Today, many businessmen, when registering an enterprise for tax purposes or registering as individual entrepreneurs, choose a simplified taxation regime. This is not surprising: this system is the simplest and most convenient for tax calculations and payments. In addition, thanks to its wide capabilities, depending on the situation, it allows you to optimize taxation in various ways. However, like any other tax system, it has its own characteristics and nuances. They must be studied before finally settling on the “simplified” version. And although it is impossible to foresee everything in advance, a preliminary analysis of the simplified tax system allows you to avoid many unpleasant situations and misunderstandings in the future.

However, as practice shows, difficult moments sometimes still happen. For example, in those fairly common cases when the customer paid an advance, but for some reason the buyer/consumer of services was forced to return it. What to do in this situation, how to return the advance and formalize this action correctly? Let's talk about this in more detail.

Advance Refund: Basics

Experienced accountants are well aware that when “simplified”, the process of repaying an advance payment requires a careful approach and careful execution. It is necessary to correctly reflect all actions in the relevant documents, as well as indicate this fact in accounting and tax records. In the future, this will contribute to the correct calculation of the single tax.

But, let's start in order. First of all, we decide what an advance is or, in other words, a deposit.

In tax accounting, the advance is considered income.

And if so, then in accordance with the Tax Code of the Russian Federation, it does not need to be included in the tax base only if the subject of taxation, that is, an enterprise or individual entrepreneur, uses the accrual method when accounting for income and expenses.

With the cash method of calculation, an advance can be included in income only during the period of its immediate receipt. In order for an enterprise or organization to take advantage of the right to reduce the tax base during the period when the advance payment was made, they need to have the following documents:

- original bank statement clearly confirming the fact of transfer of funds;

- a document stating that the contract for the delivery of goods or provision of services, under which the advance was received, has been terminated;

- information from the book of income and expenses about the payment order, where in the line “purpose of payment” it should be written that the deposit was returned to the counterparty with the obligatory indication of the contract number that served as the justification for receiving the advance.

Let's consider options for returning prepayments in different situations, depending on the tax periods when they were received and returned.

Simplified tax system with the object “income”: return of goods

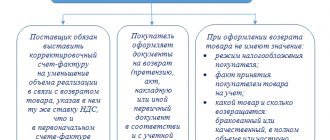

The return of goods can be made for various reasons: poor quality, delivery at the wrong time, or a defective batch. The return of goods has its own characteristics in terms of tax accounting, depending on the selected object of taxation.

In accordance with the Civil Code of the Russian Federation, it is possible to return both goods of inadequate quality and goods of proper quality. According to paragraph 2 of Art. 475 of the Civil Code of the Russian Federation, in the event of a significant violation of the requirements for the quality of goods, the buyer has the right, at his choice:

- refuse to fulfill the purchase and sale agreement and demand the return of the amount of money paid for the goods;

- demand replacement of goods of inadequate quality with goods that comply with the contract.

If we are talking about the sale of goods to individuals, then their interests are regulated and protected by legislation on the protection of consumer rights. The buyer has the right, within fourteen days from the moment the non-food product is transferred to him, unless a longer period is announced by the seller, to exchange the purchased product of good quality at the place of purchase and other places announced by the seller for a similar product of a different size, shape, dimension, style, color or complete set, making the necessary recalculation with the seller in case of a difference in price (clause 1 of Article 502 of the Civil Code of the Russian Federation, clauses 1, 2 of Article 25 of the Law of the Russian Federation of 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights”).

The legislation does not contain the concept of low-quality goods, but there is the term “defects of goods”, which means:

- external damage noticeable at first glance;

- external damage or deficiencies that are not noticeable at first glance under the original packaging are hidden defects.

Hidden defects are the most obvious manufacturing defect, associated with a violation of production technology, but not visually noticeable and appear only when opening the factory packaging.

