Cost accounting: economic interpretation

In economics, cost is usually understood as the total cost of a company to produce goods, provide services, or perform work. The costs in question are most often classified as:

- to material ones;

- those related to wages;

- depreciation;

- those related to the sale of goods, services or works.

Each of the noted expense categories can be represented by a large number of items.

Cost as an economic category is classified into 3 types:

- workshop;

- production;

- complete.

The first type of cost includes costs that are associated with the production of goods in a specific workshop (as an independent structural unit of the company).

The production type of cost includes, firstly, workshop costs, and secondly, expenses:

- general economic;

- related to losses from marriage;

- others that are related to the production of goods in the workshop, but are not related to the activities of the workshop.

The full cost includes the production component, as well as expenses that:

- related to the sale of goods;

- relate to administrative;

- are classified as commercial.

Different interpretations of cost in accounting are also reflected in regulations governing the field of accounting. Let's study them.

Production cost accounting

Accounting for the costs of a particular enterprise for the production of goods, the provision of services or the performance of work is considered to be the reflection of costs, their arrangement by elements.

Costs are compiled according to economic content according to the following elements:

- material costs;

- salary expenses;

- accruals to extra-budgetary funds;

- depreciation;

- other expenses.

Other expenses include but are not limited to:

- management salary expenses;

- operation of machines and areas;

- travel expenses of employees;

- expenses for communications, auditing, information services, security services;

- entertainment expenses;

- selling expenses;

- taxes.

Expenses incurred by an enterprise in connection with the production of goods, provision of services or performance of work are reflected in accounting and included in the cost of goods, services or work of the reporting period to which they relate, regardless of the time of their payment.

The following types of costs are distinguished:

1. In relation to cost:

- Direct - costs directly associated with the production of a specific product.

- Indirect - costs for administration salaries, general production and general economic expenses. Costs of this type are associated with the production of several types of goods and must be distributed between product positions in proportion to a certain indicator.

2. In relation to the technological process:

- basic;

- invoices.

3. In relation to production volume:

- conditional constants;

- conditional variables.

4. According to the economic element:

- elemental expenses;

- complex.

What costs form the total cost of finished products? The answer to this question is in ConsultantPlus. Study the material and calculation example by getting trial access to the K+ system for free.

Cost accounting methods:

- custom - used in small-scale production, a specific order is selected as an accounting object;

- cross-cutting - used in large-scale production, costs are accounted for step by step at production stages;

- boiler - used in enterprises that produce one type of product, accounting is made from the expenses incurred by the enterprise as a whole for the reporting period;

- normative - used in enterprises with a large range of manufactured goods, accounting is carried out using standards with the mandatory identification and consideration of the reasons for deviations from them for further analysis and prevention of these reasons during work.

You can get acquainted with detailed information regarding each method of cost accounting in the article “The concept of cost in accounting (nuances)”.

The concept of cost in accounting legislation

Why does an accountant need to take into account such an indicator as cost in the course of his work? Among the main documents of accounting (as one of the final results of accounting) is the profit and loss statement of the company. In accordance with the requirements reflected in clause 23 of PBU 4/99 (order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n), it must reflect the cost of goods, services and work.

You can learn more about how the cost is reflected in the profit and loss statement and see a sample of filling out the corresponding line in ConsultantPlus. If you do not yet have access to this legal system, trial access can be obtained for free.

There is also mention of cost in other accounting regulations. Thus, paragraph 9 of FSBU 5/2019 states that the actual cost is the indicator by which reserves are recognized in accounting. And in paragraph 59 of the Order of the Ministry of Finance No. 34n dated July 29, 1998, it is stated that finished products should be registered at their cost. But what should the cost be from the point of view of accounting legislation?

FSBU 5/2019 regulates inventory accounting from 2022. What has changed in accounting compared to the previous procedure (with the canceled PBU 5/01) can be read in the Ready-made solution from ConsultantPlus, having received free trial access to the system.

First of all, we note that there can be several types of accounting costs. Clause 59 of Order No. 34n of the Ministry of Finance, in particular, mentions the cost:

- actual;

- normative (or planned).

