How to reflect granted loans in accounting?

We already know how to keep ACCOUNTING for CREDITS AND LOANS RECEIVED.

What should we do if we issue the loan? We'll figure out!

It all depends on whether it will be interest-bearing or interest-free.

An interest-bearing loan was provided.

When we lend money at interest, it is assumed that it will bring us economic benefit. This implies the following: according to clause 2 of PBU 19/02, the provision of an interest-bearing loan is regarded as a financial investment. Therefore, it is taken into account

As you may have guessed, when issuing a loan with interest, the company is obliged to accrue interest on a monthly basis and recognize it as income from ordinary activities (if the company specializes in this), or, which is most often found in most companies, as other income (p. 34 PBU 19/02).

In the first

In this case, the accounting entry will be:

At the second

option:

“On 11.11.XX LLC “RSK” (Borrower) and LLC “Chance” (Lender) entered into loan agreement No. 10 dated 11.11. XX. for the amount of 600,000 rubles. for a period of 6 months at 8% per annum. 12.11 d/s under loan agreement No. 10 dated 11.11. XX were received in full by the account of RSK LLC.

Accounting with the lender for November:

An interest-free loan was provided.

In the case of a loan where interest is not provided, there is no economic benefit for the lender, and, therefore, it will not be considered a financial investment.

Therefore, the account for accounting for such transactions will be different:

Accordingly, if in our example, which we discussed above, we partially change the conditions and accept that the same loan agreement does not provide for interest, the journal entries will be slightly different.

Accounting with the lender for November:

If the loan is issued to an employee of the organization.

Such loans are recorded in the account

Otherwise the wiring will be the same as described above.

But I want to warn you! It is no secret that interest-free loans issued to employees are common in many companies.

What are the risks of such operations?

Let's count:

“On 06.11.XX, employee Vetrov received an interest-free loan in the amount of 450,000 rubles from his employer, Chance LLC. for a period of 10 months. Let us assume that the refinancing rate is 8%.”

Now let’s determine how much Vetrov’s income will be subject to personal income tax in November.

NB

= (450,000 x 2/3 x 8%)/365 x 24 days =

1578.08

Thus, the accountant of Chance LLC must accrue and transfer to the budget on 11/30/XX

Personal income tax

=

1578.08 x 35% = 552.33 rub.

But is it always necessary to withhold personal income tax of 35% on interest-free loans?

No not always.

If the loan is provided for the construction or purchase of a house, apartment, room, or land plots in the Russian Federation. But provided that the employee has the right to a property tax deduction.

Also, material benefits from transactions with bank cards are not taxed during the interest-free period established by the agreement.

As you can see, there are plenty of difficult situations that, due to incorrect accounting, can lead to tax risks. And to clearly know the correctness of accounting in a given case is our primary task. And for this you need to have comprehensive knowledge and practical skills, which, in fact, is what our Accounting courses provide.

| Author of the article: Matasova Tatyana Valerievna - expert on tax and accounting issues; — practicing accountant, auditor and tax consultant; — Member of the “Chamber of Tax Advisors”; — teacher of corporate and open seminars on Russian accounting and taxation. |

Tax accounting

The object of taxation for income tax for Russian organizations that are not members of a consolidated group of taxpayers is profit, defined as the difference between the income received and the amount of expenses incurred, which are determined in accordance with Chapter 25 of the Tax Code of the Russian Federation (Article 247 of the Tax Code of the Russian Federation).

At the same time, funds transferred under the loan agreement, as well as those received to repay the loan, do not take part in the calculation of taxable profit (clause 12 of article 270 of the Tax Code of the Russian Federation, clause 10 of clause 1 of article 251 of the Tax Code of the Russian Federation).

At the same time, the norms of paragraphs. 2 p. 2 art. 265 of the Tax Code of the Russian Federation allows the amounts of bad debts to be taken into account as non-operating expenses, and if the taxpayer has decided to create a reserve for doubtful debts, the amounts of bad debts not covered by the reserve funds.

Note that the creation of a reserve for doubtful debts in tax accounting in the manner prescribed by Art. 266 of the Tax Code of the Russian Federation, is the right of the organization (clause 3 of Article 266 of the Tax Code of the Russian Federation, in addition see letter of the Ministry of Finance of Russia dated May 16, 2011 N 03-03-06/1/295). Taxpayers using the accrual method include the amounts of contributions to this reserve as part of non-operating expenses on the last day of the reporting (tax) period (clause 3 of Article 266, subclause 7 of clause 1 of Article 265 of the Tax Code of the Russian Federation).

Reference

According to paragraph 1 of Art. 266 of the Tax Code of the Russian Federation, a doubtful debt is any debt to the taxpayer arising in connection with the sale of goods, performance of work, provision of services, if this debt is not repaid within the time period established by the agreement and is not secured by a pledge, surety, or bank guarantee.

Relationships for the interest-free provision of a loan do not have any signs of a service (clause 5 of Article 38 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 10, 2011 N 03-01-15/3-51, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 3, 2004 N 3009/04) .

