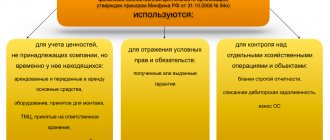

Why and how to correctly use the auxiliary account “00”

First, recall that auxiliary account 00 is a service account.

It is found only in accounting programs and is intended to enter opening balances into the program. When should you enter opening balances into the program? There are only three such cases:

- the organization is new and it is necessary to enter the first accounting entries;

- the organization is already operating, but accounting is done manually (or in another automated program);

- the organization is already operating, but accounting has not been maintained and account balances are unknown (accounting needs to be restored).

In the first case, you do not need to use account 00. To enter all balances, simple correspondence on accounting accounts is used. But in other cases you will need to use correspondence with a subsidiary account.

Balance sheet account 00 “Auxiliary account” is active-passive. The basis for using this account, as for other balance sheet accounts, is the principle of double entry. That is, when entering balances on balance accounts into an automated program, a posting must be made for two accounts.

Let us formulate the basic rules for using account 00:

- if the account for which the initial balances are entered is active, then the balance on it is reflected as a debit, and the auxiliary account 00 is entered as a credit and vice versa;

- if the account for which the balances are entered is active-passive, then the balance on it can be recorded by debit or credit in correspondence with the auxiliary account 00;

- Balances must be entered as of the last date preceding the start date of accounting. For example, if you need to start work on January 1, 2014, then the opening balances should be entered as of December 31, 2013;

- account balances in correspondence with account 00 must be entered in the context of subaccounts and analytical accounts;

- Based on the results of entering initial balances, it is necessary to create a balance sheet.

The correctness of filling out the balance sheet can be checked by checking the sum of the balances for all accounts (from 01 to 99) and for the auxiliary account 00. They must be equal.

In order to correctly form account balances, it is necessary to conduct an inventory of property and liabilities as of the date of formation of the initial balances.

We evaluate the authorized capital on the basis of constituent documents and reflect the amount in account 80 “Authorized capital”. We restore the founders' contributions (cash, fixed assets, materials, etc.) on the basis of relevant documents and reflect them in accounts 01 “Fixed assets”, 50 “Cash”, 10 “Materials” and so on.

Account 00 is used only in automated accounting programs and is intended for entering initial balances into the program.

Based on bank statements and cash book data, it is possible to determine the balance of funds in banks (the opening balance in accounts 51 “Cash Accounts” and 52 “Currency Accounts”) and the organization’s cash desk (the opening balance in account 50 “Cash Office”). If an organization has several current accounts, then the balances on bank statements must be added up.

Indicators for credit and loan accounts 66 “Short-term loans and borrowings”, 67 “Long-term loans and borrowings” can be confirmed if you reconcile settlements with debtors and creditors. In this case, it is necessary to determine data both on the amount of the principal debt and on the amount of interest accrued at the end of 2013.

The balance values at the end of the day on December 31, 2013 and at the beginning of the day on January 1, 2014 are the same.

Using reconciliation reports, information about the status of settlements with counterparties is restored. For each counterparty, receivables and payables are generated (account balances 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 76 “Settlements with various debtors and creditors”).

Here is a list of documents with which you can determine the amount of receivables and payables:

| Types of debt | Account correspondence | Documentation | |

| DEBIT | CREDIT | ||

| For advances issued for the supply of goods | 60.02 | 00 | Payment orders for the transfer of money to sellers (suppliers), incoming invoices and acts |

| By goods sold to customers | 62.01 | 00 | Bank statements, PKOs or cash receipts indicating the receipt of money from customers, outgoing invoices and acts |

| For loans issued | 76, 73 | 76, 73 | Loan agreements in which you act as a lender, bank statements, PKOs and cash register checks indicating payment of debt and interest |

| For issued accountable amounts | 71 | 00 | Expense cash orders and advance reports |

| For goods received from suppliers | 00 | 60.01 | Payment orders for the transfer of money to sellers (suppliers), incoming invoices and acts |

| For advances received from buyers | 00 | 62.02 | Bank statements, PKOs or cash receipts indicating the receipt of money from customers, outgoing invoices and acts |

| For loans received | 00 | 66, 67 | Loan agreements, payment orders for payment of debt and interest |

| To employees regarding the payment of wages, benefits and vacation pay | 00 | 70 | Payroll and payslips, sick leaves, vacation applications |

| Before extra-budgetary funds | 00 | 69 |

What is the closing balance (outgoing)

The ending balance is the total of movements in an account as of a certain date. This can be the end of any time period (month, quarter, year) or an arbitrary date. Let me remind you how to calculate the ending balance: you need to add the income turnover to the balance at the beginning of the period, and subtract the expense turnover. Moreover, the concepts of “income” and “expense” are not equivalent for active and passive accounts.