Products, services and work actually supplied to the counterparty (but for which revenue is not recognized) are recorded, in accordance with paragraph 61 of Order No. 34n, in accounting also at cost - actual, standard or planned. Moreover, this cost includes costs reimbursed under the contract and associated with:

- with production;

- implementation.

Clause 9 of PBU 10/99 talks about the need, when calculating financial results, to determine the cost of goods, services and works sold based on expenses for ordinary activities, which:

- reflected in accounting for the current reporting period, as well as previous expenses;

- are reflected in accounting in relation to income in periods that follow the current one, taking into account amendments due to the peculiarities of doing business.

The corresponding expenses for core activities in accordance with clause 8 of PBU 10/99 can be presented:

- material costs;

- labor costs;

- insurance contributions to state funds from salaries;

- depreciation;

- other costs.

In turn, commercial and administrative expenses in accordance with clause 9 of PBU 10/99 can also be reflected in accounting for the current reporting year.

Let us note that the profit and loss statement, which is prepared in accordance with PBU 4/99, is not intended to reflect data on commercial and administrative expenses as part of the cost price.

In addition, the following classification of expenses that form the cost is used in accounting (and reflected in some industry regulations):

- direct (related to a specific type of manufactured product);

- indirect (related to several types of manufactured products).

However, in practice, the division of expenses into direct and indirect is more often used not in accounting, but in tax accounting and is actively used to optimize taxation (Article 318 of the Tax Code of the Russian Federation).

Calculating product costs: where to start?

From understanding what costs are and what their classification is used for correct calculation. It is possible to determine cost without understanding the relevant or incremental costs. But without knowledge about these five groupings, its value cannot be formed correctly:

- By elements.

- Direct and indirect.

- Normative and factual.

- Current and past periods.

- Variables and constants.

By element

In this classification, costs are divided into five components. They are on the diagram. Everything that is shown on it forms the cost per unit of the product.

Figure 1. Costs by element

Here we will discuss an important issue: not all expenses of an enterprise form the cost price. There are two reasons for this:

- Some of the costs are capital.

These are all related to the acquisition of fixed assets and intangible assets. The price of their purchase does not immediately fall into the cost of the product, but is transferred there in parts through depreciation charges over more than one year; - Some expenses immediately become expenses, bypassing the cost stage.

For example, fines for failure to comply with contractual terms, negative exchange rate differences on currency transactions, interest on borrowed funds, residual value of retired fixed assets. The above will never appear in the cost of production, because it relates to other expenses.

It is also important to distinguish costs from expenses. Here are a few points:

- expenses - part of the costs that reduced the financial result. For example, the cost of goods manufactured sitting in a warehouse is the cost collected in the valuation of the asset. Once the product is sold, the cost becomes an expense. The process is based on the principle of matching income and expenses: if they recognized income from the sale of something, they immediately wrote off the costs of this something as expenses;

- costs are shown on the balance sheet and expenses on the income statement;

- current expenses are deposited in the debit of accounting accounts 20, 23, 25, 26, 29, 44, and expenses are recorded in the debit of 90 and 91. In this sense, it is easier for accounting experts not to confuse one with the other. For them, the clue is in the bills.

Direct and indirect

In Figure 2 we showed the essence of the second classification. Please note: each organization independently decides what is classified as direct costs and what is classified as indirect. This point is recorded in the accounting policy.

Figure 2. Direct and indirect costs

If an organization produces only one type of product, then this classification is unimportant for it. When there are many such species, you can’t live without it.

Why? Because if only stools of one style are produced, then all costs form their cost. Sum them up and divide by the number of finished products. The result is the cost of one piece.

Now imagine that in addition to stools, chairs are also made. Question: in this case, what should be included in the cost price of the salary of the director, chief accountant, production manager, expenses for office materials or for brooms used to sweep in the workshop? It is logical that they should be included in the cost of both products. For this purpose, it is necessary to divide costs into direct and indirect.

Do this:

- direct expenses are summed up separately by type of product, and indirect expenses are summed up by their total value without breakdown;

- select the distribution base of the indirect component from among the direct elements. This could be, for example, direct wages of workers or direct materials. In accordance with it, they calculate how much overhead costs are incurred for a specific item.

As a result, the total cost of the product is formed from the sum of direct and part of indirect costs.