GOOD TO KNOW

From a technical point of view and from the point of view of documents, it is important to correctly formalize the delivery, and the type of documents taking into account the requirements for details on the basis of Art. 9 of Law No. 402-FZ “On Accounting” is established by counterparties independently. However, it is advisable to specify in detail what documents are used to document the acceptance, delivery and return of goods.

In addition, you can return high-quality goods, but for this it is advisable to include relevant provisions in the contract. The parties have the right to include in the contract any condition that does not contradict the law or other legal acts (clause 4 of Article 421 of the Civil Code of the Russian Federation). Accordingly, the supply agreement can provide for the buyer’s right to return goods of proper quality to the supplier.

In order to reduce the risks associated with returning goods, as well as the risks of legal disputes, it is necessary to draw up the contract correctly:

- indicate in the contract the terms allotted for the return of goods and acceptance of goods for quality;

- establish a procedure for identifying hidden product defects;

- determine the procedure for incurring costs associated with returning goods;

- indicate in the contract what specific documents are used to document the return of the goods.

GOOD TO KNOW

The return of goods should be formalized as a normal termination of the contract (by the buyer drawing up and consideration by the supplier of a claim, the signing by the parties of a report on identified deficiencies, and the return of funds to the buyer).

Payment for the goods and its return occurred in the same tax period

Regardless of whether a high-quality or low-quality product is returned, the revenue of the current reporting period should be reduced by the amount returned to the buyer. If the return of goods and the refund of funds were carried out in the same period, then it is possible to simply adjust the income. The return of goods will not be reflected in any way on the tax base. This position is also confirmed by the courts (decrees of the FAS of the East Siberian District dated 10/09/2013 No. A33-15601/2012, FAS of the Volga District dated 02/12/2013 No. A65-14995/2012).

POSITION OF THE FTS

If a party refuses to fulfill the contract, the necessary adjustments in tax accounting should be made for the period in which the implementation occurred, i.e., the correction of the error (distortion) should be reflected in the tax accounting.

— Letters from the Federal Tax Service of Russia for Moscow dated March 11, 2012 No. 16-15/ [email protected] , Letters from the Federal Tax Service of Russia for St. Petersburg dated March 24, 2006 No. 02-06/07199.

Payment for the goods and their return occurred in different tax periods

There is another situation when, for example, an advance or the full amount under the contract was received in one tax period, and the shipment and, accordingly, the return of the goods occurred in another. In this case, it is not entirely clear in what period the income should be reduced:

- when the funds are received;

- when the item was returned.

According to the Ministry of Finance of the Russian Federation, the taxpayer must take into account income from the sale of property when determining the tax base in the reporting (tax) period of their receipt. It is necessary to apply the procedure provided for in paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, according to which, in the event of a taxpayer returning advances received from buyers (customers), the income of the tax (reporting) period in which the return was made is reduced by the amount being refunded (letter dated 05/07/2013 No. 03-11-11/15936) .

In the event of a refund in connection with termination of the contract, it is necessary to apply the procedure provided for in paragraph. 3 p. 1 art. 346.17 of the Tax Code of the Russian Federation, according to which, in the event of a taxpayer returning advances received from buyers (customers), the income of the tax (reporting) period in which the return was made is reduced by the refunded amount (letter of the Ministry of Finance of Russia dated March 25, 2013 No. 03-11-11/ 114).

According to the tax authorities, in this situation the seller should also submit updated tax returns to the tax authority (letter of the Federal Tax Service of Russia for Moscow dated March 11, 2012 No. 16-15/ [email protected] ).

In the accounting records of the supplier of the goods, upon receipt of the returned goods, the following adjustment entries must be reflected:

- reversal of entries to reflect sales revenue (Debit 62 Credit 90, sub-account “Revenue”) and write-off of the cost of goods (Debit 90, sub-account “Cost of Sales” Credit 41);

- reflection of transactions on acceptance of goods for accounting (Debit 41 Credit 60).

ORIGINAL SOURCE

If the taxpayer returns amounts previously received as advance payment for the supply of goods, performance of work, provision of services, transfer of property rights, the income of the tax (reporting) period in which the return was made is reduced by the amount of the refund.