For example, if you generate a current account statement for any period in an accounting program, you can use simple arithmetic calculations to check this ratio: add the debit turnover to the balance at the beginning of the period and subtract the credit turnover - we get the opening balance.

And if we pick up the same statement generated by the bank, then all transactions will be reflected “in reverse”: the initial and final total in the bank statement is displayed for the loan, debit turnover reflects the expenses of the account holder, and credit turnover shows the receipt of money. What is this connected with? The fact is that for the bank our money is an attracted liability. Accordingly, movements of funds are reflected in passive accounts.

Entering initial balances. Account 000. Courses 1C Accounting

Place a link to this article on your website or social network page and receive 20% of the order of any registered user. For details, see the “Invite a Friend” form on the right.

Information: Visit the VKontakte group. Professional humor and useful information. Regular publications on 1C and other interesting topics

December 10, 2016

For novice users of 1C Accounting, especially if they are new to accounting, the operation of entering initial balances into the 1C Enterprise information base often causes difficulties.

Therefore, now we will understand what entering initial balances is and why this operation is needed in general.

I also recommend that you read the description of typical errors when working in the program.

Even now there are still people who keep their books on paper. When a company switches to 1C Accounting, it is required to enter balances, but this operation turns out to be unfamiliar. Why is this happening?

The thing is that the operation of entering initial balances has nothing to do with accounting itself. That is why people unfamiliar with accounting in a computer program have never heard of it. You can learn how to do your own bookkeeping here.

Entering initial balances is a purely technical auxiliary operation. Its purpose is to transfer the state of the company at the time of the start of accounting in the program to the 1C program.

Let me give you an example. Let's say there is a company (LLC or individual entrepreneur) created in 2010. From the moment the company was created, accounting was carried out on paper or in some kind of program.

Since the enterprise conducts business activities, various documents, reports, etc. accumulate. There are also goods, products in warehouses, cash in the bank and at the cash register.

Someone owes the company for goods supplied, and there is also debt from customers. And so on…

Let’s say that from January 1, 2015, it was decided to keep accounting records in 1C Accounting. We installed the program and created a database. However, there is nothing in the new database yet, i.e. the program does not yet “know” anything about the company’s previous activities. So, entering initial balances is the transfer of data to the new 1C Accounting information base.

Of course, not all data needs to be transferred. There is no need to re-enter all the company documents into 1C Accounting, starting from the moment of registration. All you need to do is transfer account balances. That is, if, for example, there are 1,000,000 rubles in a bank account, then this amount should be recorded in account 51. It's the same with

other accounts.

However, as any accountant knows well, if changes occur in one account of the chart of accounts, they must also occur in another. The principle of double entry cannot be violated.

Then in this case the question arises: if an amount of 1,000,000 rubles (yes, even 1 kopeck!) suddenly appeared on account 51, then where did this amount come from? This is not a bank loan, not payment from the buyer - this is already ours.

It turns out that money should seem to come out of nowhere!

The same question can be expressed more briefly: Dt=51 Kt=? 1,000,000

This is where the special auxiliary account000 comes to our aid. I’ll say right away that you shouldn’t look for it in the Chart of Accounts - this account exists exclusively in the 1C Accounting program and is intended to be inserted in transactions when entering initial balances. The wiring in the example above then becomes:

Dt=51 Kt=000 1,000,000

How to check whether opening balances are entered correctly

Of course, you noticed that as a result of such posting, a credit balance of 1,000,000 rubles was formed on account 000. Thus, when entering balances for active accounts in account 000, loan amounts accumulate.