Normative and factual

The norm is the ideal cost value. It does not include payment for the first days of workers’ incapacity, their downtime due to the fault of the enterprise, defects, or a sharp increase in prices for materials from suppliers.

Fact is how it really happened. Obviously: it is a rare situation when it completely corresponds to the norm. Deviations are common practice. Then why are standard costs needed if they are still not met?

Let's use an example. The organization produces stools every day. And salaries, deductions from them and depreciation are calculated only once at the end of the month. It is then that the amount of actual production costs is determined. If we choose them as a basis, then at what cost will we accept ready-made stools for a month, since neither the total amount of expenses nor the volume of production in pieces is yet known?

The use of a standard value helps to remove such complexity. The application scheme is as follows:

- within a month, finished products are accounted for at standard cost;

- at the end of the month, the actual value is calculated after accrual of wages, insurance premiums, depreciation, taxes and distribution of the indirect component;

- At the same time, the deviation between fact and plan is revealed. If the fact turns out to be more, then there is an overrun. Otherwise, save money. Overexpenditure is written off as an increase in costs at the time of sale of finished products, and savings are written off as a reduction in costs.

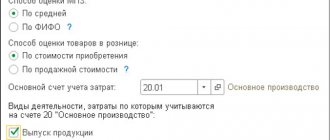

Organizations themselves decide which cost to take as a basis - actual or standard. Your choice is stated in the accounting policies. But it is obvious: the option with an actual amount is difficult to implement in practice, although initially it seems simpler.

Current and past periods

The name of the classification elements suggests the essence. Current expenses were incurred in this month, and the previous period - in the previous month. How do the latter affect costs? Their impact will manifest itself in those organizations where there is work in progress (WIP).

What is this? WIP is no longer materials, but also not a fully finished product, since the entire processing cycle has not yet been completed.

Why does WIP appear? Because the company's products have a long production cycle. At the end of the month, when the accounting department sums up the results, part of the costs cannot be converted into the cost of the finished product. They remain hanging on the balance of the account 20. Next month they are added to the new expenses of the enterprise. If the product is completed, then the past costs will form the cost in the current period.

The process obeys the following formula:

Product cost = WIP at the beginning of the month + Costs of the current month – WIP at the end of the month

Here are the important points about WIP.

Moment 1.

Its appearance depends on the specifics of the product being manufactured and the technological process.

For example, one organization produces stools, for which ready-made components are purchased. It’s hard to imagine that at the end of the month the workers will not be able to “compile” a few stools. This means there is no WIP.

Another company produces custom-carved furniture. It takes an artisan an average of two months to create one cabinet. It turns out that “unfinished work” will definitely appear.

Moment 2.

To correctly calculate the cost, start by estimating the work in progress at the end of the month. The only sure way to understand what it is is to go to the workshop and take an inventory. The point is to determine the percentage of product readiness.

Simplified it looks like this. Let's say an inventory commission headed by a technical specialist determined the completion of a particular product as 50%. This means that half of its standard or actual value (depending on the valuation method chosen by the enterprise) will remain in the work in progress. The cost of finished products will decrease by this amount.

Moment 3.

In serial and mass production, WIP is assessed in any of three ways:

- on material costs;

- by direct costs;

- at full cost based on standard or actual value.

For single production, only the last option is used.

The chosen valuation method affects the financial result. Let's consider an example that is far from reality, but well illustrates this statement.

Two organizations that manufacture the same type of product have identical cost values. At the end of the month they have an equal amount of WIP remaining. In the first enterprise it is assessed only by material costs, in the second - by the full standard value. Moreover, everything that was produced was sold that same month. Look at the diagram to see how this will affect production costs and financial results.

Figure 3. How the WIP assessment method affects the financial result

Variables and constants

This approach to classifying costs is based on their relationship to production or sales volume.

When such a connection exists, we talk about variable costs. For example, to make one stool you will need one seat blank and four legs. To make ten pieces, respectively, ten seats and forty legs. This is an obvious point and a very simple illustration of the relationship between spending and quantity of product. More like this:

- wages for piece workers;

- insurance premiums accrued on it;

- auxiliary materials such as screws, glue, etc.