— Paragraph 3, paragraph 1, art. 346.17 Tax Code of the Russian Federation.

What if you exchange?

Let's imagine a situation: the product was sold in December 2015, returned in January 2016, and in January the seller exchanged the product for a similar one, but of a different color. What will happen in this case?

The exchange of goods purchased by the buyer for a similar product of equal value was made in the next tax period (clause 1 of Article 346.19 of the Tax Code of the Russian Federation), in this case, in January there is no income or expenses taken into account for tax purposes, since the goods returned and transferred in exchange equal in sales price and acquisition cost. That is, there is no need to adjust the tax base.

Example.

LLC "Poshiv-2" sells its own clothing models. On October 15, 2015, a dress was sold to buyer A. A. Ivanova at a cost of 4,000 rubles. On October 16, 2015, the buyer contacted the seller with a statement that the style did not suit her.

It is necessary to make accounting entries on October 16, 2015 at the time of returning the goods:

| Debit | Credit | Amount (rub.) | Contents of operation |

| 41 | 62 (76) | 4000 | Goods returned by the buyer are accepted for accounting |

| 62 (76) | 50 | 4000 | Refunds for goods |

| 62 (76) | 90-1 | 4000 | STORNO Adjusted revenue for the current reporting period |

| 90-2 | 62 (76) | 4000 | REVERSE Adjusted cost of sales for the current reporting period |

Mixed cases are also possible when, for example, the entire batch of goods is returned to the seller, but the seller partially returns the money and partially sells goods of a different quality, color, or style.

In this case, the following entries will be made:

| Debit | Credit | Amount (rub.) | Contents of operation |

| 41 | 62 (76) | 40 000 | Goods returned by the buyer are accepted for accounting |

| 62 (76) | 50 | 10 000 | Refunds for goods |

| 62 (76) | 41 | 30 000 | The product has been replaced with another product |

It should be noted that if the period of purchase and sale coincides, in accounting it is enough to reverse the cost amounts. If the product was sold in the previous reporting period, then it is necessary:

- reflect the return as a decrease in the amount of income in a given period;

- restore the cost of goods that was previously written off;

- return the money to the buyer.

In addition, it is important to remember that all transactions must be documented.

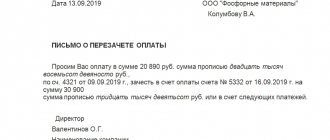

Example 1. Advance and return within one reporting month

On February 25, 2014, in our case, the Contractor, entered into an agreement with the organization “Curtains and Draperies,” that is, the Customer, for the sale of certain goods, subject to the payment of a 100% deposit.

On March 23, Curtains and Draperies transferred the required advance payment in the amount of 70 thousand rubles. As expected, it was taken into account in the tax base as income for the first quarter. But on March 29, they were forced to return this deposit, since, by mutual agreement of the parties, the contract was terminated.

Now the accountant must reflect this fact in the book of income and expenses. In section 1 of the book, in column 4, he must enter the amount of the returned prepayment with a minus value.

Since this entire operation occurred in one quarter, that is, in one tax period, it does not affect the size of the advance payment in any way. And if so, then there is no need to pay tax to the state treasury on this prepayment.

Refund from the supplier upon registration

We advise you to attach to the letter to the tax authorities confirmation of payment of money to the supplier and their return. You can also get a letter from the supplier stating that he returned the amount received and did not charge you VAT, did not ship goods, work, or services against this amount.

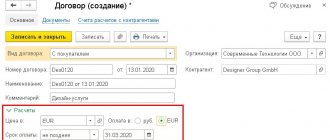

When deciding whether to include certain receipts in taxable income, it is important not to make a mistake in the date of their receipt. And if we are talking about income in kind or in foreign currency, it is necessary to correctly determine the amount on which you will have to pay tax. This recommendation will help you understand everything.

Example 2. Advance and return in different quarters

The situation is somewhat more complicated if the prepayment is returned in different quarters. Let's look at the situation with the same companies mentioned above, but let's just change the conditions a little.