And, as you might guess, when entering balances on passive accounts, the amounts in account 000 are accumulated as a debit. Since the fundamental accounting equation of Assets = Liabilities (A = P) must always be observed, the following is obvious.

Remember: after entering all balances, the ending balance on account 000 should be zero!

Thus, it is very easy to check the correctness of entering initial balances in 1C Accounting. It is enough to create a TSA (turnover balance sheet) for account 000. If the final balance on the account is zero, then the balances have been entered correctly. If not, then you will have to check the operations performed for errors. An example of OCB is given below.

artemvm.info_946abbece88fa26e7b9cd6be943fedfe

It should be noted that the SALT for account 000 allows you to check only the correctness of entering the total balances. If you make a mistake when entering quantitative balances (for example, the quantity of goods in stock), the program will not be able to detect this error.

In fact, entering balances is more difficult than it seems. Only the basic principle is described here. In fact, there are many features and, of course, there is a high probability of making a mistake when entering data. The 1C courses presented on this site will help you eliminate errors when entering initial balances.

Similar articles:

Use of maternity capital balances

Transferring balances from Tele2: how to share minutes, description, how to connect and disconnect

The balances of accounts 206.21, 206.34 (advances issued) were transferred from “1C: Accounting of a budgetary institution 8” - the documents “Operation (entering balances)” were created. When posting receipt documents – “

How to close a deposit in mobile Sberbank Online?

Post Bank - how to properly close a credit card?

Rules for calculating the final balance

So, how to calculate the final balance without errors? Here are the basic rules:

- The initial balance must be included in the calculation if available.

- All account transactions must be reflected correctly and in full.

- If a negative balance occurs (the accounting program highlights such balances in red), you need to check the data for errors.

The final balance of the active account is determined by the formula:

\[ S_{end.}=S_{start.}+O_{d}-O_{k}, where: \]

\( С_{con.} \) – final (outgoing) balance;

\( C_{beg.} \) – initial (opening) balance;

\( O_d \) – debit turnover for the period;

\( O_k \) – credit turnover for the period.

The final balance of an active account is equal to zero if the amount of income, taking into account the initial balance, is equal to the amount of expense.

For example, the buyer’s debt at the beginning of September is 112,500 rubles. ($1,500 or 43,500 UAH). In September, goods worth 37,500 rubles were shipped. ($500 or 14,500 UAH) and payment was received in the amount of 150,000 rubles. ($2,000 or 58,000 UAH). Thus, there is no final balance for settlements with the buyer.

For passive accounts the following formula is used:

\[ S_{end.}=S_{start.}+O_{k}-O_{d.} \]

The final balance of the liability account is zero if, on the reporting date, the obligations to the creditor are fully repaid. For example, in October the company entered into an agreement with a new supplier. On October 15, materials were received in the amount of 30,000 rubles. ($400 or 11,600 UAH), and on October 25 the same amount was paid. At the end of the month the balance will be zero.

If we made a mistake and paid 37,500 rubles. ($500 or 14,500 UAH), then a debit balance is formed in the amount of 7,500 rubles. ($100 or 2,900 UAH). This means that there has been an overpayment to the supplier, which can be returned by writing a letter to the counterparty asking for a refund, or offset against future deliveries.

Overpayment is not necessarily reflected in red. In the chart of accounts, all accounts reflecting mutual settlements are active-passive. If there is an overpayment on such an account, it will be reflected in debit as an advance.

But if in the accounts of some assets (cash or property) you see a negative balance, highlighted in red, there is clearly an accounting error. Perhaps some receipt transaction was not taken into account or an expense was reflected twice. Assets for which the balance under no circumstances should be negative include:

- Inventory assets.

- Fixed assets.

- Cash.

How to reflect losses of previous years in 1C 8.3 Accounting

Let's consider two situations to reflect losses of previous years in 1C Accounting 8.3:

- While working with the 1C 8.3 program, a loss arose for the current period, which must be transferred to the future.

- At the time of starting work with the 1C: Enterprise Accounting 3.0 program, it is necessary to reflect the presence of losses from previous years.

How should the loss of previous years be reflected in the program in both cases? How should the program behave in this case?

The occurrence of a loss while working in 1C

So, let's consider the first option: the loss in the period arose in the process of working with the 1C: Enterprise Accounting 3.0 program (note that this scheme also works for the previous edition of the 1C 8.3 Enterprise Accounting 2.0 program).

