Keeping an organization's accounting records involves consistent reflection of all changes, including those related to interaction with inventory items. Timely acceptance onto the balance sheet allows you to record further transactions with certain objects qualified as the property of the institution, and provides conditions for monitoring their safety. The guidelines, approved by Order of the Ministry of Finance No. 91N of 2003, contain a definition of the concept of inventory number and determine the correct procedure for assigning it.

General overview

The code identifier is assigned to the property at the time of registration and secures its status as an item subject to inventory. The number value is applied in various ways: using paints, fixing a token, engraving or bar code. Other options are possible that meet two priority criteria - the impossibility of quick removal and ease of visual identification during audit activities.

Moving between branches and divisions of an organization is not a basis for changing the inventory number - this is determined by the safety of inventory items on the balance sheet of the enterprise. The assigned codifier remains unchanged throughout the entire period of operation. In cases where fixed assets are not owned, it is recommended to keep records using the lessor's markings. It is also worth noting that the disposal of a previously accepted object as a result of sale or write-off does not mean the possibility of reassigning the released code to other property - the minimum waiting period must be at least five years.

Normative base

There are no legal provisions that strictly define how to correctly assign an inventory number to a fixed asset. There is instruction No. 174n, published by the Ministry of Finance, which contains general recommendations, as well as regulation No. 157n, which is relevant for municipal unitary enterprises. These documents are considered as the basis used by organizations when independently developing inventory codifiers and the procedure for their assignment. Algorithms are fixed by local acts, or determined within the departmental hierarchy, being established by higher authorities.

Why is numbering needed?

Accountants who have been working at enterprises for more than one year know that their organization has fixed assets on its balance sheet, but not everyone in practice is faced with the need to accept a new fixed asset item. Some accounting workers have no idea how to correctly carry out this procedure, register an object in the accounting registers and reflect it on the balance sheet. There are many reasons why an inventory number of fixed assets is necessary:

- The presence of a large number of objects at the enterprise;

- Constant movements of material assets;

- Existence of leased buildings, machinery, machinery and equipment;

- Regular inventories of the organization's funds.

Knowing how inventory numbers are assigned to fixed assets, an enterprise accountant will constantly have up-to-date information about the state of fixed assets accounting and promptly provide it to the organization’s management and regulatory authorities.

The official document that you need to refer to when resolving this issue is the Methodological Guidelines for Accounting for Fixed Assets, approved by Order of the Ministry of Finance of the Russian Federation on October 13, 2003 No. 91 n. Here we will only briefly outline the necessary steps and the approximate sequence of the procedure.

Basic Rules

- Each OS object is assigned an inventory number once for the entire period of its operation.

- If an object consists of several parts, each is numbered separately.

- The number of an object written off the balance sheet should not be assigned to other types of property of the enterprise for 5 years.

- Moving the OS within the enterprise does not serve as a reason to change the number.

- Leased funds can be accounted for by numbers assigned by the lessor.

Numbering of fixed assets

The Order on the accounting policy of an enterprise must include a clause on how to assign inventory numbers to fixed assets. The numbering order of the OS is reflected here, that is, the inventory number, how many digits it can have, is regulated only by this document. In enterprises where the number of objects is small, you can use simple numbering: 001, 002, 003, etc. For a large number of objects, a more complex system is used, let’s take No. 0104001, where:

01 - code in synthetic accounting (Chart of Accounts);

04 — code of a structural unit of the organization (warehouse, workshop, office);

001 - serial number of OS in the list of items similar in purpose.

Inventory number example:

A forklift has arrived at warehouse No. 2, and the same warehouse already has one. The inventory number of a new forklift can be set using the above method:

- 01 - account number in the Chart of Accounts;

- 02 - warehouse number;

- 002 is the serial number of forklifts in this warehouse.

In this case, the number will be 0102002.

Method of applying the number to the OS

In the practice of accountants, there are cases when it is impossible to apply numbering to an object using accessible methods; in such situations, data about the operating system is stored only on accounting registers. Objects to be numbered can be marked using any method possible for the organization:

- Using paint and stencil:

- Apply stickers or tokens;

- Use engraved plates.