Let’s assume that the deal was again concluded on February 23, the money was transferred on March 23, but due to circumstances, the contract was terminated on April 17, and the advance was returned on April 24.

Thus, if “Tables and Chairs” saw an advance payment on its accounts in March, but already returned it in April, then the income for April should be reduced by the amount of this returned deposit. By the way, in this case there is no need to recalculate the tax base for the first quarter.

Since all operations for receiving and returning funds occur in different tax periods, the company will need to pay advance payments to the treasury from the previously paid deposit. True, then all this can be compensated by reducing the income received in the second quarter by the amount of the prepayment.

Are refunds of advances from suppliers included in income under the simplified tax system?

As a general rule, it is not allowed to re-reflect the amount previously taken into account by the organization in income (clause 3 of Article 248 of the Tax Code of the Russian Federation). The organization will be able to recognize the advance payment transferred to the supplier using the simplified tax system as an expense only after goods (work, services) have been supplied to it (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). Until then, the corresponding amount will be listed in the buyer’s tax records as his property.

We recommend reading: What benefits do citizens living in the Chernobyl Exclusion Zone enjoy?

An organization using the simplified tax system with the object “income minus expenses” transferred an advance to the supplier, which was later returned due to termination of the contract. Should this income be included in income?

Example 3. Advance and return with a difference in the reporting period of one year

All the same characters. Only now “Tables and Chairs” returns the deposit in an even later tax period - January 19, 2015. Here the procedure will be the same as in the second example, however, “Tables and Chairs” will return the amount of the advance payment returned to “Curtains and Draperies” should be excluded from income received in the first quarter of 2015. However, if the income in a given tax period is small or non-existent, then it will not be possible to take into account the refund.

Refund of money by the supplier upon registration

Question:

Are the following receipts taken into account in income under the simplified tax system: return of funds from a terminated transaction, return of overpayments from suppliers, receipt of money from the Social Insurance Fund (return of child care benefits and sick leave)?

In the case of an advance refund, the income of the tax (reporting) period in which the refund was made is reduced by this amount. As we said above, this rule is established by the Tax Code of the Russian Federation. This procedure for reducing income applies to both taxpayers using the simplified tax system with the object “income minus expenses” and to “simplified” taxpayers who have chosen the object “income”. This rule provides the taxpayer with the opportunity, when returning an advance payment, to exclude from the object of taxation the income that was actually not received in the tax period when the advance payment was returned to the counterparty. In this case, the return of the advance cannot be considered as expenses and is not a loss of previous periods.

We recommend reading: What benefits do labor veterans on Sakhalin receive and are entitled to?

Question and answer: is it necessary to submit a “clarification”?

As the law states, if an entrepreneur or organization uses a simplified regime in its taxation, then when returning amounts that were previously paid as a deposit for any transaction, a reduction in income in the corresponding tax period must be made by their amount.

In the book of income and expenses, where this operation must be reflected, the advance must be shown with a minus sign (1 section, 4 columns). If everything is done in the above order, then you will not need to submit an updated declaration to the tax office.

But! In some cases problems may arise. In particular, when during the period of return of the deposit the individual entrepreneur or organization’s income turned out to be lower than the refundable prepayment or there was no income at all. In this case, a negative basis appears for calculating the “simplified tax”, which always arouses suspicion among representatives of the tax authorities.

Attention! If just such a situation arises, as an argument in favor of fair tax assessment, one should keep in mind the decision of the Federal Antimonopoly Service of the North Caucasus District No. A53-24985/2010 dated September 9. 2011. In it, the judges precisely ruled that the legislator does not in any way limit or prohibit enterprises and organizations on the “simplified tax” from filing a declaration with the tax authorities with data on the return of tax amounts in the event that the amount of the deposit was in the previous period and returned in the present, exceeds the amount of income for the current tax period.