Based on the results of the activities of Moneta LLC in the fourth quarter of 2015, a loss was recorded in the amount of 235,593.27 rubles. In January 2016, a profit was made in the amount of 211,864.41 rubles.

Let's look at the results of document posting for December 2015:

As you know, we obtain the results of an organization’s financial activities as a result of automatic calculations using the Month Closing processing, which includes a list of necessary routine operations (menu Operations – Period Closing – Month Closing).

As we can see, the resulting loss for December is recognized as a deferred tax asset. The financial result in postings for the month amounted to 245,762.71 rubles:

To see the financial result for the entire tax period, we will generate a reference calculation Calculation of income tax (menu Operations – Reference calculations – Accounting and tax accounting – Calculation of income tax):

As can be seen from column 10 of the calculation certificate, the loss for the past 2015 amounted to 235,593.27 rubles.

Transfer of losses from previous years to the current period in 1C 8.3

First of all, in order to see the entire amount of ONA received for losses in 2015, we will create a balance sheet for account 09:

To transfer the loss of 2015 to the current year 2016, we will create a new document Transactions entered manually (menu Transactions - Accounting - Transactions entered manually) and fill it out as follows:

We will assign the balance of account 09 “Loss of the current period” to account 09 “Expenses of future periods”.

Get 267 video lessons on 1C for free:

The second line in the Transactions entered manually document will transfer the 2015 loss to deferred expenses in tax accounting (accordingly, a temporary difference will arise for the same amount).

Let's check the balance sheet for account 09 to see if this operation was performed correctly:

As can be seen from the above report, the balance for the loss of the current period is zero, while our amount of IT is allocated to the expenses of future periods.

And we will pay special attention to filling out the analytics of account 97.21, namely the Expense of the future period (the division is not filled in in the posting). In our case, this is the Loss of 2015:

After filling out the Transaction entered manually has been completed, let us pay attention to the month-closing operation for December of the year resulting in a loss:

As we can see from the picture, the documents need to be re-issued within a month. In this case, you must skip the operation:

And re-perform the Balance Reformation operation.

Reflection of profit in the current period

Let me remind you that in January 2016 the organization made a profit of 211,864.41 rubles.

Let's carry out the operation of closing the month for January 2016 in 1C 8.3. At the end of January, in 1C 8.3 we will generate a report on document postings. Write-off of losses from previous years:

And Calculation of income tax:

Entering initial balances of losses from previous years

In a situation where you start working with the 1C 8.3 program, while having a balance of losses based on the results of previous years, the sequence of entering the initial balances will be as follows:

- Let's reflect the balances of the deferred tax asset at the beginning of the year (we use the same numbers as in the first section of the article, the date for entering the balances is December 31, 2015):

To create the document Entering initial balances for account 09, go to the Main menu – Initial balances – Assistant for entering balances:

- Let's reflect the balance on account 97.21 for last year's losses:

It should be noted that the balance for the loss of the previous year must be entered into the system in a document separate from the rest of the balances under the BPR.

At this point, the entry of initial balances for the purposes of accounting for losses of previous years can be considered complete. I will only say that in the case where losses need to be transferred over several years, this should be made in separate entries: separately for each year.

Work in the current period

Let's see how the program will work in the current period if it makes a profit (the profit in this example was also received in January of this year and amounted to 211,864.41 rubles).

Let's carry out the month-closing operation for January and generate a transaction report for the operation Write-off of losses from previous years:

And operations Calculation of income tax:

Thus, profit for the current period was reduced by the amount of IT.

Unfortunately, we are physically unable to provide free consultations to everyone, but our team will be happy to provide services for the implementation and maintenance of 1C. You can find out more about our services on the 1C Services page or just call +7 (499) 350 29 00. We work in Moscow and the region.

Why and how to use the auxiliary account “00” correctly | About banks and finance

Creator: rechargeable. V. Lesina, accountant, for the publication “Practical Accounting”

: July 21, 2014

This article will be necessary for those who are switching to an automated form of accounting, and for those who are engaged in restoring accounting. The message will be sent about why a zero account is needed, how to use it correctly, how to correctly close balances on it, how to find and correct inaccuracies that appear when using the reserve account 00.