Advice. Do not forget that by applying the inventory number incorrectly, you can spoil the numbering object itself; carefully consider all the nuances before you begin to act.

The head and chief accountant of the organization must constantly monitor the correct and timely registration of the movement of fixed assets, this will ensure their safety, allow for prompt receipt of clear information, and will help in organizing the entire work of the enterprise.

Number structure

For small businesses, regular sequential numbering may be sufficient. If objects are posted between accounting accounts, a logical solution would be to include this information in the inventory number: for example, if the accounting details of an intangible asset are 04, the department code is 11, and the ordinal value is 23, then the final identifier will look like 041123.

When filling out, it is also allowed to use letter designations and abbreviations to simplify the decoding of markers. In this case, it is important to consider that inventory items can move within departments, so when choosing a number structure, you should avoid designations that can complicate inventory. The chosen approach is necessarily fixed in the accounting policy and is subject to strict compliance.

The most common mistakes when assigning codes

The presence of errors in the order of assigning inventory numbers or inaccuracies made by employees can bring chaos to the entire asset accounting system and cause trouble during external audits. This is especially true for state-owned enterprises.

Where is it written down what this code means?

The most common mistakes are:

- Inconsistency with existing accounting policies: incorrect cipher length, addition of unregulated letter designations, etc.

- Applying a unique code in an unreliable way that does not ensure durability: with an erasable marker, a peel-off sticker, etc.

- The absence of a number on the object on which it can be placed, due to the “impossibility of placing it.” If the OS is too small, you are allowed not to put a registration code on it. However, if, upon inspection, the commission finds that it was possible to apply it, the company may have problems.

- Setting the cipher without such a need. Most often this applies to objects worth up to 3 thousand rubles.

How not to assign inventory numbers: examples of errors

Violation of the standard, as a rule, negatively affects the overall accounting processes, and in some cases can cause problems with inspection and control agencies. The clarity of codification is of particular importance within the framework of the activities of state and municipal institutions, as well as subordinate structures - even one incorrectly specified code value can violate the strict reporting procedure and cause the application of disciplinary measures.

The reason for errors is usually an insufficient level of qualifications - not all responsible employees actually know how to correctly assign inventory numbers to fixed assets, and from what amount they are assigned. Among the common problems it is worth highlighting:

- Failure to comply with accounting policies and adjustments to the number structure.

- Poor quality markings making identification difficult.

- The decision to abandon physical numbering due to an alleged lack of possibility.

- Acceptance of values and assets that do not meet basic criteria onto the balance sheet.

To avoid such situations, it is recommended to strictly adhere to the rules that determine the need for the presence of a special commission during the distribution of inventory numbers of objects - this guarantees compliance with standards and reduces the likelihood of errors.

Inventory number and features of its use

An inventory number is assigned to a property at the time it is accepted for registration. After this, it acquires the status of an inventory object - a control unit. The number is applied to the object using durable paint, a barcode, engraving, using a token that cannot be quickly and discreetly removed, or in another similar way. The number must be applied so that during an inventory it can be easily and without errors identified with the BU data.

The main objects in relation to which management is organized in this way and control is exercised are:

- OS - fixed assets, objects of property of the organization that have been in operation for more than a year, are intended for production needs, and the cost of which is a legally defined amount;

- intangible objects, assets (IMA) - these include products of intellectual labor, for example, technological developments, software development, trademarks, brand names and other objects that do not have a material form, but which can in the future bring material benefits (see. Civil Code of the Russian Federation Article 1225-1, PBU 14/07);

- non-produced objects, assets - these are natural objects, subsoil, lands, water bodies, etc.

Objects costing less than 3 thousand rubles. no inventory number needed.

The following mandatory requirements apply to inventory numbers:

- they should not be duplicated;

- they must be assigned in order.