According to the explanations of the Ministry of Finance of Russia, the possibility of an organization creating a reserve for doubtful debts under loan agreements of the Tax Code of the Russian Federation is not provided for (letter of the Ministry of Finance of Russia dated May 12, 2009 N 03-03-06/1/318).

At the same time, there are examples of court decisions that allow taxpayers to form a reserve for doubtful debts in relation to debt on interest-free loans (resolution of the Federal Antimonopoly Service of the Ural District dated January 11, 2008 N F09-10201/07-S2 (the decision of the Supreme Arbitration Court of the Russian Federation dated May 15, 2008 N 4335/08 was rejected in transfer to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the manner of supervision), FAS of the Volga-Vyatka District dated 02.22.2007 N A29-1496/2006a (by determination of the Supreme Arbitration Court of the Russian Federation dated 18.06.2007 N 6926/07, the transfer to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in supervision order)).

However, it should be taken into account that in the given examples of arbitration practice, the judges proceeded from the wording of paragraph 1 of Art. 266 of the Tax Code of the Russian Federation, in force until it was amended by Federal Law No. 58-FZ of 06.06.2005, which did not indicate that debt arising in connection with the sale of goods, performance of work, or provision of services is considered doubtful. No more recent materials from arbitration practice on the creation of a reserve for doubtful debts in relation to debt under loan agreements have been found.

Thus, we believe that the organization in the situation under consideration does not have the right to create a reserve for doubtful debts in tax accounting in relation to funds not repaid within the prescribed period under the loan agreement. However, this circumstance does not deprive the organization of the right to take into account the amount of bad debts in the prescribed manner when forming the tax base for income tax.

Reference

Based on clause 2 of Art. 266 of the Tax Code of the Russian Federation, bad debts (debts that are unrealistic for collection) are those debts to the taxpayer for which the established limitation period has expired, as well as those debts for which, in accordance with civil law, the obligation has been terminated due to the impossibility of its fulfillment, on the basis of an act of a state body or liquidation of the organization.

Bad debts (debts that are unrealistic for collection) are also debts, the impossibility of collection of which is confirmed by a resolution of the bailiff on the completion of enforcement proceedings, issued in the manner established by the Federal Law of 02.10.2007 N 229-FZ “On Enforcement Proceedings”, in the case return of the writ of execution to the claimant on the following grounds:

- it is impossible to establish the location of the debtor, his property or to obtain information about the availability of funds and other valuables belonging to him in accounts, deposits or deposits in banks or other credit organizations;

- the debtor does not have any property that can be foreclosed on, and all measures taken by the bailiff that are permissible by law to find his property were unsuccessful.

The provisions of Chapter 25 of the Tax Code of the Russian Federation do not contain any restrictions on the recognition of bad debt on a loan. The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 15, 2008 N 15706/07 also states that the Tax Code of the Russian Federation does not contain any restrictions for including bad debts in non-operating expenses, depending on the type and nature of the previously completed business transaction.

At the same time, the letter of the Ministry of Finance of Russia dated March 23, 2009 N 03-03-06/1/176 regarding the debt under the transaction for the acquisition of the right of claim states that the debt on such a debt cannot be taken into account for profit tax purposes in accordance with paragraphs . 2 p. 2 art. 265 of the Tax Code of the Russian Federation, since it is not related to the sale of goods (work, services). This conclusion indirectly indicates that tax authorities may object to writing off debt under a loan agreement for profit tax purposes on the basis of paragraphs. 2 p. 2 art. 265 Tax Code of the Russian Federation.

In addition, it should be taken into account that in this case the accounts receivable are associated with an interest-free loan agreement, that is, with a transaction that was not directly aimed at generating income, which comes into some conflict with the norms of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

Arbitration practice

From the analysis of arbitration practice, it follows that courts in some cases recognize it as legitimate to include bad debts in the form of receivables under interest-free loan agreements in non-operating expenses. At the same time, there are also examples of arbitration practice not in favor of taxpayers.

Thus, in the decisions of the FAS North Caucasus District dated March 27, 2013 N F08-1117/13 in case N A32-5142/2012, the FAS West Siberian District dated September 27, 2010 in case N A27-448/2010 (as determined by the Supreme Arbitration Court of the Russian Federation from 03/25/2011 N VAS-228/11 was refused to be transferred to the Presidium of the Supreme Arbitration Court of the Russian Federation for review by way of supervision), FAS North-Western District dated 02/08/2010 N F07-13508/2009 in case N A05-7369/2009, dated 12/17. 2009 N A05-4157/2009) the courts found it justified to write off bad debts arising from interest-free loan agreements due to the liquidation of the debtor organization.

In the decision of the Federal Antimonopoly Service of the Volga Region dated April 23, 2010 in case No. A72-15093/2009 (the decision of the Supreme Arbitration Court of the Russian Federation dated August 11, 2010 No. VAS-9226/10 refused to transfer to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the order of supervision), the courts recognized the writing off of bad debt as justified for an interest-free loan due to the expiration of the established limitation period.

At the same time, there are also examples of arbitration practice not in favor of taxpayers.