When the connection between costs and the natural values of what was produced is not traceable, then they talk about a constant component. For example, even if production stops for some reason, then:

- the manager, chief accountant, watchman or cleaner will still receive their salary;

- The accountant will calculate monthly depreciation on buildings, office furniture or equipment, and will also write off spare parts and gasoline for the boss’s car.

Not all costs are so clear cut. Therefore, conditionally constant or conditionally variable groups are distinguished. Example: salary of a sales manager. It consists of a constant part - salary, and a variable part - percentage of sales.

Unlike previous classifications, you can do without this one when you consider the full cost. It is useful only if the calculations are based on the direct costing method. Read about it further.

Cost accounting: main tasks of an accountant

Thus, the concept of cost in the legislation regulating accounting is given in several interpretations. When solving any problems related to cost accounting, the accountant carries out:

- registration of business transactions for expenses that form the cost;

- cost calculation (determining the cost of relevant objects);

- the use of accounting accounts to reflect transactions on transactions within the framework of accounting for cost objects.

Let's study the features of these areas of work of an accountant in more detail.

Registration of transactions with cost accounting objects within the cost price

In order to reflect business transactions on expenses that form the cost, various accounting registers are used. Their list and structure are formed by the accounting department in such a way that:

- the accountant had the opportunity to trace the relationship of expenses belonging to different categories (for example, those associated with the production of specific goods, services, works and those associated with the payment of employees);

- the accountant had the opportunity to summarize the relevant expenses in order to reflect the cost in the consolidated reporting documents for the structural unit or the company as a whole.

Based on the characteristics of the organization of production processes in a particular company, one or another accounting object is selected. It could be:

- a certain type of product (service, work);

- batch of products;

- production stage;

- another object determined based on the specifics of production at a particular enterprise.

The practical significance of the correct classification of accounting objects lies in its subsequent application within the framework of cost calculation - the procedure for determining the amount of expenses that make up the cost.

Let's study its essence in more detail.

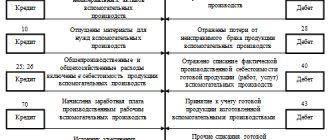

Cost Accounts in Accounting

To collect the costs of producing goods, providing services or performing work, use Section III “Production Costs” of the chart of accounts.

Grouping of costs within this section is most often done using the following calculation and collection and distribution accounts: 20, 23, 25, 26, 28.

Account 20 “Main production” serves to summarize information about the costs of producing goods, services or works, which, in turn, were the purpose of establishing the company.

This account records both direct costs determined by the production process and included in the cost price, and indirect costs associated with the management and maintenance of production.

Analytical accounting in this account is carried out for specific types of goods, works, and services.

Indirect costs relating to several types of goods are distributed in proportion to the approved indicator. Expenses are written off to cost at standard (planned) or at production actual cost.

You can look at an example of accounting for this account in the article “Account 20 in accounting (nuances).”

Account 23 “Auxiliary production” contains the costs of production that are auxiliary to the main one (OS service, provision of heat, electricity, etc.).

Analytical accounting on this account is carried out by type of production. Expenses are written off to account 20 or to the cost of a specific product as direct expenses or distributed between individual types of goods in proportion to the selected indicator.

You can learn about the features of auxiliary production in the material “Wirings Dt 20 and Kt 23, 10 (nuances)”

On account 25 “General production expenses” the costs of servicing the main and auxiliary production of the enterprise are grouped. Among the costs that are taken into account in this account may be payments for insurance of production machines, costs for service repairs of these machines, operational maintenance costs, costs for renting production space and equipment, and other similar ones.

Analytical accounting on the account is carried out by individual divisions of the enterprise and expense items. At those enterprises where homogeneous goods are produced, expenses, without being distributed, are written off as a debit to account 20. At enterprises producing different goods, expenses are subject to distribution between the types of goods produced and those remaining in work in progress, and are also included in the cost of defects and expenses for fixing the marriage. Expenses are written off to the debit of accounts 20, 23, 29. Account 25 has no balance at the end of the reporting period.

Account 26 “General expenses” groups costs that are not directly related to production processes and relate to management needs. For example, salaries of managers, accounting departments, depreciation of property that the administration uses in its activities, rental payments for premises for the administration, etc.

