Settings for accounting parameters for wages, taxes and contributions

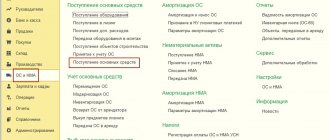

The sequence of payroll calculation in 1C Accounting 3.0, keeping records of calculations in this area and the implementation of subsequent payments initially require settings. Let's turn to the section “ZIK/Directories and settings/Salary settings/General settings”, where they can be implemented.

And the first thing you need to do for this is to activate “In this program” in the group of switches “Payroll accounting and personnel records are maintained.”

Fig. 1 Group of switches “Accounting for payroll and personnel records”

Settings for salary accrual and payment conditions

“ZIK/Directories and settings/Salary settings/General settings/Salary accounting procedure/Salary.”

- First, you need to specify the “Reflection method in accounting”, which allows you to select a value from the “Salary accounting method” directory. The specified method will be applied automatically if no other accounting method is specified for specific accruals or employees.

Fig. 2 “Method of reflection in accounting”

Fig. 3 Setting up reflection in salary accounting (item of the reference book “Methods of salary accounting”)

- Next, in the “Salary paid” detail, you must indicate the date of payment of the salary.

Fig. 4 “Salary is paid” detail

- In the case of salary deposition, you will need to set the method of recording deposits in the “Write-off of deposited amounts” detail.

Fig.5 Details “Write-off of deposited amounts”

Fig.6 Setting up reflection in the accounting of depositors (the reference book element “Salary accounting method”)

- If the company is participating in the Social Insurance Fund pilot project, you need to select the “Payment of sick leave” attribute from the drop-down list.

Fig.7 Requisites “Payment of sick leave”

Setting up the inclusion of the function for calculating sick leave, vacations and writs of execution

“ZIK/Directories and settings/Salary settings/Payroll calculation.”

Activation of “Keep records of sick leave, vacations and writs of execution” is responsible for the ability to work with documents in the database such as “Sick Leave”, “Vacation”, “Writ of Execution”, with the help of which the corresponding accruals will be realized. Otherwise, all accruals will be made only using the “Payroll” document.

Fig.8 Checkbox “Keep records of sick leave, vacations and executive documents”

Settings for insurance premium rates and contribution rates for NS and PP

“ZIK/Directories and settings/Salary settings/General settings/Salary accounting procedures/Setting up taxes and reports/Insurance contributions.”

Fig.9 Link “Setting up taxes and reports”

Fig. 10 Setting up the tariff of insurance premiums and the contribution rate for NS and PZ

Let's pay attention to the “Insurance Premium Tariff”*, which allows you to add the value of the required tariff from the “Types of Insurance Premium Tariff” directory.

Fig. 11 Directory element “Types of insurance premium rates”

*The link “Insurance premium rates” as an element of the directory “Types of insurance premium rates” allows you to view the premium rates available for a given tariff.

Fig. 12 Insurance premium rates

If the company has additional contributions (a common practice for positions such as miners, pharmacists, flight crew members, etc.), you must check the box and enter the data in “ZIK/Directories and settings/Salary settings/General settings/Accounting procedure salaries/Setting up taxes and reports/Insurance premiums/Additional contributions.”

Fig.13 Setting up additional contributions

Procedure for calculating personal income tax

“ZIK/Directories and settings/Salary settings/General settings/Salary accounting procedures/Setting up taxes and reports/NDFL.”

Fig. 14 Setting up the procedure for calculating personal income tax

Setting up cost items to reflect insurance premiums

“ZIK/Directories and settings/Salary settings/Reflection in accounting/Cost items for insurance premiums.”

Fig. 15 Register of information “Cost items for insurance premiums”

Fig. 16 Setting up cost items for insurance premiums

By default, taxes and payroll deductions are reflected in cost accounts under the same cost item as the accruals from which the calculation was made. In this case, the “Accrual Cost Item” detail is not filled in. If you need to reflect in accounting insurance premiums or contributions to the Social Insurance Fund from NS and PZ for cost items other than the accrual cost item, you must indicate the item to reflect the accrual in the “Accrual Cost Item” attribute, and in the “Cost Item” attribute indicate where it should come from. reflect contributions.