First, we note that the auxiliary account 00 is a service account. It is seen only in accounting programs and is recommended for entering opening balances into the program.

At what time do you need to enter opening balances into the program? There are only three such cases:

- the organization is new and you need to enter the first accounting entries;

- the organization is already working, but accounting is done manually (or in a second automated program);

- the organization is already working, but accounting records were not kept and the balances on receipts are little known (the records must be returned).

In the first case, it is not necessary to use account 00. To enter all balances, simple correspondence with accounting receipts is used. But in other cases you will need to use correspondence with a reserve account.

Balance sheet account 00 “Auxiliary account” is energetically passive. The basis for the use of this account, as for other balance sheet receipts, is the principle of double entry. In other words, when entering balances on balance sheet receipts into an automated program, a posting must be made for two receipts.

Let us formulate the main rules for using account 00:

- if the account for which the initial balances are entered is active, then the balance on it is reflected as a debit, and the auxiliary account 00 is entered as a credit and vice versa;

- if the account for which the balances are entered is active-passive, then it is possible to record the balance on it by debit or credit in correspondence with the reserve account 00;

- Balances must be entered as of the last date preceding the start date of accounting. For example, if you need to start work on January 1, 2014, then

All balances should be entered as of December 31, 2013;

- balances on receipts in correspondence with account 00 must be entered in the context of analytical accounts and subaccounts;

- Based on the results of entering the initial balances, you need to organize a balance sheet.

- the organization is new and it is necessary to enter the first accounting entries;

- the organization is already operating, but accounting is done manually (or in another automated program);

- the organization is already operating, but accounting has not been maintained and account balances are unknown (accounting needs to be restored).

You can check the correctness of filling out the balance sheet if you check the amount of balances on all receipts (from 01 to 99) and on the reserve account 00. They must be equal.

We determine the price of liabilities and assets

In order to correctly organize balances according to accounting receipts, you need to make an inventory of liabilities and property as of the date of formation of the initial balances.

We evaluate the authorized capital on the basis of the constituent documents and reflect the amount in account 80 “Authorized capital”. We restore the contributions of the co-founders (financial funds, fixed assets, materials, etc.) on the basis of the relevant documents and reflect them on receipts 01 “Fixed assets”, 50 “Cash”, 10 “Materials” and without that later.

Account 00 is used only in automated accounting programs and is recommended for entering initial balances into the program.

Based on bank details

records and cash book data, it is possible to find out the balance of funds in banks (the opening balance on receipts 51 “Settlement and” Currency 52 “accounts”) and the organization’s cash desk (the opening balance on account 50 “Cashier”). If an organization has a couple of payment receipts, then the balances on bank statements need to be added up.

Indicators on receipts of loans and borrowings 66 “loans and Short-term loans”, 67 “loans and Long-term loans” can be confirmed if you reconcile settlements with creditors and debtors. Along with this, it is necessary to find out these, both by the amount of the principal debt and by the amount of interest accrued at the end of 2013.

The balance values at the end of the day on December 31, 2013 and at the beginning of the day on January 1, 2014 are the same.

Through reconciliation reports, information about the status of settlements with agents is restored. For each agent, receivables and loan debt are generated (receipt balances 60 “Settlements with contractors and suppliers”, 62 “Settlements with customers and buyers”, 76 “Settlements with creditors and various debtors”).

Here is a list of documents with which it will be possible to find out the amount of receivables and loan debt:

Particular attention should be paid to unfinished capital investments. To create balances on account 08 “Investments in non-current assets”, go to raise all documents that are related to unfinished capital investments, summarize all costs and evaluate any unfinished object. Their price can be determined from primary documents.

If, for example, the construction of an object was entrusted to a contractor, a contract agreement, certificates of completed work, and payment orders for payment of their cost are needed. If the construction was carried out independently, then estimates, cash receipts, pay slips, invoices for vacation and purchase of materials will be required.

The inventory is needed to estimate the price of inventories (account 10 “Materials”), work in progress (account 20 “Main production”), finished products (account 43 “Finished products”) and other assets that have not only a cost, but also a quantitative assessment by condition as of January 1, 2014.

