Increasingly, payments received from customers are made electronically and by bank cards. There are also frequent situations when buyers purchase goods on credit.

In this article we will look at:

- how to set up acquiring in 1C 8.3 Accounting;

- how to carry out acquiring in 1C 8.3;

- accounting for acquiring transactions in 1C 8.3;

- acquiring transactions in 1C 8.3;

- how to reflect revenues from sales on payment cards and bank loans in 1C 8.3;

- what accounting entries are generated for acquiring in retail trade;

- How to close account 57 in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

Acquiring transactions in 1C

When making a payment via card, the buyer’s money after debiting is transferred not to the store, but to a special special bank account.

This is because every completed operation is inconvenient to process immediately. So, within a certain period of time - 1-3 days - the acquirer transfers money to the client (for example, a store, online store or service provider). A commission fee is charged for this, its amount is deducted when the money is transferred to the company’s account.

To display sales transactions in accounting and pay for them through a card, the so-called. accounting account 57 “Transfers in transit.”

It’s worth taking a closer look at a practical example.

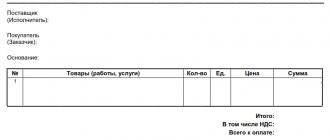

The acquiring bank and Domino LLC conclude a deal. According to the acquirer's terms, the commission is 2%. And according to the information received from the control tape, buyers made purchases for 22 thousand rubles, subject to VAT of 3,666.67 rubles. The table below clearly demonstrates the situation and wiring.

| Dt. | Kt. | What is included in the operation | Total amount in rubles |

| 62.01 | 90.01.1 | Revenue from sales that were paid with payment cards | 22000 |

| 90.03 | 68.02 | VAT is charged on the amount of revenue from cards | 3666,67 |

| 57.03 | 62.01 | Information from the electronic journal is sent to the bank | 22000 |

| 51 | 57.03 | The money goes to the current account (minus commissions) | 21560 |

| 91 | 57.03 | Commissions are written off in favor of the bank | 440 |

Bank commission accounting

The interest transferred to the bank for using the acquiring service is set by the bank itself. Each organization has its own. At Sberbank, the interest rate for non-cash payments is 1.6% and higher.

The commission depends on the direction in which the organization operates, how much monthly turnover is, what type of acquiring service is used: trade, mobile (wireless terminal) or Internet acquiring.

The postings indicate the percentage specified in the agreement with the bank. Or rather, the amount in rubles that makes up this percentage.

For example, a financial institution has set a commission of 2.2%. The goods were sold for the amount of 3,000 rubles. Then 2.2% of this amount will be 66 rubles. This figure is indicated in expenses Dt 91.2 Kt 51.

The table shows 3 banks and their acquiring commission amount that you must pay:

| Bank | Trade | Internet |

| Tinkoff | 2.1% – 2.79% – basic tariff; 1% – 5.8% – for gastrointestinal tract services; 1.55% – 5.6% – for airlines. Tariffs are calculated based on monthly turnover | From 2.19% |

| Dot | 1.3% to 2.3% | 2, 8% |

| Module | 1.65-1.9% – standard and 1.8-2.5% depending on the payment system | From 1 to 4% |

There is no need to pay for setting up the terminals; the costs reflect only the amount of rental or purchase of the device.

How acquiring is reflected, setting up directories and functionality

In order for operations to be displayed correctly, the appropriate settings must be made. To do this, go to Main, then to Settings, then to Functionality.

There in “Bank and Cash Office” (see below) follows Fr. This will make it possible to make transactions using these cards and bank loans.

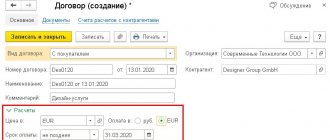

You should also first add and configure a bank agreement; you can, of course, implement the task when performing operations, but it’s worth considering this step separately. In the menu Counterparties, Directories, Purchases and Sales, enter the contract data.

Type of agreement about.

Subsequently, the information will be useful when filling out a directory on payment types, with data from the document reflecting the card payment transaction. The directory can be found through the corresponding section.

The field to fill out is available directly in the “Payment card transaction” document. You should create the “Payment Types” object in the directory and enter information in accordance with the concluded contract. It is important to take into account the payment option and terminal settings.

Accounting for transactions with bank cards

The Chart of Accounts provides account 40817 “Individuals” for recording transactions on bank cards. The account is passive. The chart of accounts for accounting in credit institutions gives the following characteristics of this account:

“...Purpose of the account: accounting of funds of individuals not related to their business activities. The account is opened both in foreign currency and in foreign currency on the basis of a bank account agreement.

The credit of the account reflects the amounts deposited in cash; amounts received in favor of an individual by bank transfer from the accounts of legal entities and individuals, deposits (deposits); amounts of loans provided and other receipts of funds provided for by regulations of the Bank of Russia.