In addition, when using inventory numbers in accounting records, it is important to be guided by the following important information:

- The inventory number is applied in the presence of a commission specially created for this purpose and recorded in the inventory number journal.

- If the inventory object is a whole consisting of separate functional parts, a number is applied to each part.

- Moving an inventory item within the organization or its divisions is not a reason to change the number or adjust it. The inventory number does not change during the entire operation of the object to which it is assigned.

- If fixed assets are leased by a company, they are usually accounted for by numbers assigned by the lessor. At the same time, from Resolution 11 of the Arbitration Court of Appeal No. A55-24142/2013 dated 04/28/14, it follows that when the rights to an inventory object are transferred, for example, when signing a leasing agreement, it may be assigned a new inventory number of the organization that acquired such rights. It is argued that the assignment of inv. numbers are an internal matter of the organization.

- The inventory number of an object deregistered (sold, written off, etc.) cannot be assigned to another object in the same organization.

What exactly is to be taken into account

Identifiers are used to register the following types of organizational property:

- Fixed assets (FPE) are property assets of an enterprise that have a certain value, have been in operation for more than 12 months, and are used to implement production tasks.

- Intangible assets (IMA) are products that are the result of intellectual activity, including trademarks, design documents and developments, as well as other elements that do not have their own material form.

- Non-production objects are natural resources that are formed naturally.

The procedure for assigning inventory numbers to inventory items and fixed assets excludes from mandatory accounting any types of property worth less than three thousand rubles, and defines a number of requirements, the observance of which makes it possible to organize control properly:

- No duplicate values.

- Sequential numbering.

- Application in the presence of a commission.

- Recording in the accounting journal.

For technically complex objects consisting of several functional parts, marking is carried out on each element of the structure.

Press center

What you need to know about inventory numbers

Assigning an inventory number is possible for any object listed in the organization - it does not matter whether this item is in constant use or is stored in stock in a warehouse;

An inventory number may not be assigned if the cost of the object is less than one thousand rubles. In addition, jewelry, library items and valuables may not be numbered;

If an object consists of several parts, then the same inventory number is applied to each of them. The exception is those items whose parts have different shelf life/useful lives - then it is necessary to assign a separate inventory number to each of them.

Once assigned, the inventory number does not change as long as the object is under the jurisdiction of the organization;

Inventory numbers must be unique and cannot be repeated. The inventory number of a decommissioned object cannot be assigned to another object, for example, one that has just arrived at the organization;

In the event that several different numbers were applied to one object (for example, as a result of an error or a change in the numbering system), the unused number should simply be crossed out so that there are no difficulties during inventory.

Structure

At the moment, the legislation of the Russian Federation does not oblige the implementation of a certain structure of inventory numbers - each organization itself determines how objects will be numbered. This decision is confirmed by an internal document of the company, which is signed by the persons responsible for the process. However, it is worth remembering that in order to correctly account for all items, it is necessary that the inventory number is not only unique, but also sequential.

If the organization is small, then inventory numbers may look like three-digit numbers - 001, 002, etc. In addition, you can use a numbering system that includes not only numbers, but also letters - this will allow you to divide all objects into groups , which will simplify subsequent inventory. If we are talking about a large company, then it is worthwhile to provide a system that allows you to number several thousand objects.

Application methods

In addition to the documentary assignment of the number, it is necessary to directly apply it to the numbering object. Each organization can choose convenient methods and methods for applying inventory numbers, taking into account the operating conditions of the objects. The most popular numbering methods are:

Manual or machine application of a number to an object using indelible paint;

Carrying out minting, if a metal object or an object with metal parts is subject to numbering;

Creation of tags or metal tokens with an inventory number and securely attaching them to the object;

Bar coding is the most modern and convenient way to assign an inventory number, allowing you to quickly carry out inventory using special programs and readers.

After choosing a specific numbering method, you should, if possible, adhere to this method for applying numbers to all objects - this will avoid unnecessary confusion and allow you to carry out inventory quickly and without errors.

Correct and timely assignment of inventory numbers will allow you to significantly speed up the inventory process - use our advice and keep track of all the organization’s objects quickly.