Thus, if partner companies, after concluding an agreement on a transaction, break it for some reason, but one company has already paid an advance to the other, then the matter of returning the deposit should be approached very carefully. It’s good if the matter happens in one quarter, but if suddenly the operation stretches over several tax periods, then when returning the nuance, you need to take into account a number of features at once. And if any misunderstanding suddenly arises, it is better not to act at random, but to seek clarification from more experienced accountants or tax service specialists.

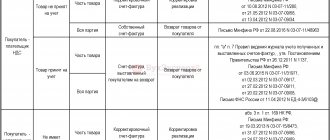

If the buyer returns the entire shipment of goods

If a “simplified” buyer returns all the goods (no matter whether he has received them or not), the seller does not need to prepare an adjustment invoice. To apply the deduction in the purchase ledger, he must record the invoice issued for the returned shipment of goods when it was shipped. The invoice is registered during the period of returning the goods and receiving the relevant documents from the buyer.

See also “What are the features of returning goods with VAT under the simplified tax system?”

IP on usn returns funds to the buyer

The content of the article

Refund of the prepayment to the buyer under the simplified tax system. I, as an individual entrepreneur working under the simplified tax system of 6% of income, carried out ch.z. bank account for payment of goods. Due to the impossibility of providing me with the paid goods, the client returns it to me for payment. invoice the full amount back with the wording "Refund of funds." Question: is the returned amount income received on the river? sch. and do I have to pay 6% tax on this amount? no, you do not have to pay tax By virtue of paragraph 1 of Art. 346.15 of the Tax Code of the Russian Federation, under the simplified system, takes into account income from sales and non-operating income, the composition of which is determined in accordance with Art. 249 and art. 250 Tax Code of the Russian Federation. According to paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, the date of receipt of income is recognized as the day of receipt of funds to bank accounts and (or) to the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment) to the taxpayer in another way (cash method ).

How to take into account the return of funds to the client when registering income

Such clarifications are given to taxpayers who have chosen the object of taxation “income”. However, one can argue with the position of officials. Here, taxpayers should pay attention to Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 09.09.2021 N A53-24985/2021. So, the crux of the matter is this. The courts of the first and appellate instances came to the conclusion that losses for previous tax periods can only be taken into account by taxpayers applying the simplified tax system with the object “income reduced by the amount of expenses.” A loss is the excess of expenses over income. A “simplified” person with the object “income”, if the amount of returned advances exceeded the amount of income received, must put a dash in the tax return, since in fact no income was received.

Accordingly, when prepayments are received against a future delivery, they automatically fall into the “simplified” tax base.

How not to pay the simplified tax system for erroneously received r

According to information from the Ministry of Finance of Russia (Letters dated 05.18.2021 N 03-11-06/2/69, dated 07.07.2021 N 03-11-11/172, dated 01.18.2021 N 03-11-11/03, dated 09.08. 2021 N 03-11-04/2/159, currently in force), since the date of payment is important for calculating the tax base under the simplified tax system, receipt and expense documents are indicated as primary documents, which confirm the fact of receipt or transfer (transfer) ) cash: bank statements, payment orders, incoming and outgoing cash orders, receipts for incoming cash orders, cash and sales receipts, etc. Indication of contract details in the accounting book is not required.

Based on Art. 39 of the Tax Code of the Russian Federation, the sale of goods, work or services by an organization or an individual entrepreneur is recognized, respectively, as the transfer on a paid basis (including the exchange of goods, work or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for by the Tax Code of the Russian Federation, the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person - on a free basis.

We recommend reading: Find out the status of a student’s social card

Return of quality goods: supplier on the simplified tax system, buyer on the basis

Example 1 . In March 2022, the supplier shipped a batch of 1,000 products to the buyer. in the amount of 200,000 rubles. excluding VAT (“accounting” cost per unit of production is 150 rubles). According to the terms of the contract, the buyer has the right to return quality goods that he has not sold within three months from the date of delivery. The buyer, who is a VAT payer, exercised this right and returned the goods in the amount of 300 pieces to the supplier, and also presented VAT in the amount of 10,800 rubles. and issued an invoice.