Balances of inventories have their own characteristics. Since it is necessary to first calculate the amount of raw materials, goods and materials, and after that the resulting result must be assessed in monetary terms. In a situation where a company stores a pair of homogeneous groups of goods, it is possible to use an average cost estimate. What if the organization has a huge

a nomenclature of various treasures, we suggest using the FIFO method to evaluate them. Note that with this method, raw materials transferred into production and goods shipped are valued at the price of the first ones at the time of acquisition. Accordingly, inventory balances should be valued at the price of the last purchased lots.

Please note: the method you use must be enshrined in the organization's accounting policies.

To apply the FIFO method, you must: count the quantity of goods or materials of a certain type, pick up the latest invoice by date for which this type was purchased.

If the quantity of inventory items is less than the quantity purchased on the invoice or corresponds to it, then the balances can be assessed at the cost mentioned in it.

What if the last time you bought less than what was available, then you also need to pick up the data from the previous invoice.

If the average cost method is used, then you will need to add up the balances on invoices in cost and quantitative terms, find the average unit price and calculate the price of inventory items.

After all balances are posted on receipts, it is necessary to calculate the debit and credit turnover on the reserve account 00, the difference between them should be attributed to account 84 “Retained earnings (uncovered loss).” This procedure is necessary.

If the amount on the credit of account 00 is greater than the amount on the debit, we make a posting:

DEBIT 00 CREDIT 84

– the organization’s retained earnings are reflected as of December 31, 2013;

If the amount on the credit of account 00 is less than the amount on the debit, we make a posting:

DEBIT 84 CREDIT 00

– the uncovered loss of the organization is reflected as of December 31, 2013.

We form initial balances based on receipts

Let's look at an example using the reserve account 00, and provide the documents on the basis of which records are made on receipts.

The date of formation of the initial balances is December 31, 2013.

Stalker LLC is switching to an automated form of accounting from January 1, 2014. At the end of 2013, the inventory working group completed an inventory, which resulted in the assessment of liabilities and assets.

DEBIT 00 CREDIT 80

– 800,000 rub. – the amount of the authorized capital is reflected on the basis of the charter;

– 982,374 rub. – the balance of funds in the current account is reflected based on the bank statement;

– 32,000 rub. – the balance of finished products in the warehouse is reflected on the basis of the inventory inventory;

DEBIT 41 CREDIT 00

– 100,000 rub. – the balance of goods in the warehouse is reflected on the basis of the inventory inventory;

DEBIT 62 CREDIT 00

– 5100 rub. – accounts receivable for goods sold to customers are reflected on the basis of an inventory of settlements with customers;

DEBIT 00 CREDIT 60

– 41,800 rub. – the loan debt for goods taken from the supplier is reflected on the basis of the act of inventory of settlements with suppliers;

DEBIT 00 CREDIT 70

– 83,000 rub. – the loan debt to employees for payment of wages is reflected on the basis of the payroll;

DEBIT 00 CREDIT 69

– 27,000 rub. – the loan debt to extra-budgetary funds is reflected on the basis of calculation in form No. RSV-1 and calculation in form No. 4-FSS;

DEBIT 00 CREDIT 68

– 3800 rub. – the debt to the budget for fees and taxes is reflected on the basis of the reconciliation report.

Now it is necessary to find out the monetary result of Stalker LLC - retained earnings or uncovered losses.

The credit turnover on account 00 is equal to 1,461,654 rubles (287,580 + 4600 + 982,374 + 50,000 + 32,000 + 100,000 + 5100).

The debit turnover for account 00 is equal to 1,051,625 rubles (800,000 + 40,000 + 56,025 + 41,800 + 83,000 + 27,000 + 3800).

In this case, the cash result is retained earnings, which will amount to 410,029 rubles (1,461,654 – 1,051,625) and will be reflected by posting:

DEBIT 00 CREDIT 84

– 410,029 rub. – the organization’s retained earnings are reflected.

What specific inaccuracies appear when entering opening balances?

Inaccuracy when entering balances for fixed assets

For example, the initial price of a fixed asset is 900,000 rubles, and its depreciation is 200,000 rubles.