The debit of the account reflects the amounts received by an individual in cash; amounts transferred by an individual by bank transfer to the accounts of legal entities and individuals, to deposit accounts; amounts aimed at repaying debt on granted loans and other operations provided for by regulations of the Bank of Russia.

Analytical accounting is maintained on personal accounts opened for individuals in accordance with bank account agreements...”

Reflection of sales and reflection of payment

To make the example clearer, we will show the “Sales” operation in the “Sales” section.

Filling out the data in the document should not be difficult, so let's immediately look at the next step. Using the finished document, we create a new one using the “Create based on” button.

All data from the previous one will be transferred there; all that remains is to mark the payment method.

Next you need to go through the document and study all the information obtained during the above operations. Postings can be viewed by clicking on Dt/Kt at the top of any of the documents.

A posting is made for settlements with consumers Dt 62.01 Kt 90.01.1 for the amount of payment and VAT is noted - Dt 90.03 Kt 68.02.

For transactions from a payment card, the posting is Dt 57.03 Kt 62.01 for the amount of funds received after payment by card.

In this situation, the supporting document was processed first, and only then was the actual payment. Otherwise, the wiring would be in the reverse order.

Next, the fact of sale of the goods is noted; the time when the document was processed should also be taken into account.

According to the document movement report, the account is 62.02, the program automatically generates a new transaction.

By clicking the “More” button, you can explore other documents related to the current one.

This way you can quickly go to each document entered based on the current one.

If you find it difficult to find out where the generated “Payment card transaction” document is, then by using the “Settings” button and the “Navigation settings” command, you can move the necessary information data to the desktop.

The required item is placed in the window on the right via the “Add” button.

After opening the “Buyers’ Documents”, a person gets access to all relevant documents, including the required “Payment by payment card”.

Acquiring under the simplified tax system “income”

For tax accounting they keep KUDiR - a book of income and expenses.

How “income” is reflected in this register for acquiring transactions under the simplified tax system:

- amounts are included in income according to the date of crediting funds to the recipient’s current account (clause 1 of Article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia No. 03-11-06/2/36926 dated July 28, 2014);

- Advances received from counterparties are also considered income;

- in the revenue they show how much the buyer transferred - before the acquirer deducts the commission (letter of the Ministry of Finance of Russia No. 03-11-11/54526 dated September 19, 2016).

Usually, the funds are transferred to the seller’s bank account minus the bank commission. Reflecting only the amount received in income will understate the tax base. And expenses under the object “income” are not taken into account (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). The taxable revenue of a “simplified” must include the entire amount paid by the counterparty for the sale of goods, works, and services.

Receipt by acquiring

Payments from consumers will accumulate in account 57.03 until the bank credits them in our favor. The document for crediting is created in various ways - when downloading statements from the client bank and by independently entering the statements through the “Bank and cash desk-Bank” section.

You can enter a document using “Payment card payment” as the basis through the “Create based on” button and then indicate “Receipt to current account”.

Then the data will be filled in automatically - the amount credited, the company account and commissions.

You should post the document and study the postings. After “Receipt...” is processed, the money will be transferred to our company.

Acquiring under the simplified tax system “income minus expenses”

Accounting for revenue under “simplified” taxation does not depend on the selected tax object. Therefore, income from acquiring under the simplified tax system “income minus expenses” is included in KUDiR according to the same rules as for the object “income”.

However, the commission retained by the acquirer can be included in expenses. The tax base under the simplified tax system “income minus expenses” is reduced on the basis of paragraphs. 9, pp. 24 clause 1 art. 346.16 Tax Code of the Russian Federation.

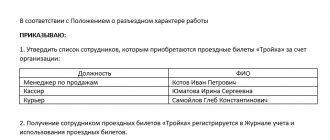

Retail sales report

If you need to reflect retail sales, then use a document with the appropriate name from the “Sales-Retail” section.

Information on both items sold and income is displayed here. In order to mark the fact of payment by payment card, you need to fill out a bookmark with the name “Non-cash payments”, noting the payment by card.

The document is carried out and informed about the following financial transactions:

- the price of the goods is written off - debit 62.R, credit 90.01.1;

- income from the sale is reflected - debit 57.03, credit 62.R;

- payment by payment cards is noted - debit 90.03, credit 68.02;

- VAT is taken into account - see invoice 57.03.

Checking the correctness of reflection of transactions

To make sure that everything was done correctly, the accountant looks at the balance sheet.

The amounts of all payments are visible there.

It is important that in the context of sub-accounts all turnovers are closed in sub-accounts without balances. If a balance arises, you need to check the sequence in which the documents were posted. It is necessary to monitor the detailing of all sub-accounts.

So, acquiring operations in 1C are not too complicated if you configure the program correctly and understand their meaning. The use of acquiring reduces payment processing costs, reduces store queues, this is beneficial to all participants in transactions.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter