russian Federation).

Calculation of contributions using the combined tariff formula

Let's figure out the calculation of pension contributions for individual entrepreneurs' income in 2021 over 300,000 rubles.

Example 3

Individual Entrepreneur E.T. Krasilnikov applies a general taxation system and works without the involvement of hired labor. Its performance indicators in 2021:

- income - 5,638,339 rubles;

- expenses - 4,060,788 rubles.

Thus, to calculate contributions to compulsory pension insurance, the income of individual entrepreneur E.T. Krasilnikov (reduced by the amount of expenses) amounted to 1,577,551 rubles. (5 638 33 – 4 040 788).

Since RUB 1,577,551 exceeds 300,000 rubles, E.T. Krasilnikov needs to apply the formula to calculate the amount of contributions to the compulsory pension insurance for 2021:

SWOPS = 32,448 + 1% × (1,577,551–300,000) = RUB 45,223.51.

The deadlines for paying contributions for yourself differ from the deadlines for paying contributions for employees, as well as from the deadlines for transferring 1% of income over 300 thousand rubles.

A ready-made solution from ConsultantPlus will help you avoid making mistakes in your calculations. Get free demo access to K+ and get tips from the experts.

Get acquainted with various calculation formulas using the articles:

- “By what formula and how to calculate profitability?”;

- “Financial stability coefficient (balance sheet formula)”;

- "Financial leverage ratio - formula for calculation."

Results

Insurance premium rates are established by law as a percentage or a fixed amount (individual entrepreneurs’ contributions for themselves with an income of no more than 300,000 rubles) or combine percentage and fixed tariffs (individual entrepreneurs’ contributions for themselves with incomes over 300,000 rubles). Contribution rates (basic, reduced and additional) are established in the Tax Code, and the procedure for determining tariffs “for injuries” is established by Law No. 125-FZ of July 24, 1998.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.