Algorithm for assigning codes

Identifiers are applied to inventory items by a responsible employee, in the presence of representatives of a separately established group responsible for controlling the receipt and disposal of assets. The main criteria are visibility and readability, reliability, impossibility of correction, as well as compliance of the inventory number with the model defined within the accounting policy of the organization.

Some objects have properties and characteristics that do not allow physical marking, or make it impractical due to the nature of their operation. In these cases, accounting recommendations require entering a description and code into the register, and also indicating that there is no identifier on the item itself.

Examples and sample documents

To record property accepted on the balance sheet, special journals are used. The standard form, placed on the title page of the inventory book, provides information about the enterprise, as well as personal data of the employee responsible for maintaining the accounting book. Starting from the second page, a table is maintained into which information about each new object is entered as it becomes available:

- Sequential and inventory numbering.

- Full nomenclature name.

- The document serving as the basis.

- Balance date.

- Initial cost and depreciation.

- Useful life.

Movements are registered using a separate card, which also indicates changes occurring with inventory items.

Responsibility for filling out and signing documentation rests with the accounting department. For large organizations, it is recommended to use specialized software - mobile automation solutions offered by , significantly simplify routine processes and facilitate inventory management.

Error 4. Making a decision about the impossibility of affixing an inventory number

As expressly stated in paragraph 46 of Instruction No. 157n, if it is impossible to designate an inventory number on a fixed asset object in cases determined by the requirements of its operation, the inventory number assigned to it is used for accounting purposes with reflection in the relevant accounting registers without applying the fixed asset to the object .

For many sports equipment, there is a temptation to apply this paragraph and not indicate the accession numbers. Is it possible to say that the requirements for using sports equipment for team games make it impossible to affix an equipment number? Materials from inspections of the activities of institutions do not always allow us to answer this question positively.

In practice, the impossibility of designating an inventory number in cases determined by operational requirements is most often due to the fact that the affixed number is constantly erased and needs to be restored, or the object may deteriorate due to affixing the number. A classic example is dishes (pans, pots), the operating conditions of which require heating to high temperatures. In this case, when accepting the dishes for accounting as fixed assets, a special commission of the institution for the receipt and disposal of assets has the right to determine that, taking into account the special procedure, the inventory numbers on Such categories of fixed assets are not recorded, but are only reflected in the accounting registers.

However, in our opinion, this approach should be used with caution in relation to sports equipment. Otherwise, there is a high probability of claims from specialists from regulatory agencies during inspections.

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

One of the mandatory conditions for commissioning a fixed asset in any production is assigning it an inventory number. How this process occurs, what regulatory act is regulated, and what information is encrypted in this license plate will be discussed in the article.

Compilation example

Stroitel OJSC received computer equipment - an MFP device, issued to a division with serial identifier 13. The last previous code recorded in the register is 0506. The specified object within the BU belongs to the category "Machinery and Equipment", which allows you to assign it a number value 13050634122, where:

- 13 - department of the enterprise;

- 0506 and 34 - synthetic and analytical codifiers;

- 122 - sequence in order.

Algorithm for forming accounting policies

Local acts regulating who and how should assign inventory numbers to fixed assets provide clear instructions for filling them out. The records indicate:

- Number and types of characters used.

- Rules for determining values and the sequence of their addition.

- The procedure for marking specific objects.

The regulations must be comprehensive, excluding the possibility of arbitrary decisions that complicate subsequent identification and can lead to errors in the accounting process. The best option is to use automated software templates that significantly simplify control and reporting.

Templates for inventory numbers in 1C: Accounting departments of a state institution 8 edition 2.0

Published 05/07/2017 22:10 When accepting for accounting a fixed asset that comes into the ownership of an institution, regardless of the method of acquisition (purchase, gratuitous receipt), it is necessary to assign an inventory number. This number allows you to uniquely identify the fixed asset, which facilitates the accounting of the institution’s property.