Now let's move on to the seller's tax obligations. Let us recall that we previously concluded that the tax consequences of returning a quality product are the same as when returning a low-quality product, that is, the income tax payer must reflect:

25 Jul 2022 jurist7sib 425

Share this post

- Related Posts

- Taxable to Usn Compensation for Losses IP

- Psychiatrist when hiring

- Documents for registration of a voucher to a Military Holiday Home for a Pensioner of the Moscow Region of the Russian Federation

- How long does it take for wine to leave the body?

The tax office returned the overpayment, how to take it into account when taxing

These expenses ensure a reduction in the volume of the tax base if the object of the simplification is “income minus expenses” or the very amount of tax required for payment under the simplified tax system with the object “income”. If a company or individual entrepreneur wishes to continue to apply the simplified tax regime with the same taxable object, then the easiest way to use the resulting tax overpayment will be to take it into account in upcoming payments for the simplified tax itself.

Previously, the application was submitted in any form; a copy of the reconciliation report and payment order could be attached to it. The tax authorities are given 10 working days to consider the application and make a decision on it, and another 5 days to notify the taxpayer about it in writing. The application for tax refund is written in the form given in Appendix No. 8 (). Upon a positive decision, the Federal Tax Service issues an order to the Treasury to return the excess tax to the entrepreneur’s current account.

Returning goods to the supplier: accounting entries

The procedure for settlements under retail purchase and sale agreements is regulated by Ch. 30 Civil Code of the Russian Federation. Textiles, perfumes, jewelry, etc. cannot be returned. In other cases, the seller cannot refuse to accept the sold items. Let's take a closer look at how the return of goods is processed.

In accounting, the procedure for reflecting a return by the buyer depends on the moment the defect was discovered. If discrepancies are identified before the values are accepted for accounting, a report is drawn up and the goods are returned to the supplier. Ownership remains with the seller. The buyer credits the goods to off-balance sheet account 002 “Inventory in custody”, and when returned, writes them off from the credit. Posting DT51 KT76 reflects the receipt of money from the supplier for the claim. Thus, only three operations need to be displayed in the BU:

Refund of overpaid tax is income in case of taxation

Refunds of overpaid tax from the budget are made according to the rules established by Article 78 of the Tax Code of the Russian Federation. Paragraph 7 of this article determines that the amount of overpaid tax is subject to refund upon a written application from the taxpayer. If the taxpayer has arrears in the payment of taxes and fees or arrears in penalties accrued to the same budget (non-budgetary fund), the refund of the overpaid amount to the taxpayer is made only after the specified amount is offset against the arrears (debt). It is important! An application for a refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount. The refund of the amount of overpaid tax is made from the budget (non-budgetary fund) into which the overpayment occurred, within one month from the date of filing the application for refund.

- Taxation of reimbursement of agent expenses under the simplified tax system An organization applying the simplified tax system has concluded an agency agreement, according to which the agent enters into agreements with third parties, where they act on their own behalf, but at the expense of the principal.

Documents for processing the return of goods

If low-quality products are identified when returning goods from a simplified seller, you need to draw up special documents about the defects - a report. It is drawn up by the buyer or representative. A simplified person can return a product, but only if a justification for the return is drawn up for the OSN company that pays the tax.

The form of the act can be presented in the supply agreement or developed by the consumer. Based on the act, a claim is filed, and the person has the right to recover damages associated with the delivery of non-conforming goods.

When returning a defect that the consumer has accepted for accounting, in addition to the acceptance and transfer certificate, a TORG-12 form with a note is drawn up. This list of papers has been approved by judicial practice.

The invoice must indicate that a report on defects has been drawn up and a claim has been filed with the seller. It is recommended that the report be drawn up immediately after deficiencies have been identified. If the papers are drawn up correctly, the buyer increases the chance of confirming his position in court and may receive compensation. If the goods are returned by mutual agreement, a corresponding agreement must be signed.