Settings for main types of charges

“ZIK/Directories and settings/Salary settings/Payroll calculation/Accruals.”

Fig. 17 List of charges

Some types of charges are already present in the program by default. In the list of accruals, using the “Create” button, it is also possible to add new types of accruals (for example, “Compensation for unused vacation”, “Monthly bonus”, “Payment for time on a business trip”).

Fig. 18 Example of setting up a new type of accrual “Monthly bonus”

Settings for main types of holds

“ZIK/Directories and settings/Salary settings/Payroll calculation/Deductions.”

Fig.19 Hold list

“Deduction by writ of execution” is preinstalled in the program. The list of holds can be expanded by the following categories using the “Create” button:

- Union dues;

- Performance list;

- Paying agent remuneration;

- Additional insurance contributions for the funded part of the pension;

- Voluntary contributions to non-state pension funds.

Fig. 20 Example of setting up a new type of deduction “Union dues”

Setting up a salary project

“ZIK/Directories and settings/Salary projects.”

Fig. 21 Setting up a salary project

Data on employees’ personal accounts is entered in the “ZIK/Salary projects/Entering personal accounts” section or in the “Employees” directory using the “Payments and cost accounting” link in the “Personal account number” detail.

HR settings

“ZIK/Directories and settings/Salary settings/HR records.”

Fig.22 HR settings

Using the “Full” switch, personnel documents “Hiring”, “Personnel Transfer” and “Dismissal” are created. If you set the “Simplified” switch, there are no personnel documents in the program; personnel orders are printed from the employee’s card.

Setting up the way wages are reflected in accounting

The first setup that users need to perform is to set the methods of reflection in accounting, in other words, the analytics of accounting for labor costs. In the program “1C: Salaries and Personnel Management 8”, ed. 3 (hereinafter referred to as “1C:ZUP”), such analytics are installed only in the reference book “Methods of reflecting salaries in accounting”

(section

“Settings”

-

“Method of reflecting salaries in accounting”

). The directory itself indicates only the name of the method of reflecting wages in accounting.

The program does not require you to specify transactions or accounting accounts. The salary configuration synchronizes the data of this directory in 1C: Accounting 8, ed. 3.0, where a directory identical in name is located, and when the data enters “1C: Accounting 8”, then in each method of reflection in accounting the debit account and analytics are indicated, on the basis of which the accounting and tax accounting entries are generated.

Accrual and payment of advance

If the advance payment is made directly from the cash desk, its calculation is carried out through the document “Statement to the cash desk”. Advance payment through the bank is calculated in the document “Statement to the Bank”. Both documents can be found in the “ZIK/Salary” section.

To automatically fill them out* in the “Pay” field, select the “Advance” value and click on the “Fill” button.

*Please note that for the automatic completion of these documents, the “Advance” requisite in the “Hiring” personnel documents is responsible, as well as “Personnel transfer” with “Full” personnel records or a mark on the employee’s card with “Simplified”.

Fig. 23 “Advance payment” in the “Hiring” document

The “Advance” detail can be filled in in one of two possible ways:

- Fixed amount;

- % of the tariff.

Fig. 24 Calculation of advance payment in the document “Statement to the Cashier”

The fact of issuing an advance from the cash register must be recorded using the document “Cash Withdrawal (RKO)” with the transaction type “Payment of wages according to statements”, which was created on the basis of the document “Statement to the Cashier”. The fact of payment of the advance by the bank should be reflected using the document “Write-off from the current account” with the type of operation “Transfer of wages according to statements”, created on the basis of the document “Statement to the bank”.

Fig. 25 “Cash issuance” with the type of operation “Payment of wages according to statements”

The “Cash Withdrawal” document will generate transactions Dt 70 – Kt 50.