In 1C programs, in particular in the 1C program: Accounting of a state institution 8 edition 2.0, there is a convenient mechanism for creating inventory numbers - templates for generating inventory numbers.

It is a directory where a certain template is formed, according to which each fixed asset is assigned a number when accepted for accounting. If it is absent, the program will generate numbers in order.

And when creating a template, you can set rules under which the number will be significant, that is, carry meaning. For example, you can encode the accounting account and the date of acceptance for accounting into it.

Let's look at the procedure for creating an inventory number template. You can find this directory in the organization card:

Follow the hyperlink on the left. The directory form will open:

You can create a new element in this directory. I would like to draw your attention to the fact that each element must be tied to a specific organization, so it will not be possible to create two templates for one institution. This is due to the fact that the procedure for generating inventory numbers for fixed assets must be uniform.

In our demo database, one template has already been created, so it will not be possible to save another one. Let's look at the procedure for creating a template without saving.

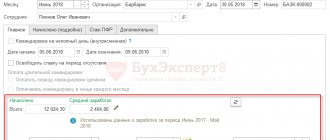

Clicking the “Create” button opens the following form:

The “Name” attribute is a free text field that specifies the name of the template.

The “Organization” attribute indicates the organization in the database to which the template will belong and for which it will be valid.

The next detail is “Length of inventory number”. Designed, respectively, to indicate the length of the number. This indicator must be entered before creating rules in the tabular section, otherwise the program will generate an error about the length of the inventory number being exceeded. The specified length in this attribute will also be checked for compliance with the length of the rules described in the tabular section. The number of characters cannot exceed 30 characters.

After filling out the header fields, you need to fill out the tabular part. Add a new line:

You can use various details (components) in the template. The list is presented below:

When selecting a specific component, the remaining columns of the tabular part are filled in: length, symbol, expression.

Length – the number of characters in the inventory number that will be allocated to the component.

Symbol – a symbol designating this attribute for visual display:

Expression – an expression in the built-in 1C language that will be used to determine the value.

The user can change the length of the template components only for the serial number and the year (from four characters to two characters).

The order of the components can be edited, the only rule is that the serial number must be at the very end of the chain (since it will automatically change and increase by one during the process of applying the template for generating inventory numbers):

Users also have the opportunity to vary the length of the account or OKOF code. To do this, you need to slightly change the form using the “All actions” button:

The setup form opens:

On the left side, you need to check all the details to display them on the form:

The form is modified as follows:

“Remove spaces” attribute: when this flag is checked, all spaces will be removed.

In the “Synonyms” column you can specify synonyms for the details that are specified in the expression. For example, the expression Lev(Account, 3) is based on a fixed asset account; you can add the details AccountAccount, AccountDebit in the synonym column, and these details will be automatically substituted into the expression.

This article discussed the procedure for generating inventory number templates for fixed assets, a very convenient and useful mechanism. If you have any questions, you can ask them in the comments.

Author of the article: Svetlana Batomunkueva

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+2 Olga 09/08/2020 11:12 Hello. Please help me solve this problem: I made a template for generating inventory numbers, but in my accounting the last number is, for example, 101341000554, and when a new OS is accepted for accounting, the program assigns 101341000001, i.e. starts over. I can't find how to set it up

Quote

Update list of comments

JComments

Changes in inventory numbers of fixed assets

The accounting policy of the enterprise also determines the provisions that guide responsible employees in the event of questions arising related to the need to adjust the serial numbering. As a rule, the assigned identifier remains unchanged throughout the entire operation cycle of the facility, however, if an error is detected, the standard protocol approved by the local act should be followed.

Inventory commission

The documentation drawn up during the implementation of agreed changes contains a list of corrections and is approved by a special group. A sample form is indicated in the appendix to the accounting policy. A typical list of recorded data includes:

- nomenclature characteristics;

- information about the adjustment;

- position and full name responsible person.

The signed document is the basis for changing the registration number.