The accountant needs to make two entries:

DEBIT 01 CREDIT 00

– 900,000 rub. – reflects the initial price of fixed assets;

DEBIT 00 CREDIT 02

– 200,000 rub. – the accrued depreciation of fixed assets is reflected.

Inaccuracy when entering balances on expense receipts

For example, an accountant needed to enter the balance of account 20 “Fixed Assets” in the amount of 78,005 rubles. When entering the initial balances, the following entry was made:

DEBIT 84 CREDIT 20

– 78,005 rub. – reflects the amount of work in progress costs.

How true? Any account for entering initial balances must correspond only with account 00. The accountant needs to make the following entry:

DEBIT 20 CREDIT 00

– 78,005 rub. – reflects the amount of work in progress costs.

Inaccuracy: entry of initial balances is completed, but the balance sheet does not “converge”

First, recall that auxiliary account 00 is a service account. It is found only in accounting programs and is intended to enter opening balances into the program.

When should you enter opening balances into the program? There are only three such cases:

In the first case, you do not need to use account 00. To enter all balances, simple correspondence on accounting accounts is used. But in other cases you will need to use correspondence with a subsidiary account.

Balance sheet account 00 “Auxiliary account” is active-passive. The basis for using this account, as for other balance sheet accounts, is the principle of double entry. That is, when entering balances on balance accounts into an automated program, a posting must be made for two accounts.

Let us formulate the basic rules for using account 00:

- if the account for which the initial balances are entered is active, then the balance on it is reflected as a debit, and the auxiliary account 00 is entered as a credit and vice versa;

- if the account for which the balances are entered is active-passive, then the balance on it can be recorded by debit or credit in correspondence with the auxiliary account 00;

- Balances must be entered as of the last date preceding the start date of accounting. For example, if you need to start work on January 1, 2014, then the opening balances should be entered as of December 31, 2013;

- account balances in correspondence with account 00 must be entered in the context of subaccounts and analytical accounts;

- Based on the results of entering initial balances, it is necessary to create a balance sheet.

The correctness of filling out the balance sheet can be checked by checking the sum of the balances for all accounts (from 01 to 99) and for the auxiliary account 00. They must be equal.

Costs of manufacturing products, performing work, providing services.

To account for operations on the costs of manufacturing products, performing work, and providing services, analytical accounting accounts are used: account 0 109 00 000 “Costs for manufacturing products, performing work, services”, given in Appendix 1 to Instruction No. 162n, indicating in 1 - 17 - digits of the account number of the corresponding code (component of the code) of the budget classification of the Russian Federation, and in the 24th - 26th digits of the account number - subarticle of the KOSGU, corresponding to the economic essence of the actual fact of economic life (reflected accounting object) (clause 40 of the instructions in the new editors). In this regard, the breakdown of accounts by subarticles of KOSGU was removed from both Instruction No. 162n and the chart of accounts. In particular, Appendix 1 to the said instructions contains the following cost accounts:

| Cost of finished products, works, services | 0 109 60 000 |

| Direct costs for the manufacture of finished products, performance of work, provision of services | 0 109 60 200 |

| Overhead costs of production of finished products, works, services | 0 109 70 000 |

| Overhead costs of production of finished products, works, services | 0 109 70 200 |

| General running costs | 0 109 80 000 |

| General business expenses for the production of finished products, works, services | 0 109 80 200 |

We form initial account balances

Let's consider an example using auxiliary account 00; we will present the documents on the basis of which entries are made in the accounts.

The date of formation of the initial balances is December 31, 2013.

Here are the main entries that need to be made in accounting using a subsidiary account:

Example

Stalker LLC is switching to an automated form of accounting from January 1, 2014. At the end of 2013, the Inventory Commission carried out an inventory, as a result of which the valuation of assets and liabilities was determined.