How to calculate and pay salaries in 1C

The second step is that the employee must be hired. In this case, we will look at an example of an employee who has a minor child. As you know, in such cases a tax deduction is applied. You can indicate an application for it in the employee’s card by going to the “Income Tax” section. Please note that tax deductions are cumulative. If they are not applied in one month, then in the next they will be taken into account for both periods.

Once all personnel documents are completed, you can proceed directly to payroll. To do this, select the “All accruals” item in the “Salaries and Personnel” menu.

In the list of documents that opens, select “Payroll” from the “Create” menu. Fill in the accrual month and department in the header and click on the “Fill” button.

The program will fill in all the necessary data. Manual adjustments are allowed. It is important to remember that the 1C: Accounting program does not maintain the “Timesheet” document. All absences from work (vacations, sick leave) must be filled out before the salary is calculated in order to correctly reflect the actual time worked in this document.

The “Employees” tab displays a summary table of the document broken down by employees.

The next tab displays accruals and deductions for employees and the amount of time actually worked. These data can be adjusted manually if necessary. You can also print a payslip on this tab.

The “Deductions” tab in this example is empty, since the employee did not have any. We'll let her through.

The next tab reflects personal income tax and tax deductions. This employee has a deduction for children, which we previously introduced. The data on this tab can be corrected by checking the appropriate flag.

The “Contributions” tab details contributions to the Pension Fund, Social Insurance Fund and the Federal Compulsory Compulsory Medical Insurance Fund. Manual adjustment is also available here.

The very last tab displays manual adjustments.

Click “Post and close” and here we will finish calculating the salary.

Calculation of salaries, taxes and contributions for the month

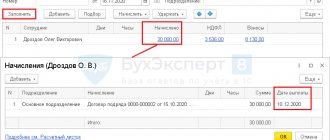

In order for the payroll of the company’s employees to be correctly displayed in the program, we fill out the document “Payroll”, which is located in the “ZIK/Salary” section. Accrual is made by clicking the “Fill” button.

Fig. 26 Calculation of salaries, taxes and contributions in the document “Payroll”

To carry out payroll calculations in 1C, use the “Pass” button.

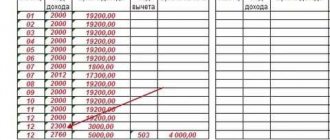

The “Payroll” document will allow you to generate a number of transactions:

Fig.27 Wiring

Document movement and reports

Let's see how the program generated the accounting entries and movement of the document we just created. In order to open the document movement log, you must click on the “Dt/Kt” button at the top of the “Payroll” document.

In our example, we calculated payroll in the program for August for a small commercial organization engaged in trading activities. By the movement of the document, you can see that all accruals have occurred and are reflected correctly.

The salary was credited to account 44.01, since we indicated it above in the Salary Accounting Settings. We see the costs of the enterprise in the Debit of the expense account (column “Debit”), while accounts payable have formed (column “Credit”). This means that the company has an obligation to employees in the form of salary payments.

Debt to employees is reduced by an amount equal to the withheld personal income tax amount. Even if an enterprise is not a personal income tax payer, it is obliged to transfer tax to the budget for its employees. Therefore, it is deducted directly from the employee's salary. The organization acts here as a tax agent. But the direct payments to the organization are insurance premiums.

Salary payment

Salaries can be paid to employees either through the bank or from the cash desk at the place of work. For the first case, it is necessary to generate the document “Statement to the Bank”, for the second - “Statement to the Cashier”.

Fig. 28 “Statement to the bank”

The fact of salary payment is recorded in the “Write-off from the current account” if the salary payment was made through a bank, or using the “Cash Withdrawal” document when the salary was paid from the cash desk.

Fig. 29 “Write-off from the current account” with the type of operation “Transfer of wages according to statements”

The document “Write-off from the current account” generates transactions Dt 70 – Kt 51.