Inventory: how to correctly number accounting objects

However, there are ways to streamline this aspect of accounting activities, making object accounting simple, convenient and transparent. Requirements for numbers By and large, only two requirements can be presented to an inventory number: the number must be unique, and the numbering system must be orderly.

Uniqueness refers to the assignment of only one unique inventory number to one object. Simply put, the same number cannot be assigned to two or more objects and, conversely, one object should not be assigned two or more inventory numbers.

Moreover, we recommend adhering to this rule even if the object has been removed from the balance sheet. To avoid possible confusion, it is better not to assign the number of a retired object to a new one. After all, documentation for the retired object continues to be stored in the organization, and mixing numbers can lead to errors.

The inventory number must be unique.

Thus, the legislation does not establish any requirements for the number of digits in the inventory number of a fixed asset and the content of these digits. According to , the inventory number assigned to an object must be designated by a financially responsible person in the presence of an authorized member of the commission for the receipt and disposal of assets by attaching a token to it, applying paint to the accounting object or in another way that ensures the safety of the marking.

If the fixed asset object is complex (a complex of structurally articulated objects), i.e. includes separate

Names of fixed assets

The provisions of paragraph 13 of methodological instructions No. 157n prescribe the use of the Russian language to reflect the names of the organization's OS. Objects subject to mandatory state registration requirements must be named in accordance with the data presented in the accompanying documentation. So, for example, a vehicle whose technical passport contains the designation “VAZ-2110” cannot be placed on the balance sheet of an enterprise with the simplified name “Lada”.

Inventory numbers of individual premises

Registration rules applied to real estate require independent inventory identification of objects with different functional purposes, even in cases where they are located on the territory of the same building. Based on the procedure determined by the Unified State Register, the basis in this case is the cadastral document. The name indicates characterizing data, such as letter, wing, floor, etc.

Registration of office equipment

Material assets belonging to the category of technical equipment, be it household or digital equipment, tools, complex instruments and devices, are taken into account in accordance with the following regulations:

- The name of the type and brand is given in full, without using abbreviations and abbreviations, similar to the information specified in the accompanying documents.

- Original brands in English or another language are entered according to their spelling in the passport.

- The OS card records the full composition, serial and factory numbering, including individual codifiers used to designate components.

Inventory number as a means of control

For accounting purposes, the organization's property consists of inventory items. The inventory number confirms that the object has been capitalized and registered. Guidelines No. 91n regulate the general requirements for accounting for inventory items and establish the rules for assigning inventory numbers. The name of the object, number, location allow you to identify the property, control the condition of the assets, movement, and period of use.

The inventory number is permanently retained for the object. One number always belongs to only one inventory object. The organization assigns numbers in order. The priority is established according to the journal (book) for recording inventory numbers. The inventory card of the object must indicate the inventory number.

Marking fixed assets for inventory

In accordance with the recommendations of the Ministry of Finance, various methods can be used to apply identification marks:

- attaching a token with a number or bar code;

- image using paint, permanent marker or corrector;

- gluing special labels or engraving the surface.

The choice of the appropriate method depends on the available resources, as well as the specifics of storing and operating the OS. The main requirement is the legibility and reliability of the markings, with the help of which reconciliation is carried out during the inventory.

What records should be kept at the enterprise?

The list of documentation required for preservation depends on the specifics of the object:

- Certificates of state registration - for real estate and vehicles.

- Technical data sheets - for complex production equipment, digital equipment, household appliances.

- Warranty certificates - for fixed assets, the operation of which requires a certain period allowing for replacement and repair at the expense of the supplier or manufacturer.

For the latter case, it is also relevant to reflect the established deadlines in the object card, indicating previously unscheduled work. This approach simplifies control and record keeping, and allows for timely identification of potential costs associated with the failure of operating equipment.

Journal of inventory numbers

For companies with a large number of fixed assets on their balance sheets, as well as regular movement of assets, it is recommended to maintain a separate document that takes into account inventory numbering. The presence of a consolidated catalog containing information about assigned and retired codifiers facilitates the prompt introduction of current changes and reduces the likelihood of errors.