To enter opening account balances into the new program, the accountant makes the following entries:

DEBIT 00 CREDIT 80 - 800,000 rub. – the amount of the authorized capital is reflected on the basis of the charter; DEBIT 00 CREDIT 82 - 40,000 rub. – reflects the amount of reserve capital based on the charter; DEBIT 01 CREDIT 00 - 287,580 rub. – the initial cost of all fixed assets is reflected on the basis of acts of putting fixed assets into operation; DEBIT 00 CREDIT 02 - 56,025 rub. – depreciation was calculated on fixed assets based on inventory cards; DEBIT 50 CREDIT 00 - 4600 rub. — the balance of funds in the cash register is reflected on the basis of the cash book; DEBIT 51 CREDIT 00 - 982,374 rub. — the balance of funds in the current account is reflected based on the bank statement; DEBIT 10 CREDIT 00 - 50,000 rub. — the balance of materials in the warehouse is reflected based on the inventory inventory of goods and materials; DEBIT 43 CREDIT 00 - 32,000 rub. — the balance of finished products in the warehouse is reflected based on the inventory of goods and materials; DEBIT 41 CREDIT 00 - 100,000 rub. — the balance of goods in the warehouse is reflected based on the inventory of goods and materials; DEBIT 62 CREDIT 00 - 5100 rub. — accounts receivable for goods sold to customers are reflected on the basis of an inventory report of settlements with customers; DEBIT 00 CREDIT 60 - 41,800 rub. — accounts payable for goods received from the supplier are reflected on the basis of an inventory report of settlements with suppliers; DEBIT 00 CREDIT 70 - 83,000 rub. — accounts payable to employees for payment of wages are reflected on the basis of the payroll; DEBIT 00 CREDIT 69 - 27,000 rub. — accounts payable to off-budget funds are reflected on the basis of calculation in form No. RSV-1 and calculation in form No. 4-FSS; DEBIT 00 CREDIT 68 - 3800 rub. — the debt to the budget for taxes and fees is reflected on the basis of the reconciliation report.

Now you need to determine the financial result of Stalker LLC - retained earnings or uncovered loss.

The credit turnover on account 00 is equal to 1,461,654 rubles (287,580 + 4600 + 982,374 + 50,000 + 32,000 + 100,000 + 5100).

The debit turnover for account 00 is equal to 1,051,625 rubles (800,000 + 40,000 + 56,025 + 41,800 + 83,000 + 27,000 + 3800).

In this case, the financial result is retained earnings, which will amount to 410,029 rubles (1,461,654 – 1,051,625) and will be reflected by posting:

DEBIT 00 CREDIT 84 - 410,029 rub. — the organization’s retained earnings are reflected.

What errors occur when entering opening balances?

Error when entering balances for fixed assets

For example, the initial cost of a fixed asset is 900,000 rubles, and its depreciation is 200,000 rubles.

The accountant reflected the residual value of 700,000 rubles with the following posting:

DEBIT 01 CREDIT 00 - 700,000 rub. — reflects the initial cost of fixed assets.

But in account 02 “Depreciation of fixed assets” the accountant did not reflect anything.

Which is correct? The balance sheet reflects the residual value of the fixed assets.

The accountant needs to make two entries:

DEBIT 01 CREDIT 00 - 900,000 rub. – the initial cost of fixed assets is reflected; DEBIT 00 CREDIT 02 - 200,000 rub. – the accrued depreciation of fixed assets is reflected.

Error when entering cost account balances

For example, an accountant needed to enter the balance of account 20 “Fixed Assets” in the amount of 78,005 rubles. When entering the initial balances, the following entry was made:

DEBIT 84 CREDIT 20 - 78,005 rub. – reflects the amount of work in progress costs.

Which is correct? Each account for entering initial balances should correspond only with account 00. The accountant needs to make the following entry:

DEBIT 20 CREDIT 00 - 78,005 rub. – reflects the amount of work in progress costs.

Error: entry of opening balances has been completed, but the balance sheet does not add up

Which is correct? The last posting when entering initial balances is the posting:

DEBIT 84 (00) CREDIT 00 (84) - reflects the financial result of the organization.

T. V. Lesina, accountant, for the magazine “Practical Accounting”

Have a question?

“Practical Accounting” is an accounting journal that will simplify your work and help you keep your books without errors. Get a guaranteed expert answer to your questions, as well as full access to all materials >>

Why do you need a closing balance?

Formation of account balances on any date is necessary for the following purposes:

- formation of accounting, tax, financial, management reporting;

- obtaining operational information about the account status for various purposes.

The main function of the balance is to provide data for reporting. Reports are generated for managers, tax authorities, business owners, potential investors and the state. Also, information about balances is needed for any action related to finance. Below are some examples.