Analytical accounting is carried out according to budget items and the location of costs. The expenses collected for the month are written off depending on the chosen method of forming the cost of production. When an accountant chooses the accounting method at full production cost, expenses are written off by accounting records Dt 20 Kt 26, Dt 23 Kt 26, Dt 20 Kt 26. If the method of accounting for products at a reduced cost is chosen, the contents from account 26 are written off directly to account 90-2.

It will be useful to familiarize yourself with the main components of general business expenses, consider an example of their accounting and write-off in the article “Account 26 in accounting (nuances)” .

Find out what is included in fixed costs and how they relate to the cost of finished products in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Costing: classification of methods

The procedure for calculating cost in accounting is not defined at the level of industry-wide legal acts, but a number of industry regulations (including, in particular, Soviet standards) recommend the use of the following cost accounting methods:

- cross-cutting (in particular, process-by-process);

- custom-made (in particular, product-based);

- boiler room;

- normative.

These methods are proposed in the following sources:

- “Basic provisions for planning at industrial enterprises”, approved by the State Planning Committee, the State Committee for Prices, the Ministry of Finance, the Central Statistical Office of the USSR on July 20, 1970;

- Order of the Ministry of Agriculture of the Russian Federation “On Methodological Recommendations for Accounting in Agricultural Organizations” dated 06.06.2003 No. 792;

- Order of the Ministry of Industry of the Russian Federation “On approval of the Methodological Regulations for Accounting at Chemical Complex Enterprises” dated January 4, 2003 No. 2.

Let us study the specifics of the methods enshrined in the noted sources of law in more detail.

Progressive and process-by-process methods of cost accounting

The cross-cutting method is most often used in mass and large-scale production, which is characterized by the use of raw materials that are subject to several stages of processing - redistribution. Moreover, after each redistribution - not counting the one that leads to the formation of a finished product - a semi-finished product is obtained, which in principle has a commercial value (and therefore can be sold externally).

The method under consideration most often involves accounting for costs within each structural division of the company in relation to specific production processes. Production costs of divisions in which redistribution of semi-finished products received for further processing are carried out are formed from internal costs in these divisions, as well as the cost of semi-finished products (if they are accounted for).

The fact is that the company can keep records of the corresponding semi-finished products or not keep it. In the first case, movements in redistributions are not reflected in accounting registers (but can be recorded in management - most often in physical terms). In the second case, the movement of semi-finished products is recorded in registers at accounting prices, sometimes at planned or actual costs.

The process-by-process method is a subtype of the step-by-step method. It is used in enterprises characterized by short production cycles, a minimum number of work-in-progress items, and a small range of manufactured goods. The main object of accounting in the process method is the stage of product release, corresponding to the volume of work performed by a specific division of the company, or the full cycle of product release if it is produced by one division (or the company as a whole - if it has only one workshop).

Order-based and piece-by-piece cost accounting methods

The custom method is most often used by small companies that produce small series of goods, provide repair services, and piece assembly of certain products. The object of cost accounting in this case is a specific order for which the company produces a product or provides a service. The cost of the accounting object is determined in accordance with the agreement between the company and the customer.

If a product is produced within the framework of a long technological cycle, cost accounting can be carried out, similar to a step-by-step scheme, based on the completion of a certain stage of production (assembly, packaging), upon which a ready-to-use part or semi-finished product is formed (which in this case become objects of accounting ).

The item-by-item method is used if a company (or its division) produces the same product in large quantities, in series. It involves determining the cost of a unit of goods based on the average cost of its production within the reporting period.

Boiler cost accounting method

This method involves calculating the cost of goods and services based on the expenses incurred by the enterprise as a whole during the reporting period. It is assumed that a company using the boiler method produces one type of product.

Standard cost accounting method

The essence of the normative method is the use of established norms and standards for cost accounting purposes. Most often it is used in enterprises that produce different types of goods, which are presented in a large range.

This method involves taking into account production costs for the production of various types and groups of goods in relation to specific divisions of the company. Costs are usually classified as follows:

- to comply with norms and standards;

- those that are recorded in values above and below the norms and standards.

The considered cost accounting method involves the accounting department and other responsible departments of the organization solving the following tasks:

- preliminary regulatory calculation - based on established cost standards (in kind or in value terms);

- taking into account adjustments to applicable norms and standards in the process of production optimization;

- determining the correlation between adjustments to norms and standards and production performance;

- recording deviations of actual costs from norms and determining their causes.

Norms and standards used for cost accounting purposes can be established:

- taking into account the provisions of regulatory legal acts (for example, those that determine or significantly influence the standards for wages, the credit burden on the enterprise);

- in intercorporate agreements (for example, on the rental of premises, on tariffs for utility services, on licensing fees);

- in local regulatory sources (for example, determining the consumption rates of raw materials or materials, production, formation of overhead costs).

The next task of an accountant whose competence is cost accounting is to reflect business transactions on expenses that form the cost in accounting accounts.

Let's take a closer look at the features of these accounts.

Methods of cost formation

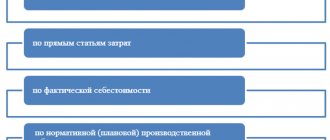

The cost of products, works or services that are the subject of the organization’s activities may be:

- production (incomplete), which, in addition to direct production costs, also includes overhead costs (general production costs), which ensure the functioning of the departments that collect these direct costs;

- planned, including standard indicators in costs;

- complete, including, in addition to direct and general production costs, also the costs necessary to support the activities of the organization as a whole (general economic).

The organization makes its own choice of the cost formation method, fixing it in its accounting policy.

Read more about collecting partial costs in the article “Marginal method of cost accounting - how to apply?”

The collection of costs in both methods follows the same principle: in correspondence with accounts reflecting the sources of origin, they are attributed to cost accounts, broken down by divisions of the organization. Depending on the type, costs are collected as follows:

- straight lines - on counts 20, 23, 29;

- general production - on account 25;

- general business - on account 26.

Every month for both methods, account 25 is closed, distributing its amount among direct cost accounts in proportion to the base chosen by the organization, specified in the accounting policy:

Dt 20 (23, 29) Kt 25.

Closing account 26 will also be monthly, but different, depending on the chosen method of generating cost:

- when collecting incomplete cost, the entire amount collected on account 26 will be written off at a time as a debit to account 90:

Dt 90 Kt 26;

- to obtain the full cost, the costs generated on account 26 will also have to be distributed to direct cost accounts in proportion to the base chosen by the organization (and the base may differ from that established for the distribution of account 25):

Dt 20 (23, 29) Kt 26.

Thus, the differences in the process of writing off production costs are already inherent in the very principle of cost formation. However, regardless of whether the cost includes general business expenses, further write-off of costs for the completed product generated on accounts 20, 23, 29 will be carried out in one of 2 ways, the difference between which depends on the type of final product being created. The type of product for these purposes is determined by the form in which it is created: either it is an object of a material nature, or a result that arises during the provision of work or services.

ATTENTION! From 2022, work in progress is accounted for in accordance with FAS 5/2019 “Inventories”.

ConsultantPlus experts explained in detail how to correctly account for work in progress according to the rules of FSBU 5/2019. Sign up for trial demo access to the K+ system and switch to the Ready-made solution for free.

Application when accounting for the cost of accounting accounts

Costs that form the production cost of goods, services and work are most often reflected in accounting registers using accounts:

- 20 (for operations within the main production);

- 23 (for operations supplementing the main production);

- 26 (for transactions corresponding to indirect costs);

- 28 (to account for production losses due to defects).

Sometimes accounts are also used for cost accounting:

- 21 (if the company produces not only goods ready for use or consumption, but also semi-finished products);

- 25 (if the company has costs for operations that are separate from operations within the main production and complementary to it, but at certain points become associated with them).

These accounts most often correspond to:

- with a score of 10 (to reflect transactions on write-off of raw materials and materials into production);

- with accounts 69, 70 (to reflect operations to include personnel salaries in production costs, as well as contributions to insurance funds);

- with accounts 02, 05 (to reflect depreciation).

For example, by posting Dt 20 Kt 10, the fact of writing off materials for production is reflected, and posting Dt 20 Kt 70 reflects the accrual of salaries to employees.

If a company produces semi-finished products, then account 21 can also be a corresponding account. Thus, the fact of transfer of semi-finished products for further production can be reflected by posting Dt 20 Kt 21.

Accounting for finished products based on their cost indicators is carried out, as a rule, using account 43, corresponding to such accounts as 20, 90. For example, the receipt of goods at the warehouse is reflected by posting Dt 43 Kt 20, and if the products were sold, posting Dt is used 90 Kt 43.

Accurate costing

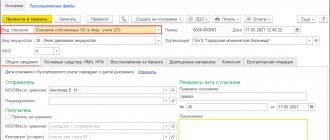

Starting with version 3.0.53 in 1C: Accounting 8, it became possible to calculate the cost of production, taking into account the specific costs of manufacturing specific types of products or semi-finished products. For this purpose, account 20.01 “Main production” now has a subaccount Products.

Please note that costs allocated to this subconto are included in the cost of production of a specific item, whenever possible. In particular, if the specified products are not released, then the costs will be included in the cost of other product items belonging to the same product group, as if the subconto had not been filled in.

In the tabular part of the documents Shift Production Report, Receipt from Processing, Request-Invoice, etc., the Products column now appears. This field can be filled in (manually or automatically), or it can be left blank for those materials for which it is unknown or impractical to determine what specific products (semi-finished products) they were spent on.

In this case, the cost of materials is distributed across the product group in proportion to the planned cost, as before.

In simple production conditions, when only one item group is used, the Item group field is not displayed in documents by default. At the same time, the Nomenclature Group subconto does not disappear anywhere, since it remains:

- in the chart of accounts for accounts 20 and 23;

- in postings as Main item group;

- in the directory Nomenclature groups.

If the user creates a second item group, the Item Group field will immediately be displayed in the documents.

If, for the compatibility of calculation indicators, it is necessary to maintain the behavior of the program similar to previous versions, then the Products subconto can be removed from the account 20.01, which will not lead to loss of data in the documents. Also, the Products subconto can be deleted if account 20 is used for additional cost analysis of enterprises providing services, and costing by item groups is sufficient.

On the contrary, if auxiliary production manufactures products or provides services, the cost of which needs to be calculated more accurately, the Products subconto can be added to account 23.

New features of the program allow you to combine costs, both distributed within a product group and directly related to a specific product, when calculating product costs.

Let's use the conditions of Example 1 and consider how the cost will be calculated if for each material we indicate the name of the product for the manufacture of which it was used. Let's reflect the production output and write-off of materials in one document Production report for the shift - the Products (Fig. 1) and Materials (Fig. 2) tabs.

Rice. 1. Write-off of materials in the “Shift Production Report”, “Products” tab

Rice. 2. Write-off of materials in the “Production report for a shift”, tab “Materials”

Other costs of main production accounted for on account 20 (wages and insurance premiums, depreciation of fixed assets, etc.) are included in the cost of a specific product item if it is indicated in the Products subconto. If the Products subconto is not filled in in the relevant documents, then the costs are distributed across the product group in proportion to the planned cost, as was the case before.

After completing the routine operation Closing accounts 20, 23, 25, 26, which is included in the Closing of the month processing, we will generate a certificate-calculation Cost calculation (Fig. 3).

Rice. 3. Accurate costing

The cost calculation form starting from version 3.0.52 “1C: Accounting 8” is a full-fledged report that displays cost data in the following sections:

- period of occurrence of costs;

- expense account;

- cost element;

- cost item;

- material.

In addition, the amounts of work in progress (WIP) at the end of the reporting period are now calculated and displayed in the calculation in detail - in the same sections as data on the cost of products produced or services provided.

Thus, new possibilities for calculating the cost of products (semi-finished products) allow:

- obtain a calculation corresponding to the actual consumption of raw materials;

- get clear data in the Costing report;

- do not abandon the enlarged grouping for the sake of obtaining a calculation;

- avoid creating unnecessary item groups;

- avoid averaging the consumption of raw materials and supplies within product groups;

- organize complex accounting - combine the allocation of costs to both products and product groups.

Results

The concept of cost in accounting has several interpretations.

An accountant involved in cost accounting will have to work with various accounting objects (selecting them from the list of production costs, calculating them), and also reflect transactions with these objects on special accounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.