Thus, in the resolution of the Federal Antimonopoly Service of the North-Western District dated May 19, 2008 N A42-9501/2005, the court found the taxpayer’s expenses on an interest-free loan with an expired statute of limitations to be unjustified due to the fact that the provision of the loan is not related to the purposes aimed at generating income for the taxpayer.

And in the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated May 17, 2006 N A11-8632/2005-K2-25/484, it was concluded that the taxpayer unreasonably attributed to non-operating expenses the amount of an interest-free loan issued to an individual (later deceased) for the construction of a private housing, since such expenses are not related to the taxpayer’s activities aimed at generating income.

Thus, the question of the possibility of accounting for receivables under an interest-free loan agreement as expenses when forming taxable profit is ambiguous. We believe that if the operation to provide an interest-free loan in one way or another was aimed at generating income, then the lending organization, when fulfilling the other requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation may take into account the debt under this agreement as part of non-operating expenses during the period of occurrence established by clause 2 of Art. 266 of the Tax Code of the Russian Federation grounds for recognizing it as hopeless. However, it is possible that the organization will have to defend this point of view in court.

Features of taxation under loan agreements

Tax consequences for the lender.

If the lender organization applies the general taxation system, then the funds transferred under the loan agreement, as well as the amounts received for its repayment, are not taken into account as expenses and income (clause 12 of article 270, subclause 10 of clause 1 of article 251 Tax Code of the Russian Federation). The returned amount of the principal debt does not apply to income on the basis of paragraphs. 10 p. 1 art. 251 Tax Code of the Russian Federation. An exception would be a situation where a previously issued loan was duly recognized as a bad debt. This is possible if the statute of limitations has expired, the debtor organization has been liquidated (the corresponding entry has been made in the Unified State Register of Legal Entities), or the debtor organization has been declared bankrupt and the court ruling on the end of bankruptcy proceedings has entered into force. Under such conditions, a bad debt can be classified as non-operating expenses (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation).

The amount of interest due, in contrast to the repaid debt, is non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation) and will be taken into account for tax purposes in accordance with clause 1 of Art. 346.15 Tax Code of the Russian Federation. The date of recognition of such income is the day the funds are received into the bank account or cash register.

Operations for the provision and repayment of loans in cash are not subject to VAT (subclause 1, clause 2, article 146, subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation). Let us emphasize once again that there will be no VAT only if the form of the loan is monetary, but not in the form of things.

Tax consequences for the borrower.

In the event that he applies the general taxation system, receiving a loan is not recognized as income (clause 10, clause 1, article 251 of the Tax Code of the Russian Federation), and the return is not recognized as an expense (clause 12, article 270 of the Tax Code of the Russian Federation).

If the borrower applies a simplified taxation system, then the receipt of a loan is still not recognized as income (clause 1, clause 1.1, Article 346.15 of the Tax Code of the Russian Federation), and its return is not recognized as an expense, since this type is not indicated in the closed list given in clause 1 art. 346.16 Tax Code of the Russian Federation.

Sometimes taxpayers-organizations have a question about whether an interest-free loan will provide material benefits from saving on interest. The reason for the question is a similar situation when using interest-free loans by individuals. In relation to personal income tax, tax legislation considers savings on interest as a benefit and requires the calculation and payment of tax. However, despite the similarity, the situation is more favorable for legal entities. Savings on interest when using an interest-free loan do not form a tax base, and such savings are not subject to taxation (Letter of the Ministry of Finance dated 02/09/2015 No. 03-03-06/1/5149).

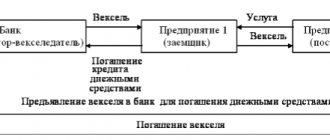

We reflect the issuance or receipt of an interest-free loan

When issuing an interest-free loan, it is impossible to display its investment property, since it does not generate commercial income. Therefore, the operation is carried out on account No. 76 - settlements with debtors and creditors. Since these operations do not imply the receipt of income, then when issuing or receiving money, the loan amount is not subject to value added tax.

For the borrower, these amounts are displayed as loans issued, on which no interest is charged. A loan can be subject to VAT only if the assistance is in actual size: materials, raw materials and other valuables. The tax will be calculated from the monetary value of the loan object.

An interest-free loan was issued - how to reflect this in transactions

However, a loan issued in cash may also be interest-free (Articles 809, 810 of the Civil Code of the Russian Federation). In such a situation, it loses the main feature (the ability to generate income), which allows it to be included in financial investments. How to show the borrower's debt in this case? It should be reflected as a regular debt of the counterparty for settlements not related to sales to him, i.e. using account 76.

Find out whether an interest-free loan is subject to income tax here.

Depending on whether the transfer of funds issued as a loan is made in rubles or in foreign currency, the entry - a loan was issued to another organization - without interest will take the form Dt 76 Kt 51 or Dt 76 Kt 52.

Since accrual of income is not provided, records of transactions for recording interest and for their payment will not appear. That is, until the debt is repaid, its amount will be listed in the debit of account 76. The return will be reflected by the reverse entry to the one with which the debt was registered: Dt 51 (52) Kt 76.

Thus, in a situation where another organization has been issued an interest-free loan, the entries for it will only reflect its occurrence in accounting and write-off when the funds are returned.